“If you can’t fly then run, if you can’t run then walk, if you can’t walk then crawl, but whatever you do you have to keep moving forward.”

― Martin Luther King Jr.

Weekly Jobless Claims down Week over Week Yet Again

- The reopening of the U.S. economy pushed weekly filings for jobless benefits to a new pandemic low for the sixth consecutive week, the Labor Department said Thursday of last week, though at a slower rate than expected. A seasonally adjusted 376,000 new claims were filed in the week ended June 5.

- Another 71,292 new claims, were made under a special program helping freelance workers and others not normally eligible for aid, 2,000 less than the week prior, the report said.

- The data offers further evidence that workers who lost their jobs due to the business restrictions caused by Covid-19 are getting employed again.

- “As fewer people are laid off, we need those on sidelines to rejoin labor force,” investment manager Steven Rattner said on Twitter, calling the report “good news.” After spiking into the millions as the pandemic began in March 2020, claims have been on a sustained downward trend in recent months.

Stocks up Friday of last week Dow Down week over week

The Dow closed higher on Friday of last week, up +13.36 (+0.04%) points closing out the week at 34,479.60, down -276.79 points week over week. The S&P 500 closed higher on Friday of last week, up +8.26 points (+0.19%) and closing out the week at 4,247.44, up +17.55 points week over week. The Nasdaq closed higher on Friday of last week, up +49.09 points (+0.35%) and closing out the week at 14,069.42, up +254.93 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 12 points.

Oil up again week over week

Oil traded up again last week, settling again at multi year highs, and recording a 3rd straight week of gains. “Demand is coming back faster than supply and we’re going to need more supply to meet that demand,” said Phil Flynn of Price Futures Group in Chicago”. The International Energy Agency (“IEA”) said in its monthly report that OPEC+ would need to boost output to meet demand set to recover to pre-pandemic levels by the end of 2022. Even the jet fuel market has improved with European air traffic up 17% over the past two weeks, according to Eurocontrol. Oil rigs are back to their highest level since April 2020, with 365 active last week. U.S. investment bank Goldman Sachs said it expects Brent crude prices to reach US$80.00 per barrel this summer as vaccine rollouts boost global economic activity.

WTI crude rose on Friday of last week +$0.62 a barrel to settle at $70.91 a barrel, up +99 cents a barrel week over week. Brent crude oil for August delivery closed higher on Friday of last week gaining +$0.17 a barrel, and closing at $72.69, up $0.80 a barrel week over week its highest since May of 2019.

U.S. commercial crude oil inventories decreased by 5.2 million barrels week over week. At 474.0 million barrels, U.S. crude oil inventories are 4% below the five year average for this time of year.

Total motor gasoline inventories increased by 7.0 million barrels week over week and are at par with the five year average for this time of year. Finished gasoline and blending components inventories both increased last week.

Distillate fuel inventories increased by 4.4 million barrels week over week and are 5% below the five year average for this time of year.

Propane/propylene inventories increased by 5.5 million barrels week over week and are 12% below the five year average for this time of year.

Total commercial petroleum inventories increased by 15.5 million barrels last week.

U.S. crude oil imports averaged 6.6 million barrels per day last week, an increase of 1.0 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 1.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.1 million barrels per day, and distillate fuel imports averaged 189,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending June 4, 2021 which was 327,000 barrels per day more week over week. Refineries operated at 91.3% of their operable capacity last week. Gasoline production decreased last week, averaging 9.4 million barrels per day. Distillate fuel production increased last week, averaging 4.9 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $71.39, up 48 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 12.2% year over year in week 22 (U.S. +12.9%, Canada +15.1%, Mexico -7.7%) resulting in quarter to date volumes that are up 23.5% year over year and year to date volumes that are up 12.0% year over year (U.S. +13.5%, Canada +9.0%, Mexico +4.7%). 9 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+9.4%), coal (+31.3%), metallic ores & metals (+37.2%) and chemicals (+14.8%).

In the East, CSX’s total volumes were up 21.0%, with the largest increases coming from intermodal (+17.4%), coal (+65.2%), chemicals (+28.2%) and motor vehicles & parts (+44.8%). NS’s total volumes were up 17.8%, with the largest increases coming from intermodal (+9.9%), coal (+78.7%), metals & products (+65.3%), chemicals (+21.3%) and motor vehicles & parts (+26.6%).

