“Don’t let yesterday take up too much of today.” — Will Rogers

Jobs Update

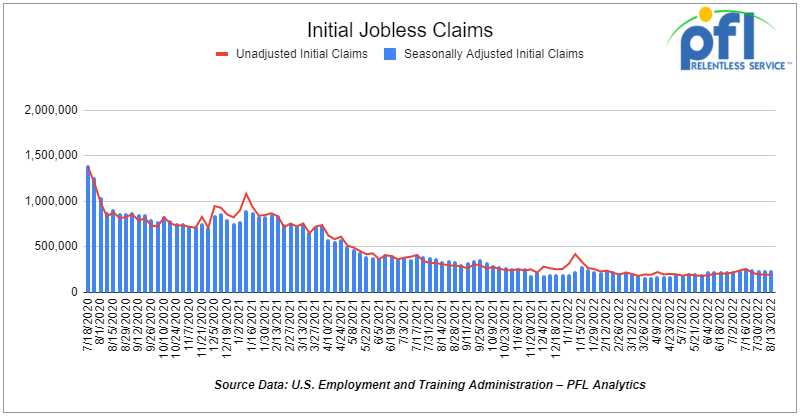

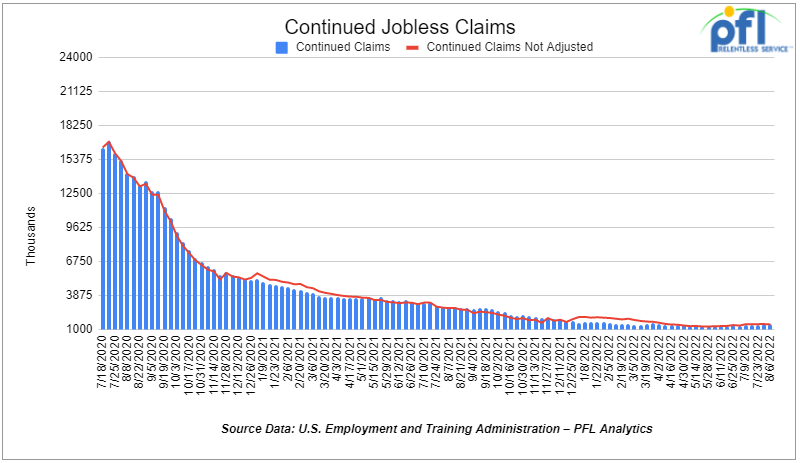

- Initial jobless claims for the week ending August 13th, 2022 came in at 250,000, down 2,000 people week-over-week.

- Continuing claims came in at 1.437 million people, versus the adjusted number of 1.43 million people from the week prior, up 7,000 people week over week.

Stocks closed lower on Friday of last week and down week over week

The DOW closed lower on Friday of last week, down -292.0 points (-0.86%), closing out the week at 33,706.74, down -55.26 points week over week. The S&P 500 closed lower on Friday of last week, down -55.26 (-1.29%) and closed out the week at 4,228.48, down -51.67 points week over week. The NASDAQ closed lower on Friday of last week, down -260.13 points (-1.99%) and closed the week at 12,705.22 points, down -341.97 points week over week.

Oil closed higher on Friday of last week, but lower week over week

Oil prices were higher on Friday of last week, but down week over week as a stronger dollar and slowing global economy was the theme for this week. USD strength hit a five-week high. “Although the oil complex has been able to shrug off a strong dollar on any given session, extended strong dollar trends will pose a major headwind against sustainable oil price gains,” said Jim Ritterbusch of Ritterbusch and Associates. In a sign of easing oil supply tightness, the price gap between prompt and second-month Brent futures has narrowed by $5 a barrel since the end of July to under $1. The spread for WTI has shrunk to a 39-cent premium from a nearly $2 premium in late July. WTI traded up $0.27 or (+.29%) to close at $90.77. Brent traded up $0.13 or (+.13%) to close at 96.72

