“I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.”

― Maya Angelou

Jobs Update

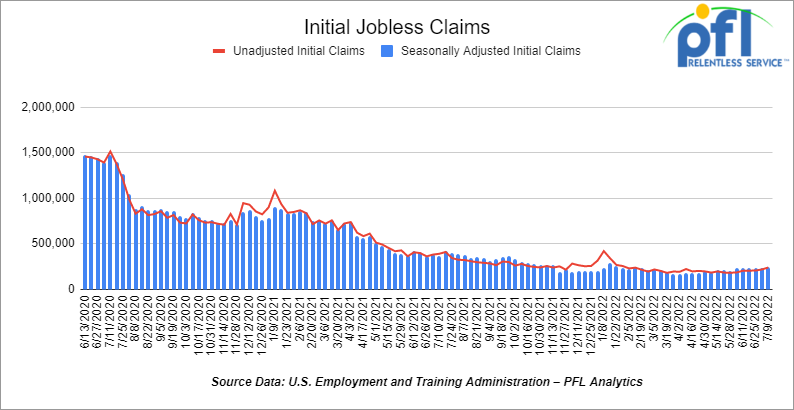

- Initial jobless claims for the week ending July 9th, 2022 came in at 244,000, up 9,000 people week-over-week.

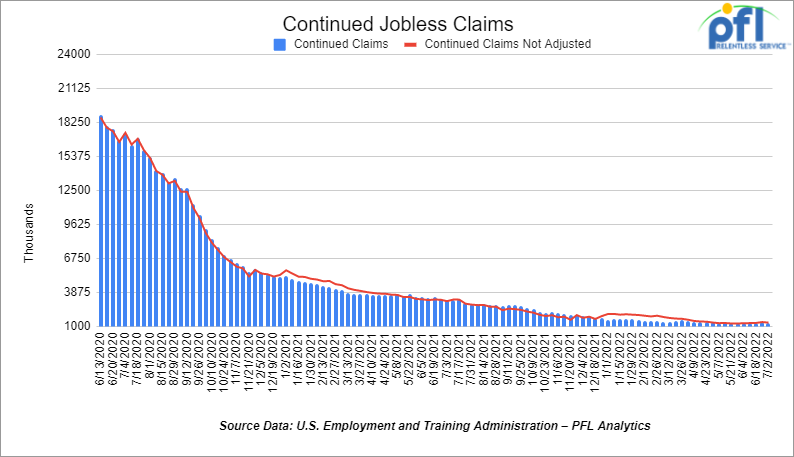

- Continuing claims came in at 1.331 million people, versus the adjusted number of 1.372 million people from the week prior, down -41,000 people week over week.

Stocks closed higher on Friday of last week – down week over week

The DOW closed higher on Friday of last week, up 658.09 points (+2.15%), closing out the week at 31,288.26, down -49.89 points week over week. The S&P 500 closed higher on Friday of last week, up 72.78 (+1.92%) and closed out the week at 3,899.38, down -36.22 points week over week. The NASDAQ closed higher on Friday of last week, up 201.24 points (+1.79%) and closed the week at 11,452.42 points, down -182.89 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 31,578 this morning up 331 points.

Oil settled higher day over day and lower week over week.

Oil saw another hugely volatile week of trading, where prices at one point wiped out all of their gains since Russia invaded Ukraine. Earlier last week, a report showed that U.S. inflation rose to its highest in four decades while high U.S. gasoline prices are starting to take their toll on consumption.

Oil ended the week below $100 for the first time since early April after another volatile period of trading last week marked by escalating concerns over an economic slowdown. WTI for August delivery rose $1.81 on Friday of last week to settle at $97.59, but down $7.20 per barrel week over week. Prices were down 6.9% last week. Brent for September settlement rose $2.06 per barrel on Friday of last week to settle at US$101.16 per barrel.

