“Being on par in terms of price and quality only gets you into the game. Service wins the game.”

Tony Alessandra.

COVID-19

The United States currently has 28,765,423 confirmed COVID 19 cases and 511,133 confirmed deaths.

US Jobless Claims

The Department of Labor released its weekly report on new jobless claims Thursday morning of last week detailing another 861,000 workers filed for first time unemployment benefits according to seasonally adjusted data released from the Labor Department. That’s nearly 100,000 more claims than economists had predicted and the highest number in a month. It was also an increase from the week before — which was revised higher as well!

America’s jobs recovery has really lost steam and last week’s initial claims were four times higher than in the same period last year. Quite frankly folks, we are getting tired of reporting the bad news especially when we are seeing good jobs disappear overnight with a stroke of a pen. For example the cancellation of Keystone and the economy and schools not reopening as promised. The worst is not over in our opinion, as we have yet to see the trickle-down effect of recent decisions made, so buckle up, folks.

Markets closed mostly lower Week over Week over a weaker Economic Outlook

The Dow closed higher on Friday of last week, up +.98 (+0.00%) closing out the week at 31,494.32 points, up 35.92 points week over week. The S&P 500 closed lower on Friday of last week, down -7.26 points (-0.19%) and closing out the week at 3,906.71 points, down 28.12 points week over week. The Nasdaq closed higher on Friday of last week, up +9.11 points (+0.07%) closing out the week at 13,874.46 points, down 221.01 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning -177.00 points.

WTI Lower Week over Week – Gulf Coast Refineries Slow to Get Operating

WTI crude oil for March delivery declined -$1.28 to $59.24 a barrel Friday of last week, down 23 cents per barrel week over week. Brent crude oil for April delivery declined -$1.02 to $62.91 a barrel Friday of last week, up 48 cents per barrel week over week.

U.S. commercial crude oil inventories decreased by 7.3 million barrels week over week. At 461.8 million barrels, U.S. crude oil inventories are at the five year average for this time of year. Total motor gasoline inventories increased by 0.7 million barrels week over week and are 1% above the five year average for this time of year. Finished gasoline and blending components inventories both increased last week. Distillate fuel inventories decreased by 3.4 million barrels week over week and are 6% above the five year average for this time of year. Propane/propylene inventories decreased by 2.9 million barrels week over week and are 9% below the five-year average for this time of year. Total commercial petroleum inventories decreased by 15.1 million barrels week over week.

U.S. crude oil imports averaged 5.9 million barrels per day last week, up by 41,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 5.8 million barrels per day, 13.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 670,000 barrels per day, and distillate fuel imports averaged 362,000 barrels per day.

Oil is higher in overnight trading and WTI is poised to open at $59.77 up 53 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 0.2% year over year in week 6 (U.S. +0.3%, Canada +2.8%, Mexico -8.7%) resulting in year to date volumes that are up 3.3% year over year (U.S. +4.0%, Canada +5.4%, Mexico -14.1%). 2 of the AAR’s 11 major traffic categories posted year over year increases with the largest increase coming from intermodal (+7.8%). The largest decreases came from coal (-11.0%) and nonmetallic minerals (-17.8%).

In the East, CSX’s total volumes were up 1.3%, with the largest increase coming from intermodal (+8.6%). The largest decreases came from motor vehicles & parts (-26.4%) and petroleum (-28.4%). NS’s total volumes were down 0.8%, with the largest decrease coming from petroleum (-39.0%) and motor vehicles & parts (-13.5%). The largest increases came from intermodal (+2.2%).

In the West, BN’s total volumes were down 3.5%, with the largest decreases coming from coal (-25.6%), petroleum (-35.6%) and stone sand & gravel (-46.9%). The largest increases came from intermodal (+7.2%) and grain (+10.8%). UP’s total volumes were down 0.6%, with the largest decreases coming from coal (-19.3%), petroleum (-34.0%), motor vehicles & parts (-20.8%) and stone sand & gravel (-25.6%). The largest increases came from grain (+52.8%) and intermodal (+7.6%).

In Canada, CN’s total volumes were up 10.3%, with the largest increases coming from intermodal (+39.1%) and grain (+66.6%). The largest decrease came from motor vehicles & parts (-27.2%). RTMs were up 10.7%. CP’s total volumes were down 12.5%, with the largest decreases coming from intermodal (-12.6%), petroleum (-35.5%) and chemicals (-19.4%). RTMs were down 15.7%.

KCS’s total volumes were down 4.6%, with the largest decrease coming from motor vehicles & parts (-37.9%).

Source: Stephens

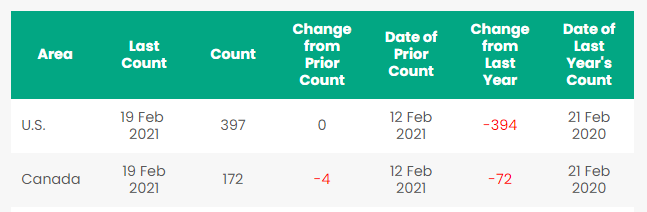

Rig Count

North America rig count is down by 4 rigs week over week. The U.S. was flat week over week (oil rigs were down 1 to 305, gas rigs up 1 to 91, and miscellaneous rigs unchanged at one rig, according to Baker Hughes). The U.S. currently has 397 active rigs. Canada’s rig count was down by 4 rigs week over week and Canada’s overall rig count is 172 active rigs. Year over year we are down 466 rigs collectively.

