“The way I see it, if you want the rainbow, you gotta put up with the rain.” – Dolly Parton

Jobs Update

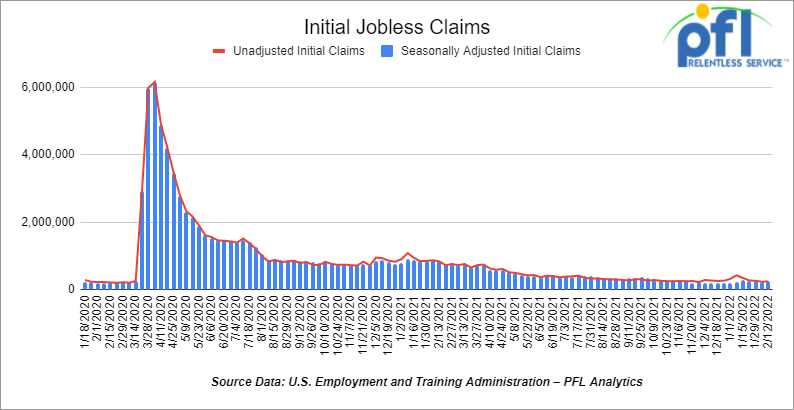

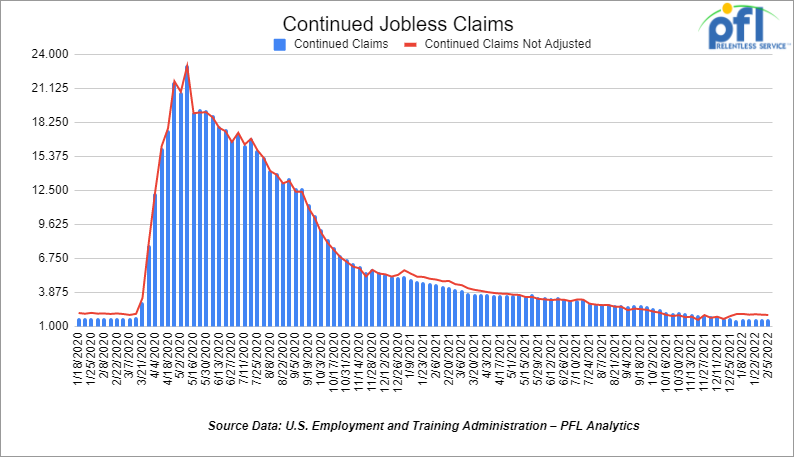

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending February 12th came in at 248,000, up 23,000 people week over week.

- Continuing claims came in at 1.593 million people versus the adjusted number of 1.619 million people from the week prior, down -26,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -232.85 points (-0.68%), closing out the week at 34,738.06 points, down -658.88 points week over week. The S&P 500 closed lower on Friday of last week, down -31.39 points and closed out the week at 4,348.87, down 69.77 points week over week. The Nasdaq closed lower on Friday of last week, down -168.65 points (-1.23%) and closed out the week at 13,548.06 down -243.09 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,948 this morning down -59 points.

Oil closed lower on Friday of Last Week down week over week

Oil prices were down on Friday of last week, ending the week mixed with WTI snapping its 8 week streak of gains. The prospect of increased Iranian supply was overshadowing geopolitical tensions as the U.S. says a deal could be reached “in a few days”. However, according to sources, the deal structure lays out phases of mutual steps to bring both sides back into full compliance and the first does not include waivers on oil sanctions. In other words, even if a deal was reached it would be some time before Iranian crude hit the market. Reflecting the tightness in global oil supplies, the six-month backwardation for Brent crude hit its widest on record on Wednesday of last week

West Texas Intermediate (WTI) crude closed down -69 cents (-.05%) on Friday of last week to settle at $91.07, down $2.03 cents per barrel week over week ending 8 weeks of gains, while Brent closed up +57 cents (+0.06%) to settle at $93.54 per barrel down 90 cents a barrel week over week.