Prices pared some of their weekly losses with President Joe Biden’s trip to Saudi Arabia as he begged for more oil to be produced from the state which market participants expect little outcome also the prospects receded for a full percentage-point rate hike by the Federal Reserve.

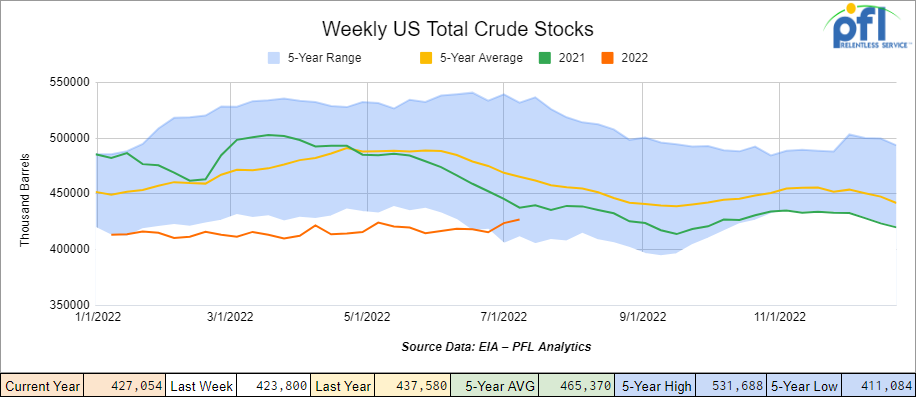

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.3 million barrels week over week. At 427.1 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

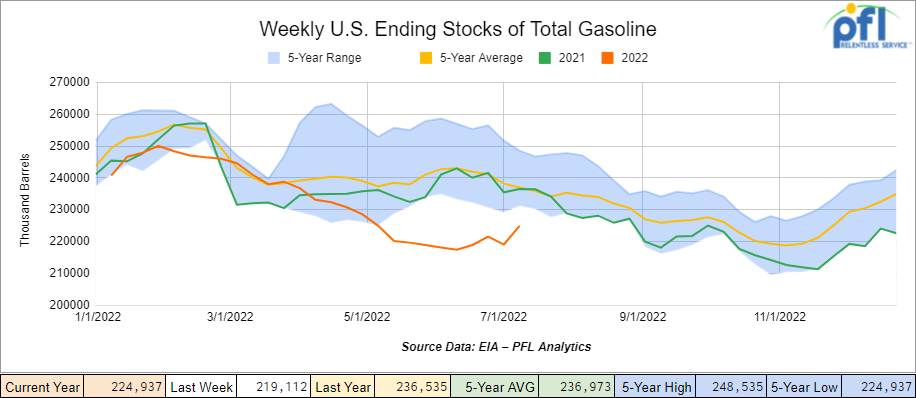

Total motor gasoline inventories increased by 5.8 million barrels week over week and are 5% below the five-year average for this time of year.

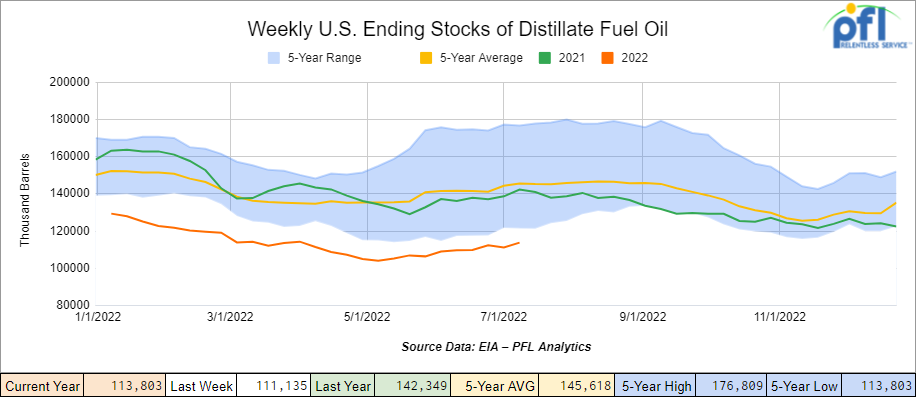

Distillate fuel inventories increased by 2.7 million barrels week over week and are 18% below the five-year average for this time of year.