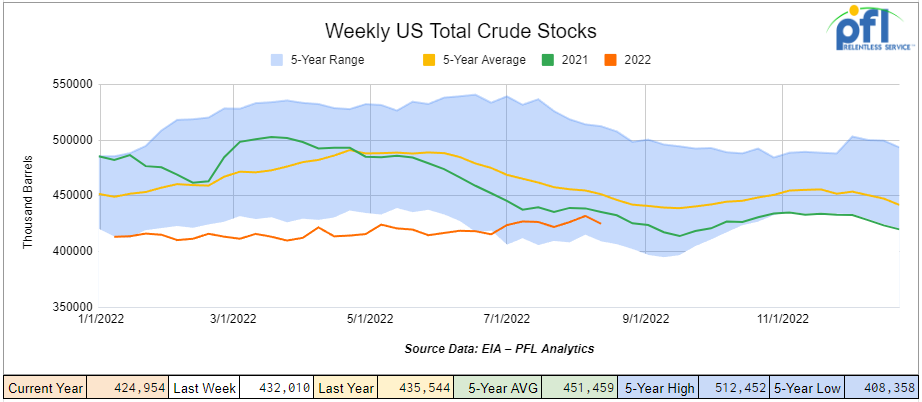

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 7.1 million barrels week over week. At 425.0 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

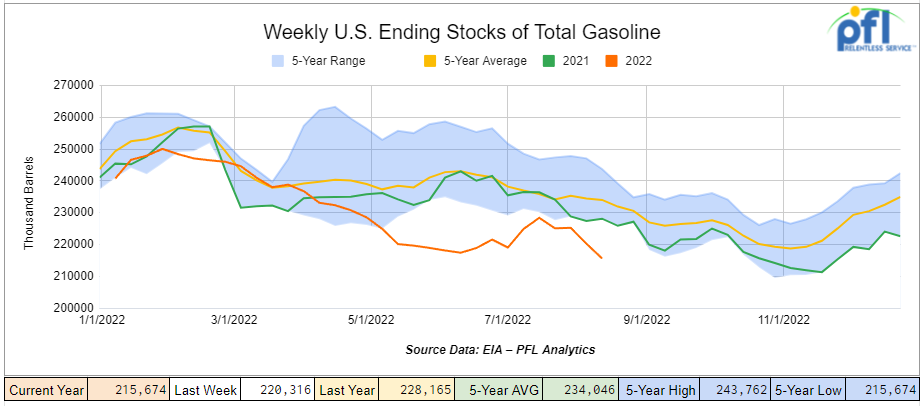

Total motor gasoline inventories decreased by 4.6 million barrels week over week and are 8% below the five-year average for this time of year.

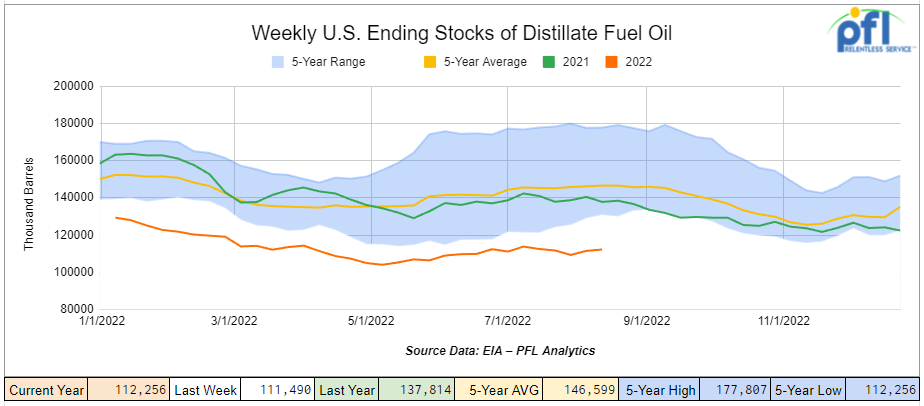

Distillate fuel inventories increased by 800,000 barrels week over week and are 23% below the five-year average for this time of year.

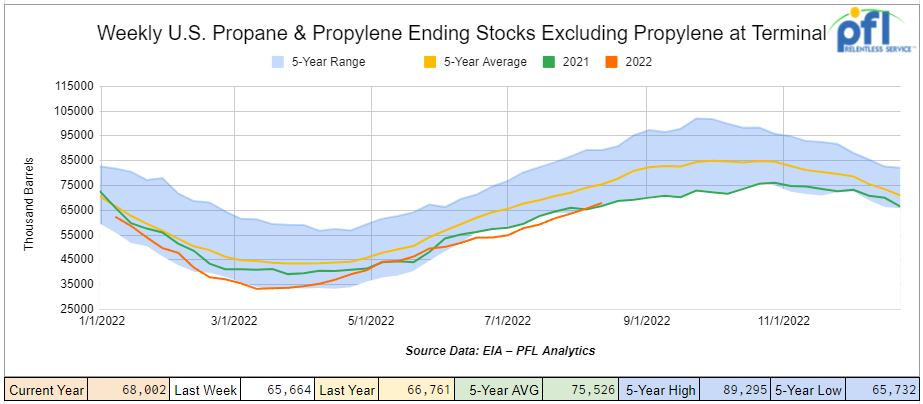

Propane/propylene inventories increased by 2.3 million barrels week over week and are 8% below the five-year average for this time of year.

