“What you stay focused on will grow.”

– Roy T. Bennett

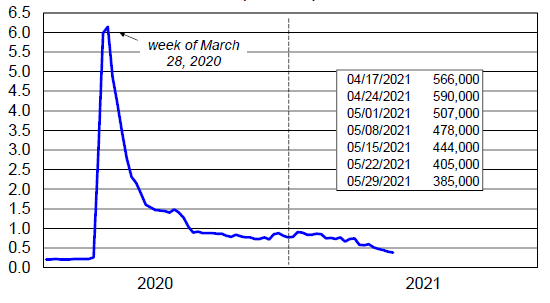

Weekly Jobless Claims down Week over Week Yet Again

Initial claims for jobless benefits totaled 385,000 last week, better than the 390,000 estimate. (See Chart)

The fifth straight weekly decrease in claims was led by Texas and Florida. They could decline further as Republican governors in 25 states, including Florida and Texas, are cutting off unemployment programs funded by the federal government for residents starting Saturday of this week. These states account for more than 40% of the workforce. About 4 million workers will be affected. The benefits being terminated early include a weekly $300 unemployment subsidy, which businesses say is discouraging the jobless from seeking work. The expanded benefits will end in early September across the country. Economists estimate unemployment benefits payments totaled $35.1 billion in May.

Hiring appears to have improved in May, with the ADP National Employment Report showing private payrolls increased by 978,000 jobs, the biggest increase since June last year, after rising 654,000 in April. Economists had forecast private payrolls would increase by 650,000 jobs in May.

Stocks up Friday of last week and up week over week

The Dow closed higher on Friday of last week, up +64.81 (+0.19%) points closing out the week at 34,529.45, up +321.91 points week over week. The S&P 500 closed higher on Friday of last week, up +3.23 points (+0.08%) and closing out the week at 4,204.11, up +48.25 points week over week. The Nasdaq closed higher on Friday of last week, up +12.46 points (+0.09%) and closing out the week at 13,748.74, up +277.75 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 49 points.

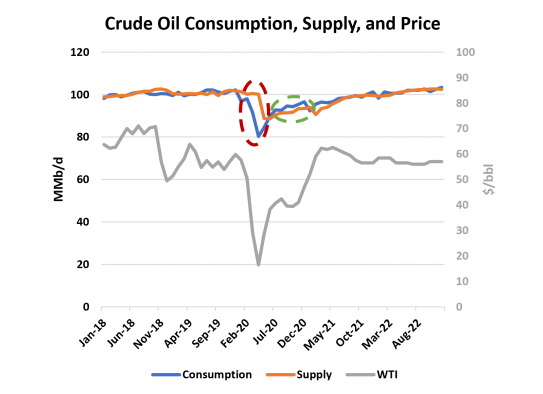

Oil up nearly 5% week over week – Oil hits two year high- can it last?

Extending the previous week’s gains of 4%, WTI rose nearly 5% last week. Oil extended gains on Friday of last week as OPEC+ supply discipline and recovering demand countered concerns about a patchy COVID-19 vaccination rollout around the globe. Also, data from the Labor Department showed that the U.S. added 559,000 nonfarm payroll jobs last month coupled with a weaker U.S. dollar were other contributing factors for oils relentless climb. We may be due for some profit-taking at some point. The price point that we are at now works for everyone and it is going to take continued discipline from not only OPEC+ but non OPEC producing countries as the price, demand and the supply situation as predicted by the EIA is flattish, that is if you take into account all of the shut in, easy to bring on production. (See chart)

WTI crude rose Friday of last week +0.81 to settle at $69.62 a barrel. Brent crude oil for August settlement closed higher gaining +$0.58 a barrel, closing at $71.89, after touching $72.17 a barrel its highest since May of 2019.

U.S. commercial crude oil inventories decreased by 5.1 million barrels week over week. At 479.3 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

Total motor gasoline inventories increased by 1.5 million barrels week over week and are 3% below the five-year average for this time of year. Finished gasoline and blending components inventories both increased last week.

Distillate fuel inventories increased by 3.7 million barrels week over week and are 8% below the five-year average for this time of year.

Propane/propylene inventories increased by 4.1 million barrels week over week and are 19% below the five-year average for this time of year.

Total commercial petroleum inventories increased by 1.9 million barrels last week.

U.S. crude oil imports averaged 5.6 million barrels per day last week, a decrease 600,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.0 million barrels per day, 0.7% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 933,000 barrels per day, and distillate fuel imports averaged 516,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending May 28, 2021 which was 358,000 barrels per day more than the previous week’s average. Refineries operated at 88.7% of their operable capacity last week. Gasoline production decreased last week, averaging 9.6 million barrels per day. Distillate fuel production increased last week, averaging 4.8 million barrels per day.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $69.34, down .28cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 28.1% year over year in week 21 (U.S. +34.0%, Canada +13.2%, Mexico +16.6%) resulting in quarter to date volumes that are up 25.0% year over year and year to date volumes that are up 12.1% year over year (U.S. +13.6%, Canada +8.7%, Mexico +7.0%). All 11 of the AAR’s major traffic categories posted year over year increases with the largest increases coming from intermodal (+28.1%), coal (+42.0%), metallic ores & metals (+47.8%) and motor vehicles & parts (+104.2%). Coal has been back big folks who would have thought! Coal carloads were 41.7% higher in May 2021 than in May 2020. They averaged 65,574 per week in May 2021, the highest weekly average since January 2020. For the year to date through May, coal carloads were 1.29 million.

