“If a man does his best, what else is there?”

– Gen. George S. Patton, Jr.

Weekly Jobless Claims Down, Unemployment Number Disappointing

The Bureau of Labor Statistics announced on May 7 that a net 266,000 new jobs were created in April 2021. That’s far below the million or so that most economists expected. Moreover, job gains in March were revised down to 770,000 from last month’s initial estimate of 916,000. April’s job gains mean that, of the 22.4 million jobs lost in March and April 2020, 14.1 million have been regained, leaving 8.2 million to go. The official unemployment rate rose to 6.1% in April from 6.0% in March.

The Department of Labor released its weekly report on new jobless claims on Thursday of last week at 8:30 a.m. ET.

Initial jobless claims, for the week ending May 1: 498,000 vs. 540,000 expected. This was the lowest level since March 2020. The decline in claims was led by Virginia, Florida, New York and California.

U.S.-based employers in April announced the fewest job cuts in nearly 21 years. The initial jobless claims report added to other upbeat employment data suggesting that the economy enjoyed a great month of job growth in April.

Although new claims continue to decline, an elevated number of Americans have still been sidelined from the labor market as businesses struggle to fill entry level positions. More than 16.3 million Americans are still receiving unemployment benefits, down 300,000 people week over week.

Tech is down, value is up week over week

Stocks fell Friday after a record-setting session a day earlier, with stocks taking a pause after strong earnings results and more encouraging economic data helped fuel the latest leg higher. With rising inflation expectations and the potential for higher interest rates, investors are moving money from high-flying Tech stocks to industries that have more pricing control (ie. Energy, financials, materials etc).The three major indexes posted strong gains for the month of April, but were mostly down week over week.

The Dow closed higher on Friday of last week, up 229.23 (+0.66%) points closing out the week at 34,777.76, up +902 points week over week. The S&P 500 closed higher on Friday of last week, up +30.98 points (+0.74%) and closing out the week at 4,232.60, up +51.43 points week over week. The Nasdaq closed higher on Friday of last week, up +119.39 points (+0.88%) closing out the week at 13,752.24, down -54.13 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 62 points.

Crude strong week over week – supply/demand tug a war continues

Oil prices were mostly flat on Friday but were set for strong weekly gains. Brent and WTI both traded up $.19 on Friday, closing at $68.28 and $64.90 respectively. WTI was up 1.32 or 2.07% week over week, and Brent was up $1.52 or 2.27% week over week. Crude is being pressured by rising Covid cases in Japan and India, two major importers, but strong fuel demand in Europe and the US is helping to offset that. US refiners operated at their highest levels last week since March 2020, and with big export numbers as well that led to a big draw in US commercial crude inventories.

U.S. commercial crude oil inventories decreased by 8.0 million barrels week over week. At 485.1 million barrels, U.S. crude oil inventories are 2% below the five year average for this time of year.

Total motor gasoline inventories increased by 700,000 barrels week over week and are 2% below the five year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 2.9 million barrels week over week and are 2% below the five year average for this time of year.

Propane/propylene inventories increased by 500,000 barrels week over week and are 19% below the five year average for this time of year. Well folks we were 18% behind over the last several weeks we are getting a little concerned. Asia keeps buying and we keep selling – we are going to be short this winter if the current trend continues. Folks this is with Enbridge line five still in operation – what is the Governor of Michigan thinking – she wants the pipeline shut down – we don’t need America freezing next winter!

Total commercial petroleum inventories decreased by 5.6 million barrels last week.

U.S. crude oil imports averaged 5.5 million barrels per day last week, a decrease of 1.2 million barrels per day week over week. Over the past four weeks, crude oil imports averaged about 5.8 million barrels per day, 7.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.0 million barrels per day, and distillate fuel imports averaged 169,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending April 30, 2021 which was 225,000 barrels per day more than the previous week’s average. Refineries operated at 86.5% of their operable capacity last week. Gasoline production decreased last week, averaging 9.1 million barrels per day. Distillate fuel production decreased last week, averaging 4.5 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $65.11, up 21 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 25.8% year over year in week 17 (U.S. +29.6%, Canada +8.7%, Mexico +57.3%) resulting in quarter to date volumes that are up 25.2% year over year and year to date volumes that are up 9.3% year over year (U.S. +10.5%, Canada +7.2%, Mexico +2.8%). All of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+25.2%), coal (+32.5%) and motor vehicles & parts (+595.2%).

