“Success usually comes to those who are too busy to be looking for it.”

– Henry David Thoreau

Jobs Update

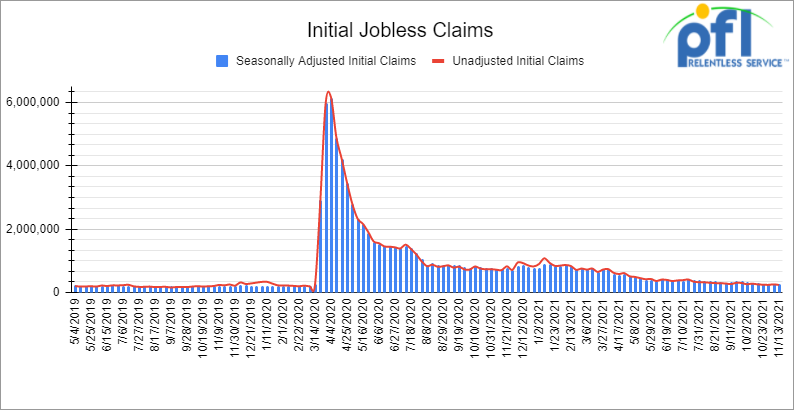

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending November 13th came in at 268,000, down 1,000 people week over week.

- Continuing claims came in at 2.08 million people versus the adjusted number of 2.209 million people from the week prior, down 129,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed mixed on Friday of last week – and mixed week over week

The DOW closed lower on Friday of last week, down -268.97 points (-0.75%), closing out the week at 35,601.98 points, down 498.33 points week over week. The S&P 500 closed lower on Friday of last week, down -6.58 points (-0.14%) and closed out the week at 4,697.96, up 15.11 points week over week. The Nasdaq closed higher on Friday of last week, up 63.73 points (+0.4%) and closed out the week at 16,057.44, up 196.48 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 35,668 this morning up 119 points.

Oil posts fourth straight weekly loss as COVID concerns emerge

Oil posted its largest weekly drop since August as Europe’s worsening COVID-19 crisis renewed the prospect of lockdowns just as key consuming nations look to add emergency supply to the market. The wave of infections in Europe is growing once again and raising the prospect of mobility restrictions that would hit oil demand. Austria imposed a lockdown while Germany has introduced some restrictions.

The December contract for WTI, which expired Friday, closed down $2.91 at $76.10 per barrel. WTI for January delivery lost $2.47 to reach $75.94 down $4.85 cents a barrel week over week.

Brent fell $2.35 to settle at $78.89 per barrel down $3.28 per barrel week over week.

Weakening demand comes at a time when China and the U.S. are looking at releasing oil from strategic reserves and increasing production coming online weighed heavily on the market last week.

On an interesting note OPEC+ compliance for agreed output cuts stood at 116% in October, up from 115% the previous month, indicating that some producers continued to struggle to meet agreed production quotas. Compliance for core OPEC members in the group rose from 115% in September to 121% in October, the highest since May, according to a Reuters report referencing internal data, indicating the alliance continues to produce less than its agreed targets. Historically, under-compliance has been an issue for OPEC, with some members overproducing from agreed output quotas, but the high compliance figures suggest several producers cannot meet quotas. This includes Nigeria and Angola, which have faced upstream problems, while Libyan volumes have been curtailed by political and financial issues. Compliance for non-OPEC participating producers stood at 106% in October, down from 114% in September. Folks there may not be enough crude out there at the moment!

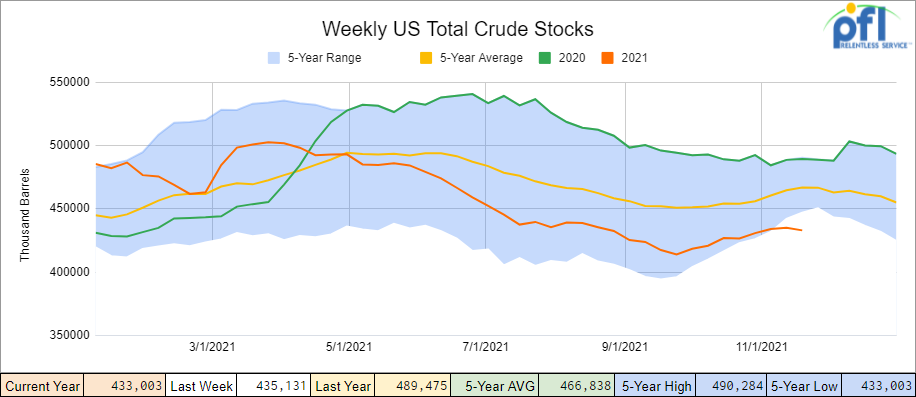

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.1 million barrels week over week. At 433.0 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

