“Wisdom is the reward you get for a lifetime of listening when you’d have preferred to talk.”

– Doug Larson

Jobs Update

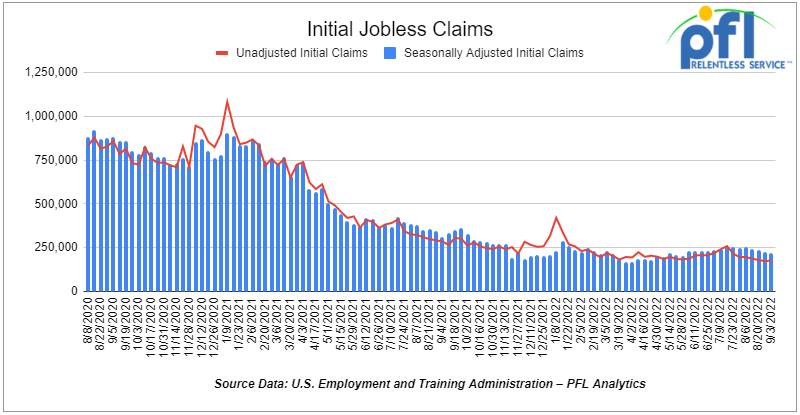

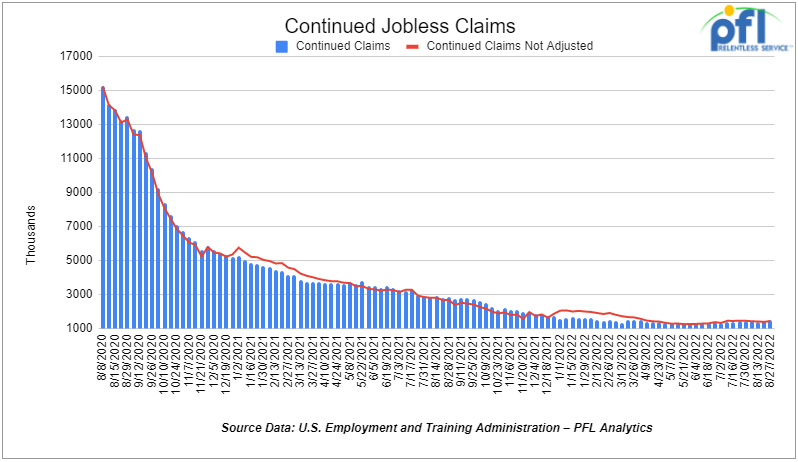

- Initial jobless claims for the week ending September 3rd, 2022 came in at 222,000, down -6,000 people week-over-week.

- Continuing jobless claims came in at 1.473 million people, versus the adjusted number of 1.437 million people from the week prior, up 36,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 377.19 points (1.19%), closing out the week at 32,151.71, up 833.27 week over week. The S&P 500 closed higher on Friday of last week, up 61.18 (1.53%) and closed out the week at 4,067.36, up 143.1 points week over week. The NASDAQ closed higher on Friday of last week, up 250.18 points (2.15%), and closed the week at 12,112.31 points, up 481.45 points week over week.

Oil closed higher on Friday of last week and flat week over week

Oil prices rose 4% on Friday of last week as OPEC threatened to cut supply, the Fed’s rate hiking and the continued desire to do so as a result of Biden induced inflation and China’s crazy lockdowns. Also, Russian President Vladimir Putin has threatened to halt oil and gas exports to Europe if price caps are imposed. At the same time, some people here in the U.S. want crude oil pipelines to shut down and are preventing new oil and natural gas pipelines from getting built. What a crazy situation- we can’t even make this stuff up!

U.S. West Texas Intermediate (WTI) crude rose $3.25 (+ 3.9%) to settle at $86.79 per barrel on Friday of last week and Brent crude rose $3.69 (+4.1%), to settle at US$92.84 per barrel. Despite Friday’s bounce, both crude benchmarks were headed for a weekly drop, with Brent down about 0.2 per cent on the week after at one point hitting its lowest since January. WTI posted a weekly decline of 0.1 per cent.

