“Develop a passion for learning. If you do, you will never cease to grow.”

– Anthony J. D’Angelo

Jobs Update

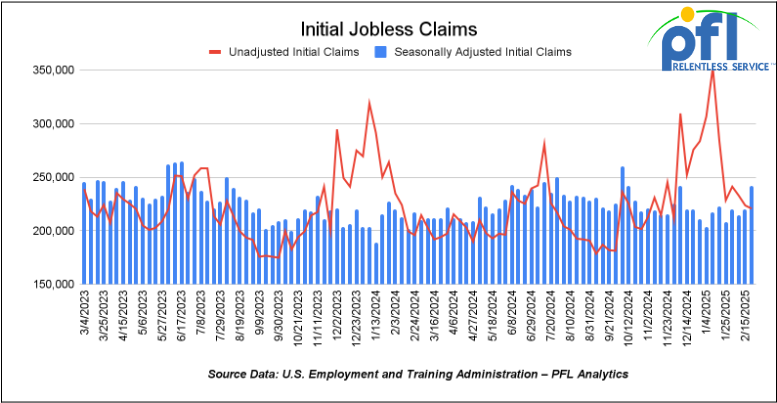

- Initial jobless claims seasonally adjusted for the week ending February 22nd came in at 242,000, up 22,000 people week-over-week.

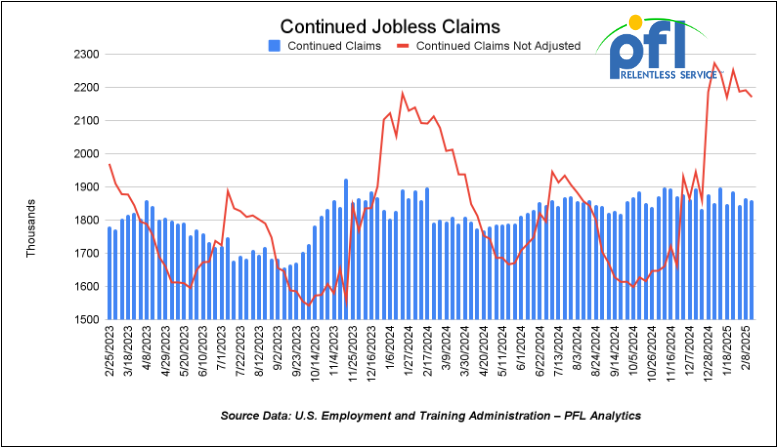

- Continuing jobless claims came in at 1.862 million people, versus the adjusted number of 1.867 million people from the week prior, down -5,000 people week-over-week.

Stocks closed higher on Friday of last week, but mixed week over week

The DOW closed higher on Friday of last week, up 601.41 points (1.39%) and closing out the week at 43,840.91, up 412.9 points week-over-week. The S&P 500 closed higher on Friday of last week, up 92.93 points, and closed out the week at 5,954.5, down -58.63 points week-over-week. The NASDAQ closed higher on Friday of last week, up 302.86 points (1.55%), and closed out the week at 18,847.28, down -676.73 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 43,968 this morning, up 79 points.

Crude oil closed lower on Friday of last week, and lower week over week.

West Texas Intermediate (WTI) crude closed down- $0.59 per barrel (-0.84%), to close at $69.76 per barrel on Friday of last week, down -$0.64 per barrel week over week. Brent traded down -$0.86 cents USD per barrel (-1.16%) on Friday of last week, to close at $73.18 per barrel, down -$1.25 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for April delivery settled on Friday of last week at US$12.80 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$59.80 per barrel.

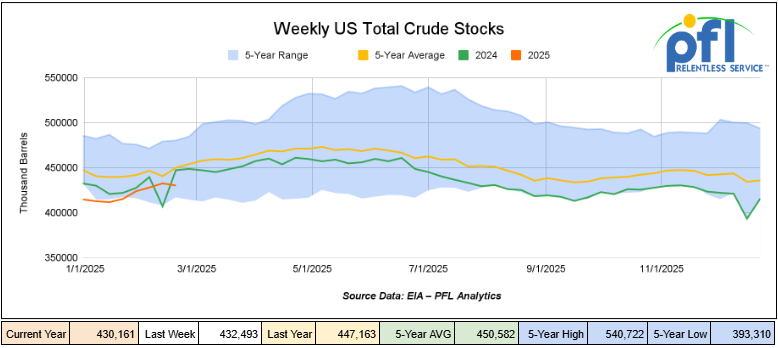

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.3 million barrels week-over-week. At 430.2 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

