“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

Winston Churchill

COVID-19 Update

Folks, there are a lot of difficulties out there right now. Last week was certainly a difficult week as COVID -19 continues to create havoc across the world. Where we go from here is really anyone’s guess, but welcome to the “Great American Shut Down.”

Last week’s PFL Railcar Report mentioned that a decrease in consumer discretionary spending is worrisome. It appears as though this is the reality that we are now facing. With flights essentially grounded to Europe and Asia (UK Ireland added to the no fly zone on Saturday), limiting gatherings, restaurant closures, sporting events cancelled, school cancellations, conference cancellations and much much more, the question is what are consumers going to spend their money on?

Consumers are now worried about their jobs as layoffs are accelerating at a rapid pace, discretionary spending has fallen by the wayside and consumers are resorting to the essentials – food, supplies etc. Trump is doing what he can and we did see a glimmer of hope late last week where we saw a 2,000+ point rally in the DJIA on Friday, only to fade in overnight markets. There was quite a bit of bad news over the weekend in regard to the spread of COVID-19. We are keeping this week’s report short and sweet due to ever-changing news and market conditions that I am sure you are inundated with. Here is what we know now:

- President Trump said he was going to buy oil and fill up the strategic oil reserves that led to a six percent jump in oil on Friday during his speech – bottom line market did not care – overnight markets had oil trading down to $30 per barrel. Be prepared for a weak open.

- Cenovus Energy said that it was temporarily suspending its crude by rail program and scaling back production after WCS tumbled below $20 per barrel.

- The Fed slashed rates to near-zero on Sunday

- China in contraction – retail sales in China down 24.5%, industrial output down 13.5% in February reported 10:00 PM EST Sunday (wow).

- No gatherings of 50 or more for now, urges the Centers for Disease Control and Prevention.

- Cuomo says New York City schools will close this week – other school districts closing across the country including here in Florida.

- California tells residents 65 and older to stay at home as more states add restrictions.

- Italy’s deaths jump, Germany closes borders and restrictions multiply around the world. A top U.S. health official says Americans should be prepared to “hunker down.”

- Fed announces QE of $700B on Sunday.

- Dow Futures limit down in overnight markets.

We will see the first wave of demand destruction fundamentals certainly spilling over here in the US, if China and Europe are any indication.

Railcar Volumes

We have been extremely busy at PFL with return on lease programs, storage and an unprecedented number of subleases and leases – please call PFL today 239-390-2885.

PFL attended SEARS last week and was honored to speak at their conference. Click here to view slide deck.

North American rail volumes were down 6.4% year over year in week 10 (U.S. -9.1%, Canada +3.2%, Mexico -6.7%), resulting in quarter to date volumes that are down 5.2% (U.S. -7.0%, Canada -1.5%, Mexico +5.4%). 4 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-11.9%) and coal (-20.0%). The largest increases came from petroleum (+21.4%), chemicals (+6.3%), farm products & food (+10.8%), motor vehicles & parts (+6.8%) and grain (+6.7%). KEY POINTS:

In the East, CSX’s total volumes were up 1.6%, with the largest increases coming from intermodal (+2.3%) and stone sand & gravel (+29.0%). The largest decrease came from coal (-18.9%). NS’s total volumes were down 13.8%, with the largest decreases coming from intermodal (-13.8%) and coal (-43.7%). The largest increase came from petroleum (+31.8%).

In the West, BN’s total volumes were down 12.6%, with the largest decreases coming from intermodal (-22.6%), coal (-21.5%) and stone sand & gravel (-12.4%). UP’s total volumes were down 4.1%, with the largest decreases coming from intermodal (-13.7%) and coal (-11.1%). The largest increases came from chemicals (+13.3%) and petroleum (+31.5%).

In Canada, CN’s total volumes were down 5.5% with the largest decrease coming from intermodal (-17.5%). The largest increase came from petroleum (+20.9%). RTMs were up 7.4%. CP’s total volumes were up 22.2%, with the largest increases coming from intermodal (+24.0%), petroleum (+55.2%) and coal (+21.8%). RTMs were up 21.2%.

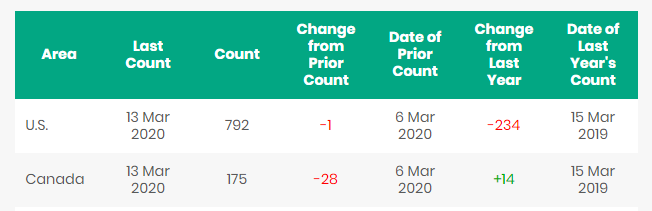

KCS’s total volumes were down 2.1%, with the largest decreases coming from stone sand & gravel (-64.1%) and intermodal (-4.5%). The largest increase came from petroleum (+40.1%). North American Rig count is down 29 rigs week over week with the U.S. losing 1 rig and Canada losing 28 rigs week over week. Year over year we are down 220 Rigs collectively.

North American Rig Count Summary

Railcar Markets

PFL is offering: 340Ws for long and short term lease, 117Rs last in diesel service, various box cars for lease, 31.8’s clean and last in refined products and 25.5K 117Js coiled and insulated, 5000 CFC Center Flow Pressureaide Covered Hopper cars that have recently been cleaned.Call PFL for details today!

PFL is seeking: 23.5Ks and 25.5Ks for fuel oil products, 117s with magnetic gauging devices for lease, 117s dirty with condensate, 89 ft flat cars for purchase, 100 mil gons for short term lease, 117Js last in ethanol, and 4750s for use in coke service.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|