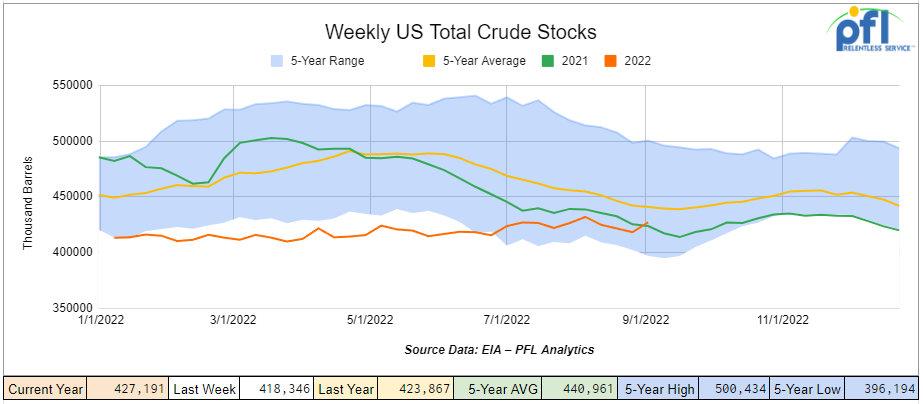

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.8 million barrels week over week. At 427.2 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

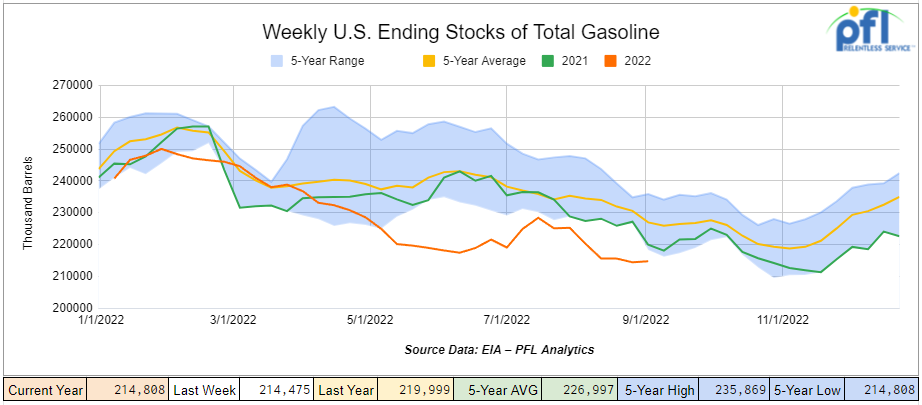

Total motor gasoline inventories increased by 400,000 barrels week over week and are 6% below the five-year average for this time of year.

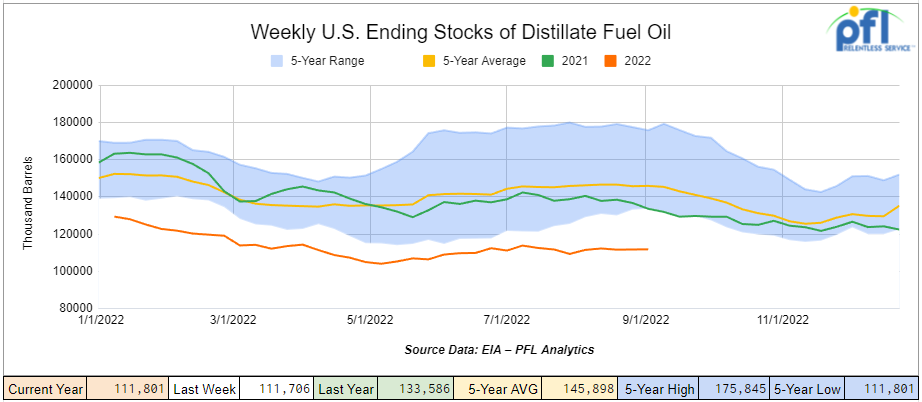

Distillate fuel inventories increased by 100,000 barrels week over week and are 23% below the five-year average for this time of year.

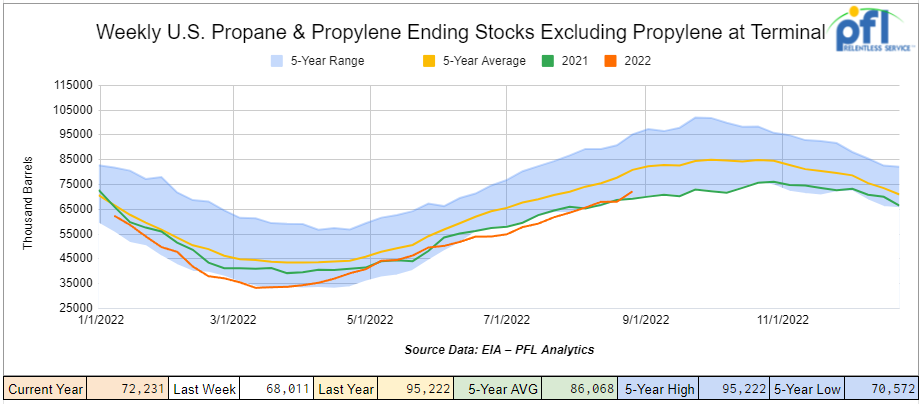

Propane/propylene inventories increased by 1.9 million barrels week over week and are 9% below the five-year average for this time of year.

