“Most of the important things in the world have been accomplished by people who have kept on trying when there seemed no help at all.”

– Dale Carnegie

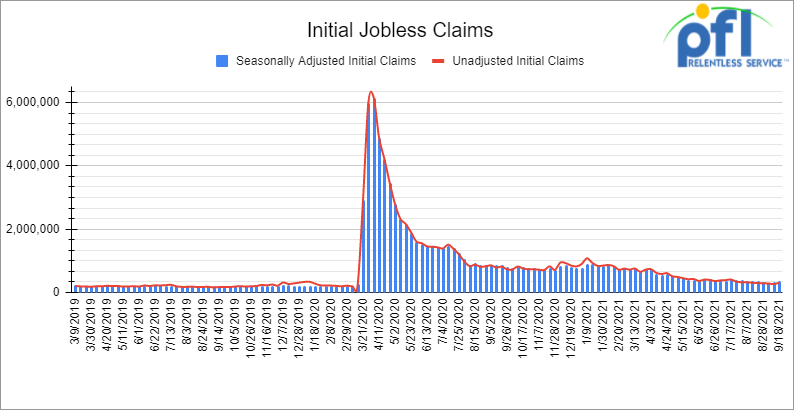

Jobs Update

- Initial jobless claims for the week ending September 18th came in at 351,000, up 16,000 people week over week.

- Continuing claims came in at 2.845 million people versus the adjusted number of 2.714 million people from the week prior, up 131,000 people week over week.

FedEx announced they had to re-route 500,000 packages due to labor shortages. Costco announced they are limiting sales of certain items due to supply constraints. With 10 million jobs opening, why are initial jobless claims going up? Some people simply feel they do not need to work. The feds have and continue to pay multiple stimulus checks, paid 18 months of unemployment and told everyone they didn’t have to pay rent or their mortgage in certain circumstances. On top of that millions more qualified for food stamps, fuel assistance, welfare and other perks programs. We need to get back to work. The jobs are out there.

Stocks closed lower on Friday of last week and are down week over week

The DOW closed higher on Friday of last week, up 33.18 points (+.10%), closing out the week at 34,798 points, up 213.12 points week over week. The S&P 500 closed higher on Friday of last week, up 6.5 points and closed out the week at 4,455.48, up 22.49 points week over week. The Nasdaq closed lower on Friday of last week, down -4.54 points(-.03%) and closed out the week at 15,057.7, up 3.73 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 130 points.

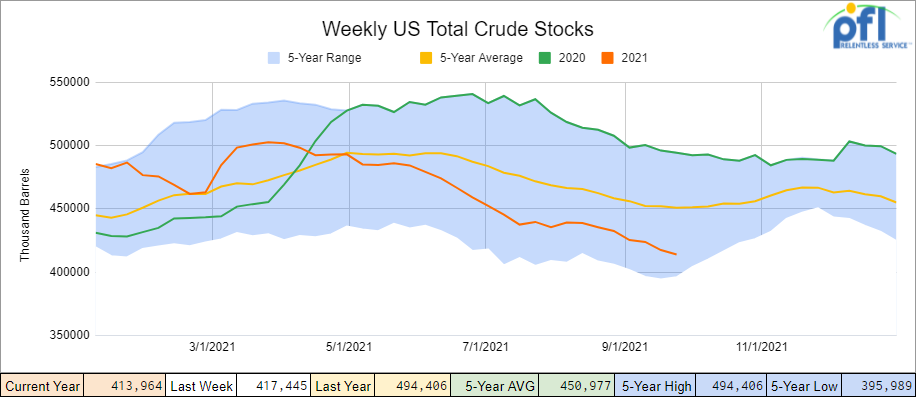

Oil hit its highest level in almost three years last week as supply tightens

West Texas Intermediate (WTI) crude rose 68 cents, or (+0.9%) on Friday of last week, to settle at US$73.98, while Brent futures rose 84 cents, or 1.1 per cent, to settle at US$78.09/bbl. That was the highest close for Brent since October 2018 and for WTI since July 2021, both for a second day in a row.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.5 million barrels week over week. At 414.0 million barrels, U.S. crude oil inventories are 8% below the five-year average for this time of year.

