“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.”

– Seth Godin

Jobs Update

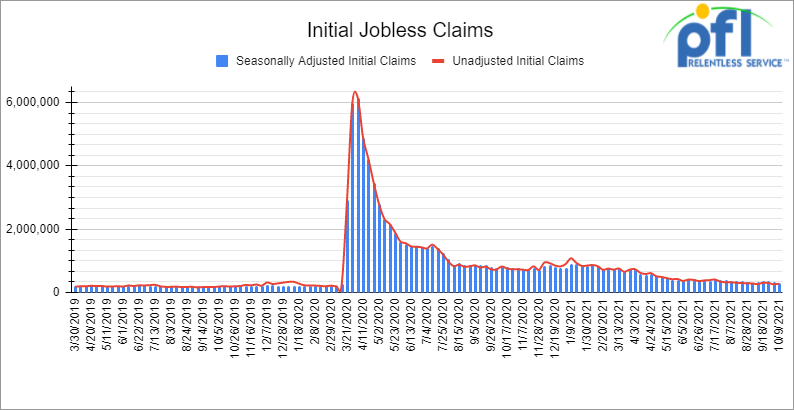

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending October 9th came in at 293,000, down -36,000 people week over week.

- Continuing claims came in at 2.593 million people versus the adjusted number of 2.727 million people from the week prior, down -134,000 people week over week.

Source Data: U.S. Employment and Training Administration – PFL Analytics

Stocks closed lower on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 382 points (1.09%) closing out the week at 35,294.76 points, up 548.51 points week over week. The S&P 500 closed higher on Friday of last week, up 33.11 points and closed out the week at 4,471.37, up 80.03 points week over week. The Nasdaq closed higher on Friday of last week, up 73.91 points (0.50%) and closed out the week at 14,897.34, up 317.8 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 35,079 this morning up 90 points.

Oil up on Friday of last week and up week over week

West Texas Intermediate (WTI) crude closed up $0.97 (+1.19%) per barrel on Friday of last week, to settle at $82.28, up $2.93 per barrel week over week. Brent futures closed up 92 cents (+1.095%), to settle at $84.92 per barrel up $2.53 per barrel week over week.

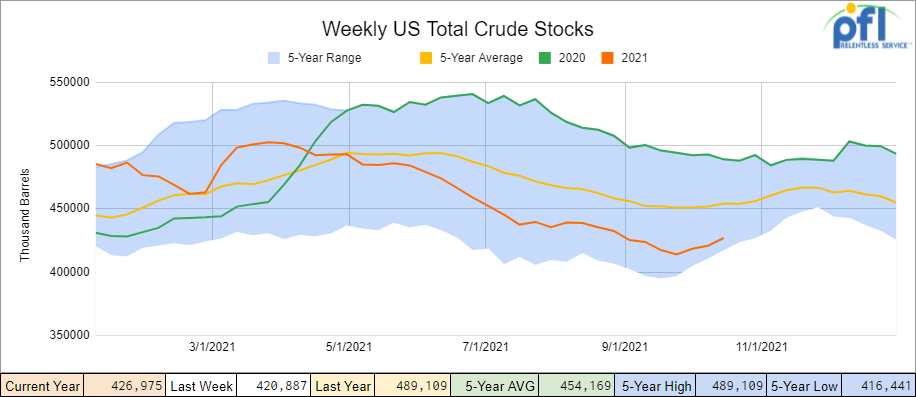

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 6.1 million barrels week over week. At 427.0 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

