“Don’t bother just to be better than your contemporaries or predecessors. Try to be better than yourself.” — William Faulkner

Jobs Update

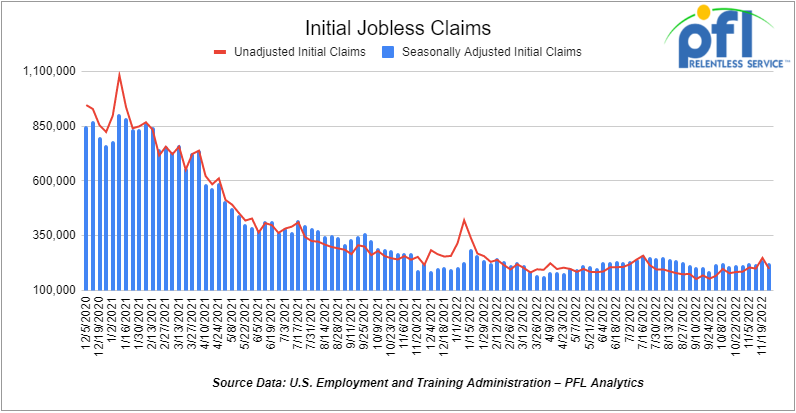

- Initial jobless claims for the week ending November 26th, 2022 came in at 225,000, down -16,000 people week-over-week.

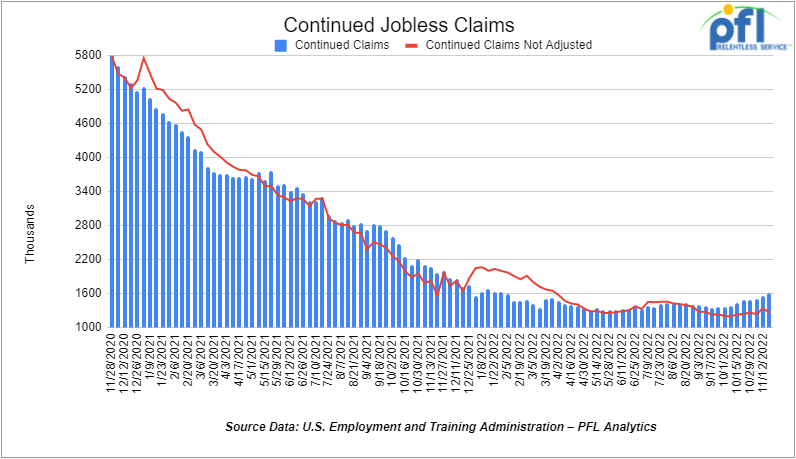

- Continuing jobless claims came in at 1.608 million people, versus the adjusted number of 1.551 million people from the week prior, up +57,000 people week over week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 34.87 points (+0.1%), closing out the week at 34,429.88, up 82.85 points week over week. The S&P 500 closed lower on Friday of last week, down -4.87 points (-0.12%), and closed out the week at 4,071.7, up 45.58 points week over week. The NASDAQ closed lower on Friday of last week, down -20.95 points (-0.19%), and closed the week at 11,461.5, up 235.14 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,325 this morning down -134 points.

Oil closed lower on Friday of last week, but higher week over week

WTI traded down -1.24 per barrel (-1.5%) to close at $79.98 per barrel on Friday of last week, but up +$3.70 per barrel week over week. Brent traded down -US$1.31 per barrel (-1.5%) on Friday of last week, to close at US$85.57 per barrel, up +$1.94 per barrel week over week.

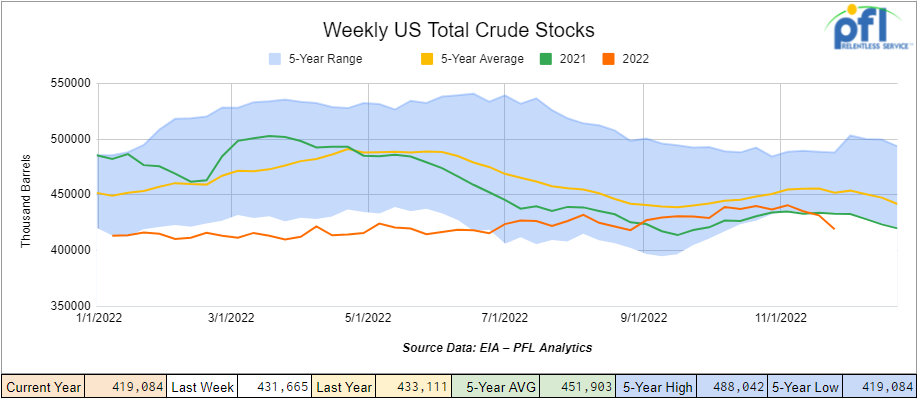

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 12.6 million barrels week over week. At 419.1 million barrels, U.S. crude oil inventories are 8% below the five-year average for this time of year.