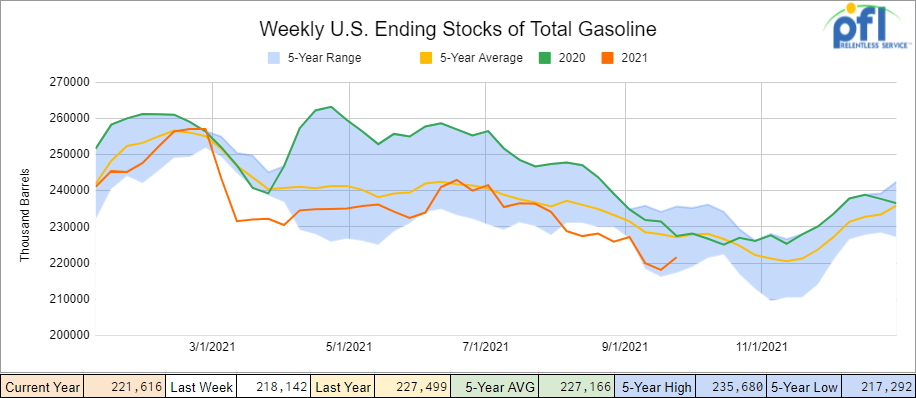

Total motor gasoline inventories increased by 3.5 million barrels week over week and are 3% below the five-year average for this time of year.

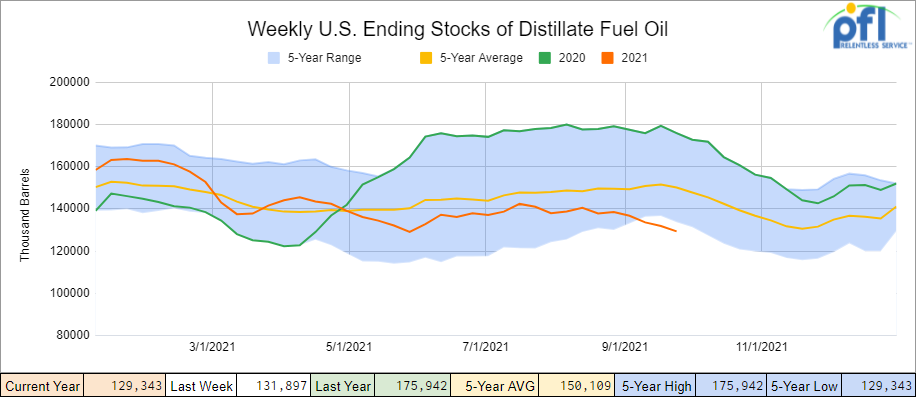

Distillate fuel inventories decreased by 2.6 million barrels week over week and are 14% below the five-year average for this time of year.

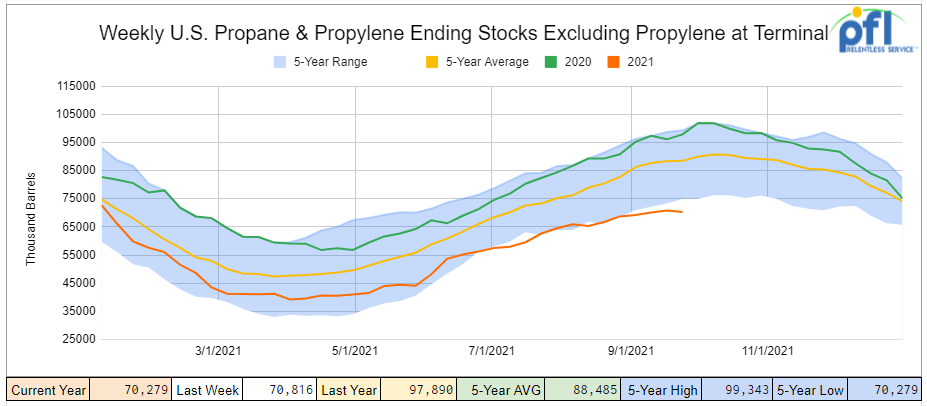

Propane/propylene inventories decreased by 500,000 barrels week over week and are 21% below the five-year average for this time of year.

