“It is difficult to say what is impossible, for the dream of yesterday is the hope of today and the reality of tomorrow.”-

Robert H. Goddard

Jobs Update

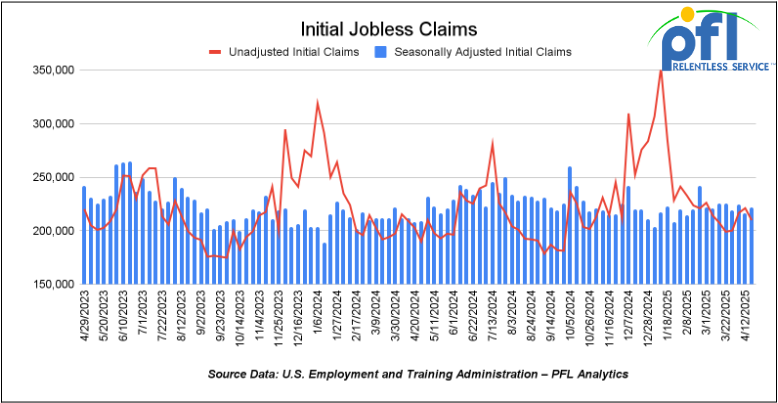

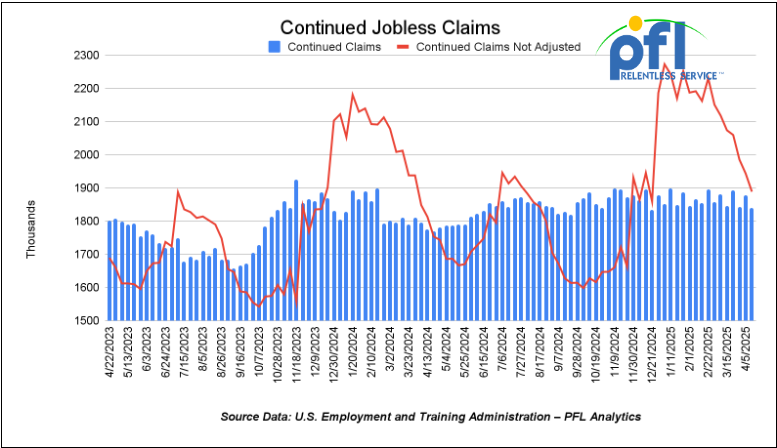

- Initial jobless claims seasonally adjusted for the week ending April 19th came in at 222,000, up 6,000 people week-over-week.

- Continuing jobless claims came in at 1.841 million people, versus the adjusted number of 1.878 million people from the week prior, down 37,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 20.10 points (0.05%) and closing out the week at 40,113.5, up 930.52 points week-over-week. The S&P 500 closed higher on Friday of last week, up 40.44 points, and closed out the week at 5,525.21 and up 238.52 points week-over-week. The NASDAQ closed higher on Friday of last week, up 216.9 points (1.33%), and closed out the week at 17,382.94, up 1,109.14 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 40,219 this morning, down 35 points.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up $0.23 per barrel (0.37%), to close at $63.02 per barrel on Friday of last week, but down -$1.66 per barrel week over week. Brent crude closed up $0.32 USD per barrel (0.48%) on Friday of last week, to close at $66.87 per barrel, but down -$1.09 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled on Friday of last week at US$9.60 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$52.35 per barrel.

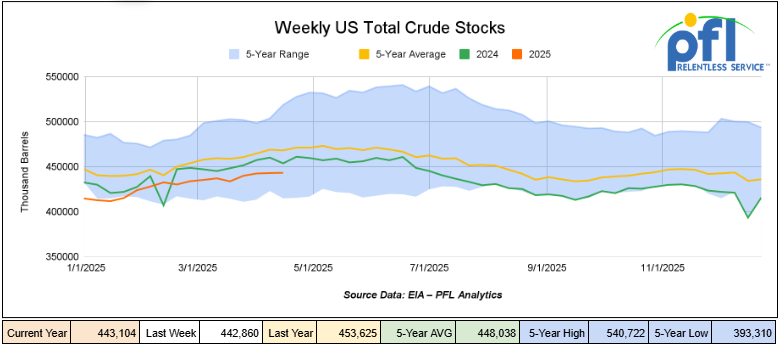

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 200,000 barrels week-over-week. At 443.1 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

