“Success always demands a greater effort” – Winston Churchill

Jobs Update

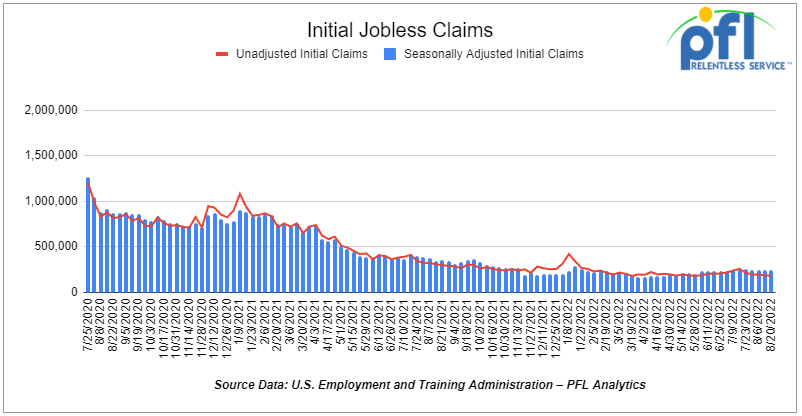

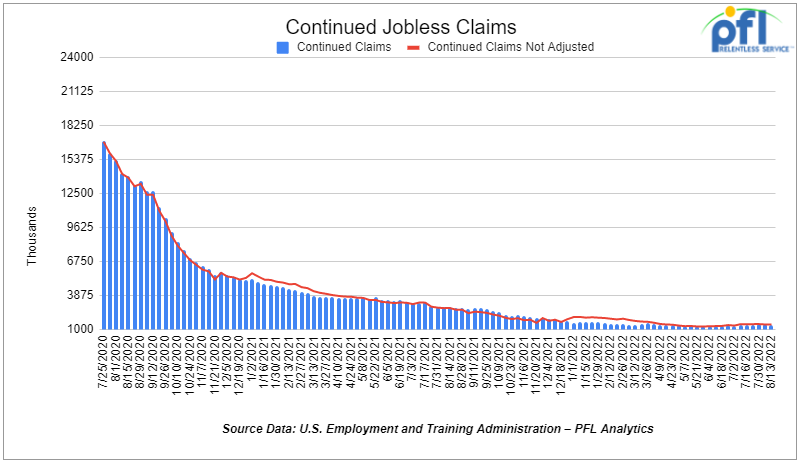

- Initial jobless claims for the week ending August 20th, 2022 came in at 243,000, down 2,000 people week-over-week.

- Continuing claims came in at 1.415 million people, versus the adjusted number of 1.434 million people from the week prior, down 19,000 people week over week.

Stocks closed lower on Friday of last week and down week over week

Stocks plunged Friday as Federal Reserve Chairman, Jerome Powell, gave a brief and blunt message that the Fed plans to keep raising interest rates. During his Jackson Hole speech, Powell said that the Fed will continue raising interest rates and hold them at a higher level until it is confident inflation is under control. The DOW closed lower on Friday of last week, down -1,008.38 points (-3.03%), closing out the week at 32,283.4, down –1,423.34 points week over week. The S&P 500 closed lower on Friday of last week, down -141.46 (-3.37%), and closed out the week at 4,057.66, down -170.82 points week over week. The NASDAQ closed lower on Friday of last week, down -497.56 points (-3.92%), and closed the week at 12,141.71 points, down -563.51 points week over week.

