“Do you want to know who you are? Don’t ask. Act! Action will delineate and define you.”

― Thomas Jefferson

Jobs Update

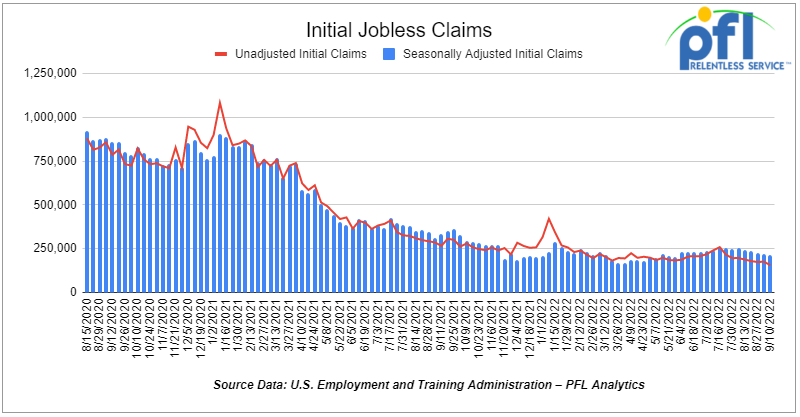

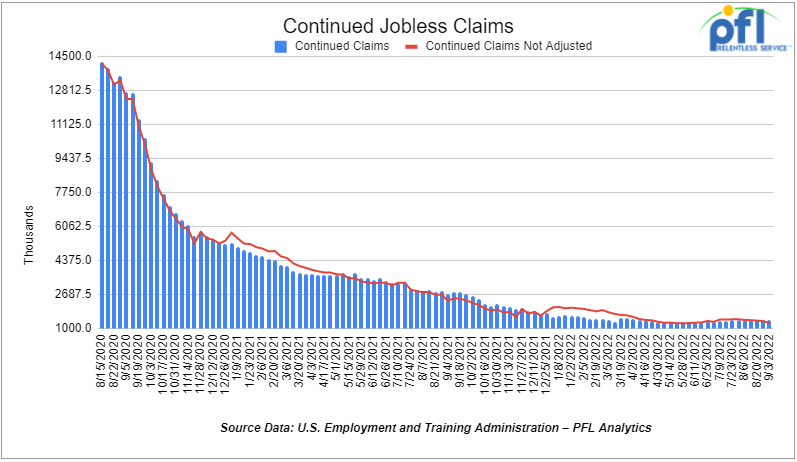

- Initial jobless claims for the week ending September 10th, 2022 came in at 213,000, down -5,000 people week-over-week.

- Continuing jobless claims came in at 1.403 million people, versus the adjusted number of 1.401 million people from the week prior, up 2,000 people week over week.

Stocks closed lower on Friday of last week and down week over week

The DOW closed lower on Friday of last week, down -139.40 points (-0.45%), closing out the week at 30,822.42, down -1,329.29 points week over week. The S&P 500 closed lower on Friday of last week, down -28.02 points (-0.72) and closed out the week at 3,873.33, down -194.03 points week over week. The NASDAQ closed lower on Friday of last week, down -103.95 points (-0.86%), and closed the week at 11,448.4, down -663.91 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 30,663 this morning down -259 points.

Oil closed higher on Friday of last week and flat week over week

Oil settled at its third weekly loss as mounting evidence of an economic slowdown overshadowed supply-risk concerns. Hotter-than-expected inflation figures fanned expectations that more interest-rate hikes will crimp growth according to some. The potential for more supply disruptions from Russia remains a risk, while China’s economic data suggested stimulus measures there were having some success ramping up demand. This has seemed to put somewhat of a floor on prices.

On Friday of last week, WTI for October delivery rose 1 cent per barrel to settle at $85.11 per barrel in New York. Brent for November settlement rose 51 cents to close out the week at $91.35 per barrel. WTI was down 1.9% week over week.

