“Paying attention to simple little things that most men neglect makes a few men rich.”

– Henry Ford

COVID 19 and Markets Update

The United States currently has 7,004,768 confirmed COVID 19 cases and 204,118 confirmed deaths.

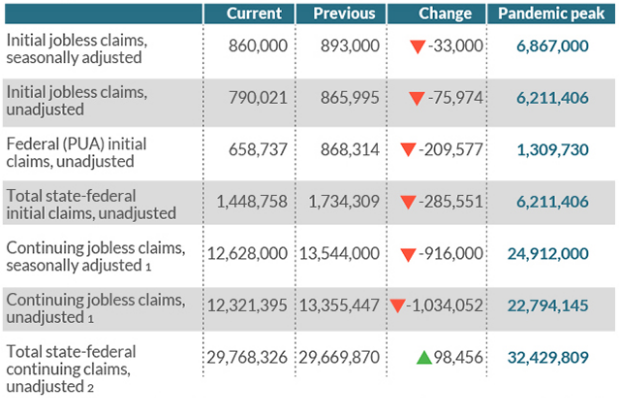

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 860,000 initial jobless claims. Initial jobless claims are still very high and point to ongoing job losses due to the coronavirus pandemic. A program introduced in August by the Federal government called “Pandemic Unemployment Assistance Act” (PUA) has been stubbornly high as well and saw 658,737 claims last week. This program is designed for self-employed workers (please see below U.S. Jobless claims numbers):

US Jobless Claims

DOW and NASDAQ

The DOW closed lower on Friday, down 244.56 points (-0.88%) to finish out the week at 27,657.42 down 8.22 points week over week. The S&P 500 traded lower 37.54 points (-1.12%) on Friday, closing at 3,319.47, down 21.5 points week over week. The Nasdaq finished Friday’s session lower as well, losing 116.99 points (-1.07%) closing out the week at 10,793.28, down 60.26 points week over week. In overnight trading, DOW futures traded lower and are expected to open up this morning 563 points.

Oil Markets

West Texas Intermediate (WTI) traded up 14 cents to close at $41.11 on Friday of last week on the New York Mercantile Exchange, a gain of $3.82 or 10.1% per barrel week over week.

Brent traded down 15 cents to close at $43.15 on Friday of last week, a gain of $3.32 or 8.3% per barrel week over week. Goldman Sachs is bullish on oil, expecting the market to be in a deficit of around 3 million barrels per day by the fourth quarter and Brent Crude prices to recover to $49 a barrel by the end of this year, from $43 on Friday. According to a new report from Goldman analysts, carried by Reuters, the recent floating storage of oil is more “transient inventory allocation dynamics,” instead of a signal of a new glut. “We estimate that the oil market remains in deficit with speculative positioning now at too low levels,” Goldman Sachs said, keeping its Brent Crude target at $49 by end-2020 and $65 by the third quarter of 2021.

U.S. crude inventories decreased by 4.39 MM/bbls last week and now stand at 496 MM/bbls according to the EIA. Consensus was for a 1.5 million barrel draw. Hurricane Sally impacted last week’s numbers taking roughly 500K/bpd of production offline. Gasoline inventories were down by 381K/bbl. Distillate stocks had a build of 3.46MM/bbls.

Saudi Arabia is cracking down on OPEC+ members

Saudi Arabia is forcefully cracking down on OPEC+ member countries that failed to comply with their planned cuts. The Saudi’s announced an extraordinary meeting in October if oil markets continue to weaken adding to the price gains seen last week. The Saudi Energy minister is warning speculators from betting against oil prices, saying “We will never leave this market unattended. I want the guys in the trading floors to be as jumpy as possible. I’m going to make sure whoever gambles on this market will be ouching like hell.” Prices were kept in check from rising further on Friday on of last week after Libyan commander Khalifa Haftar announced he would lift his blockade of oil output for one month. The blockade slashed Libyan production to just over 100,000 bbls/d now from around 1.2 million bbls/d previously. It is unclear how quickly Libya could ramp up production.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $40.27 down 84 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 9.2% year over year in week 37 (U.S. -9.9%, Canada -5.2%, Mexico -15.4%), resulting in quarter to date volumes that are down 6.9% and year to date volumes that are down 10.5% (U.S. -11.2%, Canada -8.1%, Mexico -9.6%). 9 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decreases coming from intermodal (-5.9%), coal (-23.4%) and nonmetallic minerals (-20.6%). The largest increases came from grain (+12.1%) and farm products & food (+11.0%).