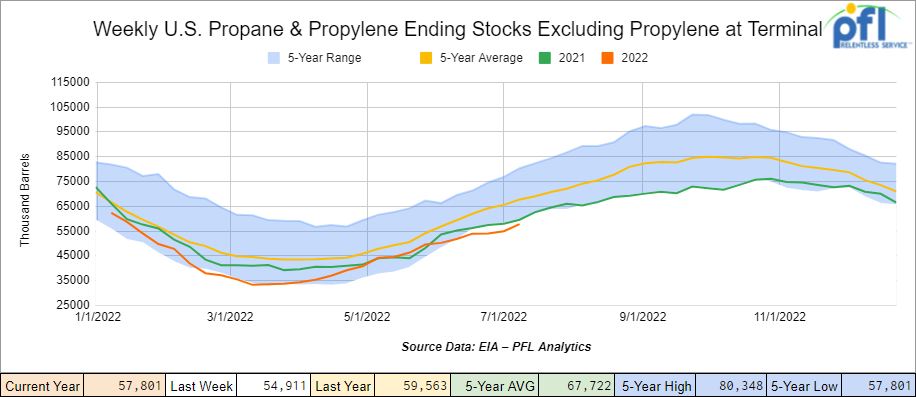

Propane/propylene inventories increased by 2.9 million barrels week over week and are 12% below the five-year average for this time of year.

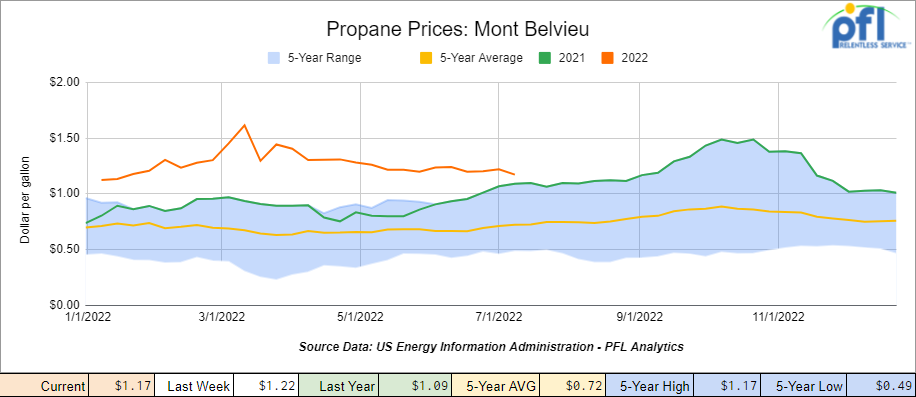

Propane closed out the week at $1.17 per gallon, down 5 cents per gallon week over week, but up 18 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 21.7 million barrels last week.