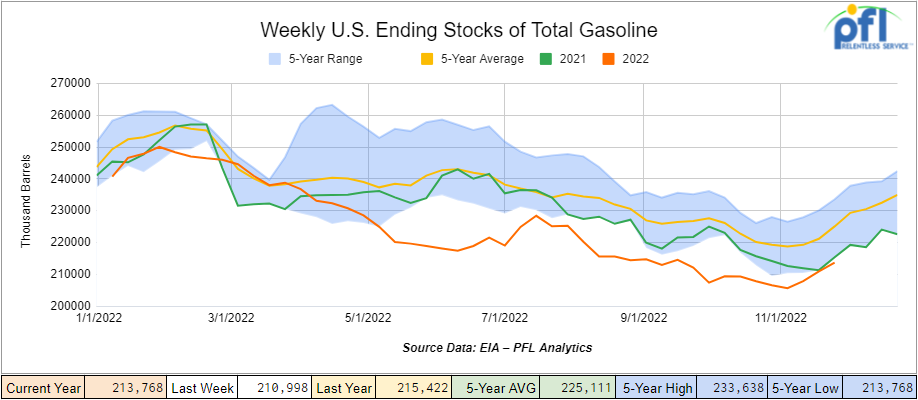

Total motor gasoline inventories increased by 2.8 million barrels week over week and are 4% below the five-year average for this time of year.

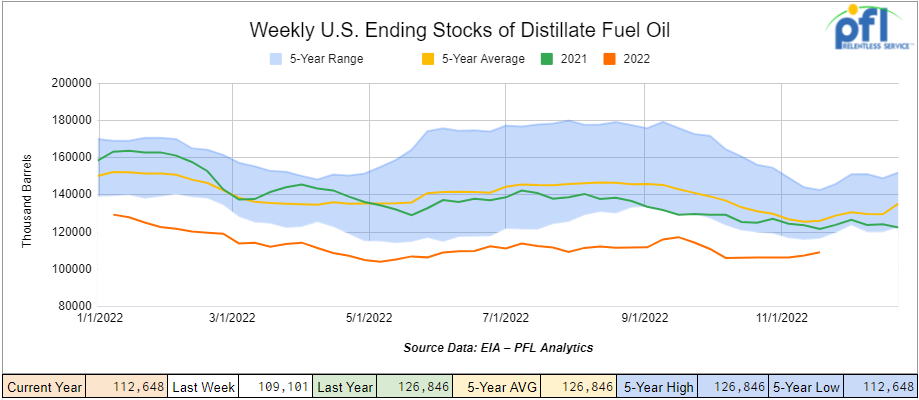

Distillate fuel inventories increased by 3.5 million barrels week over week and are 11% below the five-year average for this time of year.

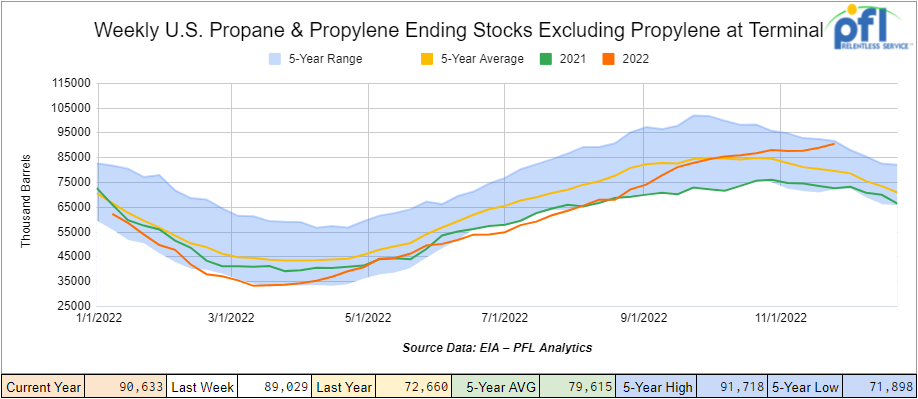

Propane/propylene inventories increased by 1.6 million barrels week over week and are 13% above the five-year average for this time of year.

