Once you realize that you can do something, it would be difficult to live with yourself if you didn’t do it. – James Baldwin

Jobs Update

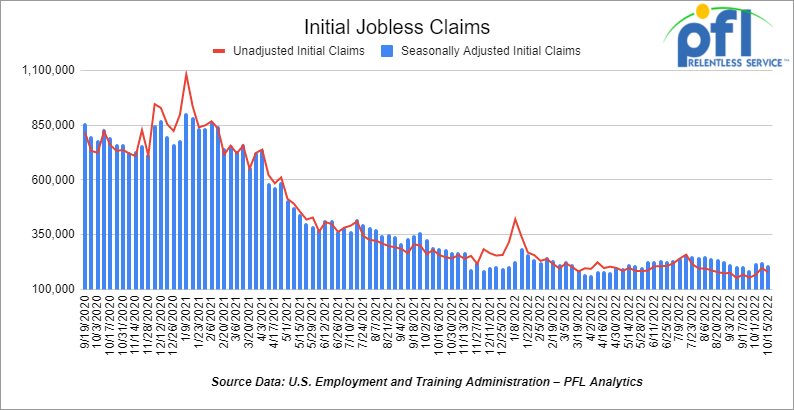

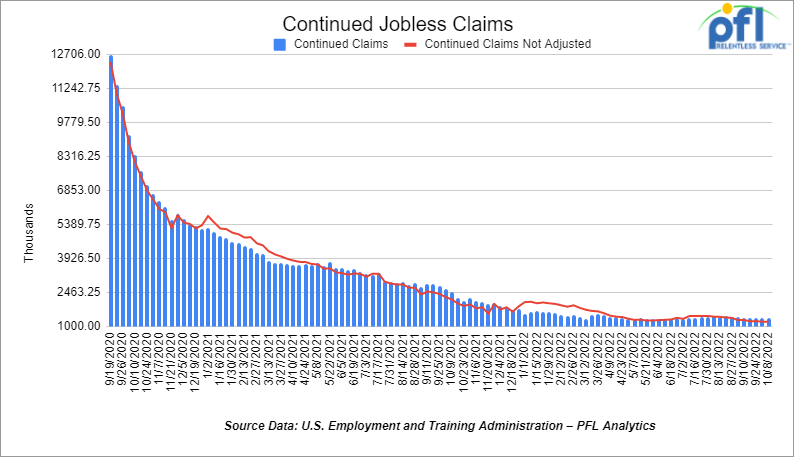

- Initial jobless claims for the week ending October 15th, 2022 came in at 214,000, down -12,000 people week-over-week.

- Continuing jobless claims came in at 1.385 million people, versus the adjusted number of 1.364 million people from the week prior, up +21,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 748.97 points (+2.47%), closing out the week at 31,082.56, up +1,447.73 points week over week. The S&P 500 closed higher on Friday of last week, up 86.97 points (+2.37%), and closed out the week at 3,752.75, up +169.68 points week over week. The NASDAQ closed higher on Friday of last week, up 244.87 points (+2.37%), and closed the week at 10,859.72, up +538.33 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 31,220 this morning up +97 points.

Oil closed higher on Friday of last week and mixed week over week

Oil prices settled higher on Friday, as hopes for stronger Chinese demand and a weakening U.S. dollar outweighed concerns about a global economic downturn and the impact of interest rates on fuel use. WTI traded up $0.54 per barrel (+0.6%) to close at $85.05 per barrel on Friday of last week, down -$0.56 per barrel week over week. Brent traded up US$1.12 per barrel (1.2%) on Friday of last week to close at US$93.50 per barrel, up $1.87 per barrel week over week.

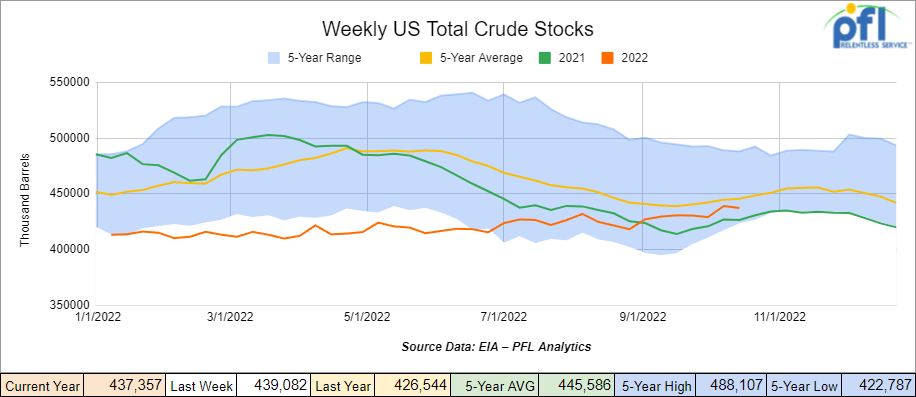

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.7 million barrels week over week. At 437.4 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