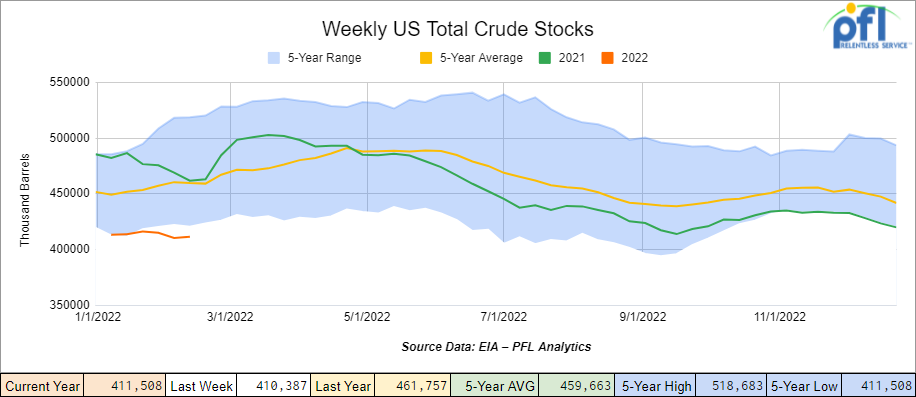

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.1 million barrels week over week. At 411.5 million barrels, U.S. crude oil inventories are 10% below the five-year average for this time of year.

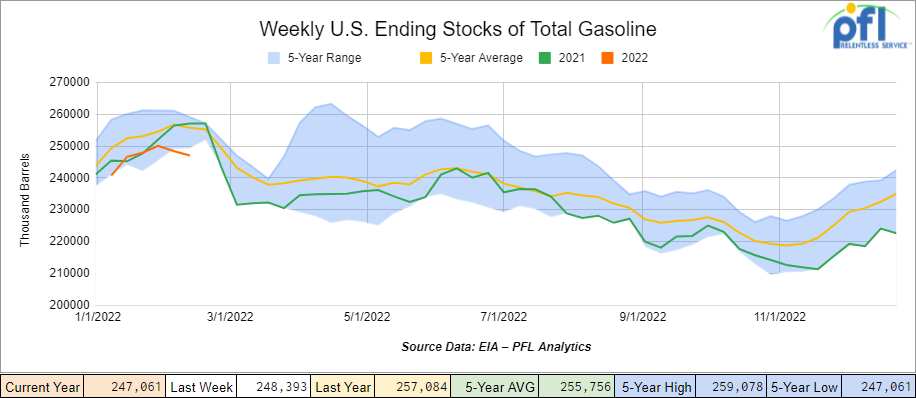

Total motor gasoline inventories decreased by 1.3 million barrels week over week and are 3% below the five-year average for this time of year.

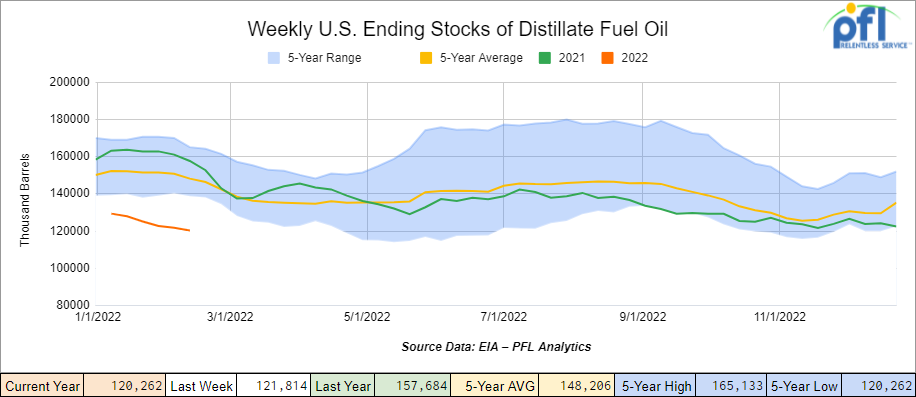

Distillate fuel inventories decreased by 1.6 million barrels week over week and are 19% below the five-year average for this time of year.

