“The only place success comes before work is in the dictionary.”

– Vidal Sassoon

COVID 19 and Markets Update

The United States currently has 7,637,066 confirmed COVID-19 cases and 214,615 confirmed deaths.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 837,000 initial jobless claims. The number of first-time filers for unemployment benefits were slightly lower than expected last week. An estimated 650,120 people also filed new claims under the Pandemic Unemployment Assistance Act, the federal law passed that temporarily made self-employed workers eligible for benefits. That put the number of actual or unadjusted new claims at 1.44 million a staggering and troubling number.

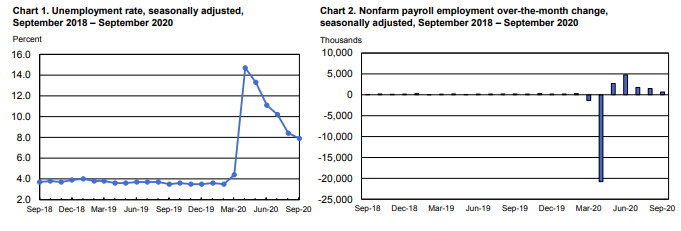

Total nonfarm payroll employment rose by 661,000 in September and the unemployment rate declined to 7.9 percent, according to the U.S. Labor Department in a report released Friday of last week. According to the U.S. labor department, the improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to COVID-19 pandemic and efforts to contain it. In September, notable job gains occurred in leisure and hospitality, retail trade, health care and social assistance and in professional and business services. Employment in government declined over the month, mainly in state and local government education.

U.S. Employment Situation

DOW and NASDAQ

The DOW closed lower on Friday, down 134.09 points (-0.48%) to finish out the week at 27,682.81 up 508.85 points week over week. The S&P 500 traded lower 32.36 points (-0.96%) on Friday, closing at 3,348.44, up 28.97 points week over week. The Nasdaq finished Friday’s session lower as well, losing 251.49 points (-2.22%) closing out the week at 11,075.02 up 161.46 points week over week. In overnight trading, DOW futures traded higher and are expected to open up this morning 182points.

Oil Markets

Oil prices declined on Friday of last week on the back of rising COVID cases, weak demand and increasing oil production. WTI traded down $1.67 or -4.31% to close at $37.05 a loss of $3.20 per barrel week over week.

Brent traded down $1.66 on Friday of last week or -4.06% to close at $39.27, a loss of $2.65 per barrel week over week.

U.S. crude inventories fell by 2.0MM/bbls last week and now stand at 492.4 MM/bbls according to the EIA. Consensus was for a draw of 1.6MM/bbls. Crude production was up 538K/bpd to 11MM/bpd. OPEC is due to taper their production cuts by 2 million barrels per day in January. OPEC and other major oil producers announced record oil cuts in March this year as fuel demand collapsed with half the world in some form of lockdown to stop the spread of COVID-19. Traders doubt this will happen (OPEC production increase that is) as scheduled due to the already low price environment. Distillate inventories were down by 3.2MM/bbls, significantly higher than the forecasted draw of -917K/bbl. Gasoline stocks rose by 683K/bbl versus a forecast draw of -1.1MM/bbls. U.S. gasoline demand remained flat for most of the third quarter, undercutting hopes of a rebound.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $38.48 up $1.43 per barrel from Friday’s close as yet another hurricane threatens gulf coast production.

North American Rail Traffic

Total North American rail volumes were down 2.3% year over year in week 39 (U.S. -2.1%, Canada 0.0%, Mexico -13.5%), resulting in 3Q20 volumes that were down 6.2% and YTD volumes that are down 10.0% (U.S. -10.7%, Canada -7.7%, Mexico -9.8%). 8 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decrease coming from coal (-25.8%). The largest increases came from intermodal (+4.0%) and grain (+27.6%).