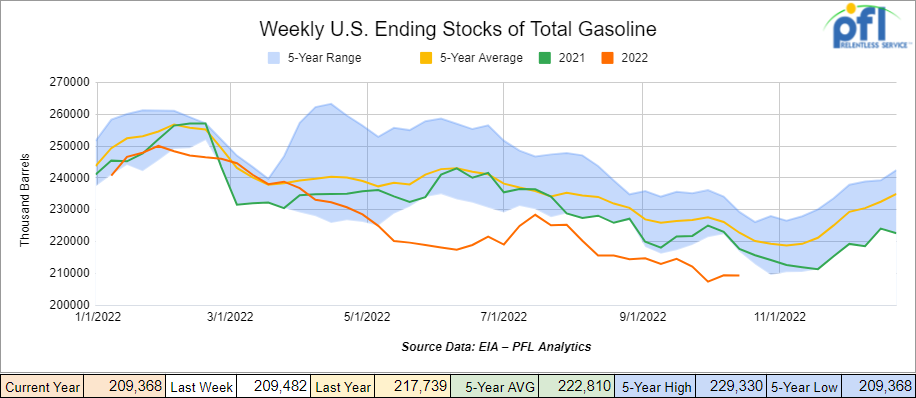

Total motor gasoline inventories decreased by 100,000 barrels week over week and are 7% below the five-year average for this time of year.

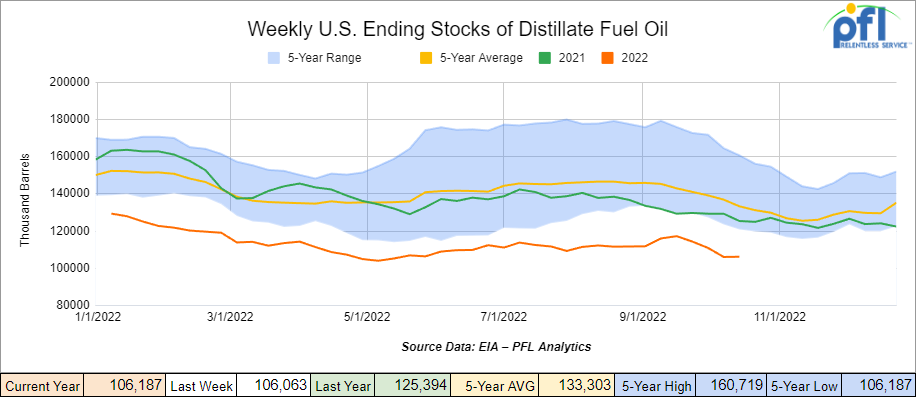

Distillate fuel inventories increased by 100,000 barrels week over week and are 20% below the five-year average for this time of year.

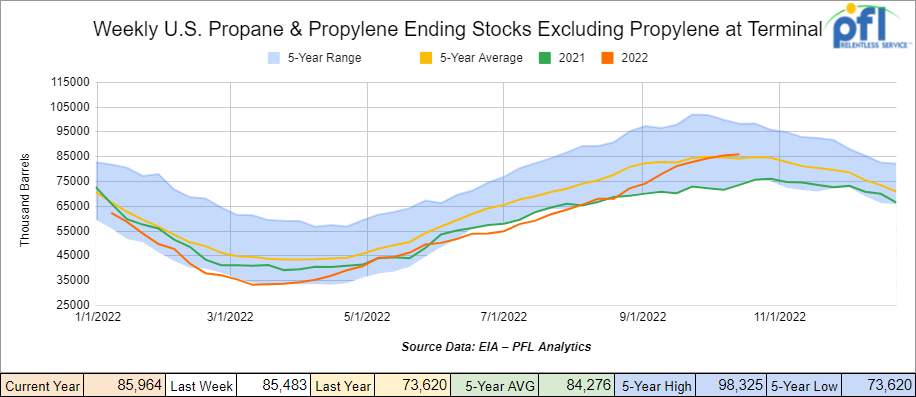

Propane/propylene inventories increased by 500,000 barrels week over week and are 2% above the five-year average for this time of year.

