“You renew yourself every day. Sometimes you’re successful, sometimes you’re not, but it’s the average that counts.”

— Satya Nadella

Jobs Update

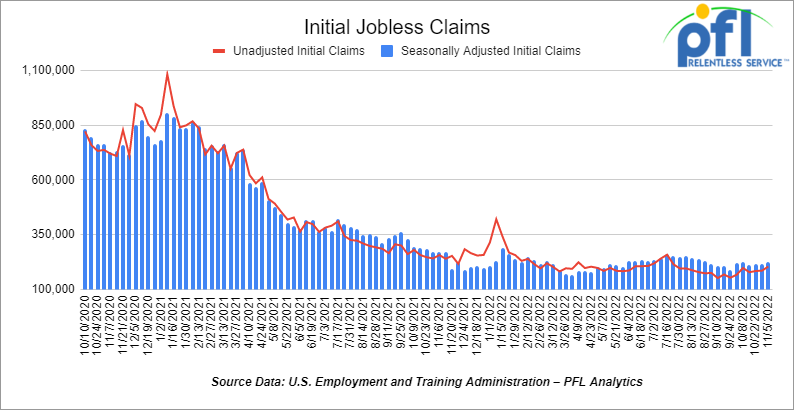

- Initial jobless claims for the week ending November 5th, 2022 came in at 225,000, up 7,000 people week-over-week.

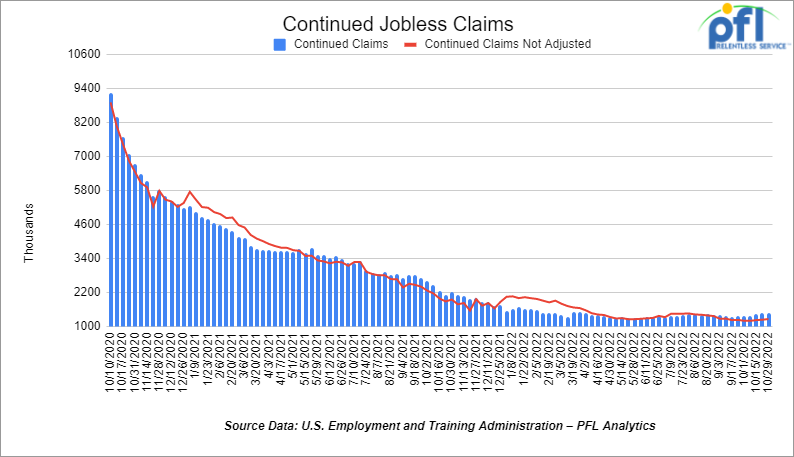

- Continuing jobless claims came in at 1.493 million people, versus the adjusted number of 1.487 million people from the week prior, up +6,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 32.49 points (+0.1%), closing out the week at 33,747.86, up +920.86 points week over week. The S&P 500 closed higher on Friday of last week, up 36.56 points (+0.92%), and closed out the week at 3,992.93, up +186.13 points week over week. The NASDAQ closed higher on Friday of last week, up 209.18 points (+1.98%), and closed the week at 11,323.33, up +758.81 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,677 this morning down -86 points.

Oil closed higher on Friday of last week but lower week over week

WTI traded up +$2.49 per barrel (+2.88%) to close at $88.96 per barrel on Friday of last week, down -$3.65 per barrel week over week. Brent traded up +US$2.32 per barrel (+2.48%) on Friday of last week to close at US$95.99 per barrel, down -$2.58 per barrel week over week.

