“Your present circumstances don’t determine where you can go, they merely determine where you start.”

– Nido Qubein

Jobs Update

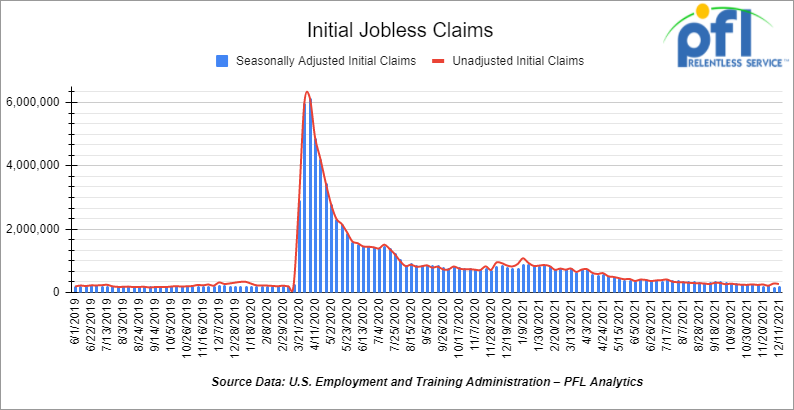

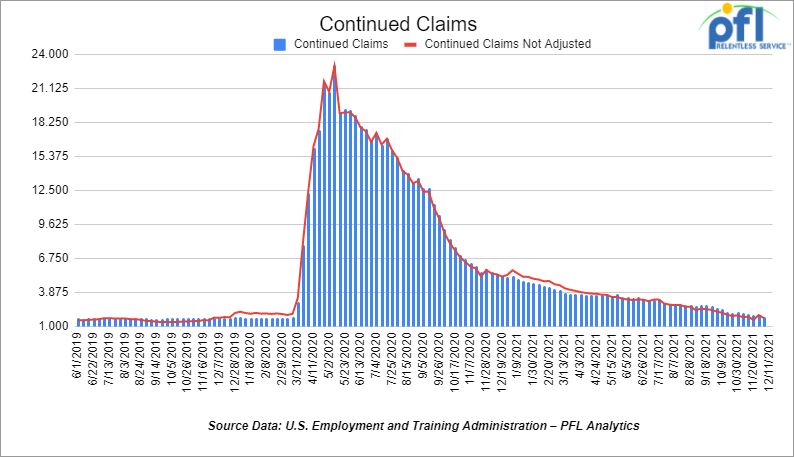

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending December 11th came in at 206,000,up 18,000 people week over week.

- Continuing claims came in at 1.845 million people versus the adjusted number of 1.999 million people from the week prior, down -154,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down 532.2 points (-1.48%), closing out the week at 35,365 points, down -605.99 points week over week. The S&P 500 closed lower on Friday of last week, down -48.03 points and closed out the week at 4,620.64, down -91.38 points week over week. The Nasdaq closed lower on Friday of last week, down -10.75 points (-0.07%) and closed out the week at 15,169.68, down -460.92 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,844 this morning down -408 points.

