“Some days, doing ‘the best we can’ may still fall short of what we would like to be able to do, but life isn’t perfect on any front-and doing what we can with what we have is the most we should expect of ourselves or anyone else.”

– Mr. Fred Rogers

COVID-19

The United States currently has 30,962,803 confirmed COVID 19 cases and 562,526 confirmed deaths.

US Jobless Claims

The number of people seeking unemployment benefits fell sharply last week to 684,000, the fewest since the pandemic erupted a year ago and a sign that the economy is improving.

Last Thursday’s report from the Labor Department showed that jobless claims fell from 781,000 the week before. It is the first time that weekly applications for jobless aid have fallen below 700,000 since mid-March of last year. Before the pandemic tore through the economy, applications had never topped that level. The number of people seeking benefits under a federal program for self-employed and contract workers also dropped, to 241,000, from 284,000 a week earlier. All told, the number of applicants fell below 1 million for the first time since the pandemic.

Markets were Mixed Week over Week; Cyclical Strong, Tech Weaker

The Dow closed higher on Friday of last week, up +453.40 (+1.39%) closing out the week at 33,072.88 points, up +441.91 points week over week. The S&P 500 closed higher on Friday of last week, up +65.02 points (+1.66%) and closing out the week at 3,974.54, up +61.44 points week over week. The Nasdaq closed higher on Friday of last week, up +161.04 points (+1.24%) closing out the week at 13,138.72 points, down -76.52 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 165 points.

Crude Flat Week over Week

WTI crude oil for April delivery rose +$2.41 to settle at $60.97 a barrel Friday of last week, down $0.47 a barrel week over week. Brent crude oil for May delivery also rose higher gaining $2.62 a barrel on Friday of last week closing at $64.57 a barrel, up $.03 per barrel week over week. Oil barely moved last week as renewed lockdowns in Europe and Brazil muted the impact of the Suez Canal being shut.

U.S. commercial crude oil inventories increased by 1.9 million barrels week over week. At 502.7 million barrels, U.S. crude oil inventories are 6% above the five-year average for this time of year. Total motor gasoline inventories increased by 0.2 million barrels week over week and are 3% below the five-year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories increased by 3.8 million barrels week over week and are 1% above the five year average for this time of year.

Propane/propylene inventories increased by 0.2 million barrels week over week and are 13% below the five year average for this time of year. Total commercial petroleum inventories increased by 4.8 million barrels last week.

U.S. crude oil imports averaged 5.6 million barrels per day week over week, up by 0.3 million barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 9.5% less than the same four-week period last year.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $61.34, up 37 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 9.5% year over year in week 11 (U.S. +11.6%, Canada +6.5%, Mexico -4.5%) resulting in year to date volumes that are up 3.4% year over year (U.S. +3.5%, Canada +5.7%, Mexico -5.7%). 5 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+18.8%), grain (+29.0%) and coal (+4.6%). The largest decreases came from chemicals (-7.1%) and nonmetallic minerals (-6.5%).

In the East, CSX’s total volumes were up 2.4%, with the largest increase coming from intermodal (+13.9%). The largest decreases came from motor vehicles & parts (-16.0%) and petroleum (-28.6%). NCS’s total volumes were up 7.8%, with the largest increases coming from intermodal (+13.1%) and coal (+15.8%). The largest decrease came from petroleum (-31.0%).

In the West, BN’s total volumes were up 16.4%, with the largest increases coming from intermodal (+29.1%) and grain (+37.4%). UP’s total volumes were up 6.8%, with the largest increases coming from intermodal (+18.9%) and grain (+53.4%). The largest decreases came from chemicals (-12.4%) and motor vehicles & parts (-14.2%).

In Canada, CN’s total volumes were up 5.1%, with the largest increases coming from intermodal (+28.2%) and grain (+50.2%). The largest decreases came from petroleum (-29.3%) and coal (-31.4%). RTMs were down 4.4%. CP’s total volumes were up 6.1%, with the largest increases coming from intermodal (+6.9%) and grain (+20.9%). RTMs were up 8.1%.