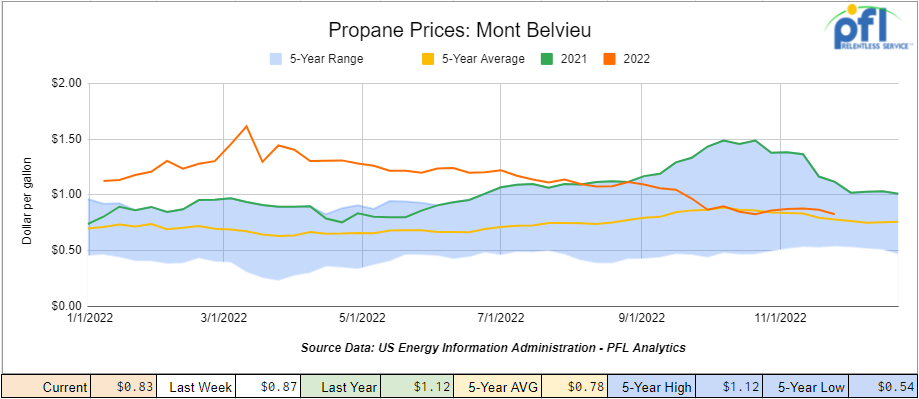

Propane prices were down 4 cents per gallon week over week, closing at 84 cents per gallon, down 28 cents per gallon year over year as inventories swell.

Overall, total commercial petroleum inventories decreased by 8.8 million barrels week over week.

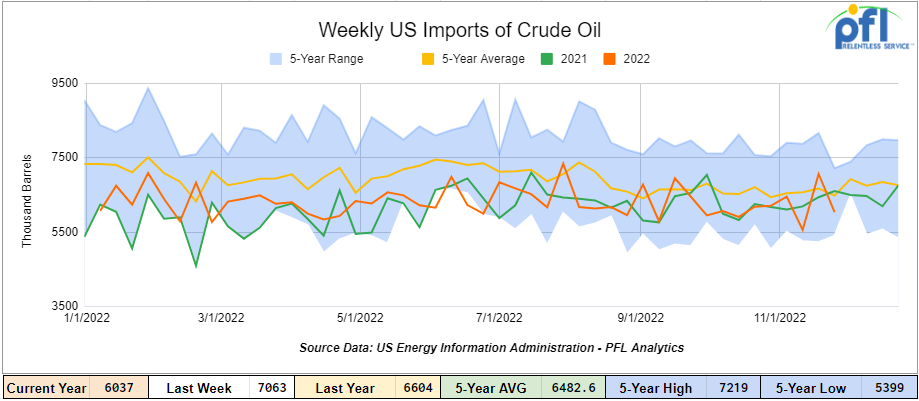

U.S. crude oil imports averaged 6.0 million barrels per day during the week ending November 25th, 2022, a decrease of 1 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 0.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 535,000 barrels per day, and distillate fuel imports averaged 152,000 barrels per day during the week ending November 25, 2022.

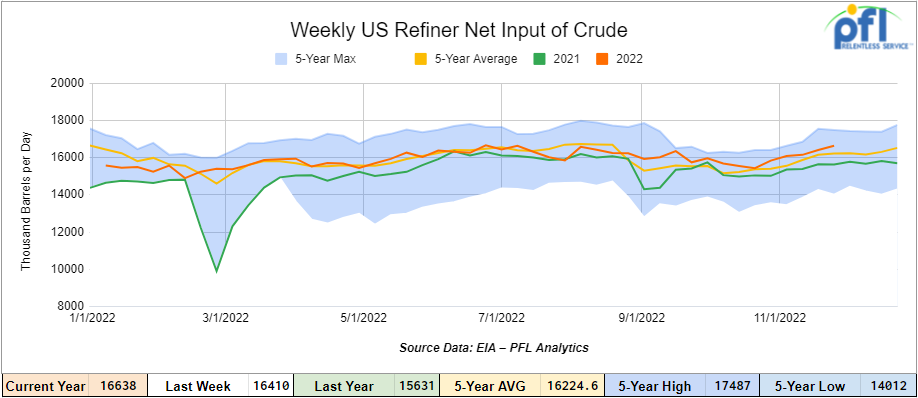

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending November 25, 2022 which was 228,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $81.90, up +$1.92 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 26th, 2022.