North American Rig Count Summary

Things we are keeping an eye on

The Situation in Texas

Folks, all eyes were on Texas last week – The Vortex invaded Texas in a big way. We all know a lot of people in the great State of Texas and our hearts go out for all and the suffering our colleagues had to endure. What we know from what happened this past week is that we need more pipelines not less! What is really cool is how people work together behind the scenes to get people what they need without people even realizing it! The average consumption of Natural Gas in the United States is 85.7 bcf/day. TC Energy delivered to the U.S. through their pipeline network 101 BCF over a 3 day period, so Americans would not freeze and would be able to use the natural gas for heating and for electricity generation. Folks, this was a record for peaking supply delivered by TC Energy the same people that got their pipeline cancelled (Keystone). I don’t know about you, but we are proud of them for turning the other cheek and helping us out!

The situation right now in Texas is very complex and how it plays out is anyone’s guess. From the demand side a number of refineries and plants declared force majeure and simply ceased operating cutting off a huge chunk of demand for oil, gas and power. Here is a list of what we know about:

- Total: 1.15 million mt/year PP, La Porte, Texas

- Formosa Plastics USA: 513,000 mt/year PVC, 653,000 mt/year VCM, Baton Rouge, Louisiana

- Lotte Chemical: 700,000 mt/year MEG, Lake Charles, Louisiana

- Sasol: 463,000 mt/year cracker, 380,000 mt/year EO/MEG, Lake Charles, Louisiana

- Braskem: 360,000 mt/year PP Freeport, Texas; 475,000 mt/year PP La Porte, Texas; 225,000 mt/year PP Seadrift, Texas

- ExxonMobil: Cumulative 1.53 million mt/year from three units, HDPE and LLDPE capacity, Mont Belvieu, Texas

- Indorama Ventures: Port Neches, Texas, 235,867 mt/year cracker, 1 million mt/year ethylene oxide/monoethylene glycol unit, 238,135 mt/year propylene oxide unit, and 988,000 mt/year of MTBE capacity; Clear Lake, Texas, 435,000 mt/year EO, 358,000 mt/year MEG.

- Olin: Freeport, Texas complex, with 3 million mt/year of caustic soda and 2.73 million mt/year of chlorine capacity; 748,000 mt/year of EDC

- OxyChem: Ingleside, Texas, 544,000 mt/year cracker; 248,000 mt/year chlor-alkali; 680,000 mt/year EDC; Deer Park and Pasadena, Texas, 1.27 million mt in PVC capacity; 1.79 million mt/year of VCM capacity; 580,000 mt/year chlor-alkali

- Shintech: Freeport, Texas: 1.45 million mt/year PVC

- Formosa Plastics USA: Entire Point Comfort, Texas, complex, including three crackers with a cumulative capacity of 2.76 million mt/year; 875,000 mt/year of high density polyethylene; 400,000 mt/year of low density PE; 465,000 mt/year of linear low density PE; two PP units with combined capacity of 1.7 million mt/year; 798,000 mt/year of PVC; 1 million mt/year of caustic soda and 910,000 mt/year of chlorine; 753,000 mt/year of VCM; 1.478 million mt/year of EDC; and a cumulative 1.17 million mt/year of monoethylene glycol operated by sister company Nan Ya Plastics.

- ExxonMobil: Baytown, Texas, refining and chemical complex, including three crackers with a combined capacity of 3.8 million mt/year; 800,000 mt/year PP

- ExxonMobil: Beaumont, Texas, refining and chemical complex, including an 826,000 mt/year cracker; 225,000 mt/year HDPE; 240,000 mt/year LDPE; 1.19 million mt/year LLDPE with some HDPE capacity

- Dow Chemical: Certain units offline within Dow sites along the US Gulf Coast, but the company did not specify. Dow’s Gulf Coast operations include a complex at Freeport, Texas, with three crackers able to produce a combined 3.2 million mt/year, two LDPE units with 552,000 mt/year and 186,000 mt/year HDPE; Dow’s Seadrift, Texas, complex includes 490,000 mt/year LLDPE and 390,000 mt/year HDPE; Dow told South American customers in a letter dated Feb. 16 that the company was assessing impact on PE production capacity “and we know that our ability to supply various products could be affected.”

