“The man who moves a mountain begins by carrying away small stones.” ― Confucius

COVID-19

The United States currently has 28,317,703 confirmed COVID 19 cases and 498,203 confirmed deaths.

US Jobless Claims

The Department of Labor released its weekly report on new jobless claims Thursday morning of last week at 8:30 a.m.

Initial jobless claims for the week that ended February 6 was 793,000 versus 760,000 which was expected and a revised 812,000 for the prior week.

Continuing jobless claims for the week endeding January 30 was 4.545 million versus 4.420 million expected and a revised 4.690 million during the prior week.

New weekly jobless claims fell relative to the prior week’s level, which was upwardly revised to 812,000 from the 779,000 previously reported. This brought new claims for the week ended February 6 to the lowest level in five weeks. And despite last week’s upward revision, the four-week moving average for new claims fell by 33,500 to 823,000.

By state, some of the most populous parts of the country saw encouragingly large drops in unadjusted new jobless claims last week. Florida saw by far the greatest decrease with unadjusted initial jobless claims dropping by more than 51,000 last week. On the other hand, California saw another surge in new claims with these rising by more than 23,000.

On the whole, new jobless claims have been tracking a decline in COVID-19 cases, with the rate of new cases, hospitalizations and deaths retreating after a holiday spike. Over the past week, an average of 105,000 cases were reported per day, dropping 36% from the average of two weeks earlier.

Markets close strong Week over Week over 1.9 Trillion Stimulus Bill

The Dow closed higher on Friday of last week, up +27.7 (+0.09%) closing out the week at 31,458.40 points, up 310.16 points week over week. The S&P 500 closed higher on Friday of last week, up +18.45 points (+0.47%) and closing out the week at 3,934.83 points, up 48 points week over week. The Nasdaq also closed higher on Friday of last week, up +69.70 points (+0.50%) closing out the week at 14,095.47 points, up 239.17 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 172 points.

Oil posts fourth weekly gain with global surplus dwindling

Optimism for a recovery in oil demand as COVID-19 vaccines are rolled out while producers rein in supply has pushed the market structure for Brent and U.S. crude into the deepest backwardation since the start of the pandemic Backwardation means the current value is higher than prices for later months and encourages traders to draw down oil supplies and sell promptly. Brent backwardation was at its deepest since January 2020 and late last week at $2.80 per barrel. That structure encourages financial investors to hold large positions in oil futures because it makes it cheaper to roll over monthly contracts. (See below)

As a result Oil prices hit its highest level in a year on Friday of last week since January of 2020, closing in on $60/bbl, supported by economic revival hopes and supply curbs by producer group OPEC and its allies. Oil was also supported as U.S. stock markets hit record highs on signs of progress towards more economic stimulus, while a closely watched jobs report confirmed the labor market was stabilizing. WTI crude oil for March delivery rose +$1.23 to $59.47 a barrel Friday of last week, up $2.62 per barrel week over week. Brent crude oil for April delivery rose +$1.29 to $62.43 a barrel Friday of last week, up $3.09 per barrel week over week.

U.S. commercial crude oil inventories decreased by 6.6 million barrels from the previous week. At 469.0 million barrels, U.S. crude oil inventories are 2% above the five year average for this time of year. Total motor gasoline inventories increased by 4.3 million barrels last week and are 0% below the five year average for this time of year. Finished gasoline and blending components inventories both increased last week. Distillate fuel inventories decreased by 1.7 million barrels last week and are 7% above the five year average for this time of year. Propane/propylene inventories decreased by 4.5 million barrels last week and are about 9% below the five year average for this time of year. Total commercial petroleum inventories decreased by 11.2 million barrels last week.

U.S. crude oil imports averaged 5.9 million barrels per day last week, decreased by 0.7 million barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 5.9 million barrels per day, 12.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 657,000 barrels per day, and distillate fuel imports averaged 356,000 barrels per day

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at 59.90, up 43 cents per barrel from Friday’s close.

