“The successful man is the one who finds out what is the matter with his business before his competitors do.”

-Roy L. Smith

Jobs Update

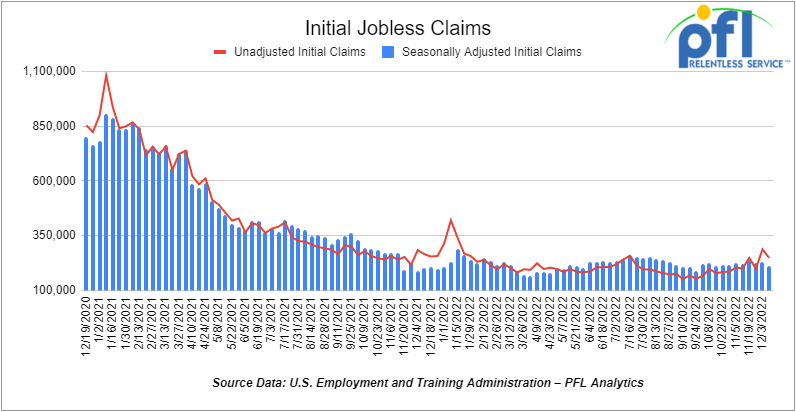

- Initial jobless claims for the week ending December 10th, 2022 came in at 211,000, down -21,000 people week-over-week.

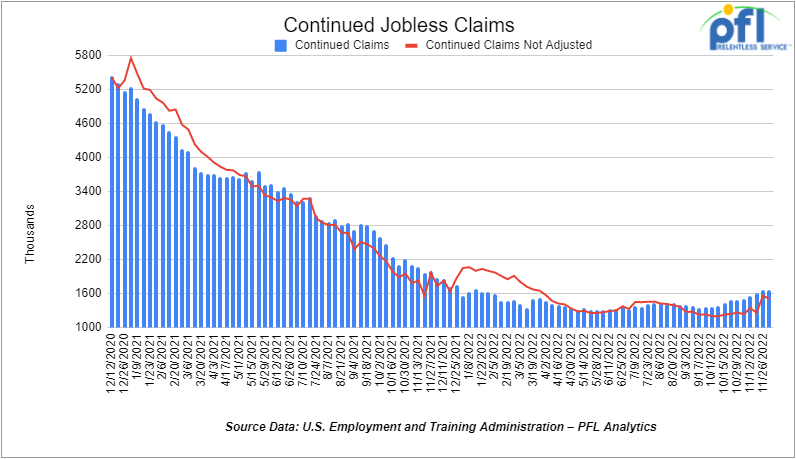

- Continuing jobless claims came in at 1.671 million people, versus the adjusted number of 1.67 million people from the week prior, up +1,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -281.76 points (-0.85%),closing out the week at 32,920.46, down –556 points week over week. The S&P 500 closed lower on Friday of last week, down -43.39 points (-1.11%) and closed out the week at 3,852.36, down -82.02 points week over week. The NASDAQ closed lower on Friday of last week, down -105.11 points (-0.96%), and closed the week at 10,705.41, down -299.21 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,275 this morning up +129 points.

Oil closed lower on Friday of last week, but up week over week

WTI traded down -1.82 per barrel (-2.4%) to close at $74.29 per barrel on Friday of last week, up $3.27 per barrel week over week. Brent traded down -US$2.17 per barrel (-2.4%) on Friday of last week, to close at US$79.04 per barrel, up $2.94 per barrel week over week.