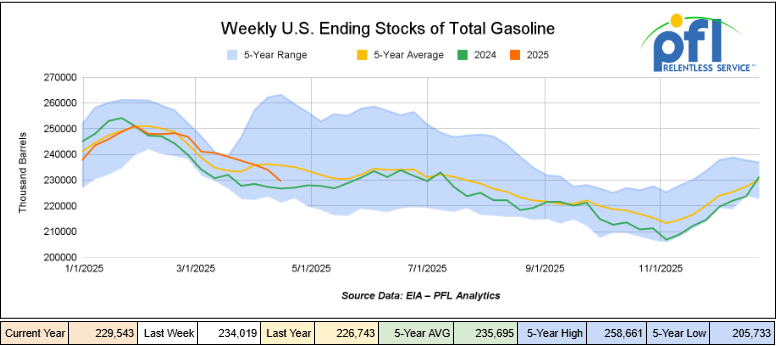

Total motor gasoline inventories decreased by 4.5 million barrels week-over-week and are 3% below the five-year average for this time of year.

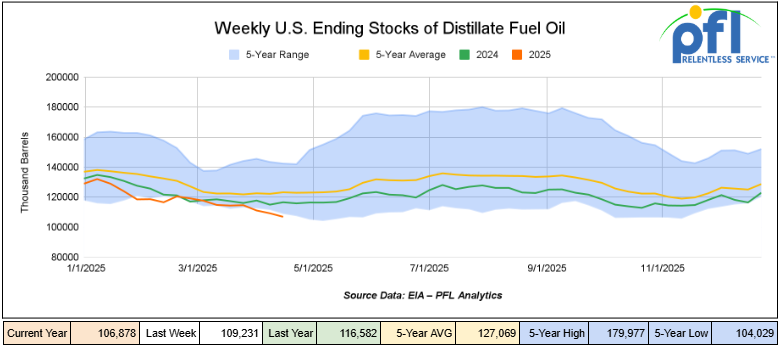

Distillate fuel inventories decreased by 2.4 million barrels week-over-week and are 13% below the five year average for this time of year.

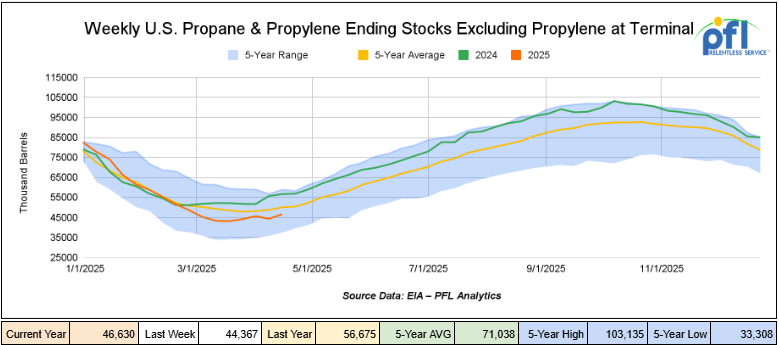

Propane/propylene inventories increased by 2.3 million barrels week-over-week and are 7% below the five-year average for this time of year.

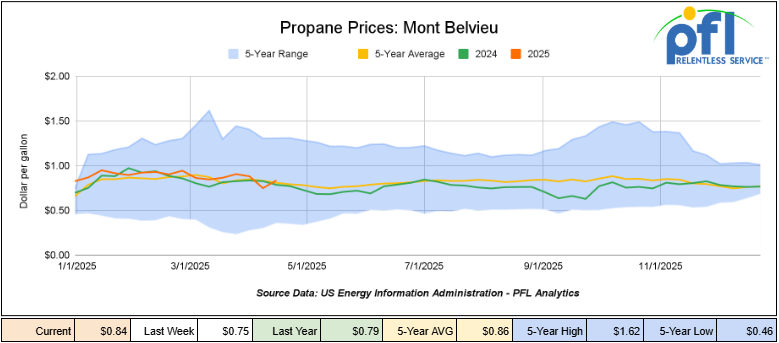

Propane prices closed at 84 cents per gallon on Friday of last week, up 9 cents per gallon week-over-week, and up 6 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 700,000 barrels last week during the week ending April 18, 2025.

