“You cannot control the behavior of others, but you can always choose how you respond to it.”

― Roy T. Bennett

Jobs Update

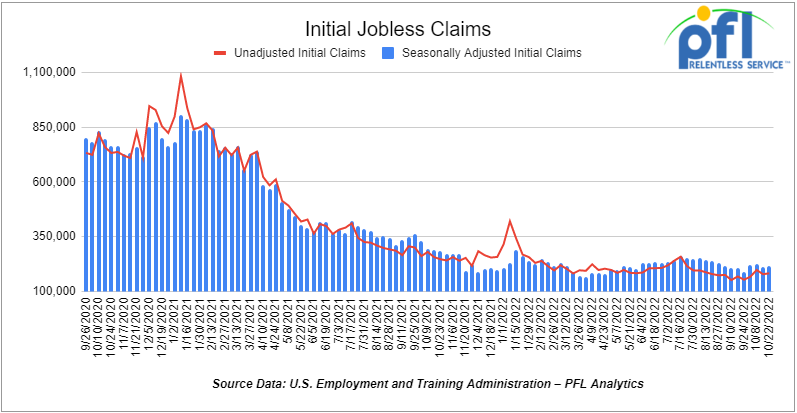

- Initial jobless claims for the week ending October 22nd, 2022 came in at 217,000, up +3,000 people week-over-week.

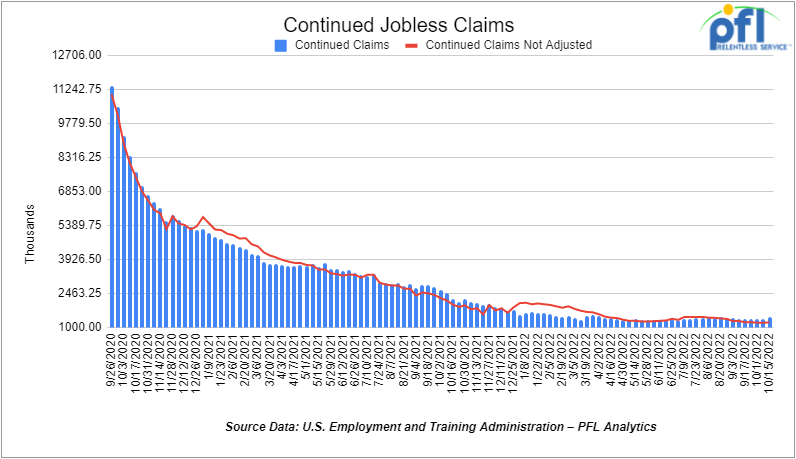

- Continuing jobless claims came in at 1.438 million people, versus the adjusted number of 1.383 million people from the week prior, up +55,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 828.52 points (+2.59%), closing out the week at 32,861.8, up +1,362.18 points week over week. The S&P 500 closed higher on Friday of last week, up 93.76 points (+2.46%), and closed out the week at 3,901.06, up +103.72 points week over week. The NASDAQ closed higher on Friday of last week, up 309.78 points (+2.83%), and closed the week at 11,102.45, up +149.84 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 32,789 this morning down -107 points.

Oil closed lower on Friday of last week, but higher week over week

WTI traded down -$1.18 per barrel (-1.3%) to close at $87.90 per barrel on Friday of last week, up $2.85 per barrel week over week. Brent traded down -US$1.19 per barrel (-1.2%) on Friday of last week to close at US$95.77 per barrel, up $2.27 per barrel week over week.

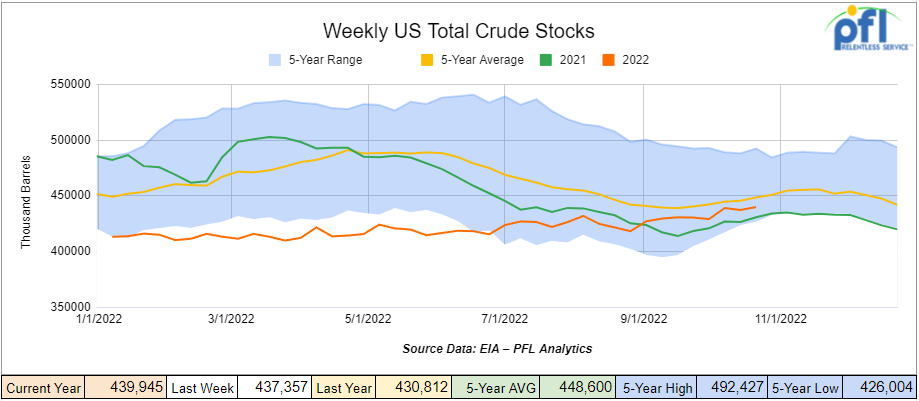

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.6 million barrels week over week. At 439.9 million barrels, U.S. crude oil inventories are -2% below the five-year average for this time of year.

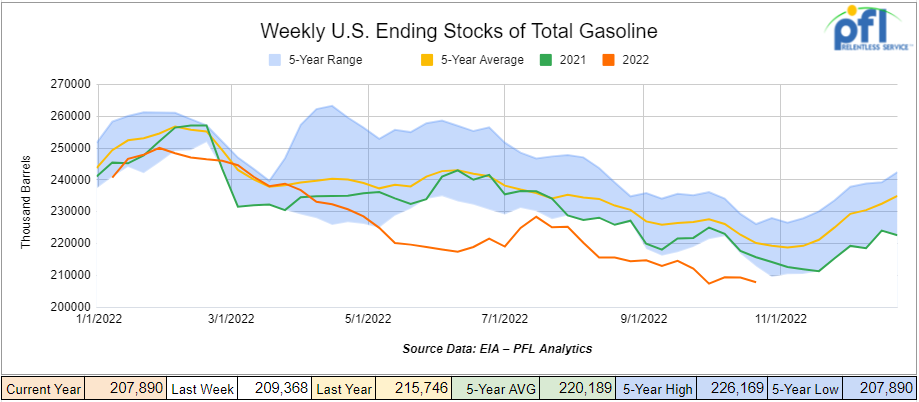

Total motor gasoline inventories decreased by 1.5 million barrels week over week and are -6% below the five-year average for this time of year.

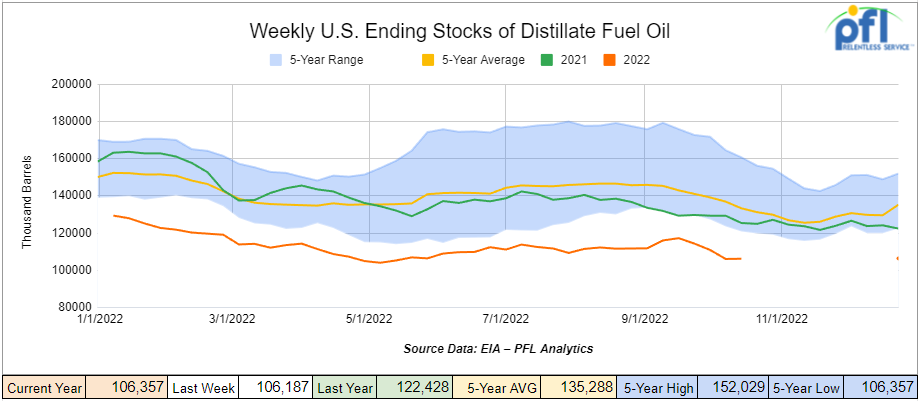

Distillate fuel inventories increased by 200,000 barrels week over week and are -20% below the five-year average for this time of year.

