Millions saw the apple fall, but Newton was the one who asked why.

-Bernard Baruch

Jobs Update

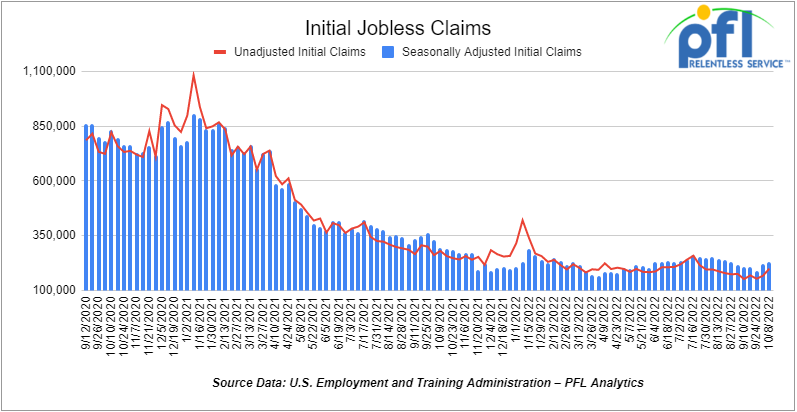

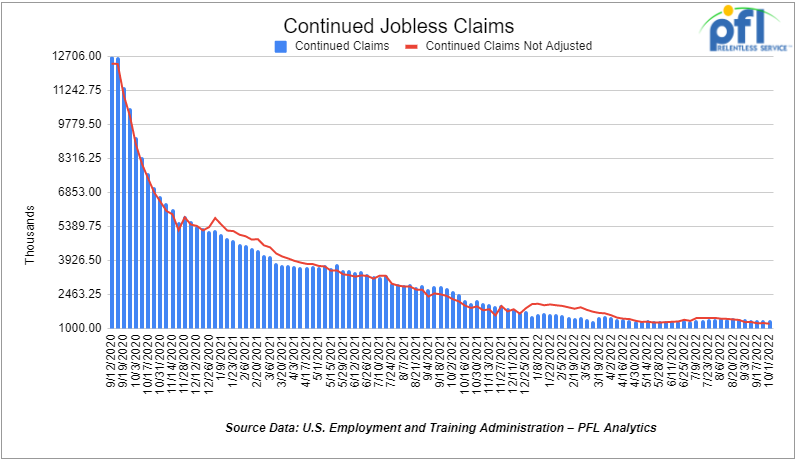

- Initial jobless claims for the week ending October 8th, 2022 came in at 228,000, up +9,000 people week-over-week.

- Continuing jobless claims came in at 1.368 million people, versus the adjusted number of 1.365 million people from the week prior, up +3,000 people week over week.

Stocks closed lower on Friday of last week and for the most part, down week over week

The DOW closed lower on Friday of last week, down -403.89 points (-1.34%), closing out the week at 29,634.83, up +338.04 points week over week. The S&P 500 closed lower on Friday of last week, down -86.84 points (-2.37%) and closed out the week at 3,583.07, down -56.59 points week over week. The NASDAQ closed lower on Friday of last week, down -327.76 points (-3.08%), and closed the week at 10,321.39, down -331.02 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 29,980 this morning up 272 points.

Oil closed lower on Friday of last week and lower week over week

Opec + decided on Wednesday of last week to cut target production by 2 million barrels per day and that decision spurred a flurry of activity in the options market,but with more people buying options from a bearish stance in the form of buying put options. Producers are either bearish from increased downside risk due to forecasted weaker demand and demand destruction or view the premiums paid for the puts are not as significant when looking at other options to hedge production. Some companies have been really hurt this year, locking in outright price hedges or over hedging if you can call it that.

WTI traded down -$3.5 per barrel (-3.9%) to close at $85.61 per barrel on Friday of last week, down -$7.03 per barrel week over week. Brent traded down US-$2.94 per barrel (-3.1%) on Friday of last week to close at US$91.63 per barrel, down -$6.29 per barrel week over week.