Total North American weekly rail volumes were down (-2.84%) in week 47 compared with the same week last year. Total carloads for the week ending on November 26th were 321,675, down (-0.70%) compared with the same week in 2021, while weekly intermodal volume was 270,347, down (-5.27%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Grains (-10.08%). The largest increase was from Other (+11.09%).

In the east, CSX’s total volumes were down (-1.97%), with the largest decrease coming from Chemicals (-9.41%) and the largest increase from Coal (+12.15%). NS’s volumes were down (-0.14%), with the largest decrease coming from Forest Products (-7.54%) and the largest increases from Grain (+49.8%).

In the West, BN’s total volumes were down (-10.63%), with the largest decreases coming from Chemicals (-21.88%), and the largest increase coming from Motor Vehicles and Parts (+12.63%). UP’s total rail volumes were down (-1.05%) with the largest decrease coming from Coal (-10.61%) and the largest increase coming from Other (+23.33%).

In Canada, CN’s total rail volumes were up (+5.84%) with the largest decrease coming from Chemicals (-9.76%) and the largest increase coming from Coal (+43.03%). CP’s total rail volumes were up (+9.84%) with the largest decreases coming from Coal (-16.52%)).

KCS’s total rail volumes were up (+5.11%) with the largest decrease coming from Grain (-22.40%) and the largest increase coming from Nonmetallic Minerals (+22.59%).

Source Data: AAR – PFL Analytics

Rig Count

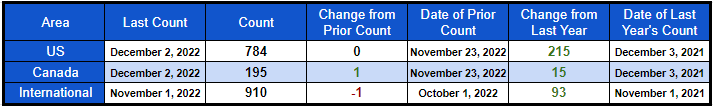

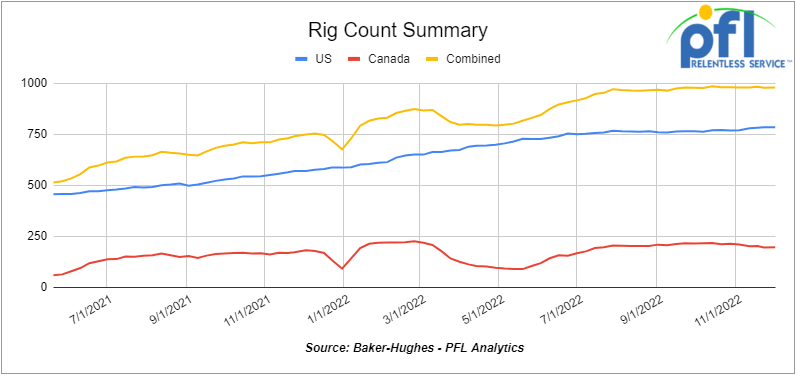

North American rig count was up by +1 rig week over week. U.S. rig count was flat week-over-week and up by +215 rigs year over year. The U.S. currently has 784 active rigs. Canada’s rig count was up by +1 rig week-over-week, and up by +15 rigs year-over-year. Canada’s overall rig count is 195 active rigs. Overall, year over year, we are up +230 rigs collectively.

International rig count, which is reported monthly, is down by -1 rig month over month, but is up +93 rigs year over year. Internationally there are 910 active rigs.

North American Rig Count Summary

A few things we are keeping an eye on

EPA Sets Renewable Fuel Standards – Good For Rail

EPA proposes growing the total volume of biofuels blended with petroleum products by more than 2 billion gallons between 2023 and 2025, according to a multi-year Renewable Fuel Standard volumes proposal released on Thursday. On Thursday of last week, The EPA also included in their proposal credits for electric vehicles.

EPA’s proposal includes a slight bump up in corn-based ethanol production and biodiesel by 2025.

This is the agency’s first attempt at setting RFS volumes beyond the 2022 statutory deadline for the law.

EPA would set overall renewable fuels volumes at 20.63 billion gallons in 2022, but that bumped to 20.88 billion gallons with a 250-million-gallon supplemental added in for the agency illegally waiving gallons in 2016.

The overall volume for 2023 would be set at 20.82 billion gallons, 21.87 billion gallons in 2024, and 22.68 billion gallons in 2025.

The overall growth in biofuel’s volumes would come primarily from a surge in renewable natural gas production, according to the proposal.