Oil down Friday of last week and down week over week

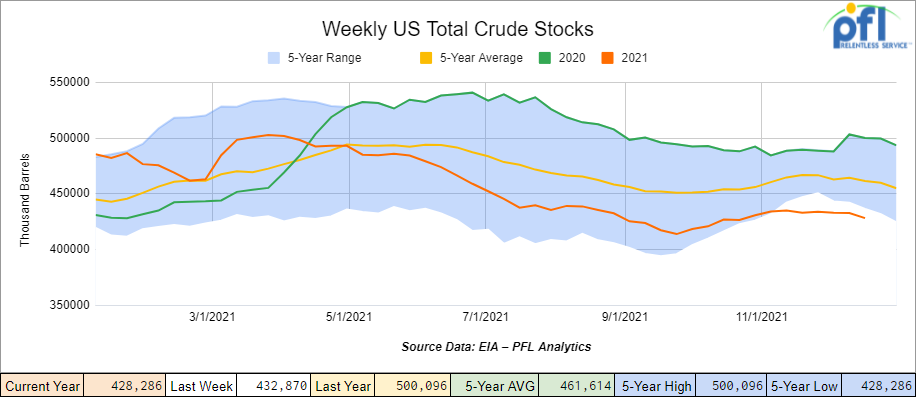

West Texas Intermediate (WTI) crude closed down $1.52 a barrel on Friday of Last week, or 2.1% to settle at $70.86 down 81 cents a barrel week over week, while Brent futures closed down $1.50 per barrel, or down 2.0% to settle at $73.52 per barrel, down $1.63 per barrel week over week. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.6 million barrels week over week. At 428.3 million barrels, U.S. crude oil inventories are 7% below the five year average for this time of year.

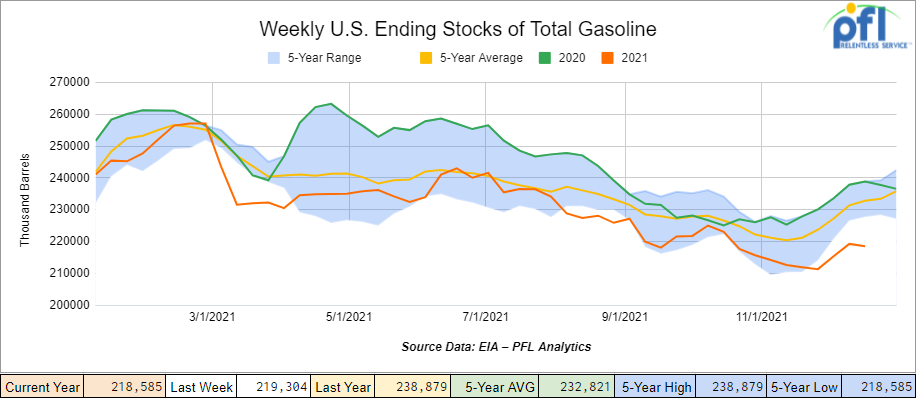

Total motor gasoline inventories decreased by 700,000 barrels week over week and are 6% below the five year average for this time of year.

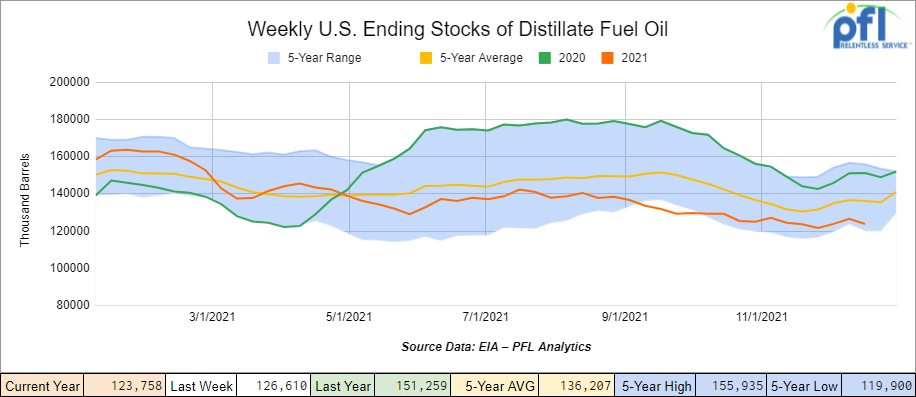

Distillate fuel inventories decreased by 2.9 million barrels week over week and are 9% below the five year average for this time of year.