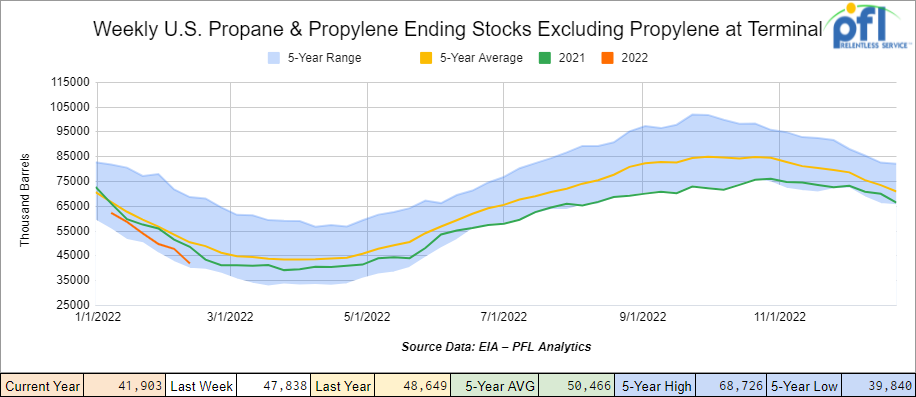

Propane/propylene inventories decreased by 5.9 million barrels week over week and are 17% below the five-year average for this time of year.

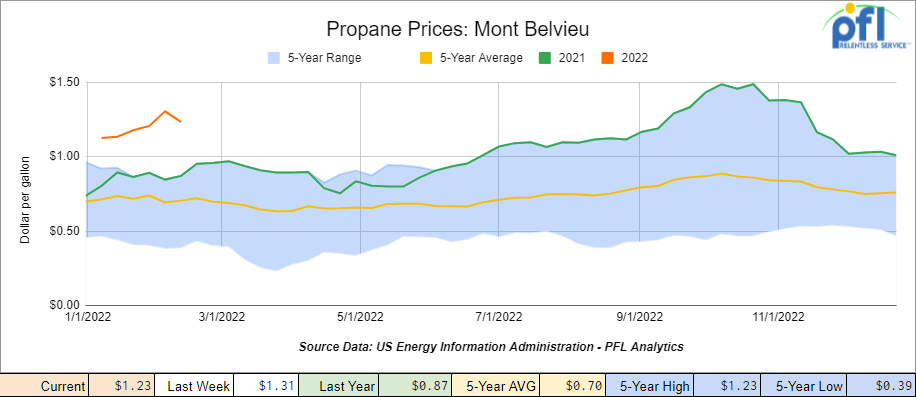

Propane prices saw some relief last week closing down 8 cents per gallon week over week, but up 36 cents a gallon year over year.

Overall, total commercial petroleum inventories decreased by 9.9 million barrels week over week.

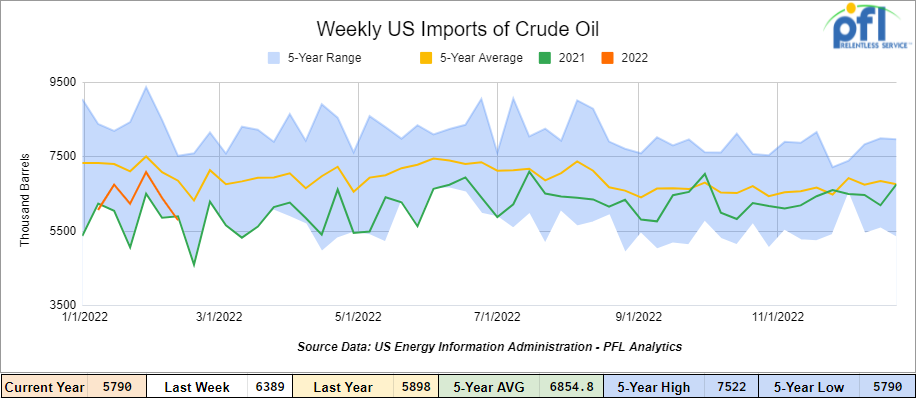

U.S. crude oil imports averaged 5.8 million barrels per day for the week ending February 11th 2022, a decrease of 600,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 9.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 555,000 barrels per day and distillate fuel imports averaged 437,000 barrels per day for the week ending February 11th.

