The worst lesson that can be taught a man is to rely upon others and to whine over his sufferings. If an American is to amount to anything he must rely upon himself, and not upon the State; he must take pride in his own work

– Theodore Roosevelt

Jobs Update

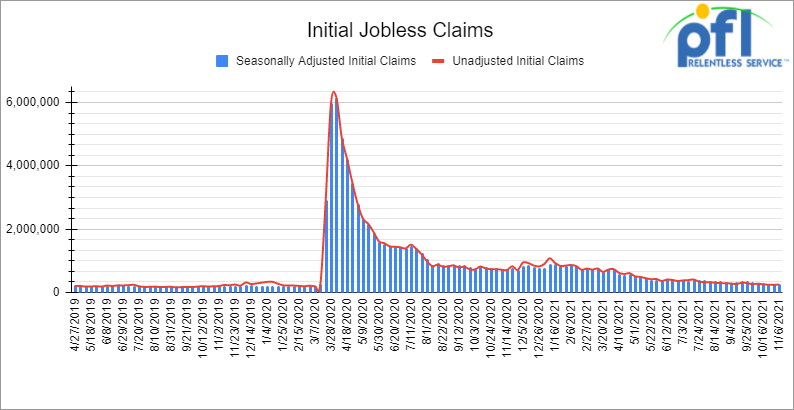

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending November 6th came in at 267,000, down 4,000 people week over week.

- Continuing claims came in at 2.160 million people versus the adjusted number of 2.101 million people from the week prior, up 59,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed higher on Friday of last week – but lower week over week

The DOW closed higher on Friday of last week, up 179.08 points (+0.50%), closing out the week at 36,100.31 points, down 227.64 points week over week. The S&P 500 closed higher on Friday of last week, up 33.58 points (+0.72%) and closed out the week at 4,682.85, down 14.68 points week over week. The Nasdaq closed higher on Friday of last week, up 156.68 points (+1%) and closed out the week at 15,860.96, down 110.63 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 36,118 this morning up 105 points.

Oil down on Friday of last week and down week over Week

Russia’s Rosneft expects a new supercycle in oil and gas markets amid rapid growth in global demand for fossil fuels, the world’s second-largest oil-producing company after Saudi Aramco said in its third-quarter results. While the outlook of the global economy remains uncertain due to Covid-19, “we observe a rapid growth in demand for traditional energy resources,” the company’s CEO, Igor Sechin, said on Friday of last week.

“As structural discrepancies between supply and demand on global energy markets are further revealed, we may witness a new supercycle on the oil and gas markets,” Sechin added.

Rosneft said it would increase its investment in new gas and oil projects to meet rising demand.

Both benchmarks fell for a third consecutive week, hit by a strengthening dollar and speculation that President Joe Biden’s administration might release oil from the U.S. Strategic Petroleum Reserve to cool prices. On a weekly basis, Brent fell 0.7 per cent, while WTI declined 0.6 per cent.

West Texas Intermediate (WTI) crude closed down $0.80 cents on Friday of last week to settle at $80.79, down $0.48 per barrel week over week. Brent futures closed down $0.70, to settle at $82.17 per barrel, down $0.59 per barrel week over week.

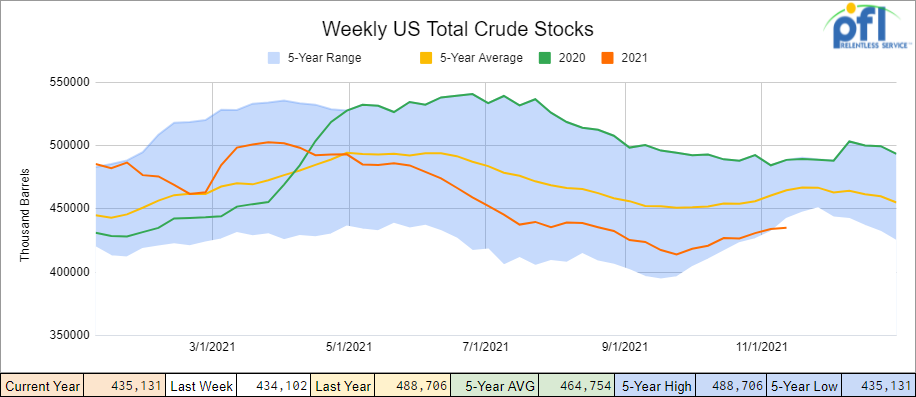

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.0 million barrels week over week. At 435.1 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

