“Do what you feel in your heart to be right — for you’ll be criticized anyway” – Eleanor Roosevelt

COVID 19

The United States currently has 11,367,214 confirmed COVID 19 cases and 251,901 confirmed deaths.

We are starting off this week with another vaccine development, this time it was biotech company Moderna (whose shares are soaring pre-market along with the broader market). Moderna announced that preliminary phase 3 clinical studies showed that vaccine was 94% effective amongst 30,000 participants. Like the Pfizer vaccine announced last week, the Moderna vaccine requires two doses and uses mRNA technology. Both will be submitted the FDA in the coming weeks. The big development here is the how the doses are stored; the Pfizer vaccine must be stored at -94 degrees Fahrenheit, which presents distribution challenges. In contrast, the Moderna vaccine will remain stable at 36 – 46 degrees Fahrenheit, the temperature of a standard home fridge.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 709,000 initial jobless claims. The number of first-time filers for unemployment benefits were lower than expected and were estimated to come in at 731,000. This was the fourth straight week that claims were below 800,000. The number of people already collecting state-provided benefits, known as continuing claims, declined by 436,000 to a seasonally adjusted 6.79 million in the week ended Oct 31.

Another 298,154 people applied for benefits through a temporary federal-relief program that expires at the end of the year, the government said Thursday.

If both state and federal claims are combined, the number of new applications for unemployment benefits has yet to fall below 1 million a week since the onset of the pandemic.

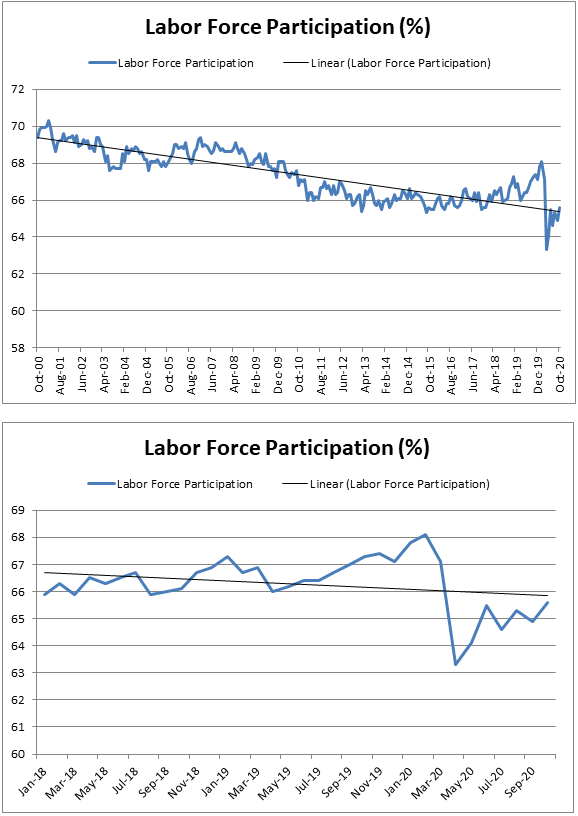

Labor force participation describes the working age population either working or actively seeking work. While continuing unemployment claims are improving, these unemployment numbers fail to take into account the large number of Americans who are sidelined from the “active” workforce. The number of people actively reentering the work force seems to be stalling. V shaped recovery?

Dow Wraps Up another Strong Week Nasdaq Down

The Dow closed higher on Friday, up 399.64 points (+1.37%) closing out the week at 29,479.81 points up a 1,156.41 points week over week in another big week for the market. The S&P 500 closed higher on Friday as well, up 48.14 points (+1.36%) closing out the week at 3,585.15 points, up 75.71 points week over week. The Nasdaq Composite closed higher as well on Friday of last week, up 119.70 points (1.02%) closing out the week at 11,829.29 points. The Nasdaq was down 65.94 points week over week as the market looked to exit technology and get back into value stocks.

In overnight trading, DOW futures traded higher and are expected to open up this morning 506 points.

Oil Ends the Week Weaker

Oil prices fell on Friday pressured by rising COVID cases and further lockdown restrictions. Production in Libya is also swelling, reaching as much as 1.125 MM/bpd. WTI traded down $.99 or -2.41% to close at $40.13 but up 8.1% week over week. WTI posted the largest weekly gain in a month as optimism from news of a potential Covid-19 vaccine breakthrough jolted markets earlier in the week. Brent traded down $.27 or -.62% to close at $42.78.

