“As we express our gratitude, we must never forget that the highest form of appreciation is not to utter words, but to live by them”

– John F. Kennedy

COVID 19

The United States currently has 12,589,088 confirmed COVID 19 cases and 262,701 confirmed deaths.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 742,000 initial jobless claims. The number of first-time filers for unemployment benefits were higher than expected and were estimated to come in at 700,000. This was the first increase in five weeks and a sign that the resurgent viral outbreak is likely slowing the economy and forcing more companies to cut jobs. Of the roughly 20 million Americans now receiving some form of unemployment benefits, about half will lose those benefits when two federal programs expire at the end of the year. Some states are now starting to shut down again ahead of these benefits expiring and some closing schools against CDC guidelines. One has to ask themselves why they are doing this. Certainly jobs and businesses and mental health are going to be affected in a huge way.

Evidence is emerging that consumers are losing confidence in the economic outlook and pulling back on shopping, eating out and other activities. Spending on 30 million credit and debit cards tracked by JPMorgan Chase fell 7.4% earlier this month compared with a year ago. That marked a sharp drop from two weeks earlier. Consumer sentiment also declined in early November and is down nearly 21% from a year ago, according to a University of Michigan survey.

Markets End the Week Mixed

The Dow closed lower on Friday, down -219.75 points (-0.75%) closing out the week at 29,263.48 points down -216.33 points week over week. The S&P 500 closed lower on Friday as well, down -24.33 points (-0.68%) closing out the week at 3,557.54 points, down -27.61 points week over week. The Nasdaq Composite closed lower as well on Friday of last week, down 49.74 points (-0.42%) closing out the week at 11,854.97 points. The Nasdaq actually traded higher week over week up 25.68 points.

In overnight trading, DOW futures traded higher and are expected to open up this morning 144 points.

Oil Rises for Third Straight Week on COVID-19 Vaccine Optimism

Oil rose to the highest level in nearly three months with positive Covid-19 vaccine developments paving the way for a more sustained recovery in oil demand. Futures rose 5% in New York this week for a third straight weekly gain as Pfizer Inc. and BioNTech SE requested emergency authorization of their Covid vaccine Friday. Moderna Inc. also released positive interim results from a final-stage trial and said it’s close to seeking emergency authorization. Further gains were limited by broader market declines amid a dispute between the White House and the Federal Reserve over emergency lending programs. WTI traded up $.41 per barrel to close at $42.15 up $2.02 a barrel week over week. Brent traded up $.76 per barrel closing at $44.96 up $2.18 a barrel week over week.

U.S. crude oil inventories increased by 0.8 million barrels from the previous week. At 489.5 million barrels, U.S. crude oil inventories are about 6% above the five year average for this time of year. Total motor gasoline inventories increased by 2.6 million barrels last week and are about 4% above the five year average for this time of year. Finished gasoline and blending components inventories both increased last week. Distillate fuel inventories decreased by 5.2 million barrels last week and are about 11% above the five year average for this time of year. Propane/propylene inventories decreased by 2.0 million barrels last week and are about 6% above the five year average for this time of year. Total commercial petroleum inventories decreased by 10.2 million barrels last week.

U.S. crude oil refinery inputs averaged 13.8 million barrels per day during the week ending November 13, 2020 which was 395,000 barrels per day more than the previous week’s average. Refineries operated at 77.4% of their operable capacity last week. Gasoline production decreased last week, averaging 9.1 million barrels per day. Distillate fuel production increased last week, averaging 4.3 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $42.81, up 39 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 4.4% year over year in week 46 (U.S. +5.2%, Canada +6.1%, Mexico -13.8%), resulting in quarter to date volumes that are up 2.0% and year to date volumes that are down 8.2% (U.S. -8.8%, Canada -5.7%, Mexico -10.3%). 6 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+12.2%) and grain (+25.0%). The largest decreases came from coal (-16.2%) and petroleum (-25.2%).

In the East

CSX’s total volumes were up 10.2%, with the largest increases coming from intermodal (+15.7%) and chemicals (+17.5%). NS’s total volumes were down 0.6%, with the largest decreases coming from coal (-17.5%) and petroleum (-48.4%). The largest increases came from intermodal (+4.6%).

In the West

BN’s total volumes were up 4.5%, with the largest increases coming from intermodal (+16.3%) and grain (+24.5%). The largest decreases came from coal (-20.5%) and petroleum (-38.5%). UP’s total volumes were up 2.7%, with the largest increases coming from intermodal (+11.6%) and grain (+51.7%). The largest decreases came from coal (-26.0%) and petroleum (-33.2%).

In Canada

CN’s total volumes were up 5.9% with the largest increases coming from intermodal (+19.3%) and grain (+27.5%). The largest decreases came from motor vehicles & parts (-31.1%), petroleum (-20.0%) and stone sand & gravel (-38.6%). RTMs were up 1.9%. CP’s total volumes were up 2.4%, with the largest increases coming from intermodal (+15.6%). The largest decrease came from petroleum (-43.9%). RTMs were down 1.3%.

Kansas City Southern

KCS’s total volumes were down 3.6%, with the largest decrease coming from intermodal (-13.7%) and the largest increase coming from petroleum (+42.6%).

