“Don’t gain the world and lose your soul.”

Bob Marley

Folks, it was a really bad week last week for commodities and equities – a historic sell off, all related to the coronavirus outbreak (“COVID-19” ) took place as you are all aware. Demand destruction continues and public companies have come out with earning warnings including Apple and Microsoft. Last week was the worst week since the financial crisis – Futures in New York fell 16 percent this week, marking the biggest weekly drop since December 2008. (see one year chart)

Market Summary > Dow Jones Industrial Average

The COVID-19 outbreak shows no signs of letting up, with the World Health Organization raising global risk to “very high” from “high.” The collapse of financial markets prompted U.S. Federal Reserve Chairman Jerome Powell to assure investors that the central bank is prepared to cut interest rates to mitigate COVID-19 threat to economic activity.

Oil prices have tumbled almost 27% this year on concerns that the COVID-19 outbreak will dent crude demand and it has. OPEC and its allies have signaled the coalition could reach an agreement to stem falling prices before meeting in Vienna later this week. Saudi Arabia is reportedly pushing for collective OPEC production cuts of an additional 1 million barrels a day, of which it would bear the most of those cuts. This may not be enough. Libya production is rumored to come back online soon which is roughly 1 million barrels of oil per day.

WTI for April delivery fell $2.33, or five percent, on Friday to settle at US$44.76 per barrel on the New York Mercantile Exchange. The crude market is trading in backwardation. Ethanol at Argo traded down to $1.25 per gallon on Friday rattling Ethanol producers across the country that are already operating on razor-thin margins. Natural gas closed at $1.684 per MMBTU for April delivery on Friday – folks this is almost free (at least the Natgas market is contango – nice spread between April and December if you have storage)

President Trump authorized new travel restrictions and warnings Saturday and said he’s even looking at closing the southern border in response to the COVID-19 outbreak that has claimed the first American life over the weekend, while assuring the nation at an all-hands-on-deck press conference there’s “no reason to panic.” President Trump also warned that there will be more infections and in fact there has been. Shortly after his speech to the nation on Saturday at 1:30 EST and elderly nursing home in Washington State announced several cases with one 70 year old women in critical condition.

The number of confirmed cases around the globe passed 85,000 on Saturday, according to a tracker maintained by Johns Hopkins University, and more than 2,900 infected people have died. While the virus’s growth appeared to slow in China last week, it was accelerating elsewhere, with many new cases linked to an outbreak in Italy. On Sunday Scotland and the Dominican Republic announced cases of COVID-19. COVID-19 has now infected 60 countries and Sundays update showed over 90,000 people infected.

How prepared is the U.S. for an outbreak? It’s better positioned than most countries, according to experts, though there could be shortages of ventilators and protective equipment. The most important thing you can do: Wash your hands often.

For week 8, total U.S. weekly rail traffic was 482,690 carloads and intermodal units, down 7.6 percent compared with the same week last year.

Total carloads for the week ending February 22 were 232,869 carloads, down 9.3 percent compared with the same week in 2019, while U.S. weekly intermodal volume was 249,821 containers and trailers, down 6 percent compared to 2019.

Four of the 10 carload commodity groups posted an increase compared with the same week in 2019. They included chemicals, up 2,366 carloads, to 33,284; petroleum and petroleum products, up 1,217 carloads, to 13,401; and motor vehicles and parts, up 1,193 carloads, to 17,898. Commodity groups that posted decreases compared with the same week in 2019 included coal, down 23,225 carloads, to 63,540; grain, down 2,785 carloads, to 18,909; and nonmetallic minerals, down 1,628 carloads, to 29,854.

For the first eight weeks of 2020, U.S. railroads reported cumulative volume of 1,858,165 carloads, down 6.5 percent from the same point last year; and 1,999,804 intermodal units, down 6.2 percent from last year. Total combined U.S. traffic for the first eight weeks of 2020 was 3,857,969 carloads and intermodal units, a decrease of 6.4 percent compared to last year.

North American rail volume for the week ending February 22, 2020, on 12 reporting U.S., Canadian and Mexican railroads totaled 329,343 carloads, down 6.7 percent compared with the same week last year, and 324,723 intermodal units, down 7.3 percent compared with last year. Total combined weekly rail traffic in North America was 654,066 carloads and intermodal units, down 7 percent. North American rail volume for the first eight weeks of 2020 was 5,278,276 carloads and intermodal units, down 4.7 percent compared with 2019.

Canadian railroads reported 76,331 carloads for the week, up 1.9 percent, and 56,299 intermodal units, down 14.9 percent compared with the same week in 2019. For the first eight weeks of 2020, Canadian railroads reported cumulative rail traffic volume of 1,121,322 carloads, containers and trailers, down 1.7 percent.

Mexican railroads reported 20,143 carloads for the week, down 6.4 percent compared with the same week last year, and 18,603 intermodal units, up 1.1 percent. Cumulative volume on Mexican railroads for the first eight weeks of 2020 was 298,985 carloads and intermodal containers and trailers, up 8.9 percent from the same point last year.

Amidst the COVID-19 induced market volatility, we are expecting lowered guidance from the railroad management teams on earnings. Rail networks can manage a potential snapback in activity if a post COVID-19 surge coincides with a recovery. Adopting PSR likely provides networks with better flexibility to manage a volume recovery and creating capacity through more efficient operations. Therefore do not expect a deluge of volume will overwhelm the U.S. networks. Hold on think we are in for a little bit of a ride.

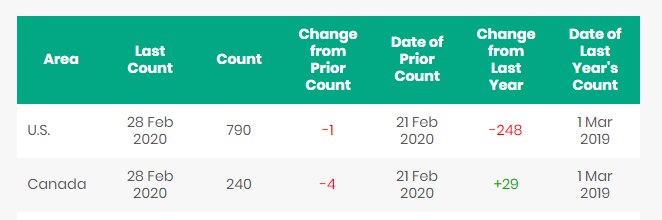

North American Rig count is down 5 rigs week over week with the U.S. losing 1 rig and Canada losing 4 rigs week over week. Year over year we are down 219 Rigs collectively.

North American Rig Count Summary

PFL is offering: 340Ws for long and short term lease, 117Rs last in diesel service, various box cars for lease, 31.8’s clean and last in refined products and 25.5K 117Js coiled and insulated, 5000 CFC Center Flow Pressureaide Covered Hopper cars that have recently been cleaned.Call PFL for details today!

PFL is seeking: 23.5Ks and 25.5Ks for fuel oil products, 117s with magnetic gauging devices for lease, 89 ft flat cars for purchase, 100 mil gons for short term lease, 117Js last in ethanol, and 4750s for use in coke service.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|