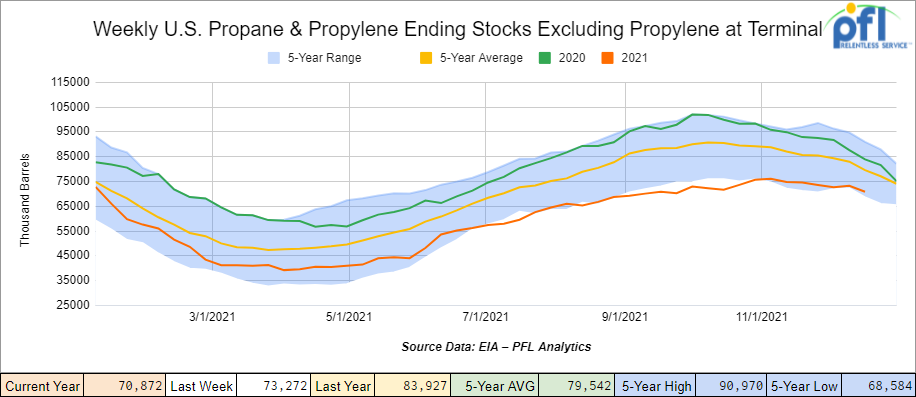

Propane/propylene inventories decreased by 2.4 million barrels week over week and are 10% below the five year average for this time of year.

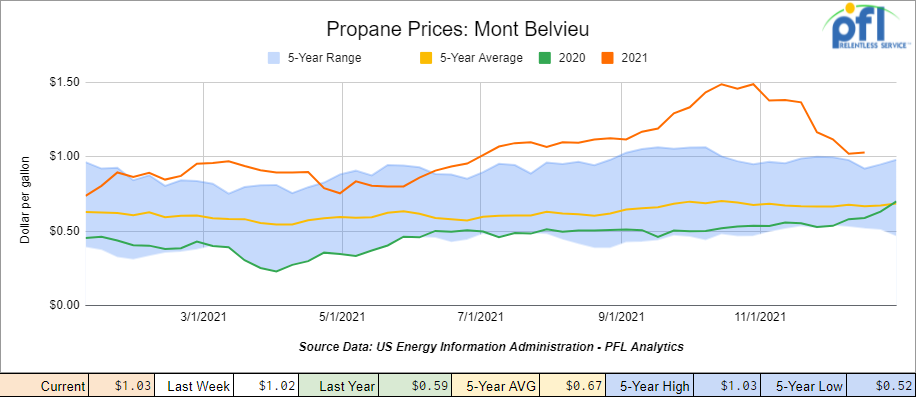

Propane Prices – As inventories continue to level out propane prices were virtually flat gaining a mere penny per gallon week over week closing out the week at one dollar and three cents ($1.03) per gallon.

Overall, total commercial petroleum inventories decreased by 15.9 million barrels for the week ending December 10, 2021.

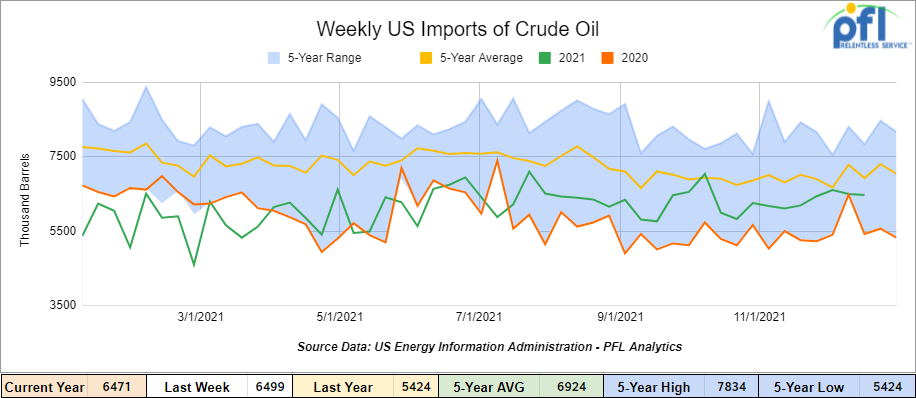

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending December 10th, down by 28,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 15.4% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 499,000 barrels per day, and distillate fuel imports averaged 450,000 barrels per day for the week ending December 10, 2021.