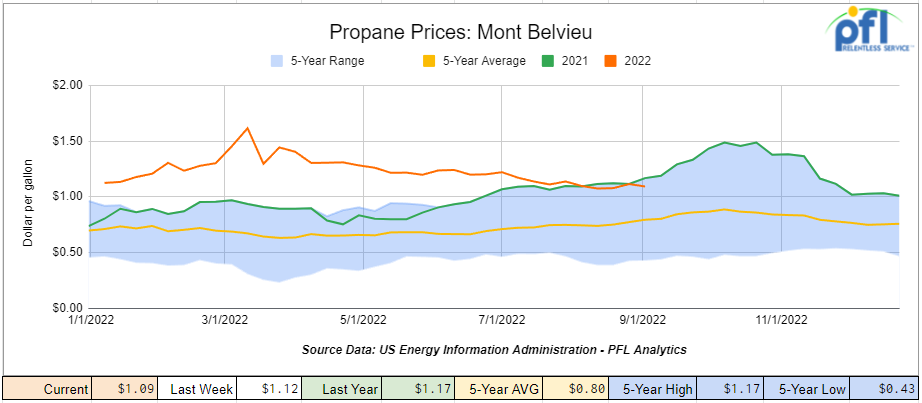

Propane prices were down 3 cents week over week closing at $1.09 per gallon and down 8 cents year over year.

Overall, total commercial petroleum inventories increased by 11.2 million barrels week over week.

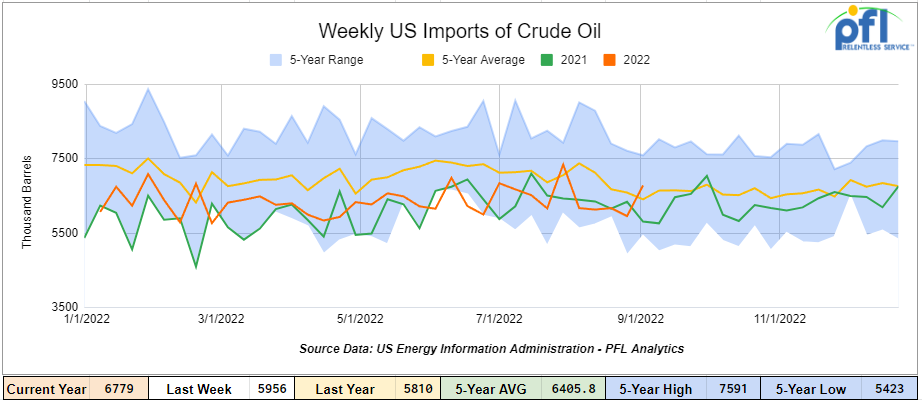

U.S. crude oil imports averaged 6.8 million barrels per day during the week ending September 2nd, 2022, an increase of 824,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 1.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 1 million barrels per day, and distillate fuel imports averaged 172,000 barrels per day during the week ending September 2nd, 2022.

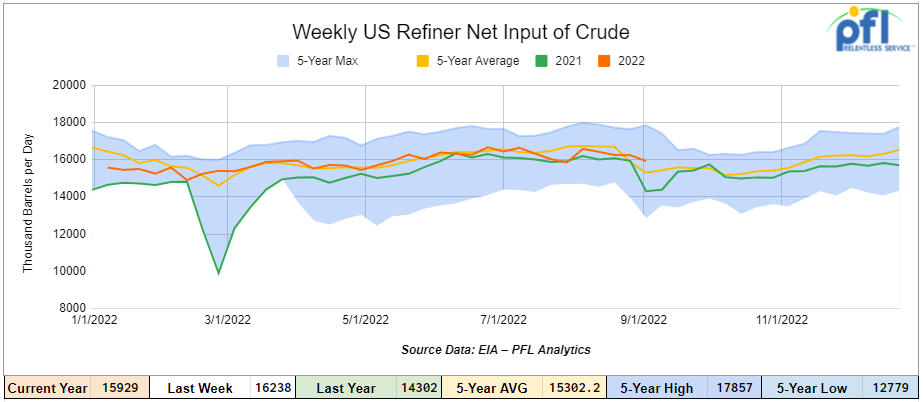

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending August 26, 2022, which was 17,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $87.52, up $0.84 per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 2nd, 2022.

Total North American weekly rail volumes were up 5.1% in week 35 compared with the same week last year. Total carloads for the week ending September 2nd were 357,036, up 7.84% compared with the same week in 2021, while Weekly intermodal volume was 345,036, up 2.42% compared to 2021. 9 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Metallic Ores and Minerals (-4.27%). The largest increase was from Motor Vehicles and Parts (+21.13%).

