“Don’t sit down and wait for the opportunities to come. Get up and make them.”

-Madam C.J. Walker

Jobs Update

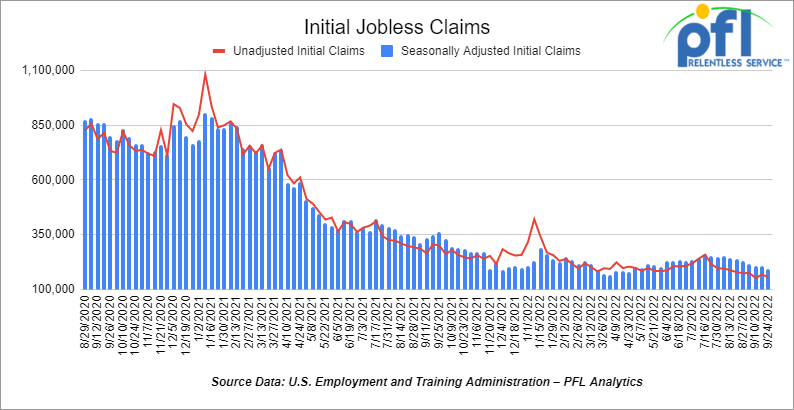

- Initial jobless claims for the week ending September 24th, 2022 came in at 193,000, down -16,000 people week-over-week.

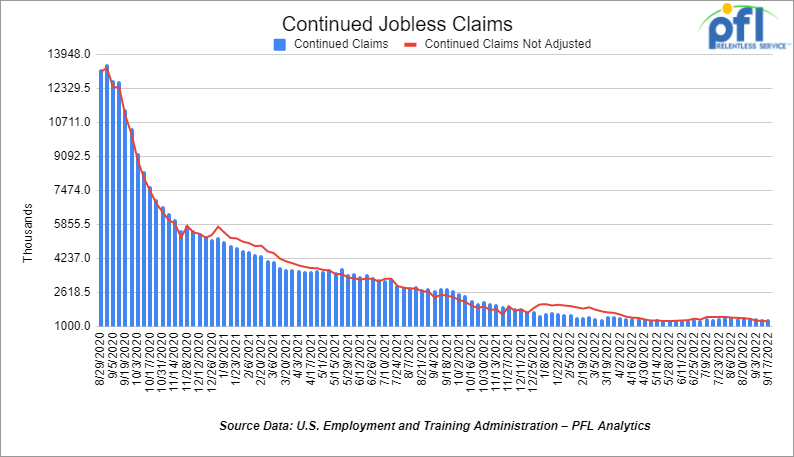

- Continuing jobless claims came in at 1.347 million people, versus the adjusted number of 1.376 million people from the week prior, down -29,000 people week over week.

Stocks closed lower on Friday of last week and down week over week

The DOW closed lower on Friday of last week, down -500.1 points (-1.71%),closing out the week at 28,725.51, down -535.3 points week over week. The S&P 500 closed lower on Friday of last week, down -54.85 points (-1.51%) and closed out the week at 3,585.62, down -69.42 points week over week. The NASDAQ closed lower on Friday of last week, down -161.89 points (-1.5%), and closed the week at 10,575.62, down -227.3 points week over week.

Oil closed lower on Friday of last week and up week over week

Oil prices dipped on Friday in choppy trading but notched their first weekly gain in five weeks on Friday, on the back of the possibility that OPEC+ will agree to cut crude output when it meets on October 5th.

Brent crude futures for November, which expired on Friday, fell 53 cents, (-0.6%), to US$87.96 a barrel. The more active December contract was down $2.07per barrel at US$85.11. U.S. West Texas Intermediate (WTI) crude futures fell $1.74, or 2.1%, to settle at $79.49 per barrel.

