“What do you do when there’s nowhere to turn? You drive straight ahead.” – Leslie Gordon

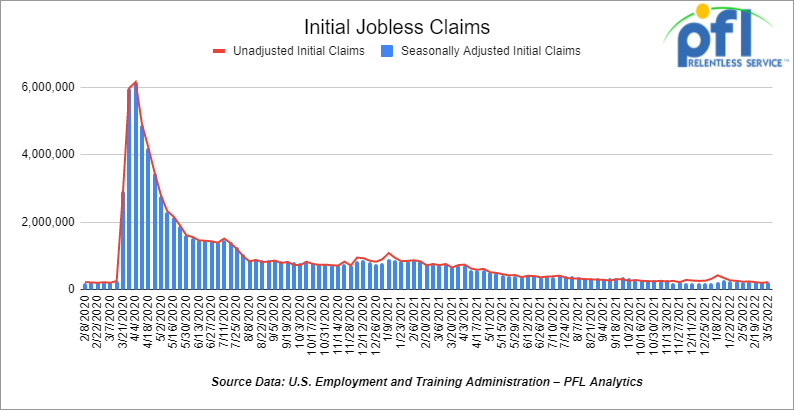

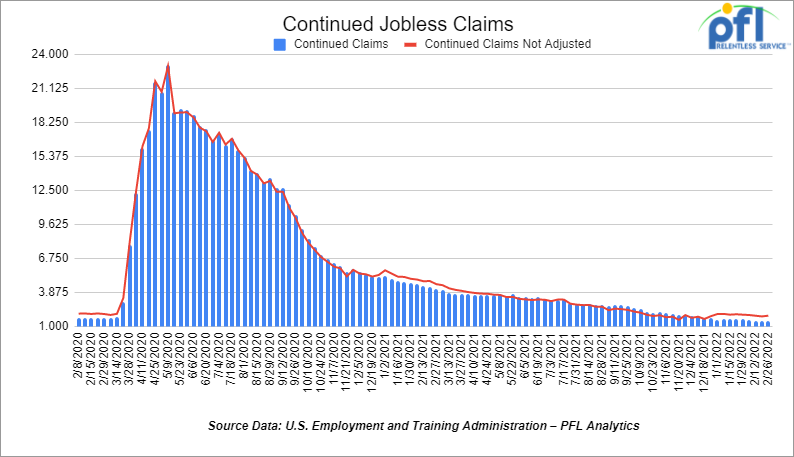

Jobs Update

- Initial jobless claims for the week ending March 5th came in at 227,000, up 11,000 people week over week.

- Continuing claims came in at 1.494 million people versus the adjusted number of 1.469 million people from the week prior, up 250,000 people week over week.

Stocks closed lower on Friday of last week and down week over week

The DOW closed lower on Friday of last week, down -229.88 points (-0.69%), closing out the week at 32,944.19 points, down 670.61 points week over week. The S&P 500 closed lower on Friday of last week, down -55.21 points and closed out the week at 4,204.31, down -124.56 points week over week. The Nasdaq closed lower on Friday of last week, down -286.16 points (-2.19%) and closed out the week at 12,843.81, down -469.63 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,205 this morning up 280 points.

Oil closed higher on Friday of last week and higher week over week

Oil prices rose on Friday of last week, but posted the biggest week over week decline since November after previously hitting the highest prices since 2008. The U.S. made moves on Friday of last week to revoke Russia’s “most favored nation” status, announcing a ban on their seafood, alcohol, and diamonds. They also left the door open for future tariffs. “Iran talks on hold is one factor supporting markets,” said UBS analyst Giovanni Staunovo, adding that “market participants will now closely track Russian export data to get a sense how much supply is disrupted.” WTI traded up $3.31 or 3.1% to close at $109.33. Brent traded up $3.34 or 3.1% to close at $112.67 on Friday of last week.