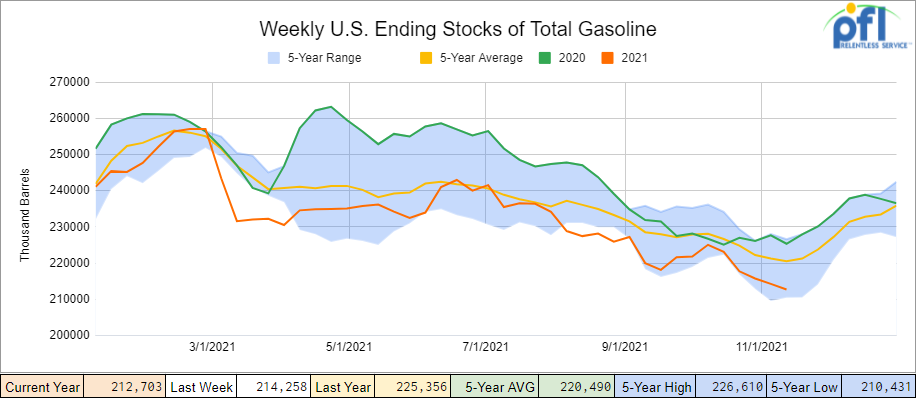

Total motor gasoline inventories decreased by 1.6 million barrels week over week and are 4% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

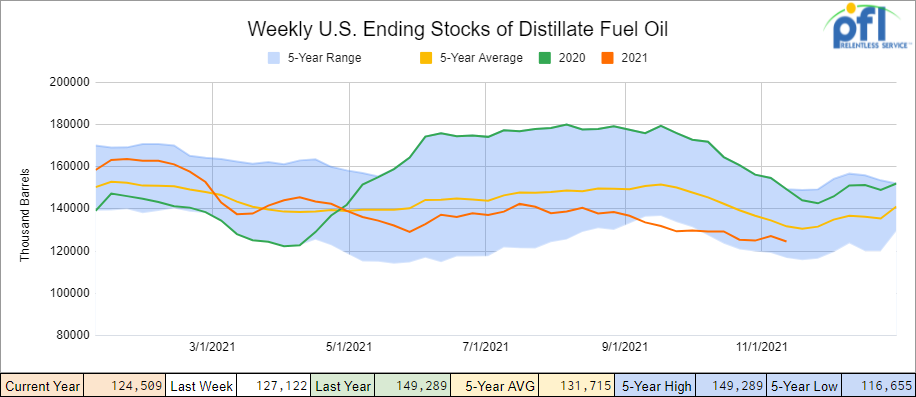

Distillate fuel inventories decreased by 2.6 million barrels week over week and are 6% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

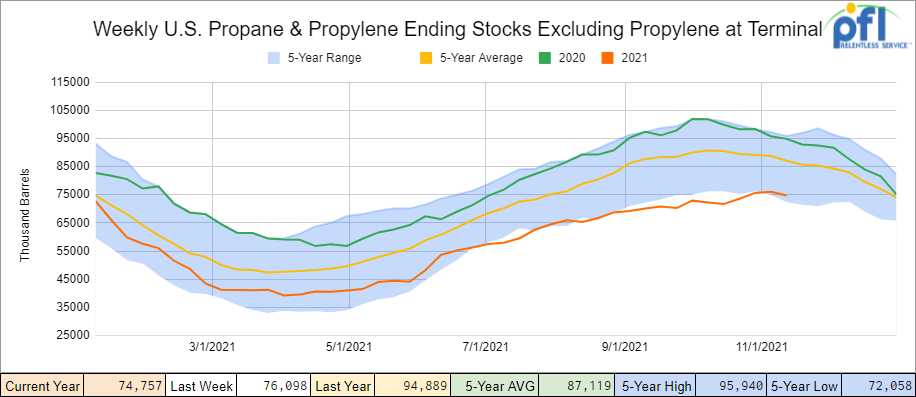

Propane/propylene inventories decreased by 1.3 million barrels week over week and are 14% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