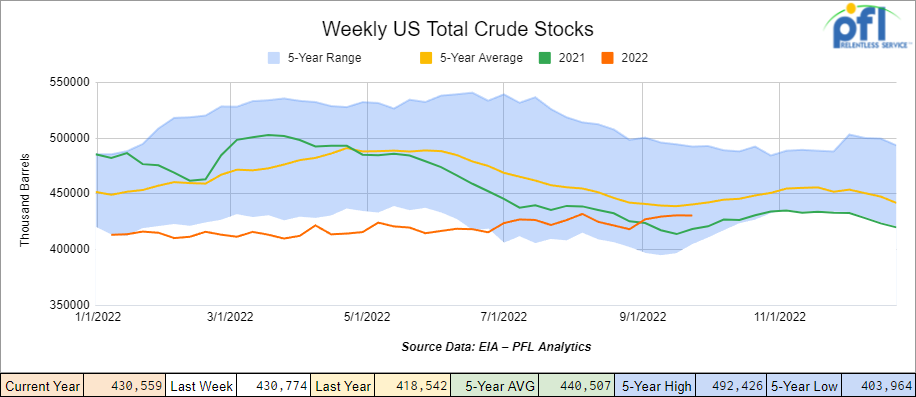

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 200,000 barrels week over week. At 430.6 million barrels, U.S. crude oil inventories are 2% below the five year average for this time of year.

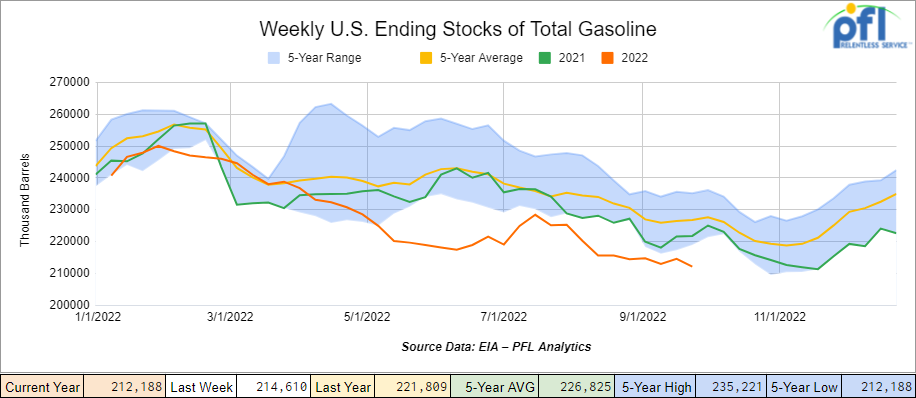

Total motor gasoline inventories decreased by 2.4 million barrels week over week and are 6% below the five year average for this time of year.

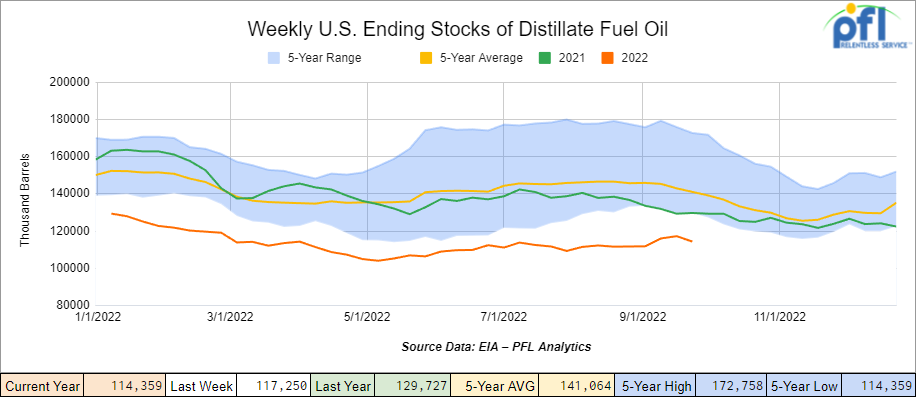

Distillate fuel inventories decreased by 2.9 million barrels week over week and are 20% below the five year average for this time of year.

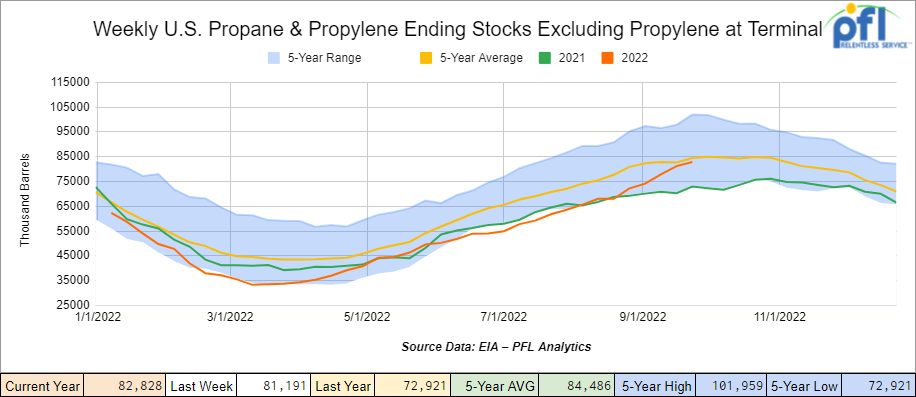

Propane/propylene inventories increased by increased by 1.6 million barrels week over week and are 2% below the five year average for this time of year.

