“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

– Warren Buffett

Jobs Update

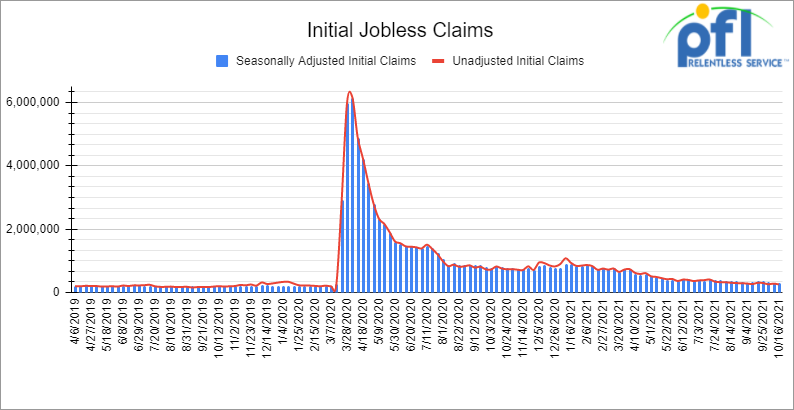

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending October 16th came in at 290,000, down -6,000 people week over week.

- Continuing claims came in at 2.481 million people versus the adjusted number of 2.603 million people from the week prior, down -122,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 73.94 points (0.21%) , closing out the week at 35,677.02 points, up 382.26 points week over week. The S&P 500 closed lower on Friday of last week, down -4.88 points and closed out the week at 4,544.9, up 73.53 points week over week. The Nasdaq closed lower on Friday of last week, down -125.5 points (-0.82%) and closed out the week at 15,090.20, up 192.86 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 35,568 this morning up 11 points.

Oil up on Friday of last week and up week over week yet again

Oil traded just below multi-year highs on Friday with bullish sentiment about low supplies tamped by concerns from world leaders that demand disruptions from the COVID-19 pandemic which may not be over because of their self inflicted shut downs.

Prices have also been boosted by worries about coal and gas (Natgas and LPG’s) shortages in China, India and Europe, spurring some power generators to switch from gas to fuel oil and diesel. The result of the higher oil price has led to higher prices at the pump and the American public is not happy about it. Biden is blaming OPEC! Biden says he does expect U.S. gasoline prices to start to come down after the New Year.

“I don’t see anything that’s going to happen in the meantime that’s going to significantly reduce gas prices,” he said during what seemed to be a staged Town Hall hosted by CNN in Baltimore on Thursday of last week.

Biden suggested that he had few near-term options for moderating high fuel prices while Saudi Arabia did have the ability to cool off the market. “A lot of Middle Eastern folks want to talk to me,” he said. “I’m not sure I’m going to talk to them, but the point is, it’s about gas production.”

Biden did not mention U.S. oil production, which remains nearly 2 million barrels per day below its 13 million barrels per day peak in November 2019, before the pandemic, and the 2020 price war between the Saudis and Russia crippled the industry in the short term. President Biden also failed to mention that he cancelled the Keystone pipeline – has halted energy permits in certain cases and is making it difficult for oil and gas companies to raise capital. Our advice for the President is “let America loose,” we will fix the problem. Maybe President Biden should call Canada, the State of Texas, the State of North Dakota and the State of New Mexico to increase oil and natural gas production and reverse the decision to cancel Keystone instead of calling Opec – just a thought. The fact is, there is a lot of untapped energy in America including natural gas which is a very clean burning fuel. There is quite a bit of talk about Hydrogen, but the production of Hydrogen involves carbon recapture to make it clean. We are better off burning natural gas and we have a ton of it as touched on later in today’s report.

West Texas Intermediate (WTI) crude closed up $1.26 (+1.5%) per barrel on Friday of last week, to settle at $83.76, up $1.48 per barrel week over week. Brent futures closed up 92 cents (+1.1%), to settle at $85.53 per barrel up 61 cents per barrel week over week.