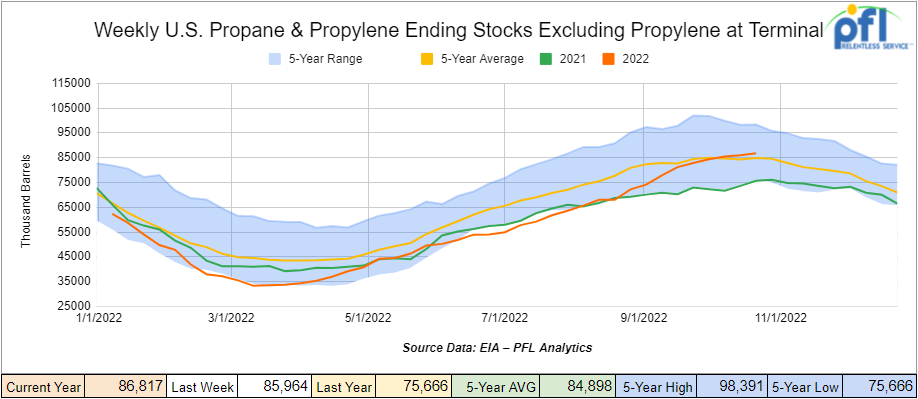

Propane/propylene inventories increased by 900,000 barrels week over week and are 3% above the five-year average for this time of year.

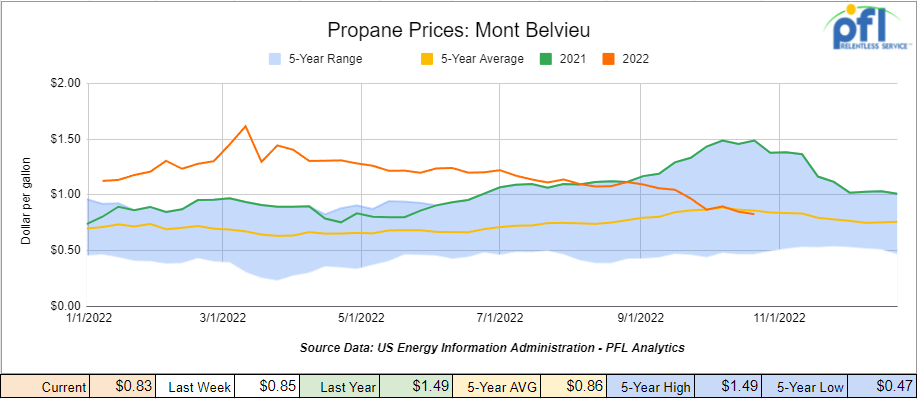

Propane prices on the back of increasing inventories closed lower week over week by 2 cents per gallon, closing at 83 cents per gallon, down 66 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 1.7 million barrels last week.

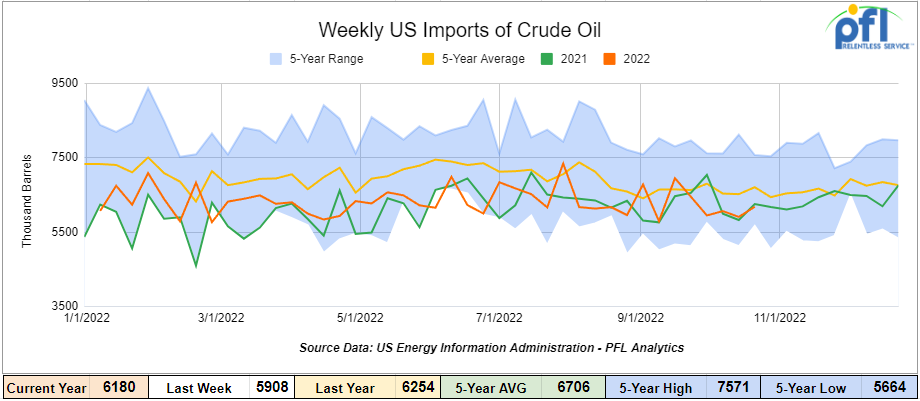

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending October 21st, 2022, an increase of 300,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 600,000 barrels per day, 4.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 655,000 barrels per day, and distillate fuel imports averaged 139,000 barrels per day during the week ending October 21st, 2022.

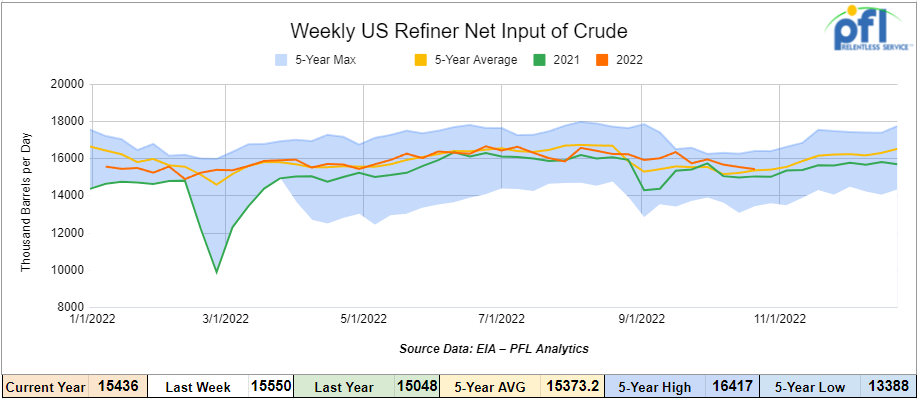

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending October 21, 2022, which was 114,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $86.52, down -$1.38 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 22nd, 2022.

Total North American weekly rail volumes were down (-1.08%) in week 42 compared with the same week last year. Total carloads for the week ending October 22nd were 353,750, up (+0.04%) compared with the same week in 2021, while weekly intermodal volume was 336,803, down (-2.24%) compared to 2021. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Other (-10.83%). The largest increase was from Motor Vehicles and Parts (+8.34%).