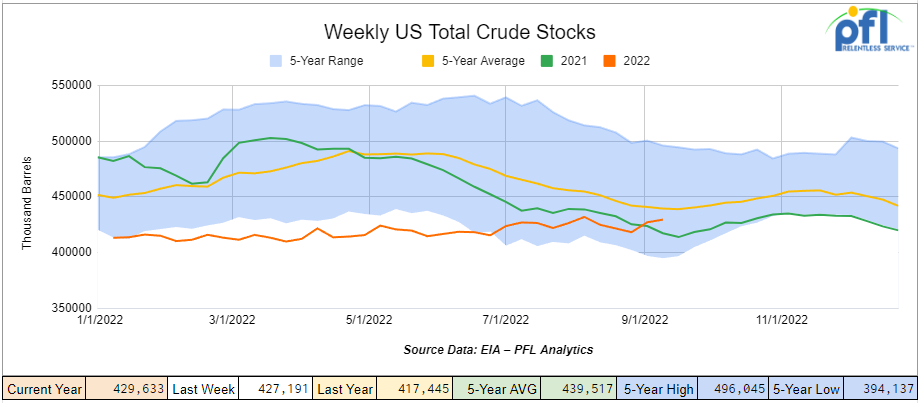

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.4 million barrels week over week. At 429.6 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

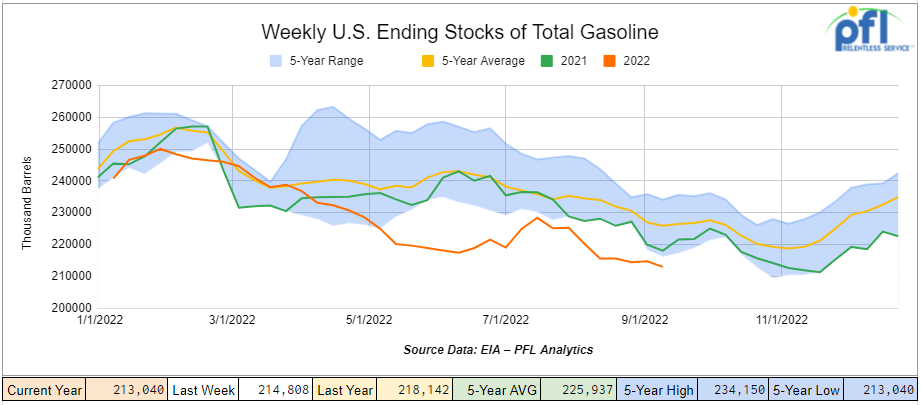

Total motor gasoline inventories decreased by 1.8 million barrels from week over week and are 6% below the five-year average for this time of year.

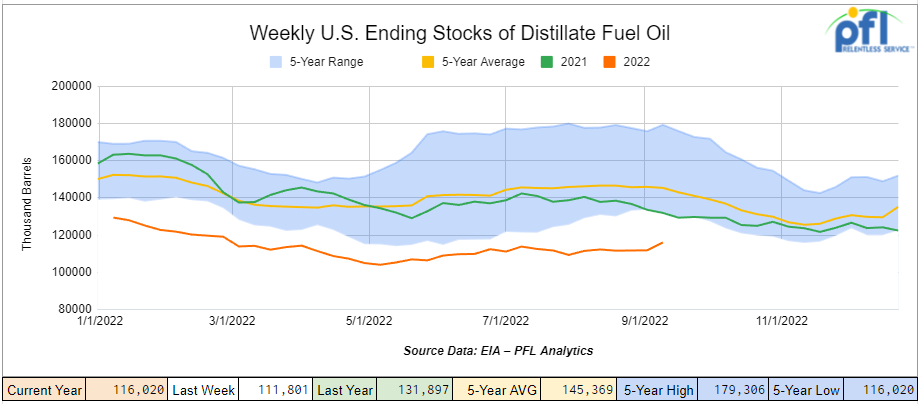

Distillate fuel inventories increased by 4.2 million barrels week over week and are 21% below the five-year average for this time of year.