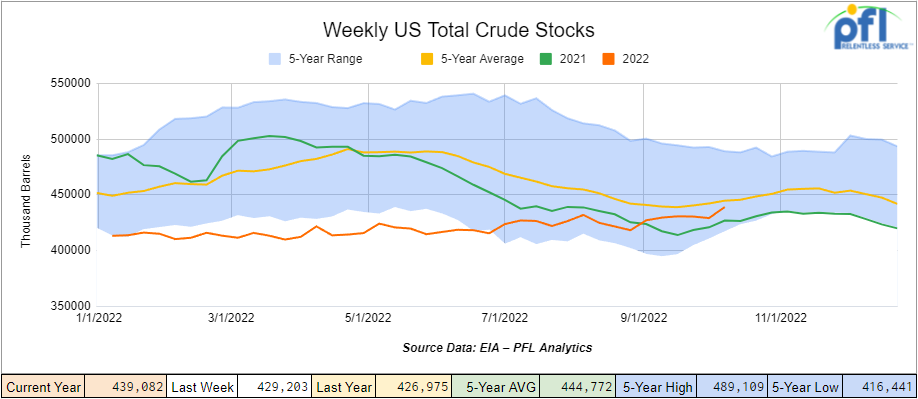

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 9.9 million barrels week over week. At 439.1 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

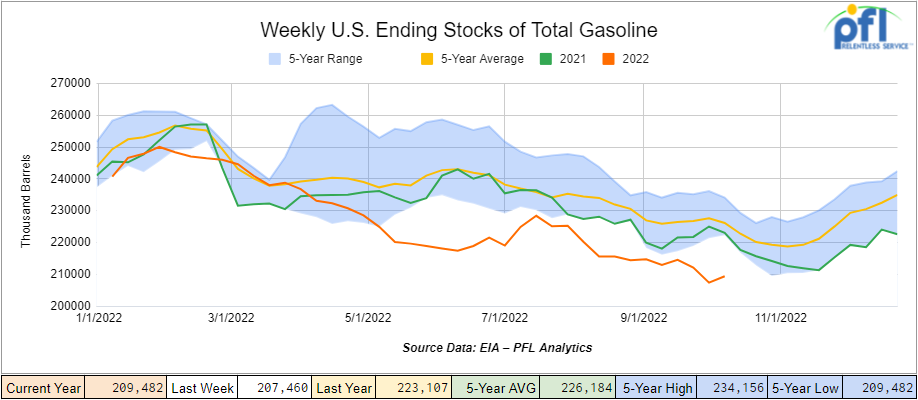

Total motor gasoline inventories increased by 2 million barrels week over week and are 8% below the five-year average for this time of year.

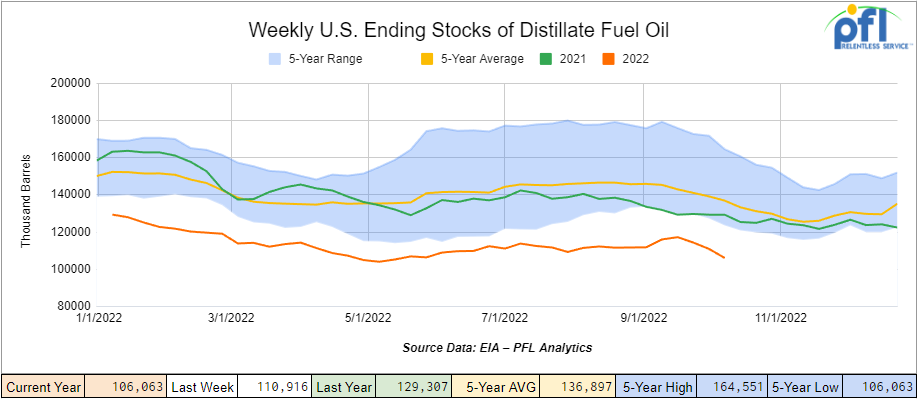

Distillate fuel inventories decreased by -4.9 million barrels week over week and are 23% below the five-year average for this time of year.