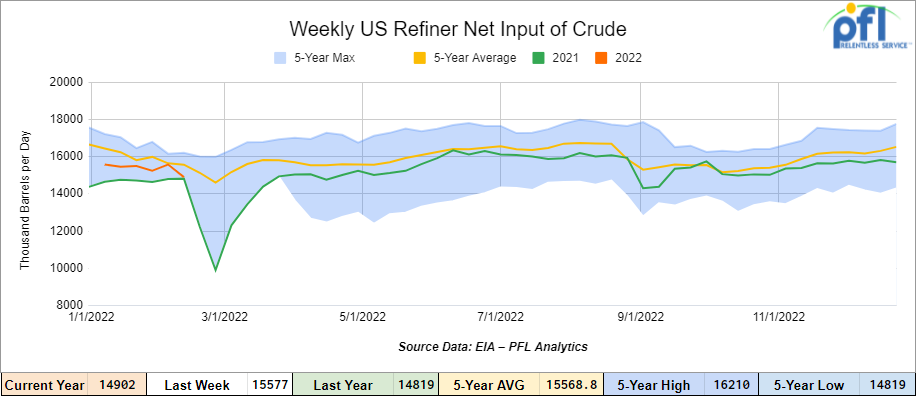

U.S. crude oil refinery inputs averaged 14.9 million barrels per day during the week ending February 11, 2022 which was 700,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $93.84, up $2.77 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 4.3% year over year in week 6 (U.S. +5.0%, Canada +5.0%, Mexico -7.6%) resulting in quarter to date volumes that are down 7.8% year over year (U.S. -9.1%, Canada -15.2%, Mexico -1.4%). 8 of the AAR’s 11 major traffic categories posted year over year growth with the largest increases coming from coal (+26.9%) and nonmetallic minerals (+17.0%).

In the East, CSX’s total volumes were up 3.1%, with the largest increase coming from intermodal (+4.3%). The largest decrease came from coal (-13.1%). NS’s total volumes were up 4.7%, with the largest increases coming from coal (+32.5%) and intermodal (+2.0%).

In the West, BN’s total volumes were up 8.0%, with the largest increases coming from coal (+39.0%) and stone sand & gravel (+86.8%). UP’s total volumes were up 8.8%, with the largest increases coming from coal (+42.1%), stone sand & gravel (+36.6%), grain mill (+37.0%) and intermodal (+1.5%).

In Canada, CN’s total volumes were up 7.9%, with the largest increases coming from coal (+114.1%) and petroleum (+30.2%). The largest decrease came from metallic ores (-9.5%). Revenue per ton miles was up 7.9%. CP’s total volumes were up 9.7%, with the largest increases coming from intermodal (+15.1%) and coal (+30.4%). Revenue per ton miles was up 8.8%.

KCS’s total volumes were up 5.0%, with the largest increases coming from coal (+44.0%) and grain (+42.4%). The largest decrease came from petroleum (-24.5%).

Source: Stephens

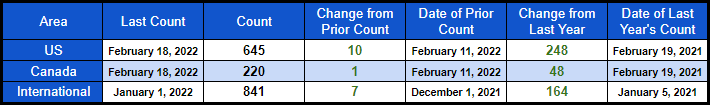

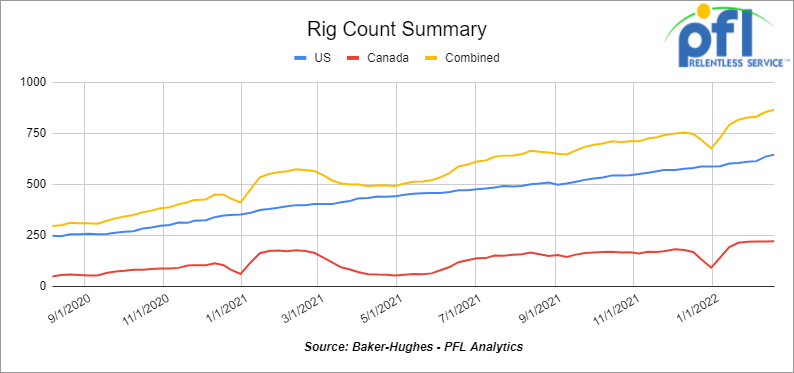

Rig Count

North American rig count is up by 11 rigs week over week. U.S. rig count was up by 10 rigs week over week and up by 248 rigs year over year. The U.S. currently has 645 active rigs. Canada’s rig count was up by 1 rig week over week and up by 48 rigs year over year and Canada’s overall rig count is 220 active rigs. Overall, year over year, we are up 296 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,219 from 24,168, a gain of 51 rail-cars week over week. Canadian volumes were higher: CP volumes rose by 7.8% and CN volumes rose by 9.4% week over week. U.S. volumes were up across with the NS having the largest percentage increase (up by 35.7%).