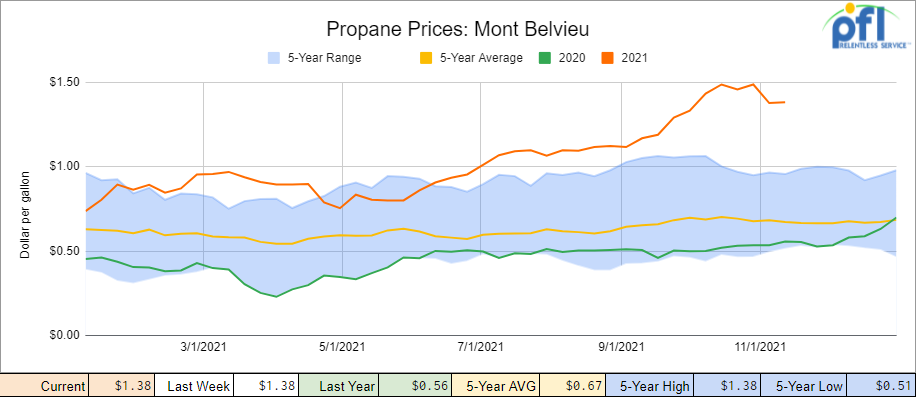

Propane prices were flat week over week as inventory levels dwindled. Meanwhile, European natural gas rebounded strongly on Thursday of last week amid further uncertainty over Russian supplies, with Dec21 TTF closing 7% up at €75/MWh.

“European gas prices rallied following concerns of further disruptions to Russian gas flows into Europe,” said Daniel Hynes, senior commodity strategist at ANZ, noting Belarus had threatened to shut down a key pipeline linking Russia to Europe.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories decreased by 1.2 million barrels week over week

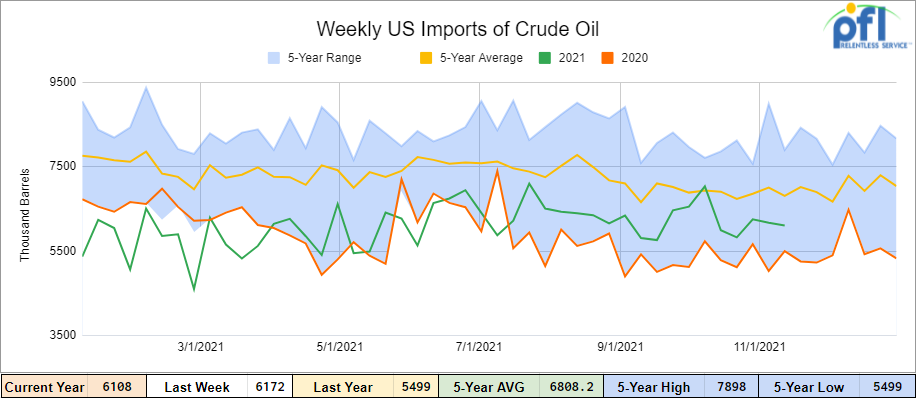

U.S. crude oil imports averaged 6.1 million barrels per day for the week ended November 5th, down by 63,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 14.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 587,000 barrels per day, and distillate fuel imports averaged 278,000 barrels per day for the week ending November 5, 2021.

Source Data: EIA – PFL Analytics

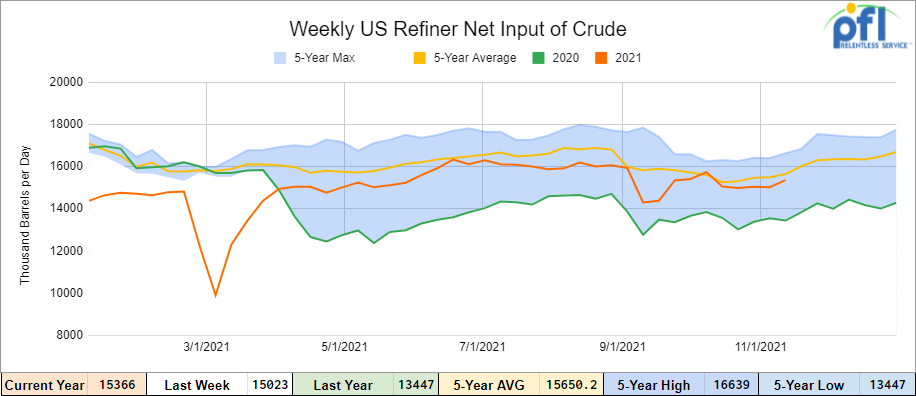

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending November 5, 2021 which was 343,000 barrels per day more than the previous week’s average. Refineries operated at 86.7% of their operable capacity during the week ending November 5th.

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at 79.98 , down 0.81 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.3% year over year in week 44 (U.S. -3.5%, Canada -2.4%, Mexico -4.7%) resulting in quarter to date volumes that are down 3.6% and year to date volumes that are up 6.5% year over year (U.S. +7.5%, Canada +3.7%, Mexico +4.0%). 4 of the AAR’s 11 major traffic categories posted a year over year decrease with the largest decline coming from intermodal (-7.8%). The largest increases came from coal (+11.7%) and metallic ores & metals (+17.9%).