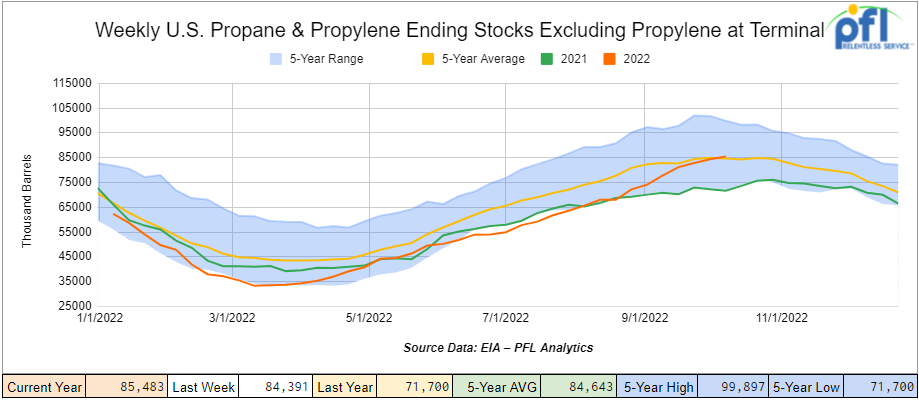

Propane/propylene inventories increased by 1.1 million barrels week over week and are 1% above the five-year average for this time of year.

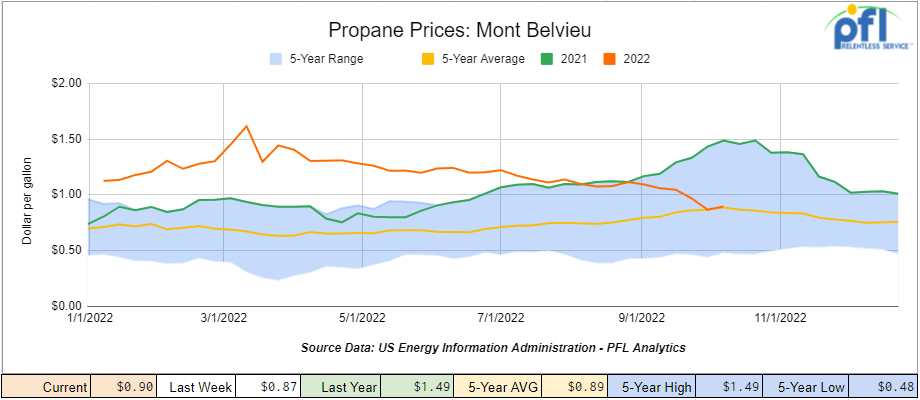

Propane prices traded up 3 cents week over week closing at 90 cents per gallon on Friday of last week, but down 59 cents year over year and are pretty much at the 5-year price average for this time of year. Propane is really the only cheap commodity out there right now!

Overall, total commercial petroleum inventories increased by 8.0 million barrels last week.