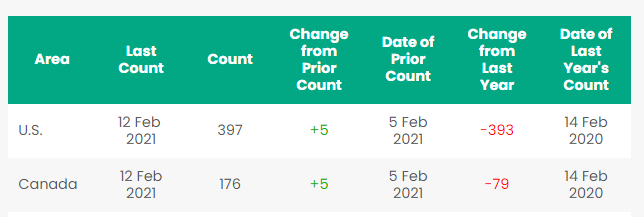

Rig Count

North America rig count is up by 10 rigs week over week. The U.S. gained 5 rigs week over week (oil rigs were up seven to 306, gas rigs down two to 90, and miscellaneous rigs unchanged at one rig, according to Baker Hughes). The U.S. currently has 397 active rigs. Canada’s rig count was up by 5 rigs as well week over week and Canada’s overall rig count is 176 active rigs. Year over year we are down 472 rigs collectively.

North American Rig Count Summary

North American Rail Traffic

Total North American rail volumes were up 2.1% year over year in week 5 (U.S. +2.2%, Canada +7.4%, Mexico -18.6%) resulting in year to date volumes that are up 3.9% year over year (U.S. +4.7%, Canada +5.9%, Mexico -15.3%). 5 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+6.5%) and grain (+22.8%). The largest decreases came from petroleum (-20.3%) and nonmetallic minerals (-13.0%).

In the East, CSX’s total volumes were down 3.1%, with the largest decrease coming from stone sand & gravel (-32.7%) and motor vehicles & parts (-17.5%). NS’s total volumes were up 1.3%, with the largest increase coming from intermodal (+3.7%). The largest decreases came from petroleum (-33.3%).

In the West, BN’s total volumes were up 3.6%, with the largest increases coming from intermodal (+10.1%) and grain (+35.4%). The largest decreases came from coal (-10.7%) and petroleum (-30.3%). UP’s total volumes were up 1.5%, with the largest increases coming from intermodal (+10.4%), chemicals (+13.4%) and grain (+32.3%). The largest decreases came from coal (-22.1%) and stone sand & gravel (-28.9%).

In Canada, CN’s total volumes were up 5.6%, with the largest increases coming from intermodal (+17.9%) and grain (+67.1%). The largest decreases came from petroleum (-28.9%) and motor vehicles & parts (-25.2%). RTMs were up 7.7%. CP’s total volumes were up 7.6%, with the largest increases coming from intermodal (+11.5%), grain (+40.7%), farm products (+145.3%) and coal (+30.2%). The largest decrease came from petroleum (-31.2%). RTMs were up 8.0%.

KCS’s total volumes were up 0.9%, with the largest increase coming from petroleum (+35.2%).

Source: Stephens

Things we are keeping an eye on

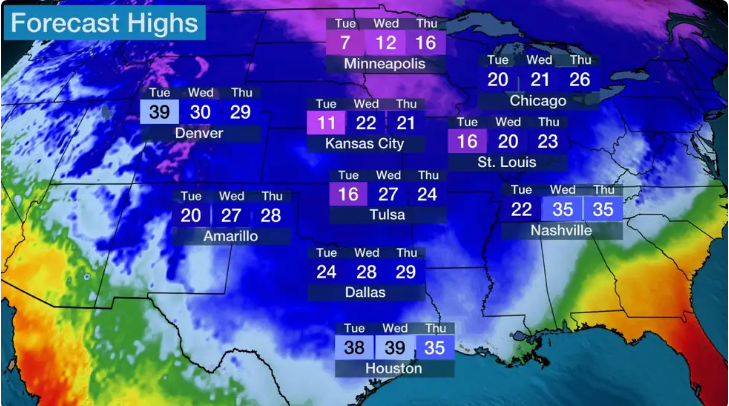

The Weather

We have been watching the weather folks – Extreme cold is gripping the Plains and Midwest this week. Numerous daily cold records will be shattered this week. The cold has taken its toll in Texas, where rolling blackouts had left more than 3.5 million homes and businesses without electricity as of late Monday afternoon. Expect rail traffic to be impacted – PFL has already received notices and warnings from a number of Class 1’s. Look at the forecasted High’s over the next three days:

The weather has created havoc on energy markets across the country – get you check books out! Spot natural gas prices across much of the Western US surged to record highs on Friday of last week, as arctic weather fueled extreme localized demand, pushing supply and deliverability to their physical limits. At locations across Kansas, Oklahoma and Eastern Arkansas, hub prices were trading at single-day record highs around $200 to $300/MMBtu. Regional hubs, which typically service only limited local demand, saw fierce competition among shippers, utilities and end-users looking to meet weekend requirements. At one Enable Gas Transmission location, the cash market traded as high as $500 per MMBtu with weighted-average prices holding steady by mid-session around $359/MMBtu. At other nearby hubs, cash markets moved to dizzying, record highs with One Oak Oklahoma at $374, Southern Star at $275, Panhandle at $225 and ANR Oklahoma at $205. At the region’s benchmark location, NGPL Midcontinent, the market was holding around $205/MMBtu, data from the Intercontinental Exchange showed.