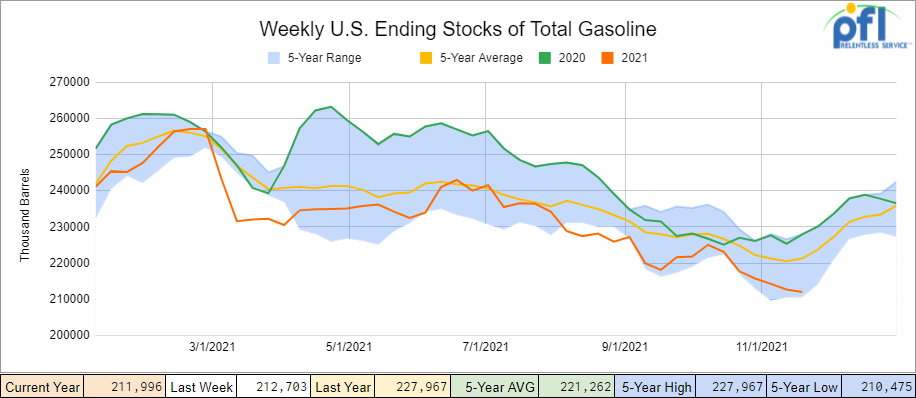

Total motor gasoline inventories decreased by 700,000 barrels week over week and are 4% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

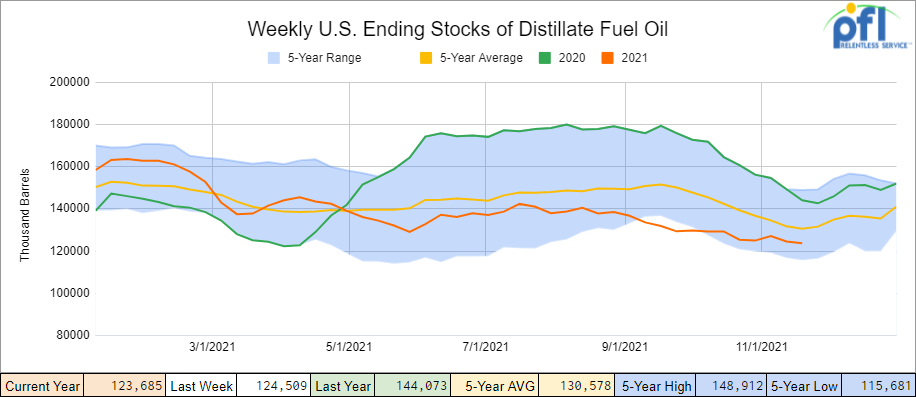

Distillate fuel inventories decreased by 800,000 barrels week over week and are 5% below the five year average for this time of year.

Source Data: EIA – PFL Analytics

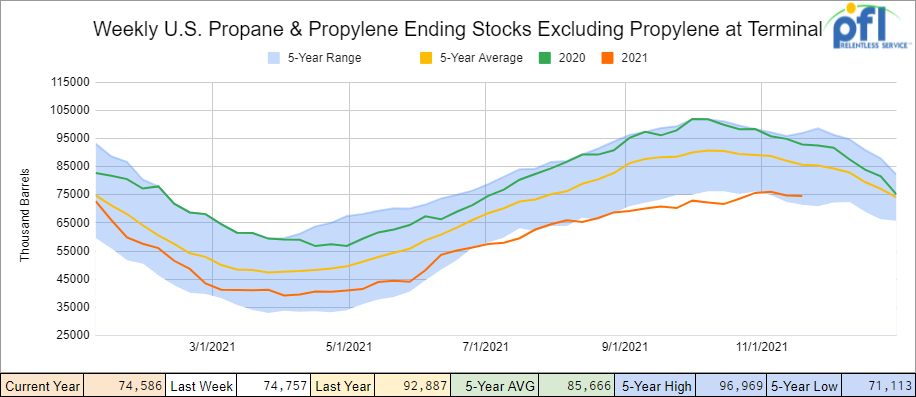

Propane/propylene inventories decreased by 200,000 barrels week over week and are 13% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