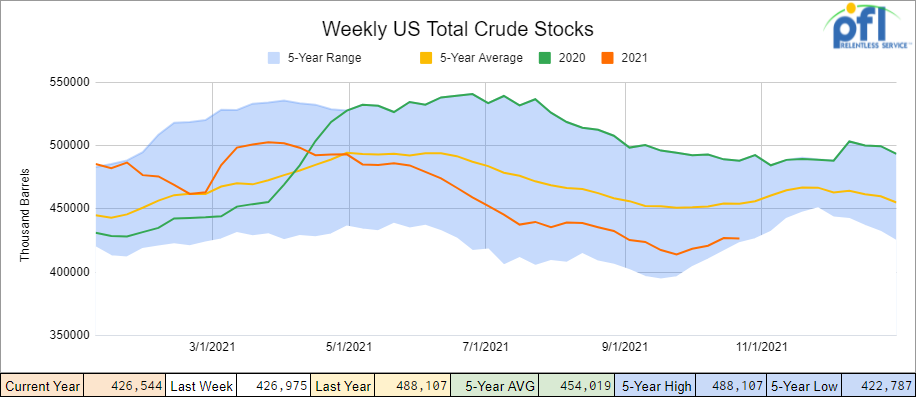

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 400,000 barrels from the previous week. At 426.5 million barrels, U.S. crude oil inventories are 6% below the five year average for this time of year.

Source Data: EIA – PFL Analytics

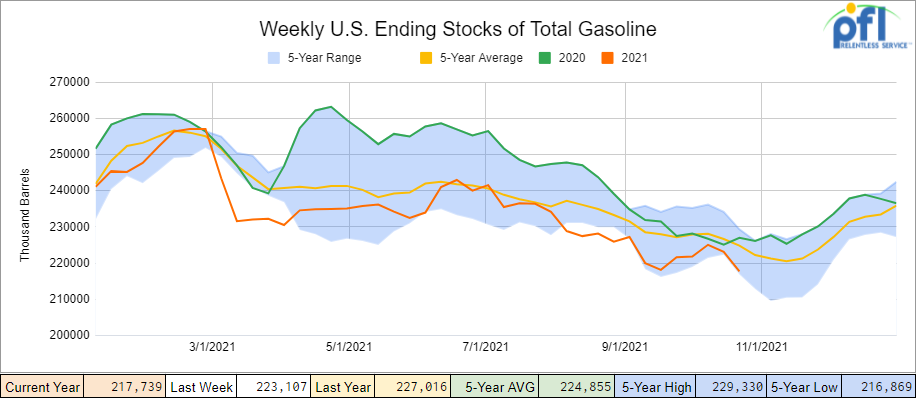

Total motor gasoline inventories decreased by 5.4 million barrels week over week and are 3% below the five year average for this time of year.

Source Data: EIA – PFL Analytics

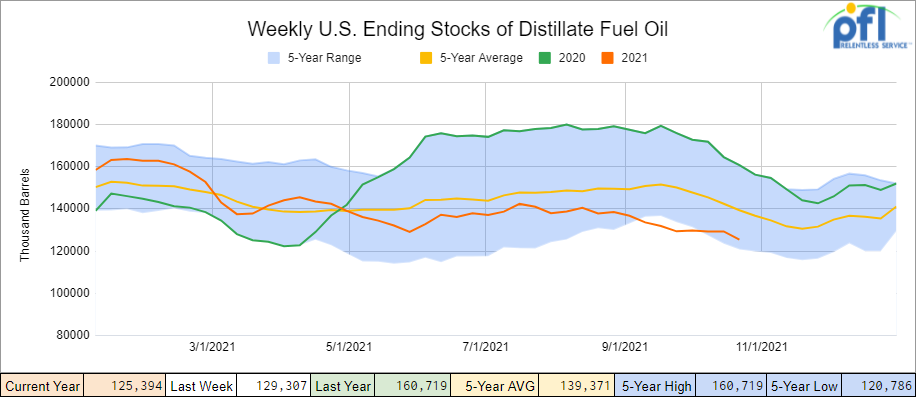

Distillate fuel inventories decreased by 3.9 million barrels week over week and are 10% below the five- year average for this time of year.

