“Success depends upon previous preparation, and without such preparation there is sure to be failure.”

Confucius

COVID 19 and Markets Update

The battle continues with COVID -19 as cases continued to rise over the weekend in the U.S. and deaths from the virus continue. In the United States, we currently have 965,933 confirmed cases and 54,877 confirmed deaths. Restrictions are easing in certain states for now and the path forward is now being left up to the individual governors and how each individual State get back to work. Georgia opened up on Friday with controversy with other states to follow including South Carolina, Oklahoma, Texas and Alaska.Some lawmakers and government officials say that the Chinese inflicted COVID-19 on the United States and the rest of the world was on purpose or at least negligently – legislation is being introduced by Senator Cotton and other Senators allowing individuals, families, the government, and businesses to sue China for damages. The State of Missouri is the first of many that have initiated suit against China.

The Theory

- The Wuhan lab is where the virus is believed to have escaped from, on an accidental basis.

- China knew it was spreading among its population – locked down the City of Wuhan from travel to other parts of China.

- China then imported medical supplies when they are normally an exporter.

- China, in an effort to create a leveled playing field, continued to allow international flights out of Wuhan to other parts of the world to purposely spread the virus knowing the dangers and the virus’s ability to spread from human to human efficiently.

Equities traded up on Friday, with the DOW closing up 260.01 points on the day or 1.11%. In overnight trading futures traded higher and we are expected to open up 241 points on the DOW.

Oil had a rough week last week with WTI crude futures settling at -$37.63 per barrel on April 20. Since then, oil has recovered settling at $16.94 per barrel on Friday of last week. There has been a move by regulators to curb oil production here in the U.S., as the Texas Railroad Commission may vote on a plan as soon as May 5. Our feeling is they don’t need to – let the market work – production is shutting in. In fact, Continental Resources shut in production last week and declared force majeure on some oil deliveries. According to a Bloomberg report Ron Ness, president of the North Dakota Petroleum Council, said that Bakken crude regional prices were $14 to $15 per barrel below WTI. The same is happening in Canada where crude by rail is suffering. In fact, Canada has enough pipe for the first time in 30 months as production cuts in Canada intensify. Enbridge’s 2.9 million barrel a day pipeline accepted all crude nominations for May without proration.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

Railcar Volumes

Total North American rail volumes were down 20.0% year over year in week 16 (U.S. -23.3%, Canada -10.9%, Mexico -10.2%), resulting in quarter to date volumes that are down 18.8% and year to date volumes that are down 8.4% (U.S. -10.0%, Canada -4.7%, Mexico -2.2%). All of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-16.5%), coal (-39.0%) and motor vehicles & parts (-90.0%).In the East, CSX’s total volumes were down 20.6%, with the largest decreases coming from motor vehicles & parts (-92.8%), intermodal (-14.0%), and coal (-32.5%). NS’s total volumes were down 32.0%, with the largest decreases coming from intermodal (-25.9%), coal (-51.4%) and motor vehicles & parts (-96.0%).

In the West, BN’s total volumes were down 24.9%, with the largest decreases coming from coal (-49.6%), intermodal (-16.4%), motor vehicles & parts (-79.3%), stone sand & gravel (-40.5%) and petroleum (-21.5%). UP’s total volumes were down 24.4%, with the largest decreases coming from intermodal (-24.0%), motor vehicles & parts (-90.1%) and coal (-31.2%).

In Canada, CN’s total volumes were down 13.6% with the largest decreases coming from motor vehicles & parts (-92.6%), intermodal (-8.8%), petroleum (-30.7%), stone sand & gravel (-56.8%) and grain (-26.6%). The largest increase came from farm products (+91.5%). RTMs were down 14.0%. CP’s total volumes were down 11.7%, with the largest decreases coming from intermodal (-8.8%), motor vehicles & parts (-79.8%), stone sand & gravel (-66.3%) and coal (-17.9%). RTMs were down 1.5%.

KCS’s total volumes were down 21.1%, with the largest decreases coming from motor vehicles & parts (-93.8%), intermodal (-16.3%) and coal (-53.3%).

The Railway Supply Institute (RSI) just reported industry railcar statistics for Q12020. Orders for new railcars declined to 6,200 units down 36% year over year and the backlog fell 10% to 46,300 units. The decline in orders was driven by a 3,100 unit decrease in non-tank car orders that was partially offset by an 800 unit increase in tank car orders. Moving forward, expect minimal orders in for the foreseeable future given today’s economic environment. We expect railcar production to approach prior recessionary levels over the next couple years given numerous headwinds currently impacting demand (elevated railcar storage levels, weak rail volumes, PSR implementation and a distressed energy sector).

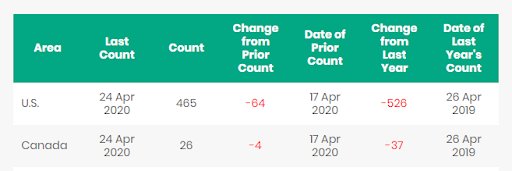

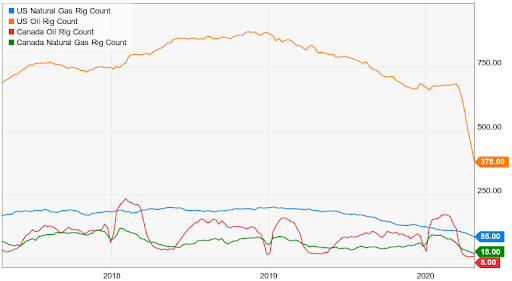

North American rig count is down 8 rigs week over week with the U.S. losing 64 rigs and Canada losing 4 rigs week over week. Year over year we are down 563 rigs collectively. Cuts in drilling continue as demand for oil continues to decline and storage continues to fill. Canada now only has 26 rigs nationwide operating and the U.S. has 465.

North American Rig Count Summary

Railcar Markets

PFL is offering: Various tank cars with potential dirty to dirty service including gasoline, diesel, crude oil and LPG services – terms negotiable. Sand cars, Box cars, coal cars and hoppers. Call PFL today to discuss your needs and our availability.

PFL is seeking: 50-100 340Ws for winter service in the Conway area, Plate C boxcars, 20 CO2 Cars, and pressure cars for butane service 3-6 month term beginning June 1st.

Live Railcar Markets

Lease Offers

Lease Bids

Sales Offers

Sales Bids

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|