CSX’s total volumes were down 4.0%, with the largest decrease coming from motor vehicles & parts (-37.4%). The largest increase came from grain (+41.9%). NS’s total volumes were down 4.5%, with the largest decreases coming from intermodal (-5.2%), grain (-35.3%) and motor vehicles & parts (-15.4%).

BNSF’s total volumes were down 0.7%, with the largest decreases coming from intermodal (-7.4%) and motor vehicles & parts (-23.8%). The largest increase came from coal (+23.2%). UP’s total volumes were down 4.7%, with the largest decrease coming from intermodal (-15.7%). The largest increases came from chemicals (+12.6%) and coal (+11.6%).

In Canada, CN’s total volumes were down 0.2%, with the largest decreases coming from intermodal (-9.2%) and grain (-30.9%). The largest increases came from coal (+80.3%) and metallic ores (+26.8%).

Revenue per ton miles was down 2.0%. CP’s total volumes were down 1.3%, with the largest decreases coming from grain (-22.4%) and motor vehicles & parts (-37.5%). Revenue per ton miles was up 2.3%.

KCS’s total volumes were up 4.0%, with the largest increase coming from grain (+40.5%).

Source: Stephens

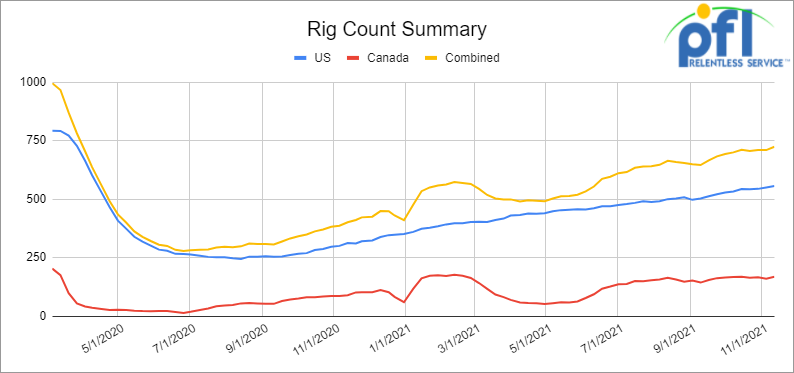

Rig Count

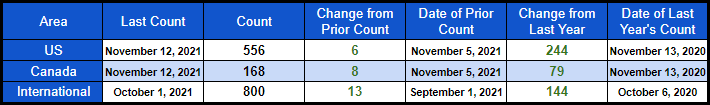

North American rig count is up by 14 rigs week over week. The U.S. rig count was up by 6 rigs week over week and up by 244 rigs year over year. The U.S. currently has 556 active rigs. Canada’s rig count was up by 8 rigs week over week, and up by 79 rigs year over year and Canada’s overall rig count is 168 active rigs. Overall, year over year, we are up 323 rigs collectively.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,092 from 23,840, a gain of 252 rail cars week over week. Canadian volumes were mostly higher: CP volumes were down 1.7% and CN volumes were up roughly 7.9%. U.S. volumes were mixed with the UP having the largest percentage increase up by 10.8% and the NS having the largest percentage decrease, down by 12%.

New Railcar Orders and Outlook

New railcar orders moderated slightly to 8,600 units in the third quarter of 2021 versus 9,500 in the second quarter of 2021, but the backlog increased 1% sequentially to 37,800 units. Overall, we are hovering around replacement levels. Railcar utilization and lease rates continue to improve while network fluidity remains challenged. Looking ahead, we continue to expect a slow recovery with the improvements in the railcar leasing sector leading to improvements in the railcar manufacturing sector.

Railcar deliveries in the third quarter of 2021 were 8,300 units – up 4% year over year and up 22% quarter over quarter. Railcar orders in the third quarter of 2021 were 8,600 units, up 2,800 unit’s year over year. This compares to the second quarter of 2021 orders for 9,500 units. Third quarter 2021 backlog was 37,800 units, representing an increase of 1% year over year. At the third quarter of 2021 build rate, this equates to 4.6 quarters of production.

On average, year to date train speeds are down 7% year over year. Our thoughts – the leading indicators for railcar demand continue to improve with fewer railcars in storage, slower train speeds and elevated scrap prices. These trends have driven improvement in the leasing market, and the manufacturers have seen an impact with orders trending higher the past couple of quarters. With that being said, there is tremendous pressure from the STB against all class 1’s to improve service, which should lead to more cars being available to cycle and should result in less cars being needed to accomplish the same job at least that is the hope.

