“While you can’t control adverse circumstances, you can choose an attitude that helps you endure them, or benefit from, those circumstances.” – Dave Anderson

COVID-19

The United States currently has 26,767,229 confirmed COVID 19 cases and 452,279 confirmed deaths.

US Jobless Claims

The number of Americans applying for unemployment benefits fell, but remained at a historically high 847,000 people last week. This is a sign that layoffs keep coming as the economy struggles due primarily at this point to forced shut downs.

Last week’s claims dropped by 67,000, from 914,000 the week before, the Labor Department said on Thursday of last week. Before the virus hit the United States hard last March, weekly applications for jobless aid had never topped 700,000.

Tempering last week’s bigger-than-expected drop in claims: The four-week moving average rose by more than 16,000 last week to 868,000, the highest since September.

Overall, nearly 4.8 million Americans received traditional state unemployment benefits the week of Jan. 16. That is down from nearly 5 million the week before and far below a staggering peak of nearly 25 million in May when the virus and subsequent shutdown of the economy brought economic activity to a near halt. The drop suggests that some of the unemployed are finding new jobs and that others have exhausted state benefits.

There is optimism by some that COVID-19 vaccines will end the health crisis, state economies will reopen that have not done so already and the economy will stabilize. The United States is now recording just under 150,000 new coronavirus cases a day. That is down from nearly 250,000 a day early this month but still more than twice the levels seen from March until resurgence in cases in late October.

Markets Close Lower Week over Week

The Dow closed lower on Friday of last week, down -620.74 points (-2.03%) closing out the week at 29,982.62 points, down 1,014.36 points week over week. The S&P 500 closed lower on Friday of last week, down -73.14 points (-1.93%) closing out the week at 3,714,24 points, down 54.01 points week over week. The Nasdaq also closed lower on Friday of last week, down -266.46 points (-2.00%) closing out the week at 13,070.69 points, down 472.37 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 242 points.

Oil Markets Relatively Stable Week over Week

WTI crude oil for March delivery fell -$0.14 to $52.20 a barrel Friday of last week. Brent crude oil for April delivery fell -$0.06 to $55.04 a barrel, while the March contract increased 35 cents to close at $55.88 per barrel.

U.S. commercial crude oil inventories decreased by 9.9 million barrels week over week. At 476.7 million barrels, U.S. crude oil inventories are 5% above the five year average for this time of year. Total motor gasoline inventories increased by 2.5 million barrels last week and are 3% below the five year average for this time of year. Finished gasoline and blending components inventories both increased last week. Distillate fuel inventories decreased by 0.8 million barrels last week and are 8% above the five year average for this time of year. Propane/propylene inventories decreased by 2.2 million barrels last week and are 9% below the five year average for this time of year. Total commercial petroleum inventories decreased by 11.7 million barrels last week.

U.S. crude oil imports averaged 5.1 million barrels per day last week, a decrease by 1.0 million barrels per day week over week. Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 13.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 465,000 barrels per day, and distillate fuel imports averaged 474,000 barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at 52.68, up 48 cents per barrel from Friday’s close

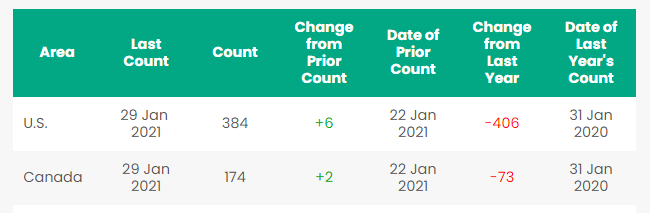

Rig Count

North America rig count is up by 8 rigs week over week. The U.S. gained 6 rigs week over week. The U.S. currently has 384 active rigs. Canada’s rig count was up by 2 rigs week over week and Canada’s overall rig count is 174 active rigs. Year over year we are down 479 rigs collectively.

North American Rig Count Summary

North American Rail Traffic

Total North American rail volumes were up 7.4% year over year in week 3 (U.S. +9.0%, Canada +4.2%, Mexico +1.0%) resulting in year to date volumes that are up 6.3% year over year (U.S. +6.5%, Canada +8.8%, Mexico -4.8%). 4 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+14.4%) and grain (+30.9%). The largest decrease came from petroleum (-15.4%).