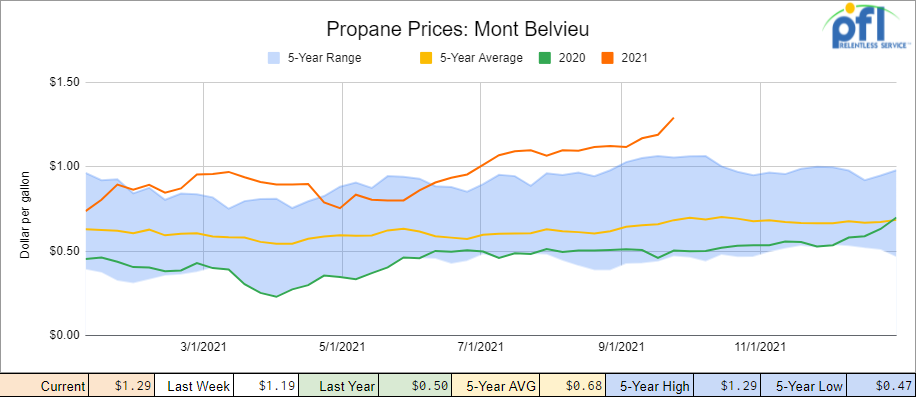

Propane prices continue to rise hitting all time highs yet again.

Overall total commercial petroleum inventories decreased by 2.6 million barrels for the week ending September 17, 2021.

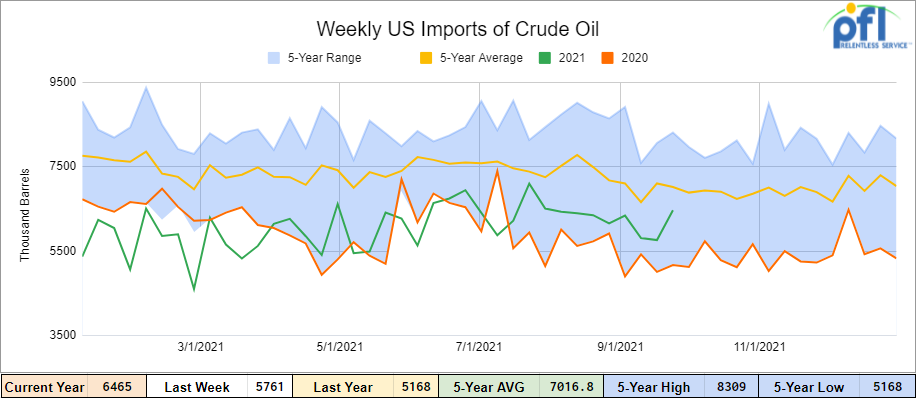

U.S. crude oil imports averaged 6.5 million barrels per day for the week ending September 17, an increase of 700,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 18.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) for the week ending September 17, 2021 averaged 1.1 million barrels per day, and distillate fuel imports averaged 184,000 barrels per day.

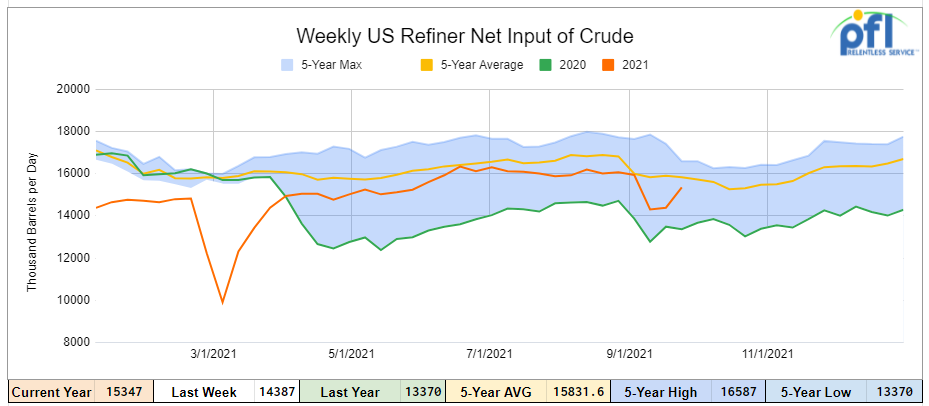

U.S. crude oil refinery inputs averaged 15.3 million barrels per day during the week ending September 17, 2021 which was 1.0 million barrels per day more week over week. Refineries operated at 87.5% of their operable capacity for the week ending September 17th. Gasoline production increased week over week, averaging 9.6 million barrels per day.