The EPA would set corn-ethanol blending at 15 billion gallons for 2023 and proposes adding a 250-million-gallon supplement for 15.25 billion gallons. In addition, EPA would require 15.25 billion gallons to be blended in 2024 and 2025. The ethanol industry was particularly concerned the agency would dial back on corn-ethanol volumes in favor of more advanced biofuels such as biomass-based diesel.

The supplemental addition in 2023 would be part of restoring 500 million gallons illegally waved by the agency in 2016.

Overall, the EPA would set advanced biofuel’s volumes at 5.82 billion gallons in 2023, 6.62 billion gallons in 2024, and 7.43 billion gallons in 2025. The EPA has scheduled a virtual public hearing for Jan. 10, 2023, on the proposal, with the possibility of an additional hearing on Jan. 11 if necessary, according to the agency. Stay tuned to PFL for further details.

Rail Strike Averted

To us at PFL, there was in our opinion no risk for a strike – it simply could not happen at this point of time. After saying that President Biden as expected signed legislation on Friday of last week to block a national U.S. railroad strike that could have devastated the American economy.

The U.S. Senate voted 80 to 15 on Thursday of last week to impose a tentative contract deal reached in September on a dozen unions representing 115,000 workers, who could have gone on strike on Dec. 9. However, the Senate failed to approve a measure that would have provided paid sick days to railroad workers.

Eight of 12 unions had ratified the deal. But some labor leaders have criticized Biden, a self-described friend of labor, for asking Congress to impose a contract that workers in four unions have rejected over its lack of paid sick leave.

A rail strike could have frozen almost 30% of U.S. cargo shipments by weight, stoked already surging inflation, cost the American economy as much as US$2 billion a day, and stranded millions of rail passengers.

We are watching Natural Gas, LNG and LPG’s

Folks, there has been some calming in the gas markets – seems like we are well supplied for both natural gas and propane going into the winter and Asia and Europe for the most part are not in as bad of a state then we might have thought they would be. On the Domestic side, we still have Freeport’s 2bcf per day facility down that has helped with natural gas storage fills here in the U.S. and we have better than expected production numbers. Still long term bullish natgas you have to be!

Asian spot LNG prices rose for the second consecutive week on higher gas prices in Europe where a cold spell is on the horizon, but ample Asian inventories are expected to curb prices in the coming weeks.

The average LNG price for January delivery into Northeast Asia was $35/mmBtu, up $4, or 13% week over week. Much of the Northeast Asian price gains last week were driven by the rise in European LNG and gas hub prices. European LNG imports for the EU and Britain reached a record high of 11.14 million tons in November 2022, with France being the largest, importing 2.6 million tons

LNG freight rates have extended sharp declines, with both basins down more than 30 percent on export project interruptions, lower cargo demand and increasing prompt vessel availability. The Atlantic rate on Friday of last week fell to $262,000/day, while the Pacific rate fell to $243,500/day.

On the domestic side, Henry Hub natural gas pricing closed on Friday of last week at $6.738 per MMBTU, down 16 cents per MMBTU day over day and Propane prices at Mt. Bellville closed at 84 cents per gallon, down 4 cents per gallon week over week.

We are Watching Russia and the EU – New Price Cap on Russian Crude

The European Union (EU) agreed on Friday of last week to cap Russian seaborne oil prices to other destinations at $60/bbl. The deal was made after days of intense negotiations and just days before the EU’s ban today on itself receiving Russian seaborne crude and most pipeline imports from the country.

The announcement comes after the G-7 group of advanced economies agreed earlier this year to cap prices on Russian seaborne crude in an effort to limit the country’s revenues.

The deal, which still needs to be approved by Poland, was confirmed on Twitter by European Commission President Ursula von der Leyen. “The EU agreement on an oil price cap, coordinated with G-7 and others, will reduce Russia’s revenues significantly. It will help us stabilize global energy prices, benefitting emerging economies around the world,” she said. We shall see – Stay tuned to PFL for further details.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 2-4, 28k Tanks for purchase in Minnesota off of the BNSF for use in Biodiesel.

- 8, 23.5 tanks CSX in the east for polyacryamide for 2 years plus

- 35, 5400-6300 Covered hoppers for lease off the BN needed in Iowa for 3-5 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 20, CPC 1232s last in Gasoline. On the UP in Texas, Short term.

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|