Source Data: EIA – PFL Analytics

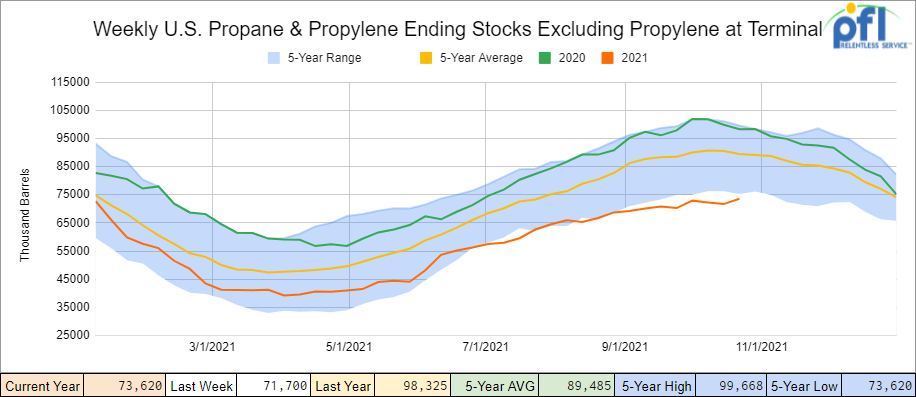

Propane/propylene inventories increased by 1.9 million barrels week over week and are 17% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

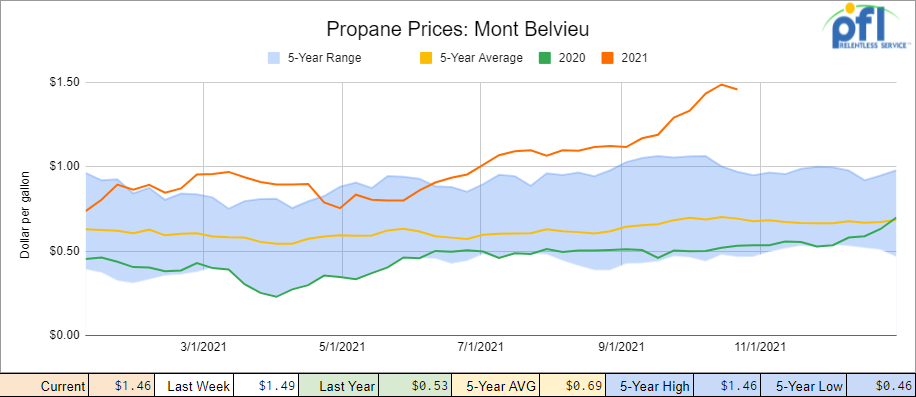

Folks, we finally saw some relief in propane prices decreasing by 3 cents per gallon week over week at the same time adding some decent inventory. In fact, LPG exports to Europe have slowed so far this month giving us some relief here at home as above average temperatures have persisted during the month of October – it’s all about the weather at this point.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories decreased by 9.8 million barrels for the week ending October 15th.

