“The function of leadership is to produce more leaders, not more followers.” – Ralph Nader

COVID-19

The United States currently has 25,702125 confirmed COVID 19 cases and 429,490 confirmed deaths.

US Jobless Claims

The number of Americans seeking unemployment benefits fell slightly last week to 900,000. This is still a historically high level that points to ongoing job cuts in a raging coronavirus pandemic.

The government said 5.1 million Americans are continuing to receive state jobless benefits, down from 5.2 million in the previous week. That suggests that while some of the unemployed are finding jobs, others are likely using up their state benefits and transitioning to separate extended-benefit programs.

More than 10 million people are receiving aid from those extended programs, which now offers up to 50 weeks of benefits or a new program provides benefits to contractors and the self-employed. Overall, nearly 16 million people were on unemployment in the week that ended January 2, the latest period for which data is available.

Markets Close Higher Week over Week

The Dow closed lower on Friday of last week, down -179.03 points (-0.57%) closing out the week at 30,996.98 points, up 182.72 points week over week. The S&P 500 closed lower on Friday of last week, down -11.60 points (-0.30%) closing out the week at 3,768.25 points, up 73.22 points week over week. The Nasdaq Composite bucking the trend closed higher on Friday of last week, up +12.15 points (+0.09%) closing out the week at 13,543.06 points, up a whopping 544.56 points week over week.

In overnight trading, DOW futures traded higher and are expected to open down this morning 137 points.

Oil Mixed as New COVID Cases Continue to Weigh on Demand Outlook

WTI crude oil for February delivery fell -$0.86 to $52.27 a barrel Friday of last week, down 9 cents per barrel week over week. Brent crude oil for March delivery fell -$0.69 to $55.41 a barrel, up 31 cents a barrel week over week.

U.S. commercial crude oil inventories increased by 4.4 million barrels from the previous week. At 486.6 million barrels, U.S. crude oil inventories are 9% above the five year average for this time of year. Total motor gasoline inventories decreased by 0.3 million barrels last week and are 3% below the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories increased by 0.5 million barrels last week and are 8% above the five year average for this time of year. Propane/propylene inventories decreased by 6.2 million barrels last week and are about 11% below the five-year average for this time of year. Total commercial petroleum inventories decreased by 0.7 million barrels last week.

U.S. crude oil imports averaged 6.0 million barrels per day last week, down by 194,000 barrels per day from the previous week.Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 11.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 504,000 barrels per day, and distillate fuel imports averaged 460,000 barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at 52.21, down 6 cents per barrel from Friday’s close.

Rig Count

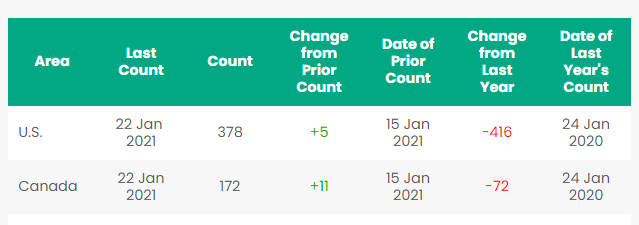

North America rig count is up by 16 Rigs week over week. The U.S. gained 5 rigs week over week. The U.S. currently has 378 active rigs. Canada’s rig count was up by 11 rigs week over week and Canada’s overall rig count is 172 active rigs. Year over year we are down 488 rigs collectively.

North American Rig Count Summary

North American Rail Traffic

Total North American rail volumes were up 8.6% year over year in week 2 (U.S. +5.8%, Canada +22.7%, Mexico -2.4%) resulting in year to date volumes that are up 5.8% year over year (U.S. +5.2%, Canada +11.3%, Mexico -7.7%). 6 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+12.9%) and grain (+51.0%). The largest decreases came from coal (-11.7%) and nonmetallic minerals (-9.4%).

In the East, CSX’s total volumes were up 3.2%, with the largest increases coming from intermodal (+15.4%) and chemicals (+11.4%). The largest decrease came from coal (-16.0%). NCS’s total volumes were up 5.8%, with the largest increase coming from intermodal (+11.3%). The largest decreases came from coal (-9.8%) and petroleum (-35.6%).