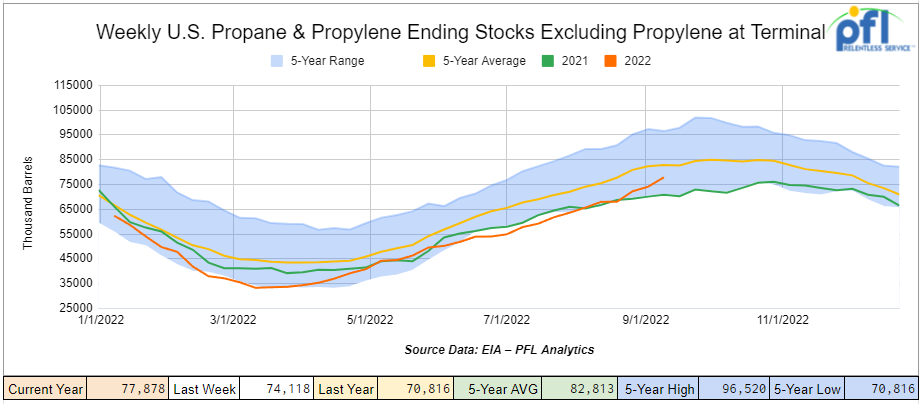

Propane/propylene inventories increased by 3.8 million barrels from week over week and are 6% below the five-year average for this time of year.

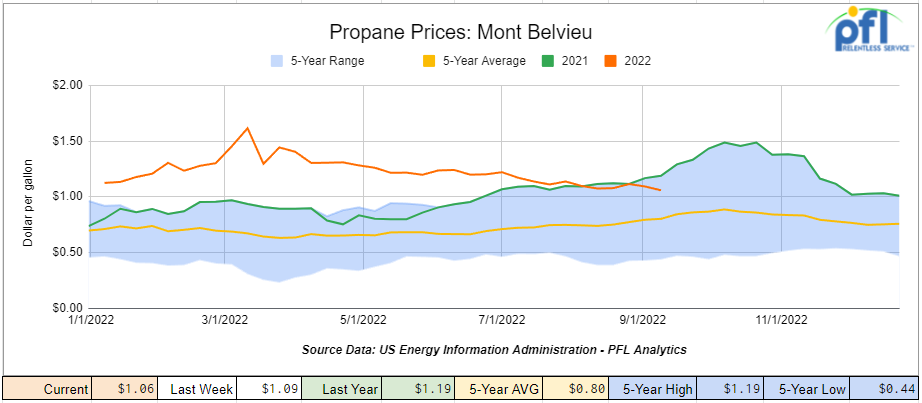

Propane prices were down 3 cents per gallon week over week closing out the week at $1.06 per gallon, down 13 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 5.5 million barrels week over week.

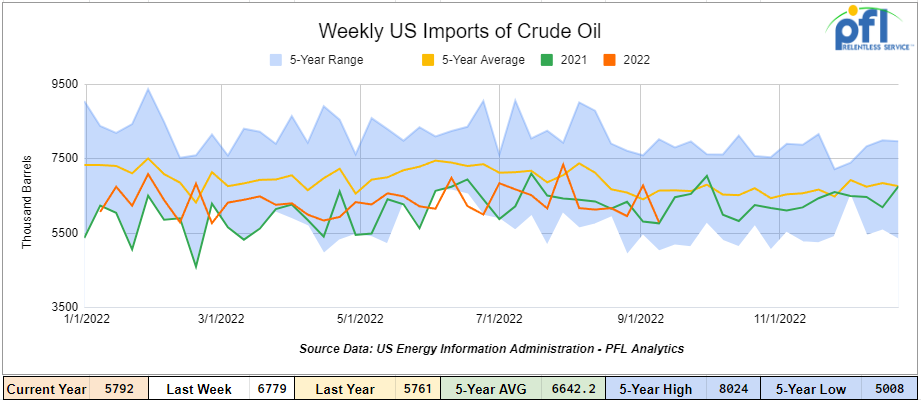

U.S. crude oil imports averaged 5.8 million barrels per day during the week ending September 9th, 2022, a decrease of 988,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, (+2.6%) more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 522,000 barrels per day, and distillate fuel imports averaged 125,000 barrels per day during the week ending September 9th, 2022.