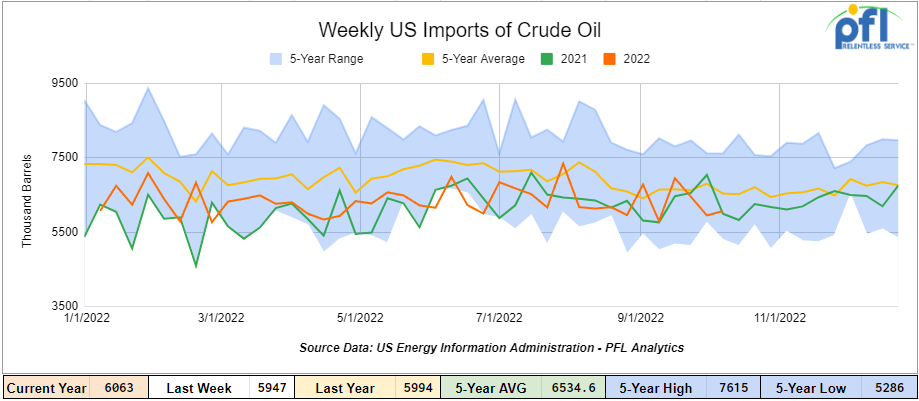

U.S. crude oil imports averaged 6.1 million barrels per day during the week ending October 7th, 2022, an increase of 100,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 2.5% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 699,000 barrels per day, and distillate fuel imports averaged 79,000 barrels per day during the week ending October 7th, 2022.

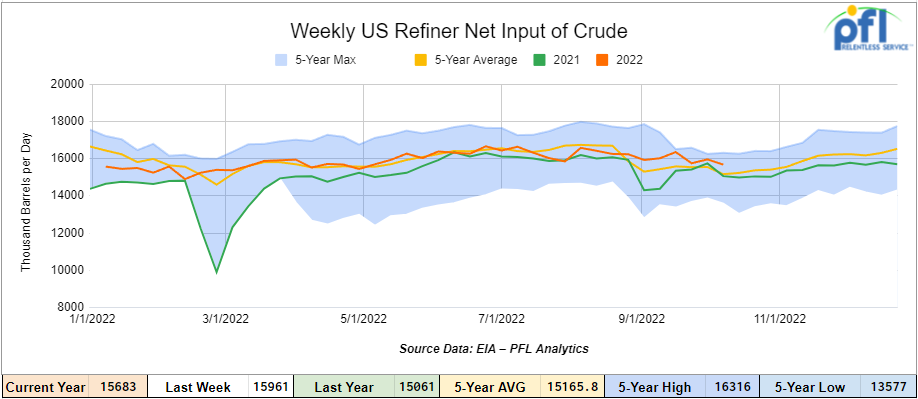

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending October 7, 2022 which was 279,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $85.57, down -$0.04 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 8th, 2022.

Total North American weekly rail volumes were down (-1.96%) in week 40 compared with the same week last year. Total carloads for the week ending October 8th were 348,975, down (-0.88%) compared with the same week in 2021, while Weekly intermodal volume was 333,489, down (-3.06%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Chemicals (-7.97%). The largest increase was from Motor Vehicles and Parts (+16.30%).

In the east, CSX’s total volumes were down (-2.22%), with the largest decrease coming from Nonmetallic Minerals (-25.63%) and the largest increase from Coal (+10.79%). NS’s volumes were down (-3.01%), with the largest decrease coming from Chemicals (-14.14%) and the largest increases from Petroleum and Petroleum Products (+17.12%).

In the west, BN’s total volumes were down (-4.92%), with the largest decreases coming from Forest Products (-16.28%) and Metallic Ores and Minerals (-15.39%), and the largest increase coming from Motor Vehicles and Parts (+19.83%). UP’s total rail volumes were up (+3.32%) with the largest decrease coming from Grain (-20.86%) and the largest increase coming from Motor Vehicles and Parts (+35.95%).

In Canada, CN’s total rail volumes were down (-4.47%) with the largest decrease coming from Other (-43.40%) and the largest increase coming from Motor Vehicles and Parts (+35.01%). CP’s total rail volumes were down -5.29% with the largest decrease coming from Metallic Ores and Metals (-49.46%) and the largest increase coming from Other (+48.61%).

KCS’s total rail volumes were up (+2.49%) with the largest decrease coming from Farm Products (-18.50%) and largest increase coming from Motor Vehicles and Parts (+127.89%).