Oil closed higher on Friday of last week and higher week over week

Oil prices ended the day higher on Friday of last week as the market shrugged off warnings from the Fed about economic pain ahead after initially trading lower. Oil prices had briefly fallen after Fed Chair Jerome Powell said tight monetary policy may be in store “for some time” to fight inflation, meaning slower growth, a weaker job market, and “some pain” for households and businesses. Meanwhile, the prospects of OPEC+ production cuts may be getting stronger. The UAE is the latest country to side with Saudi Arabia on their thinking with crude markets. The impression remains that Saudi Arabia is not willing to tolerate any price slide below $90 per barrel. “Speculators could view this as an invitation to bet on further price rises without the need to fear any more pronounced price declines,” Commerzbank said in a note. WTI traded up 54 cents a barrel or (+.59%) to close at $93.06 a barrel on Friday of last week. Brent traded up US$1.65 a barrel or (+1.66%) to close at $100.99 per barrel U.S.

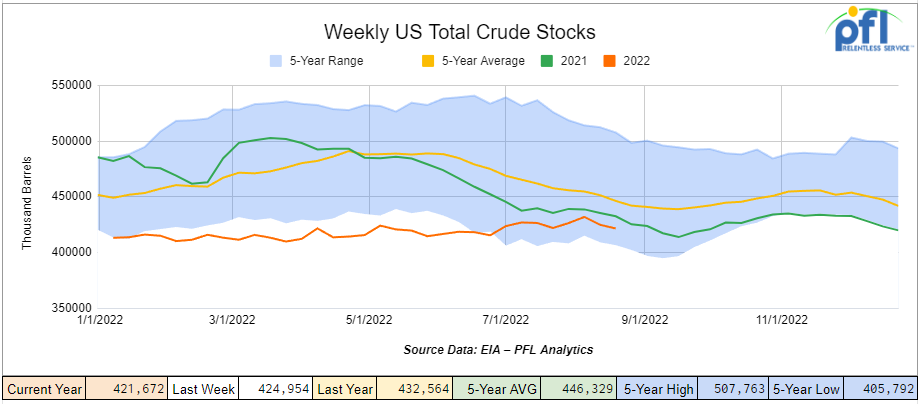

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 7.1 million barrels week over week. At 425.0 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

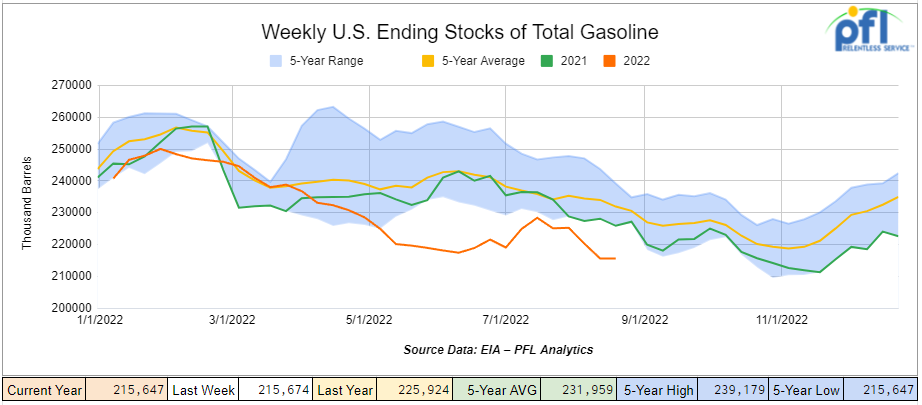

Total motor gasoline inventories were virtually unchanged week over week and are 7% below the five-year average for this time of year.

