“Hard work spotlights the character of people: some turn up their sleeves, some turn up their noses, and some don’t turn up at all.”

– Sam Ewing

Jobs Update

Another 553,000 Americans filed new jobless claims last week

New weekly jobless claims dropped from the prior week’s upwardly revised level to a fresh pandemic-era low last week, with the accelerating pace of COVID-19 vaccinations in the U.S. helping support the labor market’s recovery.

The Department of Labor released its weekly report on new jobless claims on Thursday of last week at 8:30 a.m. ET.

Initial jobless claims, for the week ending April 24: 553,000 vs. 540,000 expected and an upwardly revised 566,000 during the prior week

Continuing claims, for the week ending April 17: 3.660 million vs. 3.590 million expected and a downwardly revised 3.651 million during the prior week.

New jobless claims held below 600,000 for a third straight week, dipping to the lowest level since mid-March 2020. During the comparable week last year, new weekly jobless claims totaled nearly 3.5 million.

Though headline new claims have been on the decline, an elevated number of Americans have still been sidelined from the labor market. More than 16.5 million Americans are still receiving unemployment benefits.

Markets were down Week over Week- profit taking on strong earnings

Stocks fell Friday after a record-setting session a day earlier, with stocks taking a pause after strong earnings results and more encouraging economic data helped fuel the latest leg higher. The three major indexes posted strong gains for the month of April, but were mostly down week over week.

The Dow closed lower on Friday of last week, down -188.51 (-0.54%) points closing out the week at 33,874.85, down -168.64 points week over week. The S&P 500 closed lower on Friday of last week, down -30.30 points (-0.72%) and closing out the week at 4,181.17, up a mere 1 point exactly week over week. The Nasdaq closed lower on Friday of last week, down -119.86 points (-0.85%) closing out the week at 13,962.68, down -54.13 points week over week. In overnight trading, DOW futures traded higher and are expected to open up this morning 200 points.

Crude Mixed Week Over Week, but Strong Monthly Gains – Demand Supply Tug of War Happening

Friday of last week was the biggest drop for the Brent and WTI contract in over 3 weeks, prices did have large month over month gains. “The tug of war between summer demand growth prospects and worsening COVID infections is still in full swing,” a JBC Energy analysts wrote. Japan’s imports fell 25% in March year over year to 2.34 million bpd according to government figures. WTI crude oil fell -$1.43 a barrel (-2.2%) to settle at $63.58 a barrel on Friday of last week, up +$1.44 a barrel week over week. Brent crude oil also closed lower on Friday losing -$1.43 a barrel (-1.9%), closing at $66.76 a barrel down -$0.65 a barrel week over week.

U.S. commercial crude oil inventories increased by 100,000 barrels week over week. At 493.1 million barrels, U.S. crude oil inventories are at the five year average for this time of year.

Total motor gasoline inventories increased by 100,000 barrels week over week and are 3% below the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week.

Distillate fuel inventories decreased by 3.3 million barrels last week over week and are at the five year average for this time of year.

Propane/propylene inventories increased by 500,000 barrels week over week and are still 18% below the five year average for this time of year. Get ready for price spikes this winter for propane.

Total commercial petroleum inventories decreased by 1.6 million barrels last week.

U.S. crude oil imports averaged 6.6 million barrels per day last week, an increase of 1.2 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.0 million barrels per day, 10.7% more than the same four-week period last year.

Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.0 million barrels per day, and distillate fuel imports averaged 135,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.0 million barrels per day during the week ending April 23, 2021 which was 253,000 barrels per day more than the previous week’s average. Refineries operated at 85.4% of their operable capacity last week. Gasoline production increased last week, averaging 9.6 million barrels per day. Distillate fuel production increased last week, averaging 4.6 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $63.72, up 14 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 24.8% year over year in week 16 (U.S. +30.0%, Canada +5.5%, Mexico +47.0%) resulting in quarter to date volumes that are up 25.0% year over year and year to date volumes that are up 8.4% year over year (U.S. +9.4%, Canada +7.1%, Mexico +0.6%). All of the AAR’s 11 major traffic categories posted year increases with the largest increases coming from intermodal (+27.2%), coal (+28.4%) and motor vehicles & parts (+549.9%).

In the East, CSX’s total volumes were up 34.2%, with the largest increases coming from intermodal (+38.4%), motor vehicles & parts (+1,254.6%), coal (+29.2%) and chemicals (+25.8%). NS’s total volumes were up 35.4%, with the largest increases coming from intermodal (+29.6%), coal (+68.8%) and motor vehicles & parts (+1,008.2%).