Source Data: AAR – PFL Analytics

Rig Count

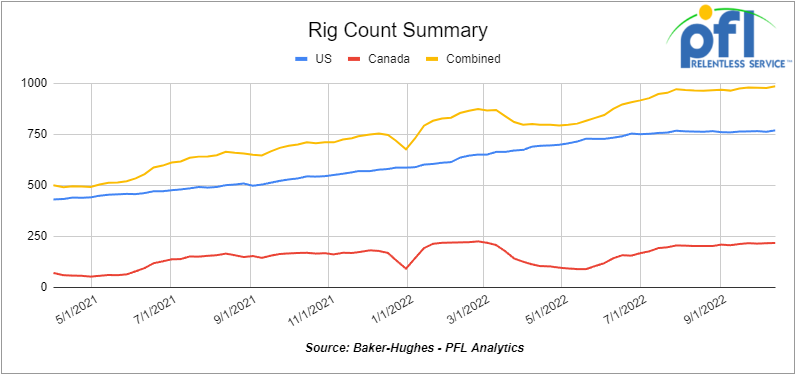

North American rig count was up by +8 rigs week over week. U.S. rig count was up by +7 rigs week-over-week and up by +226 rigs year over year. The U.S. currently has 769 active rigs. Canada’s rig count was up by +1 rigs week-over-week, and up by 48 rigs year-over-year. Canada’s overall rig count is 216 active rigs. Overall, year over year, we are up +274 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,689 from 23,257 which was a gain of 432 railcars week-over-week. For the second week in a row, we saw week-over-week gains. Canadian volumes rose, CP’s shipments rose by +0.5% week over week, and CN’s volumes were up by +5.9% week over week. U.S. shipments were mostly lower. The UP had the largest percentage increase, up by +21.9%, and the NS had the largest percentage decrease and was down by -16.8%.

We are Watching Natural Gas and Natural Gas Liquids

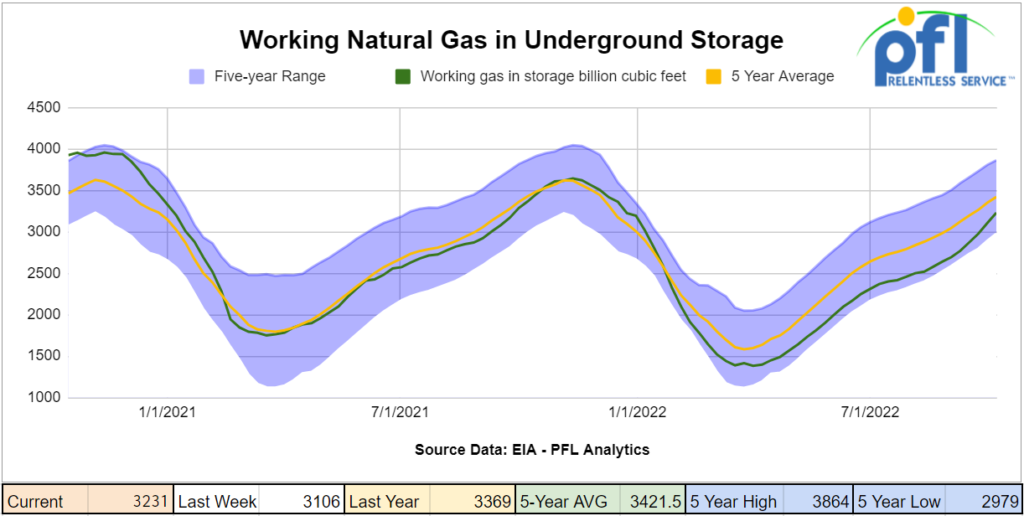

Folks, NatGas storage is filling up. U.S natural gas just like propane is filling quickly and prices are dropping as a result. The industry pumped 460 bcf into U.S. storage facilities over the past month, the largest four-week build of the shale era, according to Energy Information Administration (“EIA”) data released Thursday of last week. Injections of gas into underground caverns and salt dome facilities by traders hoping to sell the fuel for higher prices this winter has reduced half the deficit to normal inventories of late.