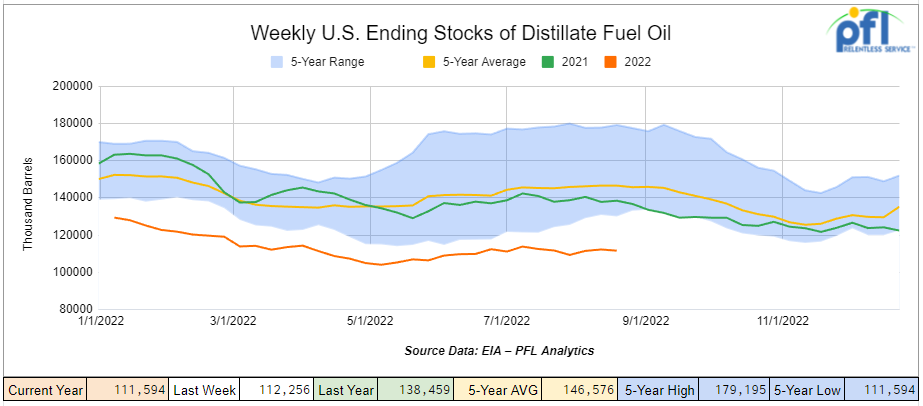

Distillate fuel inventories decreased by 700,000 barrels week over week and are 24% below the five-year average for this time of year.

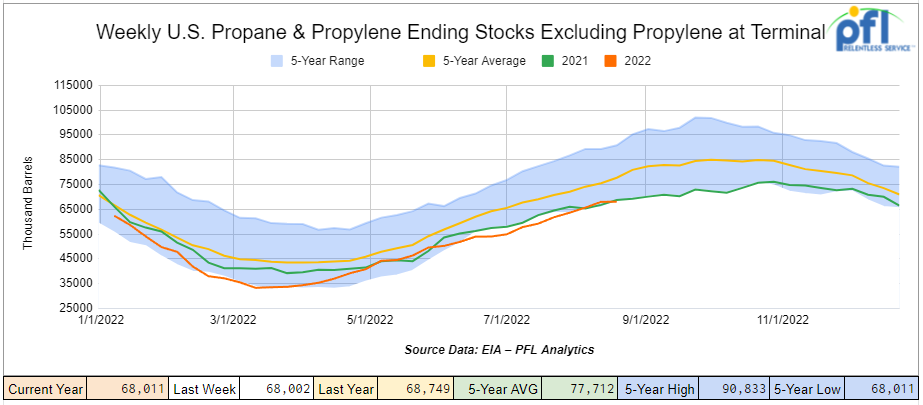

Propane/propylene inventories were also virtually unchanged week over week and are 11% below the five-year average for this time of year.

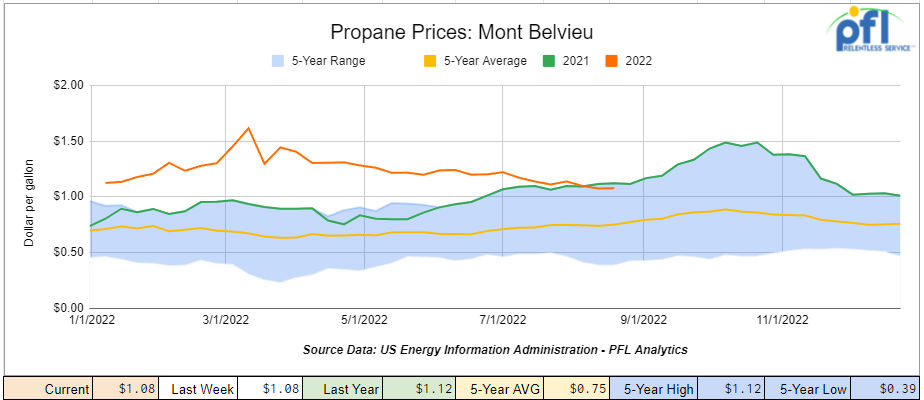

Propane prices were down 2 cents per gallon week over week and down 4 cents per gallon year over year, settling at $1.08 per gallon on Friday of last week.

Overall, total commercial petroleum inventories increased by 1.4 million barrels week over week.