In the East

CSX’s total volumes were down 1.3%, with the largest decreases coming from coal (-15.5%) and stone sand & gravel (-25.8%). The largest increase came from intermodal (+8.7%). NCS’s total volumes were down 4.0%, with the largest decreases coming from coal (-27.3%) and petroleum (-49.1%). The largest increases came from intermodal (+2.3%) and motor vehicles & parts (+20.6%).

In the West

BN’s total volumes were down 3.6%, with the largest decreases coming from coal (-27.7%), petroleum (-30.0%) and stone sand & gravel (-34.6%). The largest increases came from grain (+62.5%) and intermodal (+4.1%). UP’s total volumes were up 1.2%, with the largest increases coming from intermodal (+10.0%) and grain (+63.6%). The largest decrease came from coal (-29.5%).

In Canada

CN’s total volumes were down 2.0% with the largest decrease coming from petroleum (-29.7%). The largest increases came from intermodal (+3.6%) and farm products (+56.9%). RTMs were up 2.1%. CP’s total volumes were up 2.1%, with the largest increases coming from farm products (+95.1%), intermodal (+5.7%) and grain (+24.4%). The largest decreases came from petroleum (-45.0%) and coal (-18.7%). RTMs were up 5.8%.

Kansas City Southern

KCS’s total volumes were down 2.2%, with the largest decrease coming from chemicals (-16.7%) and the largest increase coming from petroleum (+32.5%).

Source: Stephens

Things we are keeping an eye on:

- Trump Signs Emergency Order To Bolster Rare Earth Mining on Oct 01, 2020:

President Donald Trump has signed an executive order declaring a national emergency in the mining industry, a move that seeks to curb the country’s reliance on rare earths in his latest bid to end China’s control of the market.

The directive, issued late Wednesday night, asks the Interior Department to explore using the 70-year-old Defense Production Act to speed up mines development. It also calls for a report evaluating possible measures such as tariffs, quotas or other trade restrictions targeting China and “other non-market foreign adversaries.” Local rare earth miners hailed the move. Pini Althaus, Chief Executive of USA Rare Earth, said it was “an important step toward ensuring the U.S. is free from price manipulation and other aggressive economic maneuvers.” Critical minerals have been a focus of the Trump administration. The White House has signed agreements with Canada and Australia, among other nations, to secure supply of minerals needed for a range of modern life’s aspects, including electric vehicles (EVs), green technologies and military applications. Last year, the White House ordered the Defense Department to boost production of rare-earth magnets used in consumer electronics, military hardware and medical research, amid concerns China would restrict exports of the products as trade tensions between the countries grew. The U.S. is not alone in its quest to reduce reliance on foreign producers. In September, the European Union stepped up its push to become less dependent on imported raw materials, including rare earths and, for the first time, lithium. - Petroleum by Rail –The four-week rolling average of petroleum carried on the largest North American railroads rose to 21,963 compared with 21,560 the prior week. CP shipments fell by 4.5% and CN volumes rose slightly. In the U.S. UP had the largest percentage increase at !0.3% while the BN had the largest percentage loss at -3,7%

- Alaska – Alberta Railway – President Trump Clears Hurdle for Alaska-Alberta Rail Corridor by issuing a Presidential Permit last week. The Proposed Alaska – Alberta Railway will link transportation networks in North America to world markets. President Donald Trump issued a Presidential Border Crossing Permit (presidential permit) for the Alaska – Alberta Railway Corporation (A2A Rail) to lay track across the border between Alaska and Canada, a crucial step for the $17 billion USD rail line to become a reality. The A2A railway an efficient way to transport a wide range of bulk commodities including grain, oil, ore, and other resources, in addition to containerized goods and passengers. The proposed route connects Alaska’s deep-water ports and the existing Alaska Railroad network to Canadian railroads through northern Alberta. Construction is anticipated to be complete by 2025, with the railway being fully operational in 2026. Soft construction is ready to commence this year. The A2A border crossing, which will be located between Alaska and Yukon, provides a long sought “missing link” between Alaska and the North American railway system, ensuring free flow of freight from the Gulf of Mexico to the Gulf of Alaska. This rail link will be the anchor tenant of a major northern development corridor; the purpose of which is to facilitate economic development, rural household service provision, and other opportunities to the communities in this isolated region. The presidential permit was signed following advice from the U. S. Department of State that the A2A railway was in the best foreign policy interest of the United States. A2A Founder and Chairman Sean McCoshen welcomed the news: “I would like to extend my thanks to President Trump, Alaska Governor Mike Dunleavy, the Alaska Congressional Delegation and the Alaska State Legislature for their unwavering support for this project throughout the entirety of the presidential permit process.” The issuance of a presidential permit is a significant milestone that will greatly assist with our continued efforts to build the A2A railway. This is a world-class infrastructure project that will generate thousands of jobs for American and Canadian workers provide a new, more efficient route for trans-Pacific shipping and link Alaska to North American transportation networks. The new rail line will provide for greater national, international and global trade and create new and exciting economic development opportunities for a wide range of businesses, communities and indigenous peoples in Canada and Alaska. McCoshen added: “We estimate that this rail line could unlock $60 billion in additional cumulative GDP through 2040 and create more than 28,000 jobs.