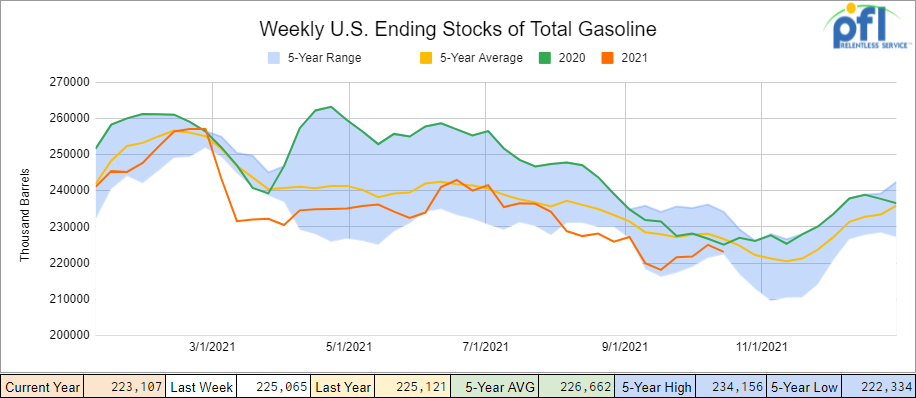

Total motor gasoline inventories decreased by 2.0 million barrels week over week and are 2% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

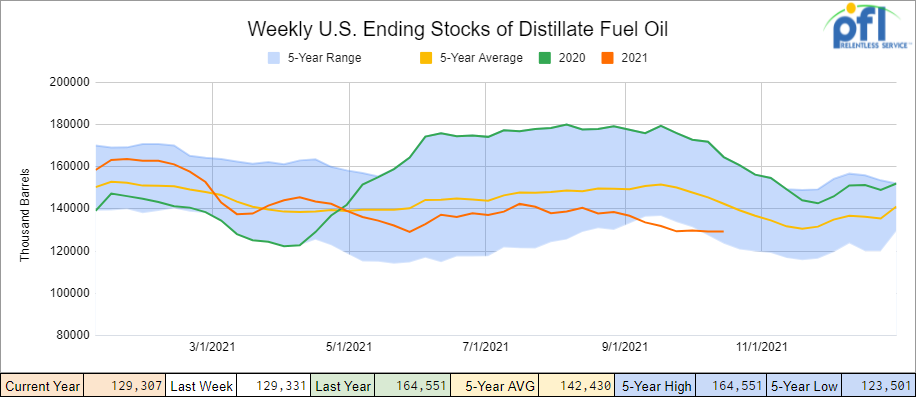

Distillate fuel inventories were virtually unchanged week over week and are 9% below the five-year average for this time of year.

Source Data: EIA – PFL Analytics

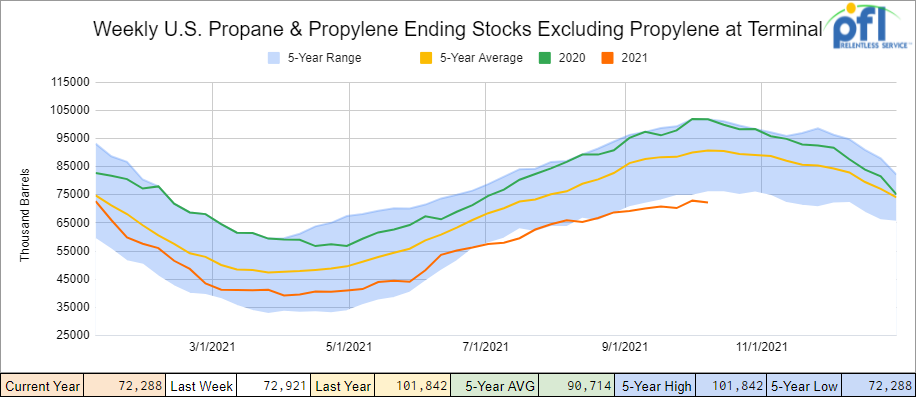

Propane/propylene inventories decreased by 600,000 thousand barrels week over week and are 21% below the five-year average for this time of year