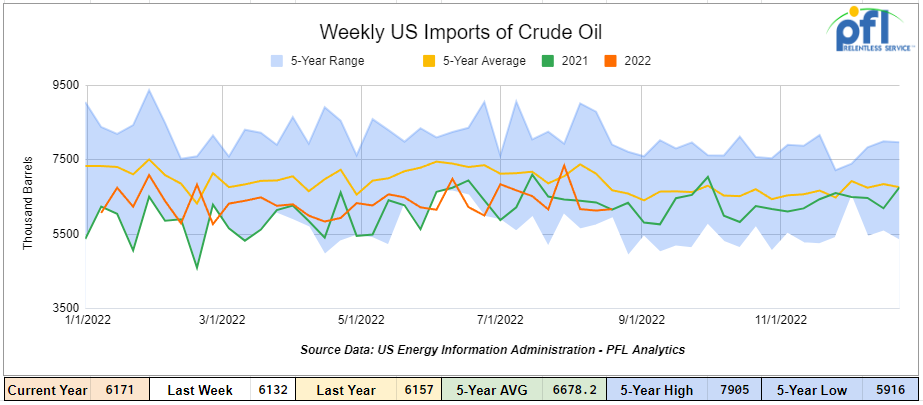

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending August 19th, an increase of 40,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 1.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 615,000 barrels per day, and distillate fuel imports averaged 173,000 barrels per day during the week ending August 19th, 2022.

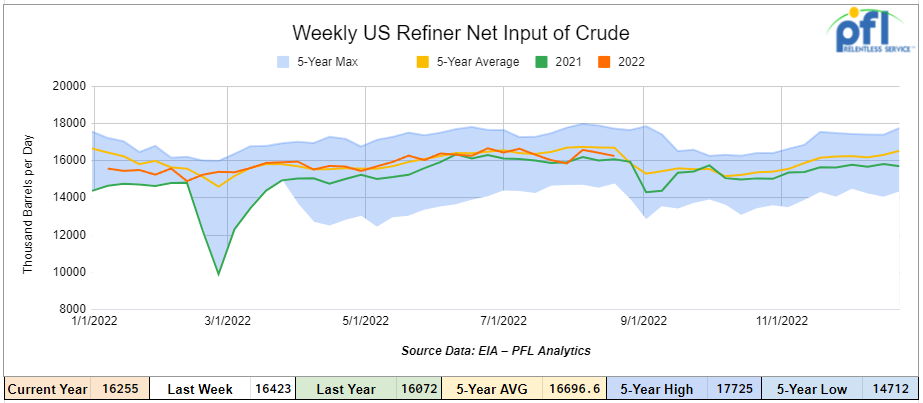

U.S. crude oil refinery inputs averaged 16.3 million barrels per day during the week ending August 19, 2022, which was 168,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $90.64, up $0.93 per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 24th, 2022.

Total North American weekly rail volumes were down -2.8% in week 33 compared with the same week last year. Total carloads for the week ending August 20th were 334,389, down -0.6% compared with the same week in 2021, while Weekly intermodal volume was 354,588, down -4.8% compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year declines with the most significant decrease coming from Grain (-11.6%). The largest increase was from Coal (+4.5%) and Nonmetallic Minerals (+4.2%).

In the east, CSX’s total volumes were down -2.49%, with the largest decrease coming from Other (-12.93%) and the largest increase from Grain (+14.21%). Norfolk Southern’s total volumes were up +2.55%, with the largest decrease coming from Petroleum and Petroleum products (-15.65%) and the largest increase from Coal (+23.32%).

In the west, BN’s total volumes were up 4.41%, with the largest decrease coming from Other (-23.15%), the largest increase coming from Grain (+19.60%) UP’s total rail volumes were up +7.52% with the largest decrease coming from Petroleum and Petroleum Products (-15.36%) and the largest increase coming from Grain (+32.67%).

In Canada, CN’s total rail volumes were down -by 2.37% with the largest decrease coming from Chemicals (-9.82%) and the largest increase coming from Nonmetallic Minerals (+35.53%). CP’s total rail volumes were down -2.08% with the largest decrease coming from Other (-34.55%) and the largest increase coming from Intermodal (+18.38%).