In the east, CSX’s total volumes were up 6.27%, with the largest decrease coming from Petroleum and Petroleum Products (-15.15%) and the largest increase from Motor Vehicles and Parts (+30.66%). Norfolk Southern’s total volumes were up +6.52%, with the largest decrease coming from Metallic Ores and Metals (-15.14%) and the largest increases from Coal (+26.97%) and Nonmetallic Minerals (+26.47%).

In the west, BN’s total volumes were down 1.94%, with the largest decrease coming from Other (-20.69%), and the largest increase coming from Grain (+42.60%). UP’s total rail volumes were up +7.22% with the largest decrease coming from Petroleum and Petroleum Products (-8.91%) and the largest increase coming from Motor Vehicles and Parts (+37.44%).

In Canada CN’s total rail volumes were up 15.41% with the largest decrease coming from Grain (-10.91%) and the largest increase coming from Petroleum and Petroleum Products (+65.76%). CP’s total rail volumes were up 1.38% with the largest decrease coming from Petroleum and Petroleum Products (-24.52%) and the largest increase coming from Coal (+29.60%) and Motor Vehicles and Parts (+29.39%).

KCS’s total rail volumes were up across the board (+16.50%) with the largest increase coming from Motor Vehicles and Parts (+66.09%).

Source Data: AAR – PFL Analytics

Rig Count

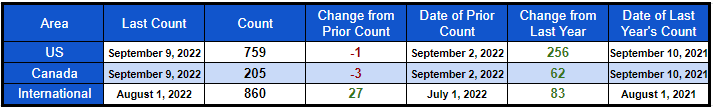

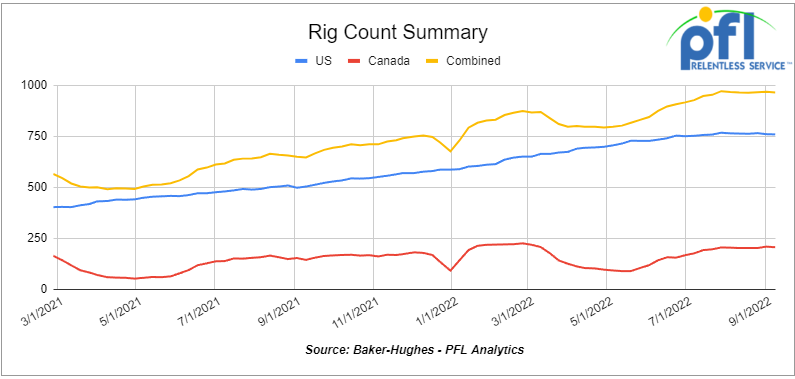

North American rig count was down -4 rigs week over week. U.S. rig count was down 1 rigs week-over-week and up by 256 rigs year over year. The U.S. currently has 759 active rigs. Canada’s rig count was down 3 rigs week-over-week, and up by 62 rigs year-over-year. Canada’s overall rig count is 205 active rigs. Overall, year over year, we are up 318 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,447 from 23,557 which was a loss of 110 railcars week-over-week. This was the sixth week-over-week decline after a five-week run of increases. Canadian volumes were higher, CP’s shipments rose by +0.06% and CN’s volumes were up 7.7% week over week. U.S. shipments were mixed. The BN had the largest percentage increase, up by +4.4%, and the UP the largest percentage decrease, down by -7.3%.

We are eyeing Crude Enbridge Line 5

Folks, just when you thought it was over. As previously reported by PFL in PFL’s’ 8-22-2022 rail report the Governor of Michigan Gretchen suffered a crushing and for her a heartbreaking defeat; losing another battle with Enbridge in her battle to threaten U.S. energy security and fast-track the green agenda by shutting down Enbridge line 5. She was trying to get the case switched from Federal court to State court. Well, now it is Wisconsin’s turn to take a swipe at Enbridge! A Wisconsin judge ruled against Enbridge in a dispute over Line 5 pipeline last week.

District Court Judge William Conley Judge stopped short of ordering a shutdown for fear of foreign policy consequences.

The judge felt that if he did shut the pipeline down such a decision would carry “significant” public and foreign policy implications for both Canada and the United States.

The judge sided with the Bad River Band of the Lake Superior Chippewa in his ruling, issued late Wednesday of last week, ordering Enbridge to reroute the pipeline around the band’s territory within five years, an effort Enbridge has said is already underway. The judge also said the band is entitled to financial compensation.

The band wanted an automatic injunction but was denied. The decision came just days after Ottawa invoked a 45-year-old energy treaty between the two countries in an effort to prevent U.S. courts from shutting down the pipeline, which carries crude oil and natural gas liquids from Alberta to Ontario through the United States.

It’s estimated Line 5 provides half the oil and propane used in Ontario and the U.S Midwest. We are already in an Energy crisis – we could not imagine this pipeline being shut down, but they keep trying.