In the East, CSX’s total volumes were up 9.2%, with the largest increase coming from intermodal (+21.2%). The largest decrease came from coal (-8.8%).

NS’s total volumes were up 10.8%, with the largest increase coming from intermodal (+17.1%). The largest decrease came from petroleum (-35.8%).

In the West, BN’s total volumes were up 8.4%, with the largest increases coming from intermodal (+19.6%) and grain (+25.9%). The largest decreases came from coal (-16.5%) and petroleum (-17.4%). UP’s total volumes were up 3.8%, with the largest increases coming from intermodal (+9.7%) and grain (+24.7%). The largest decreases came from stone sand & gravel (-22.0%) and petroleum (-16.5%).

In Canada, CN’s total volumes were up 4.8%, with the largest increases coming from intermodal (+13.8%) and grain (+80.3%). The largest decreases came from metallic ores (-17.5%) and petroleum (-20.0%). RTMs were up 9.7%. CP’s total volumes were up 2.6%, with the largest increases coming from coal (+33.8%) and grain (+34.1%). The largest decrease came from petroleum (-30.3%). RTMs were up 0.8%.

KCS’s total volumes were up 5.6%, with the largest increase coming from petroleum (+27.5%).

Things we are keeping an eye on

We are Watching DAPL

A U.S. appeals court dealt a blow to the Dakota Access crude oil pipeline on Tuesday of last week, upholding a lower court’s decision to throw out a key federal permit for the line and ordered a lengthy environmental review that will determine if it can keep operating. The decision is the latest in a series of legal and regulatory setbacks for the U.S. energy industry. Last week, regulators denied permits to notable natural gas pipelines, while the new Biden administration effectively killed the Keystone XL pipeline project and is soon expected to limit oil and gas drilling on federal lands. Tuesday’s court ruling raises the chances that Energy Transfer’s 557,000 bbl/d Dakota Access Pipeline (DAPL) will be shut pending environmental review. Supporters of DAPL said closing the primary artery for delivering crude from North Dakota’s Bakken field, could hurt output in the shale region, which produces more than one million bbls/d of oil. The U.S. Court of Appeals for the District of Columbia ruling means the U.S. Army Corps of Engineers will have to conduct another environmental review that could take months. The line can remain open, however, as the appeals court disagreed with a lower court ruling that ordered the line shut while the environmental review is being conducted. As background in July, the district court ruled that the U.S. Army Corps of Engineers violated federal environmental law when it permitted Energy Transfer to construct and operate a portion of DAPL that crosses Lake Oahe, a drinking water source for native tribes that brought the suit and want the pipeline shut down. Attorneys for the Standing Rock Sioux tribe say the Biden administration could shut the line now. The Standing Rock tribe has filed for an injunction to shut the pipeline while the environmental review is underway. “We look forward to showing the U.S. Army Corps of Engineers why this pipeline is too dangerous to operate,” said Standing Rock Sioux Tribe chairman Mike Faith. Shippers who use the line told Reuters on Tuesday that because the line can remain open, it is, for now, a win for Energy Transfer. Because the appeals court upheld the rulings, the Biden administration could force the line to close, said Height Capital Markets analyst Josh Price. However, he said the administration is more likely to allow the pipeline to keep operating while the review is conducted.

We are watching CP who is bullish on crude by rail out of Canada

CP expects its crude-by-rail business will benefit from U.S. President Joe Biden’s formal revoking of the permit needed to build the Keystone XL pipeline, which would have carried some 830,000 bbls/d of Alberta crude to the U.S. On an earnings call Wednesday of last week President and CEO of CP Keith Creel said:

“We think that this creates more support for scaling up and expansion of the DRU, and so we’re bullish on that opportunity, while pipeline capacity will eventually “catch up” to meet demand, Biden’s decision means it will take longer to do so”. Ultimately, he believes there are opportunities for both pipelines and crude-by-rail. A diluent recovery unit, abbreviated as DRU, allows an oil company to extract the condensate used to allow bitumen to be transported via pipeline. Bitumen is usually too viscous to flow in a pipeline therefore it has to be blended with condensate to flow in a pipeline. Condensate usually trades a premium to West Texas Intermediate (“WTI”), so adding condensate to dilute bitumen reduces the producers’ returns. Taking the condensate out of the crude oil and loaded onto a coiled and insolated rail car while still warm enhances producer returns. Raw bitumen is considered a non- haz product for transport on rail and receives preferential shipping rates making it competitive with pipelines (so we are told).