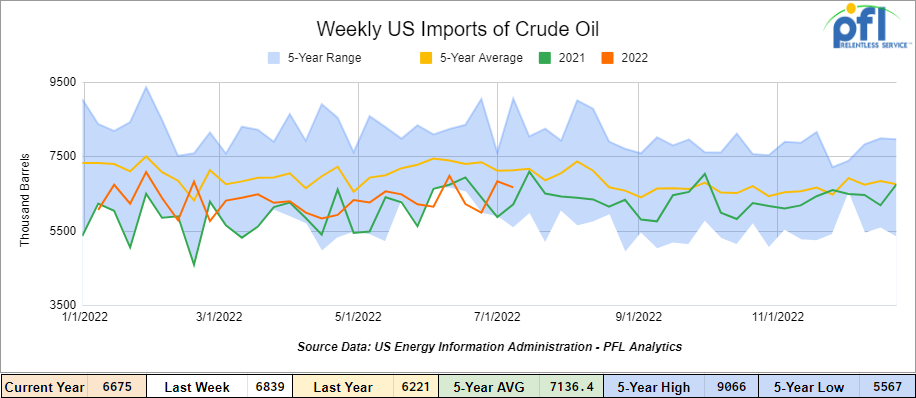

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending July 8th,2022, and decreased by 200,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 1.2% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 715,000 barrels per day, and distillate fuel imports averaged 137,000 barrels per day for the week ending July 8, 2022.

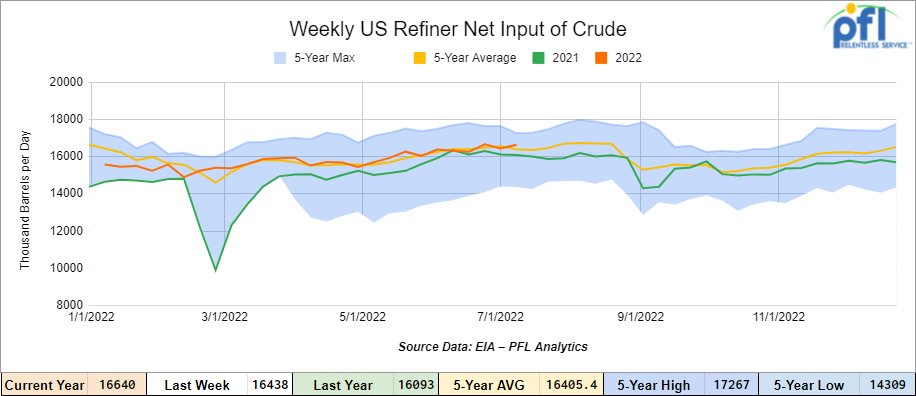

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending July 8, 2022, which was 202,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $99.87, up $2.28 per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 2nd, 2022.

Total North American weekly rail volumes were down -3.4% in week 28 compared with the same week last year. Total carloads for the week ending July 9th were 325,519, down -0.9% compared with the same week in 2021, while US Weekly intermodal volume was 347,481, down -5.6% compared to 2021. 6 of the AAR’s 11 major traffic categories posted year-over-year declines with the most significant decreases coming from Grain (-13.8%) and Other (-7.1%). The largest increase was from Coal (4.9%) and Nonmetallic Minerals (4.4%).

In the east, CSX’s total volumes were up 4.83%, with the largest decrease coming from Chemicals (-20.54%) and the largest increase from Metallic Ores and Minerals (+11.63%). Norfolk Southern’s total volumes were down -3.27%, with the largest decrease stemming from Petroleum and Petroleum Products (-17.69%) and the largest increase from Motor Vehicles and Parts (+15.7%).

In the west, BNSF’s total volumes were down -6.75%, with the largest decrease stemming from Intermodal (-10.99%) and Motor Vehicles and Parts (-8.26%), the largest increase from Petroleum and Petroleum Products (16.28%) UP’s total rail volumes were up 2.64% with the largest decrease stemming from Petroleum and Petroleum Products (-4.79%) and the largest increase from Coal (+23.18%).

In Canada CN’s total rail volumes were up 3.89% with the largest decrease stemming from Grain (-7.42%) and the largest increase from Coal (+29.41%). CP’s total rail volumes were up 0.4% with the largest decrease stemming from Farm and Food Products (-4.63%) and the largest increase from Coal (84.71%).

KCS’s total rail volumes were up 11.99% with the largest decrease from Motor Vehicles and Parts (-23.08%) and the largest increase from Chemicals (75%).