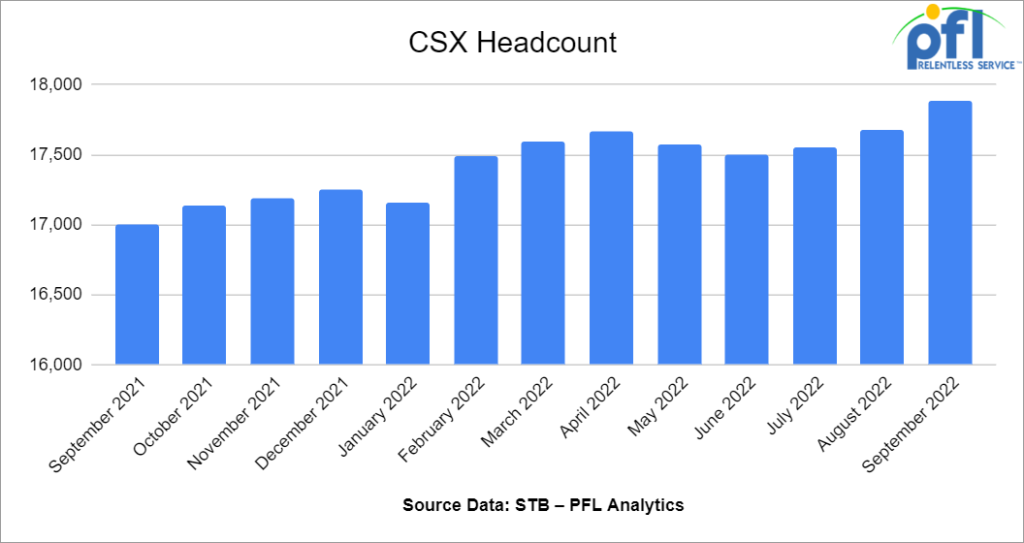

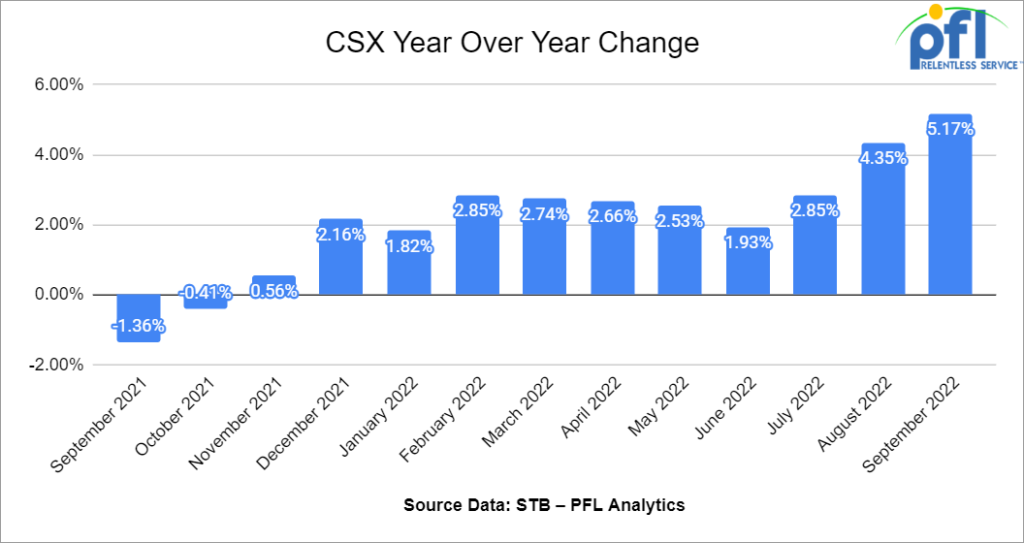

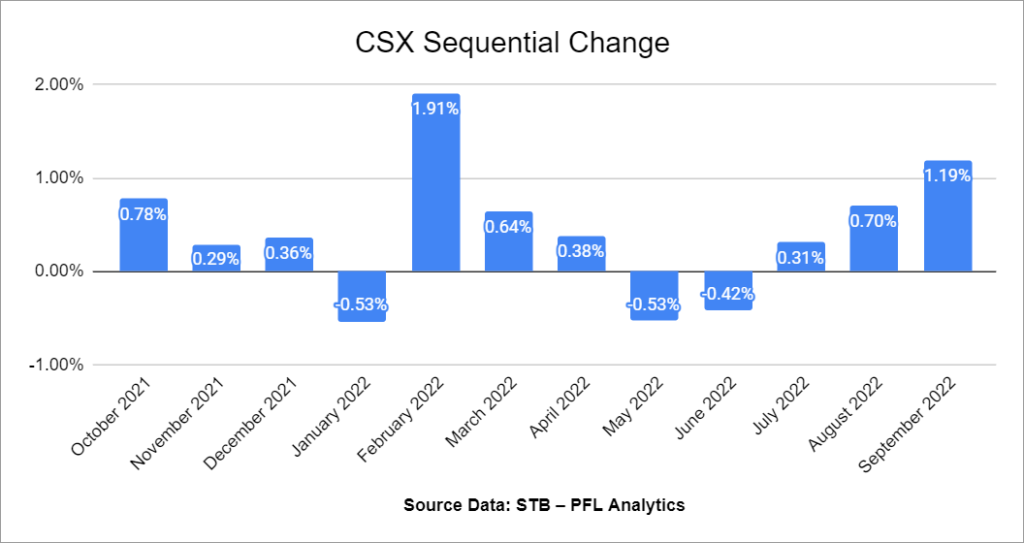

In the east, CSX’s total volumes were down (-0.54%), with the largest decrease coming from Forest Products (-12.22%) and the largest increase from Motor Vehicles and Parts (+13.31%). NS’s volumes were up (0.68%), with the largest decrease coming from Chemicals (-20.41%) and the largest increases from Grain (+30.59%).

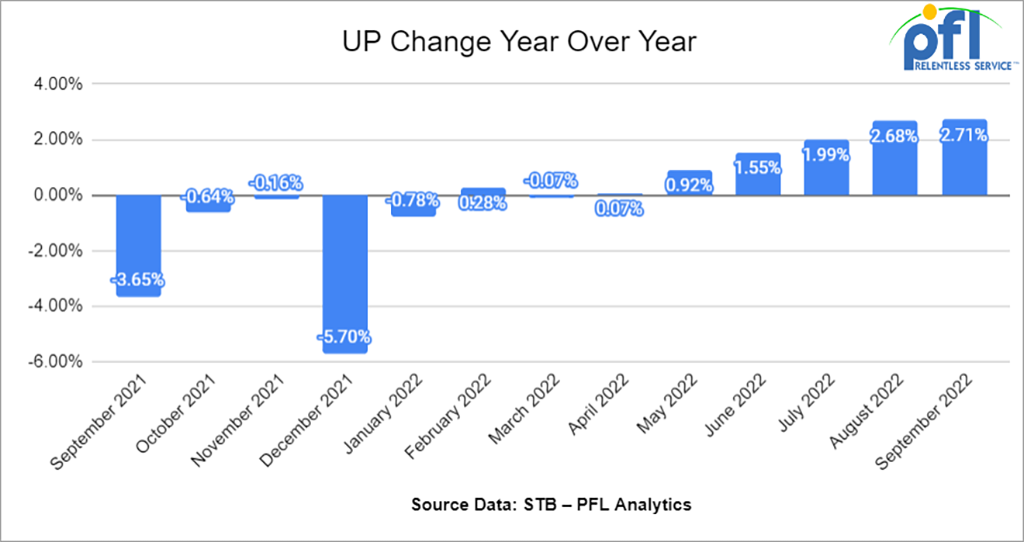

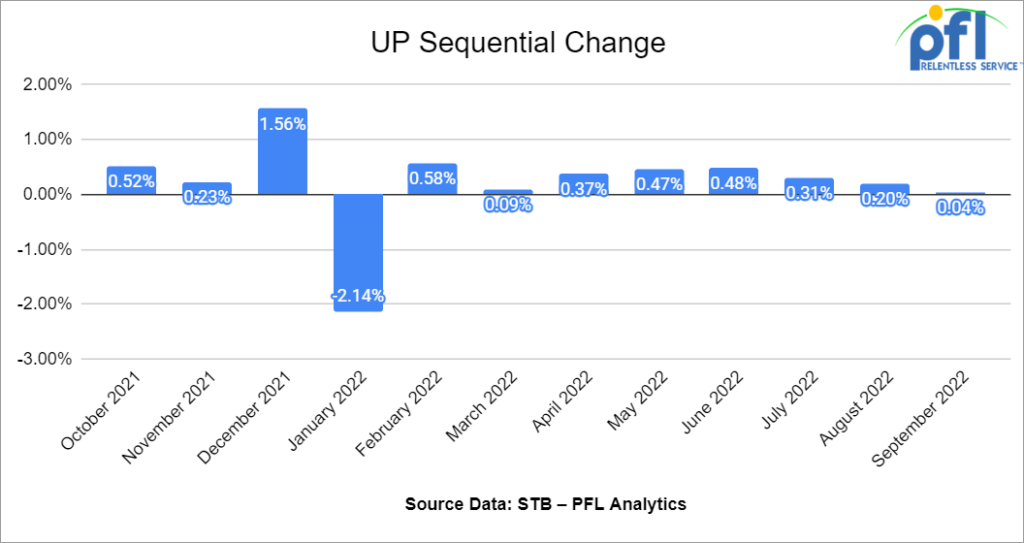

In the West, BN’s total volumes were down (-7.91%), with the largest decreases coming from Metallic Ores and Minerals (-20.01%), and the largest increase coming from Farm Products (+1.84%). UP’s total rail volumes were up (+7.06%) with the largest decrease coming from Forest Products (-12.88%) and the largest increase coming from Motor Vehicles and Parts (+31.87%).