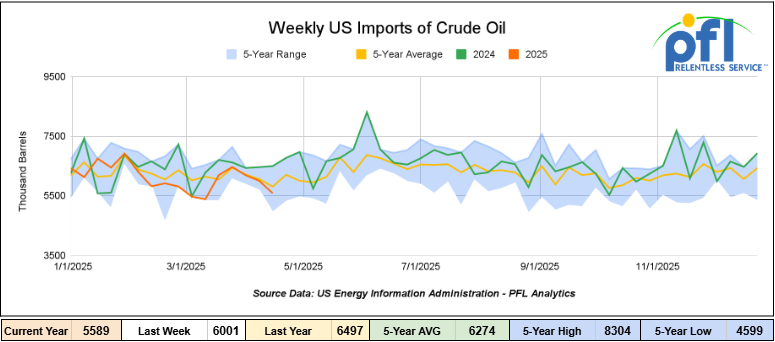

U.S. crude oil imports averaged 5.6 million barrels per day during the week ending April 18, 2025, a decrease of 412,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 6.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 858,000 barrels per day, and distillate fuel imports averaged 97,000 barrels per day during the week ending April 18, 2025.

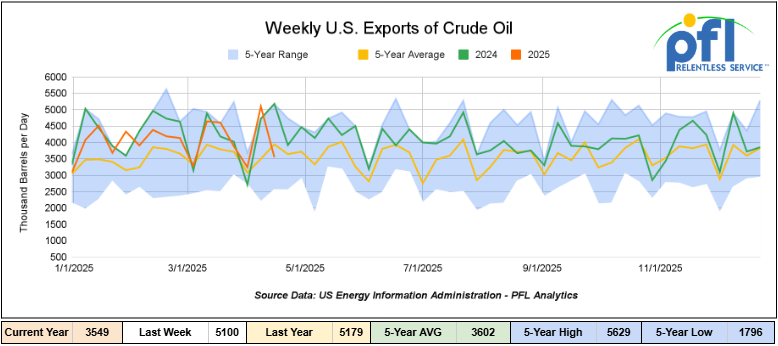

U.S. crude oil exports averaged 3.549 million barrels per day during the week ending April 18, 2025, a decrease of 1.551 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.943 million barrels per day.

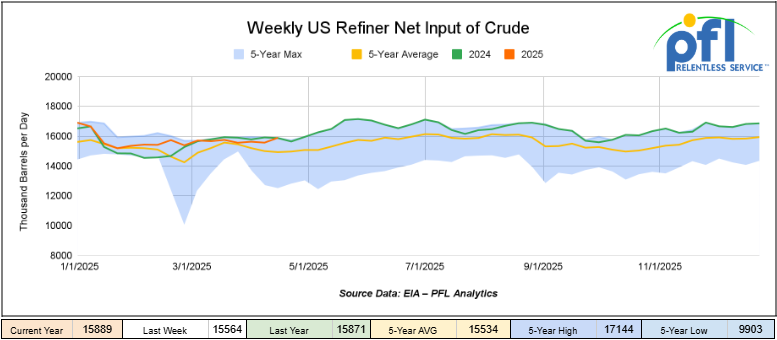

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending April 18, 2025, which was 326,000 barrels per day more week-over-week.

WTI is poised to open at $62.79, down -23 cents per barrel from Thursday’s close.

North American Rail Traffic

Week Ending April 23, 2025.

Total North American weekly rail volumes were up (+1.8%) in week 17, compared with the same week last year. Total carloads for the week ending on April 23 were 343,236, up (+0.46%) compared with the same week in 2024, while weekly intermodal volume was 334,411, up (+3.22%) compared to the same week in 2024.

8 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest increase came from Coal, which was up (+20.89%) while the largest decrease was from Metallic Ores and Metals, which was down (-9.97%).

In the East, CSX’s total volumes were up (+2.41%), with the largest decrease coming from Chemicals (-11.83%) while the largest increase came from Coal (+7.26%). NS’s volumes were up (3.03%), with the largest increase coming from Coal (+22.26%) while the largest decrease came from Other (-4%).