In the West Southern and Northern California spot gas prices saw a sharp divergence on Friday of last week. At the SoCal Gas city-gate the cash market surged to $95.41/MMBtu while PG&E city-gates held at just $6.03/MMBtu.

At the Permian’s benchmark Waha location, cash prices climbed to an all-time high of $158.52/MMBtu as weekend temperatures were forecast to fall into the single-digits Fahrenheit, Feb. 14-15. In addition to boosting demand, the colder weather could risk wellhead production freeze-offs.

Spot gas prices in the Rockies also smashed all-time records on Friday of last week with Cheyenne Hub soaring to $182.53/MMBtu and CIG, Rockies surging to $172.20/MMBtu. The sky-high Rockies gas prices reflect a fierce battle to keep supply in-region to service local demand as production plummets from freeze-offs.

In the Upper Midwest, prices continued to spike in the Midcon market-area on Friday of last week Chicago city-gates reaching an all-time high at $122/MMBtu and Natural Gas Pipeline-Nipsco hitting a record $203/MMBtu. MichCon and Consumers city-gates, however, held at $6.19/MMBtu and $10.57/MMBtu, respectively – still their highest prices since 2015.

Chicago temperatures were forecast to reach minus 3 F on Feb. 13 with one to four inches of snow in the forecast according to AccuWeather. Demand in the Upper Midwest was projected to reach 33.7 Bcf/d over the long holiday weekend – its highest level since 2019.

In the Southeast & Houston, Texas-area prices also reached all-time highs on Feb. 12, with Houston Ship Channel rising to $182.04/MMBtu and Katy Hub hitting $127.52/MMBtu.

While Houston’s gas prices skyrocketed, spot locations further east were unfazed and trading in the $5-$7/MMBtu range with cash Henry Hub at $6.00/MMBtu, up just 11.5 cents from the prior-day settlement. Through the upcoming weekend, production in the Southeast was forecast to remain fairly insulated from freeze-offs seen in the Permian, Midcontinent, and Rockies.

Northeast – Gas markets in the Northeast also remained largely insulated from the Feb. 12 price frenzy, shrugging off frigid temperatures. Prices stayed in the single digits across most indexes except Algonquin city-gates and Dracut, where cash markets slipped more than $1 on the day to reach $10.59/MMBtu and $12/MMBtu respectively.

Not only did natural gas prices rise to historical rates, but electricity prices followed suit with ERCOT reaching over $11,000 per MW hours reaching “holy shit levels” according to a trader. With any trading environment there will be some winners and some losers and we are certainly going to see some fall out in the coming days. Folks the good news is we expect above average temperatures next week, until then bundle up unless you live in Florida.

Petroleum By Rail

The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 27,492 from 27,892 week over week. Canadian volumes were lower on the back of a tighter basis market. CP shipments fell by 17.9% and CN volumes were down by 1.2%. U.S. rail road operators were mixed. BN had the largest percentage loss, down by 3.9% while UP had the largest percentage increase up by 9.7%

DAPL

Still threatened by a pending shutdown a hearing that was to have taken place on whether to shut down the 570,000 barrel per day pipeline involving permitting issues was delayed yet another two months. The U.S. Department of Justice and the Army Corps of Engineers requested a continuance to April 9th so that officials in the new Biden Administration could be briefed on the case and Litigation surrounding it. DAPL moves Bakken crude to Patoka Illinois then southward to Texas and the Standing Rock Sioux tribe wants the pipeline shut down saying the Army Corps of Engineers original environmental review failed to adequately study certain issues related to potential oil spills from the pipeline.