In the West, BN’s total volumes were up 14.4%, with the largest increases coming from intermodal (+15.3%), coal (+17.5%) and metallic ores (+485.7%). The largest decrease came from grain (-12.3%). UP’s total volumes were up 16.1%, with the largest increases coming from chemicals (+33.9%), intermodal (+6.8%), coal (+27.7%) and motor vehicles & parts (+77.5%).

In Canada, CN’s total volumes were up 16.8%, with the largest increases coming from intermodal (+19.2%), coal (+48.8%), chemicals (+21.9%) and metallic ores (+13.4%). RTMs were up 20.8%. CP’s total volumes were up 16.9%, with the largest increases coming from intermodal (+12.6%), petroleum (+76.9%), coal (+28.4%) and motor vehicles & parts (+73.4%). RTMs were up 15.7%.

KCS’s total volumes were up 21.3%, with the largest increases coming from intermodal (+15.4%), petroleum (+81.3%) and coal (+56.8%).

Source: Stephens

Rig Count

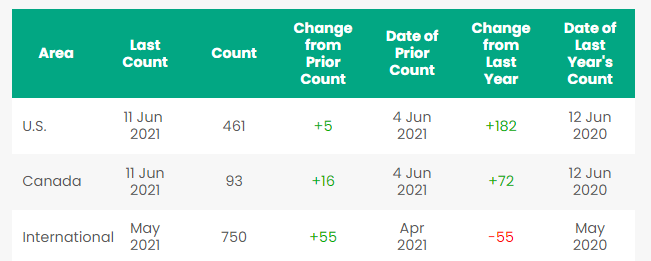

North American rig count is up by 21 rigs week over week. The U.S. was up by 5 rigs week over week and up by 182 rigs year over year. The U.S. currently has 461 active rigs. Canada’s rig count was up by 16 rigs week over week, and up by 72 rigs year over year and Canada’s overall rig count is 93 active rigs. Year over year we are up 254 rigs collectively.

North American Rig Count Summary

We thought that we would highlight International rig count in this week’s rail report. Total rig count outside of U.S. and Canada is 750 active rigs – while down 55 rigs year over year a significant jump of 55 rigs occurred during the month of May. Folks, people are drilling at these prices. Expect rig count to continue to rise worldwide week over week in the current price environment that we are in. U.S. producers are seemingly more disciplined in adding rigs – you know the old saying “once bitten twice shy”.

Things We are Keeping an Eye on

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,410 from 23,234 a gain of 176 rail cars week over week. Canadian volumes were higher overall – CN shipments declined by 1.0% while CP shipments were up by 31.5%. U.S. volumes were mostly lower. The CSX had the largest percentage decrease in the U.S., down by 13.2% and the NS had the largest percentage increase up by 2.0%.

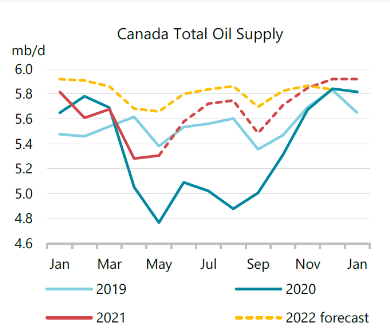

- Canadian oil supply is set to climb to a record high in the second half of 2021, the International Energy Agency (IEA) noted in its latest oil market report released Friday of last week (See Chart)

- TC Energy Corporation confirmed on Thursday of last week that after a comprehensive review of its options and in consultation with its partner, the Alberta government, it has terminated the Keystone XL pipeline project. We were surprised to hear about this. It was PFL’s thoughts that there has been a decade of work put into this project and thought it would have got put on a temporary hold pending a political shift. Yet another tailwind for crude by rail.

- Rail Cars in storage – The AAR released monthly data on railcars in storage via its Rail Time Indicators report. As of June 1, 2021. There were 363,700 empty railcars in storage representing 22.1% of the N.A. fleet. This is a decrease of roughly 1,700 unit’s month over month and 157,000 unit decrease year over year. We are expecting the number of railcars in storage to continue to decline as fleet size continues to adjust. Scrapping prices have continued to remain strong the economy continues to improve resulting in accelerated rail traffic.