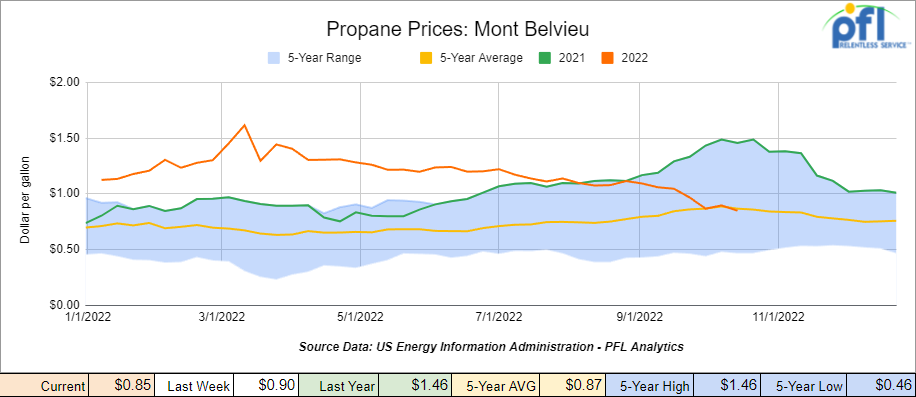

Propane prices closed at 85 cents per barrel on Friday of last week, down 5 cents per barrel week over week and down 61 cents per gallon year over year. Propane prices are so low right now, at 2 cents below the 5-year average for this time of year.

Overall, total commercial petroleum inventories decreased by 2.5 million barrels last week.

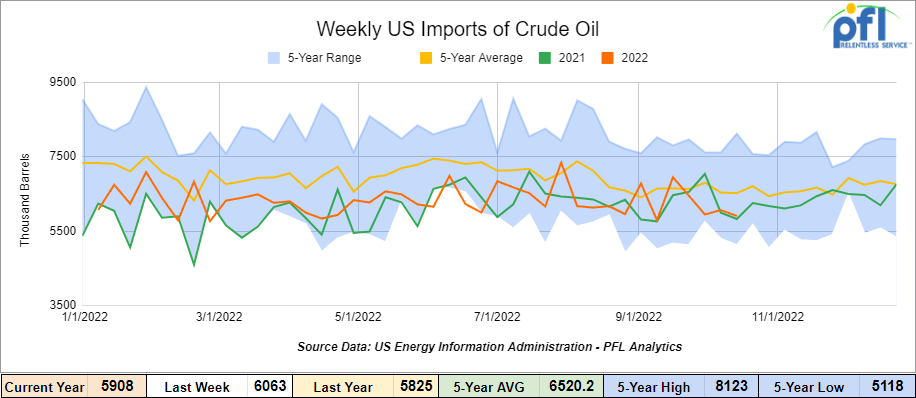

U.S. crude oil imports averaged 5.9 million barrels per day during the week ending October 14th, 2022, a decrease of 200,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 4.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 475,000 barrels per day, and distillate fuel imports averaged 111,000 barrels per day during the week ending October 14th, 2022.

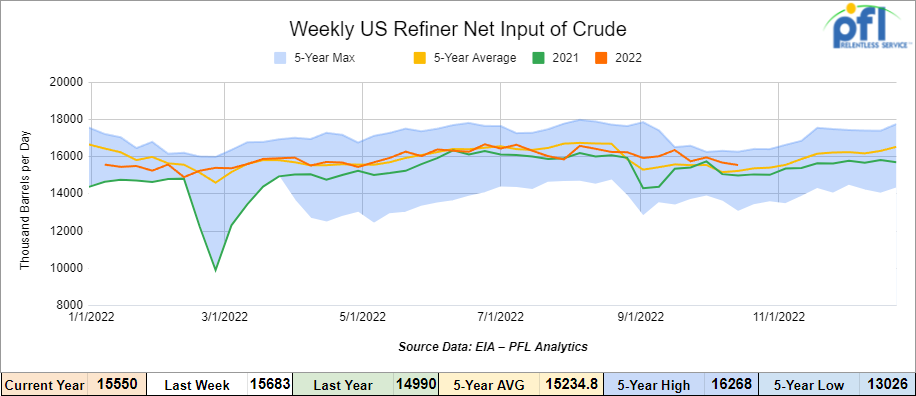

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending October 14, 2022, which was 132,000 barrels per day lower week over week.

As of the writing of this report, WTI is poised to open at $84.07, down -$0.98 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 15th, 2022.

Total North American weekly rail volumes were up (0.82%) in week 41 compared with the same week last year. Total carloads for the week ending October 15th were 353,828, up (2.5%) compared with the same week in 2021, while weekly intermodal volume was 336,899, down (-0.89%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Forest Products (-10.14%). The largest increase was from Motor Vehicles and Parts (+13.07%).