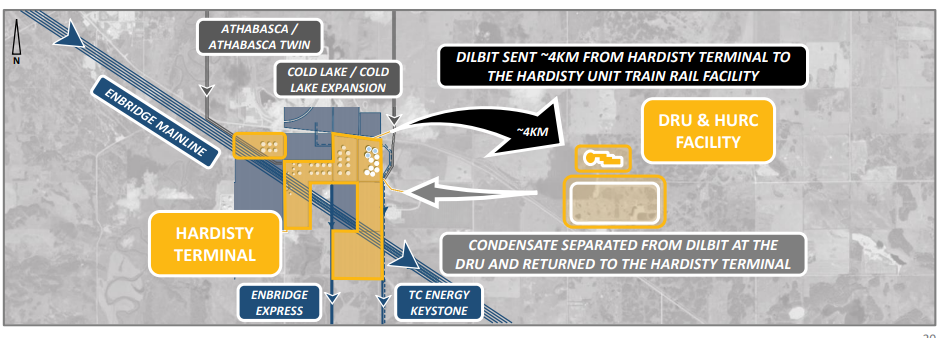

CP is bullish because in December 2019, Gibson Energy Inc. and US Development Group LLC (USD) agreed to build and operate a diluent recovery unit (DRU) near Hardisty, Alberta using USD’s patented technology. The project was to take between 18 months and two years to complete and it expected to be online sometime in Q2. ConocoPhillips Canada contracted to process 50,000 bbls/d of inlet bitumen blend through the DRU, which CP and Kansas City Southern Railway Company would ship to the U.S. Gulf Coast.

“The most exciting part about the DRU is that it scales up,” Creel said, adding the project is protected, it is “pipeline-competitive” and “environmentally competitive,” and it comes with 10-year contracts. “And so, across the board, that DRU piece is really, really exciting.

“Given the facility being build right now will come online by midyear, and we exclusively service it in Hardisty, and it’s scalable and can go up to twice as large as it is coming out of the gate, that’s really exciting.” Creel Added

Please see overview of the Hardisty DRU operation below:

Diluent Recovery Unit Project

We are watching Enbridge Line 5

In other news regarding yet another pipeline battle Enbridge’s Line 5 is going ahead. Michigan’s environmental agency said on Friday of last week it has approved construction of an underground tunnel to house a replacement for a controversial oil pipeline in a channel linking two of the Great Lakes. The decision, which is a victory for Enbridge Inc., comes as the company resists Democratic Gov. Gretchen Whitmer’s demand to shut down its 68-year-old line in the Straits of Mackinac. Enbridge disputes her claim – which is echoed by environmentalists and native tribes –– that the pipeline segment crossing 6.4-kilometre-wide waterway is unsafe. The project required permits from the state Department of Environment, Great Lakes and Energy and the U.S. Army Corps of Engineers. Liesl Clark, director of the Michigan agency and a Whitmer appointee, said the company’s application satisfied state legal requirements. Enbridge has pledged to cover all costs of the $500 million project, which it says will be completed by 2024. Environmental groups and tribes fighting to decommission Enbridge’s Line 5, which transports oil and natural gas liquids used in propane between Superior and Sarnia also oppose the tunnel. They say it would pollute the waters, harm fish and damage shoreline wetlands while boosting use of fossil fuels that contribute to global warming. The permit approval is “a huge disappointment,” said Liz Kirkwood, executive director of Traverse City-based For Love of Water, saying there was “compelling evidence of significant environmental harm.”