In the West, BN’s total volumes were up (1.45%), with the largest increase coming from Coal (14.15%) while the largest decrease came from Metallic Ores and Metals (26.93%). UP’s total rail volumes were up (+4.8%), with the largest increase coming from Coal (+41.87%), while the largest decrease came from Petroleum and Petroleum Products (-12.79%).

In Canada, CN’s total rail volumes were down (-9.62%) with the largest increase coming from Grain, up (+59.87%), while the largest decrease came from Metallic Ores and Metals (-24.72%). CP’s total rail volumes were down (-8.54%) with the largest increase coming from Coal (+69.42%), while the largest decrease came from Intermodal (-24.58%).

KCS’s total rail volumes were up (+5.18%) with the largest increase coming from Farm Products (+75.63%), while the largest decrease came from Chemicals (-7.68%).

Source Data: AAR – PFL Analytics

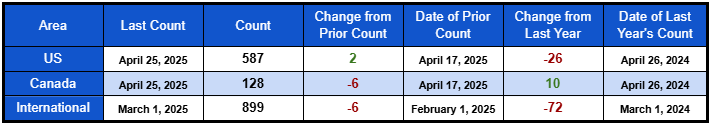

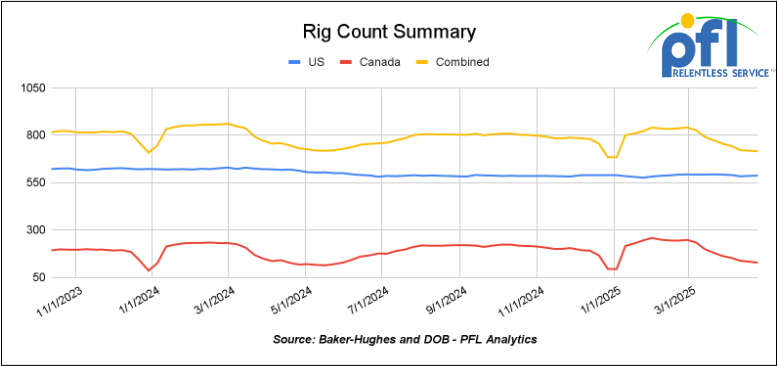

Rig Count

North American rig count was down by -4 rigs week-over-week. U.S. rig count was up +2 rigs week over week, but down by -26 rigs year-over-year. The U.S. currently has 587 active rigs. Canada’s rig count was down -6 rigs week-over-week but up by +10 rigs year-over-year. Canada currently has 128 active rigs. Overall, year over year we are down by -16 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 26,951 from 27,297 which was a decrease of -346 railcars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -7.2% week over week, CN’s volumes were lower by -5.2% week-over-week. U.S. shipments were mostly higher. The UP had the largest percentage increase and was up by +5.0%. The NS was the sole decliner and was down by -9.0%

We are Watching Crude by Rail out of Canada

Crude by rail out of Canada collapsed month over month. The Canadian Energy regulator reported on Friday of last week, that 65,399 barrels were exported per day during the month of February 2025, down from 83,832 barrels in January of 2025, a decrease of 17,929 barrels per day, month over month. This is Canada’s lowest level of exports by rail into the U.S. since August of 2020 and is the 4th lowest month in 12 years.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines and raw bitumen shipped as a non-haz product, which is not able to flow in pipelines and is competitive with pipeline tolls. This is a growing market to keep an eye on despite the downturn we are now seeing. Other factors would be existing long-term contractual commitments and basis -we really need to see basis the WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to -17 per barrel for sustained periods of time to make economic sense. We don’t anticipate seeing that anytime soon – a bunch of turnarounds about to happen in Canada limiting crude available to be shipped.

We are watching East Palestine

On Thursday of last week, a jury held Norfolk Southern fully responsible for the East Palestine derailment, assigning them a $600 million settlement. The railcar’s owner, GATX, was found not liable. While this decision is specific to the case, it suggests courts may increasingly hold railroads accountable for the condition of cars they move unless third-party fault is proven.

