“Some people dream of success, while other people get up every morning and make it happen.”

– Wayne Huizenga

COVID-19

The United States currently has 24,626,441 confirmed COVID 19 cases and 408,623 confirmed deaths.

US Jobless Claims

New weekly unemployment claims spiked far more than expected last week and reached a five-month high, as the coronavirus pandemic and stay-in-place orders weighed heavily on the labor market.

The U.S. Department of Labor released its weekly report on new jobless claims Thursday morning of last week. Initial jobless claims for the week ended January 9th,2021 were 965,000 versus 789,000 expected.

Continuing claims week ended Jan 2, 2021 were 5.271 million versus 5.000 million expected and 5.072 million during the prior week.

At 965,000, new jobless claims hit the highest level since August, ending what had been a tentative start of a downward trend in initial claims.

Markets Close Lower Week over Week

The Dow closed lower on Friday of last week, down -177.26 points (-0.57%) closing out the week at 30,814.26 points, down 283.71 points week over week. The S&P 500 closed lower on Friday of last week, down -27.29 points (-0.72%) closing out the week at 3,768.25 points, down 56.43 points week over week. The Nasdaq Composite closed lower as well on Friday of last week, down -114.14 points (-0.87%) closing out the week at 12,998.50 points, down 203.48 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 172 points.

Oil Slightly Lower Week over Week as Consumption Fears Spread

WTI crude oil for February delivery fell -$1.21 to $52.36 a barrel Friday of last week, down 37 cents per barrel week over week. Brent crude oil for March delivery fell -$1.32 to $55.10 a barrel, down 89 cents a barrel week over week.

U.S. commercial crude oil inventories decreased by 3.2 million barrels from the previous week. At 482.2 million barrels, U.S. crude oil inventories are 8% above the five year average for this time of year. Total motor gasoline inventories increased by 4.4 million barrels last week and are 1% above the five year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories increased by 4.8 million barrels last week and are 9% above the five year average for this time of year. Propane/propylene inventories decreased by 6.7 million barrels last week and are 12% below the five year average for this time of year. Total commercial petroleum inventories decreased by 9.4 million barrels last week.

U.S. crude oil imports averaged 6.2 million barrels per day last week, an increase of 0.9 million barrels per day week over week. Over the past four weeks, crude oil imports averaged about 5.6 million barrels per day, 14.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 383,000 barrels per day, and distillate fuel imports averaged 346,000 barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at 52.53, up 18 cents per barrel from Friday’s close.

Rig Count

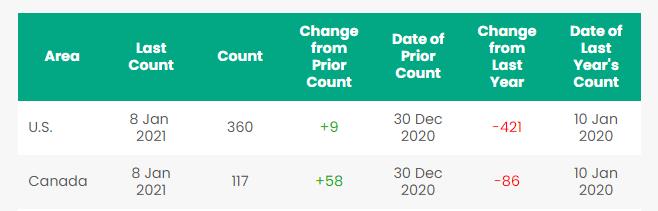

North America rig count is up by 57 Rigs week over week. The U.S. gained 13 rigs week over week. The U.S. currently has 373 active rigs. Canada’s rig count was up by 44 rigs week over week and Canada’s overall rig count jumped to 161 active rigs. Year over year we are down 506 rigs collectively.

North American Rig Count Summary

North American Rail Traffic

Total North American rail volumes were up 3.0% year over year in week 1 (U.S. +4.7%, Canada +1.3%, Mexico -13.0%). Five of the AAR’s eleven major traffic categories posted year over year increases with the largest increases coming from intermodal (+8.3%) and grain (+36.9%). The largest decreases came from coal (-13.1%), petroleum (-21.6%) and nonmetallic minerals (-13.0%).

In the East, CSX’s total volumes were up 3.9%, with the largest increase coming from intermodal (+9.7%). The largest decrease came from coal (-8.2%). NCS’s total volumes were up 2.3%, with the largest increase coming from intermodal (+6.3%). The largest decreases came from coal (-12.4%) and petroleum (-36.2%).

In the West, BN’s total volumes were up 5.7%, with the largest increases coming from intermodal (+17.0%) and grain (+52.6%). The largest decreases came from coal (-19.2%), petroleum (-37.3%) and stone sand & gravel (-39.5%). UP’s total volumes were down 1.3%, with the largest decreases coming from coal (-16.9%), motor vehicles & parts (-27.2%) and stone sand & gravel (-23.1%). The largest increases came from grain (+50.8%) and intermodal (+2.1%).

In Canada, CN’s total volumes were up 3.4%, with the largest increase coming from intermodal (+13.4%). The largest decrease came from petroleum (-25.3%). RTMs were up 2.4%. CP’s total volumes were down 1.3%, with the largest decreases coming from intermodal (-6.7%) and petroleum (-21.5%). RTMs were down 4.7%.

KCS’s total volumes were down 7.9%, with the largest decrease coming from intermodal (-18.4%). The largest increase came from petroleum (+23.7%).

Source: Stephens

Things we are keeping an eye on

- Spending in Washington Gone Wild – Folks, we need to buy some more ink for the printing press. President-elect Joe Biden has released the details of a proposed $1.9 trillion COVID-19 relief package aimed at supporting businesses and individuals impacted by the pandemic. Dubbed the American Rescue Plan, the package comes on the heels of the $900 billion pandemic relief bill signed into law by President Trump last month and is the first of two major spending initiatives senior Biden officials say the President-elect will seek in the first few months of his presidency.