In the West, BN’s total volumes were up 4.4%, with the largest increases coming from intermodal (+11.5%) and grain (+35.9%). The largest decreases came from coal (-20.0%), stone sand & gravel (-40.3%) and motor vehicles & parts (-23.0%). UP’s total volumes were up 2.6%, with the largest increases coming from intermodal (+10.0%) and grain (+75.0%). The largest decreases came from coal (-34.5%) and stone sand & gravel (-19.3%).

In Canada, CN’s total volumes were up 21.0%, with the largest increases coming from intermodal (+29.3%), metallic ores (+29.7%) and grain (+95.7%). The largest decrease came from motor vehicles & parts (-22.5%). RTMs were up 28.3%. CP’s total volumes were up 17.7%, with the largest increases coming from grain (+96.2%), coal (+47.4%) and chemicals (+22.0%). RTMs were up 29.8%. KCS’s total volumes were down 0.3%, with the largest decrease coming from intermodal (-6.5%). The largest increase came from petroleum (+24.3%).

Source: Stephens

Things we are keeping an eye on

1. Executive Orders – President Biden has already signed over 30 Executive Orders only 3 days into his Presidency, one of which really made Canadians angry as President Biden called for a halt of construction of the Keystone XL pipeline.” Even the Teamsters Union are upset and said in a statement on Wednesday of last week “The Teamsters strongly oppose yesterday’s decision and we would urge the administration to reconsider it. This Executive Order doesn’t just affect U.S. Teamsters; it hurts our Canadian brothers and sisters as well who work on this project. It will reduce good-paying union jobs that allow workers to provide a middle-class standard of living to their families. America needs access to various forms of energy that can keep its economy running in the years ahead. This decision will hurt that effort. Calgary-based TC Energy announced Wednesday morning of last week it was suspending the development. The decision will lead to thousands of workers losing their jobs. Keystone XL was designed to ship 830,000 bpd southward, connecting the oil sands in Canada — with the world’s third-largest proven oil reserves — to the U.S. Gulf Coast. The question now that no one is asking is what happens next? There is significant infrastructure already built – unused pipe scattered all over North America. (See below)

Miles of unused pipe, prepared for the proposed Keystone XL pipeline, sit in North Dakota

Does TC Energy leave the infrastructure in place in hopes for a more favorable administration in four years? Does the legal battle continue? Is Biden done with shutting down pipelines? Is Energy Transfer’s Dakota Access pipeline next? What about Enbridge line 5? Folks, there are a lot of unanswered questions and we don’t think the ramifications of the decision to suspend construction on XL was thought through thoroughly. Since the Keystone XL pipeline makes perfect sense, it would not surprise us to see it come back and built at some point. However, in the meantime the decision by Biden creates a significant tailwind for crude by rail as the price for crude oil rises and basis differentials cooperate which we expect as production continues to outstrip available pipeline capacity. Stay tuned to PFL for the latest and greatest!

2. Drilling Permits – President Biden made good on his promise to suspend drilling permits on Federal land. The Biden administration announced Thursday of last week a 60-day suspension of new oil and gas leasing and drilling permits for U.S. lands and waters as officials moved quickly to reverse Trump administration policies on energy and the environment. The order also applies to coal leases and permits, and blocks the approval of new mining plans. Land sales or exchanges and the hiring of senior-level staff at the agency also were suspended. What does this mean for the American consumer – get ready to pay more at the pumps. With no new drilling in the U.S. we will certainly import more foreign oil and put ourselves back in the position of being at the mercy of countries that don’t particularly like us! The American Petroleum Institute President and CEO Mike Sommers said in a statement on Friday of last week: “Restricting development on federal lands and waters is nothing more than an ‘import more oil’ policy. Energy demand will continue to rise—especially as the economy recovers—and we can choose to produce that energy here in the United States or rely on foreign countries hostile to American interests. With this move, the administration is leading us toward more reliance on foreign energy from countries with lower environmental standards and risks to hundreds of thousands of jobs and billions in government revenue for education and conservation programs. We stand ready to engage with the Biden administration on ways to address America’s energy challenges, but impeding American energy will only serve to hurt local communities and hamper America’s economic recovery.” Without access to energy development on federal lands and waters, API’s recent analysis shows that U.S. energy supply would shift to foreign sources, cost nearly one million American jobs, increase CO2 emissions and reduce revenue that funds education and key conservation programs. API represents all segments of America’s natural gas and oil industry, which supports more than ten million U.S. jobs and is backed by a growing grassroots movement of millions of Americans.