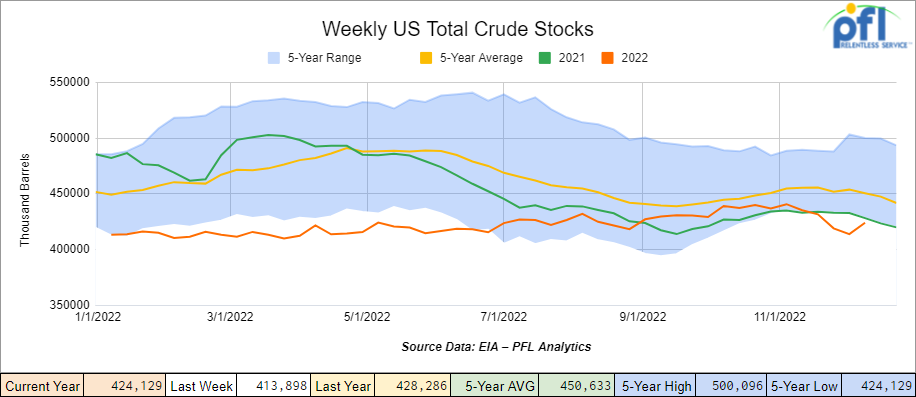

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 10.2 million barrels week over week. At 424.1 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

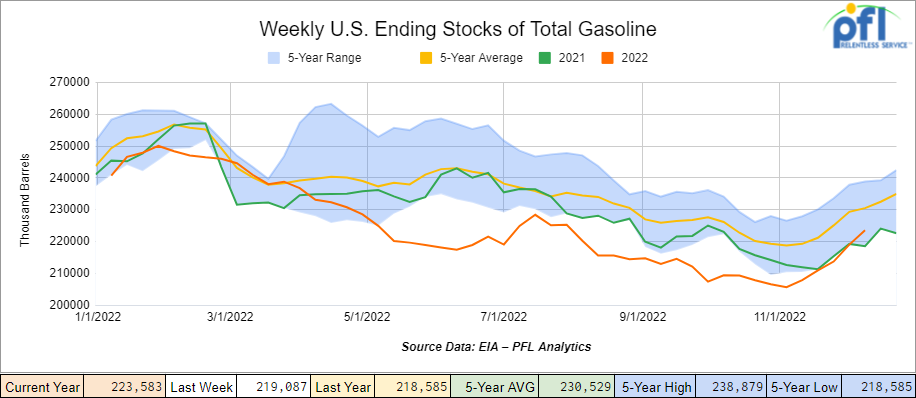

Total motor gasoline inventories increased by 4.5 million barrels week over week and are 3% below the five-year average for this time of year.

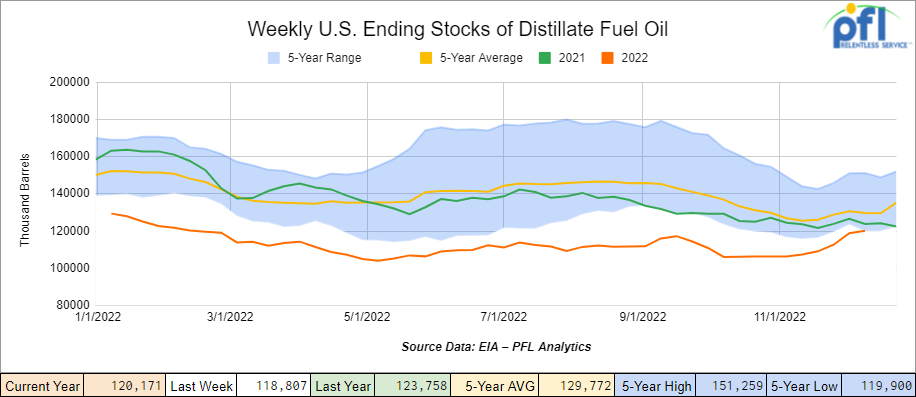

Distillate fuel inventories increased by 1.4 million barrels week over week and are 8% below the five-year average for this time of year.