Henry Hub is now forecasted to average $7.40 per MMBTU in 4th quarter according to the EIA. The EIA expects U.S. households to spend more on energy this winter compared with the 2021-22 heating season, with the largest increase for homes that heat with natural gas. We don’t know about that one, heating oil is getting really expensive!

In other Natural Gas related news EQT Reported a $1.6 billion loss in the 3rd quarter on Natural Gas Derivatives. EQT Corp. said in a regulatory filing late Tuesday of last week it expects to report steep losses on derivatives for the third quarter as U.S. natural gas prices have hit their highest levels in more than a decade.

In a Form 8-K filed with the U.S. Securities and Exchange Commission, EQT forecast a $1.6 billion loss on derivatives for 3Q2022 and a $5.5 billion loss through the first nine months of the year. EQT, the country’s largest natural gas producer, also said it expects to report more than $2 billion in cash payments to settle derivatives during the third quarter, bringing the total to $4.7 billion through the first nine months of 2022.

On a more positive note, EQT, TC Energy and Williams created a coalition for LNG Exports. The U.S. natural gas heavyweights launch a coalition to export more LNG. EQT has teamed up with midstreamers TC Energy Corp. and Williams to establish a coalition that will focus on increasing American LNG exports to help displace dirtier fuels abroad and lower greenhouse gas emissions. The Partnership to Address Global Emissions, (“PAGE”), would help develop and promote policies aimed at developing the infrastructure needed to increase liquefied natural gas production and export it. EQT, TC Energy, and Williams are PAGE’s founding members. The Progressive Policy Institute, Trade Unions, and Academia would also serve on an advisory council and provide guidance to the coalition and its members. LNG exports are expected to average 12.7 Bcf/d next year, according to the EIA. Peak U.S. export capacity is also on track to exceed 18 Bcf/d by 2025. Exciting stuff for Natural gas, EQT, and rail for LPG’s.