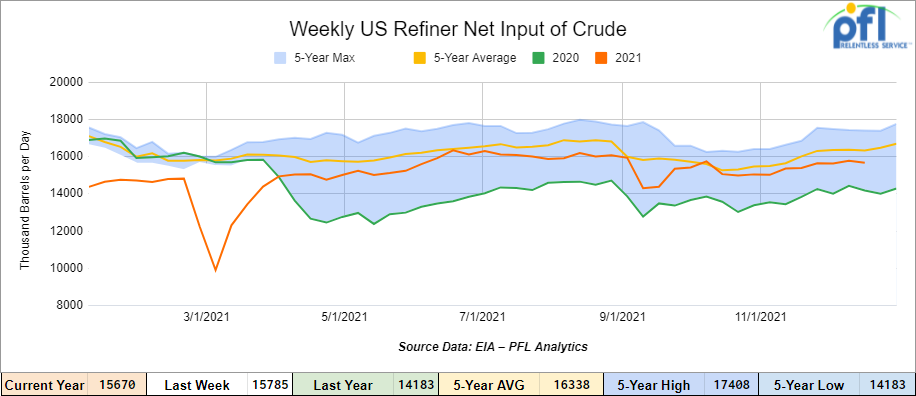

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending December 10, 2021 which was 115,000 barrels per day less than the previous week’s average. Refineries operated at 89.8% of their operable capacity last week.

As of the writing of this report, WTI is poised to open at $68.07 , down -$2.79 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 7.5% year over year in week 49 (U.S. -6.0%, Canada -15.8%, Mexico +8.0%) resulting in quarter to date volumes that are down 5.4% and year to date volumes that are up 5.0% year over year (U.S. +6.1%, Canada +1.2%, Mexico +4.3%). 8 of the AAR’s 11 major traffic categories posted year over year decreases with the largest declines coming from intermodal (-10.8%), grain (-16.6%) and motor vehicles & parts (-19.9%).

In the East, CSX’s total volumes were down 4.0%, with the largest decreases coming from intermodal (-4.0%) and motor vehicles & parts (-21.8%). NS’s total volumes were down 7.9%, with the largest decreases coming from intermodal (-12.4%) and motor vehicles & parts (-17.0%).

In the West, BN’s total volumes were down 4.7%, with the largest decreases coming from intermodal (-9.5%) and grain (-17.5%). The largest increases came from coal (+6.3%) and stone sand & gravel (+44.3%). UP’s total volumes were down 3.4%, with the largest decreases coming from intermodal (-11.3%), motor vehicles & parts (-24.9%) and grain (-19.2%). The largest increases came from chemicals (+12.1%) and stone sand & gravel (+23.6%).

In Canada, CN’s total volumes were down 14.3%, with the largest decreases coming from intermodal (-18.4%) and metallic ores (-22.5%). The largest increase came from coal (+20.4%). Revenue per ton miles was down 13.7%. CP’s total volumes were down 11.9%, with the largest decreases coming from grain (-30.1%), chemicals (-19.8%), coal (-19.9%) and farm products (-56.2%). Revenue per ton miles was down 14.7%.

KCS’s total volumes were up 7.2%, with the largest increases coming from intermodal (+7.8%), grain (+60.7%) and coal (+50.9%). The largest decrease coming from petroleum (-26.6%).