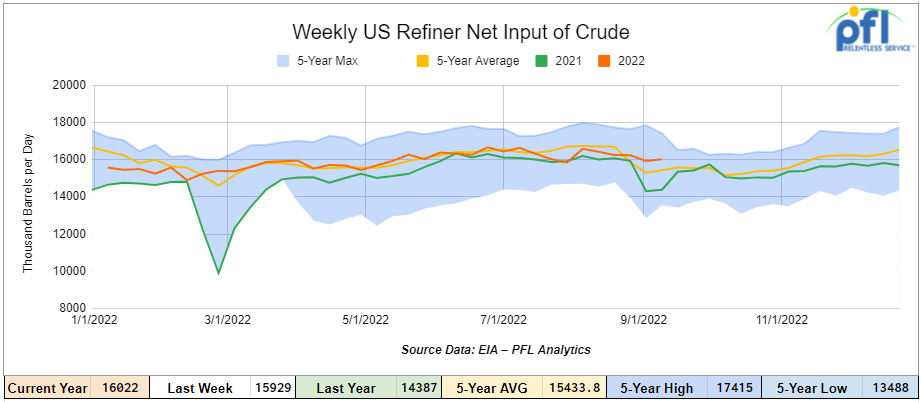

U.S. crude oil refinery inputs averaged 16 million barrels per day during the week ending September 9, 2022, which was 94,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $83.42, down -$1.69 per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 10th, 2022.

Total North American weekly rail volumes were up (+0.46%) in week 36 compared with the same week last year. Total carloads for the week ending September 9th were 337,922, up (+1.43%) compared with the same week in 2021, while Weekly intermodal volume was 311,273, down (-0.56%) compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Other (-7.38%). The largest increase was from Motor Vehicles and Parts (+40.90%).

In the east, CSX’s total volumes were up (+1.49%), with the largest decrease coming from Petroleum and Petroleum Products (-12.82%) and the largest increase from Motor Vehicles and Parts (+45.13%). NS’s volumes were down (-0.1%), with the largest decrease coming from Metallic Ores and Metals (-12.69%) and the largest increases from Grain (+29.40%) and Motor Vehicles and Parts (+21.13%).

In the west, BN’s total volumes were down (-3.29%), with the largest decrease coming from Other (-8.29%), and the largest increase coming from Motor Vehicles and Parts (+38.11%). UP’s total rail volumes were up (+3.64%) with the largest decrease coming from Petroleum and Petroleum Products (-18%) and the largest increase coming from Motor Vehicles and Parts (+59.80%).

In Canada, CN’s total rail volumes were up (+3.15%) with the largest decrease coming from Grain (-39.26%) and the largest increase coming from Motor Vehicles and Parts (+38.17%). CP’s total rail volumes were down (-4.49%) with the largest decrease coming from Forest Products (-19.05%) and the largest increase coming from Other (+28.77%).

KCS’s total rail volumes were up across the board (+4.66%) with the largest increase coming from Motor Vehicles and Parts (+59.77%).

Source Data: AAR – PFL Analytics

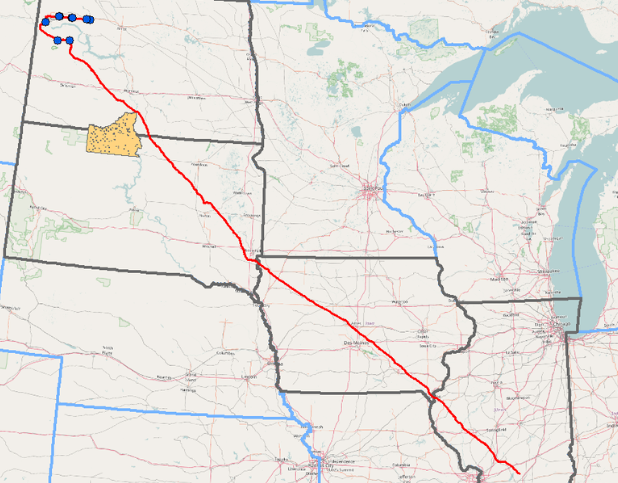

Rig Count

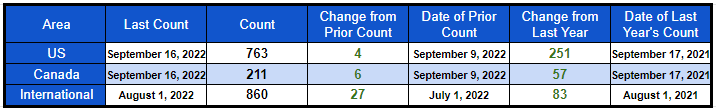

North American rig count was up 10 rigs week over week. U.S. rig count was up 4 rigs week-over-week and up by 251 rigs year over year. The U.S. currently has 763 active rigs. Canada’s rig count was up 6 rigs week-over-week, and up by 57 rigs year-over-year. Canada’s overall rig count is 211 active rigs. Overall, year over year, we are up 308 rigs collectively. Folks, we are only 26 rigs away from hitting 1,000 active rigs in North America – a big number. A level not seen since February 28th, 2020.