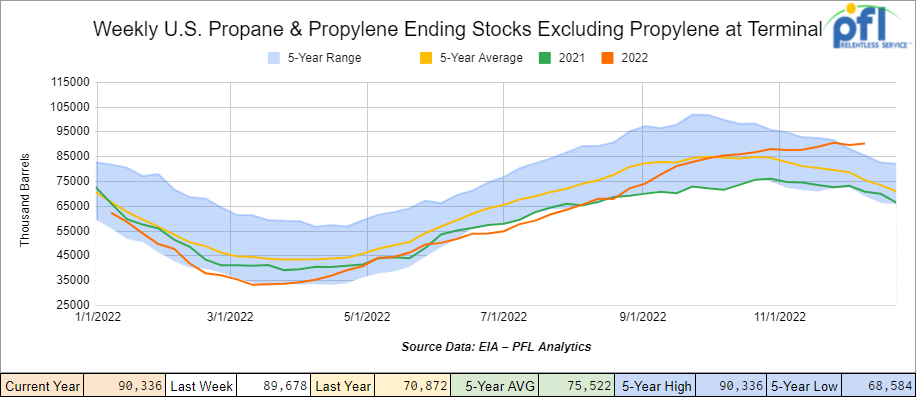

Propane/propylene inventories increased by 700,000 barrels week over week and are 17% above the five-year average for this time of year.

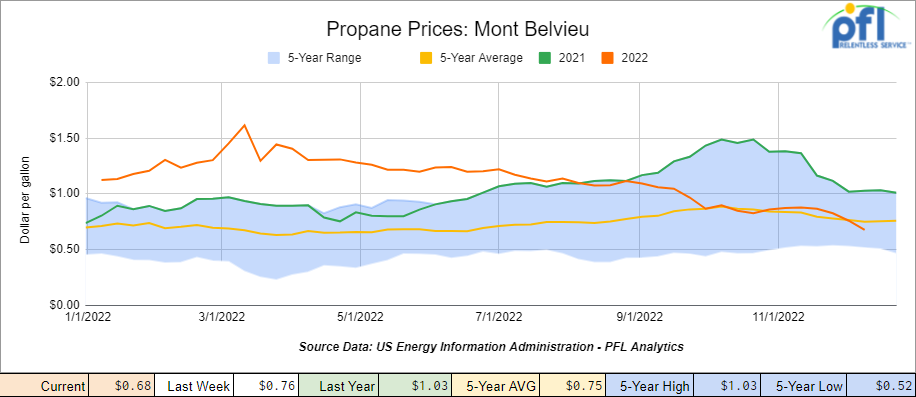

Propane prices continued to decline and lost 8 cents per gallon week over week closing at 68 cents per gallon down 35 cents per gallon year over year and are now 7 cents below the five-year average for this time of year.

Overall, total commercial petroleum inventories increased by 14.0 million barrels last week.

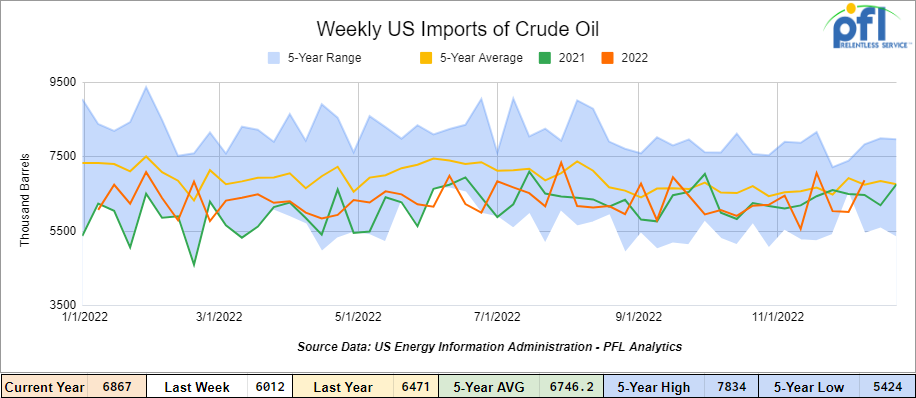

U.S. crude oil imports averaged 6.9 million barrels per day during the week ending December 9th, 2022 an increase of 855,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 0.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 790,000 barrels per day, and distillate fuel imports averaged 277,000 barrels per day during the week ending December 9th, 2022.