Petroleum By Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,405 from 26,242 week over week. Canadian volumes were mixed. CP shipments fell by 4.6% and CN volumes were up by 7.1%. U.S. rail road operators were also mixed but up overall. NS had the largest percentage loss, down by 2.3%. While CSX had the largest percentage increase and was up by 8.0%.

Biden Administration – Electric Cars

President Joe Biden ordered last week the federal government to buy electric vehicles made in America with union labor. There’s just one problem: No such vehicles exist. Tesla Inc., the leading U.S. electric vehicle manufacturer, has several American-made models, but it isn’t unionized. While General Motors Co. employs union labor to make the electric Chevrolet Bolt, roughly three-quarters of its components come from outside the U.S. — missing the 50% threshold to be considered American-made under federal procurement law. The American Fuel and Petrochemical Manufacturers (AFPM) has been contacting state and national representatives of the corn and biofuel industries in recent weeks to seek support for a policy that would reduce the carbon intensity of transport fuels and block efforts to provide federal subsidies for electric vehicles. Farmers across the U.S. could be impacted in a big way together with biofuel producers who rely on blending with conventional gasoline and diesel.

Biden Administration – CDC Travel Restrictions

On the back of an executive order last week from President Joe Biden, the Centers for Disease Control and Prevention issued an order late Friday requiring travelers in the United States to wear face masks at transportation hubs and on planes and all forms of public transportation. The Order goes into effect late Monday, one minute before midnight. “People must wear masks that completely cover both the mouth and nose while awaiting, boarding, disembarking, or traveling on airplanes, ships, ferries, trains, subways, buses, taxis, and ride-shares as they are traveling into, within, or out of the United States and U.S. territories,” the CDC says. Masks are also required at airports, bus and ferry terminals, seaports, and train and subway stations, according to the federal agency.

It’s a Busy Week in the Markets

Monday

9:45 a.m. Manufacturing PMI

10:00 a.m. ISM manufacturing

10:00 a.m. Construction spending

2:00 p.m. Atlanta Fed President Raphael Bostic and Boston Fed President Eric Rosengren

Tuesday

Vehicle sales

10:00 a.m. Housing vacancies

1:00 p.m. New York Fed President John Williams

2:00 p.m. Cleveland Fed President Loretta Mester

Wednesday

8:15 a.m. ADP employment

9:45 a.m. Services PMI

10:00 a.m. ISM Services

1:00 p.m. St. Louis Fed President James Bullard

2:00 p.m. Philadelphia Fed President Patrick Harker

5:00 p.m. Cleveland Fed’s Mester

5:00 p.m. Chicago Fed President Charles Evans

Thursday

8:30 a.m. Initial claims

8:30 a.m. Productivity and costs

10:00 a.m. Factory orders

Friday

8:30 a.m. Nonfarm payrolls

8:30 a.m. Employment report

8:30 a.m. International trade

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 1232 23.5 tanks for asphalt in Quebec 6 months price negotiable

- 200 117Js 30.3s for crude starting in June for 2 year lease negotiable

- 50 tank cars in the mid-Atlantic region price negotiable

- 250 31.8 tanks with mag rods in the northeast price negotiable

- 5-10 30K tanks lined for liquor 5 years most class ones price negotiable

- 100 31.8K CPC 1232s or 30.3K 117R for the use of Gas and Diesel.

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase

- 50-60 Sulfuric acid cars 13.6 for purchase

- 40-50 molten Sulfur Cars 13.8 for purchase

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

- 30 5400-5800 286 Hoppers needed in Texas off the BN for grain 2 years negotiable

- 50 1232 Tanks 28.3 for crude 6 months in Alberta on the CN price negotiable

- 10 Veg Oil tanks 30K needed in Mexico off the BN for 2 years negotiable

- 5100 CU FT plus hoppers needed in the Midwest off the BN or UP negotiable

- 35 lined 4000 cubic foot steel gondolas for Sulfur service. Needed in Alberta for 3-5 year lease

- 10 Veg Oil tanks 30K in the Midwest UP or BN 1-3 years negotiable

- 25 CPC 1232 31.8s in Texas UP or BN 6-12 months for Jet Fuel negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 65 Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js available March in Texas dirty to dirty price negotiable

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|