Mexican Distribution Woes

Folks, there have been problems getting fuel down to Mexico. In the U.S. we have seen KCS volumes decline (cited in last week’s rail report), PFL has seen it’s volumes in storage for residue gasoline and diesel cars build. We have been fielding requests to clean residue gasoline and diesel cars to be put into Ethanol and Biodiesel service where margins are better. It has been a little bit of a cluster in getting the right permits put in place and shippers are confused about what is going on in Mexico. The spillover is now being felt by trucking companies in Mexico for fuel distribution via truck.

Uncertainty over a new permit requirement has kept some Mexican fuel tank trucks from loading at private sector fuel storage terminals in the latest policy shift down in Mexico. Transporters must show terminal operators not only a long established permit for the tank trailers but also one certifying the legal provenance of the truck itself. Market participants are saying that the permit does not exist. The Mexican energy regulator (CRE) stopped trucks from loading at Vopaks’s 640,000 bbl fuel storage facility in late October. Trucks resumed loading as of late as long as the operator showed the tank permit and signed a waiver accepting all legal responsibilities related to the second phantom permit. Bottom line seems as though we have another supply chain disruption with the result in the short term pushing volumes back to the United states. With ultimately more cars making their way to storage in the short term. The Mexican government’s ultimate goal long term is to wean the country off of imports of both gasoline and diesel which at present they strongly rely on.

Vopaks Veracruz Terminal is located in S.E Mexico – has 1,340,359 barrels of capacity with 78 tanks onsite:

Enbridge Line 5 Update

Enbridge Energy’s Line 5 plays a crucial role in Canada’s energy exports and oil refining industry, while also supplying the state of Michigan with more than half of its propane needs. The pipeline delivers up to 540,000 barrels of Canadian crude and other petroleum products every day from Superior, Wisconsin, to Sarnia, Ontario, passing through Michigan’s Upper Peninsula and under the Straits of Mackinac on the way. The notion that President Biden might kill Line 5, the way he did with the Keystone XL pipeline earlier this year, was short lived. The White House assured reporters that it wasn’t considering closing Michigan’s controversial oil and gas pipeline, but admitted to studying the possibility. On Tuesday, White House officials confirmed that they were studying the possible economic ramifications of shutting down Line 5—as first reported last week by POLITICO—but said they had no intention of doing so. It would be political suicide to think of shutting in the pipeline now – if we thought energy prices were high now it would be a catastrophic event for the American consumer if this were to happen.

The shutting down of Line 5 down would cause serious political tensions between the United States and Canada. It also underscored the high stakes for the Biden administration, and for other Democrats, as they attempt to pass their massive domestic climate agenda. As Biden touted America’s reentrance to the world stage as a leader in the global fight against climate change at COP26, all 12 federally recognized Native tribes in Michigan urged the President to demonstrate his commitment to climate action and to uplifting underrepresented voices by supporting the state’s efforts to shut down Line 5.

Enbridge Line 3 Update

Folks, this pipeline is now up and running at 100%. From late 2020 until recently, apportionment had been running in the 40% to 50% range, after a COVID-related lull in production and pipeline congestion in the spring and summer of 2020, pipeline takeaway constraints had become an issue once again for those producers wanting to ship on the Mainline. However, with the start of line pack and subsequent operations on L3, heavy oil apportionment for October 2021 fell to 33% from 48% in September, and apportionment for November is pegged by Enbridge at only 12%. This is very low compared to historical levels and suggests that there is very little in the way of pipeline congestion occurring for heavy oil barrels since the start-up of the L3 expansion project. In other words, the barrels that want to get out of Western Canada are finding their way out with little to no pipeline impediments

On the natural gas front

Northeast Natural Energy is the First to Get EO certification in April of this year, Northeast Natural Energy (NNE), a West Virginia driller, announced it had enrolled itself in both the Equitable Origin and MiQ certification programs to prove the natural gas it produces is “responsibly sourced gas” (see WV Driller NNE Adopts Green Gas Certification Used by EQT). Friday of last week NNE announced all of its gas produced in West Virginia has achieved Equitable Origin’s EO100™ Standard for Responsible Energy Development. It is the first driller in the country to obtain the EO certification.

Manchin Pushing Back: Manchin signals hesitation to passing Biden’s social agenda with inflation ‘getting worse’. Senator Joe Manchin of West Virginia on Wednesday expressed renewed concerns about President Joe Biden’s social and climate spending plan after a new report said inflation worsened in October. Resistance from Manchin, a moderate Democrat, has already caused sizable changes to the president’s Build Back Better spending legislation, including a drastic drop in its price tag. Manchin has also often said rising inflation was a major hurdle regarding his approval of any plan.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 30-50 340 Pressure cars for propane starting Nov 3 month lease in Alberta CP or CN

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|