In the east, CSX’s total volumes were up (+0.89%), with the largest decrease coming from Nonmetallic Minerals (-13%) and the largest increase from Motor Vehicles and Parts (+23.0%). NS’s volumes were down (-2.07%), with the largest decrease coming from Metallic Ores and Metals (-11.58%) and the largest increases from Nonmetallic Minerals (+5.75%).

In the West, BN’s total volumes were down (-3%), with the largest decreases coming from Metallic Ores and Minerals (-22.86%), and the largest increase coming from Coal (+9.77%). UP’s total rail volumes were up (+7.66%) with the largest decrease coming from Forest Products (-26.98%) and the largest increase coming from Nonmetallic Minerals (+30.64%).

In Canada, CN’s total rail volumes were down (-2.33%) with the largest decrease coming from Other (-69.62%) and the largest increase coming from Grain (+24.69%). CP’s total rail volumes were up (+4.38%) with the largest decrease coming from Motor Vehicles and Parts (-16.63%) and the largest increase coming from Grain (+24.69%).

KCS’s total rail volumes were up (+9.6%) with the largest decrease coming from Other (-9.48%) and the largest increase coming from Motor Vehicles and Parts (+65.26%).

Source Data: AAR – PFL Analytics

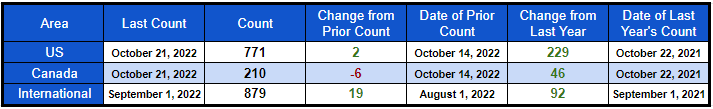

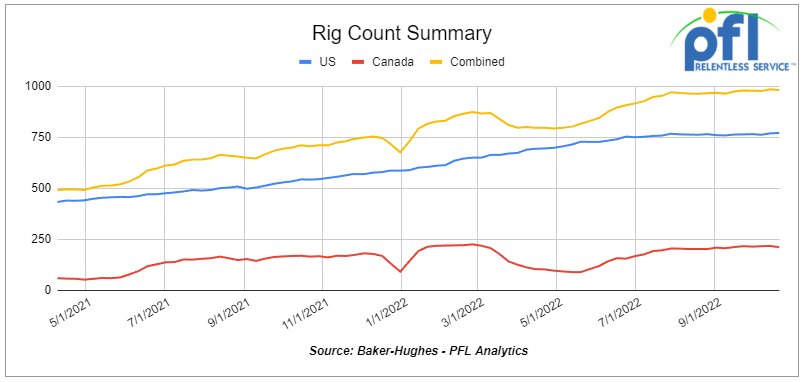

Rig Count

North American rig count was down by -4 rigs week over week. U.S. rig count was up by +2 rigs week-over-week and up by +229 rigs year over year. The U.S. currently has 771 active rigs. Canada’s rig count was down by -6 rigs week-over-week, and up by 46 rigs year-over-year. Canada’s overall rig count is 210 active rigs. Overall, year over year, we are up +275 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,786 from 23,689 which was a gain of 97 railcars week-over-week. The third week in a row of week-over-week gains. Canadian volumes declined; CP’s shipments declined by -1.6% week over week, and CN’s volumes were down by -7.4% week over week. U.S. shipments were mostly lower. The CSX had the largest percentage increase, up by +5.1%, and the NS had the largest percentage decrease and was down by -9.4%. Differentials between WTI and WCS, both in the Gulf and Edmonton, continue to be headwinds for crude by rail out of Canada with the basis in Alberta continuing to hover at US -$30 per barre.l WCS vs WTI in the gulf delivered is roughly US-$20 per barrel. On a side note, appropriation on Enbridge’s system came in at 2% for the month of November meaning that shippers on that pipeline for the month of November can ship 98% of their desired volume.

President Biden, in his wisdom, decided since it worked so well last time to sell more of our strategic reserves On Wednesday of last week the DOE said: “THE U.S. DEPARTMENT OF ENERGY ANNOUNCES CONTINUED ACTION TO PROTECT AMERICAN CONSUMERS AND ADDRESS GLOBAL SUPPLY DISRUPTION CAUSED BY PUTIN’S ENERGY PRICE HIKE.”