In the East

CSX’s total volumes were down 5.7%, with the largest decreases coming from coal (-17.3%), grain (-50.0%) and motor vehicles & parts (-11.9%). NS’s total volumes were down 12.2%, with the largest decreases coming from intermodal (-7.1%) and coal (-28.0%).

In the West

BN’s total volumes were down 8.2%, with the largest decreases coming from coal (-25.0%) and intermodal (-2.6%). The largest increase came from grain (+36.0%). UP’s total volumes were down 9.3%, with the largest decreases coming from coal (-23.4%) and intermodal (-4.9%). The largest increase came from grain (+22.4%).

In Canada

CN’s total volumes were down 3.7% with the largest decrease coming from petroleum (-38.5%). The largest increases came from grain (+60.5%) and farm products (+78.6%). RTMs were up 1.5%. CP’s total volumes were down 10.1%, with the largest decreases coming from intermodal (-15.0%) and petroleum (-50.0%). The largest increases came from farm products (+83.7%) and chemicals (+20.4%). RTMs were down 5.9%.

Kansas City Southern

KCS’s total volumes were down 2.2%, with the largest decrease coming from stone sand & gravel (-44.6%). The largest increase came from intermodal (+3.5%).

Source: Stephens

The big surge in intermodal traffic seems to have waned week over week a leading factor contributing to last week’s declines. Let’s hope this was just a Labor Day blip!

Things we are keeping an eye on:

- Biofuels – Ethanol is looking interesting so is biodiesel and could be a tailwind for rail in the days to come. President Donald Trump said he would support a plan that would allow fuel retailers to sell 15% ethanol blends in pumps that already accept E10 blends, subject to individual state approval. In addition, Brazil extended by 90 days its quota for allowing some tariff-free U.S. ethanol into the country – this is good news for U.S. exports. Also, the EPA on Monday of last week, denied more than 50 requests for retroactive small refinery exemptions (SREs) from the Renewable Fuel Standard compliance requirements. At the end of the day, these refineries must either blend biofuels when they sell gasoline, diesel or heating oil or buy RINS for not being able to or having the infrastructure to blend. The battle is not over as it relates to the small refinery exemption. Refiners HollyFrontier and CVR Energy asked the U.S. Supreme Court this month to review the ruling that they said improperly “declared the eventual extinction” of SREs and would force small refiners out of business. It is anticipated that the short to median term demand for biofuels will increase since most biofuels move on rail good news for rail and the biofuels industry – bad news for struggling refineries. The reality is longer term both big oil and the renewable fuels industry as it relates to fuels that we consume in our vehicle’s does face significant headwinds in the future as the far left has an electricity for everything agenda.

- Petroleum by Rail –The four-week rolling average of petroleum carried on the largest North American railroads fell to 21,172 compared with 21,231 the prior week. Canadian volumes fell. CP shipments fell by 9.8% and CN volumes fell by 12%. At a JP Morgan’s Industrial conference last week, CP said its crude by rail volumes most likely hit bottom in the third quarter and are expected to rebound moving forward. Take or pay contracts have offset top line revenue declines. Once the diluent recovery unit (the “DRU”) being built by Gibson and USD comes on line in Hardisty in the first half of 2021, CP expects its volumes to pick up significantly as transportation cost for the concentrated bitumen become competitive with pipelines that require condensate to move crude oil through a pipeline.

- Alberta – Canadian heavy basis closed at -$10.75 per barrel on Friday of last week. According to the International Energy Agency (IEA), Canadian oil supply rose by 130,000 barrels per day during the month of August. PFL expects more supply to start hitting the system sooner rather than later. A fire at Suncor’s Base Plant stunted production recovery during the month of August but output has been restored to 165,000 barrels per day with full production of 300,000 barrels per day expected sometime in November. Imperial oil is ramping up its 240,000 barrel per day Kearl Oil Sands mining operation as Inter Pipeline announced last week in a media statement that it restored services to its Polaris pipeline system. The Polaris Diluent Pipeline was taken off line following a diluent leak on August 29. The pipeline’s partial closure was triggered by a diluent leak east of the Fort McMurray Airport. The diluent, which is mostly condensate, is blended with the heavy oil sands to prepare the crude for pipeline transport and affected Imperial Oils operations. Fundamentally one would think that basis continues to weaken as more production hits the system leading to more crude by rail in the not so distant future assuming prices for WTI hold steady and move higher – right now the forward curve albeit marginal does not look too bad. Stay tuned to PFL for future updates.