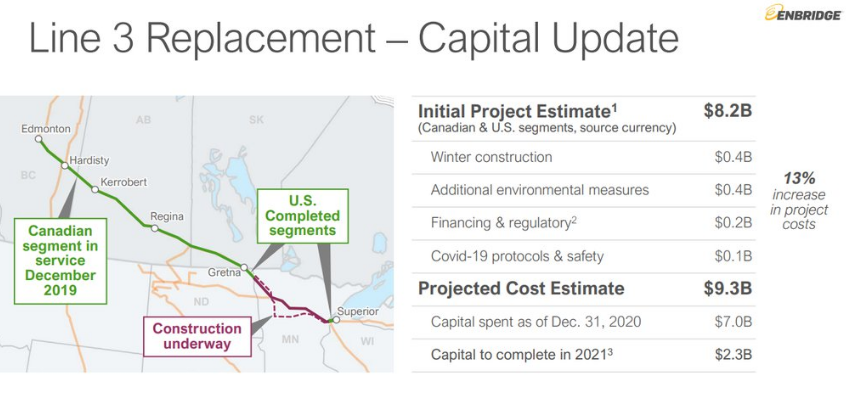

Other Pipeline News

In other pipeline news, according to Enbridge on an investor call on Friday of last week it’s Line 3 expansion is well under way and expected to be completed this year albeit at a cost. Enbridge expects costs to come in 13% above initial estimates but higher volume throughput and lower than expected interest rates will compensate for the higher expenditures (see below)

Crude by Rail

According to Canada Energy Regulator data, crude by rail in Canada has been making a quiet come back. Crude by rail programs were virtually suspended last spring amid COVID -19 pandemic but shipments are on the rise again as pipeline congestion returns. Shippers exported an average of 173,000 barrels per day by rail in November 2020 up by 80,000 barrels a day in October representing ½ of volumes shipped March of 2020 (pre COVID) at 351,000 barrels per day.

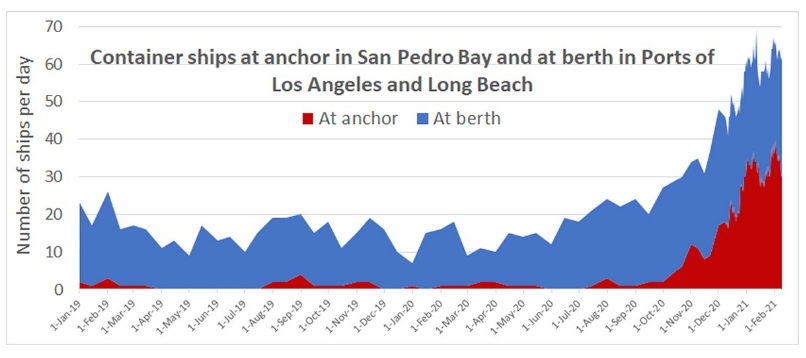

Intermodal Rail Traffic

We are watching intermodal rail traffic – which is up year over year – we do not expect to see a decline anytime soon. In fact the ports can’t seem to keep up with import demand and Americans appetite for imported goods as America’s ports are congested. The number of container ships at anchor already exceeds the number during the labor dispute between the ILWU and their employers in 2014-15. Data shows that the number of container ships at berth started to ramp up in July. A steady rise in the number of ships at anchor began in November.

By year end, the number of container ships at anchor had risen to 30. It has remained between the high 20s and up to 40 ships ever since. Meanwhile, the number of ships at the berths in Los Angeles and Long Beach has remained in the high 20s and low 30s.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 35 3000-3400 CF Aluminum Hoppers with Manual Knocker Gates for the use in Sulfur in Alberta for 3-5 Years.

- 50 25.5K-29K CPC 1232’s for the use in Bitumen Service in Saskatchewan for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 31.8K CPC 1232’s for the use in Condensate in the Northeast for 1 Year. Must have Mag Rods.

- 10 30K Tank Cars for the Use in Veg Oil in the Midwest for 1-3 Years.

- 50 340W Pressure Cars needed for Butane in the Northeast for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 23.5K CPC 1232’s for the use in Asphalt service in the Midwest or Canada.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 150 steel gondolas 2400 in Montana for 3 years BNSF Negotiable

- 50 cars for the use of Asphalt in Chicago for 1 Year. Cars can be 23.5K or 25.5K.

- 30 28.3K Tank Cars for the use of Biodiesel in Chicago for 1 Year.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 9 31.8 crude tanks in Detroit clean NS CSX CN Negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service located in multiple areas.

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riserless deck, center part for sale.

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas.

- 49 60’ Box cars 286 EOL refurbished in Tenn.

- 20 low sided gondolas for lease in NJ 2743 cu ft.

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars.

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|