“The characteristic of great innovators and great companies is they see a space that others do not. They don’t just listen to what people tell them; they actually invent something new, something that you didn’t know you needed, but the moment you see it, you say, I must have it.”

– Eric Schmidt

Jobs Update

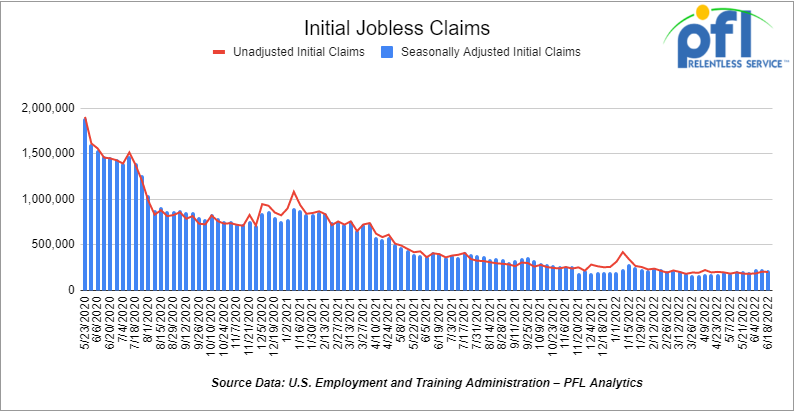

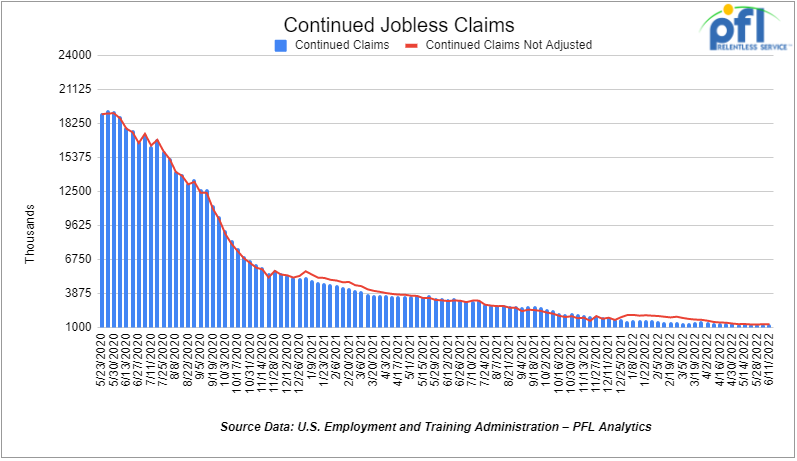

- Initial jobless claims for the week ending June 18th, 2022 came in at 229,000, down -2,000 people week-over-week.

- Continuing claims came in at 1.315 million people, versus the adjusted number of 1.31 million people from the week prior, up 5,000 people week over week.

Stocks closed up day over day and week over week.

The DOW closed higher on Friday of last week, up 823.32 points (2.68%) closing out the week at 31,500, up 1,611.22 points week over week. The S&P 500 closed higher on Friday of last week, up 116.01 points, and closed out the week at 3,911.74, up 236.9 points week over week. The NASDAQ closed higher on Friday of last week, up 375.43 points (+3.34%), and closed the week at 11,607.62 points, up 809.27 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 31,603.00 this morning up 116 points.