“The Government of Canada is also worried about the domino effects the shutdown would have on the jobs of thousands of Canadians working not only in the oil industry but in interconnected areas of our economy. The shutdown could have a major impact on a number of communities on both sides of the border that depend on the well-being of businesses along the supply chain.”

The capital of Canada – Ottawa, Ontario – has twice now formally invoked the 1977 Transit Pipelines Treaty to trigger a dispute settlement process with Washington over Line 5. Last October, the government invoked the treaty following Michigan Governor Gretchen Whitmer’s attempts to shut the line down over concerns about a potential oil spill.

In a statement Thursday of last week, Enbridge said it is pursuing a 66-kilometer reroute of Line 5 around the Bad River Reservation using a Wisconsin contractor and employing at least a 10% Indigenous workforce.

The shutdown of Line 5 in any way shape or form would have massive implications not just here in North America – but for Europe as well. Canada has been asked by Europe to provide LNG and LPG’s to Europe and line five intact would help them achieve that – without it, no such luck and the Germans are visiting Canada this week to discuss.

At the end of the day Enbridge made the following statement “Enbridge remains open to resolving issues amicably with the Bad River Band of the Lake Superior Tribe of Chippewa Indians as we also continue to focus on providing consumers and industry in the region with safe, reliable energy,” the company said. Stay tuned to PFL on this one, you know we are watching this one under a microscope.

We are Watching Joe Manchin and a Natural Gas Pipeline

Don’t know what is wrong with Natural Gas but Joe Manchin’s Pipeline Showdown Is Coming. With the ink not even dry on the deal cut with the rest of the Dems for the Inflation Reduction Act, Manchin’s plan to fast-track energy projects is headed for a showdown. Congress is headed for a showdown this month over Democratic Senator Joe Manchin’s plan to fast-track federal approvals of energy projects ranging from natural gas pipelines to wind farms. Manchin secured a pledge from congressional leaders to advance the legislation, but the proposal is already drawing fierce opposition from environmental activists and progressive Democrats, and the outcome is far from certain. The deal, which was blessed by the White House, could deliver speedier approval for Equitrans Midstream Corp.’s stalled $6.6 billion Mountain Valley gas pipeline crossing Manchin’s home state of West Virginia. It also may expedite approvals for new clean energy projects spurred by the climate law enacted last month. If the legislation is passed, it would mark a big win for the oil and gas industry, which has long sought to accelerate federal permitting and scale back environmental reviews that can lead to years of delay and hundreds of millions of dollars in extra costs. Apparently, environmentalists, so they call themselves, are heading to Washington from all over the country this week in protest. This pipeline is great for rail, the environment, energy security and the overall economy – don’t forget the more natural gas produced the more natural gas liquids such as propane are produced. We don’t know why this one has been halted and why they want to shut it down. Stay tuned – it looks like it does not pay to cut a deal with Washington at this time but only time will tell!

We are watching Biodiesel and the Possible Shift to Renewable Diesel

Folks, this is an interesting one and we see that big changes are going to happen that could make biodiesel almost obsolete. It seems a little crazy, but we believe we could be headed that way – it is all stacking up against the biodiesel producer. First of all, the Biden Administration is preparing to use a regulatory proposal that is due by November 16th to set renewable fuel mandates for not just 1 year, but possibly up to three years. The current volumetric mandate expires then. Who knows what’s going to come out of this one folks – the EPA is tight-lipped. The incentives at the federal and state levels are going to work in conjunction with one another to incentivize some combination of renewable diesel and/or aviation fuel. We are seeing it with all the big refiners – Neste increasing exports from Norway and in partnership with Marathon domestically, Phillips shut down a refinery in the Bay area to convert it into a renewable diesel facility. It seems like every major player is doing something in preparation.