Oil is higher in overnight trading and WTI is poised to open up .91 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 2.8% year over year in week 37 (U.S. -3.1%, Canada -3.2%, Mexico +5.9%) resulting in quarter to date volumes that are up 0.2% year over year and year to date volumes that are up 8.5% year over year (U.S. +9.6%, Canada +5.6%, Mexico +6.0%). 5 of the AAR’s 11 major traffic categories posted year over year decreases with the largest declines coming from intermodal (-6.2%) and motor vehicles & parts (-34.2%). The largest increases came from coal (+13.5%) and metallic ores & metals (+16.0%).

In the East, CSX’s total volumes were down 2.5%, with the largest decreases coming from motor vehicles & parts (-38.3%) and intermodal (-2.7%). NS’s total volumes were down 5.8%, with the largest decreases coming from intermodal (-11.5%) and motor vehicles & parts (-34.9%). The largest increases came from metals & products (+30.9%) and petroleum (+55.1%).

In the West, BN’s total volumes were down 1.0%, with the largest decreases coming from intermodal (-3.6%) and grain (-16.4%). The largest increase came from coal (+8.6%). UP’s total volumes were down 2.9%, with the largest decreases coming from intermodal (-8.6%) and motor vehicles & parts (-38.6%). The largest increase came from coal (+14.4%).

In Canada, CN’s total volumes were down 1.9%, with the largest decreases coming from grain (-36.6%) and intermodal (-3.3%). The largest increase came from coal (+74.9%). Revenue per ton miles was down 3.4%. CP’s total volumes were down 1.6%, with the largest decreases coming from motor vehicles & parts (-57.2%) and grain (-27.6%). The largest increase came from intermodal (10.8%). Revenue per ton miles was down 3.6%.

KCS’s total volumes were down 9.3%, with the largest decrease coming from intermodal (-19.3%).

Source: Stephens

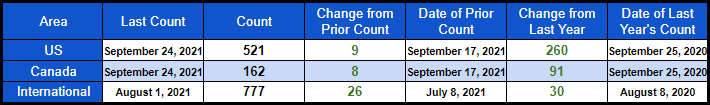

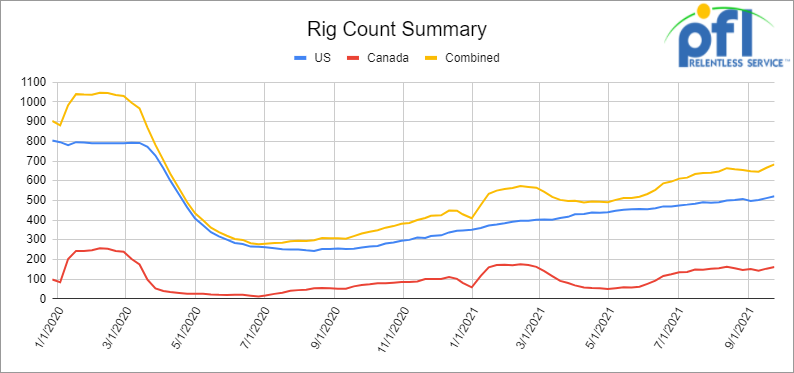

Rig Count

North American rig count is up by 17 rigs week over week. The U.S. rig count was up by 9 rigs week over week, and up by 260 rigs year over year. The U.S. currently has 521 active rigs. Canada’s rig count was up by 8 rigs week over week, and up by 91 rigs year over year and Canada’s overall rig count is 162 active rigs. Overall, year over year we are up 351 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

- The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 25,162 from 25,248 a loss of 86 rail cars week over week. Canadian volumes were mixed – CP shipments rose by 5% and CN shipments were down by 4.3%. U.S. volumes were lower across the board. The NS had the largest percentage decrease down by 15.7%.