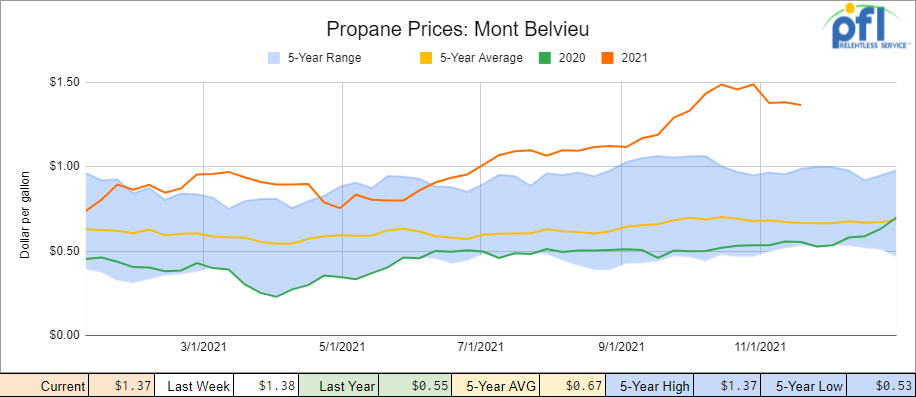

Propane prices here in the U.S. were slightly lower losing a penny week over week as inventory levels slightly improved.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories decreased by 8.9 million barrels week over week.

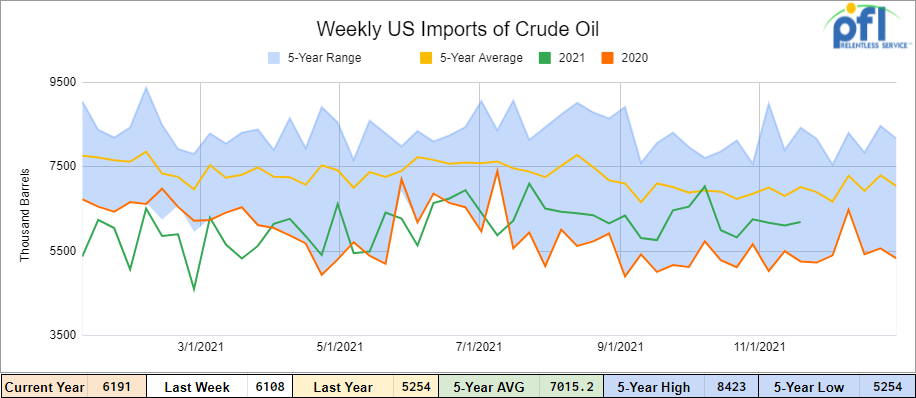

U.S. crude oil imports averaged 6.2 million barrels per day for the week ending November 12th, up by 83,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 15.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 823,000 barrels per day, and distillate fuel imports averaged 239,000 barrels per day for the week ending November 12, 2021.

Source Data: EIA – PFL Analytics

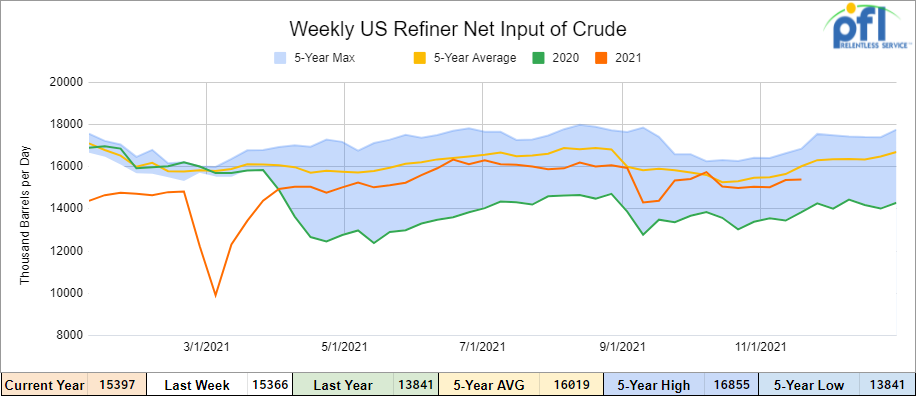

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending November 12, 2021 which was up 32,000 barrels per day week over week. Refineries operated at 87.9% of their operable capacity.