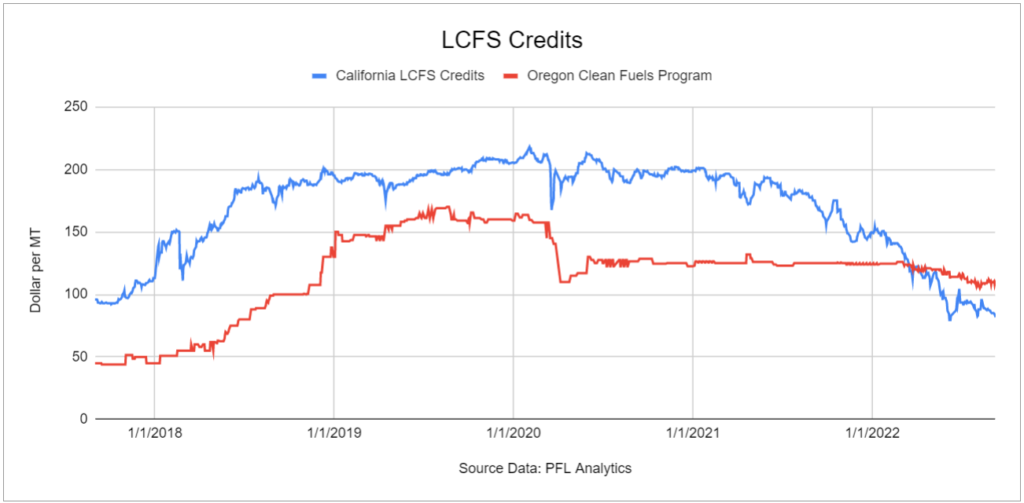

In California, you not only get RINs for Bio but LCFS credits are a big deal. The industry has been cashing in on this one for years. The party may be over for LCFS credits and we expect further deterioration in LCFS values as everyone is joining the party. See PFL chart below:

You ask how does this relate to rail? Well, it depends on the mandate, size, scope, and RIN classification that is mandated. We predict that we will have quite a few more coiled and insulated cars transporting tallow, used cooking oil, and such to the big guys feeding the new or modified refineries. The question is will that replace Biodiesel to blend in regular diesel over time? Well, folks we really don’t know but stay tuned to PFL we of course are watching this one for you.

Some Key Economic Indicators

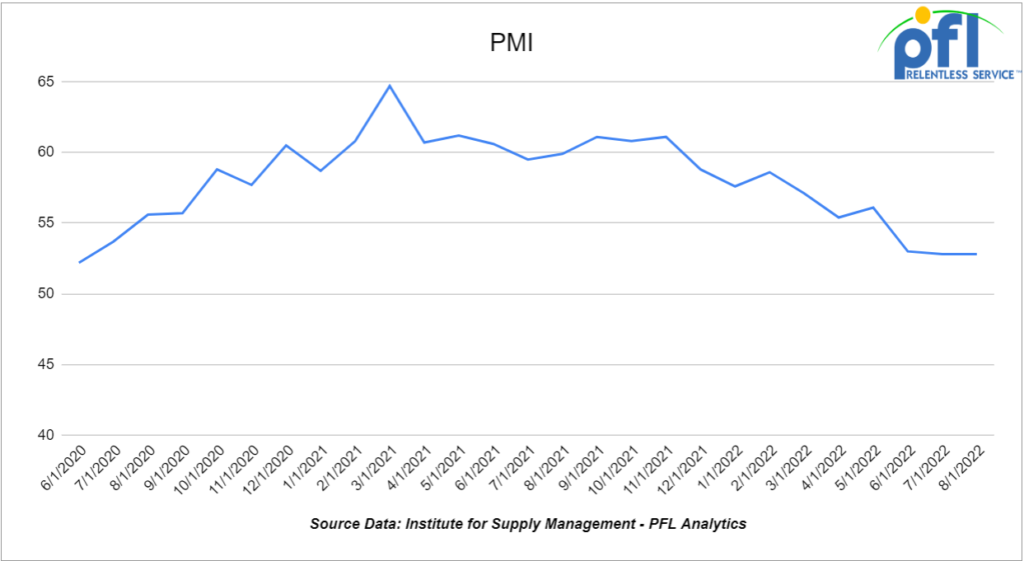

Purchasing Managers Index (“PMI”) – The PMI (which covers manufacturing) and the Services PMI (covering services) are both from the Institute for Supply Management. They are based on surveys of supply managers around the country. The surveys track the direction of changes in business activity. An index reading above 50% indicates expansion; below 50% means contraction. The more above or below 50, the faster the pace of change.

The PMI was unchanged month over month at 52.8% in July This breaks the streak of 26 consecutive month-over-month expansion, however, as noted in last month’s economic update is the lowest reading since June 2020. The new orders component of the PMI rose month over month, coming in at 51.3% in August from 48% in July.