KCS’s total rail volumes were down -2.78% with the largest increase coming from Farm Products (+11.52%) and the largest decrease coming from Motor Vehicles and Parts (-18.83%).

Source Data: AAR – PFL Analytics

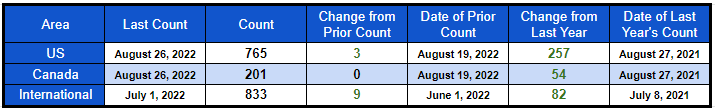

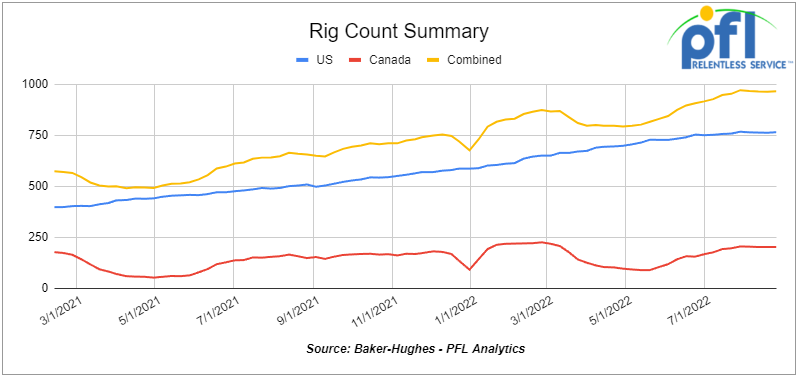

Rig Count

North American rig count was up 3 rigs week over week. U.S. rig count was up 3 rigs week-over-week and up by 257 rigs year over year. The U.S. currently has 765 active rigs. Canada’s rig count was flat week-over-week, and up by 54 rigs year-over-year. Canada’s overall rig count is 201 active rigs. Overall, year over year, we are up 311 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,662 from 24,059 which was a loss of 397 railcars week-over-week. This was the fourth week-over-week decline after a five-week run of increases. Canadian volumes were lower CP’s shipments fell by -11.2% and CN’s volumes were slightly down week over week. U.S. shipments mixed. The BN had the largest percentage increase, up by +10.9%, and NS the largest percentage decrease down by -11.9%.