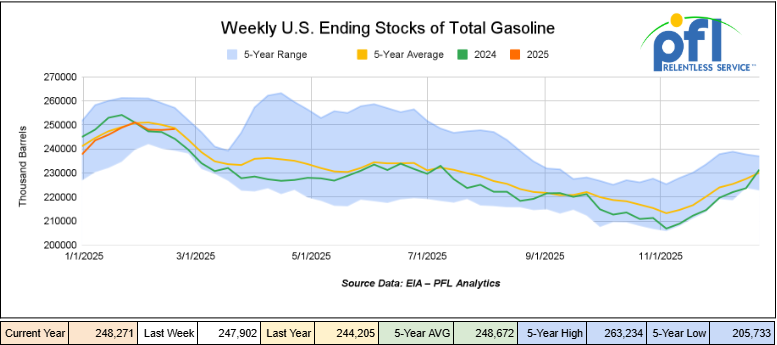

Total motor gasoline inventories increased by 400,000 barrels week-over-week and are slightly below the five-year average for this time of year.

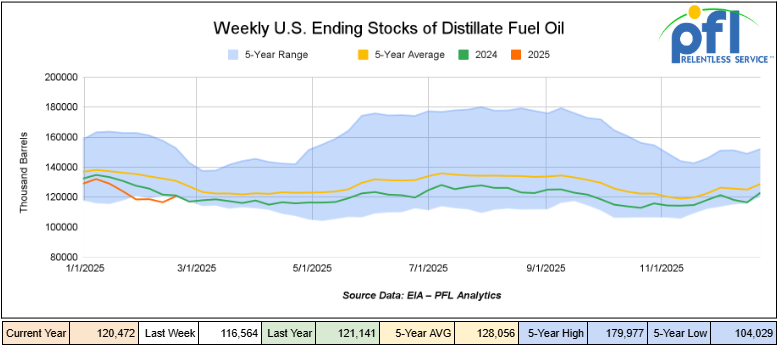

Distillate fuel inventories increased by 3.9 million barrels week-over-week and are 8% below the five-year average for this time of year.

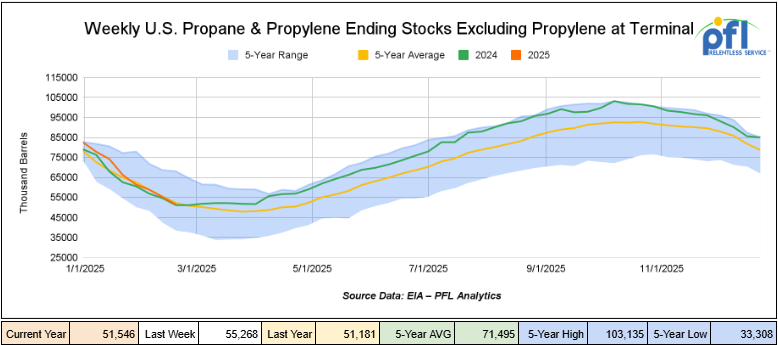

Propane/propylene inventories decreased by 3.7 million barrels week-over-week and are 1% below the five-year average for this time of year.

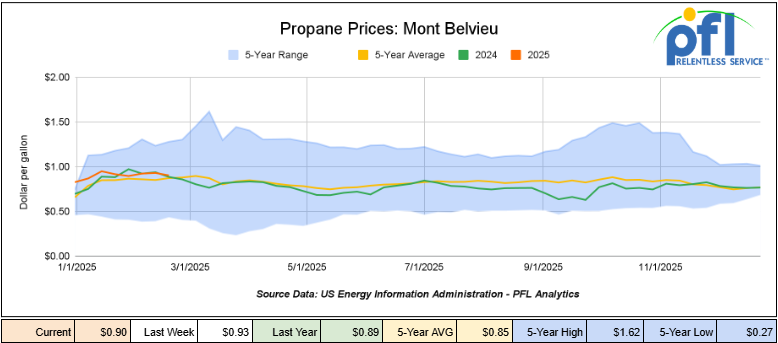

Propane prices closed at 90 cents per gallon on Friday of last week, down 3 cents per gallon week-over-week, but up 1 cent year-over-year.