- TPC Group: Houston site shut down, including 544,310 mt/year butadiene unit, when boilers lost steam

- Motiva Chemicals: Port Arthur, 635,000 mt/year mixed-feed cracker

- Shell: Deer Park, Texas, refining and chemical complex, including two crackers with a combined 961,000 mt/year of capacity

- Shell: Norco, Louisiana, refining and chemical complex, including two crackers with a combined capacity of 1.42 million mt/year

- Chevron Phillips Chemical: Pasadena, Texas, 998,000 mt/year HDPE

At the same time, production was severely affected by the extreme cold. Restarting oil and gas wells closed by the extreme cold sweeping much of the U.S. isn’t going to be quick or easy, even once the ice thaws and power is restored. Oil production nationwide has been cut by at least a third and in the Permian Basin of Texas, the heart of America’s shale industry, output has plummeted by as much as 65%. However, bringing flows back is likely to take much longer than it took for them to come off line.

Most wells produce a mixture of oil, gas and water and it is water that causes the problems. Although it may leave the well at boiling point, water immediately comes into contact with steel pipes more than a hundred degrees colder. That can cause it to freeze, choking off the flow from the well.

Water can still cause problems even after it’s been separated from oil and gas. If pipes carrying waste water away freeze, and if you can’t get rid of the water from the well you have no choice but to shut the well in.

The other big problem operator’s face is their reliance on electricity from the grid to run pumps, compressors and the electronics monitoring and reporting from the drilling pad. Lose power and you lose flow and that’s when lines freeze.

Warmer weather will help and pipelines should begin to thaw naturally. That will allow oil and gas to start flowing again, but that’s only the start. Some well sites could have experienced mechanical damage, with freezing water expanding to crack valves, compressors, and pipes.

There is a tremendous amount of water produced with oil and gas, so in areas with higher water, you’re going to have burst pipes. Safety will be paramount because of the hydraulics being damaged. So it’s going to take some time and money to get things back online. Getting to the well sites is going to be a challenge with all of the melting snow and who is going to do the work? So many people have been laid off in the oil patch. Folks, stay tuned we are certainly not out of the woods yet and it really is anyone’s guess. Be prepared for extremely volatility in energy markets in the days to come. The Texas deep freeze has become a global crisis as the world scrambles to fill supply and market chains.

FERC

Before Texas even began to thaw the Federal Energy Regulatory Commission (“FERC”) moves last week Boost Biden’s Energy Plan. FERC could shift Biden’s clean energy plan for the Texas grid. FERC Chairman Richard Glick announced a series of decisions on Friday of last week that could significantly alter Texas’ grid and boost President Biden’s zero-carbon and environmental justice goals. The influential panel moved to revise its natural gas pipeline reviews to account for impacts to disadvantaged communities, break down market barriers to renewable energy deployment and shutter a Trump-era inquiry into grid resilience, among other actions.

Economic and National Security Impacts under a Hydraulic Fracturing Ban

The US Department of Energy submitted a report to the president last month on “Economic and National Security Impacts under a Hydraulic Fracturing Ban.” This 80-page report analyzed the effects of a hypothetical United States ban on high-volume hydraulic fracturing technology used with any new or existing onshore wells starting in 2021 through 2025. Such a ban, the report predicts, would result in the loss of millions of jobs, price spikes at the gas pump, and higher electricity costs for all Americans. The report goes on to predict that a ban would eliminate the United States’ status as the top oil and gas producing country, return the United States to a net importer of oil and gas by 2025, weaken the United States’ geopolitical standing, and negatively affect its national security. Anyone with the time to have a read please click here .

Petroleum By Rail

The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 26,053 from 27,492 week over week. Canadian volumes were lower on the back of weather delays. CP shipments fell by 5.4% and CN volumes were down by 11%. U.S. rail road operators fell system wide. UP had the largest percentage loss, down by 23.1%.

Surface Transportation Board

The Surface Transportation Board (STB) has released January headcount data for the U.S. rails. For the industry as a whole, January headcount was down 11.6% year over year versus December headcount that was down 10.4% year over year. On a sequential basis, industry headcount was down 3.7% vs. the 5-year January average of down 1.5%.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 35 3000-3400 CF Aluminum Hoppers with Manual Knocker Gates for the use in Sulfur in Alberta for 3-5 Years.

- 50 25.5K-29K CPC 1232’s for the use in Bitumen Service in Saskatchewan for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 31.8K CPC 1232’s for the use in Condensate in the Northeast for 1 Year. Must have Mag Rods.

- 10 30K Tank Cars for the Use in Veg Oil in the Midwest for 1-3 Years.

- 50 340W Pressure Cars needed for Butane in the Northeast for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 23.5K CPC 1232’s for the use in Asphalt service in the Midwest or Canada.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 150 steel gondolas 2400 in Montana for 3 years BNSF Negotiable

- 50 cars for the use of Asphalt in Chicago for 1 Year. Cars can be 23.5K or 25.5K.

- 30 28.3K Tank Cars for the use of Biodiesel in Chicago for 1 Year.

- 25 CPC 1232s 31.8 Texas off UP 3 month to one year refined product negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 9 31.8 crude tanks in Detroit clean NS CSX CN Negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riserless deck, center part for sale.

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas.

- 49 60’ Box cars 286 EOL refurbished in Tenn.

- 20 low sided gondolas for lease in NJ 2743 cu ft.

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars.

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|