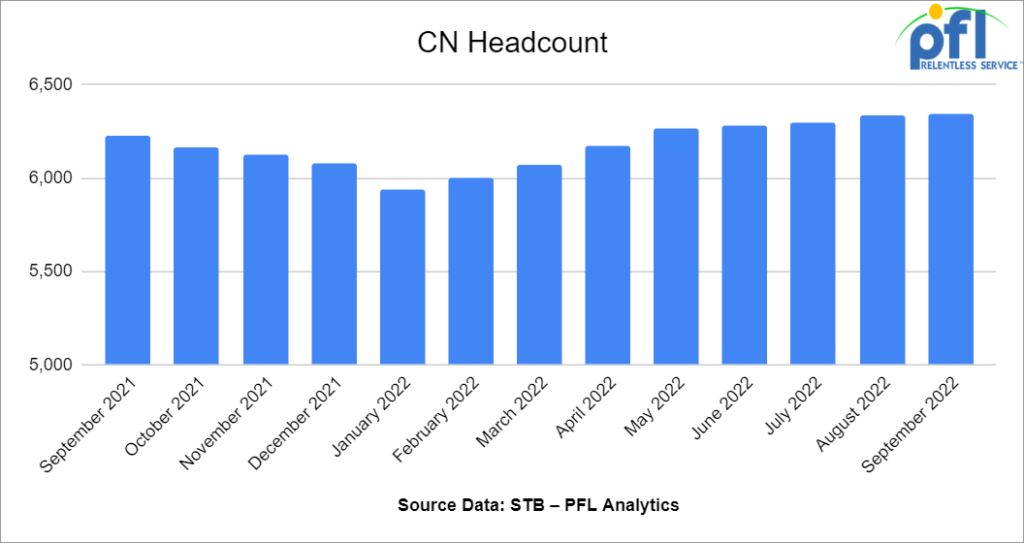

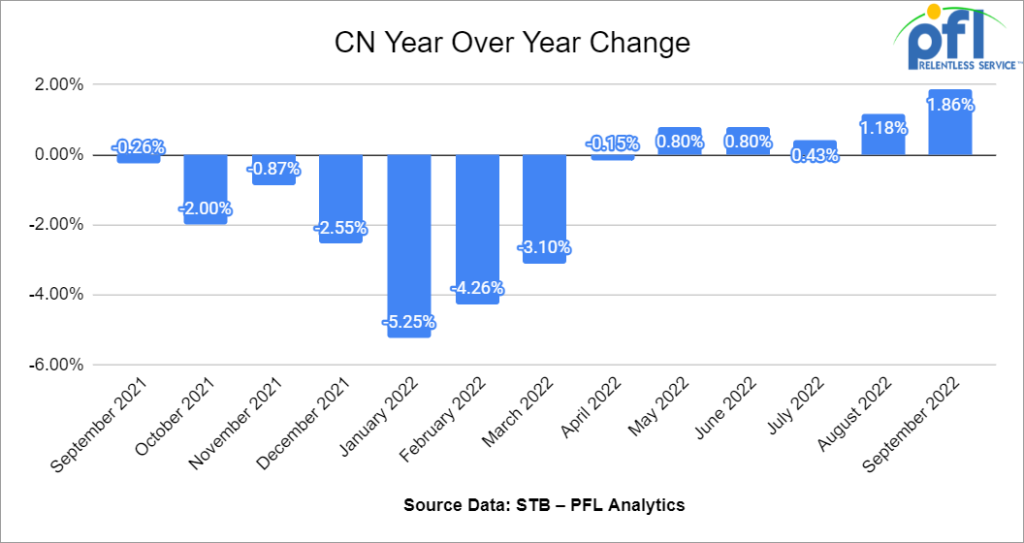

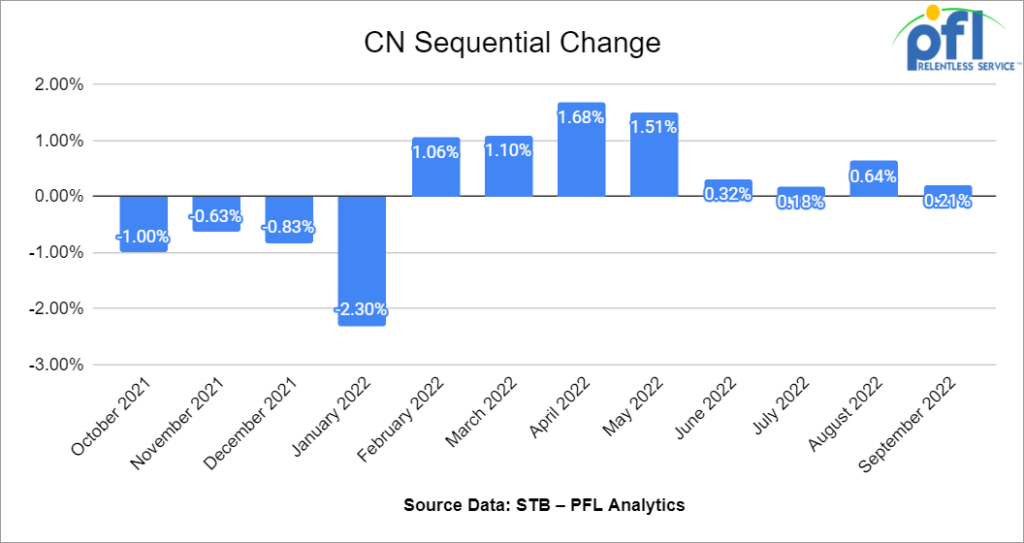

In Canada, CN’s total rail volumes were down (-4.87%) with the largest decrease coming from Other (-30.49%) and the largest increase coming from Coal (+56.90%). CP’s total rail volumes were down (-4.30%) with the largest decrease coming from Other (-18.42%) and the largest increase coming from Nonmetallic Minerals (+23.60%).