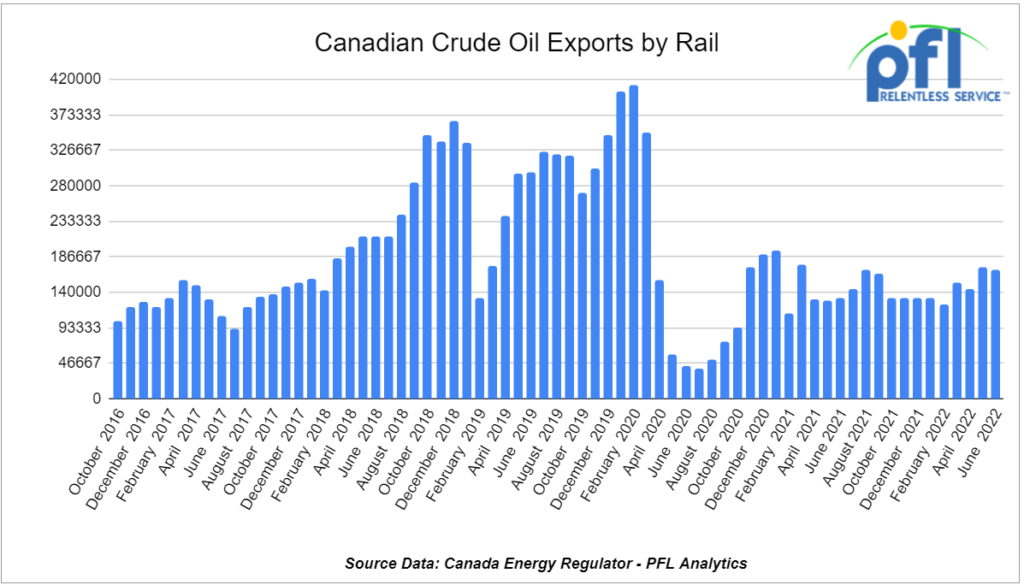

We are eying Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on August 23, 2022. For June 2022, Canada exported 170,234 barrels per day by rail (down by 2,888 barrels per day month over month) snapping a two-month streak of month-over-month increases, but still its second largest month since March of 2021. Crude by rail out of Alberta has been popular of late for raw Bitumen (no diluent added) as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. We were hoping to see month-over-month increases continue in June and do expect to see more month-over-month increases in the days to come. Crude by rail is also popular for off-spec products that can be blended here in the United States and in areas where there is no pipeline access. Before crude by rail out of Canada can come back in a meaningful way, supply needs to exceed pipeline capacity and we need to see a much wider basis for a sustained period of time (or at least predictable). We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins. WCS versus WTI closed out the trading day on Friday of last week at –US$19.75 per barrel, with an implied value of $72.17 per barrel in Edmonton down -50 cents per barrel day over day.

We are watching the weather.

As most who live in the South know, hurricane season is upon us – so far it has been very quiet however, that may change soon. AccuWeather meteorologists say that the tropics may soon come alive as they are tracking a few different areas for potential tropical development by early September.

At least two out of the three of the areas that AccuWeather meteorologists are monitoring closely for development in the tropics in the coming days could pose a threat to land, including the United States.

Conditions are changing in the tropical Atlantic. In the past week, tropical disturbances, also known as tropical waves, that move westward from Africa have shown more vigor, and an area of stiff breezes, which forecasters refer to as strong wind shear, has prevented development during much of the summer has been wavering in part of the basin.

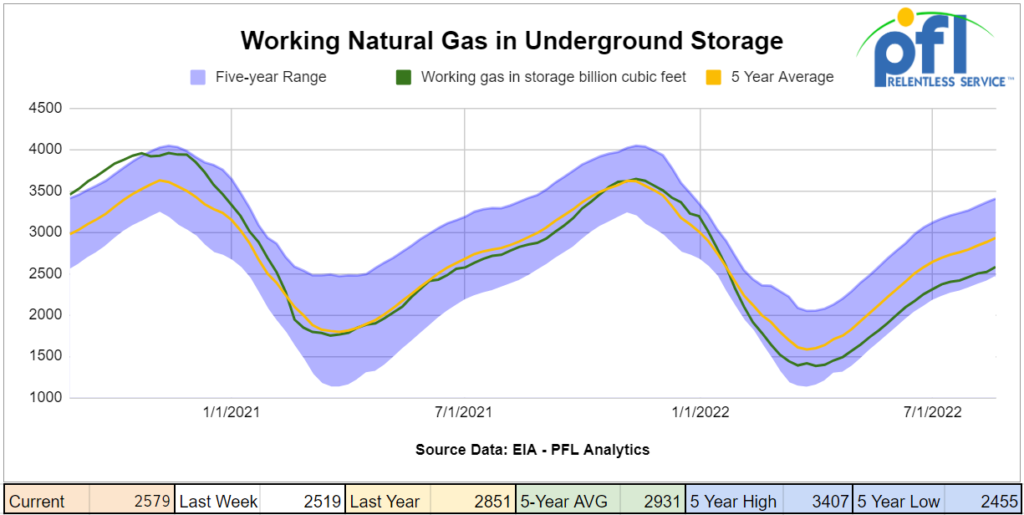

If we see a hurricane in the Gulf, get ready for Natgas to head North of $10.00 per MMBTU and stay there for a while. We are already short Natgas and storage is low and remember Freeport’s LNG 2 bcf per day export facility that has been down in the gulf since June is still not online. The expected date has now been pushed out until November 15, 2022. (after the midterm elections – go figure!) Don’t buy that electric car just yet, folks, we have a gut feeling you are not going to like your power bill!

