“Your customers are the lifeblood of your business. Their needs and wants impact every aspect of your business, from product development to content marketing to sales to customer service”

– John Rampton

We hope that everyone had a very happy New Year and welcome to week one of 2021. We at PFL are certainly glad to begin a new year and are ready to serve our customers through 2021 and are hopeful for a better year for all, as I am sure that all want to put 2020 behind them!

COVID-19

The United States currently has 21,113,528 confirmed COVID 19 cases and 360,078 confirmed deaths.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 787,000 initial jobless claims. The number of first-time filers for unemployment benefits were lower than expected and were estimated to come in at 833,000.

Markets End the Week and the Year on a Bullish Tone

The Dow closed higher on Thursday of last week, up 196.88 points (+0.65%) closing out the week at 30,606.48 points, up 406.61 points week over week. The S&P 500 closed higher on Thursday of last week, up 24.03 points (+0.64%) closing out the week at 3,756.07 points, up 53.01 points week over week. The Nasdaq Composite closed higher as well on Thursday of last week, up 18.28 points (+0.14%) closing out the week at 12,888.28 points, up 83.55 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 178 points.

Oil Pretty Much Flat Week over Week

WTI crude oil for February delivery rose 12 cents to $48.52 a barrel Thursday of last week. Brent crude oil for March delivery rose 17 cents to $51.80 a barrel.

In other Energy related markets, Wholesale gasoline for January delivery was little changed at $1.41 a gallon. January heating oil fell 1 cent to $1.48 a gallon. February natural gas rose 12 cents to $2.54 per 1,000 cubic feet.

U.S. commercial crude oil inventories decreased by 6.1 million barrels from the previous week. At 493.5 million barrels, U.S. crude oil inventories are 11% above the five year average for this time of year. Total motor gasoline inventories decreased by 1.2 million barrels last week and are 1% above the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories increased by 3.1 million barrels last week and are 6% above the five year average for this time of year. Propane/propylene inventories decreased by 6.4 million barrels last week and are 3% below the five year average for this time of year. Total commercial petroleum inventories decreased by 14.9 million barrels last week.

U.S. crude oil imports averaged 5.3 million barrels per day last week, down by 238,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 5.7 million barrels per day, 14.4% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 601,000 barrels per day, and distillate fuel imports averaged 619,000 barrels per day.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $48.25, down 27 cents per barrel from Friday’s close.

North American Rail Traffic

North American rail volume for the week ending December 26, 2020, on 12 reporting U.S., Canadian and Mexican railroads totaled 271,170 carloads, down 1.8 percent compared with the same week last year, and 288,897 intermodal units, up 16.8 percent compared with last year. Total combined weekly rail traffic in North America was 560,067 carloads and intermodal units, up 7 percent. North American rail volume for the first 52 weeks of 2020 was 34,039,326 carloads and intermodal units, down 6.8 percent compared with 2019.

Rig Count

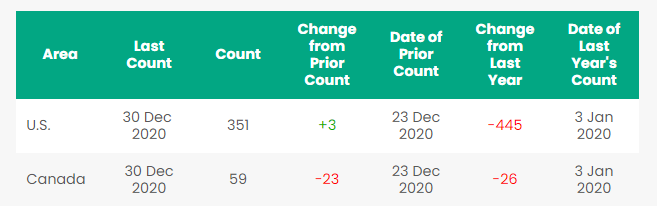

North America rig count is down by 19 Rigs week over week. The U.S. gained 3 rigs week over week. The U.S. currently has 351 active rigs. Canada’s rig count was down by 23 rigs week over week and Canada’s overall rig count is a mere 59 active rigs. Year over year we are down 471 rigs collectively.

North American Rig Count Summary

Things we are keeping an eye on

- Folks, to be honest the only thing PFL was keeping an eye on this past weekend was PFL’s fireworks show. It was more of a celebration that 2020 was now over and a celebration of hopefully a better 2021 for all of us. Please see below if you care to watch – “Happy New Year”

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

A sign of things getting better – leasing activity and inquiries have continued to be strong

PFL is seeking:

- 100 31.8K CPC 1232s or 30.3K 117R for the use of Gas and Diesel.

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase

- 50-60 Sulfuric acid cars 13.6 for purchase

- 40-50 molten Sulfur Cars 13.8 for purchase

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

- 30 5400-5800 286 Hoppers needed in Texas off the BN for grain 2 years negotiable

- 10 Veg Oil tanks 30K needed in Mexico off the BN for 2 years negotiable

- 5100 CU FT plus hoppers needed in the Midwest off the BN or UP negotiable

- 35 lined 4000 cubic foot steel gondolas for Sulphur service. Needed in Alberta for 3-5 year lease

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- 140 117R 30.3 Dirty Ethanol located east and Midwest, lease negotiable

- 25 117J 25.5 New Texas UP and BN lease negotiable

- 110 2494 CU FT Gondolas for sales or lease 286 GRL in Montana UP negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale, Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|