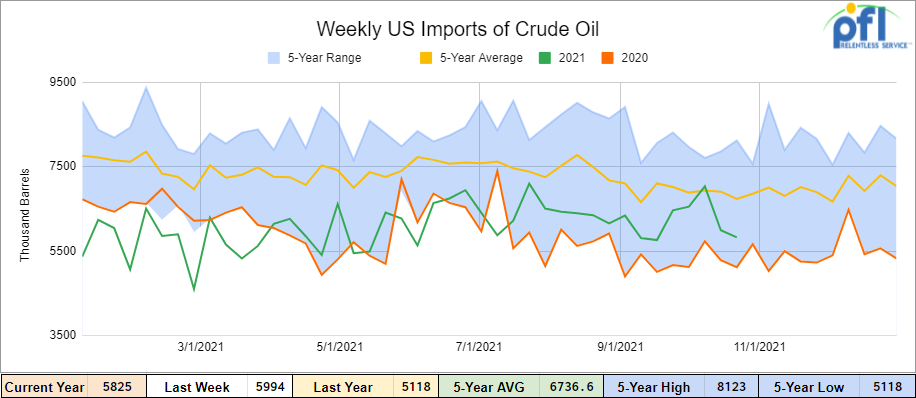

U.S. crude oil imports averaged 5.8 million barrels per day during the week ending October 15th, down by 169,000 barrels per day from the week prior. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 19.5% more than the same four-week period last year. For the week ending October 15, 2021 total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 606,000 barrels per day, and distillate fuel imports averaged 202,000 barrels per day.

Source Data: EIA – PFL Analytics

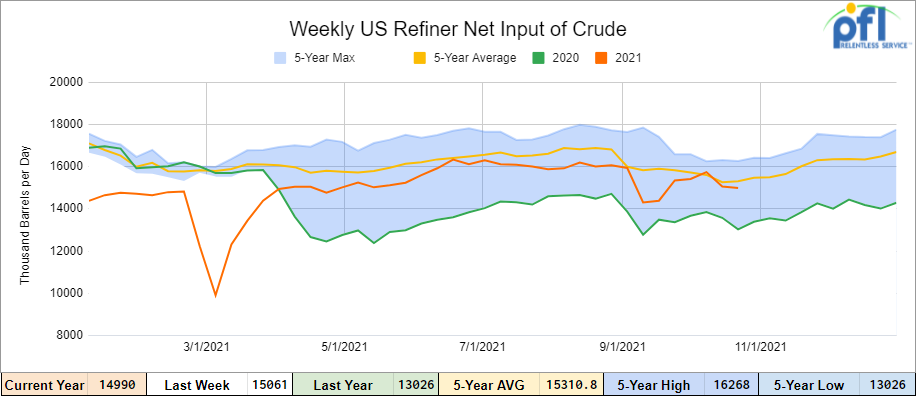

U.S. crude oil refinery inputs averaged 15.0 million barrels per day during the week ending October 15, 2021 which was 71,000 barrels per day less than the previous week’s average. Refineries operated at 84.7% of their operable capacity.

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at 84.48, up 72 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 5.1% year over year in week 41 (U.S. -4.2%, Canada -7.9%, Mexico -4.7%) resulting in quarter to date volumes that are down 4.4% and year to date volumes that are up 7.2% year over year (U.S. +8.3%, Canada +4.4%, Mexico +3.8%). 6 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decline coming from intermodal (-9.4%) and motor vehicles & parts (-18.1%).

In the East, CSX’s total volumes were down 4.2%, with the largest decrease coming from motor vehicles & parts (-30.5%). NS’s total volumes were down 2.6%, with the largest decrease coming from intermodal (-8.0%).

In the West, BN’s total volumes were down 3.0%, with the largest decrease coming from intermodal (-6.2%). The largest increase came from stone sand & gravel (+49.1%). UP’s total volumes were down 4.6%, with the largest decrease coming from intermodal (-13.6%). The largest increase came from chemicals (+13.5%).

In Canada, CN’s total volumes were down 7.3%, with the largest decrease coming from intermodal (-18.8%). The largest increase came from coal (+54.5%). Revenue per ton miles was down 7.7%. CP’s total volumes were down 3.6%, with the largest decreases coming from farm products (-48.6%) and grain (-17.2%). Revenue per ton miles was up 0.2%.

KS’s total volumes were down 0.4%, with the largest decrease coming from motor vehicles & parts (-45.7%).