WHAT’S INCLUDED IN THE AMERICAN RESCUE PLAN

i) The proposed plan calls for the following:

ii) $1,400 stimulus checks to most Americans, which is in addition to the $600 payments included in December’s pandemic relief bill

iii) $15 billion for a new grant program for small business owners

iv) Increasing federal unemployment benefits to $400 per week (from $300 per week) and extending through September 2021

v) Increasing the federal minimum wage to $15 per hour

vi) $350 billion in aid to state and local governments

vii) Reinstating paid sick and family leave benefits that expired at the end of December through September 2021

viii) $25 billion in rental assistance for certain households who have lost their jobs during the pandemic

ix) Extending the eviction and foreclosure moratoriums until the end of September 2021

x) $170 billion toward K-12 schools and higher education institutions

xi) $50 billion for COVID-19 testing

xii) $20 billion for a national vaccine program

xiii) Increasing the Child Tax Credit to $3,000 per child ($3,600 for children under 6) and making the credit fully refundable for the year. - Key Stone Pipeline – Well folks news surfaced over the weekend U.S. President-elect Joe Biden is planning to cancel the permit for the $9 billion Keystone XL pipeline project as one of his first acts in office, and perhaps as soon as his first day, according to a source familiar with his thinking. The words “Rescind Keystone XL pipeline permit” appear on a list of executive actions likely scheduled for the first day of Biden’s presidency, according to an earlier report by the Canadian Broadcasting Corp (CBC). The project, which would move oil from the province of Alberta to Nebraska, had been slowed by legal issues in the United States. It also faced opposition from environmentalists seeking to check the expansion of Canada’s oil sands by opposing new pipelines to move its crude to refineries. Alberta Premier Jason Kenney said on Twitter he was “deeply concerned” by the report, adding that canceling the presidential permit for the pipeline would kill jobs “on both sides of the border,” weaken U.S. – Canada relations and undermine American national security by making the United States more dependent on OPEC oil imports. Kenny is not happy at all with the situation should the project be cancelled, the Alberta government, which made a $1.5 billion equity investment, will be out about $1 billion, according to Kenney. This could be a huge tailwind for crude by rail.

- Drilling Permits – As part of President elects promise to band permitting on Federal Lands, U.S. oil and gas companies have amassed quite a few permits as insurance against any adverse ruling. U.S. oil and gas producers are holding onto more than 5,600 unused permits representing approximately two years of drilling activity.

- Halliburton Announces First Successful Electric Frac. Halliburton reported on Thursday of last week that it has deployed the industry’s first successful electric grid-powered hydraulic fracturing operation. Compared to turbines and Tier 4 dual-fuel engines, grid-powered electric fracturing provides a means of achieving the lowest possible emissions profile, Halliburton stated. The firm also noted the grid-powered approach boosts operational reliability and demands less capital outlay than turbines. Furthermore, the company stated that it engineers its electric-powered equipment to use the maximum power potential from the grid so that the customer can achieve pumping performance 30 to 40 percent higher than with conventional equipment.

- Petroleum By Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,860 from 25,641 week over week. Canadian volumes were higher. CP shipments were up by 15.2% and CN volumes were up by 16%. U.S. rail road operators were mostly higher. NS had the largest percentage increase, up by 45.2%. While BNSF was down by 3.2%

- December Headcount Data for the U.S. Rails – The Surface Transportation Board (STB) has released December headcount data for the U.S. rails. For the industry as a whole, December headcount was down 10.4% year over year vs. November headcount that was down 13.7% year over year. On a sequential basis, industry headcount was up 2.4% vs. the 5-year December average of down 1.1%. The industry as a whole is beginning to see a moderation of year over year declines as volumes have improved.

- Enbridge rejects Michigan Governor’s notice that it must shut down Line 5 Canadian pipeline company Enbridge Inc. has said it will not comply with Michigan Governor Gretchen Whitmer’s notice ordering it to shut down its Line 5 in May after terminating the easement for the oil and natural gas dual pipeline in the Straits of Mackinac in Northern Michigan. In a letter dated Tuesday of last week, Enbridge’s executive vice president Vern Yu informed Michigan’s governor of “Enbridge’s Rejection” of a November notice that requires it to cease operating the pipeline by May 12. Yu says in the letter “that the State lacks the authority to terminate or revoke” the easement, a move that it says would wrongfully displace the role of the federal pipeline administrator. In case you are interested, please visit Enbridge’s short video as it relates to the construction of line 5 through the great lakes by clicking the following link (we found it interesting)

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 1232 23.5 tanks for asphalt in Quebec 6 months price negotiable

- 200 117Js 30.3s for crude starting in June for 2 year lease negotiable

- 50 tank cars in the mid-atlantic region price negotiable

- 250 31.8 tanks with mag rods in the northeast price negotiable

- 5-10 30K tanks lined for liquor 5 years most class ones price negotiable

- 100 31.8K CPC 1232s or 30.3K 117R for the use of Gas and Diesel.

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase

- 50-60 Sulfuric acid cars 13.6 for purchase

- 40-50 molten Sulfur Cars 13.8 for purchase

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

- 30 5400-5800 286 Hoppers needed in Texas off the BN for grain 2 years negotiable

- 50 1232 Tanks 28.3 for crude 6 months in Alberta on the CN price negotiable

- 10 Veg Oil tanks 30K needed in Mexico off the BN for 2 years negotiable

- 5100 CU FT plus hoppers needed in the Midwest off the BN or UP negotiable

- 35 lined 4000 cubic foot steel gondolas for Sulfur service. Needed in Alberta for 3-5 year lease

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 70 117Js available March in Texas dirty to dirty price negotiable

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|