- Dakota Access Crude Oil Pipeline (“DAPL”) – Folks, it looks as though DAPL is safe until year end. The 570,000 barrel per day pipeline has been in front of the courts for quite some time and an updated court schedule will keep the pipeline in service at least until the end of the year and after the November elections. DAPL has been operating since 2017 is facing a new set of environmental challenges. The pipeline is in front of a US courts and Judge James Boasberg will hear briefings through December 18th. The standing Rock Sioux tribe and others want the pipeline shut down. A decision to shut in the pipeline would have ravaging effects on farmers, ND and shippers that would be seeking new ways to ship crude which could mean increased crude by rail out of the Bakken.

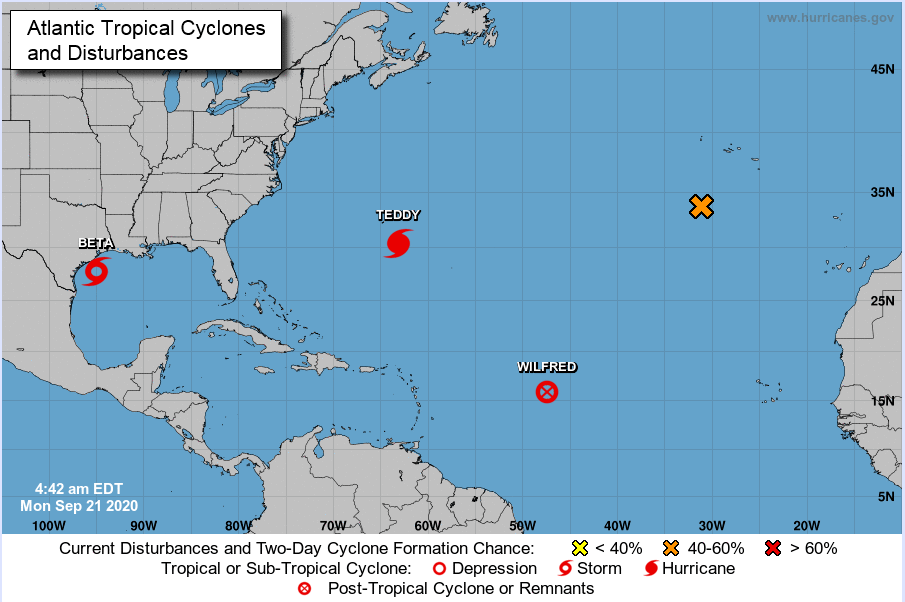

- Hurricanes – We’re keeping a close eye on hurricanes, folks. What more can 2020 bring? Well, we have gone through the Alphabet this year as it relates to named storms and we still have 9+ weeks of hurricane season to go. The Atlantic Hurricane season officially starts on June 1 and runs until November 30. While Sally was ripping apart Alabama, Florida and parts of Georgia, Hurricane Beta (now tropical storm Beta) was forming in the gulf just off the coast of Mexico and Texas. It is unclear at this point how much production has been effected in preparations for a much larger storm. Beta has its eyes on Texas in-between Houston and Corpus which will certainly have an impact on U.S. exports. While Hurricane Teddy in the Atlantic has its eyes on Eastern Canada and is expected to land as CAT 1 hurricane a rare event for Canada (See below)

Rig Count

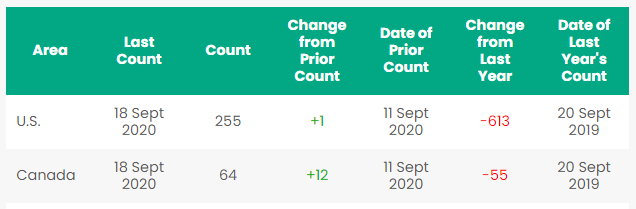

North America rig count is up 13 Rigs week over week. The U.S. gained 1 rig week over week with 255 active rigs- oil rigs were down 1 to 179, gas rigs were up 2 to 73, and miscellaneous rigs were unchanged at 3. Canada gained 13 rigs week over week and Canada’s overall rig count is now at 64 active rigs. Year over year we are down 668 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- 20 117R’s 30,000 gallon cars needed for alcohol service cars have to be non -lined

- 340W’s LPG pressure cars for various locations and lease terms,

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 100 CPC 1232 31.8 prior gasoline service for 3-6 month lease (extendable with mutual agreement) in Texas.

- 17 30.3 gal for lease in New Mexico 1 year for crude

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 17 30.3 pressure cars for lease in Midwest or west preferred

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas,

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease,

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50 300 series Pressure cars

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|