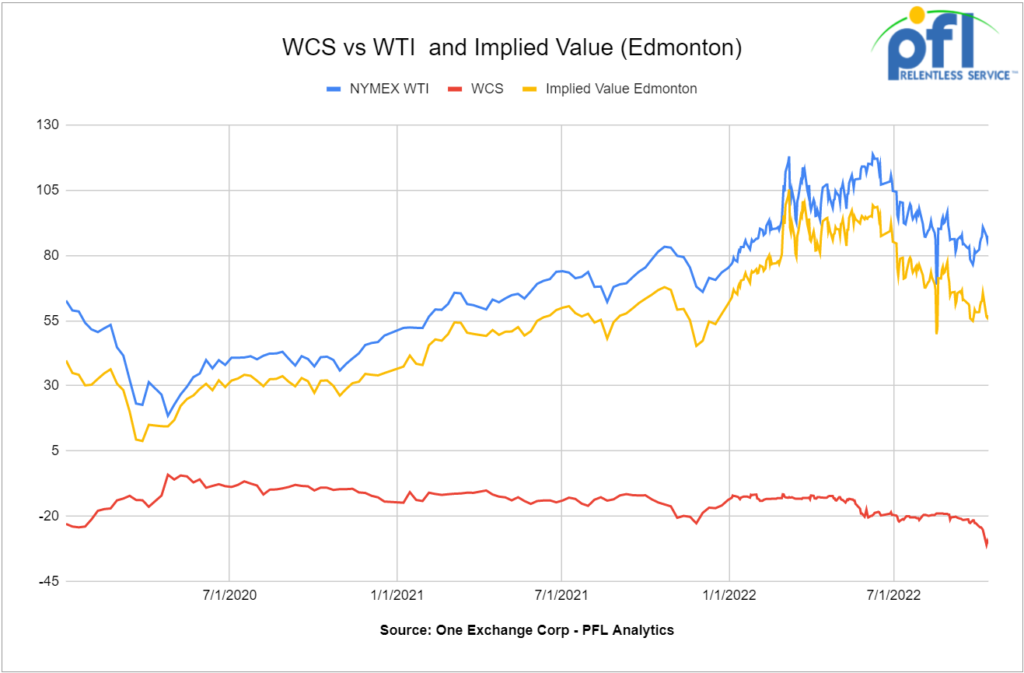

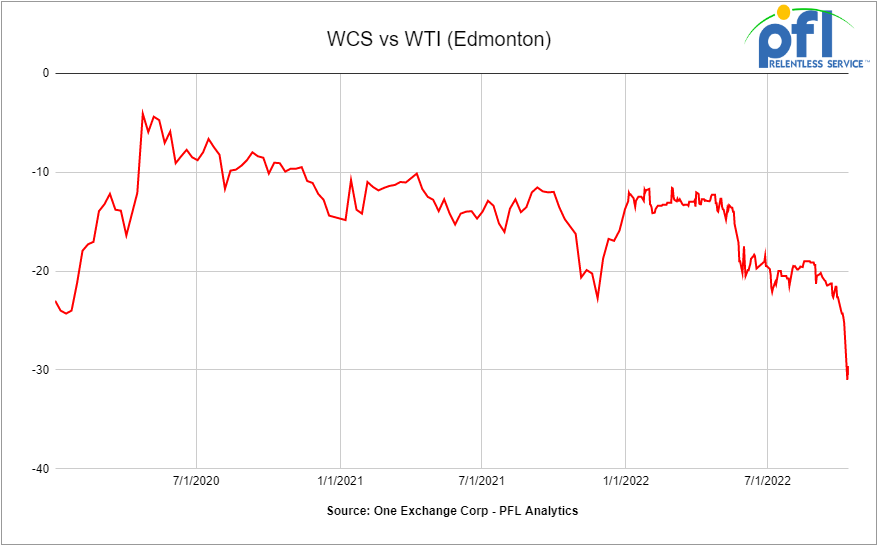

We are Watching WCS vs. WTI in Edmonton and in the Gulf

The widening of the West Texas Intermediate (WTI) vs Western Canadian Select (WCS) differential continues unabated and shows little sign that it will correct to more historic norms anytime soon. There are many factors affecting not only WTI against WCS in Edmonton but also WCS against WTI on a delivered basis in the gulf which hit historic low levels last week.

CanOils CCI for November delivery settled Friday at US$29.75 below the WTI-CMA. The implied value was US$54.59 per barrel. On Thursday, it settled at US$30.50 per barrel below the WTI-CMA for November delivery. The implied value was US$57.08 per barrel. That same basis fetched roughly US-$20 per barrel in the gulf delivered leaving only roughly a $10 transportation Arb. Normally basis in the gulf for WCS trades between US-$10.00 per barrel and US+$3.00 per barrel.

We talked to Perry Undseth on Friday of last week, President of One Exchange Corp. whose company is the largest data contributor to the CCI and he noted the widening of the WTI-WCS differentials began to really surface late last month and has continued to surge over the past few weeks.

“It was near the end of September when we started seeing a bit more pressure — it went up to US -$21.50. And then by the time the October cycle started going, it jumped right out of the gate and started trading at US-24 per barrel. Since then, this week it’s just been on a slide,” he said.

We asked Perry for the cause. Some people are pointing to the low water levels in the Mississippi and saying that is a big problem and it is a big problem. However, there is a combination of things going on right now, he added. BP’s Whiting refinery in Indiana had problems. Those barrels that were being directed to the Whiting refinery made their way to storage. The BP whiting refinery consumes 72,000 barrels a day of Canadian Heavy. Storage is also being added at Cushing and the fact that the U.S. is selling from the SPR and growing Canadian production is not helping matters. It all adds up.