North American Rig Count Summary

A few things we are keeping an eye on:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,180 from 23,447 which was a loss of 267 railcars week-over-week. This was the seventh week-over-week decline after a five-week run of increases. Canadian volumes were mixed, CP’s shipments rose by +1.7% and CN’s volumes were down -10.9% week over week. U.S. shipments were also mixed. The NS had the largest percentage increase, up by +4.9%, and the UP had the largest percentage decrease, down by -1.5%.

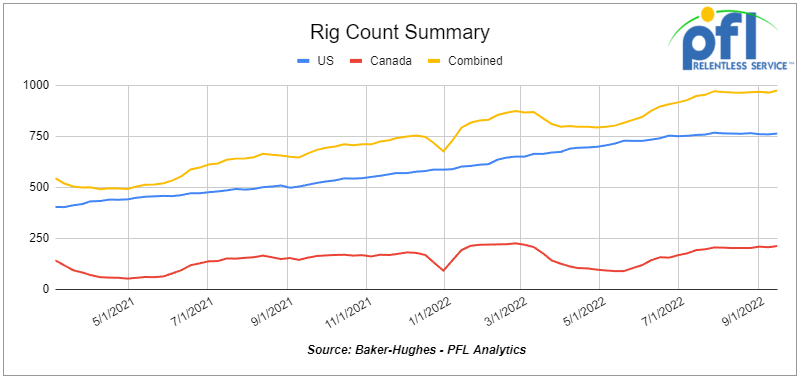

We are Watching The Dakota Access Pipeline (DAPL)

Well folk’s, good news for DAPL. On Thursday of last week, Energy Transfer received some good news from the Illinois Commerce and Trade Commission. They gave DAPL permission to install pumping stations in Illinois. They previously gave permission back in 2020 but was appealed by the Standing Rock Sioux Tribe and environmental groups that really want the pipeline shut down. Instead, it looks as though DAPL is on its way to increasing capacity from 750,000 barrels per day to nearly 1.2 million barrels per day. This obviously is not a good development for crude by rail out of the Bakken but good news for the country. The Commission found again that the pipeline was in the public interest and since it did not require the expansion of the “pipe” itself there would be a limited environmental impact. Folks, you know we are watching this one stay tuned to PFL for further details.

Dakota Access Pipeline (DAPL)

