“It always seems impossible until it is done”

– Nelson Mandela

COVID-19

The United States currently has 30,081,657 confirmed COVID 19 cases and 547,234 confirmed deaths.

US Jobless Claims

In the week ending March 6th, initial claims were 712,000, a decrease of 42,000 from the previous week’s revised level. The previous week’s level was revised up by 9,000 from 745,000 to 754,000. The 4-week moving average was 759,000, a decrease of 34,000 from the previous week’s revised average. The advance seasonally adjusted insured unemployment rate was 2.9 percent for the week ending February 27, a decrease of 0.2 percentage point from the previous week’s revised rate. The previous week’s rate was revised up by 0.1 from 3.0 to 3.1 percent. The advance number for seasonally adjusted insured unemployment during the week ending February 27 was 4,144,000, a decrease of 193,000 from the previous week’s revised level. The previous week’s level was revised up 42,000 from 4,295,000 to 4,337,000. The 4-week moving average was 4,355,000, a decrease of 103,500 from the previous week’s revised average. The previous week’s average was revised up by 10,500 from 4,448,000 to 4,458,500.

Markets Higher Week over Week Dow up Big

The Dow closed higher on Friday of last week, up +293.05 (+.90%) closing out the week at 32,778.64 points, up +1,534.64 points week over week. The S&P 500 closed higher on Friday of last week, up +4.00 points (+.10%) and closing out the week at 3,943.34 points, up +91.59 points week over week. The Nasdaq closed lower on Friday of last week, down -78.81 points (-0.59%) closing out the week at 13,319.86 points, up +248.61 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 116 points.

Despite a Higher US Dollar Crude Closes Lower Week Over Week

Oil fell for the first week in two months. With the rally losing steam, oil prices are reported as getting to far ahead of themselves and are correcting accordingly. Despite a higher U.S. dollar and Saudi Arabia announcing last week that it would extend the extra one million barrel per day cut into April. WTI crude oil for April delivery declined -$0.41 to settle at $65.61 a barrel Friday of last week, down $0.48 a barrel week over week. This was the first weekly decline in eight weeks! Brent crude oil for May delivery also lost 41 cents a barrel on Friday of last week closing at $69.22 a barrel, down $0.14 per barrel week over week.

U.S. commercial crude oil inventories increased by 13.8 million barrels week over week. At 498.4 million barrels, U.S. crude oil inventories are 6% above the five year average for this time of year. Total motor gasoline inventories decreased by 11.9 million barrels week over week and are 6% below the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week. Distillate fuel inventories decreased by 5.5 million barrels week over week and are 4% below the five year average for this time of year. Propane/propylene inventories were virtually unchanged week over week and are 15% below the five-year average for this time of year. Total commercial petroleum inventories increased by 1.3 million barrels last week.

U.S. crude oil refinery inputs averaged 12.3 million barrels per day during the week ending March 5, 2021 which was 2.4 million barrels per day more week over week. Refineries operated at 69.0% of their operable capacity last week. A far cry from the 84.9% utilization rate pre Texas freeze but we are getting there. Expect to see an increase in refinery utilization a draw down on crude replenishment of gasoline and distillates. Gasoline production did increase last week, averaging 9.0 million barrels per day. Distillate fuel production did increase last week as well, averaging 3.7 million barrels per day.

U.S. crude oil imports averaged 5.7 million barrels per day last week, a decrease of 600,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 5.6 million barrels per day, 11.7% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 577,000 barrels per day, and distillate fuel imports averaged 472,000 barrels per day

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $65.56, down .05 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 9.2% year over year in week 9 (U.S. +11.4%, Canada +6.6%, Mexico -7.3%) resulting in year to date volumes that are up 2.0% year over year (U.S. +1.7%, Canada +5.3%, Mexico -5.7%). 5 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+19.3%) and grain (+32.0%). The largest decreases came from chemicals (-9.6%) and nonmetallic minerals (-9.5%).

In the East, CSX’s total volumes were up 2.6%, with the largest increases coming from intermodal (+11.7%) and coal (+8.9%). The largest decrease came from motor vehicles & parts (-27.9%). NS’s total volumes were up 10.8%, with the largest increases coming from intermodal (+16.8%), coal (+19.5%) and stone, sand & gravel (+53.7%).

In the West, BN’s total volumes were up 16.7%, with the largest increases coming from intermodal (+31.0%) and grain (+41.0%). The largest decreases came from petroleum (-30.4%) and chemicals (-10.9%). UP’s total volumes were up 5.6%, with the largest increases coming from intermodal (+21.9%), grain (+38.0%). The largest decreases came from chemicals (-17.7%), motor vehicles & parts (-21.7%) and stone sand & gravel (-22.6%).

In Canada, CN’s total volumes were up 10.0%, with the largest increases coming from intermodal (+36.7%) and grain (+73.9%). The largest decreases came from coal (-29.7%), petroleum (-18.0%) and stone, sand & gravel (-34.7%). RTMs were up 3.8%. CP’s total volumes were down 1.8%, with the largest decrease coming from intermodal (-9.8%). The largest increase came from grain (+48.1%). RTMs were up 3.1%.

KCS’s total volumes were up 6.2%, with the largest increases coming from intermodal (+11.2%) and coal (+57.9%).