Source Data : AAR – PFL Analytics

Rig Count

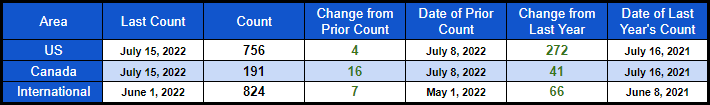

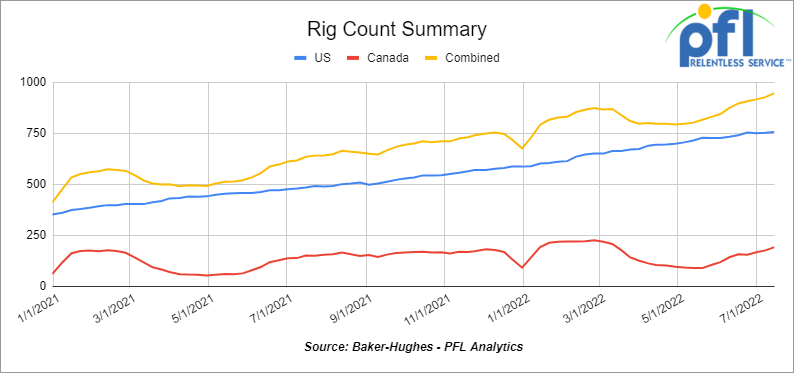

North American rig count was up 20 rigs week over week. U.S. rig count was up 4 rigs week-over-week and up by 272 rigs year over year. The U.S. currently has 756 active rigs. Canada’s rig count was up by 16 rigs week-over-week, and up by 41 rigs year-over-year. Canada’s overall rig count is 191 active rigs. Overall, year over year, we are up 313 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Rail Meltdown

Folks, we all know that the Class 1’s cut way too much on the onslaught of the pandemic – we also know that service has been terrible. Furthermore, certain shippers have been asked to actually store cars. New service is incredibly difficult, even though the railroads offer an attractive salary, and as an alternative to a college degree, they offer onsite training, the hours of work that are being asked to work are taxing on railroad veterans and their families. New hires that are trained up are quitting on the back of the long hours they are expected to put in.

Railroad Unions have been negotiating with their respective Class 1’s since January 2020, resulting in no deal. Union workers must receive federal permission to strike, per Railway Labor Act guidelines and past court decisions. Now, President Joe Biden is being charged with appointing a “Presidential Emergency Board” to nail down a new contract. If he doesn’t do so by today, railroad crews could legally have their first nationwide strike since 1992. We are not confident that the President can pull it off – but stranger things have happened!

Members of the Brotherhood of Locomotive Engineers and Trainmen (“BLET”), one of the rail labor unions involved in negotiations between rail workers and the freight railroads over a new labor contract, have decided that going on strike is an option.

“In a showing of solidarity and unity, 99.5% of the participating members voted to authorize a strike should such action become legal in the coming days, and become necessary to secure a contract worthy of [the rail carriers’] consideration,” BLET National President Dennis Pierce said in a statement on Tuesday of last week.

Union workers must receive federal permission to strike, per Railway Labor Act guidelines and past court decisions. The strike could affect up to 110,000 people. We thought we had supply chain issues, but we have not seen anything yet if a strike moves forward. Stay tuned to PFL, we are watching this one.

U.S. Trucking Trends

June’s average truckload rates ex-fuel (weighted mix of contract and spot, ex-fuel) were +12% year over year but down 2% month over month according to Cass Information Systems. Truck pricing has passed through its peak, with brokers beginning to lower contract rates at least 5-10% while assets hold price increases (2021 rates were +10-15%).

Dry-van TL spot rates through mid-July are down 10% year over year and flat month over month (including fuel). As spot volumes are moderate and capacity becomes easier to secure, dry-van spot rates will continue to fall/normalize into the second half of 2022.

June freight shipments (across all modes) were down 2% year over year and down 3% month over month, according to Cass Information Systems. Demand appears to be moderating off-peak as inventories normalize.