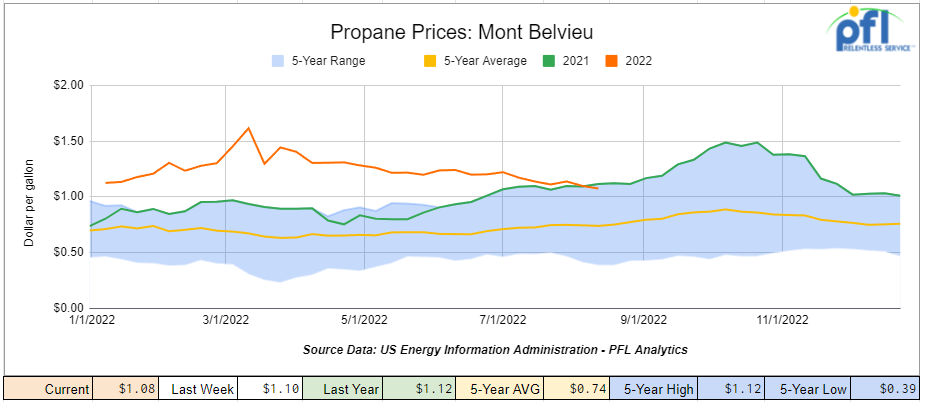

Propane prices closed down 2 cents per gallon week over week at $1.08 per gallon. Folks, we are now down 4 cents per gallon year over year, the first we have had year over year declines in 2022!

Overall, total commercial petroleum inventories decreased by 9.2 million barrels week over week.

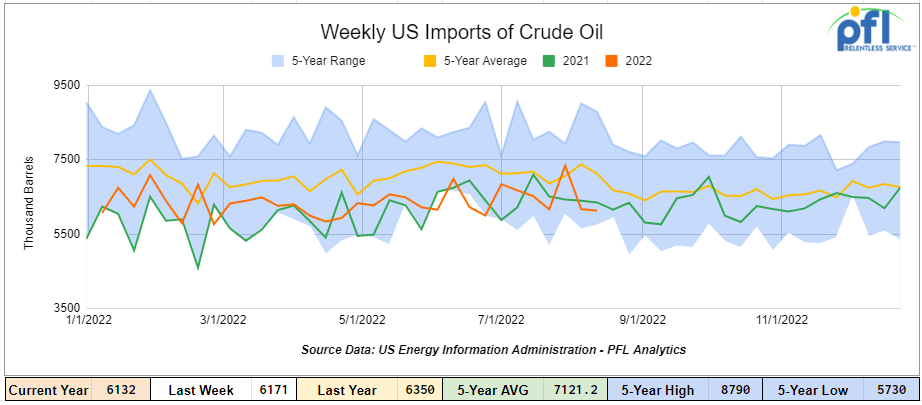

U.S. crude oil imports averaged 6.1 million barrels per day during the week ending August 12th, 2022, a decrease of 39,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 0.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 714,000 barrels per day, and distillate fuel imports averaged 164,000 barrels per day for the week ending August 12, 2022

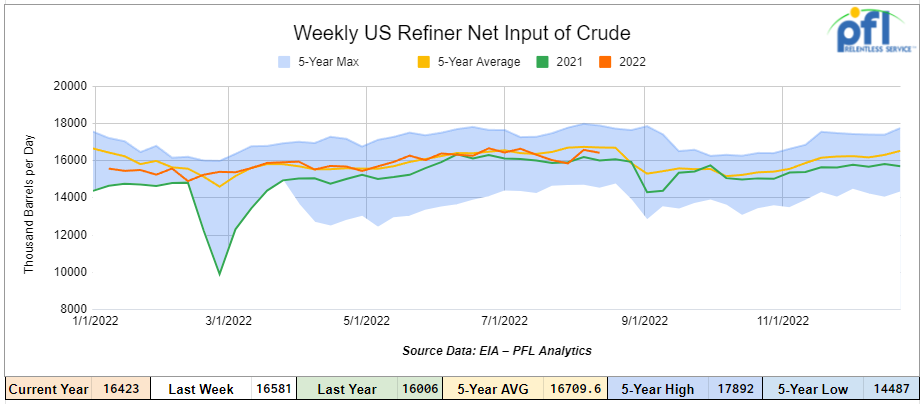

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending August 12, 2022 which was 158,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $90.64, down -$0.13 per barrel from Friday’s close.