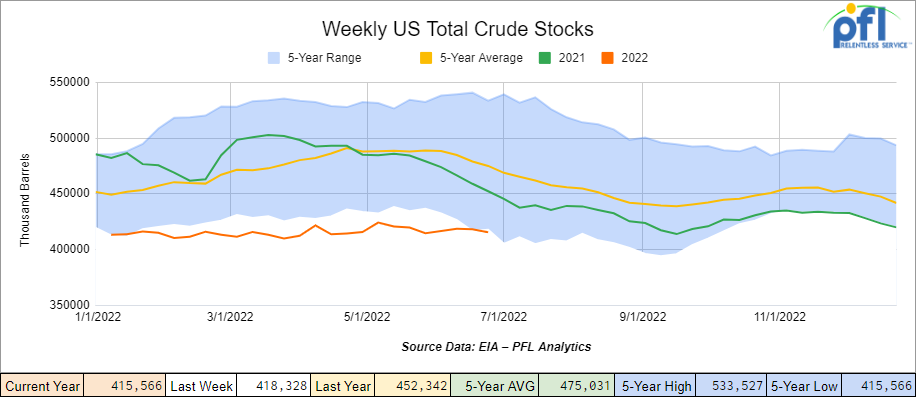

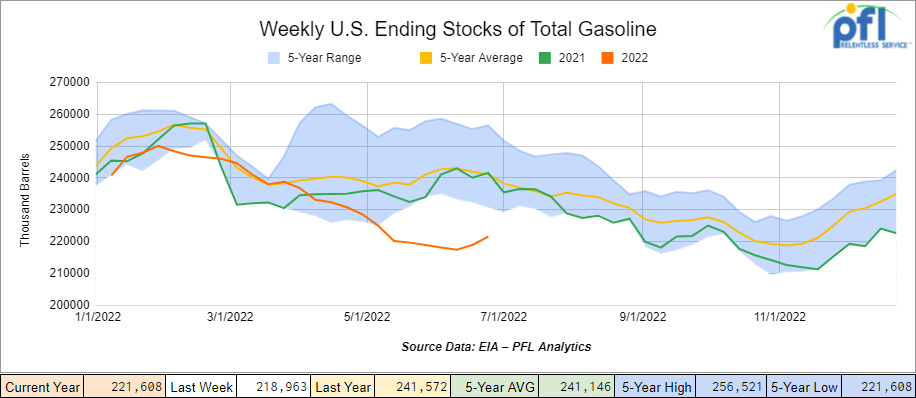

Oil settled higher day over day but lower week over week.

A survey on Friday of last week showed U.S. consumer sentiment hit a record low in June. The U.S. Federal Reserve was talking very hawkish which was undermining the oil rally, but the sentiment is changing a little especially on recent economic data. Crude made up some lost ground on Friday of last week, but was down week over week. U.S. West Texas Intermediate (WTI) crude settled up $3.35 on Friday of last week, or up 3.2%, at $107.62 per barrel on Friday of last week but down $2.56 per barrel week over week. Brent crude settled up $3.07, or 2.8% percent, at US$113.12 per barrel on Friday of last week.

The EIA Data has been updated 6-29-2022

As of the writing of this report, WTI is poised to open at $107.81, up 0.24 cents per barrel from Friday’s close.

North American Rail Traffic

The Association of American Railroads (AAR) last week U.S. rail traffic for the week ending June 18, 2022 – week 24.

Total U.S. weekly rail traffic was 501,207 carloads and intermodal units, down 2.5% compared with the same week last year.

Total carloads for the week ending June 18 were 232,921 carloads, up 0.4%compared with the same week in 2021, while U.S. weekly intermodal volume was 268,286 containers and trailers, down 4.9%compared to 2021.

Six of the 10 carload commodity groups posted year-over-year increases. They included grain, up 2,411 carloads, to 22,012; nonmetallic minerals, up 860 carloads, to 32,505; and motor vehicles and parts, up 833 carloads, to 13,366. Commodity groups that posted decreases compared with the same week in 2021 included metallic ores and metals, down 2,707 carloads, to 20,915; coal, down 1,539 carloads, to 66,281; and miscellaneous carloads, down 382 carloads, to 8,908.

For the first 24 weeks of 2022, U.S. railroads reported a cumulative volume of 5,529,499 carloads, up 0.02% year over year; and 6,349,485 intermodal units, down 6.3%year over year. Total combined U.S. traffic for the first 24 weeks of 2022 was 11,878,984 carloads and intermodal units, a decrease of 3.5%year over year.

North American rail volume for the week ending June 18, 2022, on 12 reporting U.S., Canadian and Mexican railroads totaled 328,846 carloads, down 0.8%compared with the same week last year, and 353,209 intermodal units, down 4.6% compared with last year. Total combined weekly rail traffic in North America was 682,055 carloads and intermodal units, down 2.%. North American rail volume for the first 24 weeks of 2022 was 16,198,883 carloads and intermodal units, down 3.6%compared with 2021.