- Cando Rail Services announced in a press release on Thursday of last week the opening of the Cando Sturgeon Terminal in Sturgeon County, Alberta. Cando Sturgeon Terminal will provide additional rail capacity to Alberta’s Industrial Heartland and expands Cando’s national network. With the completion of Phase 1, Cando Sturgeon Terminal can store up to 1,900 railcars utilizing a loop-track system. Cando Sturgeon Terminal is centrally located in Alberta’s Industrial Heartland directly west of the CN Beamer Spur and serviced by CN. The terminal offers services seven days per week for railcar staging and storage, including unit-train storage capability, for short or long-term, loaded or empty railcars, as well as various value-added services.

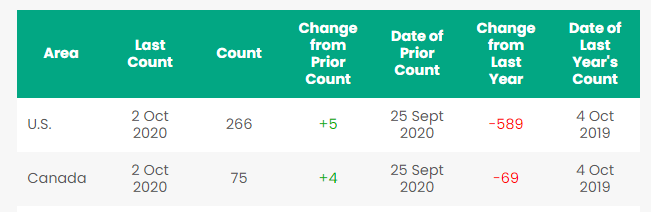

Rig Count

North America rig count is up 9 Rigs week over week. The U.S. gained 5 rigs week over week with 266 active rigs. (189 Oil Rigs, 74 gas Rigs and 3 miscellaneous rigs) Canada gained 4 rigs week over week and Canada’s overall rig count is now at 75 active rigs. Year over year we are down 658 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- 20 117R’s 30,000 gallon cars needed for alcohol service cars have to be non -lined

- 340W’s LPG pressure cars for various locations and lease terms,

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 200 117Rs 30K plus Diesel or Gas Houston dirty – negotiable

- 100 CPC 1232 31.8 prior gasoline service for 3-6 month lease (extendable with mutual agreement) in Texas.

- 17 30.3 gal for lease in New Mexico 1 year for crude

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 17 30.3 pressure cars for lease in Midwest or west preferred

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 25-50 340W Pressure cars for LPG 6-12 months Edmonton Canada

- 15 500W tanks for CO2 6-12 months multiple locations

- 20 117R 30.3K Gal BN Crude Gallup NM 1 year

- 100 1232 Tanks for BN Edmonton Canada 8 months Crude

- 200 1232 25.5K Gal Texas UP BN 2 years fuel oil

- 25 117R 28.3 Gal Texas Class One Open 2-5 years Diesel

- 6 31.8 Gal tanks Ohio 3-5 years Nonene

- 50-90 263 or 268 for Corn Syrup for sale location negotiable

- 50-60 13.6K tanks for sulfuric acid for sale location negotiable

- 40-50 13.8K tanks for Molten Sulfer for sale location negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 60 340W Pressure cars in VA – last Ammonia dirty 12-18 mos NS or CSX

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- 10-20 340W pressure cars in Miss. – last butane – dirty lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50 300 series Pressure cars

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|