In the East, CSX’s total volumes were up 34.9%, with the largest increases coming from intermodal (+38.9%), motor vehicles & parts (+1,340.6%) and coal (+34.4%). NS’s total volumes were up 28.9%, with the largest increases coming from intermodal (+26.0%), motor vehicles & parts (+949.1%), metals & products (+96.5%) and coal (+21.1%).

In the West, BN’s total volumes were up 33.1%, with the largest increases coming from intermodal (+32.6%), coal (+55.0%), grain (+31.1%) and motor vehicles & parts (+372.2%). UP’s total volumes were up 27.5%, with the largest increases coming from intermodal (+36.4%) and motor vehicles & parts (+1,016.6%).

In Canada, CN’s total volumes were up 9.8%, with the largest increases coming from coal (+57.9%), motor vehicles & parts (+409.1%) and chemicals (+16.6%). RTMs were up 15.9%. CP’s total volumes were up 17.1%, with the largest increases coming from motor vehicles & parts (+453.9%), grain (+24.2%) and coal (+23.8%). RTMs were up 15.9%.

KCS’s total volumes were up 49.4%, with the largest increases coming from intermodal (+42.2%), petroleum (+105.7%), motor vehicles & parts (+2,371.1%), grain (+102.7%) and coal (+129.9%).

Source: Stephens

Rig Count

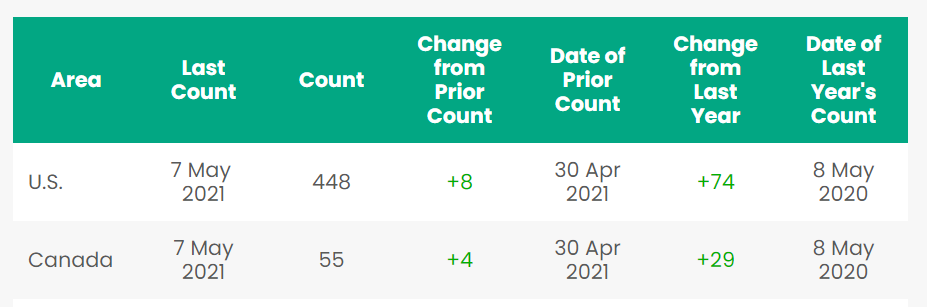

North America rig count is down by 12 rig’s week over week. The U.S. was up 8 rigs week over week and up by 74 rigs year over year. The U.S. currently has 448 active rigs. Canada’s rig count was up by 4 rigs week over week, and up by 29 rigs year over year and Canada’s overall rig count is 55 active rigs. Year over year we are up 103 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

- The Dakota Access Pipeline (“DAPL”) – In the latest and greatest on DAPL, the U.S. Army Corps of Engineers was asked by the Federal Judge Boasberg who is hearing the case to provide an opinion by the end of business on Monday May 3 if the Dakota access pipeline should be shut down. The U.S. Army Corps of Engineers echoed the arguments of the previous administration, saying they do not believe a judge should order the Dakota Access oil pipeline shut while its environmental review continues. The Army Corps said on Monday of last week that it expected to complete an environmental review of the 570,000-barrel-per-day DAPL out of North Dakota by March 2022, when it will consider whether to issue a new permit for the line. Boasberg is now considering whether to grant a request by The Standing Rock Sioux Tribe, who claims DAPL could threaten its water supply and want the pipeline shut down now. Energy Transfer, the owner of DAPL said they expect a “favorable result” and that they expect DAPL “to continue flowing oil reliably, safely and efficiently as it has done for the last four years.”

- Enbridge Line 5 – During the Calgary-based energy infrastructure company’s annual general meeting on Wednesday of last week, Al Monaco said Enbridge must continue to fight for those pipelines for its benefit as well as the benefit of the shippers who move products on them and the consumers who need those products. Enbridge’s Line 5 is facing a looming May 12 shutdown ordered by Michigan Gov. Gretchen Whitmer last fall after accusing the company of violating terms of a 1953 deal that allowed the line to traverse the bottom of the Straits of Mackinac, which connects Lake Michigan and Lake Huron. “The infrastructure assets we own as a company and the ones we’re developing and replacing, like this, and modernizing, I think are absolutely critical to the energy future no matter what the degree of change in the energy landscape is,” he said.

