“Ask not what your country can do for you, but what you can do for your country“

John F. Kennedy

COVID 19 and Markets Update

The United States currently has 9,475,788 confirmed COVID 19 cases and 236,501 confirmed deaths. Europe is once again at the epicenter of the coronavirus pandemic, with the continent now recording more and faster-rising deaths than the United States. Fresh lockdowns by governments in response to the rising infection levels, led by France and Germany, are weighing on markets. The rise in infections across parts of Europe is stretching the capacity of hospitals in cities in France, Belgium, Italy and elsewhere. On a per capita basis, deaths from COVID-19 in Europe are now rapidly approaching U.S. levels, after running significantly below since May.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 751,000 initial jobless claims. The number of first-time filers for unemployment benefits were lower than expected and were estimate to come in at 775,000. Continuing jobless claims were 7,756,000 compared to consensus of 7,775,000.

Dow Wraps up Worst Month since March

Major U.S. stock indexes slid last week on sharp selloff in Twitter and Apple shares.

The Dow Jones Industrial Average declined Friday, closing out its worst week and month since March in the final lap of the presidential race.

The Dow dropped 157.51 points, or 0.6% to 26,501.60 on Friday, paring its declines in the session’s final moments. The blue-chip index shed 6.5% for the week, marking its worst weekly performance since the height of the pandemic-induced market tumult. The S&P 500 fell 40.15 points, or 1.2%, to 3,269.96. The benchmark index is now up just 1.2% in 2020. The Nasdaq Composite dropped 274 points, or 2.4%, to 10,911.59 following a sharp selloff in big tech stocks.

All three indexes suffered losses of more than 2% for October, their second consecutive month of declines. After a remarkable run since late March, stocks peaked in early September—only to tumble on worries the market had run too far, too fast.

Although economic data and corporate earnings have improved, many investors fear the impact of another round of lockdowns in the event the number of coronavirus cases continues to increase here in the United States as Europe pursues its lock down measures. Earnings reports and guidance from technology companies also weighed heavily on stocks Friday. Twitter plunged $11.07, or 21%, to $41.36 after posting its slowest user growth in years and warning that uncertainty around the U.S. election could compress ad spending. Apple shares dropped $6.46, or 5.6%, to $108.86 after quarterly iPhone sales fell from a year earlier. That, combined with a delay in the launch of the company’s new smartphone, led to iPhone revenue falling more than analysts had expected.

In overnight trading, DOW futures traded higher and is expected to open up this morning by 440 points.

Oil Ends the Month Weak

U.S. West Texas Intermediate (WTI) crude fell 38 cents to settle at .U.S $35.79/bbl Friday, after dipping to its lowest level since June on Thursday of last week at US$34.92. WTI fell 11 per cent for the month, while Brent dropped 10 per cent.

Brent crude dropped 19 cents to settle at U.S. $37.46/bbl, after touching a five-month low of US$36.64 in the previous session. The front-month Brent contract expired on Friday and the January contract settled down 32 cents.

Oil prices fell on Friday and posted a second consecutive monthly drop as rising COVID-19 cases in Europe and the U.S. heightened concerns over the outlook for fuel consumption.

U.S. crude inventories increased by 4.320M/bbls last week and now stand at 492.427 MM/bbls, according to the EIA. Consensus was called for a lower build of 1.029M/bbls and crude production was up 1.2M/bbls per day at 11.1 mbbls per day. Refinery utilization was up 1.7% to 74.6%. U.S. gasoline inventories decreased by -892/k last week and now stand at 256.124 MM/bbls. Consensus was for a gain of 547/k. U.S. distillate inventories were down by -4.491MM/bbls and now stands at 156.225 MM/bbls. Consensus was for a draw of -2054MM/bbls.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $34.79, down $1.00 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 1.6% year over year over year in week 43 (U.S. +1.9%, Canada +4.6%, Mexico -13.1%), resulting in quarter to date volumes that are up 1.8% and year to date volumes that are down 9.0% (U.S. -9.6%, Canada -6.4%, Mexico -10.8%). 6 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+8.0%) and grain (+21.3%). The largest decrease came from coal (-19.9%).

In the East

CSX’s total volumes were up 5.3%, with the largest increase coming from intermodal (+11.8%). The largest decreases came from coal (-8.9%) and grain (-29.8%). NS’s total volumes were down 3.9%, with the largest decreases coming from coal (-31.0%), petroleum (-54.8%) and stone sand & gravel (-23.9%). The largest increases came from intermodal (+2.6%) and grain (+41.8%).

In the West

BN’s total volumes were down 2.4%, with the largest decreases coming from coal (-29.1%) and petroleum (-36.8%). The largest increases came from intermodal (+8.8%) and grain (+14.4%). UP’s total volumes were up 5.7%, with the largest increases coming from intermodal (+12.0%) and grain (+44.2%). The largest decreases came from coal (-20.0%) and petroleum (-28.9%).

In Canada

CN’s total volumes were up 3.4% with the largest increases coming from intermodal (+15.9%) and grain (+55.3%). The largest decreases came from coal (-32.7%), petroleum (-22.4%) and stone sand & gravel (-47.9%). RTMs were up 0.8%. CP’s total volumes were up 4.3%, with the largest increases coming from grain (+27.9%) and intermodal (+6.6%). The largest decrease came from petroleum (-29.5%). RTMs were up 6.5%.