Source Data: Stephens

Rig Count

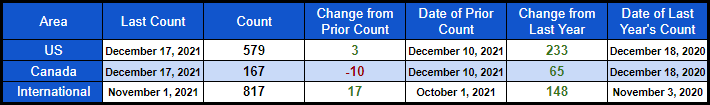

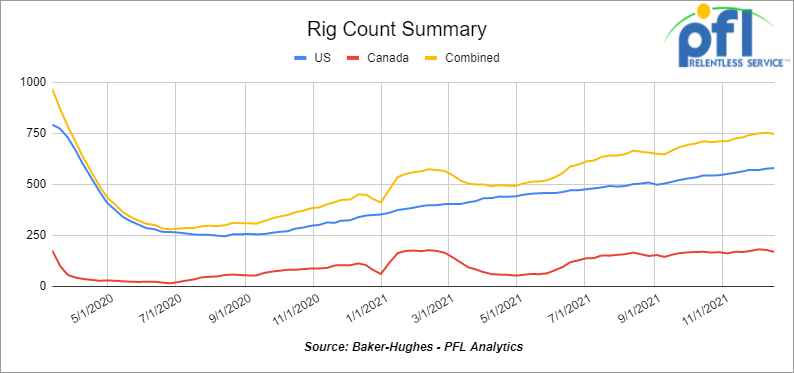

North American rig count is down by 7 rigs week over week. The U.S. rig count was up by 3 rigs week over week and up by 233 rigs year over year. The U.S. currently has 579 active rigs. Canada’s rig count was down by 10 rigs week over week but up by 65 rigs year over year and Canada’s overall rig count is 167 active rigs. Overall, year over year, we are up 298 rigs collectively.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,704 from 24,205, a gain of 499 rail cars week over week. Canadian volumes were up: CP volumes were up by 13.7% and CN volumes were up by 5.5 % week over week. U.S. volumes were mostly higher with the NS having the largest percentage increase (up by 19%) and the CSX having the largest percentage decrease (down by 15.7%).

Watching the Fed; Rate Hikes are ahead

Amid soaring inflation and falling unemployment, the U.S. Federal Reserve signaled last week that up to three rate hikes could come in 2022. This is up considerably from recent projections, and came as the Fed accelerated its tapering of monthly asset purchases, another signal that the central bank is trying to wind down monetary stimulus. Markets took the news in stride initially, as the move was widely expected, but were down Friday as other central banks around the world chimed in with their own plans for rate hikes.

Shell’s Sale of Texas Refinery Delayed

Shell said on Thursday of last week that the sale of its controlling interest in a Texas refinery to Mexican state oil company Pemex has been delayed until next year. A review of the deal by the Committee on Foreign Investment in the United States, a national security group chaired by the U.S. Treasury, had been expected to wrap up this month but has been extended into next year, Shell said. Shell in May disclosed an agreement to sell its 50 per cent interest in the 302,800 bbl/d Deer Park, Texas, refinery outside Houston to partner Pemex for $596 million. The closing was expected this month.