Source: Wikipedia

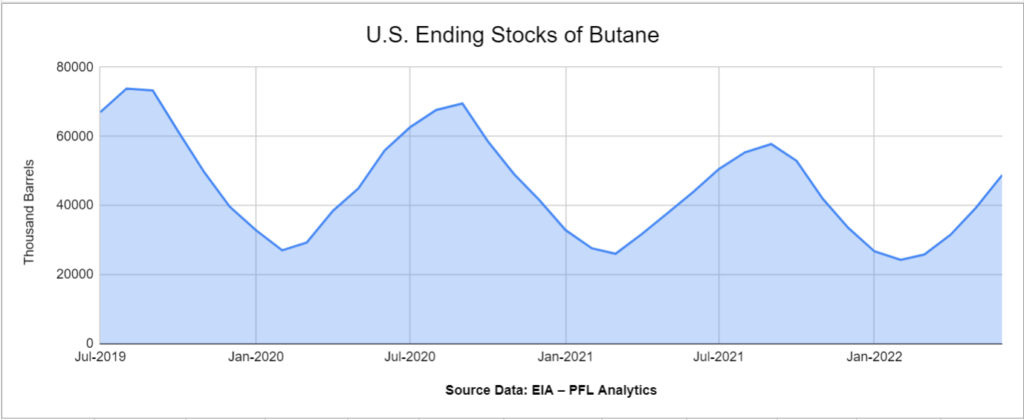

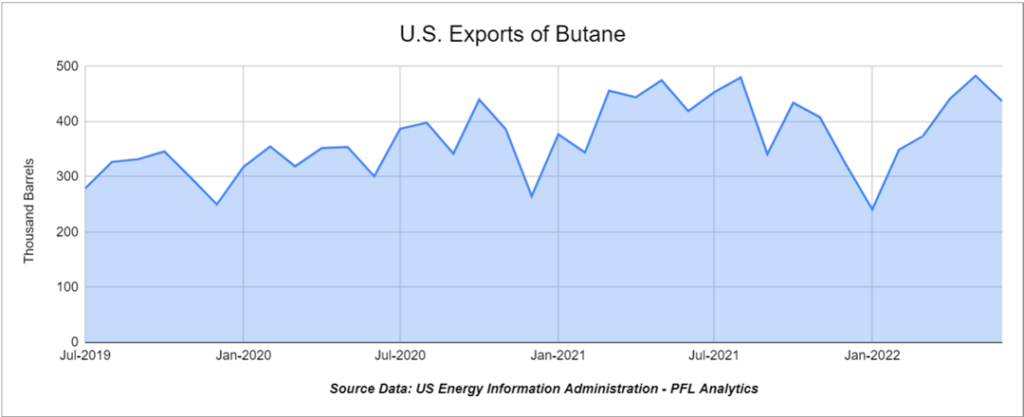

We are Keeping our Eye on Butane

Could Butane blending be back in a substantial way? It looks as though we are not going to be short heading into winter as previously thought by some. Supplies are building and price levels dropping mainly due to a lack of Asian interest at a time of weaker U.S. gas demand. It looks like we may surpass inventory levels last year going into winter. Time will tell, but a fairly dramatic price drop. U.S. exports surged to 435,000 barrels per day in May of 2022 and have backed off substantially. We are bullish on blending – see charts below:

We Were on the Road Last Week in Atlanta and Indianapolis – SEARS and FTR.

In Atlanta, we were at the South East Association of Rail Shippers. PFL was a proud Sponsor and Exhibitor at this event. The conference was well attended (200+ people). The conference was held at the Westin Buckhead and people were there to do business. We are so happy that we attended. Interesting speeches were from Walter Kemmsies, Managing Partner at The Kemmsies Group who said we were not in a recession and why we were not. We don’t know if we buy it, but he is the expert! The Class 1’s serving the S.E. were of course there with the same message that they need to and are working towards providing better service. We found Jacquelline Bendon from the UP to be of interest. The bottom line is top-notch presenters. If you are looking for any information as it relates to this conference, please do not hesitate to contact PFL today. We would be happy to share our findings with you!

In Indianapolis, we were at the FTR conference. The event was held at the Crowne Plaza Union Station. If you ever have the opportunity to stay in Indianapolis and like trains this Hotel is a must – they have a train in the middle of the Hotel made into rooms and is an old rail station. Curtis Chandler, our President, was asked to speak on a panel with Jay Carter from Greenbrier.

Crowne Plaza Union Station – Grand Ball Room (Todd Tranausky, Curtis Chandler, Jay Carter)

Source: – PFL Analytics

Curtis Chandler fielded a number of Questions and answered accordingly:

With the impending HM-251 deadline next year, how are the flammable liquids shippers most impacted by the mandate responding to get their fleets in compliance before the deadline?

It is not a good situation out there – Ethanol will be phased out on May 1, 2023, for DOT 111 GP 30 tank cars. For owners, you have the choice to either find an alternate market, retrofit them to 117R’s or simply just scrap them. If I owned a DOT 111 I would not retrofit. You cannot ship a 117R in unit train service on the BN and in manifest they are charging more to ship a 117R or giving discounts to J’s. Whichever way you look at it, it is not good for the R right now given shop time it takes, increasing labor rates, class 1 future reaction and the cost of steel compared to any reasonable return on investment. Ethanol producers then have until July of 2023 to deal with the non-Jacketed 1232 tank car.

Most shippers are simply phasing out the 111s and not considering retrofits for the reasons I mentioned above. They are switching to 117Js when available and 117Rs if not.

A lot of people have asked the question – there seems to be quite a few tank cars out there that still are not moving – even with the uptick in crude we don’t see much movement – can you explain why that is?

Folks, we at PFL have had several conversations with a lot of people in the industry over the past year. Why have tank cars not been leased out and why are there so many of them and have been asking what happened to crude by rail? When is it coming back?

Why is it not back right now when oil is so high and we are having supply disruptions while and in the middle of a war in Ukraine?

These are very good questions and I will try and answer them the best I can, but the bottom line is it comes down to pipeline capacity, production, and governmental policies.

If you take a look at the three basins where crude by rail was prevalent in a big way, it was the Permian, Bakken and Alberta (Saskatchewan to a lesser extent but growing).