Source Data: EIA – PFL Analytics

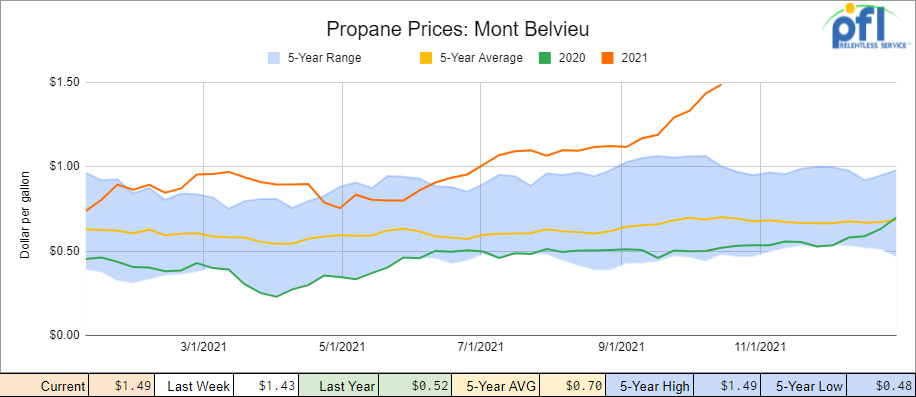

Folks we cant stop showing you this chart. We called it real early in the Cycle – we are not going to fill propane storage this year and are going to be at risk for price spikes this coming heating season. One thing we missed was the continual and relentless buying overseas driving prices up yet again week over week with propane closing at $1.49 per gallon up 6 cents per gallon. The EIA is now predicting lower stocks going down to 50 million barrels sometime during the fourth quarter. The EIA is also predicting a 50% price increase for winter propane prices compared to last year’s and they are projecting the winter to be colder than last year by 3 heating degree days. Folks, we feel the global energy crunch is short lived. Countries are burning a lot more coal, Russia will turn on the taps for the EU for Natgas – how can’t they? They can’t resist current pricing levels! Natural gas prices will continue to rise here in the U.S. because of focused producer discipline in not drilling. Opec has a lot more crude they can turn on in a moment’s notice if they want to. Not to mention there are literally thousands of rail cars here in NA that can be brought on quickly to load Canadian heavy if prices get too far out of sync. This time next year we may be singing from a completely different playbook but get ready for some short term volatility as nothing moving forward should surprise you. Call PFL for the latest and greatest. We are on top of this one.

Source Data: EIA – PFL Analytics

Overall, total commercial petroleum inventories increased by 4.9 million barrels week over week.

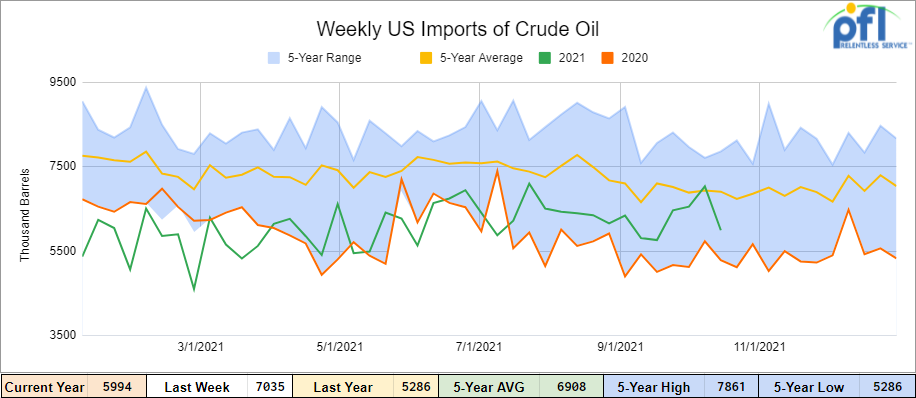

U.S. crude oil imports averaged 6.0 million barrels per day during the week ending October 8th, a decrease by 1.0 million barrels per day week over week. Over the past four weeks, crude oil imports averaged about 6.5 million barrels per day, 22.2% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 543,000 barrels per day for the week ending October 8th , and distillate fuel imports averaged 190,000 barrels per day.

