“The best argument against democracy is a five-minute conversation with the average voter.”

Winston Churchill

News Flash: Dow Jones futures plummeted Sunday night in overseas trading, along with S&P 500 futures and Nasdaq futures, as an all-out crude oil price war adds to coronavirus fears. Trading in S&P futures was halted in overnight trading once levels hit the maximum allowed drop of 5%. Covid-19 cases are increasing rapidly in the U.S. and Europe, with northern Italy on lockdown. Meanwhile, crude oil futures are crashing as Saudi Arabia ramped up production following Friday’s OPEC+ collapse. Treasury yields plunged to fresh record lows, approaching near zero yields.

Folks it was a busy week for conferences last week!

The Rail Equipment Finance Conference was held in Palm Springs, California. While we missed it this year due to conflicts, we were able to get a summary for you on the main topics of discussion.

Conference attendance held up well – Turnout was 350 people down just 20% year over year on COVID-19 concerns.

No quantifiable impact from the spread of COVID-19….yet! – Industry contacts, rail suppliers have not yet seen impacts on their businesses that are traceable to COVID-19. Specifically, no customer cancelations or deferments appear to have occurred as a result of the outbreak.

Intensifying demand headwinds in near term is base case assumption but abrupt spring/summer recovery is possible- There appears to be consensus that freight demand will come under further pressure in the next several weeks as a result of COVID-19 disruptions of global supply chains and potential negative impact on consumer spending. However, if springtime virus containment hopes materialize, a somewhat abrupt rebound could occur, driven by replenishment of depleted inventories.

Demand remains soft but has not worsened materially in recent weeks – Railcar inquiries remain fairly solid, but translation into orders continues to be low. Industry orders came in at 9,500 units and 8,400 units in Q319 and Q419, respectively. This is apparently below projected replacement demand.

PFL did attend the Opis LPG Summit last week in San Diego and SWARS in Galveston

Main topics of discussion Opis:

Attendance was lower than anticipated but Canadians were there in full force escaping the cold! Many Energy companies have instituted non-essential travel bans including BP and Shell over COVID-19.

Pressure car length and tightening supply seemed to be the theme (for now – we all know how quickly that can change in the LPG space) – New projects are coming on line in the not so distant future and we are seeing a barrel shift with more supply being supply being sourced from Mont Belvieu to export into Mexico. Sending Edmonton bbls into Mexico is no longer favorable and more of Canadian LPG’s are making their way to the West Coast for export overseas.

Main topics of discussion SWARS

Attendance was robust – receptions were full and the speakers great. Service companies and storage companies are happy and busy. Lessees looking to reposition fleets and lessors are looking for market share.

If you have any questions about any of the above conferences or want to troubleshoot with PFL please call us now at 239-390-2885. We will be attending SEARS on Tuesday and speaking on storage trends and hope to see you there!

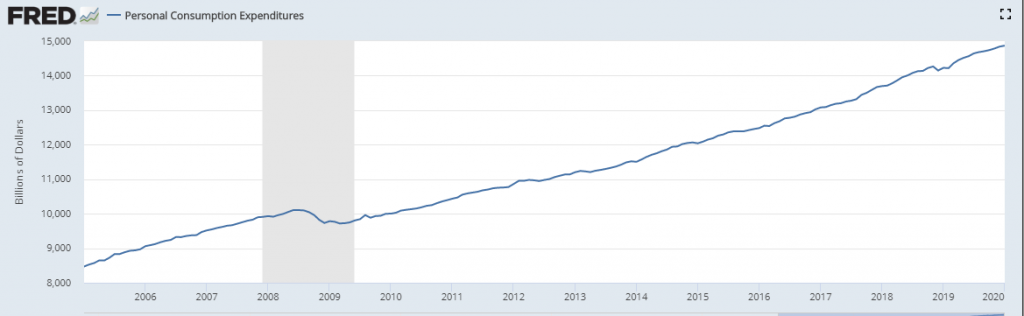

The impact of COVID-19 on world economies is not over yet as markets struggle to define a bottom. The market’s gradual rise to record highs over the first three weeks of February took a sudden turn in the final week of the month, resulting in heavy losses for equity indexes. The Dow dropped around 10% for the month, the S&P 500 tumbled around 8%, and the NASDAQ fell around 6%. Last week, believe it or not, was slightly up week over week. There is uncertainty as to how COVID-19 will continue to effect supply chains, demand destruction and ultimately consumer spending – the life blood of the U.S. economy. U.S. consumer spending grew 0.2% in January 2020 from December 2019. The average month over month gain was 0.4% in the first half of 2019 and 0.3% in the second half, so spending was already slowing over the course of last year. Anything at or above 0.3% from one month to the next is considered pretty good; January’s 0.2% is on the weaker side.