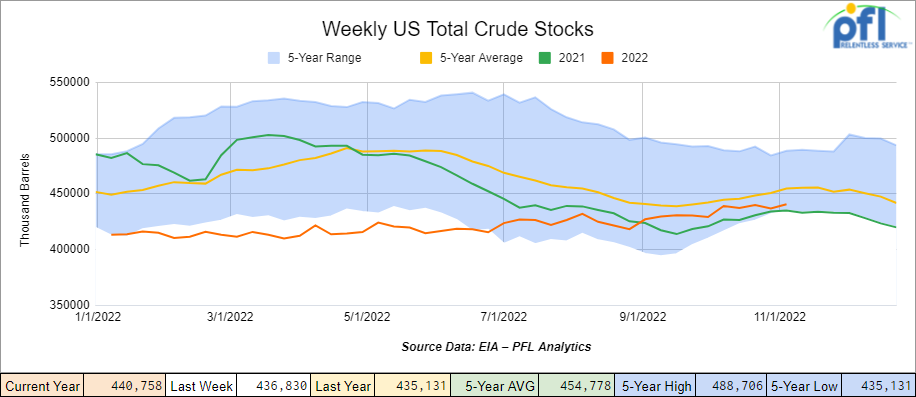

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.9 million barrels week over week. At 440.8 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

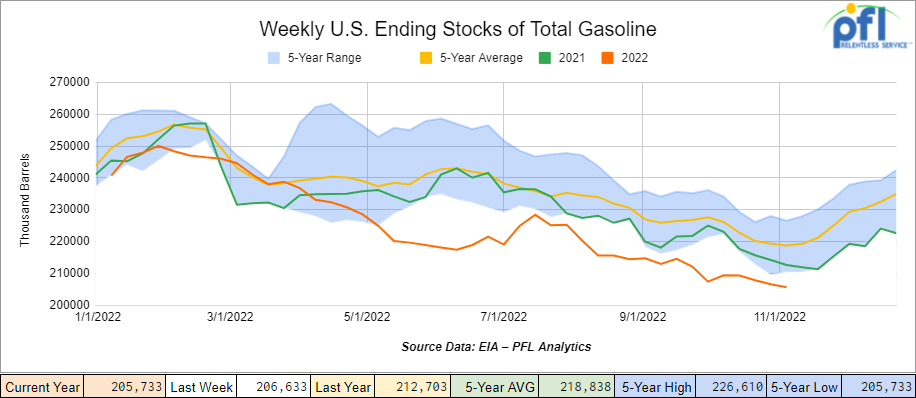

Total motor gasoline inventories decreased by 900,000 barrels week over week and are 6% below the five-year average for this time of year.

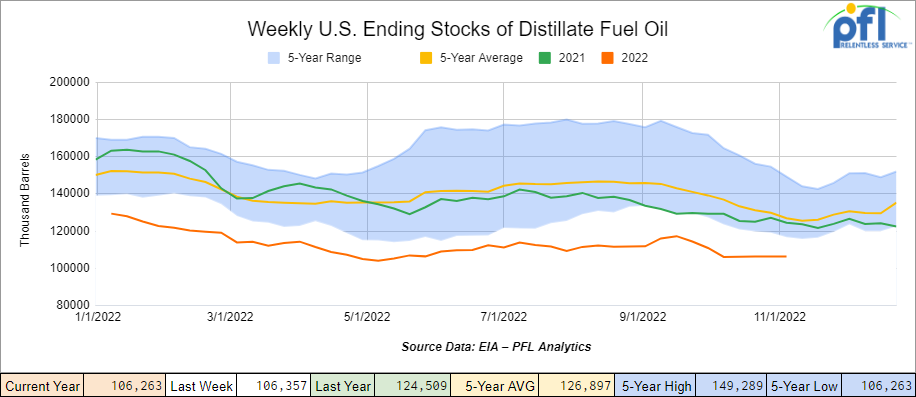

Distillate fuel inventories decreased by 500,000 barrels week over week and are 17% below the five-year average for this time of year.

Energy is a big problem in the North East US, temperatures are about to drop after an unusually warm fall. We are going straight to winter and may be headed for a crisis.

Heating oil delivered to New York harbor is the priciest ever. Retailers in Connecticut are conserving fuel to prevent panic buying. New England’s stockpiles of diesel and heating oil — the same product, taxed differently — are a third of normal levels. Natural gas inventories are also below average.

Northeast consumers will shoulder the highest energy bills in decades this winter. The Biden Administration is under pressure to tame prices. Homes and businesses run the risk of running out of fuel to heat their homes and to run their businesses.