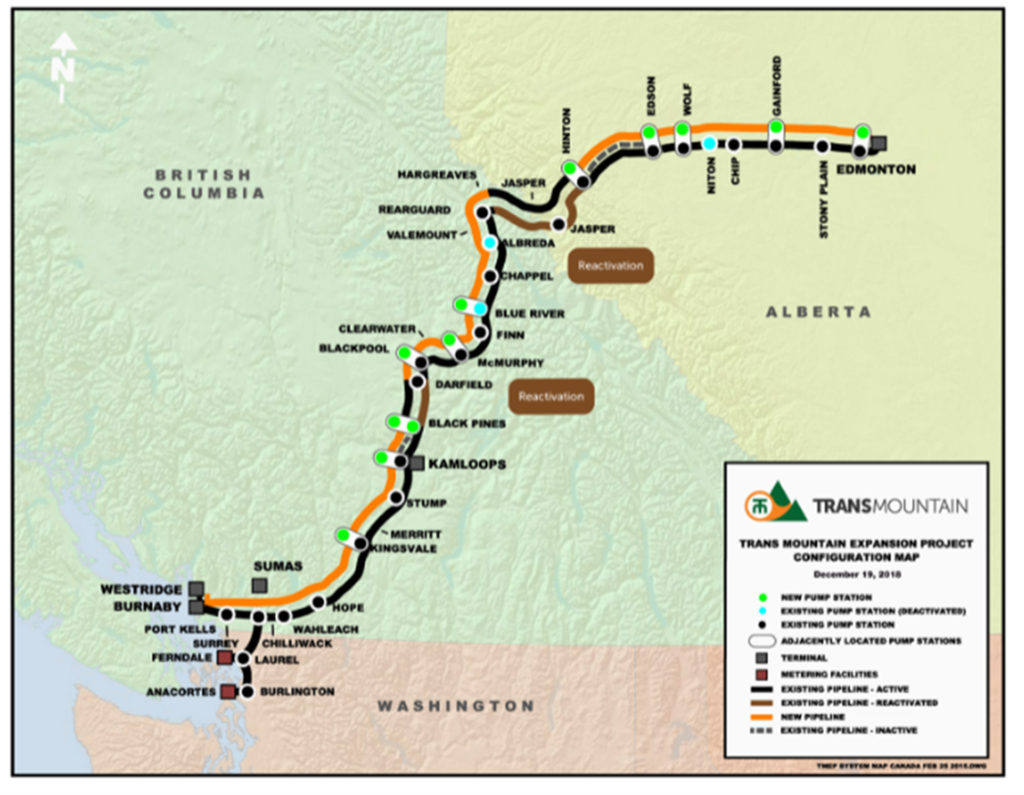

Trans Mountain cost estimates doubled and project is delayed

Mechanical completion of the project is anticipated to occur in the third quarter of 2023 instead of the 3rd quarter of 2022. The total project cost has increased from CAD $12.6 billion to CAD $21.4 billion.

The cost overrun estimates include all known project enhancements, changes, delays and financing, including impacts of the COVID-19 pandemic and the substantial preliminary impacts of the November 2021 British Columbia floods.

As a result of the flooding and wildfires, the project is advancing with significantly improved safety and environmental management, and with a deep commitment to ensure this project is being built the right way.” according to government sources. This is what happens when the government is in charge of a project – costs double and delays intensify. Prime Minister Justin Trudeau’s government bought Trans Mountain from Kinder Morgan Inc. for $4.5 billion to keep the project alive. It will expand capacity to 800,000 barrels per day of crude oil from 300,000 barrels per day, and give oil producers in Alberta a meaningful connection to Asian markets, which should result in higher prices. The oilpatch currently is at the mercy of conditions in the United States, and transportation bottlenecks tend to depress prices by creating a glut of Canadian bitumen.