Canadian railroads reported 76,443 carloads for the week, down 0.2%, and 70,088 intermodal units, down 2.6%compared with the same week in 2021. For the first 24 weeks of 2022, Canadian railroads reported cumulative rail traffic volume of 3,431,630 carloads, containers and trailers, down 5.6%.

Mexican railroads reported 19,482 carloads for the week, down 15.2% year over year, and 14,835 intermodal units, down 8.2%year over year. Cumulative volume on Mexican railroads for the first 24 weeks of 2022 was 888,269 carloads and intermodal containers and trailers, up 2.1% year over year.

Source: AAR

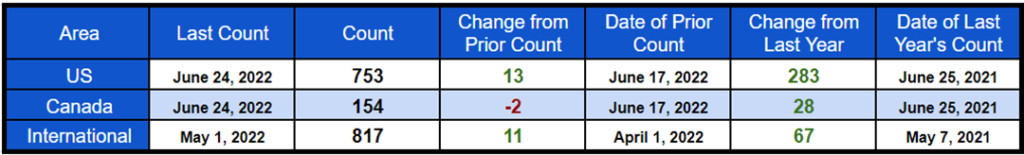

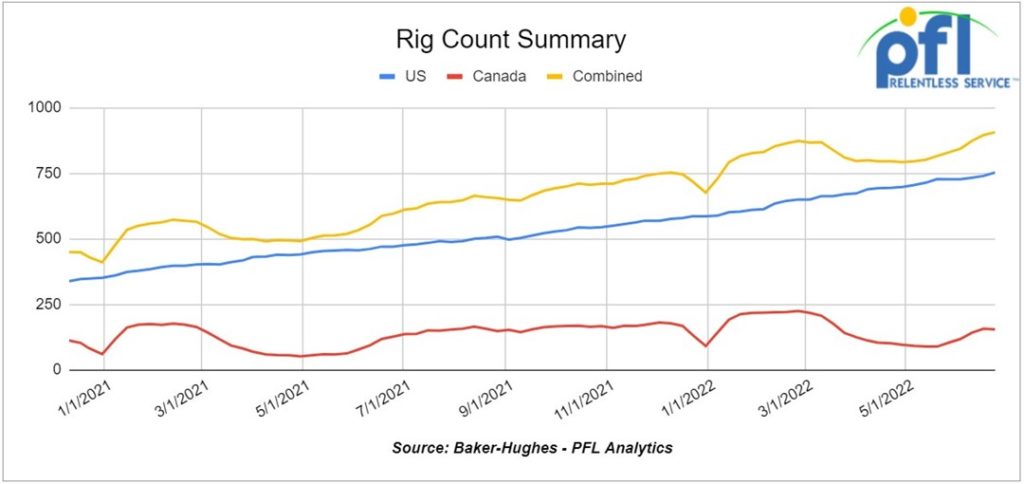

Rig Count

North American rig count was up 11 rigs week over week. U.S. rig count was up 13 rigs week-over-week and up by 283 rigs year over year. The U.S. currently has 753 active rigs. Canada’s rig count was down by -2 rigs week-over-week, but up by 28 rigs year-over-year. Canada’s overall rig count is 154 active rigs. Overall, year over year, we are up 311 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,209 from 24,303, which was a loss of 94 railcars week-over-week. Canadian volumes were mixed. CN’s shipments were up by 4.6% and CP volumes were down by 4.2%. U.S. shipments were also mixed. The BN had the largest percentage increase, up by 18.8%, and the UP was down by 4.2%.