If the COVID-19 spreads widely into U.S. communities, consumers are likely to limit their exposure to stores, theaters, restaurants, sporting events, air travel, and other places where people congregate in confined spaces. There is likely to be some advance buying and increased online shopping, but much of the discretionary spending that we have seen may not occur.

The danger we run if we see a continued decline in equities is that consumers may not feel as rich as they once were and tighten their purse strings accordingly, especially as more Baby Boomers continue to approach retirement. Though consumer spending growth is slowing, personal consumption expenditures are currently about 70% of US economic output. The most recent numbers for Personal consumption expenditures (PCE) are at an all-time high of $14.87 trillion, with total US GDP around $21 trillion. If consumer spending starts to wane, the whole economy could suffer. Let’s hope we don’t get to that point so keep spending America.

Total North American rail volumes were down 8.3% year over year in week 9 (U.S. -9.6%, Canada -4.7%, Mexico -4.4%), resulting in quarter to date volumes that are down 5.1% (U.S. -6.8%, Canada -2.0%, Mexico +7.2%). 7 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-12.4%), coal (-20.8%), non-metallic minerals (-5.2%) and grain (-5.8%). The largest increases came from petroleum (+16.7%), farm products & food (+13.9%) and metallic ores & metals (+4.6%).

In the East, CSX’s total volumes were down 2.9%, with the largest decrease coming from coal (-31.4%). The largest increase came from petroleum (+38.6%). NSC’s total volumes were down 11.5%, with the largest decreases coming from intermodal (-8.6%) and coal (-35.2%).

In the West, BN’s total volumes were down 10.1%, with the largest decreases coming from intermodal (-15.5%), coal (-20.0%) and stone sand & gravel (-19.7%). UP’s total volumes were down 7.7%, with the largest decreases coming from intermodal (-19.7%), coal (-9.6%) and stone sand & gravel (-18.7%). The largest increases came from petroleum (+39.9%) and chemicals (+7.0%).

In Canada, CN’s total volumes were down 13.4% with the largest decreases coming from intermodal (-26.4%), grain (-33.1%) and motor vehicles & parts (-24.0%). The largest increases came from metallic ores (+16.2%) and farm products (+119.6%). RTMs were down 9.3%. CP’s total volumes were up 15.6%, with the largest increases coming from intermodal (+14.6%), petroleum (+79.7%) and chemicals (+19.6%). The largest decreases came from grain (-22.9%) and coal (-15.5%). RTMs were up 14.7%.

KCS’s total volumes were up 1.7%, with the largest increase coming from petroleum (+56.7%). The largest decrease came from coal (-35.4%).

For the month of February North American rail volumes declined 6.6% year over year compared to the 3.8% year over year decrease in January. While COVID-19 may have played some role in the weakness, volumes were also negatively impacted by rail blockades in Canada, accelerating coal declines and lingering headwinds from trade and economic uncertainty.

Looking ahead, we expect rail volume weakness to persist in the near term.

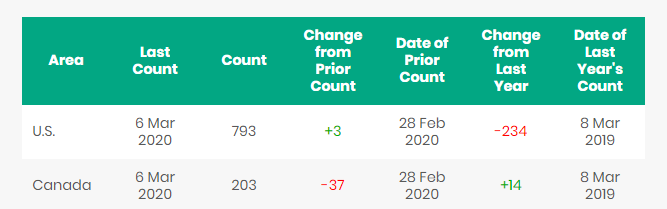

North American Rig count is down 34 rigs week over week with the U.S. gaining 3 rigs and Canada losing 37 rigs week over week. Year over year we are down 220 rigs collectively.

North American Rig Count Summary

PFL is offering: 340Ws for long and short term lease, 117Rs last in diesel service, various box cars for lease, 31.8’s clean and last in refined products and 25.5K 117Js coiled and insulated, 5000 CFC Center Flow Pressureaide Covered Hopper cars that have recently been cleaned.Call PFL for details today!

PFL is seeking: 23.5Ks and 25.5Ks for fuel oil products, 117s with magnetic gauging devices for lease, 89 ft flat cars for purchase, 100 mil gons for short term lease, 117Js last in ethanol, and 4750s for use in coke service.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|