- An energy crisis is unfolding in Europe as natural gas prices are surging to record highs. On Wednesday, the price for Europe’s regional gas benchmark, the TTF month-ahead contract, closed at a record high of $24.2 per mmBtu, according to S&P Global Platts. A colder-than-average winter in Europe or Asia could send power prices spiking even higher and potentially prompt electricity blackouts in Europe, Goldman Sachs said in a research note this week. Natural gas prices in Europe have been boosted by a range of factors including the pandemic recovery, a lack of fuel in storage, strong demand in Asia and recent weather conditions sapping wind power in the North Sea. Britain gets as much as 30% of their energy from wind generation in the North Sea and the still weather is eroding generation and pushing up prices for alternatives across the board. European nations have largely turned away from thermal coal and nuclear power in recent years, leaving them with fewer alternatives to back up power sources. To make matters worse, production cutbacks, as part of the more broad European goal to reduce emissions, are accelerating at the same time that demand is returning from lockdown induced lows. This surge in prices is forcing factory closures, as Deerfield Il based CF industries has had to shut down two fertilizer factories in the U.K. indefinitely. One result of this could be an import of higher energy prices to the U.S. Natural gas prices here at home are already at highs that haven’t been seen since 2014, but remain tame relative to what is unfolding in Europe. Europe’s need for gas is drawing cargoes of American LNG across the Atlantic, feeding into higher prices for gas in the U.S. itself. During the first half of the year, the U.S. has exported roughly 10% of its natural gas production and continues to export at near full capacity. Before opening its first export terminal in the Lower 48 states in 2016, the U.S. exported less than 1% of its natural gas. Coal exports are running high too. The U.S. exported 52.5% more coal in the second quarter than it did a year earlier, according to S&P Global Market Intelligence.

- Concoco Phillips – Is betting big on U.S. oil, buying Shell’s Permian assets for $9.5B. This will effectively make it the second biggest oil producer in the lower 48, now trailing only ExxonMobil. ConocoPhillips had just recently closed on a similar $9.7B transaction to buy Permian assets from Concho Resources Inc. in January of this year. Conoco is betting on shale just as capital investments in U.S. oil fields have dropped to the lowest level since 2004, an about-face from their previous strategy of shrinking their size and spinning off their refining business (now Phillips66). In an interview, ConocoPhillips Chief Executive Ryan Lance said that while scale was important in the oil business, growing in size wasn’t the driving force behind its recent deals. “We believe it has some of the best rocks,” Mr. Lance said of the Permian Basin. Shell’s assets will generate an additional $20 billion in cash from operations for ConocoPhillips and another $10 billion for its shareholders over the next decade. The company is sending about $6 billion back to shareholders this year, about 8% of its market capitalization, he said.

- PFL attended and participated in the North East Association of Rail Shippers (NEARS) Fall 2021 Conference held last week. Participants discussed the challenging current environment for shippers. Our take suggests a strong business growth outlook, a worrisome supply chain tightening through 2022, and most were neutral to to slightly positive in regards to their support of CP/KSU merger. More rail regulation is coming – .Robert Primus, member of the Surface Transportation Board (STB), highlighted the STB’s goal to enhance the network, focusing on service, which is “an area of concern”. Mr. Primus highlighted that railroads emphasize buybacks, dividends, OR improvement, all at the expense of service concerns. He believes PSR is a contribution to this, and while it has good intentions, the implementation has come at a cost to service; shippers are receiving the short end of the stick. Over the past five years there has been a 20% reduction in labor among the Class Is, and this is having a clear effect on reliability. We believe the STB will move forward with regulation for the rails (including reciprocal switching) that will work to improve quality of service for shippers. In terms of the CP/KSU merger, Mr. Primus stated that it is not a rubber stamp, and the STB will do their due diligence and see where the chips fall. That being said, we see it unlikely that the STB blocks the CP transaction.

- After Canadian National’s heated bidding war with Canadian Pacific over the KCS acquisition, a major CN activist investor is calling for restructuring and resignations all the way up to CN’s CEO JJ Ruest. TCI Fund Management Ltd., which owns approx. 5.2% ($4.2B) of CN, has argued that CN has exposed itself to too much regulatory and financial risk and has initiated a proxy battle to replace the CEO and restructure the board. In response, CN, on Sept 17 launched what it calls its “Full Speed Ahead – Redefining Railroading” initiative. The plan includes more stock buybacks, a decrease in capital investments, and elimination of more than 1000 jobs. One should wonder if the CN network can sustain these cuts while still providing reliable service as we head into the winter months but, with activists breathing down their neck, they may not have a choice. “TCI is not impressed with Canadian National’s sudden strategic plan. Why wasn’t this done before? The current management lacks the credibility to execute the plan.” said Sir Chris Hohn, head of TCI Fund Management Ltd. Other investors have questioned TCI’s motives, as the money manager is also a large shareholder in Canadian Pacific, a rare development effectively putting the activist investor on both sides of a trade. These investors were more sympathetic to Ruest and the board. Despite the transaction not going as the board had hoped, CN did receive break up fees and had the opportunity to learn about potential revenue opportunities from its customer base during the due diligence process. They also forced competitor CP to a pay a higher premium than what was originally agreed upon

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|