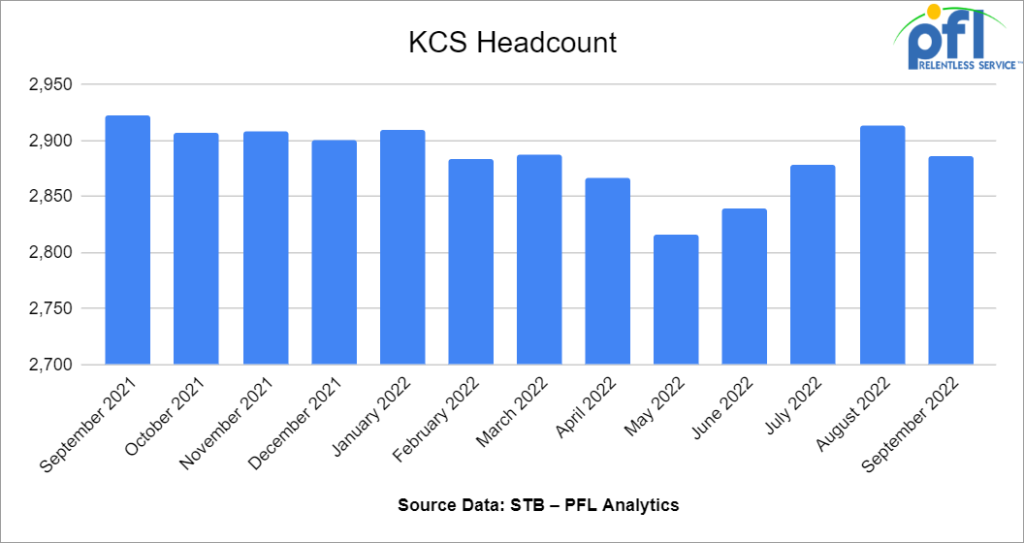

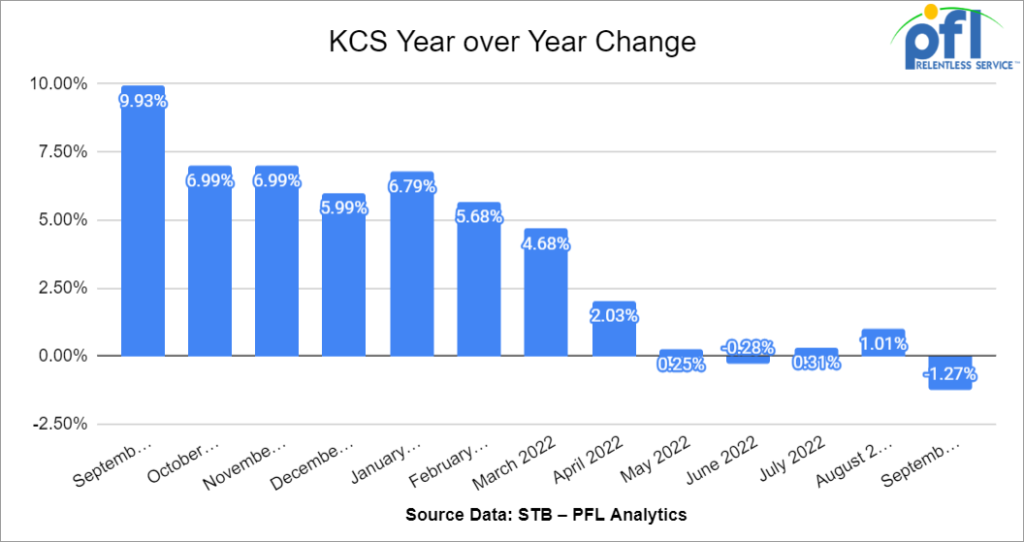

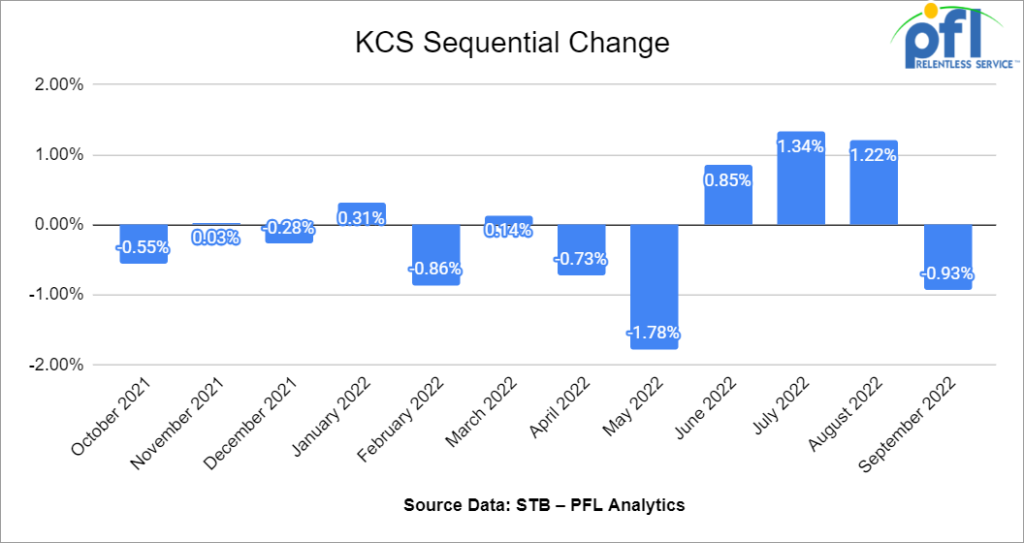

KCS’s total rail volumes were up (+2.71%) with the largest decrease coming from Farm Products (-20.19%) and largest increase coming from Coal (+24.55%).

Source Data: AAR – PFL Analytics

Rig Count

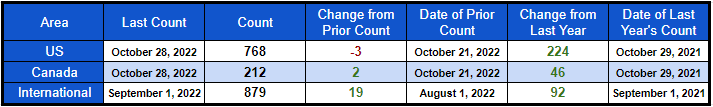

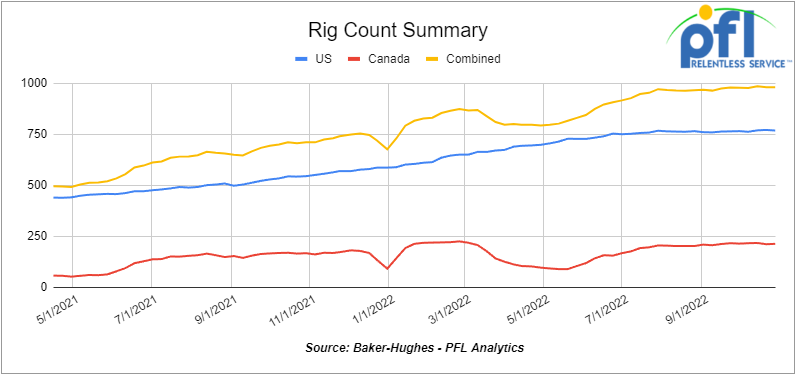

North American rig count was down by -1 rigs week over week. U.S. rig count was down by -3 rigs week-over-week and up by +224 rigs year over year. The U.S. currently has 768 active rigs. Canada’s rig count was up by 2 rigs week-over-week, and up by 46 rigs year-over-year. Canada’s overall rig count is 212 active rigs. Overall, year over year, we are up +270 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,049 from 23,756 which was a gain of 293 railcars week-over-week. The fourth week in a row of week-over-week gains. Canadian volumes were mixed; CP’s shipments decreased by -7.3% week over week, and CN’s volumes were up by +2.7% week over week. U.S. shipments were also mixed. CSX had the largest percentage decrease, down by -12.5%, and the UP had the largest percentage increase and was up by +7.3%.