From a letter obtained by the WSJ, the Biden Administration is urging refiners to limit their fuel exports amid multi-year low domestic inventory levels. See the above graphs.

U.S. fuel exports have been rising in recent months as countries in Europe and some in South America are looking to source alternatives to Russian fuel. The U.S. has been one such source, and its exports hit 1.4 million bpd in July, the highest in five years. Much of the increase is coming from Europe.

We don’t know about you, but we are getting a little tired of seeing the government interfere in free markets. Think about it we have a version of the green new deal – the government is punishing oil companies here at home (environmental), not letting them drill on certain federal lands, then bans Russian Crude, sells our emergency reserves out of the SPR, blames companies for making too much money, and building windmills off of the coast of NJ that is going to destroy fishing and seabeds. If that wasn’t enough interference, the administration then urges refineries not to export the much-needed gasoline and heating products to Europe when they originally stated they would help the European markets replace the deficit. It is our view that the current administration is trying its best to keep a lid on prices until after the midterms. We don’t know what is going to happen after the midterms are over, but the makeshift price controls by the government will cease, and get ready to pay a lot more for energy than you are now no matter who wins.

A Green Energy Project We Love

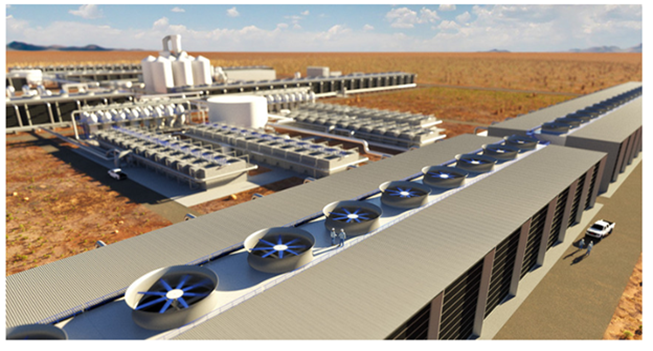

Folks, we love this one – Occidental is Constructing a Carbon Capture Facility in West TX. Occidental will break ground on the Texas direct air capture project. In a press release by the company on Thursday of last week by Occidental, they said they will begin construction on its first carbon capture project this fall. In its press release on Thursday of last week the company said:

“The construction of Oxy’s first DAC plant is an important milestone on the pathway to achieving our net-zero ambitions and helping the world meet the Paris Agreement’s climate goals,” said Vicki Hollub, President and CEO, Oxy. “We are fortunate to partner with Carbon Engineering and Worley, who share our vision in creating a carbon removal industry that can accelerate the path to net zero.”

In addition, Tom Janiszewski, vice president of regulatory and land for Occidental, told the Colorado Oil and Gas Association’s annual summit on Tuesday of last week that the West Texas facility would begin operations by 2024. Occidental’s Low Carbon Ventures LLC arm formed 1PointFive with venture capital firm Rusheen Capital Management to license, finance, and deploy direct air capture (DAC) technology, a method of extracting carbon dioxide from the atmosphere. The precise location of the West Texas facility has not been identified, but Occidental has applied for tax credits for a project in Ector County. The business also is evaluating a site in Livingston Parish, Louisiana, for a separate DAC operation. We are hoping they use the carbon captured for enhanced oil recovery – that would be killing two birds with one stone – exciting stuff.

Direct air capture plant for pulling carbon dioxide out of the atmosphere

Source: Carbon Engineering

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100, 340W Pressure cars for a 6 month term for propane. Can take in various locations, needed ASAP

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6 month term, Dirty to Dirty. Can take last in Crude.

- 100 Coiled and insulated cars for Crude. Needed in Canada for 6 months. Dirty to Dirty

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move. Available in September.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 61, 117Js in the Midwest. Last in Bakken. Dirty to Dirty service.

- 340W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|