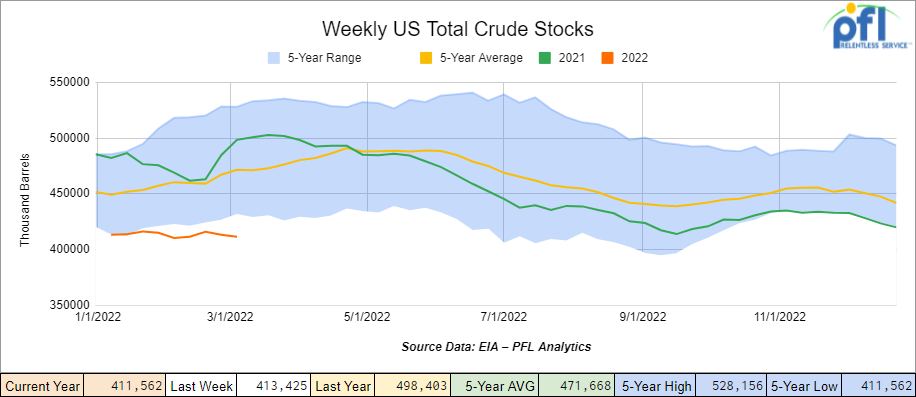

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.9 million barrels week over week. At 411.6 million barrels, U.S. crude oil inventories are 13% below the five-year average for this time of year.

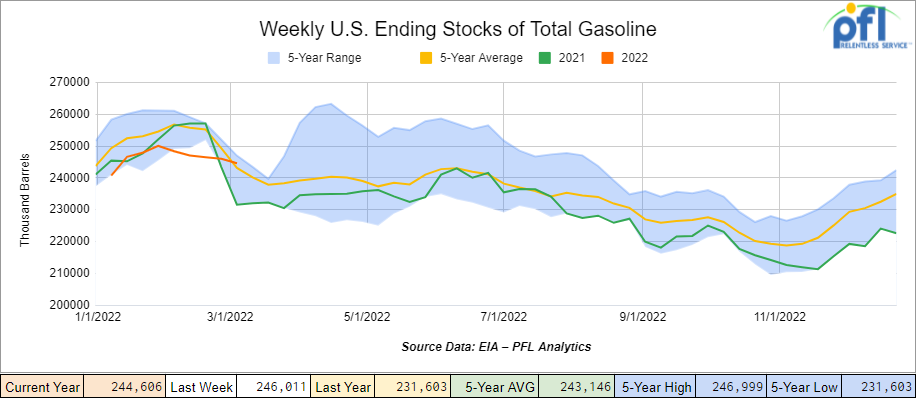

Total motor gasoline inventories decreased by 1.4 million barrels week over week and are 1% above the five-year average for this time of year.

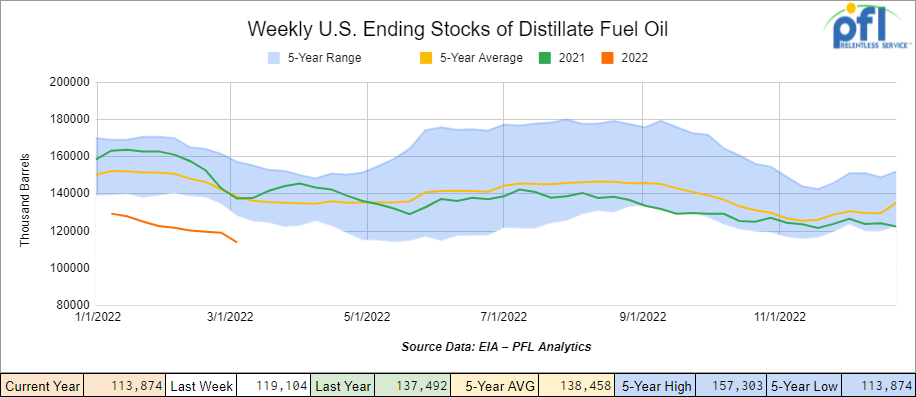

Distillate fuel inventories decreased by 5.2 million barrels week over week and are 18% below the five-year average for this time of year.