Source Data: EIA – PFL Analytics

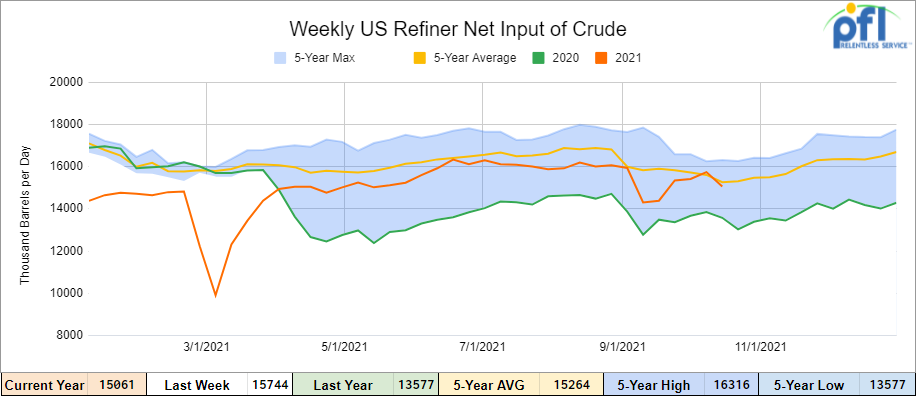

U.S. crude oil refinery inputs averaged 15.1 million barrels per day during the week ending October 8, 2021, which was 700,000 barrels per day less than the previous week’s average. Refineries operated at 86.7% of their operable capacity for the week ending October 8, 2020.

Source Data: EIA – PFL Analytics

As of the writing of this report, WTI is poised to open at $83.19, up .91 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.6% year over year in week 40 (U.S. -2.6%, Canada -5.7%, Mexico -8.8%) resulting in year to date volumes that are up 7.6% year over year (U.S. +8.7%, Canada +4.7%, Mexico +4.1%). 4 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decline coming from intermodal (-7.8%). The largest increase came from coal (+11.7%).

In the East, CSX’s total volumes were down 0.1%, with the largest decrease coming from motor vehicles & parts (-28.1%). The largest increase came from intermodal (+3.1%). NS’s total volumes were down 1.7%, with the largest decreases coming from intermodal (-4.0%) and grain (-29.2%).

In the West, BN’s total volumes were down 3.4%, with the largest decrease coming from intermodal (-7.5%). The largest increase came from coal (+10.9%). UP’s total volumes were down 2.3%, with the largest decrease coming from intermodal (-12.3%). The largest increases came from coal (+16.7%) and chemicals (+13.3%).

In Canada, CN’s total volumes were down 3.9%, with the largest decrease coming from intermodal (-11.1%). The largest increase came from coal (+165.8%). Revenue per ton miles were down 0.6%. CP’s total volumes were down 2.4%, with the largest decreases coming from grain (-23.3%), farm products (-34.0%) and motor vehicles & parts (-36.9%). RTMs were down 2.8%.

KS’s total volumes were down 4.2%, with the largest decreases coming from intermodal (-9.4%) and motor vehicles & parts (-53.0%).