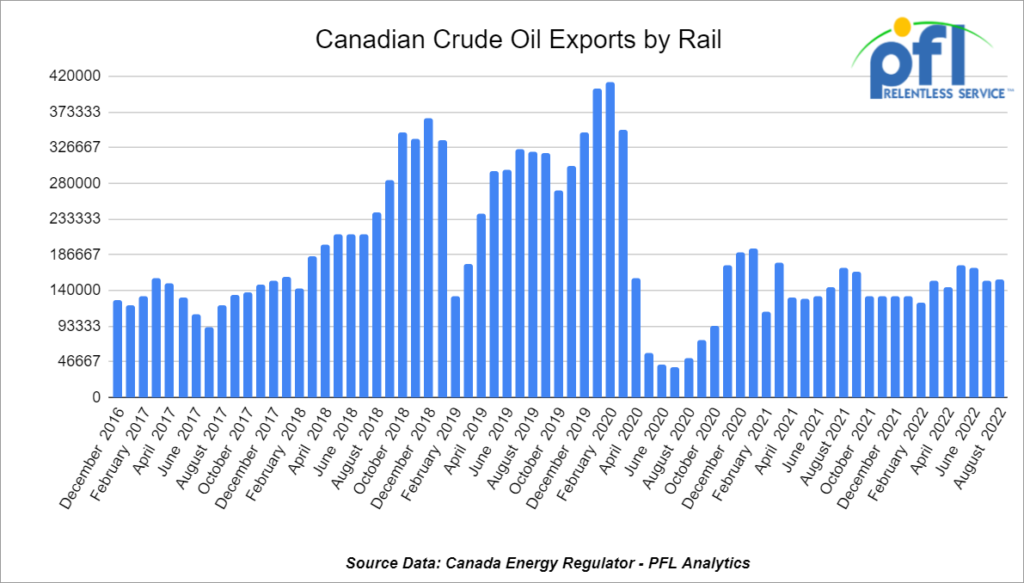

We are eyeing Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on October 23, 2022. For August 2022, Canada exported 155,146 barrels per day by rail (up by 1,954 barrels per day month over month) the first month-over-month increase in four months. Crude by rail out of Alberta has been popular of late for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. We were hoping to see month-over-month increases, but with continued competition from the U.S. government releasing heavy crude from the SPR it is difficult to get a handle on the fundamentals – Let’s see what happens after the U.S. government stops selling our strategic reserves into the gulf which has now stretched beyond the elections and into November and December. Crude by rail is also popular for off-spec products that can be blended here in the United States and in areas where there is no pipeline access. Before crude by rail out of Canada can come back in a meaningful way, supply needs to exceed pipeline capacity and we need to see a much wider basis for a sustained period of time (or at least predictable). We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins.

WCS versus WTI closed out the trading day on Friday of last week at –US$28.98 per barrel, with an implied value of $58.78 per barrel in Edmonton. Problem is, Canadian heavy delivered to the gulf traded anywhere from -US$11 to -US$20 in an unstable environment for the past month or so.

Mountain Valley Pipeline “On Hold” …Again

MVP pipeline builder halts legal effort to acquire land for NC extension. WHQR. Developers of a proposed pipeline extension that would bring natural gas to North Carolina have withdrawn legal proceedings to acquire land for the project. However, the Mountain Valley Pipeline said it’s not abandoning the $468 million project. In a federal court filing last week, the Mountain Valley Pipeline said it was dismissing eminent domain proceedings for 70 properties in Alamance and Rockingham counties in north central North Carolina. The company said it already has easements on more than 80% of the route in Virginia and North Carolina. The 75-mile MVP Southgate pipeline would be an extension of the proposed Mountain Valley Pipeline. The pipeline extension would carry fracked natural gas from Virginia into North Carolina. The proposed 75-mile Southgate pipeline would be an extension of the main $6.6 billion, 300-mile Mountain Valley Pipeline that would deliver natural gas from West Virginia into Virginia.