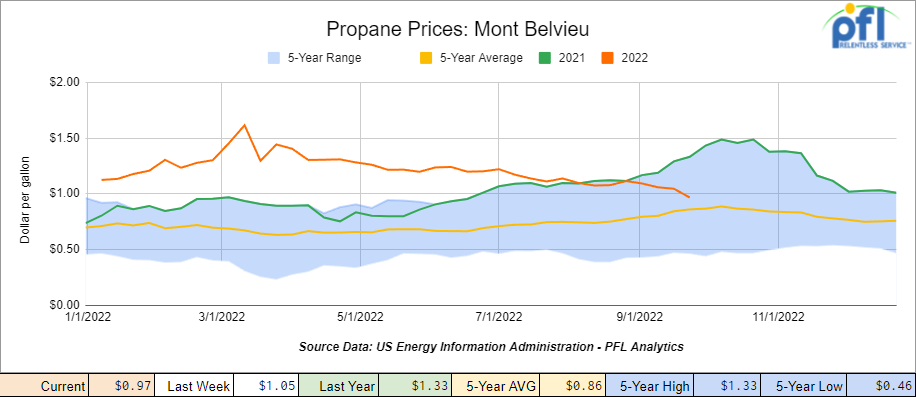

Propane prices closed at 97 cents a gallon, down 8 cents per gallon week over week and down 36 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 8.9 million barrels week over week.

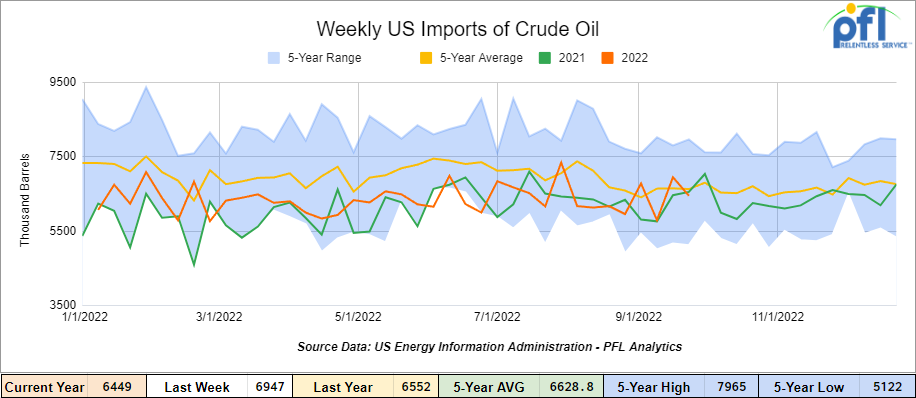

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending September 23rd, 2022, a decrease of 500,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 5.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 525,000 barrels per day, and distillate fuel imports averaged 94,000 barrels per day during the week ending September 23rd, 2022.

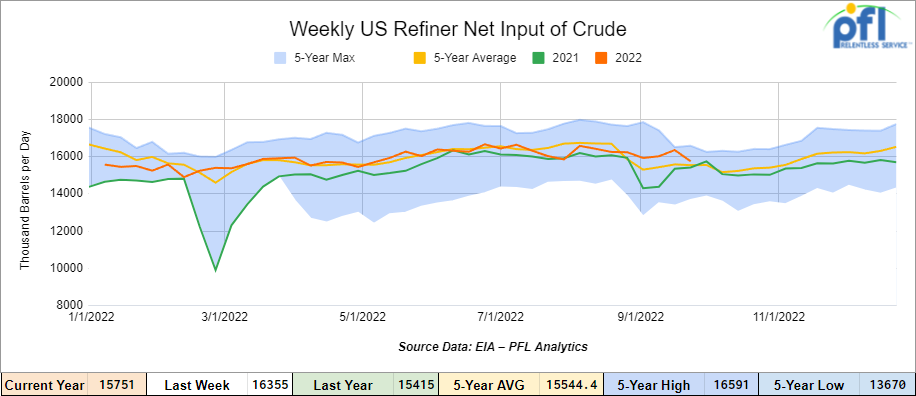

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending September 16, 2022, which was 333,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $77.94, down -$0.80 per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 24th, 2022.