Why are we in this problem in the North East? For the most part, it is simply the lack of pipeline capacity in the area. If you live in PA or Ohio, you are pretty much on the other side of the world when it comes to energy. The lack of drilling in NY and even approval of the pipelines that travel through that state has led to the problem. Now states like Massachusetts have to compete against Europe for vessels which have its own set of problems as it relates to energy.

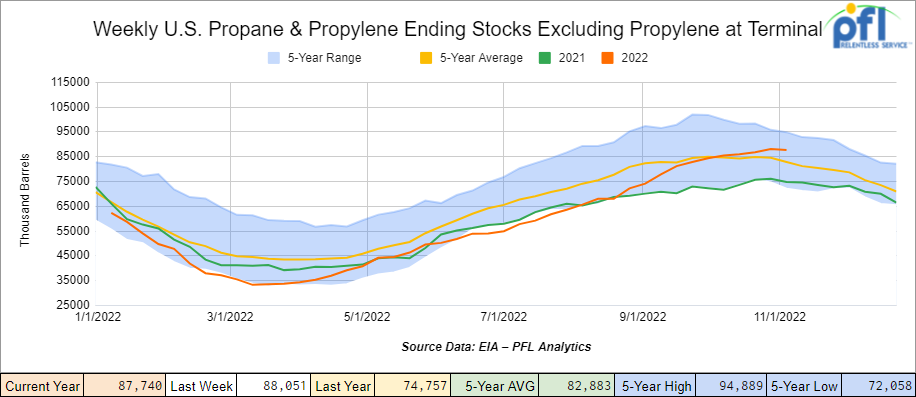

Propane/propylene inventories decreased by 300,000 barrels week over week and are 4% above the five-year average for this time of year.

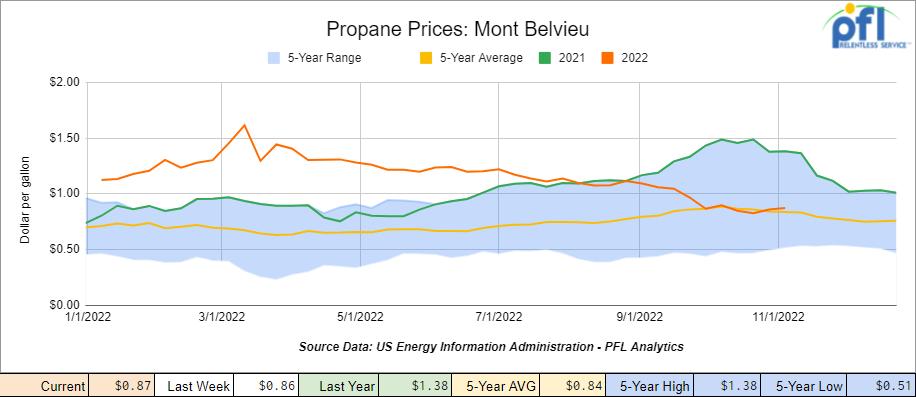

Propane prices increased a mere penny week over week closing at 87 cents per gallon, down 51 cents year over year.

Overall, total commercial petroleum inventories decreased by 800,000 barrels week over week.