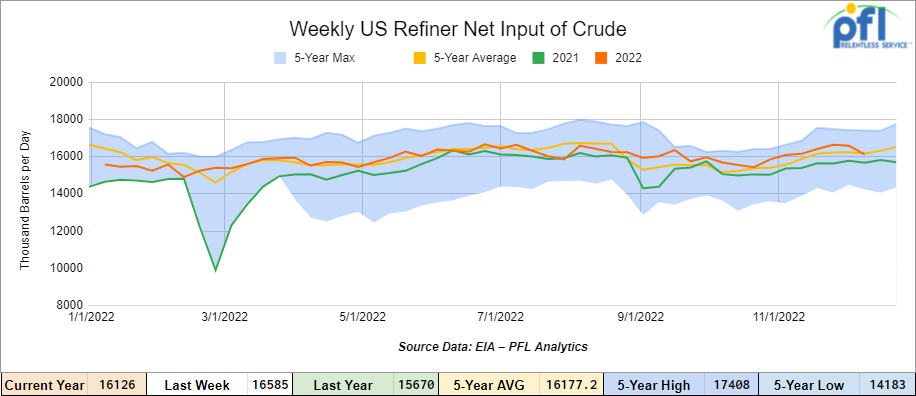

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending December 9, 2022, which was 459,000 barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $74.94, up +$0.65 per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 10th, 2022.

Total North American weekly rail volumes were down (-2.16%) in week 49 compared with the same week last year. Total carloads for the week ending on December 9th were 361,016, up (+0.92%) compared with the same week in 2021, while weekly intermodal volume was 325,793, down (-5.36%) compared to 2021. 6 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant increase coming from Coal (+8.87%). The largest decrease was from Chemicals (-11.75%).

In the east, CSX’s total volumes were down (-0.8%), with the largest decrease coming from Chemicals (-12.53%) and the largest increase from Coal (+9.85%). NS’s volumes were up (+2.57%), with the largest decrease coming from Chemicals (+9.41%) and the largest increase from Other (+22.65%).

In the West, BN’s total volumes were down (-7.48%), with the largest decreases coming from Chemicals (-19.13%), and the largest increase coming from Motor Vehicles and Parts (+10.36%). UP’s total rail volumes were down (-1.83%) with the largest decrease coming from Forest Products (-17.29%) and the largest increase coming from Motor Vehicles and Parts (+15.35%).

In Canada, CN’s total rail volumes were up (+.75%) with the largest decrease coming from Intermodal (-14.70%) and the largest increase coming from Other (+47.54%). CP’s total rail volumes were up (+0.75%) with the largest decrease coming from Motor Vehicles and Parts (-30.03%) and the largest increase coming from Other (+55.88%).

KCS’s total rail volumes were down (-2.55%) with the largest decrease coming from Grain (-31.22%) and largest increase coming from Metallic Ores and Metals (+12.14%).

Source Data: AAR – PFL Analytics

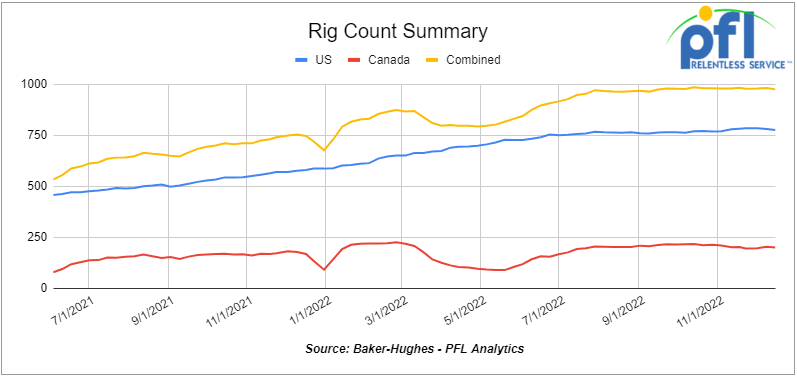

Rig Count

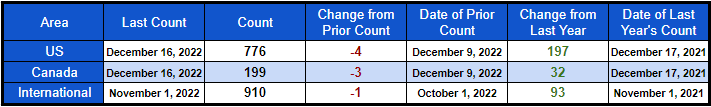

North American rig count was down by -7 rig week over week. U.S. rig count was down by -4 rigs week-over-week and up by +197 rigs year over year. The U.S. currently has 776 active rigs. Canada’s rig count was down by -3 rig week-over-week, and up by +32 rigs year-over-year. Canada’s overall rig count is 199 active rigs. Overall, year over year, we are up +229 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,843, from 24,659, which was a gain of 184 railcars week-over-week Canadian volumes were mixed; CP’s shipments increased by +5.1% week over week, and CN’s volumes were down8.7% week over week. U.S. shipments were mixed. The NS had the largest percentage increase, up by +5.6%, and the CSX had the largest percentage decline and was down by 6.9%.