Source: Stephens

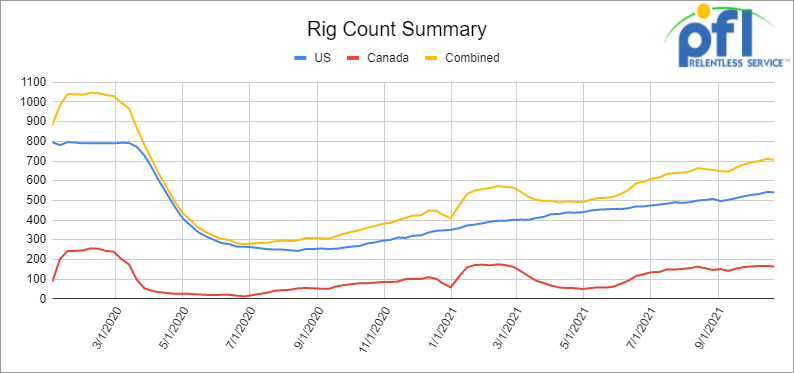

Rig Count

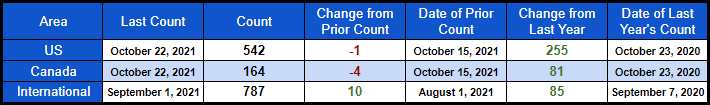

North American rig count is down by 5 rigs week over week. The U.S. rig count was down by 1 rig week over week but up by 255 rigs year over year. The U.S. currently has 542 active rigs. Canada’s rig count was down by 4 rigs week over week, but up by 81 rigs year over year and Canada’s overall rig count is 164 active rigs. Overall, year over year we are up 336 rigs collectively.

Even though there was a slight dip in rig count week over week we are seeing good signs of investment in the oil patch. We expect to see rig count to continue to increase year over year particularly in Canada as when the weather turns colder and the ground freezes up in Canada they will be adding Rigs as there are certain swampy areas where the land has to be frozen before heavy equipment is sent in. The winter drilling program in Canada will begin shortly. Another good sign that things are turning is that Fracsand cars, believe it or not, are coming back into play, but be careful local production is still a headwind and so is OPEC for that matter. Also, Schlumberger reported a rise in third-quarter adjusted income on Friday of last week, buoyed by higher demand for its services and equipment, as producers capitalize on a rebound in crude and natural gas prices.

“The industry macro fundamentals have visibly strengthened this year, particularly in recent weeks — with demand recovery, oil and gas commodity prices at recent highs, low inventory levels, and encouraging trends in pandemic containment efforts,” said Schlumberger’s Chief Executive Officer Olivier Le Peuch in a statement, adding he expects those conditions to materially drive investment over the coming years. All good news for rail!

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

We are watching the Continued Battle over Enbridge Line 5

In a press release by the Canadian press last week, lawyers for Enbridge are asking a judge in Michigan to consider the bilateral implications of the state of Michigan bid to shut down the Line 5 cross-border pipeline.

Newly filed court documents say the dispute is now well and truly a federal matter because Canada has formally invoked a 1977 pipeline treaty with the United States. Enbridge is arguing that as a result, U.S. District Court Judge Janet Neff should grant its original motion to have the case moved to federal court.

Michigan Governor Gretchen Whitmer really wants this pipeline shut down for whatever reason and is now refusing to negotiate or talk to Enbridge further. Enbridge has warned such a move would have dire consequences for energy consumers in both the United States and Canada and says it will not shut down the line voluntarily.

“Now that the dispute resolution provisions of the treaty have been formally invoked — resulting in more formal diplomatic negotiations and potentially an international arbitration concerning Michigan’s unilateral efforts to force closure of Line 5 — this development should be made part of the record,” lawyers for Enbridge argue.

In the motion, Enbridge is seeking leave to file, Enbridge says Michigan’s claims “have directly and significantly affected U.S. foreign relations with Canada.”

In other Line 5 news, Enbridge said it had to shut down the oil pipeline for several hours on Tuesday of last week after protesters trespassed onto a facility in Michigan and tampered with the pipeline, said Ryan Duffy a spokesman for Enbridge. Duffy said the line was back up and running on Wednesday and Enbridge did not anticipate any impact on deliveries to customers.

Duffy also said Enbridge would seek the prosecution of all those involved in last Tuesday’s protest.

“The actions taken to unlawfully trespass on our facility in Michigan and attempt to tamper with energy infrastructure was reckless and dangerous,” Duffy added.