Total North American weekly rail volumes were down (-4.11%) in week 38 compared with the same week last year. Total carloads for the week ending September 24th were 345,969, down (-1.96%) compared with the same week in 2021, while Weekly intermodal volume was 324,393, down( -6.3%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Other (-14.72%). The largest increase was from Motor Vehicles and Parts (+20.62%).

In the east, CSX’s total volumes were up (+1.04%), with the largest decrease coming from Forest Products (-14.30%) and the largest increase from Grain (+25.34%). NS’s volumes were down (-6.28%), with the largest decrease coming from Other (-17.50%) and the largest increases from Motor Vehicles and Parts (+10.31%).

In the west, BN’s total volumes were down (-8.65%), with the largest decrease coming from Metallic ores and Minerals (-35.66%), and the largest increase coming from Motor Vehicles and Parts (+34.45%). UP’s total rail volumes were up (+1.12%) with the largest decrease coming from Grain (-22.77%) and the largest increase coming from Motor Vehicles and Parts (+23.16%).

In Canada, CN’s total rail volumes were down (-8.78%) with the largest decrease coming from Grain (-29.01%) and the largest increase coming from Motor Vehicles and Parts (+18.58%). CP’s total rail volumes were down -5.93% with the largest decrease coming from Metallic Ores and Metals (-59.07%) and the largest increase coming from Other (+61.9%).

KCS’s total rail volumes were down (-2.86%) with the largest decrease coming from Coal (-23.91%) and largest increase coming from Motor Vehicles and Parts (+92.94%).

Source Data: AAR – PFL Analytics

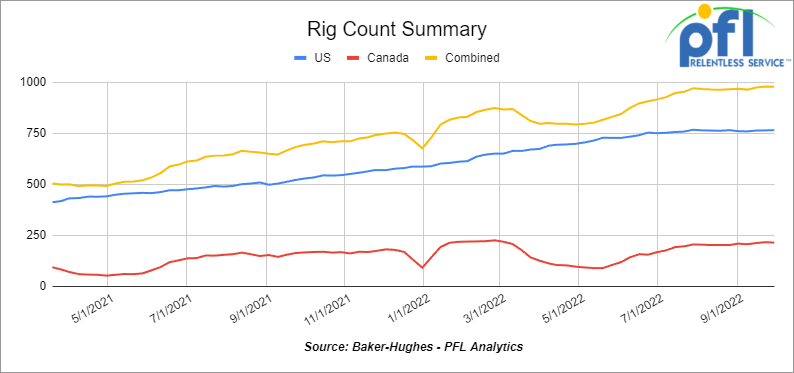

Rig Count

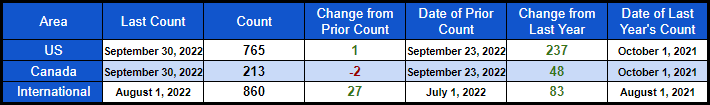

North American rig count was down by -1 week over week. U.S. rig count was up by +1 rig week-over-week and up by 237 rigs year over year. The U.S. currently has 765 active rigs. Canada’s rig count was down -2 rigs week-over-week, and up by 48 rigs year-over-year. Canada’s overall rig count is 213 active rigs. Overall, year over year, we are up 285 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

We were at the KCS Meeting In KC

Folks it was a great get together with the KCS. It seems to us that they are open for business and looking to cut deals. Attendance was great with 250 people attending and was held at Children’s Mercy Park – what a fabulous facility. A few pictures for your reference:

KCS Key Points in their presentation:

- KCS fights above its weight class

- Committed to Public service. Committed to the Monarch butterfly – KCS is planting 60,000 trees along migration roots.

- The goal is to take as many trucks off the road as possible

- Very excited about auto hubs – Mexico has 14 of them while Canada has 11

- Want to partner and cut private deals – transloading etc. – they want to cut deals on plastics, lube oil, and energy products. They are excited about non-haz bitumen.

- Committed $275 Mil in new capital spending – this is in front of the STB. Bullish that they will get approval to merge with CP.

- KCS did a deal with Commtrex (not closed yet) and Martin was speaking – don’t know what we think of that one rail is difficult to commoditize – maybe the younger guys will like that one but we don’t see it.