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at 76.14 , up .20 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 4.5% year over year in week 45 (U.S. -4.7%, Canada -5.8%, Mexico +3.4%) resulting in quarter to date volumes that are down 3.8% and year to date volumes that are up 6.2% year over year (U.S. +7.2%, Canada +3.5%, Mexico +3.9%). 5 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decline coming from intermodal (-9.1%). The largest increase came from coal (+11.9%).

In the East, CSX’s total volumes were down 3.0%, with the largest decrease coming from motor vehicles & parts (-28.5%). NS’s total volumes were down 4.1%, with the largest decrease coming from intermodal (-7.3%).

In the West, BN’s total volumes were down 4.2%, with the largest decrease coming from intermodal (-10.4%). The largest increases came from coal (+9.3%) and stone sand & gravel (+54.5%). UP’s total volumes were down 3.7%, with the largest decrease coming from intermodal (-14.8%). The largest increase came from coal (+35.6%).

In Canada, CN’s total volumes were down 5.8%, with the largest decrease coming from intermodal (-11.9%). The largest increase came from coal (+59.8%). Revenue per ton miles were down 6.2%. CP’s total volumes were up 0.5%, with the largest increase coming from coal (+20.9%). Revenue per ton miles was up 0.6%.

KCS’s total volumes were up 2.3%, with the largest increase coming from intermodal (+11.9%) and the largest decrease coming from petroleum (-30.2%).

Source: Stephens

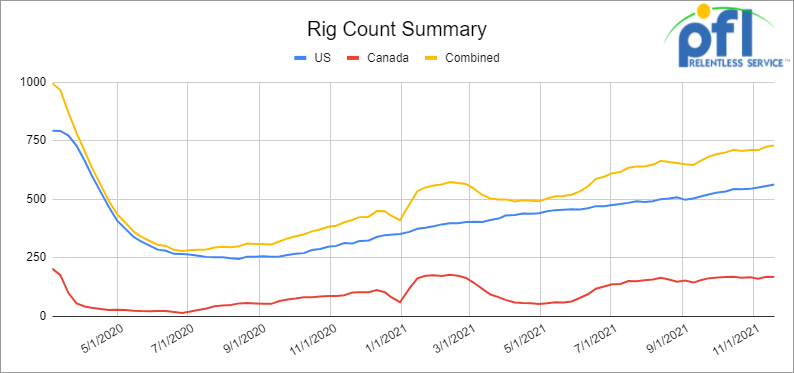

Rig Count

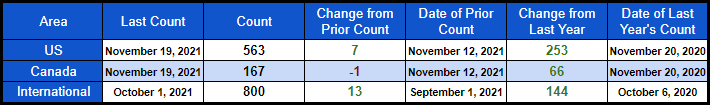

North American rig count is up by 6 rigs week over week. The U.S. rig count was up by 7 rigs week over week and up by 253 rigs year over year. The U.S. currently has 563 active rigs. Canada’s rig count was down by 1 rig week over week, and up by 66 rigs year over year and Canada’s overall rig count is 167 active rigs. Overall, year over year, we are up 319 rigs collectively.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,081 from 24,092, a loss of 11 rail cars week over week. Canadian volumes were mostly mixed: CP volumes were up by 15.7% and CN volumes were down by 9%. U.S. volumes were mostly higher with the UP having the largest percentage increase (up by 6.5%) and the NS having the largest percentage decrease (down by 8%).

ASLRRA Annual Conference and Exhibition

Well folks, PFL was there in force – we cosponsored the lunch on Thursday of last week – handed out our famous PFL eyeglass cleaners together with PFL information as far as the services we offer. Of course we had our pop-ups everywhere. If you did not make it there, it was a great show and was business as usual. The final count was over 1,200 people and exhibitors went all out – it was impressive to see America back to work in a big way despite the headwinds we’ve encountered, we continue to move forward! May God bless the American people! Break out sessions were great. The only complaint is you had to pick and choose which one you attended.

PFL was asked to speak at one of the break out sessions on Energy by Rail Dynamics and trends. Salient points below:

- We thought we did a pretty good job in our presentation and our topics included storage trends.

- We talked about the different crude basins and opportunities (or not) for crude by rail touching on Canada, Bakken and the Permian.

- We talked about gasoline and diesel markets and the current Mexican situation.

