“Either write something worth reading or do something worth writing.”

Benjamin Franklin

COVID 19 and Markets Update

Folks, the battle continues with COVID-19 as cases continued to rise over the weekend. We now have 337.933 confirmed cases. The good news is, Italy seems to be peaking and hopefully we are not far behind them if that is indeed the case.We lost a whopping 6 million jobs last week. Expect closer to 9 million job losses this week.

A virtual meeting between OPEC and its allies scheduled for Monday, April 6, has been postponed as tensions mount between Saudi Arabia and Russia over production cuts. Prices jumped 25% on Thursday and 12% on Friday on reports that OPEC (and its allies) were mulling a production cut equal to 10% of global supply while Vladimir Putin said a cut of 10M barrels a day seemed “possible.” Oil is lower in overnight trading and as of the writing of this report oil is trading down $1.12 at $27.22/bbl.

Equities traded down on Friday. Overnight futures traded higher pointing to an 800 point open in DOW.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

Railcar Volumes

Total North American rail volumes were down 11.4% year over year in week 13 (U.S. -11.8%, Canada -10.4%, Mexico -10.6%), resulting in Q1 -2020 volumes that were down 6.0% (U.S. -7.5%, Canada -2.7%, Mexico +2.3%). 10 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-14.4%), motor vehicles & parts (-66.8%) and nonmetallic minerals (-10.4%). The largest increases came from farm products & food (+11.6%).In the East, CSX’s total volumes were down 9.6%, with the largest decreases coming from motor vehicles & parts (-63.3%), intermodal (-8.5%) and coal (-8.3%). NS’s total volumes were down 19.0%, with the largest decreases coming from intermodal (-18.7%), motor vehicles & parts (-57.3%) and coal (-25.2%).

In the West, BN’s total volumes were down 8.0%, with the largest decreases coming from intermodal (-13.2%), motor vehicles & parts (-49.8%), stone sand & gravel (-26.0%) and chemicals (-11.3%). The largest increase came from coal (+16.2%). UP’s total volumes were down 9.8%, with the largest decreases coming from intermodal (-17.6%) and motor vehicles & parts (-46.0%). The largest increases came from coal (+25.9%).

In Canada, CN’s total volumes were down 13.4% with the largest decreases coming from intermodal (-20.3%) and motor vehicles & parts (-60.9%). The largest increase came from coal (+22.7%). RTMs were down 9.3%. CP’s total volumes were down 2.6%, with the largest decreases coming from motor vehicles & parts (-51.7%) and intermodal (-5.2%). RTMs were up 1.0%.

KCS’s total volumes were down 6.4%, with the largest decreases coming from intermodal (-12.3%) and motor vehicles & parts (-42.1%). The largest increase came from coal (+103.9%). Motor vehicles and parts have been hit hard and so have sales of new light vehicles. Car companies have already been grappling with collapsing sales in Europe and China as the virus spread around the globe earlier this year. New car demand in the U.S. held strong until recently with the turning point in mid – March when buyers began steering clear of showrooms to avoid interactions with others and consumer spending priorities shifted to staple items and the stockpiling of these items. New light-vehicle sales, on an annualized and seasonally adjusted basis, were 11.4 MM in March, down 32.1% from February’s figure of 16.7 million and down 37.9% year over year. This is the lowest value of monthly sales since April 2010.

Consumer spending is a real concern – U.S. consumer spending grew 0.2% in February, according to the BEA. Retail sales fell 0.5% in February from January, its weakest monthly showing in more than a year. Consumers were already dialing back spending in February. Today, in our new world, things seem to be much worse. With so many consumers now in lockdown, the only question is how much spending is falling. Everyone expects March and April consumer spending to be off-the-charts bad. Consumer spending represents 70% of the U.S. economy. When this is over, and it will be, it is not like consumers are going to whip out their checkbook – we expect consumers to be cautious on what they buy for some time to come.

Rail car owners and manufacturers are suffering. Rail car manufacturer and lessor Trinity made changes to its executive staff last week -Trinity withdrew its financial guidance from its Feb. 19 year-end earnings call “in light of the uncertain impact of COVID-19.” In a press release, CEO and President E. Jean Savage said that “while we are not able to estimate the ultimate impact of COVID-19 and the decline in crude oil prices on demand for railcars and our businesses at this time, we anticipate that these events will have a negative and potentially material impact on our financial performance in the near term.” Canadian railed crude volumes have plummeted since hitting an all-time high at the beginning of the year. CP’s weekly carloads are off by 40% in the most recent AAR data. Meanwhile CN’s carloads are off by 36% from their all-time high of 8,616. There is light at the end of the tunnel for crude by rail shippers out of Canada as USD and Gibson Energy are building a diluent recovery unit at Hardisty that will allow pure bitumen to be loaded into railcars that will allow rail to be cost-competitive with pipe.

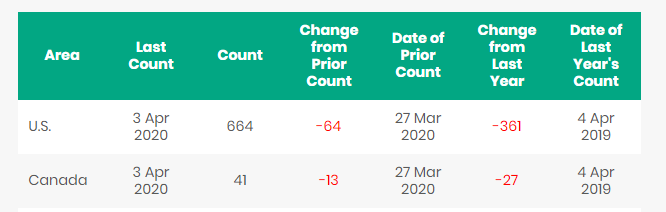

North American Rig count is down 77 rigs week over week with the U.S. losing 64 rigs and Canada losing 13 rigs week over week. Year over year we are down 388 Rigs collectively. Cuts in drilling continue as oil and gasoline demand continues to decline and storage gets full. Canada now only has 41 rigs nationwide operating and the US 664 expect continued declining rig counts in the days to come as producers buckle down to ride out the storm.

North American Rig Count Summary

Railcar Markets

PFL is offering: 340Ws for long and short term lease, 117Rs last in diesel service, various box cars for lease, 31.8’s clean and last in refined products, 25.5K 117Js coiled and insulated, as well as 5000 CFC Center Flow Pressureaide Covered Hopper cars that have recently been cleaned. Call PFL for details today!

PFL is seeking: 23.5Ks and 25.5Ks for fuel oil products, 117s with magnetic gauging devices for lease, 117s dirty with condensate, 89 ft flat cars for purchase, 100 mil gons for short term lease, and 117Js last in ethanol.

Live Railcar Markets

Lease Offers

Lease Bids

Sales Offers

Sales Bids

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|