USD and Gibson DRU Fully Operational Good news for Crude by Rail

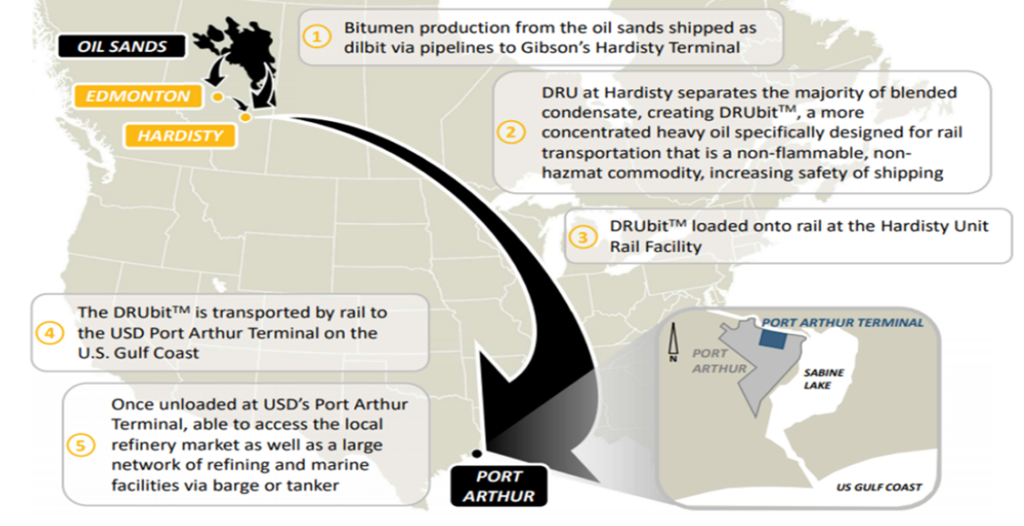

US Development Group, LLC (USD) and Gibson Energy Inc. (Gibson) announced their diluent recovery unit (DRU) has been declared fully operational and the shipment of DRUbit™ by Rail™ (DBR) has commenced. The DBR network creates a first-of-its-kind separation technology and network that safely and sustainably moves heavy Canadian crude oil, also known as bitumen, from Canada to the U.S. Gulf Coast at a cost that is competitive with pipeline alternatives.The DRU is located at the Hardisty Energy Terminal (HET) near Hardisty, Alberta and is a 50%/50% joint venture between USD and Gibson. HET is located adjacent to USD’s existing Hardisty Rail Terminal, which is the origination terminal for transloading the DRUbit™ onto railcars for shipment. The current destination terminal for the DRUbit™ is the USD-owned and operated Port Arthur Terminal (PAT) in Port Arthur, Texas. The DRUbit™ is owned by ConocoPhillips. This DBR network is highly scalable and is well-positioned for future commercial expansions. USD and Gibson continue to pursue commercial discussions with current and potential producer and refiner customers to secure additional long-term agreements to support future expansions at both the DRU and the PAT. (See below)

DRU Facility

Source: Gibson Energy Inc.

The Process

Source: Gibson Energy Inc.

USD’s patented DRU technology separates the diluent that has been added to the raw bitumen in the production process, which meets two important market needs. It creates DRUbit™, a proprietary heavy Canadian crude oil or bitumen that ships by rail and does not meet any of the defined categories of hazardous materials by U.S. DOT Hazardous Materials regulations and Canada’s Transport of Dangerous Goods regulations, creating safety and environmental benefits. Additionally, it returns the recovered diluent to ConocoPhillips at HET for reuse in the Western Canadian market, which reduces delivered costs for diluent.

The DRU at HET is operating at or above its nameplate capacity of 50,000 barrels per day of inlet bitumen blend, which the DRU separates into DRUbit™ and diluent. Transporting DRUbit™ by Rail™ is projected to reduce carbon emissions nearly 20% relative to dilbit by rail alternatives and approximately 30% compared to dilbit by pipeline alternatives.

The DBR network is supported by Canadian Pacific (CP) and Kansas City Southern Railway Company (KCS). As the initial destination terminal, PAT is unloading DRUbit™, blending it to customers’ specifications, and delivering it downstream through pipe or barge at or above current contractual requirements. PAT has significant marine, pipeline, rail and tank expansion capabilities and it is pipeline connected to Phillips 66’s Beaumont Terminal, providing customers access to a large network of refining and marine facilities. PAT has the infrastructure and ability to support growth, including allowing for efficient rail movements along mainlines from Canada and into the growing Mexico market.

Quotes

The Honorable Jason Kenney, Premier of Alberta

“Alberta’s government is obsessed with creating the best environment for job creation in Canada. We know that is the best way to attract innovators and entrepreneurs, who will help kick-start Alberta’s recovery. Not only will this vote of confidence in Alberta’s economy help to create jobs, it helps to tell our story about our energy industry, and how it constantly strives to lead the world in innovation and emissions reductions. Thank you to CP, Gibson Energy, US Development Group, ConocoPhillips, and Kansas City Southern for helping to ensure the strength and sustainability of Alberta’s energy sector.”