- We talked about renewables including Ethanol, Biodiesel and Renewable Diesel. We talked about Renewable Identification Numbers RINS and LCFS credits and the impact on the overall physical market.

- Talked about different tank car types and values.

- We talked about scrap prices and where PFL can accept cars delivered and what price we would pay for November delivery.

- We also dove into a bunch of regulatory challenges involving pipelines including Enbridge Line 3, Enbridge Line 5, The Dakota Access Pipeline (DAPL) and other pipelines that may create (or not create) opportunities for rail.

- And finally we pointed out some opportunities for short lines and storage facilities to expand their footprint, retain market share and what we feel is some useful and proactive advice.

If you wish to discuss ASLRRA Annual Conference and Exhibition on any of the points raised above reach out to PFL anytime at 239-390-2885.

We are watching White House policies on Energy and the Environment

There is quite a bit happening in the Capital. President Biden blasted American oil companies over higher gasoline prices. You have got to be kidding me it was inevitable that this would happen. You can’t cancel pipelines (Keystone) put a freeze on drilling permits – folks the list goes on. Then low and behold gas prices go up at the pumps and then blame the oil and gas sector for the rise and unleash the government to investigate and perhaps apply punitive measures against the oil companies . We guess when the Biden administration did not get anywhere blaming OPEC+ they felt like they needed to blame someone. What scares us the most is the threats of selling our emergency reserves and banning crude exports – wow that is a terrible approach – throttling back our production and selling our publicly owned emergency stocks puts us in a very bad position – what if there is an emergency – we are sitting ducks at that point. It is ironic that the newfound skepticism on energy exports comes after the Democrats in 2015 backed a bipartisan bill that lifted restrictions on crude exports in exchange for extending renewable tax credits. Former President Barack Obama’s administration approved most of the U.S. LNG export facilities that are now in operation and that today’s democrats blame for higher American energy prices. In our minds there is really no one to blame but we need to pivot quickly and reverse some of the decisions made sooner than later. I think we can all agree that reducing our carbon footprint is a great thing to do. Let’s concentrate on carbon recapture – clean coal and enhanced oil recovery to keep our nation clean and moving forward in a meaningful way. There are some great green energy projects that are being contemplated but are years away from making sense. There are on the other hand shovel ready projects that can be accomplished immediately and can be paid for by the business not the government because it makes good business sense to do so.

Carbon recapture is happening in a big way in Canada. The province of Alberta handed out more than $100 million for carbon capture, utilization and storage (CCUS) and emissions reductions projects Thursday of last week that it estimated could cut 2.9 megatonnes of greenhouse gas emissions by 2030.

Funding recipients are looking to upgrade engines at a natural gas facility to reduce fuel use and cut emissions, and convert wasted heat from generators into emissions-free technology at a gas plant, among other initiatives. Advantage Energy is constructing a CCS project at its Glacier Gas Plant. Provincial funding is supporting Phase 1 of the project, which will cut about 46,800 tonnes of emissions each year and improve the plant’s emissions intensity by 22 per cent. (see below)

Source: Advantage Energy

Making more electric cars with short battery lives and the environmental impact of making these cars together with the incremental power requirements on the grid, not to mention end of life recycling costs, is not the low hanging fruit to make a difference.

We also have the first infrastructure bill that passed nearly 1 trillion dollars and another 3 trillion dollars that congress wants to pass by year end. This is not a good idea – we don’t see any upside in following through with this plan.

CP and KCS Update

CP is now raising money to pay for its acquisition of the KCS. Canadian Pacific is issuing a debt offering in the United States and Canada. The net proceeds will be used to help fund CP’s acquisition of Kansas City Southern.

In the United States, CP is issuing $1.5 billion of 1.35% notes due 2024, $1 billion of 1.75% notes due 2026, $1.4 billion of 2.45% notes due 2031, $1 billion of 3.0% notes due 2041 and $1.8 billion of 3.1% notes due 2051, which will be guaranteed by CP, according to a company press release.

The U.S. offering is due to close Dec. 2.

In Canada, CP is issuing CA$1 billion of 1.589% notes due 2023 and CA$1.2 billion of 2.54% notes due 2028, which will be guaranteed by CP. The Canadian offering is expected to close Nov. 24.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 30-50 340 Pressure cars for propane starting Nov 3 month lease in Alberta CP or CN

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|