Transmountain Pipeline System

Source: Transmountain

Notwithstanding the cost increase and revised completion schedule, the business case supporting the project remains sound, said the company but there is a twist – despite the government owning the pipeline there will be no more government money spent on it despite the government making all the decisions and deals with all involved. “There will be no additional public money invested in TMC,” or Trans Mountain Corp., said Finance Minister Chrystia Freeland at a press conference last week. “TMC will secure necessary funding to complete the project through third-party financing, either in the public debt markets or with financial institutions.”

Cost detail

Project enhancements total approximately $2.3 billion of the increase. This includes a substantial increase in trenchless construction activity, significantly more MBAs with Indigenous communities that provide enduring economic benefits, the installation of advanced leak detection systems, and new unplanned scope and route changes that avoid culturally and environmentally sensitive areas.

Schedule pressures total approximately $2.6 billion of the increase and include permitting processes required for the several thousand permits that are required for the Project, and significant construction challenges in both marine and difficult terrain which have extended the schedule into late 2023.

The project has had to contend with generational events such as the COVID-19 pandemic and recent extreme weather in B.C. These events, combined with contractor productivity shortfalls in some areas, have resulted in a $1.7 billion increase. The combined effects of extreme weather and COVID measures is approximately $1.4 billion.

Safety and security requirements total approximately $500 million of the increase. These cost impacts include the voluntary two-month stand-down across the project in late 2020, including the related termination and replacement of a major construction contractor; additional safety and security measures across the project; and worker safety measures during the extreme heat and fires in British Columbia last year.

Financing costs have increased by approximately $1.7 billion. The increase in financing costs will be incurred due to the increased cash expenditure required to construct the project, and the extended construction schedule. Financing costs include interest paid to Trans Mountain’s owner for money borrowed for the project as well as an imputed non-cash cost of equity capital provided by the owner of the project.

The impact to producers waiting for the project to be complete is unknown at this point – maybe a short term resurgence of crude by rail could pop its head given Transmountain delays? We would have expected to have seen production volumes ramp up inside of Alberta in the anticipation of Transmountain being on time in Q32022 but now delayed, the delay could urge incremental barrels to once again hit rail at some point before Q42023 as transportation on pipelines remain relatively tight. Oil sands projects have experienced delays themselves and there is no doubt some recent production problems so time will tell. Stay tuned to PFL for further details.

In related Canadian pipeline news Enbridge’s 3 million barrel per day mainline export system will accept all pipeline nominations for the month of March. This is the first time Enbridge has not rejected any nomination of its system coming out of Canada since June of 2020. Line 3 replacement has had a significant impact on potential additional crude by rail barrels out of Canada to the downside.

Canadian Truckers – The Freedom Convoy

Police began arresting protesters Friday of last week in an effort to break the three-week siege of Canada’s capital by truckers and others upset over the country’s Covid-19 restrictions. Some protesters surrendered and were taken into custody, police said. Some were seen being led away in handcuffs. By Friday evening, the Ottawa Police Service reported 100 people had been arrested on a range of allegations, including mischief. Mischief sounds like a small petty crime, but in Canada it could carry up to 10 years in person for property valued over $5,000 dollars.

Police said at least 21 vehicles have been removed as of Friday of last week. Authorities continued to push protesters away from downtown, and said they created a “secure area” where public assembly is temporarily prohibited.

On Friday of last week, demonstrators and officers engaged in clashes and police on horses were used to push back the crowd for a time and trampled on protesters much to the horror of the public. Don’t know how this one gets spinned, but it is there on twitter.

Source: Express

Word on the ground is that police for the most part do not like the enforcement efforts they have been told to make by the Ontario and Federal governments. Many protesters stood their ground in the face of one of the biggest police enforcement actions in Canada’s history, with officers drawn from around the country to assist. Ultimately the protesters got crushed as the weekend progressed. We are keeping an eye on this one folks and will report it as we see it.

Is Biden Working looking to Increase Oil and Natural Gas Prices with his Policies?

Biden looks to pressure investors away from fossil fuels via climate disclosures. The pressure is increasing on companies to follow environmental, social, and governance standards from both the private sector and the government. The Biden administration is prioritizing proposed rulemaking that would require companies to produce climate-related disclosures, most notably through the Securities and Exchange Commission, a form of indirect pressure on fossil fuel companies. The SEC is debating the extent to which it can compel companies to disclose details about how much energy they buy and how they handle climate risks.