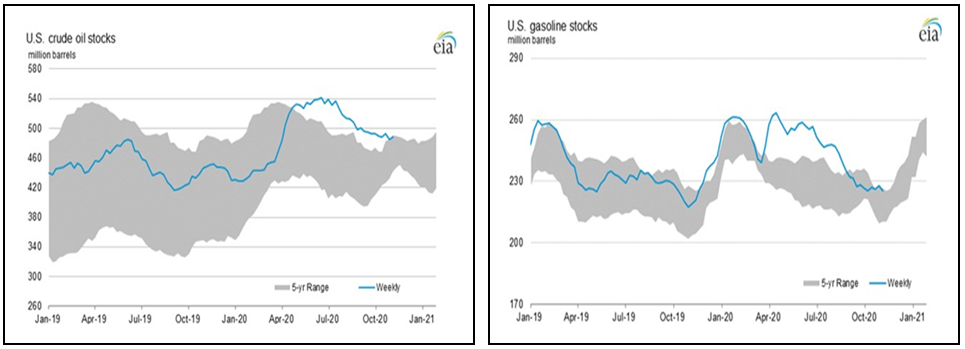

U.S. crude oil inventories increased by 4.3 million barrels from the previous week. At 488.7 million barrels, U.S. crude oil inventories are about 6% above the five year average for this time of year. Total motor gasoline inventories decreased by 2.3 million barrels last week and are approximately 3% above the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week. Distillate fuel inventories decreased by 5.4 million barrels last week and are about 15% above the five year average for this time of year. Propane/propylene inventories decreased by 0.9 million barrels last week and are about 7% above the five year average for this time of year.

U.S. crude oil refinery inputs averaged 13.4 million barrels per day during the week ending November 6, 2020 which was 105,000 barrels per day less than the previous week’s average. Refineries operated at 74.5% of their operable capacity last week. Gasoline production increased last week, averaging 9.3 million barrels per day. Distillate fuel production decreased last week, averaging 4.2 million barrels per day. U.S. Crude and Gasoline inventories looking in good shape (see below)

US Crude & Gasoline Charts

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $41.71, up $1.58 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 0.8% year over year in week 45 (U.S. +1.3%, Canada +3.0%, Mexico -14.3%), resulting in quarter to date volumes that are up 1.7% and year to date volumes that are down 8.5% (U.S. -9.1%, Canada -6.0%, Mexico -10.2%). 3 of the AAR’s 11 major traffic categories posted y/y increases with the largest increases coming from intermodal (+9.2%) and grain (+24.2%). The largest decrease came from coal (-20.1%).

In the East

CSX’s total volumes were up 1.9%, with the largest increase coming from intermodal (+8.3%). The largest decrease came from coal (-16.5%). NCS’s total volumes were down 4.2%, with the largest decreases coming from coal (-35.1%) and petroleum (-47.3%). The largest increases came from intermodal (+3.3%) and grain (+35.7%).

In the West

BN’s total volumes were up 1.3%, with the largest increases coming from intermodal (+12.6%) and grain (+25.1%). The largest decreases came from coal (-25.1%) and petroleum (-28.5%). UP’s total volumes were up 1.6%, with the largest increases coming from intermodal (+11.3%) and grain (+30.4%). The largest decreases came from coal (-19.8%), motor vehicles & parts (-20.0%) and petroleum (-29.7%).

In Canada

CN’s total volumes were up 1.8% with the largest increases coming from intermodal (+16.0%) and grain (+48.1%). The largest decreases came from motor vehicles & parts (-36.7%), metallic ores (-12.1%) and petroleum (-17.8%). RTMs were up 7.4%. CP’s total volumes were up 2.0%, with the largest increases coming from intermodal (+12.2%) and grain (+22.7%). The largest decrease came from petroleum (-44.7%). RTMs were down 2.7%.

Kansas City Southern

KSU’s total volumes were down 11.1%, with the largest decrease coming from intermodal (-12.3%)

Source: Stephens

Things we are keeping an eye on

- Michigan Gov. Gretchen Whitmer really wants to shut down Enbridge’s Line 5 and took legal action last Friday to shut down the pipeline that carries oil beneath a channel that links two of the Great Lakes.

Whitmer’s office notified Enbridge that it was revoking an easement granted in 1953 to extend a roughly 6.4-kilometre section of the pipeline through the Straits of Mackinac. The revocation will take effect within 180 days, at which point the flow of oil must stop. The Democratic governor’s legal counsel said in a letter to Enbridge that the revocation resulted from “a violation of the public trust doctrine” and “a longstanding, persistent pattern of noncompliance with easement conditions and the standard of due care.”

“Enbridge has routinely refused to take action to protect our Great Lakes and the millions of Americans who depend on them for clean drinking water and good jobs,” Whitmer said in a statement. “They have repeatedly violated the terms of the 1953 easement by ignoring structural problems that put our Great Lakes and our families at risk. “Most importantly, Enbridge has imposed on the people of Michigan an unacceptable risk of a catastrophic oil spill in the Great Lakes that could devastate our economy and way of life. That’s why we’re taking action now and why I will continue to hold accountable anyone who threatens our Great Lakes and fresh water.” Michigan Attorney General Dana Nessel said she filed a lawsuit Friday to carry out Whitmer’s decision and shut down the line, saying the actions show that “Line 5 poses a great risk to our state, and it must be removed from our public waterways.”