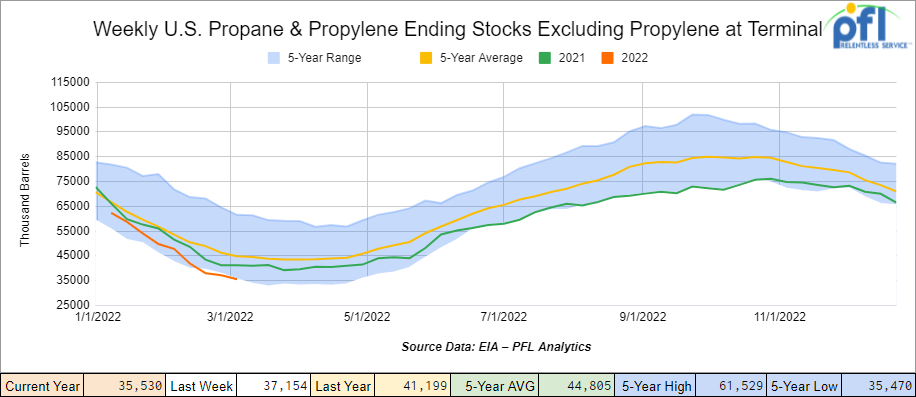

Propane/propylene inventories decreased by 1.6 million barrels week over week and are 21% below the five-year average for this time of year.

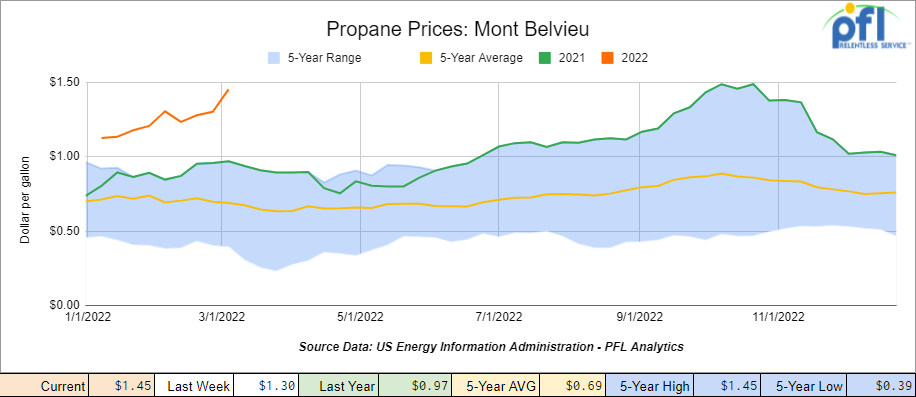

Propane prices continued to trade higher on the back of colder weather and lower inventories with propane closing at $1.45 per gallon, up 15 cents per gallon week over week and up 48 cents per gallon year over year (+33%).

Overall, total commercial petroleum inventories decreased by 8.1 million barrels week over week.

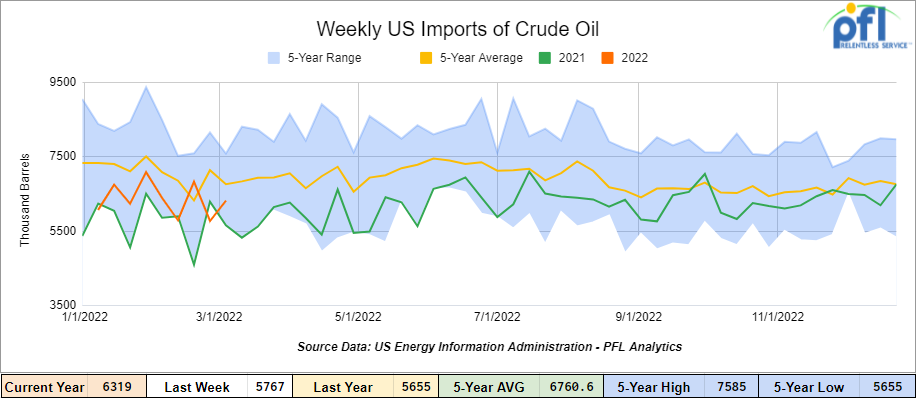

U.S. crude oil imports averaged 6.3 million barrels per day for the week ending March 4, 2022, an increase of 600,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 10.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 760,000 barrels per day, and distillate fuel imports averaged 274,000 barrels per day for the week ending March 4th.