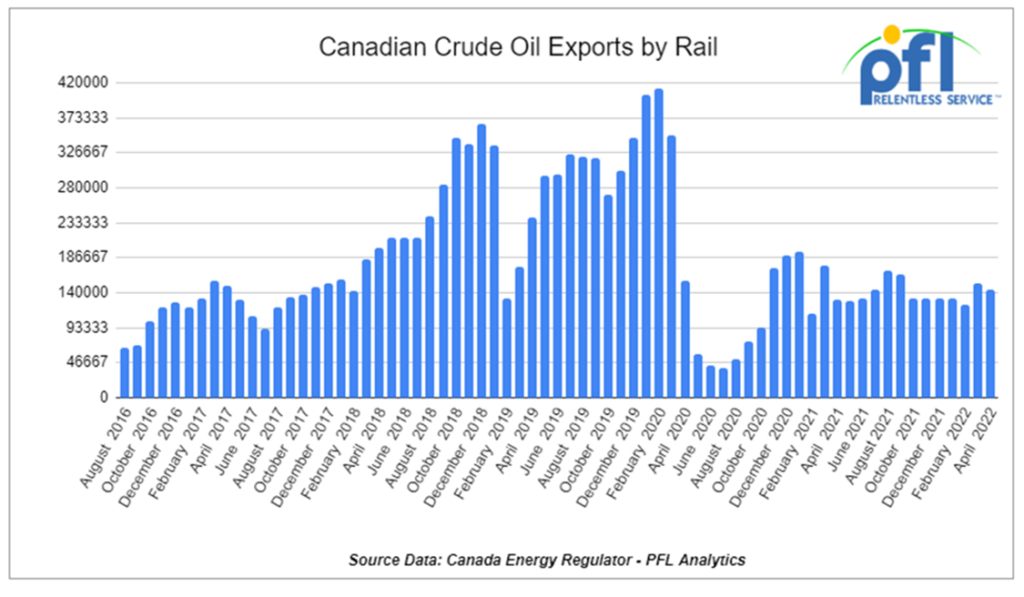

Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on June 21, 2022. For April 2022, Canada exported 144,169 barrels per day by rail, down 7,725 barrels per day month over month, a little bit of a setback from March. Crude by rail out of Alberta has been popular of late for raw Bitumen (no diluent added) as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. Crude by rail is also popular for off-spec products that can be blended here in the United States and in areas where there is no pipeline access. Before crude by rail out of Canada can come back in a meaningful way, supply needs to exceed pipeline capacity and we need to see a much wider basis. January through April represents the slowest start for CBR in the past 6 years out of Canada due to unrestricted access by producers to ship crude via pipe to the U.S. Enbridge has accepted, for a 5th consecutive month, all pipeline nominations for July flow on its 3 million barrel per day Mainline system. Planned upstream maintenance has provided relief to pipeline congestion, but growing inventories (we are up 600,000 barrels month over month) may be a sign that spare capacity is thinning. Should be interesting to how we sit going into Q3 as most major plant turnarounds in Alberta will be complete.

Robbing Peter to Pay Paul

In his wisdom, President Biden announced on Wednesday of last week that he wants to give Americans a break at the pump by introducing a three month Federal Gas Tax holiday. Below is what the White House said from the briefing room:

“The price of gas is up dramatically around the world and by almost $2 per gallon in America since Putin began amassing troops on the border of Ukraine.” President Biden understands that high gas prices pose a significant challenge for working families. That’s why he has taken action in recent months to boost the supply of oil and gas, including an historic release from the Strategic Petroleum Reserve, and encouraging oil companies and refiners to boost capacity and output to get more supply on the market.

Today, he is calling on Congress and states to take additional legislative action to provide direct relief to American consumers who have been hit with Putin’s Price Hike. Specifically, he is calling on Congress to suspend the federal gas tax for three months, through September, without taking any money away from the Highway Trust Fund.”

Even President Obama calls short-term tax breaks a gimmick. It’s mind-boggling how he can blame Putin when he created the problem by canceling the Keystone Pipeline and delaying other pipelines. In case you haven’t noticed, all of Russia’s oil is making it to market – China and India are lapping it up – the supply-demand balance worldwide has not changed on the back of the U.S. not buying Russian crude – others are and there is nothing the U.S. can do about it. We would like to know meaningful ways that the Biden Administration has encouraged oil and gas companies to increase production of oil and refining capacity – we have not seen any changes in regulation. It seems to be all lip service folks.

CN on Strike Again

750 signals and communications workers at Canadian National Rail (CN) went on strike on Saturday of last week, after the International Brotherhood of Electrical Workers and CN management failed to reach agreement in contract negotiations.

According to CN, the unresolved issues are primarily about wages and benefits.

Management has implemented a contingency plan, saying this would allow it to operate at a level of safe operations across its network as long as required, but the union has challenged that view.

The workers on strike maintain and repair trackside electrical and signaling equipment that regulates the movement and speed of trains, and the Canadian rail network has been under strain from heavy volumes of imports, particularly on the west coast.

CN has offered to resolve the differences through binding arbitration.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|