The derailment, caused by a bearing failure on a GATX-owned car carrying plastic pellets, occurred on February 3, 2023. It led to chemical spills, fires, and the use of a vent-and-burn procedure that investigators later determined wasn’t necessary. As railroads face greater legal risks, scrutiny of their inspection and acceptance practices is growing. Many defects—like internal bearing fatigue—are hard to detect during routine visual inspections, raising questions about current processes.

With two-thirds of North America’s freight cars privately owned or leased, stricter inspections and tougher car acceptance standards are expected. Advanced detection tools, such as acoustic bearing monitors and machine vision systems, could play a bigger role in finding hidden issues, though broader adoption depends on regulatory approval.

This case highlights evolving accountability in rail operations. Shippers and car owners should prepare for changes, including more thorough inspections, stricter requirements, and longer evaluation times as railroads adapt. Stay tuned to PFL for further updates on this one – this is a game changer.

We are watching Texas – We Love This State

On Thursday of last week the state of Texas took a significant step to improve its rail infrastructure by approving $350 million for upgrades to Houston’s at-grade crossings. These crossings have long been a bottleneck for the heavy rail traffic flowing through the city, especially with freight tied to the Port of Houston. By elevating or rerouting the tracks, Texas aims to smooth out traffic flow, reduce delays, and improve safety.

For those of us working with rail services, these changes are a welcomed development. Streamlined operations mean fewer delays and better scheduling, which translates to lower costs and more reliable service for shippers and railcar owners. This also bodes well for asset utilization, as railcars spend less time sitting idle. With projects like these, we could see similar improvements in other Texas cities, such as Dallas and San Antonio, keeping the state’s rail network competitive as freight volumes continue to rise.

We Are Watching Our Refineries – California Environmental Laws are Killing them

Both Marathon and Phillips shuttered refineries in California and replaced them with Renewable Diesel Facilities now here comes Valero…

Valero Energy said on Thursday of last week it would cease operations at its 170,000-barrel-per-day San Francisco-area oil refinery next year amid worries about California’s declining fuel supplies and high gasoline prices.

The decision clarifies plans for the Benicia refinery after the San Antonio, Texas-based refiner last week announced its intent to “idle, restructure, or cease operations” there by the end of April 2026. Valero also said it had recorded a $1.1 billion pre-tax impairment related to its California refineries.

Meanwhile The U.S. House of Representatives plans to vote this week on a Republican plan to repeal the Biden administration’s approval of California’s landmark plan to end the sale of gasoline-only vehicles by 2035.

House Majority Leader Steve Scalise’s office said Wednesday that lawmakers will vote on a measure to repeal a waiver granted by the U.S. Environmental Protection Agency under Biden in December allowing California to mandate at least 80% electric vehicles by 2035. Those rules have been adopted by another 11 states, including New York, Massachusetts and Oregon.

We are watching the AAR

In case you missed it, PFL attended the AAR Tank Car Committee meetings in Nashville recently and shared key updates for car owners and operators.

A major topic was the July 1, 2025 deadline for Single Car Air Brake Tests (SCABT) to meet the new 4-Port Pressure Air Test standard (AAR Standard S-4027).

This test ensures more accurate brake system checks and missing the deadline could impact your operations.

If you have idle cars in storage, now’s the time to act! PFL can perform these tests at multiple locations and is ready to help you meet the requirements. Reach out anytime -we’re here to help!

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 5000CF Covered Hoppers needed off of UP or BN in Houston for 6 Month. Cars are needed for use in Fertilizer service. Needed ASAP

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, 30K Any Type Tanks needed off of various class 1s in various locations for 1-5 years. Cars are needed for use in Condensate service.

- 6, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Av Gas service.

- 10, 25.5K-30K 117R or 117J Tanks needed off of UP or BN in Texas for 1 year. Cars are needed for use in Dicyclopentadiene service.

- 70, 30K DOT 117R/ DOT 117J Tanks needed off of UP in Corpus Christi for 5 Year. Cars are needed for use in Gasoline service.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in US and Canada. Cars were last used in Propane. Summer or Longer Lease Available.

- 100, 6250, Covered Hoppers located off of UP in US . Cars were last used in DDG. 1 Year term. Dirty to Dirty. Free move on UP.

- 25-50, 19.6K, DOT 111 Tanks located off of UP in US. Cars were last used in Molases .

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website