“Clarifying things on the front end, when they first appear on the radar, rather than on the back end, after trouble has developed, allows people to reap the benefits of managing action.”

– David Allen

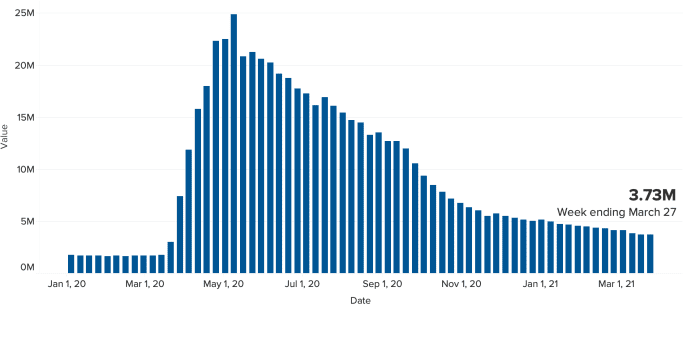

US Jobless Claims

The number of people seeking unemployment benefits rose higher than expected yet again last week to 744,000 which was 50,000 people above consensus and up from 719,000 from the week prior.

Continuing claims dropped by 16,000 people to 3.73 million which is the lowest level since March 21, 2020. (See chart below)

There are still approximately 9 million fewer workers than there was before COVID -19 as a result of lock downs in some states. The outlook looks positive with most blue states having a plan in place to slowly open their economies.

Markets were up Week over Week – Reaching all-time Highs

The Dow closed higher on Thursday of last week, up +171.66 (+0.52%) closing out the week at 33,153.21 points, up +80.33 points week over week. The S&P 500 closed higher on Thursday of last week, up +46.98 points (+1.18%) and closing out the week at 4,019.87, up +45.33 points week over week. The Nasdaq closed higher on Thursday of last week, up +233.23 points (+1.76%) closing out the week at 13,480.11 points, up +341.39 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 46 points.

Crude down week over week amid supply increases and new lockdowns

WTI crude oil for May delivery declined -$0.28 to settle at $59.32 a barrel on Friday of last week, down $2.13 a barrel week over week. Brent crude oil for May delivery also closed lower losing -$0.22 a barrel on Thursday of last week, closing at $62.95 a barrel, down $1.91 per barrel week over week. Oil declined week over week on concerns related to new lockdowns in Europe and elsewhere, growing Iranian production as talks continue with Iran to lift sanctions against that country. India has indicated that it is eagerly waiting to buy Iranian crude as soon as U.S. sanctions are lifted. Also, more OPEC+ barrels will make it to the market in the coming months as restrictions as easing.

U.S. commercial crude oil inventories decreased by 3.5 million barrels week over week. At 498.3 million barrels, U.S. crude oil inventories are 3% above the five-year average for this time of year. Total motor gasoline inventories increased by 4.0 million barrels week over week and are 2% below the five-year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories increased by 1.5 million barrels week over week and are 5% above the five year average for this time of year.

Propane and propylene inventories increased by 0.3 million barrels week over week and are 18% below the five year average for this time of year. Total commercial petroleum inventories increased by 2.3 million barrels last week. Backwardation continues and Mont Belvieu propane prices soared last week to over 97 cents per gallon as Asian demand continues.

U.S. crude oil imports averaged 6.3 million barrels per day last week, up by 119,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 5.8 million barrels per day, 5.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.3 million barrels per day, and distillate fuel imports averaged 325,000 barrels per day

U.S. crude oil refinery inputs averaged 15.0 million barrels per day during the week ending April 2, 2021 which was 103,000 barrels per day more than the previous week’s average. Refineries operated at 84.0% of their operable capacity last week. Gasoline production decreased last week, averaging 9.3 million barrels per day. Distillate fuel production decreased last week, averaging 4.6 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $60.11, up 79 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 17.6% year over year in week 13 (U.S. +20.0%, Canada +10.3%, Mexico +14.9%) resulting in year to date volumes that finished up 5.2% year over year (U.S. +5.6%, Canada +6.5%, Mexico -4.4%). 7 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+27.2%), motor vehicles & parts (+315.6%) and grain (+15.4%).

In the East, CSX’s total volumes were up 17.5%, with the largest increases coming from intermodal (+33.0%) and motor vehicles & parts (+182.4%). The largest decrease came from stone sand & gravel (-22.1%). NS’s total volumes were up 20.6%, with the largest increases coming from intermodal (+22.4%) and motor vehicles & parts (+543.8%).