North American Rail Traffic

Total North American weekly rail volumes were flat in week 32 compared with the same week last year. Total carloads for the week ending August 13th were 333,905, up 1.5% compared with the same week in 2021, while Weekly intermodal volume was 356,333, down -1.3% compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year declines with the most significant decrease coming from Grain (-12%). The largest increase was from Coal (+4.4%) and Nonmetallic Minerals (+4.1%).

In the east, CSX’s total volumes were up 2.38%, with the largest decrease coming from Petroleum and Chemicals (-19.44%) and the largest increases from Nonmetallic Minerals (+8.51%). Norfolk Southern’s total volumes were down -1.57%, with the largest decrease coming from Nonmetallic minerals (-14.63%) and the largest increases from Grain (+9.5%).

In the west, BN’s total volumes were down -2.36%, with the largest decrease coming from Petroleum and Petroleum Products (-18.09%), the largest increase coming from Farm and Food Product (+5.52%) UP’s total rail volumes were up 7.53% with the largest decrease coming from Grain (-1.72%) and the largest increase coming from Other (+29.75%) and Motor Vehicles and Parts (+24.57%).

In Canada CN’s total rail volumes were up 1.12% with the largest decrease coming from Chemicals (-7.45%) and the largest increases coming from Motor Vehicles (+44.44%) and Petroleum and Petroleum Products (42.24%). CP’s total rail volumes were down -4.5% with the largest decrease coming from Petroleum and Petroleum Products (-18.29%) and the largest increase came from Coal (+56.62%).

KCS’s total rail volumes were up 7.33% with the largest increase coming from Coal (+30.60%) and the largest decrease coming from Chemicals (-20%).

Source Data: AAR – PFL Analytics

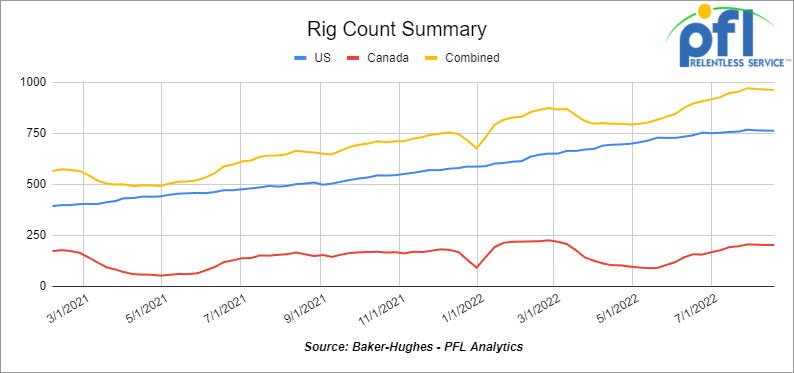

Rig Count

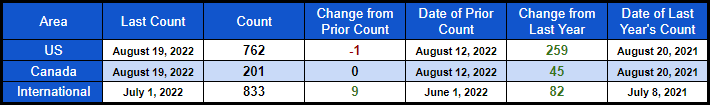

North American rig count was down by -1 rig week over week. U.S. rig count was down -1 rig week-over-week and up by 259 rigs year over year. The U.S. currently has 762 active rigs. Canada’s rig count was flat week-over-week, and up by 45 rigs year-over-year. Canada’s overall rig count is 201 active rigs. Overall, year over year, we are up 304 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

We are Watching Governor Gretchen in Michigan Lose Again in Her Attempt to Shut Down Line 5

What a heartbreaker for the Governor of Michigan losing another battle with Enbridge in her battle to threaten U.S.Energy security by fast-tracking the green agenda by shutting down Enbridge line 5. She wanted to get the case moved to State court where she could do that, but that is not going to happen. Judge sides with Enbridge in Michigan’s latest bid to halt Line 5 pipeline

It’s the second time in nine months that District Court Judge Janet Neff ruled in favor of pipeline owner Enbridge Inc., which wanted the dispute elevated to the federal level.