- The California power grid operator told the public to prepare to conserve energy next week if needed as homes and businesses crank up their air conditioners to escape what is forecast to be a brutal heat wave. Coal should continue to do well this summer as it already has. Power prices across the U.S. West spiked to their highest since the February freeze when natural gas pipelines and wind turbines froze in Texas leaving millions without power. The California ISO, which operates the state’s power grid, said in a release that “It is still too early to know the precise impact that next week’s high temperatures will have on the electric grid.” But, the ISO said it will notify the public if it needs to take steps to reduce electricity use, including a call for public conservation and if the grid becomes seriously stressed, rotating outages.

- Exxon has made yet another in a long string of discoveries offshore Guyana in the Stabroek block, the company said last week. “Longtail-3, combined with our recent discovery at Uaru-2, has the potential to increase our resource estimate within the Stabroek block, demonstrating further growth of this world-class resource and our high-potential development opportunities offshore Guyana,” said Mike Cousins, Exxon’s senior VP of exploration and new ventures. Guyana is one of the top priorities in the U.S. supermajor’s strategy to focus on high-return and cash-generating projects that would allow it to grow its dividend through 2025. The company recently revised up its Guyana production target for that year to 800,000 bpd, with output reaching 1 million bpd by 2027. By that year, there will be at least six wells operating in the Stabroek block, according to Exxon and Hess.

- Global supply chain squeeze, soaring costs threaten solar energy boom – Global solar power developers are slowing down project installations because of a surge in costs for components, labor, and freight as the world economy bounces back from the coronavirus pandemic, costs of going green are already up 15% this year alone. Governments around the world are driving up costs of wind and solar that is certainly going to put strain on the private sector and consumers alike – hold onto to wallets folks. Rising green energy and at the same time as rising petroleum products talk about a double whammy.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 50-100 117Rs 30.3 gallon for refined products UP and BN Texas negotiable

- 18-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 20-25 30K 117Rs for the use in ethanol in the Midwest. Dirty to dirty service/

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 8 plastic pellet hoppers for purchase.

- 10 PD cars for cement service for purchase.

- 20 17K tank cars for purchase. Must be food grade.

- 40 30k 117Js needed in Chicago for refined products. For jet fuel looking for dirty to dirty service.

- 50-100 C/I food grade tank cars needed for veg oil in the Midwest for 1 year

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

In May, as in April, heavy maintenance at oil sands upgraders weighed on Canadian output. Total supply was estimated at 5.3 million barrels per day, over 500,000 barrels per day above May 2020, but 400,000 barrels per day below Q1 2021 production. Suncor Energy delayed maintenance initially scheduled for May at its Base Plant upgrader to reduce the risk to staff from COVID-19 outbreaks at oil worker camps. According to Suncor, the turnarounds will now begin in sometime in June but most likely later in the summer. Bottom line a tail wind for crude by rail with no pipe to lop up the excess crude expect basis to widen and crude by rail to take hold sometime in Q4.

Construction activities to advance the project were suspended following the revocation of its presidential permit on Jan. 20, 2021. The company will continue to co-ordinate with regulators, stakeholders and Indigenous groups to meet its environmental and regulatory commitments and ensure a safe termination of and exit from the project.

The government of Alberta and TC Energy have reached an agreement for an orderly exit from the KXL project and partnership, said the Alberta government in a separate statement. The two parties will continue to “explore all options to recoup the government’s investment in the project.”

“We remain disappointed and frustrated with the circumstances surrounding the Keystone XL project, including the cancellation of the presidential permit for the pipeline’s border crossing,” said Premier Jason Kenney. “Having said this, Alberta will continue to play an important role in a reliable, affordable North American energy system. We will work with our U.S. partners to ensure that we are able to meet U.S. energy demands through the responsible development and transportation of our resources.”

“We invested in Keystone XL because of the long-term economic benefits it would have provided Albertans and Canadians. However, terminating our relationship with TC Energy’s project is in the best interest of Albertans under current conditions,” added Energy Minister Sonya Savage. “We remain undeterred in our commitment to stand up for Alberta’s energy sector and the hard-working people it employs.”

Final costs to the government are expected to be CAD $1.3 billion, in alignment with previously disclosed costs.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

PFL is offering:

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|