Source: Stephens

Rig Count

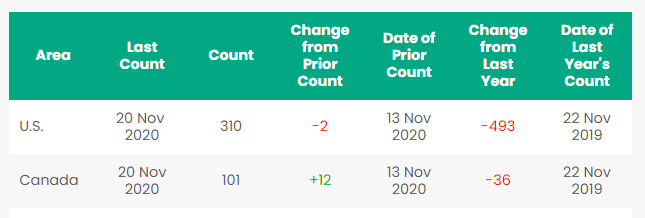

North America rig count is up by 10 Rigs week over week. The U.S. lost 2 rigs week over week with 310 active rigs. Canada’s rig count was up 12 rigs week over week and Canada’s overall rig count is 101 active rigs. Year over year we are down 629 rigs collectively.

North American Rig Count Summary

Despite the decrease in overall U.S. rig count, there is an increase in U.S. rig count involving plays in the Bakken shale formation in North Dakota. Since roughly half of the Bakken lies on Federal land producers are worried that a Biden presidency will halt drilling on Federal lands and that permits will no longer be issued so a little bit of a rush to get what they can get done. It is expected (unless Trump can pull a rabbit out of his hat) that Joe Biden will become President in January of next year.

In Canada last week the Canadian Association of Oilwell Drilling Contractors (CAODC) came out with a forecast that expects 3,771 wells to be drilled next year, up 475 from the projected total of 3,296 in 2020. The forecast is more optimistic than one made three weeks ago by the Petroleum Services Association of Canada calling for a total of 2,600 wells next year, down 8.8 per cent from an expected 50-year-low total of 2,850 wells in the current year. The CAODC forecast for 2021 represents a 71% drop from the 13,089 wells drilled in 2014, the year before the current oilfield slump began, CAODC noted.

Things we are keeping an eye on

- On Thursday of last week, TC Energy Corporation announced that it entered an agreement with Canada’s indigenous group, Natural Law Energy (“NLE”). The agreement permits NLE to invest up to C$1 billion in TC Energy’s Keystone XL Pipeline project underway in Canada despite opposition from U.S. President-elect Joe Biden. The transaction’s initial phase is expected to end in the third quarter of the next year. The project had to cope with multiple oppositions from various U.S. landowners, environmental and indigenous groups as it is thought to worsen climatic fluctuations and add to greenhouse gas emissions. TC energy is proceeding with the construction of the cross-border project, following the NLE investment in spite of Biden’s vow to stop the pipeline by revoking Keystone XL’s permit in the U.S. The midstream service believes that the NLE agreement will lead to employment generation and support from the indigenous group, which might fit well into the incoming Biden administration’s Build Back Better plan. The project is expected to enter into operation in 2023.

- Petroleum by Rail -The four-week rolling average of petroleum carried on the largest North American railroads rose to 23,274 compared with 22,933 the prior week. CP shipments rose by 0.3% and CN volumes rose by 3.4%. In the U.S shipments were up across the board week over week with the CSX and the NS both up 6.2%.

- US Trucking Trends – Dry-van rates are up 32% year over year, but largely unchanged month over month, and remain near all-time highs. As demand appears to be trending above seasonal average, rates are near flat year over year after experiencing mid-cycle rate increases over the last 60 days. While rising month over month and outperforming the seasonal trend, September truck tonnage was down 3% year over year according to Cass. The 3 month moving average is still 6% below year ago averages.

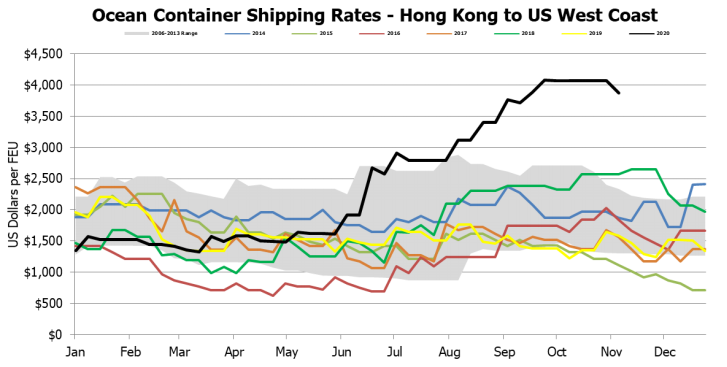

- Global Airfreight and Containerized Ocean Traffic – Total US and Canadian container imports were up 18% year over year in October, according to PIERS. Volume strength is expected into January driven by improving organic demand (inventory restocking, consumer demand), and PPE shipments (converted from airfreight)

Ocean rates in the spot market remain near all-time highs, with rates from Asia to the U.S. West Coast rising slightly over the past 30 days from $3,800 to $3,850 due to capacity constraints as volumes have recovered faster than capacity add-backs occur. FAK (spot rates with fuel) rates are now 185% above year ago levels according to the Shanghai Containerized Freight Index

Airfreight rates during August are 107% higher than year-ago levels (down 2% month over month) as capacity has shrunk faster than demand contraction. Rates are expected to remain 50%+ higher year over year into 2021 or until passenger flights (capacity) meaningfully resume.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

A sign of things getting better – leasing activity and inquiries have continued to be strong

PFL is seeking:

- 340W’s LPG pressure cars for various locations and lease terms,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

- 75 340W Dirty to Dirty last LPG – Needed in Canada UP April 2021 negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- 140 117R 30.3 Dirty Ethanol located east and Midwest, lease negotiable

- 25 117J 25.5 New Texas UP and BN lease negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

A sign of things getting better – leasing activity and inquiries have continued to be strong

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|