In the West, BN’s total volumes were up 33.3%, with the largest increases coming from intermodal (+37.1%), coal (+39.5%), motor vehicles & parts (+365.5%) and grain (+29.9%). UP’s total volumes were up 30.3%, with the largest increases coming from intermodal (+43.6%), motor vehicles & parts (+731.1%) and chemicals (+26.5%). The largest decrease came from stone sand & gravel (-12.0%).

In Canada, CN’s total volumes were up 9.1%, with the largest increases coming from motor vehicles & parts (+513.6%), intermodal (+4.1%), chemicals (+18.6%) and coal (+27.6%). RTMs were up 12.4%. CP’s total volumes were up 9.4%, with the largest increases coming from motor vehicles & parts (+661.9%) and coal (+23.6%). RTMs were up 8.3%.

KCS’s total volumes were up 41.6%, with the largest increases coming from intermodal (+39.6%), petroleum (+99.0%) and motor vehicles & parts (+2,105.9%)

Source: Stephens

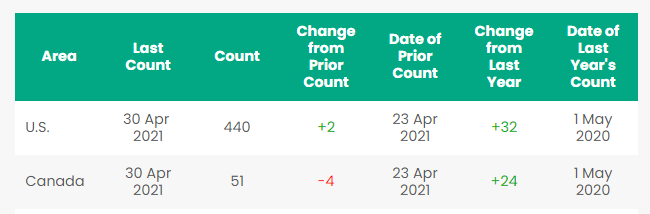

Rig Count

North America rig count is down by 2 rig’s week over week. The U.S. was up 2 rigs week over week and up by 32 rigs year over year. The U.S. currently has 440 active rigs. Canada’s rig count was down by 4 rigs week over week, but up by 24 rigs year over year and Canada’s overall rig count is 51 active rigs. Year over year we are up 56 rigs collectively. We are starting to see larger year over year increases in rig count numbers in comparison to last year’s dismal numbers as the trend upward continues.

North American Rig Count Summary

Things We are Keeping an Eye on

- The Dakota Access Pipeline (“DAPL”) – In the latest and greatest on DAPL, the U.S. Army Corps of Engineers was asked by the Federal Judge Boasberg who is hearing the case to provide an opinion by the end of today “if they have one” as to whether or not DAPL should be shut down. It looks like the judge is punting it back to the U.S. Army Corps of Engineers to make a decision as to whether or not to shut down DAPL. The judge in a court ruling also asked the U.S. Army Corps to give its latest estimate on finishing a court mandated environmental review of the pipeline. A decision could be made as early as this week. DAPL is an operating 570,000 barrel per pipeline that The Standing Rock Sioux Tribe who claims DAPL could threaten its water supply wants it shut down now. The impact of a shutdown would be devastating to North Dakota, affect refineries and cost thousands of jobs according to sources.

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,444 from 23,819 a drop of 375 rail cars week over week. Canadian volumes were down week over week. CP shipments fell by 13.5% and CN were down by 0.4%. U.S. rail road operators were mostly lower, UP had the largest percentage decrease, down by 14% and the BN had the largest percentage increase up by 8.7%.

- CP & CN Fight over the KCS – Who is going to win? KCS board of Directors has agreed to negotiate with the CN about a possible merger. KCS said the CN proposal “could reasonably be expected to lead to a company superior proposal”. CN Chief executive JJ Ruest said “CN looks forward to completing its confirmatory diligence and finalizing its merger agreement with KCS promptly. Meanwhile CP downplayed the KCS board’s decision saying that KCS is simply meeting its obligations under the merger agreement with CP and fulfilling its fiduciary duty to KCS shareholders.