In the West, BN’s total volumes were up 26.7%, with the largest increases coming from intermodal (+41.1%), grain (+35.2%), coal (+14.1%) and motor vehicles & parts (+184.0%). UP’s total volumes were up 16.5%, with the largest increases coming from intermodal (+31.1%), motor vehicles & parts (+183.0%) and grain (+38.8%). The largest decreases came from coal (-26.7%) and metals & products (-32.3%).

In Canada, CN’s total volumes were up 8.4%, with the largest increases coming from intermodal (+17.4%) and motor vehicles & parts (+274.5%). The largest decrease came from farm products (-60.3%). RTMs were up 0.2%. CP’s total volumes were up 15.3%, with the largest increases coming from intermodal (+18.2%), grain (+30.2%) and motor vehicles & parts (+199.6%). RTMs were up 13.0%.

KCS’s total volumes were up 15.4%, with the largest increases coming from intermodal (+26.6%), petroleum (+44.7%), motor vehicles & parts (+239.6%) and coal (+55.5%).

To sum up last month, total North American rail volumes were up 12.8% year over year in the past 4 weeks versus being down 1.2% year over year in the prior 4-week period. Overall, 6 of the 11 major volume categories posted year over year increases with the largest increases (in absolute carloads) coming from intermodal (+22.8% year over year), grain (+20.1% year over year) and motor vehicles & parts (+28.8% year over year). The largest decreases (in absolute carloads) came from chemicals (-3.2% year over year) and petroleum (-6.8% year over year). Excluding intermodal, volumes were up 3.2% year over year (vs. -9.1% year over year in the prior 4-week period).

Source: Stephens

Looking at the broader U.S. economy, the leading indicators continue (see PFL economic indicators below) to improve as vaccine distribution has accelerated and more re-opening has occurred or is incurring. Going forward, we are incrementally more optimistic about the recovery in 2021, and expect rail volumes to accelerate year over year in the months ahead due to a continuation of a strong consumer soon to be flush with cash to spend, inventory re-stocking, an improving industrial economy. We also expect a right sized fleet in 2021 as cars are put back into service and unwanted cars are scrapped. Please see PFL storage report on our website released last week CLICK HERE FOR PFL STORAGE REPORT

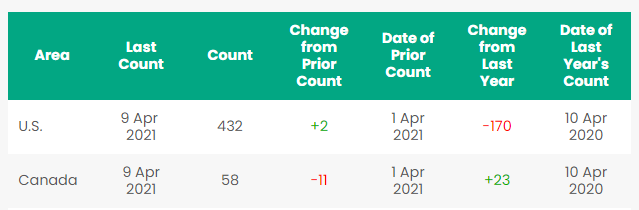

Rig Count

North America rig count is down by 9 rig’s week over week. The U.S. was up by 2 rigs week over week The U.S. currently has 432 active rigs. Canada’s rig count was down by 11 rigs week over week but up by 23 Rigs year over year and Canada’s overall rig count is 58 active rigs. Year over year we are down 147 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

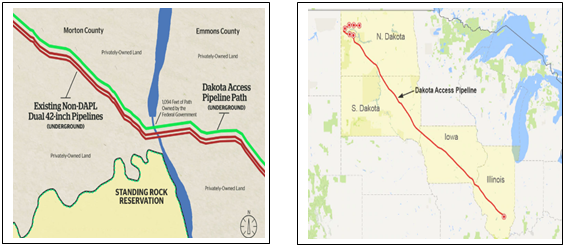

The Dakota Access Pipeline (“DAPL”)

The Biden administration punts DAPL shutdown, possibly leaving pipeline’s fate to a federal judge that ordered the pipeline shut down to begin with before an appellate court over turned the decision. In a much-anticipated federal court hearing on Friday of last week, attorneys from the Department of Justice and U.S. Army Corps of Engineers said they have not made up their minds on what to do about the North Dakota pipeline, possibly leaving its fate in the hands of a federal judge.

U.S. District Judge James Boasberg told attorneys that he was “a little surprised” that the Army Corps hadn’t reached a more definitive position at this point. The federal agency was previously scheduled to present its plans for the pipeline before Boasberg in February, but the judge granted them an extension at the time.

The further delay from the Biden administration may leave the fate of Dakota Access to Boasberg, the same federal judge who ordered an immediate shutdown of Dakota Access last summer. That order was overruled by a federal appellate court, but the Standing Rock Sioux Tribe opposed to the pipeline filed a separate shutdown motion before Boasberg last fall. The judge’s ruling on that motion could come down this spring.