The Permian play was short-term. Pipeline space was underbuilt in October of 2020 and midstream companies were tripping over themselves to get rail cars out to West Texas to load rail cars with transloaders; either from wellhead directly into railcars, or trucking from wellhead to terminals where they were then loaded into rail cars. It was a play that only stuck around for 12 months. Pipeline companies caught up and once they came online it made rail uncompetitive. We do not see this crude by rail play coming back anytime soon.

At the same time, crude by rail out of the Bakken was also on fire – terminals were built-in ND and railcars were in high demand driving prices up for rail cars significantly. The Dakota Access Pipeline (“DAPL”) solved that problem when it came online and again made rail uncompetitive, except out to the West Coast to feed refineries that did not have access to pipe out of the Bakken. President Trump got DAPL built, however, lawsuits continue to this day and the Standing Rock Sioux tribe wants the pipeline shut down despite DAPL wanting to expand. Crude by rail out of North Dakota gaining significant traction once again is a wild card, but stay tuned to PFL we are watching this one closely.

We did see some temporary relief for non-coiled 31.8 and GP 30 Dot 111 cars previously loaded with crude from the Bakken and the Permian that made its way to the gulf as diesel and gasoline by rail exploded into Mexico but that has been reined in by the Mexican government wanting Pemex to be the sole buyer and seller of the fuel. Giants like Valero and Shell have been spared the axe but we do not see this policy by the Mexican government changing anytime soon. As a result, quite a few tank cars are now in storage in Texas.

Last but not least, why is crude by rail not moving out of Canada? We peaked at 411,991 barrels per day in February of 2020. There are a few factors – but it all comes down to pipeline capacity and production. In 2020 there was not enough pipe out of Alberta. Basis in Alberta blew out to -40 against WTI and everyone was tripping over themselves to build and lease cars. Then COVID came, oil collapsed and railcars headed to storage. On top of that, the Alberta Government leased out 4,000 rail cars and never moved a barrel of crude and those cars stayed in storage and ALL have been returned to car owners and Lessors. Producers then shut in production as they were paying to have crude taken away and then Enbridge line 3 came on in October 2021 and soaked up what volume could have moved by rail adding 370,000 barrels per day of capacity. The current situation in Alberta is as follows:

a) Inventories in Alberta were very low but are building as the Canadian Energy Regulator (CER) was reporting only 64 million barrels in storage as of the end of January down 17 million barrels from just from just three months’ prior, its lowest level since 2020.

b) Right now in Alberta there is little appropriation on pipelines like there used to be, meaning there is spare capacity for crude to be shipped via pipeline. The bottom line is production has not caught up to available takeaway capacity until maybe now.

c) Basis in Alberta against WTI was only -$11 USD per barrel not so long ago – there was no commercial rail play when you took into account transportation costs on the class 1’s. Right now, basis is at or around -20 +/- but in the gulf Canadian Crude is at or around -12 +/- why you ask that does not make sense. Well nothing does anymore – when the government decided to sell crude back into the market from the SPR it sold heavy crude driving down Canadian crude sold into the gulf – also heavies from Venezuela now approved and heavies from Russia competed – it is a very complex situation.

d) Enbridge is in never-ending legal battles over line 3 with the state of Michigan and Environmental groups. The Governor of Michigan – Gretchen Whitmer really wanted the pipeline shut down. This however seems to be on the backburner now as the state of Michigan experienced a crushing defeat in the case last month.

e) If the Governor of Michigan is successful in getting Enbridge shut down, crude by rail will roar back – we are doubtful this will happen anytime soon.

f) Non-haz raw bitumen in Canada is gaining traction and both CP and CN are excited about it. We see this picking up – raw bitumen can compete head-on with pipe capacity but it is going to take time. We also expect to see Canadian production increase – they have never had it so good up in Canada. The CAD$ is weak and there is an endless production that can be brought online. We do expect crude by rail in Canada to come back; it is just a matter of when that will be. However, don’t get all excited, it is going to be rocky, and don’t forget about the TransMountain pipeline that will add some significant takeaway capacity in December 2023 out to Vancouver for Export and Pacific NW refineries. Crude by rail out of Alberta is up to the Canadian producer – let’s see if they overproduce!

g) Current situation in Alberta – The Canadian Energy Regulator updated its monthly crude by rail numbers on August 23, 2022. For June 2022, Canada exported 170,234 barrels per day by rail (down by 2,888 barrels per day month over month) snapping a two-month streak of month-over-month increases, but still its second largest month since March of 2021. Crude by rail out of Alberta has been popular of late for raw Bitumen (no diluent added) as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. We were hoping to see month-over-month increases as new Bitumen comes online and do expect to see more month-over-month increases in the days to come. Crude by rail is also popular for off-spec products that can be blended here in the United States and in areas where there is no pipeline access. Before crude by rail out of Canada can come back in a meaningful way, supply needs to exceed pipeline capacity and we need to see a much wider basis for a sustained period of time (or at least predictable). We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins. WCS versus WTI closed out the trading day yesterday –US$21.45 per barrel, with an implied value of $62.95.