That first decision prompted Michigan Attorney General Dana Nessel — believing her only path to victory to be in state court — to abandon the original case, turning instead to a separate, dormant, nearly identical circuit court case to try again.

“The court concludes that (the) plaintiff’s motion must fail, based on …(the) plaintiff’s attempt to gain an unfair advantage through the improper use of judicial machinery,” Neff wrote.

“The court’s decision … is undergirded by (the) plaintiff’s desire to engage in procedural fencing and forum manipulation.”

A spokesperson for Nessel did not immediately respond to media inquiries.

Whitmer is a Democrat and close ally of President Joe Biden whose political fortunes depending on the support of environmental groups in the state. She ordered the shutdown of Line 5 in November 2020 and Enbridge refused to do it!

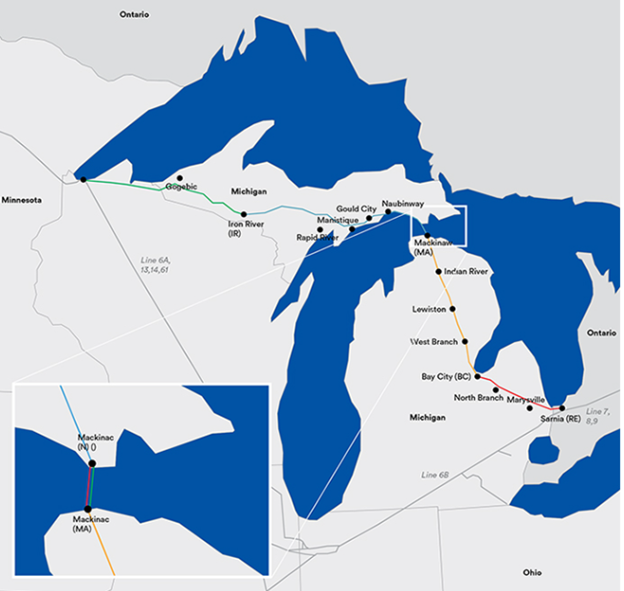

She cited the risk of an ecological disaster in the Straits of Mackinac, the environmentally sensitive passage between Lake Michigan and Lake Huron where the pipeline runs underwater between the state’s upper and lower peninsulas.

They went to circuit court, where Enbridge pushed back hard, arguing that Whitmer and Nessel had overstepped their jurisdiction and that the case needed to be heard in federal court.

Late last year, Neff sided with Enbridge, prompting Whitmer and Nessel to abandon the complaint and try again, this time with a similar circuit court case that had been dormant since 2019.

Nessel had hoped to head off Enbridge’s jurisdictional argument on a technicality: that under federal law, cases can only be removed to federal jurisdiction within 30 days of a complaint being filed.However,Neff wasn’t buying it, citing the precedent that she herself established in 2021 when she ruled for Enbridge the first time.

“It would be an absurd result for the court to remand the present case and sanction a forum battle,” Neff wrote.

The Line 5 pipeline transports upwards of 540,000 barrels per day of crude oil and natural gas liquids across the Canada/U. S. border and the Great Lakes by way of a twin line that runs along the lake bed.

Enbridge Line 5 (Note area of contention)

Source: Enbridge

Line 5 supplies 65% of propane demand in the Upper Michigan Peninsula, and 55% of Michigan’s statewide propane needs. Overall, Line 5 transports up to 540,000 barrels per day (bpd) of light crude oil, light synthetic crude, and natural gas liquids (NGLs), which are refined into propane.

Critics want the line shut down, arguing it’s only a matter of time before an anchor strike or technical failure triggers a catastrophe in one of the area’s most important watersheds.

Enbridge Line 5 (Crossing Point)

Source: Enbridge

Proponents of Line 5 call it a vital and indispensable source of energy, especially propane, for several Midwestern states, including Michigan, Ohio and Pennsylvania. It is also a key source of feedstock for refineries in Canada, including those that supply jet fuel to some of Canada’s busiest airports.

In a statement, Enbridge described last Thursday’s decision as “consistent with the court’s November 2021 ruling that the state’s prior suit against Line 5 belonged in federal court.”

That, the company said, is the correct forum for “important federal questions” about interstate commerce, pipeline safety, energy security and foreign relations.