The Senate – Fast Tracking Energy Permits Off the Table for Now

The Senate has rejected Sen. Joe Manchin’s latest effort to get his energy deal with Majority Leader Charles Schumer on Thursday of last week. The chamber blocked Manchin’s permitting reform amendment from getting onto a defense funding bill known as the National Defense Authorization Act in a 47-47 vote. 40 Dems supported the bill and 7 Republicans. Sixty votes were needed to advance the measure.

Schumer had promised Manchin he would take up the legislation to speed the process for approving new U.S. energy projects in exchange for Manchin’s vote on the Democrats’ major climate, health and tax bill. We know this one was not going to bode well and it is bad news for the delayed Mountain Valley natural gas pipeline (2 bcf per day and over 90% complete!). The Bill had a lot of hair on it – opponents said the bill did not go far enough and gave Federal Agencies too much power over states and made it easier for so-called green projects to get connected to the grid at a faster pace.

Manchin, in a statement following the vote, slammed his Republican colleagues who voted against the measure, saying they put politics ahead of the country.

“Mitch McConnell and his Republican caucus voted down a bill that would have completed the Mountain Valley Pipeline and quickly delivered natural gas to the market lowering home heating costs for families and making America more energy secure and independent. I believe anyone who voted against permitting reform has failed to act in the best interest of our country,” he added.

President Biden issued a statement Thursday morning of last week, threw his support behind Manchin’s proposal, pitching it as a continuation of Democrats’ efforts to lower costs through the Inflation Reduction Act enacted this fall.

“I support Senator Manchin’s permitting reform proposal as a way to cut Americans’ energy bills, promote U.S. energy security, and boost our ability to get energy projects built and connected to the grid,” Biden said.

The Biden Administration Starting to buy Crude for SPR that It sold

The U.S. Department of Energy’s (DOE) Office of Petroleum Reserves announced on Friday of last week that it will start repurchasing crude oil for the Strategic Petroleum Reserve (SPR) that it sold. According to the DOE this repurchase is an opportunity to secure a good deal for American taxpayers by repurchasing oil at a lower price than the $96 per barrel average price it was sold for, as well as to strengthen energy security. Last Friday’s notice will pilot this new approach by starting with a purchase of up to 3 million barrels of sour crude oil.

We are Watching the Keystone Pipeline

Crude oil is flowing again through most of the 2,687-mile Keystone Pipeline, but a section of the conduit in Kansas that leaked nearly 600,000 gallons remained shut off as an investigation of what caused the damage continues, officials said. We at PFL don’t know the exact volume that has been affected by the continued shutdown of that leg but has certainly caused some panic. Basis for WCS closed at -US30 per barrel in Edmonton on Friday of last week and we are moving unit trains out of storage – almost all dirty unit trains under PFL control have been released and put back into service. More trains are needed for immediate dirty-to-dirty service.

“The affected segment of the Keystone Pipeline System remains safely isolated as investigation, recovery, repair and remediation continue to advance,” the company said in a statement on Thursday morning of last week. The company said it is “safely restarting” the section of the pipeline running from Canada to Patoka, Illinois.

At full operation, the pipeline normally pumps about 622,000 barrels.

The Pipeline and Hazardous Materials Safety Administration, a division of the U.S. Department of Transportation must grant regulatory approval before the Cushing Extension can reopen, according to the company.

TC Energy Leak

Source Data : Drone Base/Reuters – PFL Analytics

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 2-4, 28k Tanks for purchase in Minnesota off of the BNSF for use in Biodiesel.

- 35, 5400-6300 Covered hoppers for lease off the BN needed in Iowa for 3-5 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 1000 CPC 1232’s for sale in the Midwest. Open to all offers.

- 20, CPC 1232s last in Gasoline. On the UP in Texas, Short term.

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable.

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|