Everyone who is in rail equipment has pretty much heard about the movements in steel prices and what they have done to new car pricing and even lease rates to a lesser extent. How much of an effect have steel prices had on the behavior of tank car order activity over the last few months? (Have to co-answer this one)

Even car owners and leasing companies we work with have been hesitant to have cars built at these prices. The long-term exposure with such a high price on the buy side has made some of the most aggressive participants more cautious. To justify a build at these prices requires very high lease rates and long-term leases, and even if they can get it, people are still hesitant to build. Economics for car builders such as greenbrier are different and I will let Jay speak to that.

In general, it is challenging to justify especially on the tank side as we have seen shippers hesitant to make longer-term lease commitments ever since Covid

Overall steel prices have come down as of late from recent highs but parts and labor shortages have also contributed to high new build prices.

Some shippers are resorting to scrapping the 111s and some fortuitous car owners have been able to cash in high prices over the past several months with the AMM pricing hitting the mid $500s back in March. It does seem that with the markets today, the scrap market has leveled off and pricing is back down to the low $300s for September pricing.

Poor rail service has been an issue for every railcar type. How much of an issue has it been for tank cars, particularly as shippers seek to evaluate what their true railcar needs are ahead of the HM-251 deadline?

Many of the customers in various industries we serve have had to bring more cars into service and operate less lean then they would like. A lot of shippers have had to add cars they wouldn’t normally have needed in order to keep up with demand and ship commensurate amounts of product. We know energy shippers who have had to add entire trains they know they will not need long term just to keep product moving in the short term. Shippers are hesitant to add any cars that will be phased out unless they can get very short term service to service deals

There are some parts of the tank car market, particularly the pressure car fleet that are long cars over the intermediate and longer terms, but have been squeezed in the short term by loaded storage and poor cycle times. Do you expect that market participants will resist the urge to add additional equipment into this fleet?

Yes and no. Energy companies have been weary to over extend but I think generally speaking, especially in the current environment, no one wants to be short pressure cars. So from that standpoint if there is any tightness in the fleet at all I think people will add cars because they would rather be a little long then a little short. There has been a lot of demand for loaded storage and even if the economics aren’t stellar I think shippers view that as a better alternative then subleasing or returning cars because no one wants to get caught with their pants down.

We heard a lot yesterday about Mexican energy reform and its effects on volumes. What are the biggest downside risks to the tank car market over the next year?

As you mentioned, government intervention, such as we have seen in Mexico, has absolutely crushed volumes. Class one service improvements could also hurt demand for tank cars. This would be positive for shippers but a negative for owners and leasing companies. Extremely high costs for new builds also present challenges, especially with the HM 251 deadline upcoming. If there is a lack of suitable inventory available at reasonable prices shippers may look to other modes of transportation when available.

We have spent a lot of time talking about flammables cars, but there are other types of tank cars as well and I want to make sure they don’t get lost in the discussion. What has the order and inquiry level been for food grade tanks?

Inquiries/orders for food grade tanks are fairly strong and usually are in general. Due in part to the special requirements, the fleet of food grade equipment is generally well utilized. Kosher food grade cars are an added benefit and it gives food grade shippers more versatility in terms of buyers. PFL has kosher cleaned a lot of cars this year for food grade service and that trend is not going away.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year-end

- 100-200, 340W Pressure cars for a 12-month term for propane. Can take in various locations, needed ASAP

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 10-15, 25.5K-27k Gallon pressure cars for various commodities 5-8 year term

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6-month term, Dirty to Dirty. Can take last in Crude.

- 100 Coiled and insulated cars for Crude. Needed in Canada for 6 months. Dirty to Dirty

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move. Available in September.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape..

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|