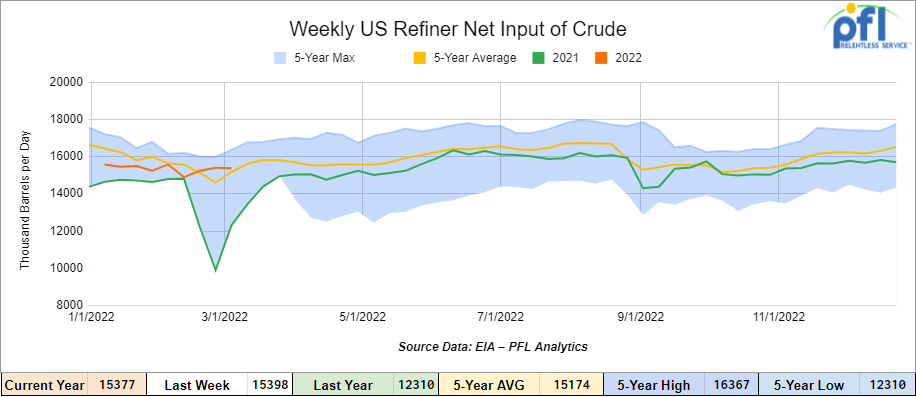

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending March 4, 2022 which was 21,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $104.80 , down $4.53 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.3% year over year in week 9 (U.S. -1.9%, Canada -10.8%, Mexico +10.6%) resulting in quarter to date volumes that are down 3.9% year over year (U.S. -2.3%, Canada -10.4%, Mexico +1.5%). 8 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-6.7%), grain (-11.4%) and motor vehicles & parts (-14.0%). The largest increases came from chemicals (+15.1%) and nonmetallic minerals (+13.3%).

In the East, CSX’s total volumes were down 2.3%, with the largest decrease coming from coal (-19.4%). NS’s total volumes were down 6.9%, with the largest decreases coming from intermodal (-8.6%) and motor vehicles & parts (-24.3%).

In the West, BN’s total volumes were down 2.5%, with the largest decreases coming from intermodal (-5.5%) and grain (-13.6%). The largest increases came from coal (+9.8%) and chemicals (+20.9%). UP’s total volumes were up 6.0%, with the largest increases coming from chemicals (+26.6%), coal (+21.4%) and stone sand & gravel (+47.2%). The largest decrease came from intermodal (-3.1%).

In Canada, CN’s total volumes were down 8.4%, with the largest decrease coming from intermodal (-16.6%). The largest increase came from coal (+136.6%). Revenue per ton miles was down 8.9%. CP’s total volumes were down 6.6%, with the largest decreases coming from grain (-18.6%), petroleum (-22.6%) and farm products (-60.0%). Revenue per ton miles was down 12.5%.

KCS’s total volumes were up 4.6%, with the largest increase coming from grain (+41.9%) and the largest decrease coming from petroleum (-23.9%).