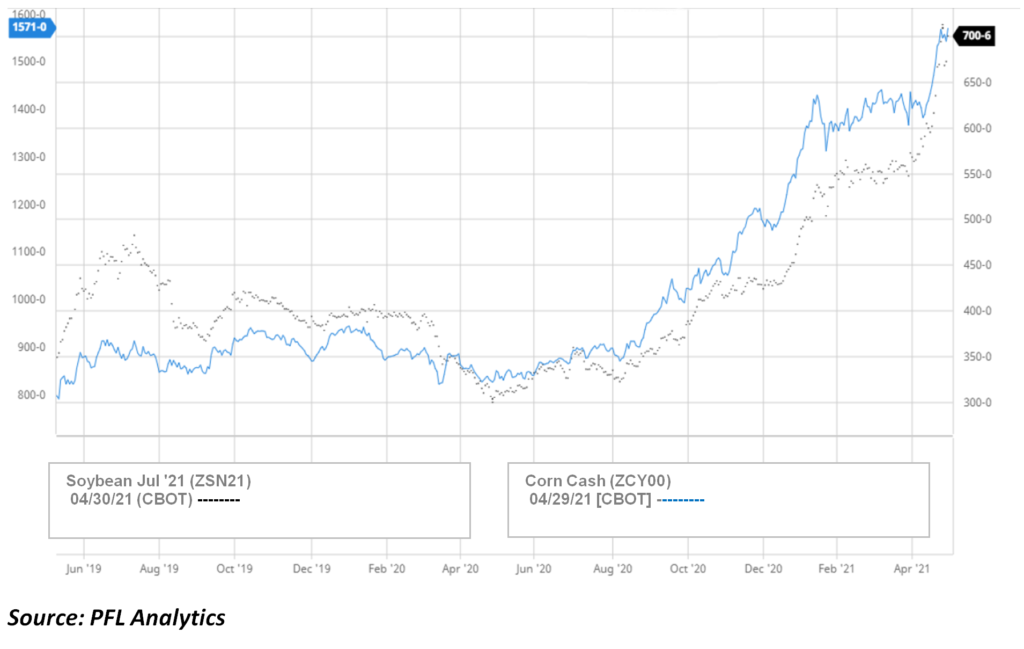

- Some refiners in the U.S. are shutting down and we may see more – get ready for higher gas prices at the pump – Why? Well, folks their compliance cost under the renewable fuels standards. If a refiner does not blend biodiesel or Ethanol they have to go and buy Renewable Identification Numbers commonly referred to as (“ RINS”) off of people that do blend. Prices have skyrocketed and last week hit all-time highs and refiners across the United States are feeling more than just a little pinch. Higher prices for corn and biomass-based diesel feedstock’s last week continue to prop up RIN credit values. Following three days of decreases last week, prices rose across soybean futures on Friday of last week. We observed the largest price change in the Jul 21 contract. In addition Corn markets opened up strong last week pushing above the $7.00 per bushel, before easing some in volatile trading sessions. Soybeans are used to make Biodiesel and Corn is used to make Ethanol – see chart below:

Corn and Soybean Pricing two year chart

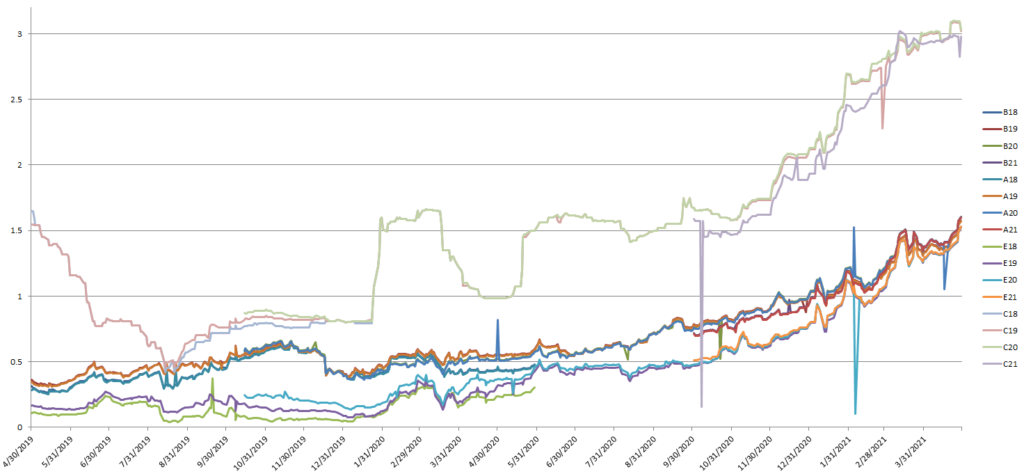

PFL has been involved in the RIN market since it’s inception and did the first brokered over the counter RIN trade and has tracked daily data as it relates to RIN pricing and the various vintages. Last week was a very busy week in the RIN’s market. Ethanol RINS (D6 RINS) on Friday closed out the day and the week at $1.50 and ½ of a cent per RIN 9 and ¼ cents per RIN week over week. Meanwhile, Biodiesel RINS (D4 RINS) closed at $1.55 and a ½ of a cent per RIN, up 7 cents per RIN week over week.

It’s not just RINS that some refiners need to contend with – if you have a refinery in California your dealing with LCFS credits but this is a story for another day. As compliance costs increase, it means that more renewables need to be produced and blended forcing refiners to potentially shut refineries and build or modify existing refineries to produce renewable fuels as Phillips is doing in the Bay area and PBF in NJ. Ultimately folks we pay for all this at the pumps. See chart below a 2 year history of RIN prices:

2019-2021 RIN Values

Source PFL Analytics

The good news for rail is the more renewables that are produced the more rail traffic – maybe we will be able soak up all the 28.3’s and 29.5’s out there. Please call PFL Analytics for more information as it relates to RINS.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|