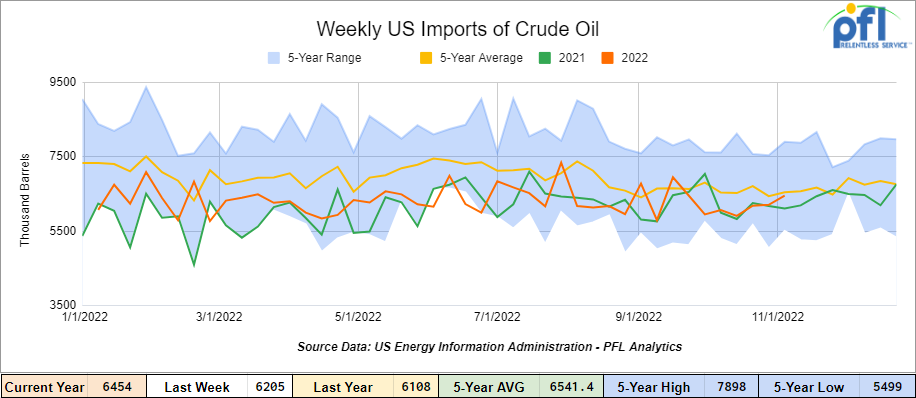

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending November 4th, 2022, an increase of 249,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 1.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 489,000 barrels per day, and distillate fuel imports averaged 328,000 barrels per day during the week ending November 4th, 2022.

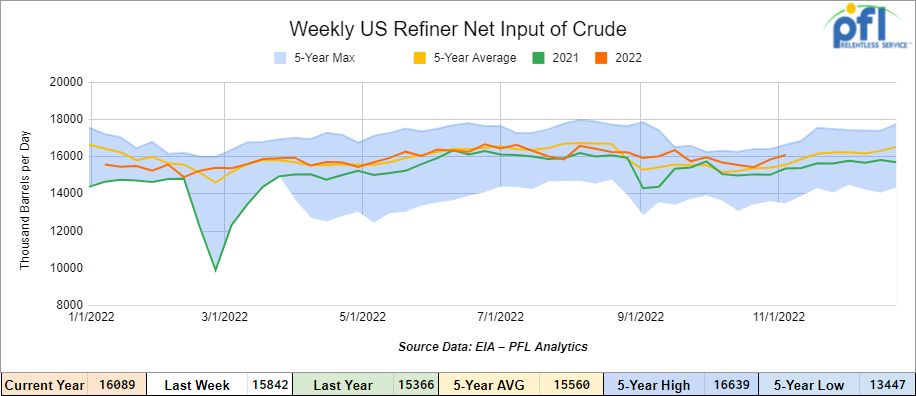

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending November 4, 2022 which was 247,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $88.22, down -$0.74 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 5th, 2022.

Total North American weekly rail volumes were down (-0.85%) in week 44 compared with the same week last year. Total carloads for the week ending on November 5th were 361,287, up (+2.55%) compared with the same week in 2021, while weekly intermodal volume was 326,891, down (-4.35%) compared to 2021. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Other (-14.3%). The largest increase was from Motor Vehicles and Parts (+17.31%).

In the east, CSX’s total volumes were up (+0.84%), with the largest decrease coming from Other (-10.56%) and the largest increase from Motor Vehicles and Parts (+22.49%). NS’s volumes were up (+2.01%), with the largest decrease coming from Metallic Ores and Metals (-6.4%) and the largest increases from Grain (+47.41%).

In the West, BN’s total volumes were down (-6.56%), with the largest decreases coming from Other (-36.39%), and the largest increase coming from Motor Vehicles and Parts (+4.55%). UP’s total rail volumes were up (+4.7%) with the largest decrease coming from Forest Products (-9.38%) and the largest increase coming from Motor Vehicles and Parts (+22.99%).

In Canada, CN’s total rail volumes were down (-6.75%) with the largest decrease coming from Other (-75.68%) and the largest increase coming from Coal (+52.98%). CP’s total rail volumes were down (-1.75%) with the largest decrease coming from Grain (-18.01%) and the largest increase coming from Nonmetallic Minerals (+49.7%).

KCS’s total rail volumes were down (-4.16%) with the largest decrease coming from Farm Products (-26.08%) and the largest increase coming from Nonmetallic Minerals (+15.2%).