KCS’s total volumes were up 2.1%, with the largest increases coming from petroleum (+39.3%) and coal (+82.1%). The largest decrease came from motor vehicles & parts (-32.9%)

Source: Stephens

Rig Count

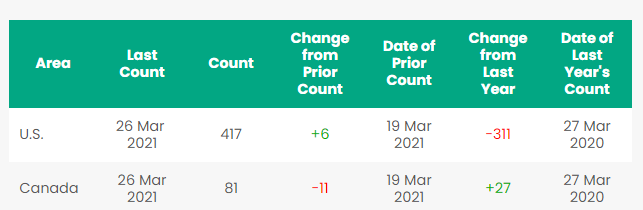

North America rig count is down by 5 rigs week over week. The U.S. was up by 6 rigs week over week The U.S. currently has 417 active rigs. Canada’s rig count was down by 11 rigs week over week and Canada’s overall rig count is 81 active rigs. Year over year we are down 284 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

Source: New York Times

- We have been watching the unprecedented event at Suez Canal, as we are sure everyone one else has. As of the writing of this report the ship Ever Given is partially free and traffic is to begin soon. With roughly 10% of world trade being disrupted the Canal has a long history of disruptions. Egypt nationalized the canal in 1956 and barred passage to Israeli ships. Israel then invaded the Sinai Peninsula and Gaza Strip. Egypt then closed the canal to all traffic. It remained closed for the next six months. The Suez Canal closed yet again in 1967 after the Six-Day War between Israel and Egypt. This time, the waterway was shut to all traffic for eight straight years, until 1975. As far as the oil trade goes the long closure sparked the construction of Very large crude carriers known as VLCC’s that can carry 2 million barrels of oil that can’t navigate through the narrow canal, so by the time the canal reopened in 1975, the majority of oil tankers were simply too large to fit. That is why we have not seen oil prices go too crazy at least not yet as only the smaller crude tankers can fit through the canal.

- The world is changing quickly – Iran and China on Saturday signed a 25-year strategic cooperation agreement addressing economic issues amid crippling U.S. sanctions on Iran. The agreement, dubbed the Comprehensive Strategic Partnership, covers a variety of economic activity from oil and mining to promoting industrial activity in Iran, as well as transportation and agricultural collaborations.

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads rose to 26,340 from 25,396 week over week on the back of continuing improvement in weather conditions. Canadian volumes suffered on the back of weaker differentials CP shipments fell by 25% and CN volumes were down by 15.7%. U.S. rail road operators were mixed, the UP had the largest percentage decline, down by 18.2% while BN’s shipments were up by 14.9%.

- Enbridge Line 5 – Ohio, Louisiana want to intervene in Line 5 federal lawsuit led by Michigan’s Governor Gretchen Whitmer who wants the pipeline shut down. The states, led by Ohio Attorney General Dave Yost, filed a request seeking amici status in Enbridge’s case against the state government’s revocation of its 1953 easement through the Straits of Mackinac. Ohio could lose up to 1,000 refinery employees in Toledo if Line 5 were shut down, the motion said. “The threat is not limited to Ohio or its refineries; it extends to workers, consumers and industries throughout Michigan, Ohio, Indiana and the surrounding region and could result in additional layoffs and other economic harm,” the motion said. The attempted closure of the pipeline has drawn criticism from the Canadian government, which also stands to lose refinery jobs and energy options should the pipeline be shuttered.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.Brian Baker

- 150 2400 CF Steel Gondolas needed for Iron Pyrite Service in Montana for 1-3 Years. Needed end of Q4 2021

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 10 30K Tank Cars for the Use in Veg Oil in the Midwest for 1-3 Years.

- 50 340W Pressure Cars needed for Butane in the Northeast for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 23.5K CPC 1232’s for the use in Asphalt service in the Midwest or Canada.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 150 steel gondolas 2400 in Montana for 3 years BNSF Negotiable

- 50 cars for the use of Asphalt in Chicago for 1 Year. Cars can be 23.5K or 25.5K.

- 30 28.3K Tank Cars for the use of Biodiesel in Chicago for 1 Year.

PFL is offering:

• 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

• 100-150 29K C/I 117J cars for lease. Dirty in Bakken curde and can be returned dirty.

• 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

• Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

• 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting April 1.

• Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

• 70 117Js in Texas dirty to dirty price negotiable

• 100 117Js 28.3 C/I for sale or lease in Texas

• 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

• 200 30K tankers cleaned and ready for service, for sale or lease,

• 218 73 ft 286 GRL riser less deck, center part for sale,

• 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

• 49 60’ Box cars 286 EOL refurbished in Tenn.,

• 20 low sided gondolas for lease in NJ 2743 cu ft,

• 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

• 10 food grade stainless steel cars

• 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

• 9 31.8 crude tanks in Detroit clean NS CSX CN Negotiable

• Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

• 70 117Js in Texas dirty to dirty price negotiable

• 100 117Js 28.3 C/I for sale or lease in Texas

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|