DOE will issue a Notice of Sale for Crude Oil from the Strategic Petroleum Reserve, finalizing the rule to replenish this critical tool for addressing global supply disruption and enhancing energy security. WASHINGTON, D.C. — The U.S. The Department of Energy’s (DOE) Office of Petroleum Reserves announced that a Notice of Sale of up to 15 million barrels of crude oil to be delivered from the Strategic Petroleum Reserve (SPR) in December 2022 will go live at 10:00 am on October 19, 2022. This Notice of Sale will fulfill President Biden’s announcement on March 31, 2022, authorizing the sale of up to 180 million barrels of crude oil from the SPR to help address the significant market supply disruption caused by Putin’s war on Ukraine and aid in lowering energy costs for American families.” The problem is this crude oil competes against Canadian heavy forcing oil back to Alberta while we deplete our reserves. Given that the Saudis already cut oil production to compensate for the last round of sales by the administration, we find it hard to see how a second round will be impactful except for making America weaker down the road when we really need oil. The only logical path forward is to increase natural gas and oil production here at home. Unfortunately, it seems to us that the administration is working against the industry to make this a reality.

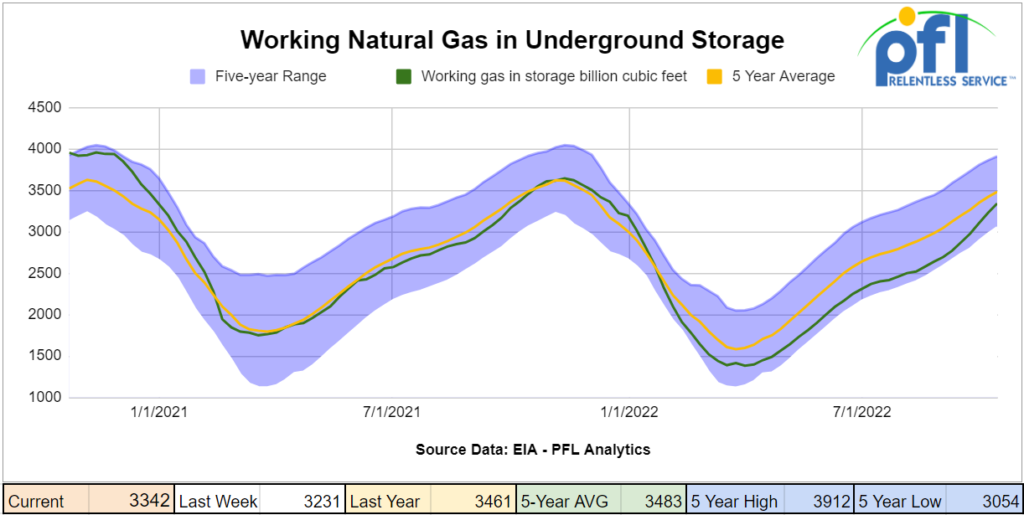

We Continue to watch Natural Gas

Folks, NatGas storage continues to fill up. U.S natural gas just like propane is filling quickly and prices are dropping as a result. The industry pumped 111 bcf into U.S. storage facilities week over week, according to Energy Information Administration (“EIA”) data released Thursday of last week. It was also the fifth week in a row that stockpiles increased by over 100 bcf. We are now only 141 bcf below the five-year average for this time of year and the weather is not cooperating if you are a bull. On the back of the build and milder weather, U.S. NatGas fell 4% lower week over week to a 3-mth low. Global LNG prices saw a similar fate and have been declining for weeks. U.S. gas prices have been declining for eight weeks as record domestic output and reduced liquefied natural gas (LNG) exports have allowed utilities to inject much more gas than usual into storage. Major LNG outages include Berkshire Hathaway Energy’s shutdown of its 0.8 bcfd Cove Point LNG export plant in Maryland for three weeks of planned maintenance on Oct. 1 and the continuing shutdown of Freeport LNG’s 2.0-bcfd plant in Texas for unplanned work after an explosion on June 8. Freeport expects the facility to return to at least partial service in early to mid-November.

Front-month gas futures fell 1.9% to settle at $5.358 per million British thermal units (“mmbtu”), after sliding to $5.253 per mmBtu earlier in the session on Friday of last week.

Despite all the natural gas out there, people in New England risk blackouts this winter due to the lack of pipeline infrastructure which is predicted to have a strain on New England power producers. Go figure!

We were at the Tank Car Committee Meeting

Folks, we were at the tank car committee meeting in full force in Dallas last week handing out to the people PFL Stress Putty (because rail is stressful) and eyeglass cleaning cloths (because people need to see clearly when they read) and of course some PFL marketing material (because we are always looking to grow our business).

Bottom line changes are coming (big surprise), it was a great meeting and lots of people turned out. Call PFL today for further details!

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 8 23.5K tanks unlined or lined in the the Mid-Atlantic for polyacrylamide on the CSX

- 30, 340Ws needed in IL for Natural Gasoline off the CN or BN. UP to 3 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 10-15, 25.5K-27k Gallon pressure cars for various commodities 5-8 year term

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6 month term, Dirty to Dirty. Can take last in Crude.

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape..

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|