In the East, CSX’s total volumes were up 41.8%, with the largest increases coming from intermodal (+41.5%), coal (+90.1%), motor vehicles & parts (+140.9%) and chemicals (+31.1%). NS’s total volumes were up 38.1%, with the largest increases coming from intermodal (+27.9%), coal (+103.9%), motor vehicles & parts (+126.5%), metals & products (+104.1%) and chemicals (+33.8%).

In the West, BN’s total volumes were up 31.6%, with the largest increases coming from intermodal (+33.6%), coal (+24.0%), metallic ores (+455.9%), motor vehicles & parts (+112.8%) and grain (+19.4%). UP’s total volumes were up 34.6%, with the largest increases coming from intermodal (+38.5%), motor vehicles & parts (+315.1%), chemicals (+25.9%) and coal (+19.0%).

In Canada, CN’s total volumes were up 15.9%, with the largest increases coming from intermodal (+15.7%), motor vehicles & parts (+133.9%), coal (+41.9%), stone sand & gravel (+132.3%) and metallic ores (+13.9%). RTMs were up 11.0%. CP’s total volumes were up 17.4%, with the largest increases coming from intermodal (+18.2%), coal (+49.7%) and motor vehicles & parts (+96.8%). RTMs were up 4.9%.

KCS’s total volumes were up 40.9%, with the largest increases coming from intermodal (+42.5%), petroleum (+73.7%) and motor vehicles & parts (+267.9%).

Source: Stephens

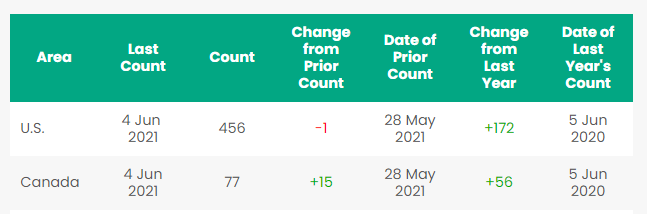

Rig Count

North America rig count is up by 14 rigs week over week. The U.S. was down 1 rig week over week but up by 172 rigs year over year. The U.S. currently has 456 active rigs. Canada’s rig count was up by 15 rigs week over week, and up by 56 rigs year over year and Canada’s overall rig count is 77 active rigs. Year over year we are up 228 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

Some Key Economic Indicators:

- Gross Domestic Product (GDP) On May 27, the Bureau of Economic Analysis (BEA) released its second preliminary estimate of Q1 2021 GDP growth at 6.4%, the same as the first estimate. The BEA said Q1 growth reflects continued economic recovery resulting from the reopening of businesses, government stimulus efforts, and widespread vaccinations.

- Industrial Output and Capacity Utilization – Total U.S. industrial output rose 0.5% in April 2021 from March 2021, compared to a 2.2% increase in March over February, according to seasonally adjusted and preliminary data from the Federal Reserve. Total output in April was still a few percentage points lower than its pre-pandemic level. There has been little to no growth in total output so far in 2021.

- New U.S. Employment – The Bureau of Labor Statistics announced on June 4 that 559,000 net new jobs were created in May 2021. In May, the vast majority of job gains were in service industries, including food services (up 186,000), entertainment and recreation (up 72,000), accommodations (up 35,000), and health care and social assistance (both up 23,000). Manufacturing jobs rose by 23,000 and construction jobs fell by 20,000. The unemployment rate fell to 5.8% in May from 6.1% in April, but the labor force participation rate showed no improvement in May.

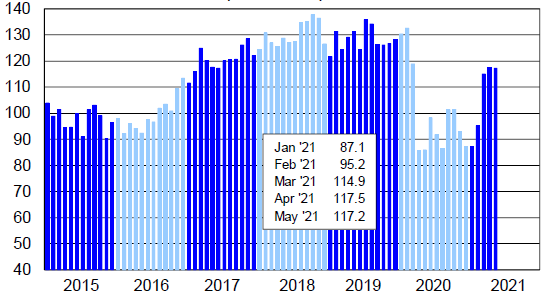

- Consumer Confidence – The Conference Board’s index of consumer confidence fell slightly in May following a gain in April. The index in May was 117.2, down from 117.5 in April. We are still a far cry away from consumer confidence numbers seen pre COVID and under the Trump years (see Chart)

- Consumer Spending – U.S. consumer spending was up 0.5% in April 2021 over March 2021. A May 28th Wall Street Journal article said, “After months of buying goods from the safety of their homes, Americans are increasingly comfortable enough to go out in public and buy things in person, a shift that economists say is crucial to getting the economy running at full speed again.” In April, spending on services, which accounts for the bulk of all consumer purchases, rose 1.1%, down from a 2.1% gain in March. Spending on goods fell 0.6% in April, following an outsized 9.7% gain in March. Adjusted for inflation, spending in March 2021 and April 2021 set new all-time records, exceeding the pre-pandemic levels for the first time.