Source: Stephens

Rig Count

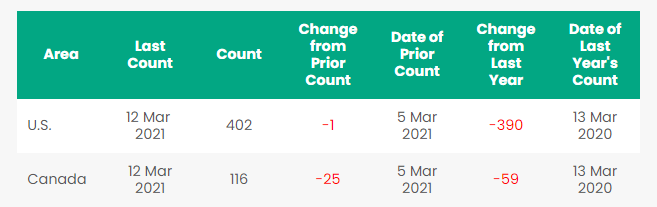

North America rig count is down by 26 rigs week over week. The U.S. was down by 1 rig week over week The U.S. currently has 402 active rigs. Canada’s rig count was down by 25 rigs week over week and Canada’s overall rig count is 116 active rigs. Year over year we are down 449 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

1. Well, our hats are off to SWARS – PFL attended SWARS rail conference in San Antonio last week. SWARS was the last conference we attended pre-COVID and the first we attended a year later, so it was sentimental in a way and we were a big sponsor and promoter of the event on the back of it! Attendance was around 300, a far cry from the 700 people that attended a year prior in Galveston but restrictions and social distancing Texas style were in place. We were thrilled to meet with many colleagues that we have not seen in a while. The theme of the conference was “On Track to Recovery” and participants at the conference were upbeat and looking to do deals. Speaker from the KCS, McCombs School of Business, NS and others did a great job it was a great lineup of speakers. The Keynote address was from James Cairns from CN and spoke on “Regaining & Retaining in a COVID World.” If you would like to discuss SWARS please give us a call at 239-390-2885 – PFL is looking forward to the next industry conference!

2. Brookfield Infrastructure who recently bought G&W takes a run at Inter Pipeline and is committed to a hostile takeover – Brookfield said on Thursday of last week it is committed to its C$7.1 billion (US$5.65 billion) hostile takeover offer for Inter Pipeline Ltd. despite the pipeline company’s board turning down the bid. Brookfield said that its offer is in the best interest of the company’s shareholders. Inter Pipeline on Tuesday asked its shareholders to reject the offer, saying it “significantly undervalues” the oil and gas Transportation Company. Inter Pipeline expects a superior offer or other alternatives to emerge and said it is looking for a partner for its C$4 billion Heartland Petrochemical Complex in Alberta that is due to start operating in early 2022. The Heartland Petrochemical Complex will consume 22,000 b/d of locally-sourced propane to produce 525 kilotons per annum of polypropylene, a high-value, easily transported plastic used in the manufacturing of a wide range of finished products. According to Inter Pipeline, the Heartland Complex will materially diversify and strengthen Inter Pipeline’s existing large-scale NGL processing business, while creating an attractive new market for Alberta propane. Construction is well underway at the Strathcona County near Inter Pipeline’s existing Redwater Fractionator. See below:

Heartland Petrochemical Complex

3. Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,448 from 24,021 week over week on the back of improved weather conditions. CP shipments rose by 15.2% and CN volumes were up by 2.4%. U.S. rail road operators were mostly higher, the NS had the largest percentage increase, up by 22.3%

4. Enbridge Line 5 – Some Propane suppliers reliant on Enbridge’s Line 5 are transitioning to railroad cars to get their products in anticipation of the oil pipeline shutting down in May. A hope maybe for depressed pricing for LPG cars. On November 13, 2020 Whitmer gave Enbridge until May 2021 to decommission Line 5 after announcing the easement revocation following a yearlong DNR compliance review. Enbridge says the aging pipeline is safe, but opponents have been arguing for years that the risk posed by an oil spill where Lakes Michigan and Huron connect is too great. Enbridge pushed back on Whitmer’s order, filing a lawsuit and saying it won’t comply with the shutdown absent a court order. As the legal battle continues, the state task force continues to identify areas where consumer protections can be strengthened and energy efficiency enhanced, including using brownfield sites for propane storage, increasing storage capacity, and offering rail development funding available to propane providers. The governor really wants this pipeline shut down it seems to be her little pet project – stay tuned.

5. We are watching the changing trends of oil production – Promises by U.S. shale producers to pursue a more restrictive approach to capital investment and production seem to have emboldened Saudi Arabia and its allies in OPEC+ to test the room for higher oil prices.

If shale firms respond to higher prices and revenues by returning capital to lenders and investors, rather than increasing output, there may be an opportunity for OPEC+ to let prices rise without losing market share. “Drill, baby, drill is gone for ever. Shale companies are now more focused on dividends,” the Saudi energy minister said in an interview on March 4.

“It’s the shale companies which are themselves changing. They have had their fair share of adventure and now they are listening to the call of their shareholders.” The kingdom’s interest in testing support for higher prices comes when many investors are expecting a strong upward cycle, or even supercycle, in oil and other commodity prices. Strong economic growth after the COVID-19 pandemic, coupled with expansionary fiscal and monetary policies, is expected to accelerate consumption growth for oil and other commodities.

At the same time, production of oil and other commodities will be constrained by lack of investment during the price slump in 2020 and early 2021 as well as the newfound enthusiasm for “capital discipline”. In the case of oil, some analysts are forecasting one last supercycle over the next few years before widespread deployment of electric vehicles in the late 2020s and through the 2030s starts to hit consumption.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 35 3000-3400 CF Aluminum Hoppers with Manual Knocker Gates for the use in Sulfur in Alberta for 3-5 Years.

- 150 2400 CF Steel Gondolas needed for Iron Pyrite Service in Montana for 1-3 Years. Needed end of Q4 2021

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 10 30K Tank Cars for the Use in Veg Oil in the Midwest for 1-3 Years.

- 50 340W Pressure Cars needed for Butane in the Northeast for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 23.5K CPC 1232’s for the use in Asphalt service in the Midwest or Canada.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 150 steel gondolas 2400 in Montana for 3 years BNSF Negotiable

- 50 cars for the use of Asphalt in Chicago for 1 Year. Cars can be 23.5K or 25.5K.

- 30 28.3K Tank Cars for the use of Biodiesel in Chicago for 1 Year.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting April 1.

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 9 31.8 crude tanks in Detroit clean NS CSX CN Negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|