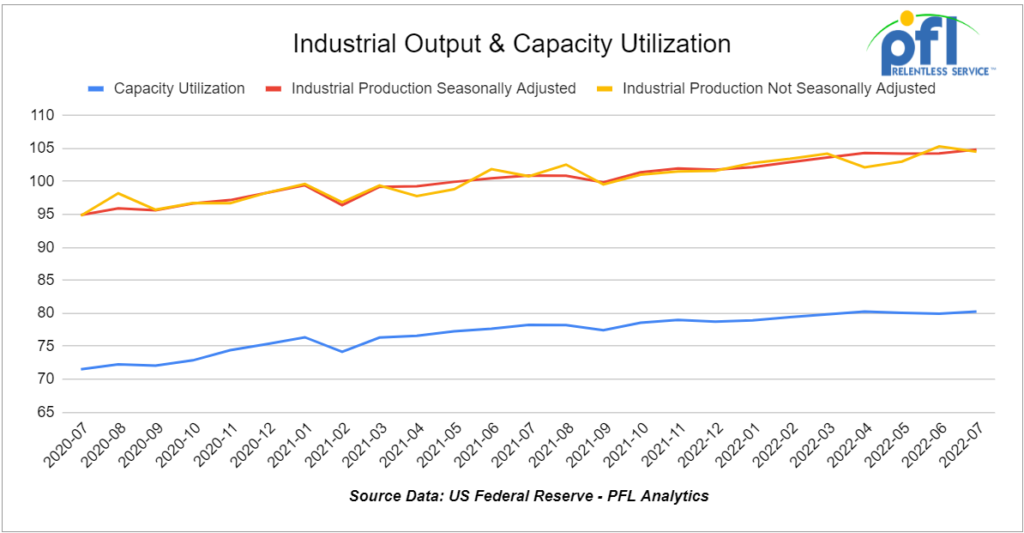

Industrial Output and Capacity Utilization – According to the Federal Reserve, preliminary seasonally adjusted total U.S. industrial output rose 0.6% in July 2022 from June 2022 on the back of a 0.7% increase in manufacturing output. If it holds after revisions, the 0.7% gain in manufacturing output will be the biggest in four months.

In July, manufacturing output (about 75% of total output), as mentioned above rose 0.7% from June. Manufacturing output was 3.2% higher in July 2022 than in July 2021. Output gains were not evenly spread across industries in July, though. Motor vehicles and parts accounted for most of it, rising 6.6% month over month. Motor vehicle assemblies were an annualized and seasonally adjusted 11.0 million in July, the most since August 2020. Excluding autos, factory output was up a much smaller 0.4% in July.

Other industries with seasonally adjusted output gains in July included railroad rolling stock, nonmetallic minerals, and wood products. Output of grain mill products, agricultural chemicals, refined petroleum products, and iron and steel fell in July. Output of plastics has been trending down for several months.

Overall capacity utilization was a preliminary 80.3% in July, the highest since August 2018, but not much different than it’s been for several months. For manufacturing, capacity utilization in July was a preliminary 79.8%, up from 79.3% in June.

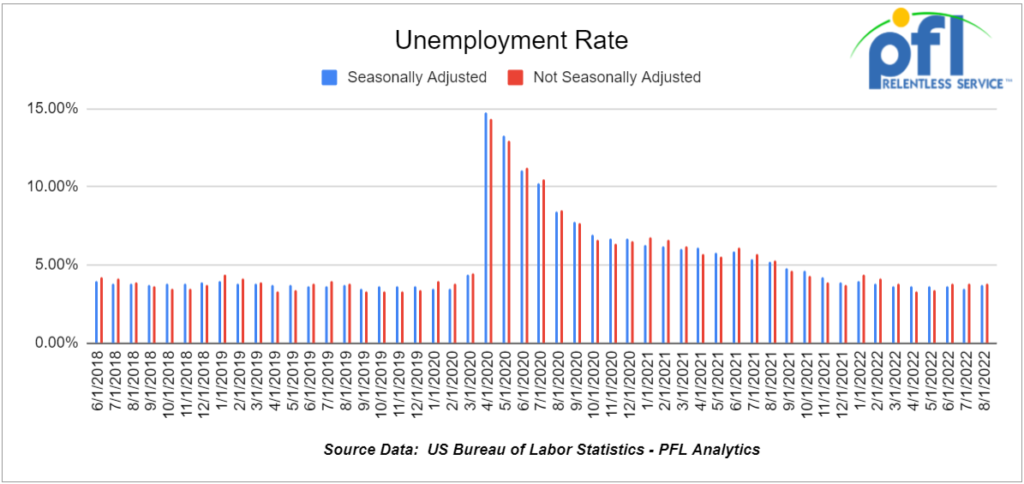

U.S. job growth was down month over month and the unemployment rate ticked higher.

The Bureau of Labor Statistics reported on September 2 that a preliminary 315,000 net new jobs were created in August 2022. That’s down from 526,000 in July.

The official overall unemployment rate ticked up to 3.7% up 0.2% month over month as 786,000 people entered the labor force in August. The labor force is defined as people who are employed or who are actively looking for work. Today, that is +/- 164 million people.