Source: Stephens

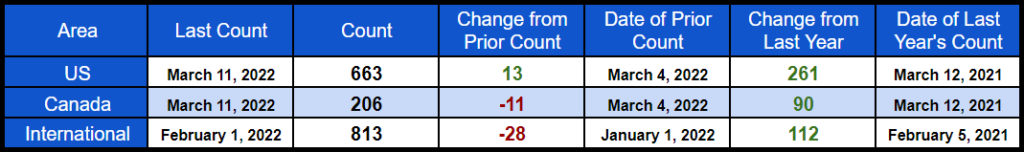

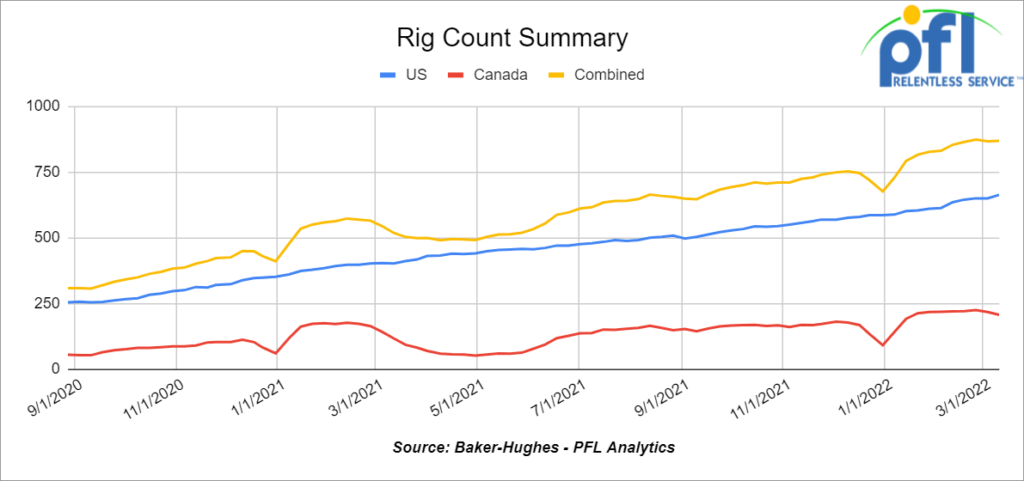

Rig Count

North American rig count is up by +2 rigs week over week. U.S. rig count was up 13 rigs week over week and up by 281 rigs year over year. The U.S. currently has 663 active rigs. Canada’s rig count was down by -11 rigs week over week and up by 90 rigs year over year and Canada’s overall rig count is 206 active rigs. Overall, year over year, we are up 351 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,623 from 24,145, which is a gain of 478 rail-cars week over week. Canadian volumes were higher week over week CP shipments were up by 11.3% while CN volumes were up by 0.1 %. U.S. volumes were mostly higher with the BN having the largest percentage increase (up by 8.0%) CSX was the only class one that lost carloads and was down by 8.2% week over week.

Energy Prices, Russia and Oil Flows

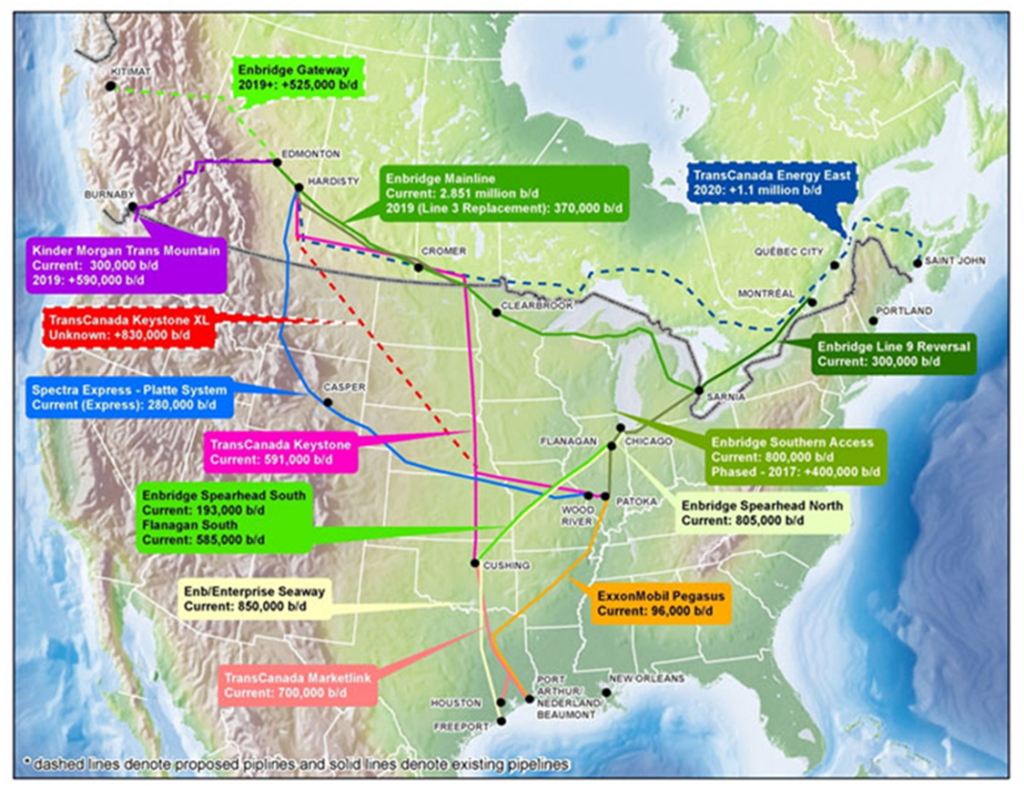

Canada is studying ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its dependence on Russian oil, the country’s natural resources minister said on Thursday of last week.