Alberta’s energy minister issued a statement about the development on Friday afternoon. “This is just the latest development in long-standing efforts by Michigan’s executive branch against a vital energy corridor for the state,” Sonya Savage said. “Like so many regulatory matters concerning pipelines, it is expected that the latest move announced today will be headed to a long, protracted process in the American court system.” Savage said Line 5 has given Michigan about 65 per cent of the propane “that heats homes in the Upper Peninsula, while also providing neighboring states, Ontario and Quebec with reliable safe energy.” “The project is a critical piece of infrastructure that is being made even safer through the Great Lakes Tunnel Project and can provide the energy still required for the coming decades,” she said.

The move escalates a multiyear battle over Line 5, which is part of Enbridge’s Lakehead network of pipelines that carries oil from western Canada to refineries in the U.S. and Ontario. The pipeline carries about 23 million gallons of oil and natural gas liquids daily between Superior, Wisconsin, and Sarnia, Ontario. The company says the underwater segment is in good condition has never leaked. Environmental groups contend it’s vulnerable to a rupture that would devastate portions of Lake Huron and Lake Michigan.

Enbridge reached an agreement with then-Gov. Rick Snyder, a Republican, in 2018 to replace the underwater segment with a new pipe that would be housed in a tunnel to be drilled through bedrock beneath the Straits of Mackinac. Enbridge is seeking state and federal permits for the project, which is not affected by Whitmer’s shutdown order regarding the existing pipeline. - Other pipelines on the chopping Block include Dakota Access. The election of Democrat Joseph Biden could create more headaches for the Dakota Access Pipeline’s (DAPL) owners, who are already embroiled in legal battles to keep the main conduit for flowing oil out of North Dakota running. DAPL’s controlling owner, Dallas-based Energy Transfer LP, is fighting to keep the pipeline running after a judge threw out its permit to run the line under a South Dakota lake that is a water source for Native American tribes that want the pipeline shut. The line was finished in 2017 after Trump, upon taking office, approved a final permit allowing construction under the lake to be completed. In July, a U.S. district court judge threw out that permit, and ordered the U.S. Army Corps of Engineers to conduct a new environmental review that is expected to take months. Biden, who defeated incumbent Trump in the election, could bring in new Army Corps leadership. That could increase the chances that the line would be shut. For now, the Corps has allowed DAPL to operate on federal land without a permit. Executives at Energy Transfer do not expect the line to be shut. “We really don’t envision or see a scenario where we will take the pipeline out of service,” Energy Transfer President and Chief Commercial Officer Marshall McCrea said on a quarterly earnings call with investors on Nov. 4, a day after the election. “We just don’t think that’s going to happen.”

Last but not least the Keystone XL pipeline could be scrapped as President –elect Biden previous said he would revoke key permits for the pipeline if elected. With three pipelines on the chopping block it could create tremendous crude by rail opportunities. - Petroleum by Rail -The four-week rolling average of petroleum carried on the largest North American railroads rose to 22,933 compared with 22,703 the prior week. CP shipments fell by 6.5% and CN volumes declined by 18.6%. In the U.S., the BN had the largest percentage loss at -12.6% while the NS had the largest percentage gain up by 10.7%.

- Last, but not least, more refiner closures were announced last week as COVID demand destruction continues. Petroineos plans to mothball nearly half of its 200,000 barrel-per-day refinery at Grangemouth in Scotland, the latest plant to scale back operations due to a coronavirus-related drop in demand and a weak long-term outlook for oil consumption. The company plans to shut down its 65,000 bpd crude distillation unit (CDU) 1 as well as the 25,000 bpd fluidized catalytic cracker unit, used to produce gasoline, the company said on Tuesday. Royal Dutch Shell said it would cut jobs and processing at its 500,000-bpd Singapore refinery.

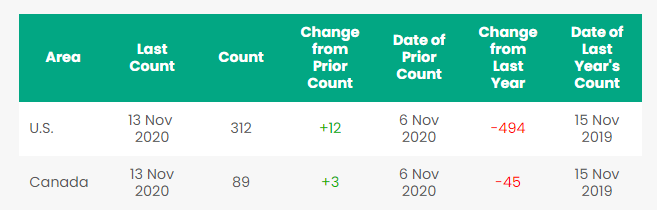

Rig Count

North America rig count is up 15 Rigs week over week. The U.S. gained 12 rigs week over week with 312 active rigs. Canada’s rig count was up 3 rigs flat week over week and Canada’s overall rig count is 89 active rigs. Year over year we are down 628 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 340W’s LPG pressure cars for various locations and lease terms,

- 17 30.3 gal for lease in New Mexico 1 year crude

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 200 117Rs 30K plus Diesel or Gas Houston dirty – negotiable

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 19 117R 28.3 Gal Texas Class One Open 2-5 years Diesel

- 6 31.8 Gal tanks Ohio 3-5 years Noneno

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 60 340W Pressure cars in VA – last Ammonia dirty 12-18 mos NS or CSX

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- 10-20 340W pressure cars in Miss. – last butane – dirty lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 30 340W dirty propane or butane west coast negotiable

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- 140 117R 30.3 Dirty Ethanol located east and midwest, lease negotiable

- 25 117J 25.5 New Texas UP and BN lease negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

A sign of things getting better – leasing activity and inquiries have continued to be strong

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|