Source Data: AAR – PFL Analytics

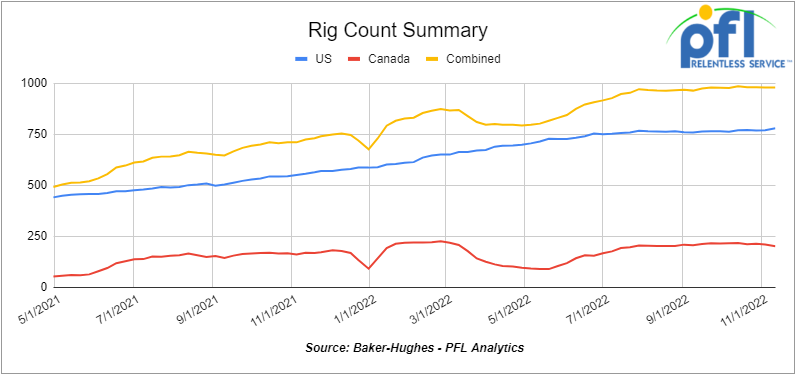

Rig Count

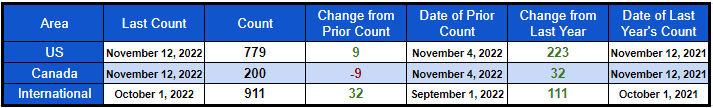

North American rig count was flat week over week. U.S. rig count was up by 9 rigs week-over-week and up by +223 rigs year over year. The U.S. currently has 779 active rigs. Canada’s rig count was down by -9 rigs week-over-week, and up by 32 rigs year-over-year. Canada’s overall rig count is 200 active rigs. Overall, year over year, we are up +255 rigs collectively.

International rig count which is reported monthly was up by +32 rigs month over month and up 111 rigs year over year. Internationally, there are 911 active rigs.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,682 from 23,897, which was a loss of 215 railcars week-over-week. The second consecutive weekly decline after 4 weeks of gains. Canadian volumes were down; CP’s shipments decreased by -16% week over week, and CN’s volumes were down by -2.2% week over week. U.S. shipments were mostly lower. UP had the largest percentage increase, up by +22.1%, and the NS had the largest percentage decrease and was down by -8.9%.

The War on Oil and Gas Continues

The Environmental Protection Agency (EPA) said on Friday of last week that it will strengthen its proposed regulations on monitoring and control of methane and other emissions associated with the production, transportation, and storage sectors of the oil and gas industry.

The announcement was timed to coincide with President Biden’s address to the United Nations COP27 climate conference in Sharm el-Sheikh, Egypt. Biden spoke of the tougher regulatory proposals as an example of his administration’s leadership to avert a “climate hell.” He also emphasized plans for U.S. financial aid to help developing nations develop energy sources that don’t rely on fossil fuels. Not only are we paying to decarbonize the U.S., but now we are paying other countries to do so themselves. Don’t know where all the money is coming from.

EPA said it not only wanted to make some of its proposals stricter but also was trying to make compliance options more flexible and cost-effective. Oil and natural gas industry representatives have been telling the agency for some time that a flexible approach especially for methane monitoring could prove to be more pragmatic.

In another setback for production in the U.S., Exxon says it will take up to a $2 billion loss on the sale of a California offshore oil and gas field that has been idled since a 2015 pipeline spill. The unfortunate spill that happened in 2015 sent 140,000 gallons of crude onto the Gaviota Coast and into the ocean, closing two state beaches, affecting 150 miles of coastline, and killing over 300 seabirds and marine mammals. The pipeline company agreed to pay $60 million in fines and to change its operations.

The sale comes after a failed bid this year to restart production at the site. The City of Santa Barbara rejected an Exxon plan to restart operations and ship oil via dozens of tanker trucks each day to inland refineries.

A blank check company founded by James Flores will borrow 97% of the $643 million purchase price from Exxon under a five-year loan. Blank check companies raise money to acquire operating businesses. If Flores fails to restart production at the Santa Ynez field by the start of 2026, Exxon could take back the entire operation.

Flores will seek permits to restart Santa Ynez and expects to pump about 28,100 bbls of oil and gas per day beginning in 2024. The field has 112 wells and the potential for at least another 100 wells.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 8, 23.5 tanks CSX in the east for polyacryamide for 2 years plus

- 35, 5400-6300 Covered hoppers for lease off the BN needed in Iowa for 3-5 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 20, CPC 1232s last in Gasoline. On the UP in Texas, Short term.

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|