Overall, total commercial petroleum inventories decreased by 2.2 million barrels during the week ending February 22nd, 2025.

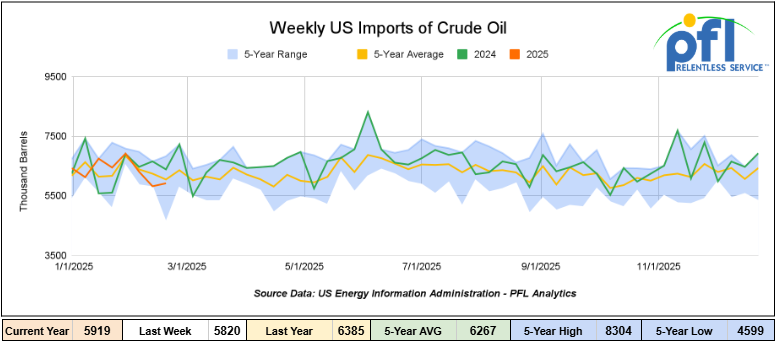

U.S. crude oil imports averaged 5.9 million barrels per day during the week ending February 22nd, 2025, an increase of 98,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 5.5% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 462,000 barrels per day, and distillate fuel imports averaged 370,000 barrels per day during the week ending February 22nd, 2025.

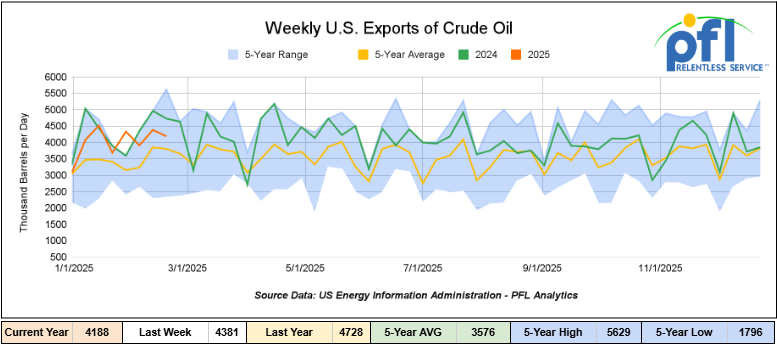

U.S. crude oil exports averaged 4.188 million barrels per day during the week ending February 22nd, 2025, a decrease of 193,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.202 million barrels per day.

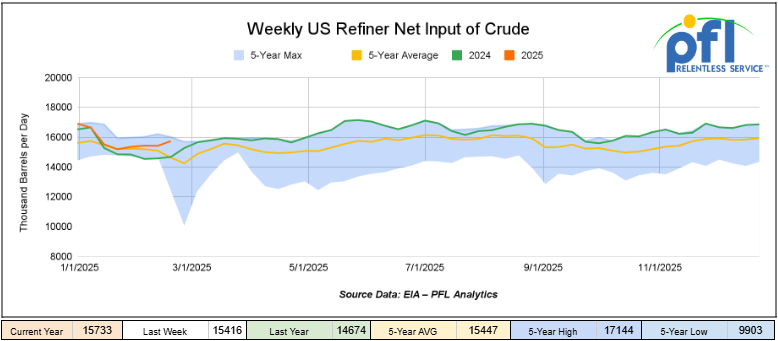

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending February 21, 2025, which was 317,000 barrels per day more week-over-week.

WTI is poised to open at $69.55, down -0.21 cents per barrel from Friday’s close

North American Rail Traffic

Week Ending February 26th, 2025.

Total North American weekly rail volumes were down (6.76%) in week 9, compared with the same week last year. Total carloads for the week ending on February 26 were 306,244, down (-13.75%) compared with the same week in 2024, while weekly intermodal volume was 329,057, up (0.85%) compared to the same week in 2024.

10 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest increase came from Intermodal Units which was up (0.85%) while the largest decrease was from Grain which was down (-24.88%)

In the East, CSX’s total volumes were down (-8.76%), with the largest decrease coming from Coal (-27.77%) while the largest increase came from Petroleum and Petroleum Products (4.31%). NS’s volumes were down (-5.05%), with the largest increase coming from Grain (23.16%) while the largest decrease came from Coal (-17.6%).