Pipeline operator Enbridge Inc. said in a statement that it was in talks with the government about “how the industry can help relieve the current energy crisis.”

Most of Canada’s crude exports travel to the United States on Enbridge’s mainline system, with another 590,000 barrels a day flowing on TC Energy’s Keystone pipeline.

“We are looking at whether our pipeline network is fully utilized,” Natural Resources Minister Jonathan Wilkinson said in a telephone interview. He said the aim was to make an “incremental” increase in exports to Europe.

Canada exports more than 4 million barrels a day of oil to the United States and a small portion of that is then re-exported to other countries.

“Both our liquids and natural gas systems are at or near capacity but we’re exploring options that may be taken to provide more energy to the U.S. and Europe. That includes using export facilities on the Gulf Coast for crude and natural gas,” Enbridge said.

Canada’s Pipeline makeup

Source: National Energy Board

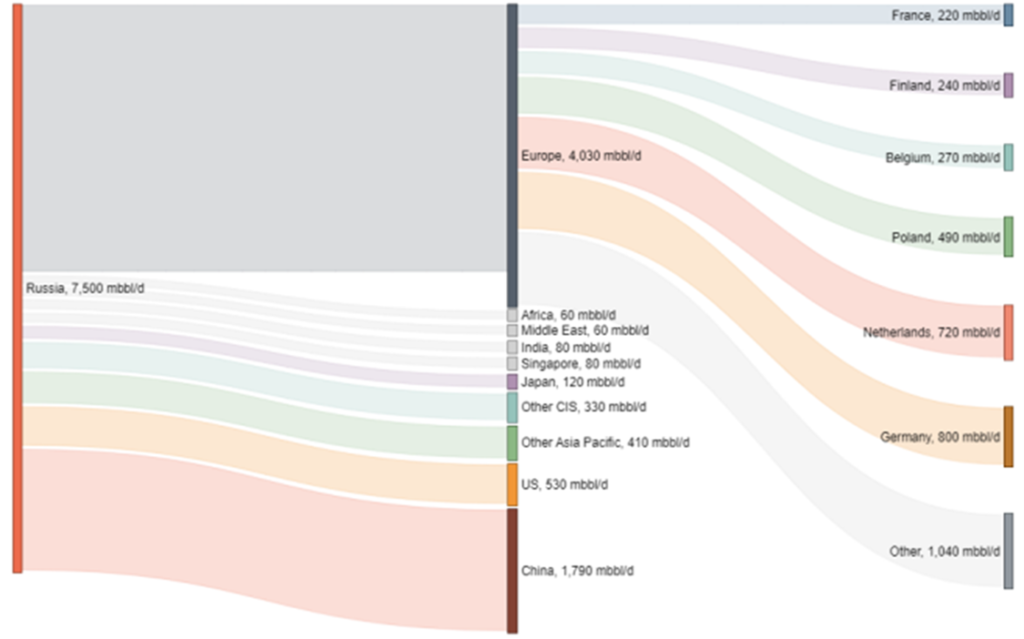

The government is conducting the analysis to ramp up pipeline flows together with industry, Wilkinson said, adding that he expected to “have an answer in terms of what Canada can do “as soon as next week. With both Canada and the US ban on Russian crude imports on the back of the Ukraine conflict the spread for Canadian sour (basis) widened last week to $10 per barrel indicating stronger demand from U.S. gulf coast refiners for Canadian heavy. With Canadian crude prices the highest since 2008, we would say that every barrel of possible production will be produced and don’t rule out a pickup in crude by rail – it seems to us that with rail traffic down in Canada, the Canadian rails would have an appetite for even short term deals. Sonya Savage, Alberta’s minister of Energy, said Alberta producers could boost in the near term and additional 200,000-400,000 barrels per day of Canadian Crude supplies. We are going to need a lot more than 400,000 thousand barrels a day. See below Russia’s current flows and the countries that have past sanctions:

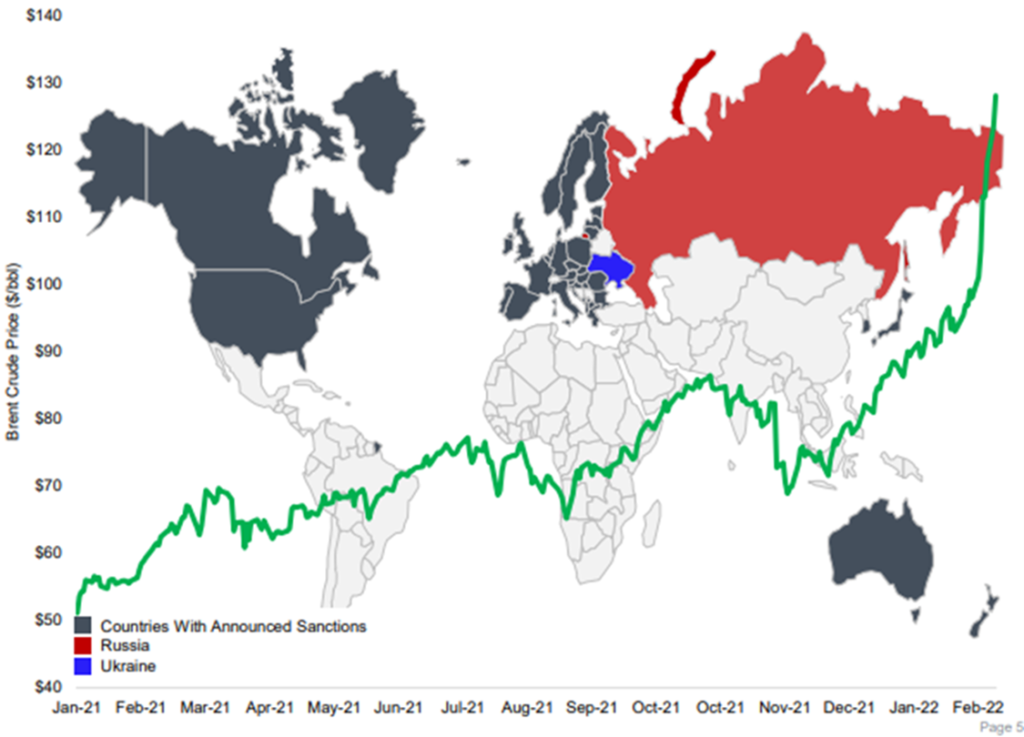

Brent Crude Price and Countries with Announced Sanctions on Russia

Source: Sproule

Russian Crude and Refined Product Export Flows

Source: Sproule

Geopolitical uncertainties are making the oil market fragile.

Setting Russia aside – there are a lot of geoportal items affecting the supply and demand dynamics in the integrated energy markets:

1) Last week Houthis attacked Saudi Refinery. Yemen’s Houthi militias launched a drone attack on the 120,000 b/d capacity Riyadh refinery along with strikes on Jizan and Abha. Fortunately, the assault caused only a small fire that was swiftly controlled.

2) Opec will not increase at this point their production beyond 450,000 barrels per day, despite missing last months target supply number by 890,000 barrels a day and despite Biden begging them to do so.

3) Iran Nuclear talks are delayed, in fact Iran is showing signs of aggression on their own. As many as 12 missiles were fired Sunday toward the U.S. consulate in Iraq’s northern city of Erbil, Iraqi security officials said. A U.S. defense official said missiles had been launched at the city from neighboring Iran. Iran’s Revolutionary Guards took responsibility for the attack later on Sunday and warned Israel of a “harsh, decisive and destructive response” in case of future attacks. An Iranian state-TV correspondent reported that the attack targeted “secret Israeli bases.”

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off the KCS for 5 years. Needs to be lined.

- 100, 2480CUFT Ag Gons needed in Texas off the UP for 1-3 Years.

- 50, 30K+ Tank cars needed in several locations. Can take in various location off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5 year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- 150 117R’s 31.8 clean for lease in Texas – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 25 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude – available Feb 2022

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|