- Housing – Housing has gone wild, especially in Florida – Total U.S. housing starts fell to a preliminary and annualized 1.57 million in April 2021, down 9.5% from last April 2020’s 1.73 million. March’s total was the most since July 2006, so a pullback wasn’t entirely unexpected. April’s total housing starts were about equal to the average for the previous nine months. For the first four months of 2021, total housing starts were 499,600, which is the highest January-to-April total since 2006. The decline in total starts in April from March was due to a decline in single-family starts — they fell to 1.09 million in April from 1.26 million in March. According to the chief economist at Fannie Mae, April’s housing starts “may be the strongest evidence yet that supply constraints, namely lumber and material prices, labor scarcity are weighing meaningfully on homebuilders’ ability to keep up with housing demand.”

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,234 from 23,091 a gain of 143 rail cars week over week. Canadian volumes were lower – CN shipments declined by 0.6% while CP shipments were down by 6.2%. U.S. volumes were mixed. The NS had the largest percentage decrease in the U.S., down by 10.4% and the CSX had the largest percentage increase up by 12.9%.

Trans Mountain Pipeline Hits another snag

An order stopping tree cutting and grass mowing across the entire Trans Mountain pipeline expansion project was issued Thursday of last week by the Canada Energy Regulator (CER). A statement released by the CER said it issued the order to immediately stop all clearing activity “to prevent harm to nesting birds in the pipeline project’s right of way and to ensure Trans Mountain is correcting any issues it has in relation to contractor oversight and management.” The release added that Trans Mountain must comply with the conditions of the expansion project certificate and its relevant obligations under the Canadian Energy Regulator Act and associated regulations. A statement from Trans Mountain said the regulator’s order was issued after a subcontractor started tree cutting and mowing activities without completing the necessary environmental compliance work. It said that no birds or bird nests were impacted by the clearing work. It also said all other construction activity will continue across the project. “Trans Mountain takes its regulatory and environmental obligations very seriously,” says the statement. “We are working with the regulator to ensure and to demonstrate that we have the appropriate communication protocols in place for contractors at all levels.” The statement did not say how many workers are affected by the stop-work order or how long the shutdown will last for the pipeline project. Environment and Climate Change Canada issued a stop-work order in April to halt Trans Mountain construction through a Burnaby, B.C., forest to protect hummingbirds and other migratory birds during nesting season. That order was expected to be in place until mid-August. Folks, this is strange, as Trans Mountain is owned by the Canadian government and it is an order where the government is essentially shutting government down. Will Trans Mountain appeal the decision? This seems doubtful – It’s likely the Alberta Government may have some things to say, but nevertheless a tail wind for crude by rail as the project gets kicked down the road once again.

Global Minimum Tax for Corporations?

UK finance minister Rishi Sunak announced the agreement in a video posted on Twitter Saturday, saying G7 finance ministers — from Canada, France, Germany, Italy, Japan, the UK and the US — had “reached a historic agreement to reform the global tax system to make it fit for the global digital age and, crucially, to make sure that it’s fair so that the right companies pay the right tax in the right places.” The agreement was made during a G7 meeting of finance ministers in London, attended by US Treasury Secretary Janet Yellen, where she sought backing for the administration’s efforts to rewrite international tax rules and discourage American companies from booking earnings abroad. Yellen said Saturday that the agreement was a “significant, unprecedented commitment,” from the world’s richest economies aimed at preventing companies from avoiding taxes by shifting profits overseas. “The G7 Finance Ministers have made a significant, unprecedented commitment today that provides tremendous momentum towards achieving a robust global minimum tax at a rate of at least 15%,” Yellen wrote in the statement.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 50-100 117Rs 30.3 gallon for refined products UP and BN Texas negotiable

- 18-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 20-25 30K 117Rs for the use in ethanol in the Midwest. Dirty to dirty service/

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 8 plastic pellet hoppers for purchase.

- 10 PD cars for cement service for purchase.

- 20 17K tank cars for purchase. Must be food grade.

- 40 30k 117Js needed in Chicago for refined products. For jet fuel looking for dirty to dirty service.

- 50-100 C/I food grade tank cars needed for veg oil in the Midwest for 1 year

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 10 Covered Hoppers 6300 CF in Wisconsin CN for 1 year Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- Several hundred small Hoppers Various Locations and Product – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|