In the West, BN’s total volumes were down (-6.69%), with the largest increase coming from Intermodal Units(4.6%) while the largest decrease came from Grain (-40.25%). UP’s total rail volumes were down (-0.57%) with the largest increase coming from Intermodal (9.43%), while the largest decrease came from Grain (-18.27%).

In Canada, CN’s total rail volumes were down (-26.57%) with the largest increase coming from Other, up (+32.2%) while the largest decrease came from Intermodal (-46.97%). CP’s total rail volumes were down (-16.97%) with the largest increase coming from Motor Vehicles and Parts (+33.47%), while the largest decrease came from Petroleum and Petroleum Products (–32.94%).KCS’s total rail volumes were up (11.77%) with the largest increase coming from Farm Products (+48.34%), while the largest decrease came from Other (-33.33%).

Source Data: AAR – PFL Analytics

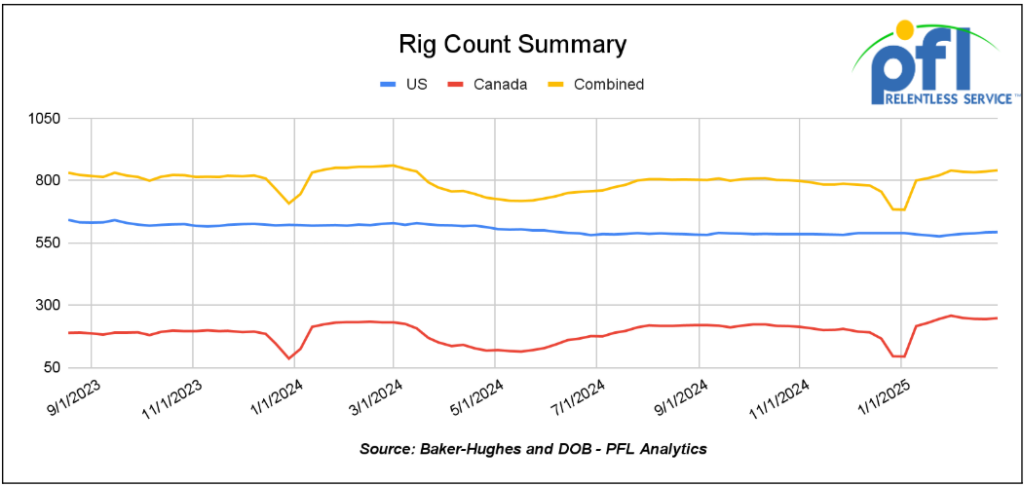

Rig Count

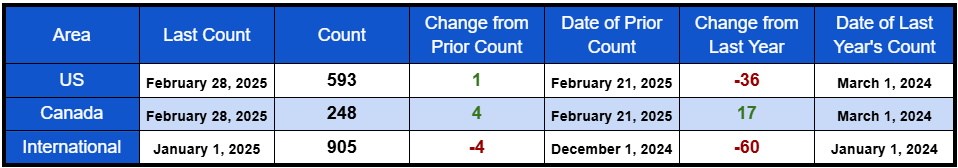

North American rig count was up by 5 rigs week-over-week. U.S. rig count was up by 1 rigs week over week, but down by -36 rigs year-over-year. The U.S. currently has 593 active rigs. Canada’s rig count was up 4 rigs week-over-week and up by 17 rigs year-over-year, and overall, Canada’s rig count is 248 active rigs. Overall, year over year we are down by -19 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are Watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,609 from 28,932 which was a decrease of 323 rail cars week-over-week. Canadian volumes were down. CPKC’s shipments were lower by -4.3% week over week, CN’s volumes were lower by -11.1% week-over-week. U.S. shipments were mostly lower board. The BN had the largest percentage decrease and was down by -24%. The NS was the sole gainer and was up by 0.05%.