Headcount for U.S. Rails

The Surface Transportation Board (STB) recently released September headcount data for the U.S. rails. For the industry as a whole, September headcount was down 3.3% year over year versus August headcount that was down 2.8% year over year. Industry headcount decreased 0.2% versus the 5-year September average decline of 0.4%. At a recent conference that PFL attended in Chicago (NARS) all Class 1’s that spoke at the conference were hiring. The STB at the same conference criticized ALL Class 1’s for all the layoffs during the start of COVID and It remains clear that finding labor is a challenge across the entire transportation network. We do believe hiring efforts from the rails have recently accelerated, but given the skilled labor shortages across the U.S. it is going to be a challenge heading into 2022 to add needed bodies.

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,016 from 24,262 a loss of 246 rail cars week over week. Canadian volumes were higher – CP shipments were up by 4.5% and CN shipments were also up by 4.5%. U.S. volumes were mostly higher week over week. The BN had the largest percentage increase, up by 16.5%.

Jean-Jacques Ruest to Resign as CEO from CN

CN said on Tuesday of last week that Chief Executive Officer Jean-Jacques Ruest will retire at the end of January or when a successor has been appointed, following investor demands for his exit after CN’s failed bid for Kansas City Southern. TCI Fund Management, which owns 5% of CN, in August pitched former Union Pacific executive Jim Vena for the top job and on Tuesday urged Canada’s largest railroad operator to secure his leadership. On the back of the news CN’s shares jumped 11% last week closing at US$135.53 on the NYSE.

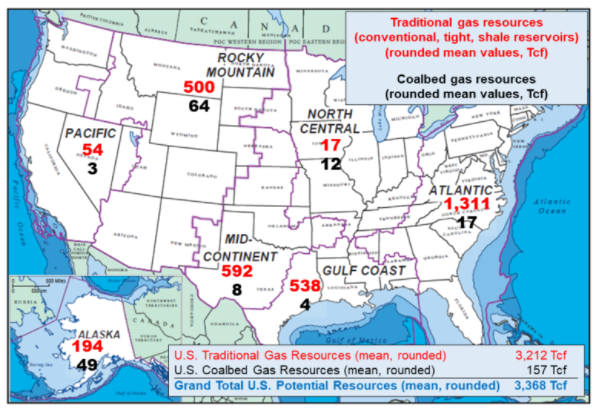

Natural Gas vs. Hydrogen

As we all know, the more natural gas we produce the more LPG’s we produce – all clean burning fuels that can power America immediately, stabilize prices and lead to increased rail traffic. How much natural gas is there? According to the American Gas Association (“AGA”) the latest resource estimate sits at 3,368 Trillion cubic feet (“Tcf”), an all time high. The AGA reported this on Tuesday of last week during a virtual AGA event that the Potential Gas Committee (PGC) determined that its year-end 2020 technically recoverable gas resource estimate — that is, in the ground but not yet recovered reserves — totals 3,368 Tcf this is up from 2,462 Tcf of technically recoverable natural gas as of January 1, 2016. Where is all the natural gas? (see below)

Source: AGA Potential Gas Committee

Let’s look at Hydrogen. CN on an earnings call last week said “This could be big” referring to hydrogen. CN’s senior vice president said hydrogen by rail could be more sustainable than that of crude by rail. The Biden administration also has its eyes on hydrogen and the US Pipeline and Materials Safety Administration is going to do a bunch of research on it. The problem with hydrogen is that it requires a whole new infrastructure of high pressure pipelines. Also, most hydrogen is manufactured from methane and would require carbon recapture. In our mind it seems to make more sense to burn Natgas and the LPG’s associated with the production of natural gas for a bunch of different reasons. Call PFL for further details, be assured we are on top of this one.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 30, 29k coiled and insulated CPC1232s for use in biodiesel. Can be dirty with biodiesel, diesel or renewable diesel. Needed for one year.

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 20-30 19K 286 GRL for caustic soda BN or UP in Texas for 1-3 years negotiable

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 30-50 340 Pressure cars for propane starting Nov 3 month lease in Alberta CP or CN

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|