Source: Stephens

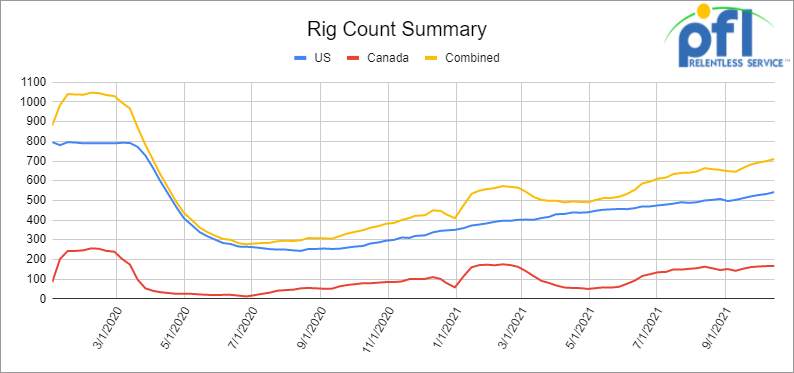

Rig Count

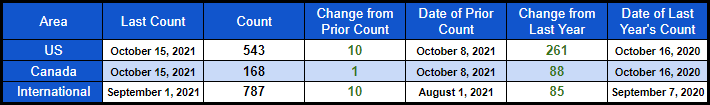

North American rig count is up by 11 rigs week over week. The U.S. rig count was up by 10 rigs week over week and up by 261 rigs year over year. The U.S. currently has 543 active rigs. Canada’s rig count was up by 1 rigs week over week, and up by 88 rigs year over year and Canada’s overall rig count is 168 active rigs. Overall, year over year we are up 349 rigs collectively.

North American Rig Count Summary

Source Data: Baker-Hughes – PFL Analytics

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,127 from 24,262 a loss of 1,135 rail cars week over week. Canadian volumes were lower – CP shipments fell by 7% and CN shipments were down by 0.4%. U.S. volumes were mixed week over week. The BN had the largest percentage decrease, down by 15.5% and the UP had the largest percentage increase up by 14.3%.

Canadian Crude

With Enbridge line 3 running in full force and a number of planned producer outages in Alberta out of the way it will be interesting to see where basis numbers settle out and what new pipeline appropriations will be come November 1st. With the final trading day for the index last week in Calgary WCS closed marginal higher from Thursdays close trading and closing at -14.65 against WTI all other grades closed lower day over day.

West Coast Ports to Operate 24/7

The AAR is hats off to the expanded hours of traffic at the country’s Los Angeles and Long beach ports that should help ease the supply chain and expand intermodal traffic.

The action, which President Joe Biden announced Wednesday of last week, will capitalize on the long-standing 24/7 rail operations and available capacity to accommodate additional containers at intermodal rail yards serving those key West Coast ports, AAR officials said in a press release.

“While this is a shot in the arm to increase capacity before containers reach rail lines, the industry knows close coordination with its trucking partners is critical to accelerate the movement of goods out of intermodal yards and into warehouses,” said AAR President and Chief Executive Officer Ian Jefferies. “Collaborative efforts like what was announced Wednesday of last week, are vital to help ease pain points and smoothly pass goods from one leg of the freight logistics relay to the next.”

Biden announced that the L.A. port would stay open around the clock and major shippers such as Walmart, UPS and FedEx would expand their working hours as the administration seeks ways to address global supply-chain gridlock. The problems have included bottlenecks at the Los Angeles and Long Beach ports, where 40% of the nation’s imports enter the country.

The L.A. port’s commitment to expand its operating hours to 24/7 follows the Port of Long Beach’s announcement a few weeks ago that it was launching a pilot project to operate 24/7.

“This is the first key step toward moving our entire freight transportation and logistical supply chain, nationwide, to a 24/7 system,” Biden said in prepared remarks.

Operational details are being discussed and worked out with supply-chain stakeholders, said Port of L.A. Executive Director Gene Seroka in a press release.

“The significance of today’s announcement is the commitment from industry leaders responsible for moving goods on behalf of American consumers and businesses to open up the capacity needed to deliver. It’s a call to action for others to follow,” Seroka said in a prepared statement. More than thirty container ships are queued at the Los Angeles and the Long Beach Ports, as congestion begins to rise again in the U.S. West Coast ports, ahead of the peak season. Usually it is less than 10 ships waiting (see below)

Source: Green Worldwide Shipping

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100-150 Ethanol Cars for 1-5 Years. Can be 117R or 117J. Can be clean or last in Ethanol, needed in the Midwest.

- 30, 29k coiled and insulated CPC1232s for use in biodiesel. Can be dirty with biodiesel, diesel or renewable diesel. Needed for one year.

- 100, 400W pressure cars for Propylene service. Preferred dirty to dirty for one year.

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 30-50 340 Pressure cars for propane starting Nov 3 month lease in Alberta CP or CN

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|