The statement goes on to say that shutting down Line 5 would “defy an international treaty with Canada that has been in place since 1977.”

Line 5 talks between the two countries under that treaty, which deals specifically with the question of cross-border pipelines, have been ongoing since late last year.

“Enbridge looks forward to a prompt resolution of this case in federal court.”

We are Watching Europe

Europe is in an Energy Crunch with Natural Gas as we all know. Things, however, are getting worse in Europe for energy. Drought has cut into European Refining. Extremely low water levels along the River Rhine (vessels are touching the riverbed even if empty) have forced UK energy major Shell to curb refinery runs at its 350,000 b/d Rhineland refinery, citing difficulties in transporting goods via the river. This is going to cut into already worldwide low storage of gasoline and distillates. Refinery runs here in the U.S. especially in the east are at high levels – problem is we don’t have enough of them (refineries that is!)

We are Watching California – Looks a lot Like Europe

California’s grid operator urged the state’s 40 million people to ratchet down the use of electricity in homes and businesses on Wednesday of last week as a wave of extreme heat settled over much of the state, stretching power supplies to breaking point.

Temperatures soared well above 100 degrees in many of the inland valleys, reaching 107 in parts of Northern California’s Shasta and Tehama counties and 108 in parts of Southern California.

To prevent power outages, the California Independent System Operator (ISO) asked people and businesses to turn off lights and appliances and preset their thermostats to 78F (26C). Reducing usage was especially critical from 4 p.m. to 9 p.m., when demand typically peaks and solar power generation begins to subside.

ISO made similar power usage requests during summer and fall over the past two years, California ISO projected power demand would peak at 44,919 megawatts.

Further, to California’s woes on Tuesday of last, the U.S. government warned that more drastic cuts in water usage were needed to protect dwindling supplies held in reservoirs that are crucial to the well-being of seven Western states.

Two Colorado River reservoirs – Lake Mead and Lake Powell – have fallen to just above one-quarter of their capacity this summer. If they fall much lower, the lakes will be unable to generate hydroelectric power for millions of customers in the West, authorities say. Folks, it does not look like renewables alone is going to cut it – don’t get us wrong we like renewables if they truly are renewable – We have to start learning from Europe – Maybe it is time to build a couple of clean coal plants or some clean burning natural gas fired generation just a thought!

We are watching Biden’s oil drilling pause

Folks, we can’t make this stuff up – at the same time California is struggling to meet power demand, we are short natural gas storage, short propane storage, short distillate storage, short gasoline storage etc…. A federal appellate judge struck down a lower court’s decision that had stopped the Biden administration from pausing the auction of oil and gas drilling rights in federal lands and water.

On Wednesday of last week, the U.S. Court of Appeals for the 5th Circuit vacated a district-court decision from last year in favor of Louisiana and a dozen other states, many of which rely on oil and gas royalties to fund their governments. Circuit Judge Patrick E. Higginbotham sent the case back to the lower court, writing that its initial decision stopping Biden’s moratorium on leasing was too vague to be valid. By sweeping away the injunction, the appeals court gives the Biden administration a potential path to pause leasing again. What happens next is unclear – stay tuned to PFL for further updates

We are watching the BN who said it will lift California permit embargo

The BN announced on Thursday of last week it will end a temporary California permit embargo on Sept. 4.

The embargo enabled BNSF “to significantly reduce backlogs and drive greater efficiencies” for its trains moving toward and in California and throughout its network, the Class I stated in a customer notification on its website.

“This embargo was one of several actions to improve network fluidity in Southern California. As a result, we have seen decreased congestion and increased velocity as network conditions are improving,” the notice states.

BN said it will continue working with individual customers “as necessary to manage traffic flows.”

Meanwhile, BN officials also commented on the Presidential Emergency Board’s recommendations issued earlier last week in an effort to help resolve the labor contract dispute between the nation’s major freight railroads and the unions that represent rail employees. The two sides now have until Sept. 16 to accept the recommendations or agree to a voluntary settlement involving other terms. No work stoppages can occur until after Sept. 16.

The board’s recommendations include “the most substantial wage increase in nearly 40 years,” BN officials said in a customer notification.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 10-20 propane cars in North Dakota ASAP for 2-3 months

- 5 20K 286 tank cars in Texas for 2 years to haul P-dichlorobenzene – negotiable

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|