One presentation that we found interesting that we thought we would share some of the key points was from Keith Praher – Amanda (Economist):

- He says the Feds have to slow the market down – the Feds target is for an unemployment rate of 4.5%

- There will be another 75-point basis hike followed by a 50-point hike with a pause.

- The only thing the Fed watches is the PCE everything else is noise – 2% is the target rate currently sitting at 4.4%

- There is $4.4 trillion sitting in U.S. bank accounts normally there is 1.1 trillion – cash must be deployed

- Consumer credit going up a lot – credit card use is the largest in history – makes sense with all the online purchasing one does today.

- Walmart and Target sales are up, however units out the door are down

- Q2 productivity drop was the steepest drop in history

- Corporate spending is up year over year by 9%.

- Construction spending is up 19% year over year

- Residential $550 billion to $920 billion

- Commercial $815 billion to $847 billion

- Tremendous opportunity in water supply – we are short. Don’t know why we don’t follow Saudi Arabia and particularly Israel in regards to building desalination plants. Why make it so complicated here is what the Israeli government says?

“Seawater desalination is the most reliable of the sources for enriching the water supply since seawater is available in unlimited quantities and involves no dependency – neither on climate nor on political factors.” Once they are finished with their program they will have 7 complete plants that are expected to provide 85% to 90% of annual municipal and industrial water consumption. If you are interested in reading more please Click Here. California should read this one – supply their farmers with water and build a water pipeline to Arizona – just a thought. For more information on the KCS conference call PFL today.

For those of you attending SWARS this week, Curtis Chandler President (239-405-3365) of PFL will be there together with Brian Baker Rail Logistics Specialist (239-297-4519) – We can’t wait for SWARS, one of our favorites!

We are watching Russia and Natural Gas

Folks, we don’t even know what to think of this one as we have crazy dealing with crazy here, but the facts are that Russia’s Norm Stream Pipeline was blown up.

Kremlin spokesman Dmitry Peskov said, “This looks like an act of terrorism, possibly on a state level. It is very difficult to imagine that such an act of terrorism could have happened without the involvement of a state of some kind”. The finger was pointed at U.S. President Joe Biden’s comment in February that if Russia sent troops into Ukraine “there will no longer be a Nord Stream 2.“

At the same time, European security officials had observed Russian navy support ships and submarines not far from the leaks, while Peskov countered by claiming that there had been a much larger NATO presence in the area. The West is pointing its finger at Russia for blowing up its own asset. President Biden said it was Russia.

At the end of the day, we have no position here anything is possible. The loss of the Russian pipeline is apparently an environmental disaster, and we are surprised that we are not hearing much about it. Researchers say that the incident amounts to the largest-ever release of the potent greenhouse gas during a single event, with an impact similar to the annual emissions of 1 million cars. Methane is apparently 81 times more potent than carbon dioxide at warming the planet.

One thing we know for sure is that Europe is going to need a lot more LNG and LPGs which is great for rail. The U.S. says they will supply it – the problem is Manchin’s “Fast Track Permitting” is done. Manchin backed off permitting reform in the spending bill. He pulled his permitting reform package from a government spending bill Tuesday of last week. The permitting legislation has divided Democrats over fears it would encourage more fossil fuel production. The death of Manchin’s permitting reform effort is a loss for everyone in the U.S., Europe, and investors in the sector. Who wouldn’t want more natural gas production? We are watching this one folks, maybe there is another kick at the cat time will tell. Stay tuned to PFL for further details.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,003 from 23,093 which was a loss of 90 railcars week-over-week. This was the ninth week-over-week decline after a five-week run of increases. Canadian volumes were mixed, CP’s shipments fell by -10.4%, and CN’s volumes were up by +5.4% week over week. U.S. shipments were mostly lower. The NS had the largest percentage increase, up by a mere +1.2%, and the UP was down by -5.4%

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 10-15, 25.5K-27k Gallon pressure cars for various commodities 5-8 year term

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6 month term, Dirty to Dirty. Can take last in Crude.

- 100 Coiled and insulated cars for Crude. Needed in Canada for 6 months. Dirty to Dirty

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 50, 30K 117Js Last in Diesel. Free move on the UP or BN. Can return Dirty

- 120, 30K 117Rs Last in Diesel. Free move on the UP or BN. Can return Dirty

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|