- Petroleum by Rail –Total NA petroleum carloads were down week over week, falling from 20,020 to 19,414. Petroleum carloads declined across all major class ones last week except for the UP, who’s petroleum carloads actually increased by 224 (5.5%). The biggest declines came from NS and KCS, with Petroleum carloads down 250(-9.8%) and 486(-9.7%) respectively. Petroleum carloads are up 18.8% from this week last year, but YTD carloads are still 10% lower. USD Group said it expects its new Diluent Recovery unit (DRU) in Hardisty, AB to start service in July and be fully operational by August, which should provide a boost for Canadian petroleum by Rail shipments.

- Railcars in Storage- The AAR just released monthly data on railcars in storage via its Rail Time Indicators report. As of May 1, 2021, there were 365,400 empty railcars in storage (22.2% of the N.A. fleet), representing a 12,900 unit decrease (-3.4%) month over month and a 52,700 unit decrease year over year (-12.6%). By car type, the largest sequential decline was for open-top hoppers. Looking ahead, we expect railcars in storage to continue this downward trend as rail volumes continue to improve and unwanted rail cars are scrapped. Please click here for PFL’s monthly storage report for further details.

- Update on the CN& CP battle for the KCS – The Surface Transportation Board (STB) has found that formal board review of the voting trust agreement for use in connection with the proposed transaction between Canadian Pacific Railway and Kansas City Southern Railway is warranted. In the decision, the board determined that the proposed arrangement is acceptable with certain modifications, STB officials said in a press release. “Following this critical milestone, we are proceeding full-steam ahead to complete this historic combination, creating the first truly North American single line railroad,” said CP President and Chief Executive Officer Keith Creel in a press release. “We are continuing to prepare our formal merger application and proxy filing for a shareholder vote in the near future.” In order to close into a voting trust, the transaction requires approval from shareholders of both companies along with satisfaction of customary closing conditions. CP would then acquire KCS shares and place them into the voting trust, at which point KCS shareholders will receive their consideration, CP officials said. KCS’ management and board will continue to steward the company while it is in trust, pursuing KCS’ independent business plan and growth strategies while the merger undergoes regulatory review, they added. David Starling, former CEO of KCS, has been appointed trustee for the voting trust.

- Colonial Pipeline – A major pipeline that carries gasoline, diesel, jet fuel, and heating oil from refineries in the Gulf Coast all over the North East was attacked by Ransomware on Friday, the company announced. The attack forced them to cease operations on the >100 Million gallon per day pipeline that supplies 45% of the East Coast’s fuel. While it is still unknown how long the pipeline will need to be shut, a lengthy shutdown of this pipeline could have serious ramifications for fuel prices and supply all over the east coast. Analysts fear a lack of Jet fuel supply in places like Atlanta and Charlotte, as well as fuel shortages and price hikes from Alabama to DC. An extended shutdown of this line would put downward pressure on Gulf Coast fuel prices and cause dislocations in the East Coast fuel markets. “The worry is, without those tanks being replenished at around Day 4 or 5, that pool — so to speak — of gasoline will be chiseled at pretty quickly,” Patrick De Haan, industry analyst at GasBuddy, said.

- Some Economic Indicators that we are keeping an eye on:

- US GDP – U.S. GDP increased an annualized 6.4% in Q1 2021 from Q4 2020, according to the first estimate released by the Bureau of Economic Analysis (BEA) on April 29.

- US Industrial Output – Seasonally adjusted total U.S. industrial output increased a preliminary 1.4% in March 2021 from February 2021. According to the Federal Reserve, “The gain in March followed a drop of 2.6% in February, which largely resulted from widespread outages related to severe winter weather in the south central region of the country.

- US Consumer Confidence – The Conference Board’s index of consumer confidence rose to 121.7 in April 2021 from 109.7 in March 2021, the second straight big increase. The index is now higher than it’s been since February 2020.

- Consumer Spending – U.S. consumer spending was up a preliminary 4.2% in March 2021 from February 2021, the largest month-to-month increase since last summer. Consumer spending was fueled by a surge in personal income, which, according to the Bureau of Economic Analysis, soared 21.1% in March from February. That’s its biggest percentage increase since 1959. The increase was triggered largely by $1,400 stimulus payments to tens of millions of Americans thanks to the pandemic relief package signed into law in March.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- Several hundred small Hoppers Various Locations and Product – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale 3000-5800 CF 263 and 286 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|