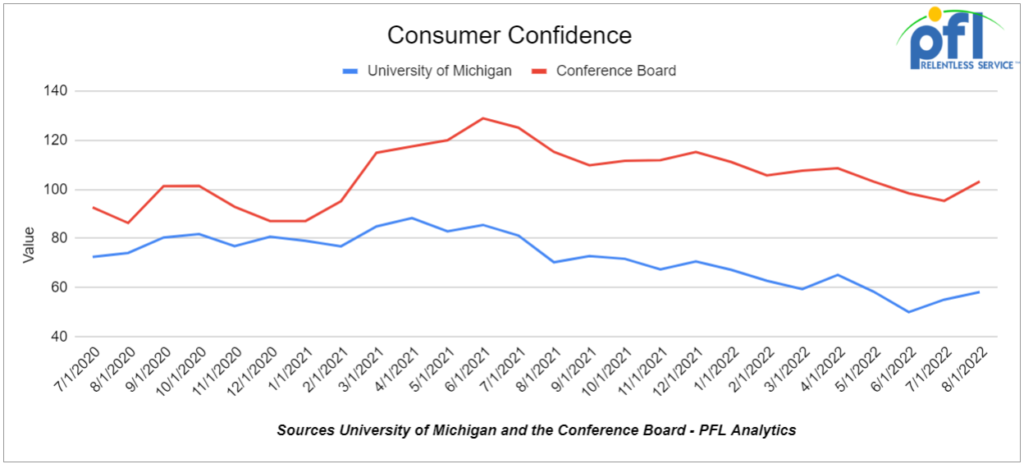

Surprisingly, but the good news is that Consumer confidence rebounded in August. The Conference Board’s Index rose to 103.2, up from 95.3 in July. That’s the first increase after three straight monthly declines.

The University of Michigan’s index of consumer sentiment rose too, up to 58.2 in August from 51.5 in July.

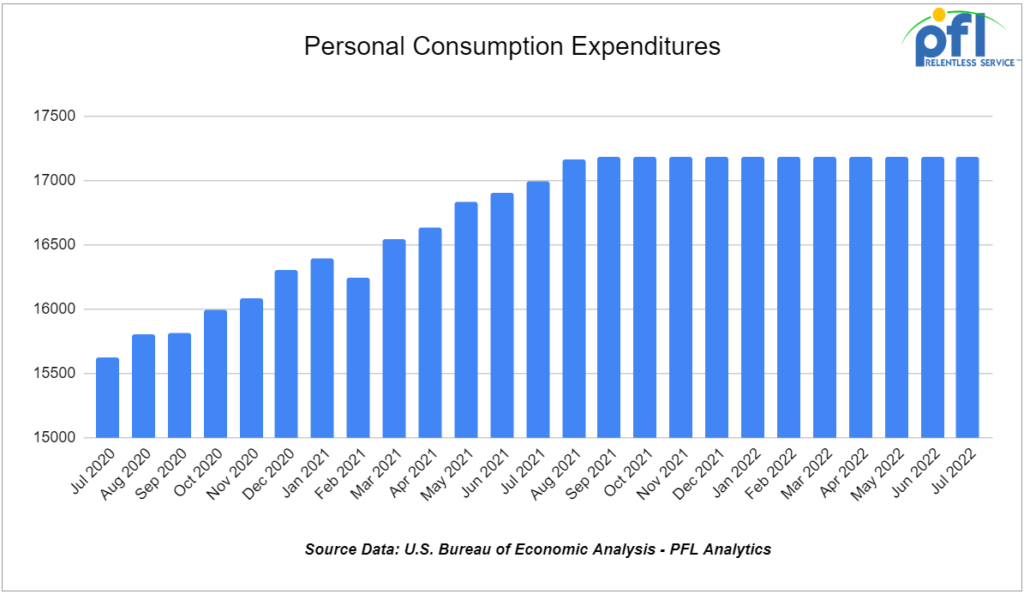

Total consumer spending not adjusted for inflation rose a preliminary 0.1% in July 2022 over June 2022. That’s the seventh straight month-to-month gain, but it’s the smallest percentage gain in those seven months. The fact that inflation is so high means that total spending may be rising, but the actual physical quantity of goods (which matters to transportation providers) is not.

Spending on goods fell 0.2% in July from June, its first decline since December 2021. Spending on services rose 0.3% in July, its 17th straight gain but the smallest gain in those 17 months. Since January 2022, growth in spending on services has slightly outpaced growth in spending on goods, but the share of total spending accounted for by services today remains well behind what it was before the pandemic.

Adjusted for inflation, total spending rose 0.2% in July, the sixth straight month with either a very small gain or a very small decline.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year-end

- 100-200, 340W Pressure cars for a 12 month term for propane. Can take in various locations, needed ASAP

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6 month term, Dirty to Dirty. Can take last in Crude.

- 100 Coiled and insulated cars for Crude. Needed in Canada for 6 months. Dirty to Dirty

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move. Available in September.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 61, 117Js in the Midwest. Last in Bakken. Dirty to Dirty service.

- 300W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|