Kansas City Southern

KCS’s total volumes were up 2.0%, with the largest increase coming from grain (+55.6%).

Source: Stephens

Things we are keeping an eye on

- US GDP – We are watching the election folks – U.S. economic activity surged at a record clip for the July through September period, as an initial easing of virus-related lockdowns allowed business activity to return after an historic slump. The Bureau of Economic Analysis released its advance print on third-quarter gross domestic product (GDP) on Thursday of last week. Here are the highlights. Here are the highlights:

- 3Q GDP, annualized quarter-over-quarter: 33.1% vs. 32.0% expected, -31.4% in the second quarter

- 3Q Personal Consumption: 40.7% vs. 38.9% expected, -33.2% in the second quarter

- 3Q GDP Price Index: 3.6% vs. 2.9% expected, -1.8% in the second quarter

- 3Q Core Personal Consumption Expenditures, quarter-over-quarter: 3.5% vs. 4.0% expected, -0.8% in the second quarter

The increase in GDP did not go far enough to bring U.S. output to pre-pandemic levels. GDP fell to a seasonally adjusted annual rate of $18.58 trillion in the third quarter this year (based on chained 2012 dollars), down from $19.24 trillion in the fourth quarter of 2019 before the pandemic began to take in effect on the domestic economy.

2. Petroleum by Rail –The four-week rolling average of petroleum carried on the largest North American railroads rose to 22,709 compared with 22,412 the prior week. CP shipments rose by 8.4% and CN volumes rose by 2.1%. In the U.S., the UP had the largest percentage increase at 22% while the BN had the largest percentage loss at -4.6%.

3. PBF to slash production at its Paulsboro 180,000 barrel per day facility in NJ amid falling demand in the East coast due to COVID. The move will allow PBF to maximize its Del City refinery. Heavy and medium crudes make up most of Paulsboro throughput which is another headwind for crude by rail out of Canada.

4. Kansas City’s Train Derailment (KCS) – At approximately 7:30 a.m. on October 29, the KCS derailed 25 cars including 10 empty and 15 loaded cars. Two hazmat ethylene oxide cars and one hazmat propylene oxide car derailed, but all three are intact and not leaking. Two hazmat monoethanolamine cars derailed and were leaking a corrosive liquid. The leaks were contained, and the product was containerized for proper disposal. As the product from these cars present hazards related to direct contact, and not respiratory exposure, the product release was mitigated without harm to the general public. Four confirmed non-hazmat tank cars were breached, and leaking a petroleum product that did not represent a health risk to the general population. KCS is working quickly with the local and state agencies to clean the spilled products. The main line remains closed and trains are not currently being re-routed around the incident. The area will be reopened to the public as soon as it is safe to do so. No injuries have been reported. The cause of the derailment remains under investigation and will be reported to the Federal Railroad Administration (FRA). KCS continues to work to comply with all FRA rules for the safe movement of freight transportation.

Rig Count

North America rig count is up 8 Rigs week over week. The U.S. gained 5 rigs week over week with 287 active rigs. Oil rigs were up six to 211, gas rigs were down one to 73, and miscellaneous rigs were unchanged at three, according to Baker Hughes. Canada gained 3 rigs week over week and Canada’s overall rig count is 83 active rigs. Year over year we are down 628 rigs collectively.

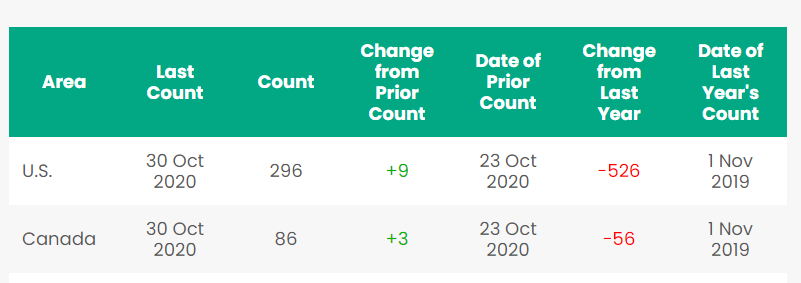

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- 20 117R’s 30,000 gallon cars needed for alcohol service cars have to be non -lined

- 340W’s LPG pressure cars for various locations and lease terms,

- 17 30.3 gal for lease in New Mexico 1 year crude

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 200 117Rs 30K plus Diesel or Gas Houston dirty – negotiable

- 100 CPC 1232 31.8 prior gasoline service for 3-6 month lease (extendable with mutual agreement) in Texas.

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 200 1232 25.5K Gal Texas UP BN 2 years fuel oil

- 19 117R 28.3 Gal Texas Class One Open 2-5 years Diesel

- 6 31.8 Gal tanks Ohio 3-5 years Noneno

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 60 340W Pressure cars in VA – last Ammonia dirty 12-18 mos NS or CSX

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- 10-20 340W pressure cars in Miss. – last butane – dirty lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 30 340W dirty propane or butane west coast negotiable

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

A sign of things getting better – leasing activity and inquiries have continued to be strong

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|