3. Petroleum By Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 26,242 from 25,860 week over week. Canadian volumes were mixed. CP shipments were up by 3.0% and CN volumes were down by 3.7%. U.S. rail road operators were also mixed but up overall. NS had the largest percentage loss, down by 9.6%. While BNSF was up by 18.1%.

4. We are watching L.A. folks – COVID outbreak of Dock workers could cripple California container ports having a dramatic affect on intermodal traffic and exports. Los Angeles County is at the epicenter of the current COVID surge. That county’s Los Angeles/Long Beach port complex is simultaneously at the epicenter of America’s import surge. These two spikes are now converging as hundreds of California dockworkers catch COVID. “If the catastrophic infection rates continue, there may be a need to close the San Pedro Bay Port Complex to protect the health and safety of the workforce,” executives of the ILWU dockworkers union warned in a letter Monday of last week to the Pacific Maritime Association (PMA), which represents employers. The ILWU reported that as of Sunday of last week, a total of 694 union members had tested positive for COVID. Of those, 364 worked in Los Angeles and 330 in Long Beach. A total of 1,080 ILWU members were exposed to people with COVID. We at PFL are monitoring the situation closely, so stay tuned to PFL for the latest and greatest.

5. Iran has started ramping up its oil production and expects to reach pre-sanctions levels in one to two months, said Deputy Oil Minister Amir Hossein Zamaninia. The oil market will be able to accommodate Iran’s maximum oil output of around 3.9 million to 4 million barrels a day, Zamaninia told reporters on the sidelines of an oil conference in Tehran on Friday of last week. Iran has been subject to tough U.S. sanctions since 2018, when President Donald Trump unilaterally withdrew from an international deal that restricted Iran’s nuclear activities. Its crude production was below 2 million barrels a day for most of 2020, according to data compiled by Bloomberg.

President Joe Biden, who took office last week, is expected to seek the restoration of that accord and officials in Tehran have expressed the hope he will ease restrictions on its petroleum sales. But for now, the sanctions are still in place and any buyer of Iranian crude would face the same legal and financial penalties that have deterred most potential customers over the past few years, however, we expect President Biden to look the other way or cut a new deal.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 1232 23.5 tanks for asphalt in Quebec 6 months price negotiable

- 200 117Js 30.3s for crude starting in June for 2 year lease negotiable

- 50 tank cars in the mid-atlantic region price negotiable

- 250 31.8 tanks with mag rods in the northeast price negotiable

- 5-10 30K tanks lined for liquor 5 years most class ones price negotiable

- 100 31.8K CPC 1232s or 30.3K 117R for the use of Gas and Diesel.

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase

- 50-60 Sulfuric acid cars 13.6 for purchase

- 40-50 molten Sulfur Cars 13.8 for purchase

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

- 30 5400-5800 286 Hoppers needed in Texas off the BN for grain 2 years negotiable

- 50 1232 Tanks 28.3 for crude 6 months in Alberta on the CN price negotiable

- 10 Veg Oil tanks 30K needed in Mexico off the BN for 2 years negotiable

- 5100 CU FT plus hoppers needed in the Midwest off the BN or UP negotiable

- 35 lined 4000 cubic foot steel gondolas for Sulfur service. Needed in Alberta for 3-5 year lease

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 70 117Js available March in Texas dirty to dirty price negotiable

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- Various Hoppers for sale/lease new and used various locations, various types, negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape..

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|