“I’m not sure this is a one-month problem. I’m not sure we’ll see US$-34.50 (the low) again, but we could.”

Adding to the issue for Canadian heavy producers is that heavy-sour Mexican volumes are now increasingly making their way into the Gulf meaning more competition is pitted against Canadian heavy oil and end markets.

One thing we are keeping close tabs on is the U.S. and its negotiations with Venezuela regarding them bringing in some opposition into the government and them having freer elections in 2024. In return, Chevron Corporation, which was one of the largest owners and operators of crude in Venezuela, would be allowed to go back in and rehabilitate the fields and get that production moving again to the Gulf Coast. If this were to happen this could put a lot of pressure on Heavy in the gulf. Stay tuned to PFL for further updates, but for now looks like crude by rail out of Alberta looks bleak unless you are shipping non-diluted bitumen.

Honeywell announced on October 10th a new, innovative ethanol-to-jet fuel (ETJ)

We found this one interesting and a plus for rail. Honeywell has developed a technology that allows producers to convert corn-based, cellulosic, or sugar-based ethanol into sustainable aviation fuel (SAF). Depending on the type of ethanol feedstock used, jet fuel produced from Honeywell’s ethanol-to-jet fuel process can reduce greenhouse gas (GHG) emissions by 80% on a total lifecycle basis, compared to petroleum-based jet fuel 1.

Demand for SAF continues to grow, yet the aviation industry is challenged by limited supplies of traditional SAF feedstocks such as vegetable oils, animal fats, and waste oils. Ethanol offers producers a widely available, economically viable feedstock. Honeywell’s ready now and the technology uses high-performance catalysts and heat management capabilities to maximize production efficiency, resulting in a cost-effective, lower carbon-intensity aviation fuel.

“Honeywell pioneered SAF production with its Ecofining™ technology, and our new ethanol-to-jet fuel process builds on that original innovation to support the global aviation sector’s efforts to reduce GHG emissions and meet SAF production targets with an abundant feedstock like ethanol,” said Barry Glickman, vice president, and general manager, Honeywell Sustainable Technology Solutions. “Honeywell’s ethanol-to-jet process, when used as a standalone or when coupled with Honeywell carbon capture technology, is ready now to provide a pathway to lower carbon-intensity SAF.”

SAF plants using Honeywell’s technology can be modularized off-site enabling lower installed costs and faster, less labor-intensive installation compared to job site construction. By utilizing Honeywell’s ETJ technology and an integrated, modular construction approach, producers can build new SAF capacity more than a year faster than is possible with traditional construction approaches.

According to Honeywell petroleum refiners and transportation fuel producers can also benefit from Honeywell’s ETJ design that is purpose-built to enable conversion of current or idle facilities into SAF production plants, potentially maximizing use of exiting sites for SAF production to meet the growing market demand.

In 2021, the Biden Administration announced its Sustainable Aviation Fuel (SAF) Grand Challenge for the U.S. aviation fuel supply sector to produce at least three billion gallons of SAF per year by 2030 and reduce emissions from aviation by 20%, with an eventual goal of meeting 100% of U.S. aviation fuel demand with SAF by 2050. Also in 2021, the European Council released its ‘Fit for 55’ package which aims to increase the share of sustainable fuels at EU airports from a minimum of 2% in 2025 to at least 63% by 2050. These and other incentives, including the Inflation Reduction Act, accelerate the need for alternative SAF feedstocks to meet demand.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 8 23.5K tanks unlined or lined in the the Mid-Atlantic for polyacrylamide on the CSX

- 30, 340Ws needed in IL for Natural Gasoline off the CN or BN. UP to 3 Years.

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 10 Propane cars needed in North Dakota for Winter Lease. Needed ASAP.

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 10-15, 25.5K-27k Gallon pressure cars for various commodities 5-8 year term

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6 month term, Dirty to Dirty. Can take last in Crude.

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|