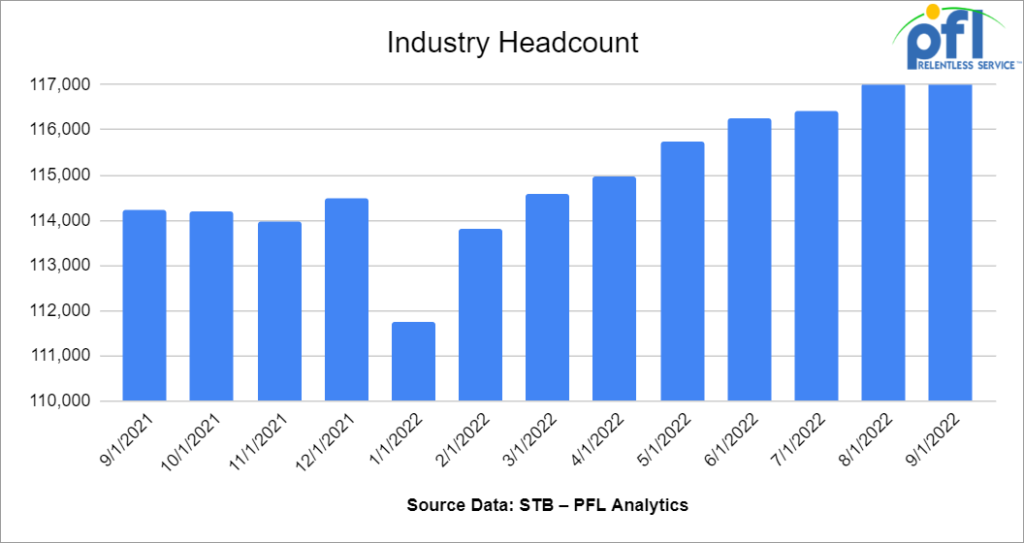

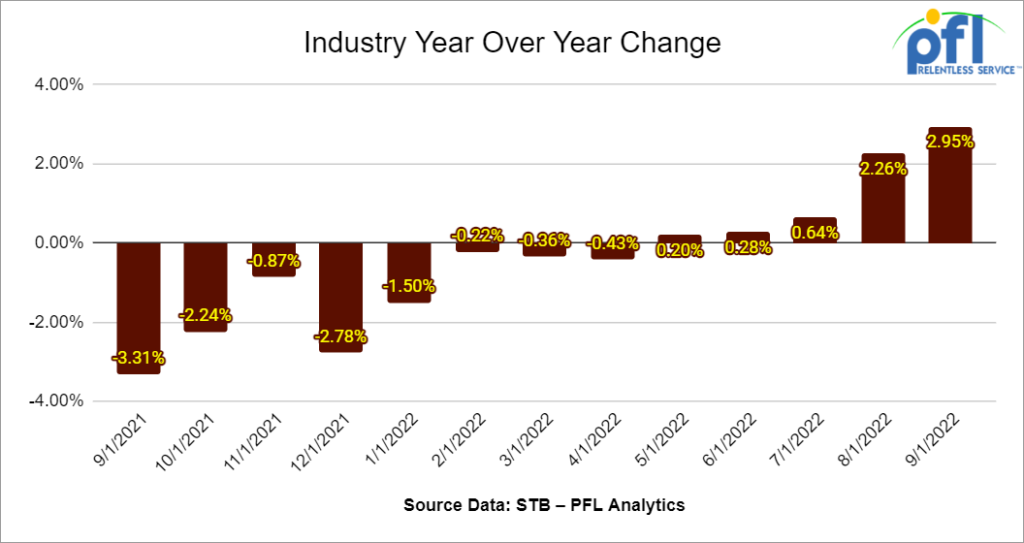

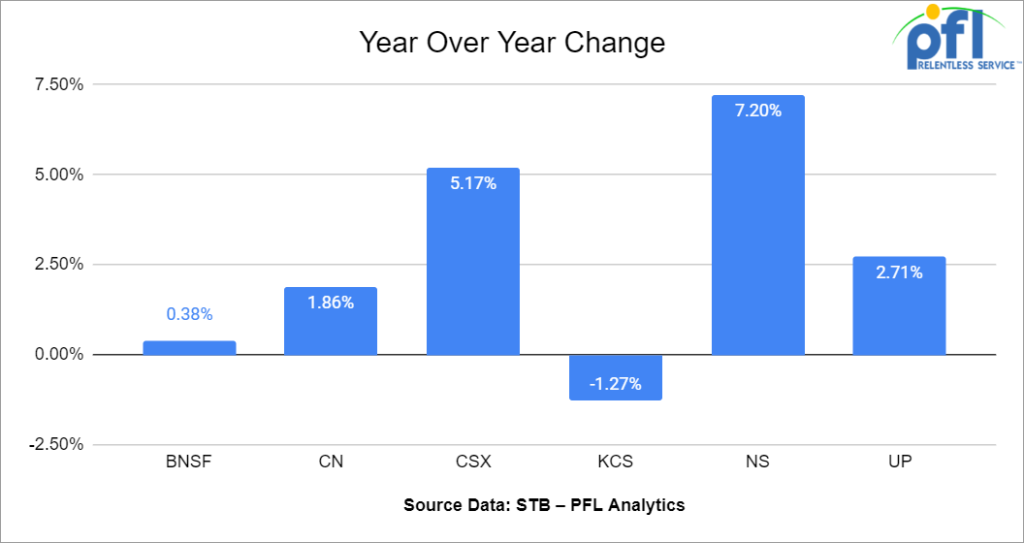

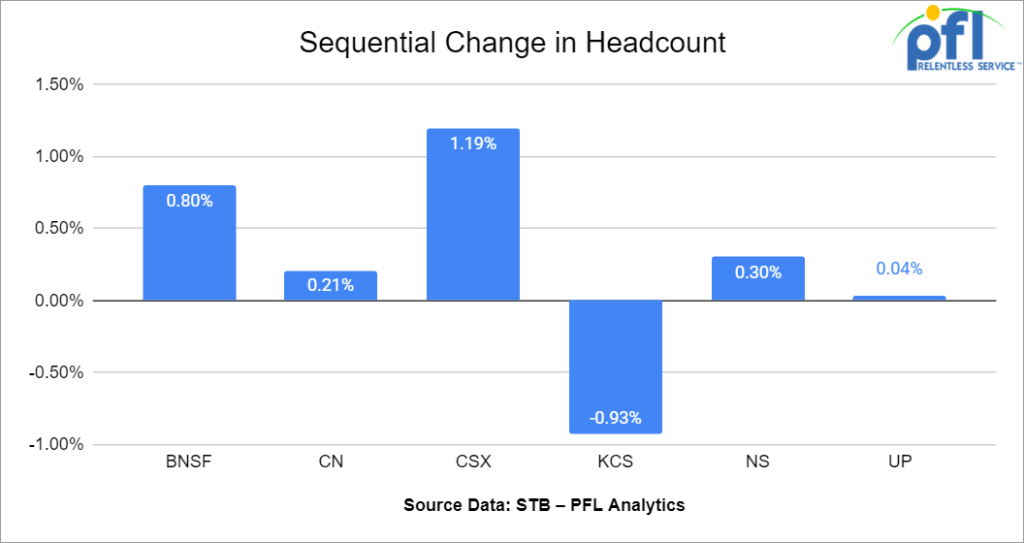

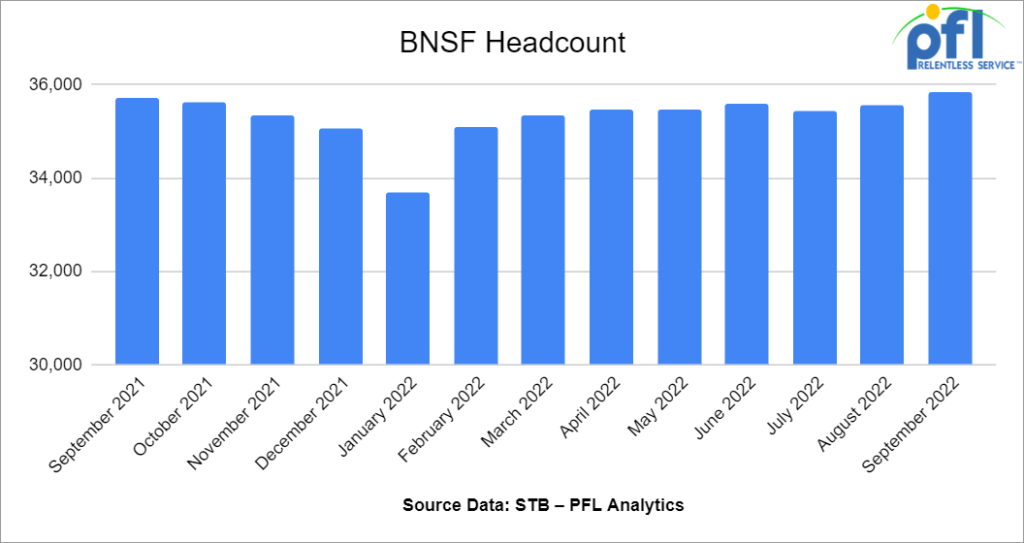

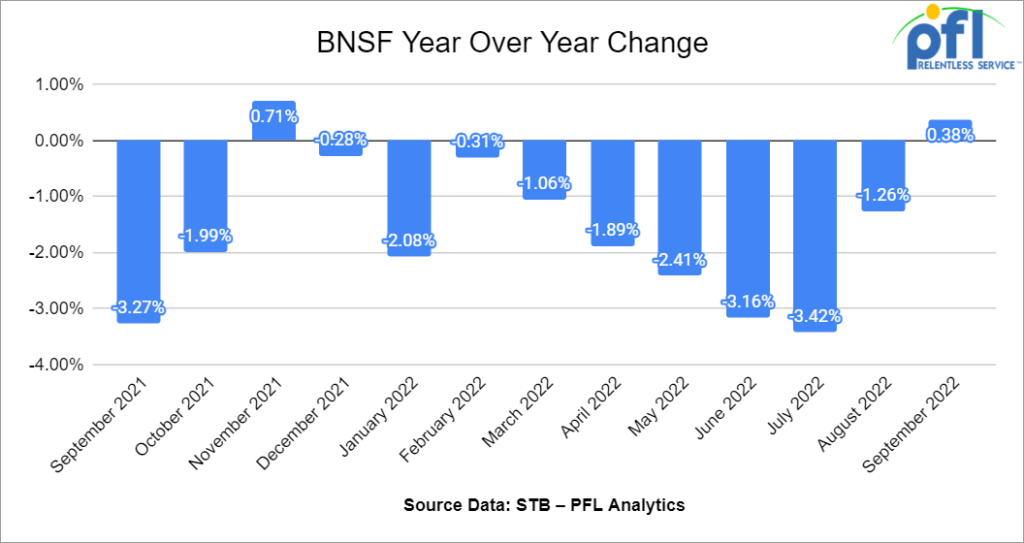

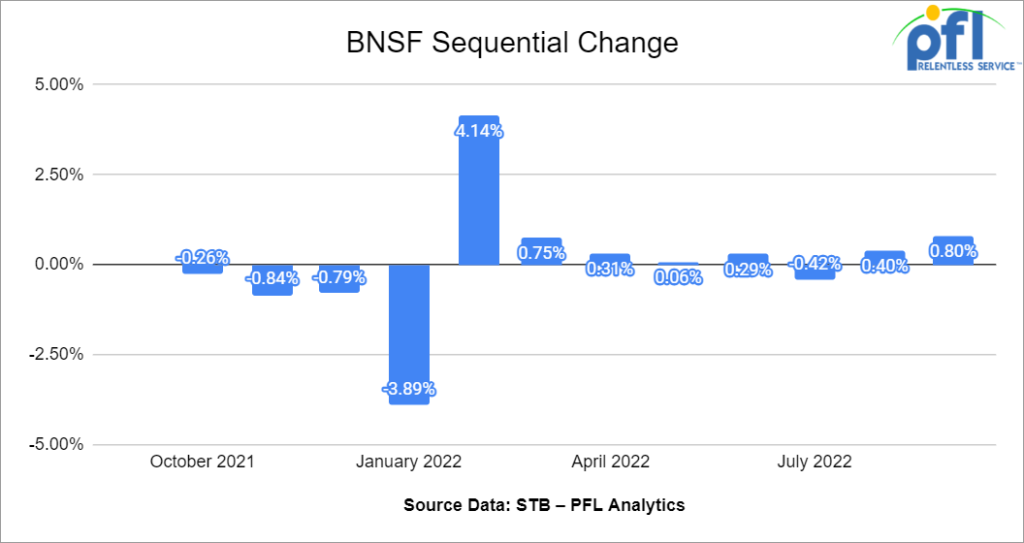

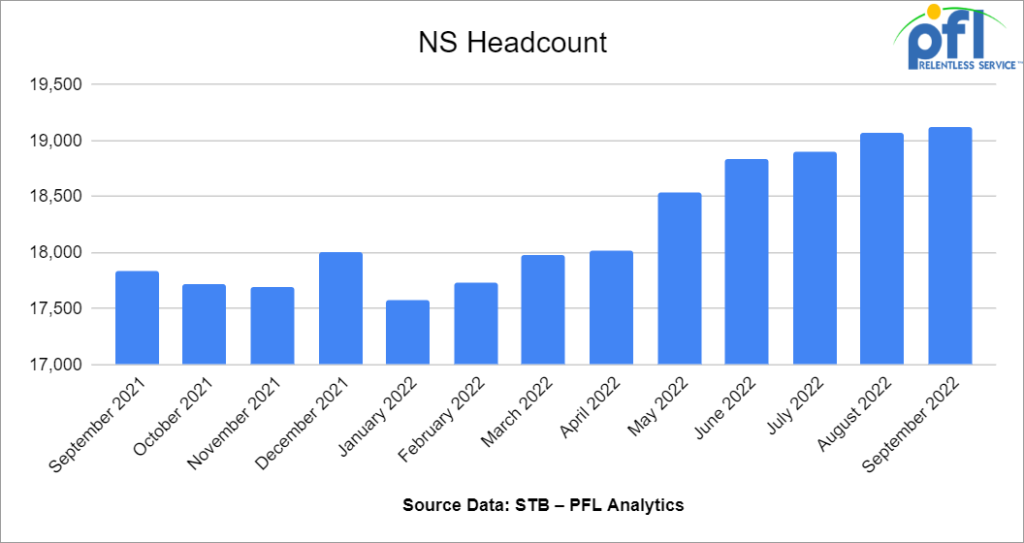

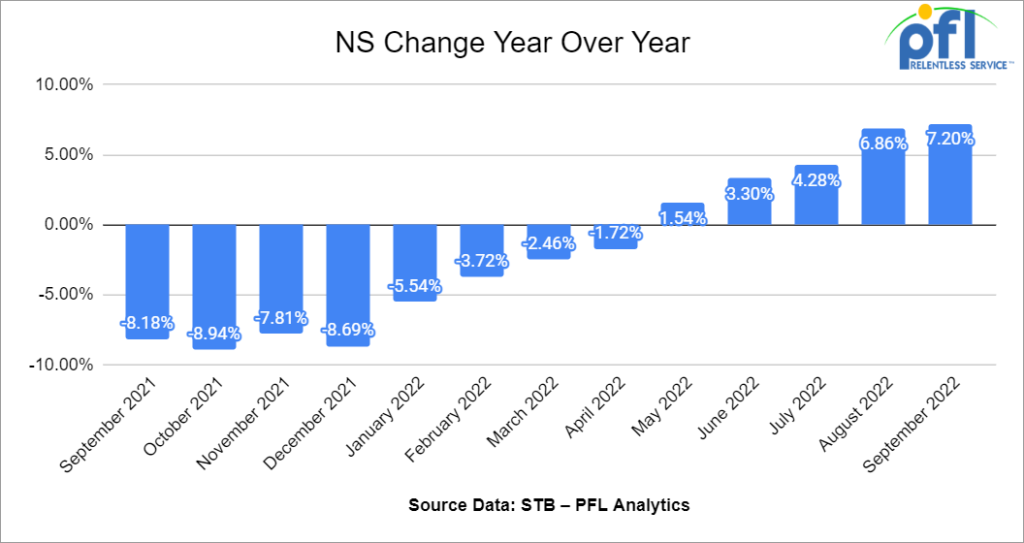

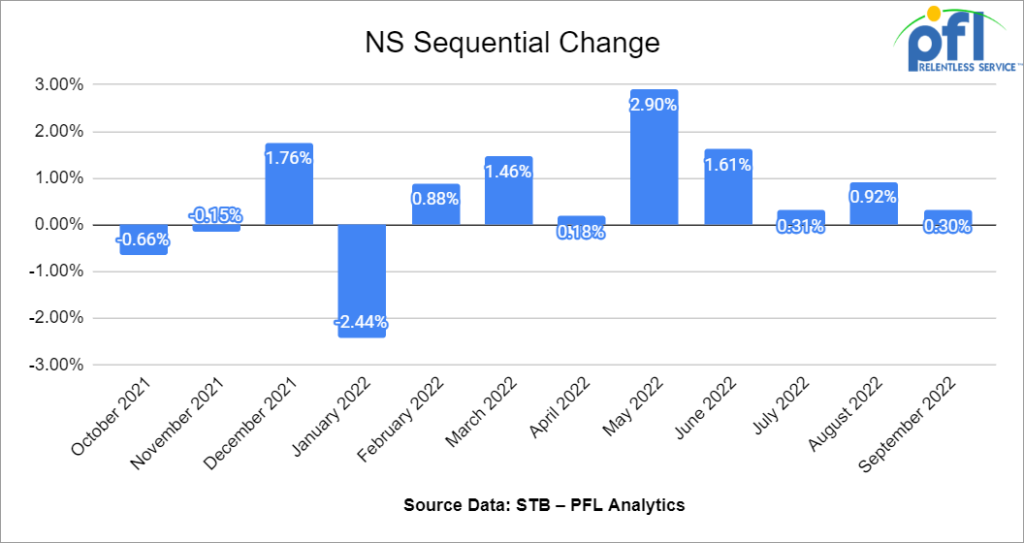

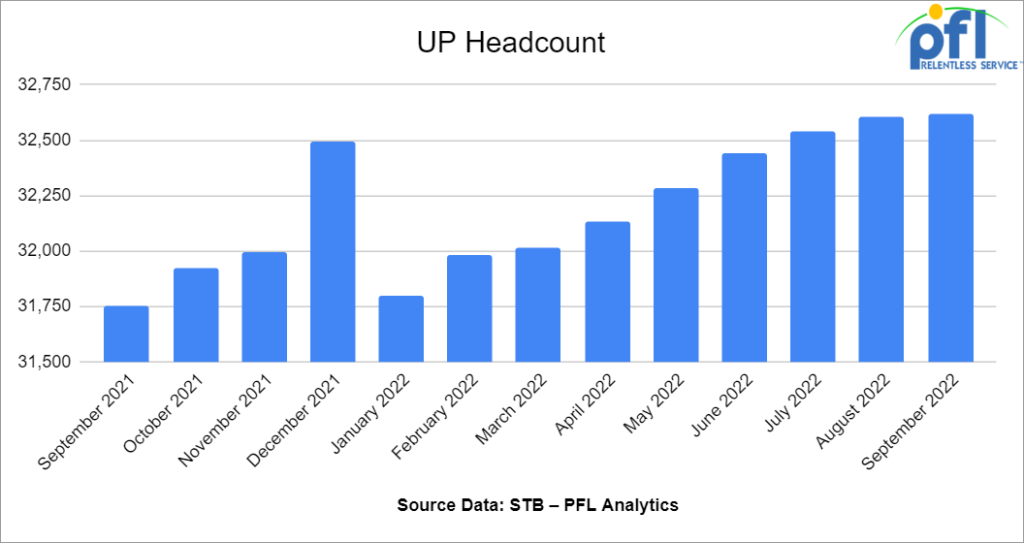

We are watching class one Industry Headcount

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 8 23.5K tanks unlined or lined in the the Mid-Atlantic for polyacrylamide on the CSX

- 30, 340Ws needed in IL for Natural Gasoline off the CN or BN. UP to 3 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 10-15, 25.5K-27k Gallon pressure cars for various commodities 5-8 year term

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6 month term, Dirty to Dirty. Can take last in Crude.

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|