ConocoPhillips Canada

“Using the DRU separation technology and DRUbit™ by Rail™ network improves netbacks and overall returns as we move our bitumen production to high-value North American markets,” said Bij Agarwal, President, ConocoPhillips Canada. “An innovative solution, the DRU separation technology and DRUbit™ by Rail™ network – which provide transportation safety and environmental benefits – will also create jobs along the rail routes and help to address constrained market access, for the benefit of all Canadians.”

USD

“Our DRU separation technology and DRUbit™ by Rail™ network create a first-of-its-kind infrastructure to move heavy Canadian crude throughout North America in a way that is safe, environmentally beneficial and economically advantaged to current pipeline alternatives,” said USD CEO, Dan Borgen. “The project stands to strengthen communities with long-term, high quality jobs along the current and future rail routes. We are thrilled to work with ConocoPhillips Canada, Gibson, CP, and KCS to deliver this industry solution that we believe will positively impact our existing and future producer and refiner customers.”

Gibson

“We were pleased to see the Hardisty Energy Terminal fully operational in-line with budgeted capital cost,” said Steve Spaulding, Gibson’s President and Chief Executive Officer. “We consider DRUs to be a cost-effective, scalable, environmentally attractive long-term egress solution for the basin, and we remain in commercial discussions for potential additional phases at the Hardisty Energy Terminal. Importantly, we believe that this and future phases will improve netbacks for producers, driving increased oilfield and related business activity, creating new jobs and helping revive communities.”

CP

“The launch of DRUbit™ by Rail™ over the CP network helps us to achieve key sustainability goals while creating new efficiencies for customers,” said Keith Creel, CP’s President and Chief Executive Officer. “CP is proud to work with USD and Gibson to make this innovative terminal a success.”

KCS

“KCS is pleased to be a strategic partner in this innovative solution to improve the safety and economics of moving crude oil,” said KCS President and Chief Executive Officer Patrick J. Ottensmeyer. “It’s also a great opportunity to grow our business in the Gulf Coast area and further develop our strategic presence in the Port Arthur market.”

Watching Russia and Natural Gas

Global natural gas prices will hinge on the Nord Stream 2 pipeline and Russia’s gas strategy. Currently, Russia is the primary source of the world’s spare capacity and delivering that supply to markets eager to meet demand and rebuild storage will dominate balances and prices in 2022. The delayed Nord Stream 2 pipeline is essential to boosting Russian gas supply into Europe as Russia is shifting away from Ukraine transit and Electronic Sales Platform (ESP) sales. Despite the fact that Europe is desperate for gas supply, regulators appear to be in no rush to sign off on Nord Stream 2. People expect the pipeline will begin operations in June, further delays would cause European buyers to scramble for alternative gas supply, boosting not only European gas prices, but global LNG prices. Even US prices would get an uplift from this, as US LNG exports will ramp up further in 2022. Why is Nord Stream 2 important for rail here in the U.S., you ask? The more natural gas that is produced here in the U.S. the more liquids that are produced with it leading to increased rail activity. A delayed pipeline into Europe would bode well for North America’s energy complex as it would be us that rush to fill that void in Europe.

Nord Stream 2 Pipeline

Source: Gazprom

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20 PD lined hoppers 5200-6200 CU FT non-food grade for 1 year plus in the south

- 20 pressure cars 340’s in SE clean or last in butane or propane 1-2 years Immediate Need

- 30 5800 and 6250 covered gons for sale

- 100 117Js Coiled and Insulated dirty to dirty service BNSF CN or CP

- 50, 5800cuft or larger Covered Hopper for the use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10 25-28K C&I tanks for veg oil needed in the south for 2 years negotiable

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- Unit Train of 28.3K 117Js for use in Crude service off the CN or BN in MT, ND, or Alberta.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 117R’s 31.8 clean for lease in Texas – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 25 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|