Global Airfreight, Containerized Ocean Traffic

Total US and Canadian container imports in June remained near-record levels, +12% year over year but down 1% month over month, according to PIERS. Year-to-date volumes are currently up +11% and willl likely take a meaningful step down and likely decline year over year as forward orders have taken a step down over the past 90 days.

Spot ocean rates from Asia to the U.S. West Coast have fallen over the past 60 days and are 27% lower year over year, according to the FBX, as new contracts took effect in 2Q and overall demand has slowed. Spot rates will likely remain significantly above pre-COVID levels into 2023 as ocean carriers likely actively manage capacity (blank, void sailings) to offset slower demand.

Airfreight demand in May was down 8% year over year as shippers are likely less urgent and convert freight back to the ocean. Capacity increased by 3% year over year. Capacity remains 15% below 2019 levels, slowing price declines. We expect airfreight demand to decline 10%+ in the second half of 2022 as inventory levels normalize and customers shift demand toward ocean freight.

Airfreight rates in June decreased sequentially likely due to disruption related to COVID lockdowns in China and softening demand. Rates from Asia to North America decreased 10% month over month and (+11% year over year). Rates to Europe are up 44% year over year as overall demand remains elevated vs pre-COVID and passenger capacity.

Russian Nord Stream 1 Pipeline – Is Canada going to send repaired Turbines for the pipeline? Justin Trudeau wants to.

A Canadian House of Commons committee held a special meeting on Friday of last week to discuss Canada’s controversial decision to send repaired parts for a Russian natural gas pipeline back to Germany.

The Liberal government is facing mounting pressure over its move to exempt six Siemens Energy turbines, which were serviced in Montreal, from the economic sanctions it levied against Russia over its invasion of Ukraine.

Russian state-owned energy company, Gazprom, has reduced gas deliveries from its Nord Stream 1 pipeline, which runs to Northeastern Germany, by 60 percent last month, citing turbine-related technical problems. They claim they are waiting for the repaired parts to be delivered by Canada.

Prime Minister Justin Trudeau said the decision to deliver the turbines was made so Canada could support European allies that are facing an energy crisis.

Conservative and NDP MPs triggered the meeting of the House of Commons foreign affairs and international development committee to raise their request for a study on the exports.

The Ukrainian Canadian Congress called for such a meeting earlier last week, and the Ukraine World Congress is petitioning the Federal Court to uphold the sanctions regime and stop the shipment.

Energy Crisis – Worst is not over According to IEA

A global squeeze on energy supply that’s triggered crippling shortages and sent power and fuel prices surging may get worse, according to the head of the International Energy Agency.

“The world has never witnessed such a major energy crisis in terms of its depth and its complexity,” IEA Executive Director Fatih Birol said Tuesday of last week at a global energy forum in Sydney, Australia. “We might not have seen the worst of it yet — this is affecting the entire world.”

The whole energy system is in turmoil following the February invasion of Ukraine by Russia, at the time the biggest oil and natural gas exporter and a major player in commodities, Birol said. Soaring prices are lifting the cost of filling gas tanks, heating homes and powering industry across the globe, adding to inflationary pressures and leading to deadly protests from Africa to Sri Lanka.

However, Hedge Funds are increasingly moving out of oil Amidst widespread recession fears, hedge funds and other money managers have been liquidating their oil positions at one of the fastest rates in the post-pandemic period, selling a total of 201 million barrels in the past four weeks. We had a triple whammy for demand destruction last week – high inflation, Covid woes in China, continued Russia uncertainty. Another point to note is that the U.S$ is at a 20-year high and trading at parity with the Euro – this reality is going to keep a lid on commodities – time to go long the Canadian Dollar? ( just kidding we would do it if it wasn’t for Justin Trudeau).

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 50-65 covered hoppers for fertilizer off most class ones for 2-3 years – negotiable

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 150 30K111’s last in ethanol dirty – negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|