The Federal Energy Regulatory Commission (“FERC”) has made pipeline construction even more difficult. FERC issues ‘historic’ overhaul of pipeline approvals. FERC issued sweeping new guidance Friday of last week for natural gas projects, including a first-ever climate change threshold, upending decades of precedent for how major energy infrastructure is approved. FERC updated a 23-year-old policy for assessing proposed natural gas pipelines, adding new considerations for landowners, environmental justice communities and other factors. In a separate but related decision, the Commission also laid out a framework for evaluating projects’ greenhouse gas emissions.

Americans are grappling with the higher cost of energy across the nation. EQT’s CEO honed in on high prices in New England which have some of the highest energy costs in the nation in regards to home heating. EQT’s CEO Toby Rice said high energy prices in New England are the direct result of takeaway issues in Appalachia. He also cautioned that a rapid energy transition and resistance to natural gas projects in places like Europe have led to their higher energy costs. “Why is what’s happening in New England relevant?” Rice asked analysts during a recent earnings call. “It’s relevant to the people in the southeast United States. You need to understand there is a pipeline that is going to allow you to benefit from low cost, reliable, clean energy, and this is something that people need to be aware of, because what’s happening in Europe, what’s happening in New England, starts with the things right now happening to MVP.” MVP (Mountain Valley Pipeline) is a natural gas pipeline project that was introduced in October of 2015. MVP project is a natural gas pipeline system that spans approximately 303 miles from northwestern West Virginia to southern Virginia – and as an interstate pipeline will be regulated by the FERC. The Mountain Valley Pipeline is expected to provide up to two billion cubic feet (Bcf) per day of firm transmission capacity to markets in the Mid- and South Atlantic regions of the United States. MVP will extend from the Equitrans transmission system in Wetzel County, West Virginia, to Transcontinental Gas Pipeline Company’s (Transco) Zone 5 compressor station 165 in Pittsylvania County, Virginia.

MVP Pipeline System

Source: Applied Economics Clinic

As stated in MVP’s formal application, Mountain Valley Pipeline has secured firm commitments for the full capacity of the MVP project under 20-year contracts. Sounds simple enough, clean burning natural gas, who can argue that one? However, the project has run into many regulatory hurdles, is over 90% built but lacks key permits needed to cross water bodies. The project has an in-service target date sometime during the summer of 2022 but the desire to shut the pipeline down by environmental groups is high.

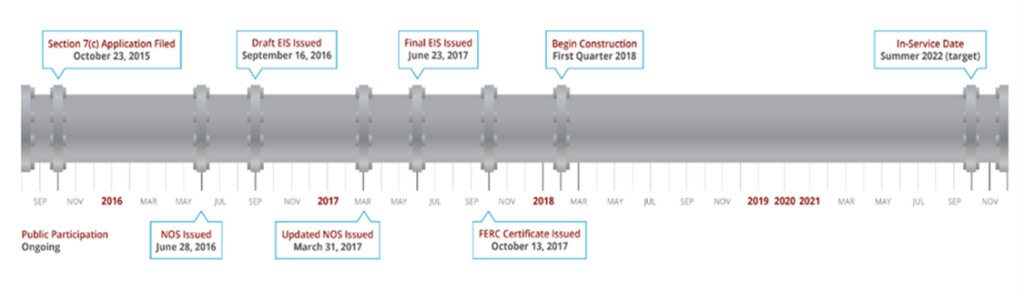

MVP Project Schedule

Source: Mountain Valley Pipeline

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 50 25.5 Tanks C&I for heavy fuel oil in Texas dirty to dirty 1-2 years negotiable

- 300 5800 Covered hoppers needed for plastic – 5 year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 20 pressure cars 340’s in SE clean or last in butane or propane 1-2 years Immediate Need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 100 117Js Coiled and Insulated dirty to dirty service BNSF CN or CP

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10 25-28K C&I tanks for veg oil needed in the south for 2 years negotiable

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- Unit Train of 28.3K 117Js for use in Crude service off the CN or BN in MT, ND, or Alberta.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- 150 117R’s 31.8 clean for lease in Texas – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 25 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars sale or lease

- 20 20K Stainless cars in 3 locations in the south – sale or lease – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude – available Feb 2022

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|