The Standing Rock Sioux Tribe has opposed Dakota Access since its construction began in 2016 and argues that the pipeline’s operations endanger their water supply at its Missouri River crossing immediately north of their reservation. The pipeline does not touch tribal land and twins an existing non DAPL pipeline (See below).

Dakota Access Pipeline (DAPL)

The pipeline has the capacity to carry 570,000 barrels of oil a day from North Dakota’s Bakken region to markets across the country, and state regulators and pipeline operators have looked to nearly double that load over the next few years. In our minds, shutting down an existing pipeline that does not cross tribal lands is a dangerous precedent. The economic fallout if the pipeline is closed will set yet another devastating blow to North Dakota. The shutdown of the pipeline could lead to a boom for crude by rail. However, don’t get fooled – pipelines right now are an easy target – next it will be crude by rail is not safe. We see it coming – this is not just a war on pipelines which is arguably the safest mode of transportation – this is a war on conventional energy. Environmental groups are opposing anything to do with oil including offshore drilling permits and most recently the Biden Administration is facing significant pressure from environmental groups to block licensing of crude export projects along the U.S. Gulf Coast that would accommodate the loading of VLCC’s.

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 24,993 from 26,230 a drop of 1,237 rail cars week over week. Canadian volumes were down week over week on the back of continued higher basis differentials in Alberta. CP shipments fell by 7.4% and CN volumes were down by 12%. U.S. rail road operators were down across the board, CSX had the largest percentage decrease, down by 15.6%.

The Surface Transportation Board has been busy – a couple of items in the news:

- Shipping groups are praising the Surface Transportation Board’s (STB) effort to address issues with demurrage billing, saying the final rule brings transparency and accountability into the billing process. The final rule, which was published in the Federal Register on Tuesday of last week and will be effective on Oct. 6, calls for Class I carriers to “include certain minimum information on or with demurrage invoices and provide machine-readable access to the minimum information.” This information includes data such as the railcar number, the date the waybill was created, the status of the car, the dates and times of the actual placement of each railcar, and the original time of arrival for a car.

The machine-readable data requirement means the data will be provided in an open format that can be easily processed by computer. That will make shippers’ auditing process more efficient.

Seemingly the new requirements will help standardize what information is available across carriers and provide transparency. Demurrage and related fees levied by the Class I railroads cost shippers almost $1.4 billion in 2020 according to the American Chemistry Council (ACC), which calculated the figure using STB data. - In other STB news, the STB last week raised the minimum revenue level a railroad needs to meet before it is considered a Class I from $504.8 million to $900 million. Class II railroads must have revenue between $40.4 million and $900 million and railroads that are considered Class III railroads revenue below $40.4 million.

We are watching Economic Indicators Folks:

- Gross Domestic Product (GDP) – The First quarter GDP is expected to come in at 6%. If Q1 2021 growth is 6%, it would be the fastest for any quarter since 2003 (other than Q3 2020, which was an artificially high 33.4%).

- Purchasing Managers Index (PMI) – The PMI rose to 64.7% in March 2021, up from 60.8% in February and its highest level since 1983. The index has been above 50% for ten straight months. In a press release, Anthony Nieves, the chair of the ISM committee behind the Services of PMI, said, “Respondents comments indicate that the lifting of pandemic-related restrictions has released pent-up demand”.

- Industrial Output and Capacity Utilization – Manufacturing output, which accounts for around 75% of total output, decreased a preliminary 3.1% in February. The Fed said, “The cutback in the output of motor vehicles and parts, which reflected a global shortage of semiconductors and the severe weather, reduced overall manufacturing output.

- Consumer Confidence – The Conference Board’s index of consumer confidence surged from 90.4 in February to 109.7 in March, the third straight monthly gain. The index is now at its highest point since the pandemic began. Still a far cry away from the higher levels we saw in 2018 and 2019 which were at or close to 130, but we are looking better.

- Consumer Spending – Total U.S. consumer spending fell a preliminary 1.0% in February 2021 from January 2021, according to the Bureau of Economic Analysis. Economists blamed the decline on winter storms in much of the country that closed businesses and kept consumers home. Expect to see consumer spending to increase as people get their checks and pent-up demand is unleashed.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 80 Pressure cars 340s west or east coast 1-2 years dirty to dirty butane or propane – negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting April 1.

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken curde and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|