We are Watching Crude by Rail out of Canada

The Canadian Energy regulator reported on February 26, 2025, that 75,412 barrels were exported per day during the month of December 2024, down from 94,188 barrels in November of 2024, a decrease of 18,776 barrels per day month over month. This is the lowest level since June 2023.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines and raw bitumen shipped as a non-haz product which is not able to flow in pipelines and is competitive with pipeline tolls is a growing market to keep an eye on. Other factors would be existing long term contractual commitments and basis -we really need to see basis the WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to -17 per barrel for sustained periods of time to make economic sense. Crude by rail will obviously be impacted if tariffs are levied against Canadian crude imports. Stay tuned to PFL for further details – we are watching this one closely.

We are Watching Keystone XL Pipeline

Folks, there was a lot of chatter last week about Keystone XL – Can It Make a Comeback? The President wants it finished – it is a year away if everyone wants to make it happen!

The Keystone XL pipeline has long been a focal point in discussions about energy security, economic growth, and environmental policy. Keystone was originally designed to transport Canadian crude oil to the U.S. Gulf Coast; the project was canceled by the Biden administration in 2021. The Keystone pipeline, if it was built as intended, would have brought 1.1 million barrels per day of Canadian crude oil to the U.S. Believe it or not, construction on the pipeline began in 2010 – 15 years ago.

Source: Wikipedia – PFL Analytics

In January 2025, President Donald Trump, upon returning to office, issued an executive order reversing Biden’s administration cancellation of the Keystone XL permit for a border crossing. Trump has actively encouraged TC Energy, the owner of the pipeline (now operating as South Bow Energy) and alternative developers, to resume the project, promising expedited regulatory approvals. This move aligns with the administration’s broader agenda to bolster domestic energy production and reduce reliance on foreign oil sources, however, at the same time the President is proposing a 10% tariff on all imported crude from Canada – we find this a little confusing.

The Canadian government now is actively seeking new pipeline infrastructure to expand Canadian crude oil export capacity that does not flow through the U.S.

Given the renewed emphasis on energy independence, the prospect of reviving Keystone XL may gain traction among industry leaders and policymakers if tariff issues gets resolved with Canada – currently we don’t see anyone jumping in to take on the risk in building more infrastructure that lands Canadian crude in the United States,.

Alberta is leading efforts to improve transportation infrastructure for natural gas and Oil exports. A revived Keystone XL could offer the most efficient route to U.S. refineries, strengthening North America’s energy partnership. While Canada is exploring market diversification, the economic and logistical advantages of direct pipeline access to the U.S. for Canadian producers remain compelling. With the right policy framework and incentives, interest in Keystone XL’s revival could grow among Canadian energy stakeholders.

Global energy instability, including ongoing conflicts in Ukraine and the Middle East, has underscored the need for a stable oil supply. Supporters argue that Keystone XL would help reduce dependence on foreign oil, create thousands of jobs, and stabilize fuel prices. While U.S. oil production remains at record levels and Canada has expanded alternative export routes and continues looking to do so energy companies have been hesitant to commit to a revived Keystone XL, citing regulatory uncertainty and challenging market conditions.

Despite strong political backing by Trump, Keystone XL faces several major hurdles. South Bow Energy, the former developer of Keystone XL, has shifted its focus and shown no interest in reviving the project, making it difficult to find a new investor willing to navigate the ongoing regulatory and financial hurdles. Even if a supportive administration were in place, Keystone XL would still face strong legal and regulatory opposition, lawsuits from environmental groups, Indigenous communities, and landowners would, without question, be launched delaying or halting the project. PFL is closely monitoring Keystone. Stay tuned for updates.

We are Watching Big Oil and the “Green Old Deal”

Is the Green New Deal now the Green Old Deal?

Big Oil’s Green initiatives are retreating. Major oil companies have been scaling back their investments in renewable energy, opting to instead focus on traditional fossil fuel projects. This strategic shift is driven by economic pressures, shareholder demands, and persistent challenges within the renewable sector. Companies like BP, Shell, and Equinor have notably reduced their green energy commitments.

BP’s Strategic Shift:

BP, once a proponent of aggressive renewable energy targets, has recently reversed its course. In early 2025, under the leadership of CEO Murray Auchincloss, the company announced plans to increase oil and gas production to 2.3-2.5 million barrels per day by 2030, with annual spending rising to $10 billion. This move includes the sale of BP’s Castrol lubricants business and aims to reallocate capital to higher-return ventures, scaling back investments in renewable initiatives. Auchincloss emphasized the need for sustainable growth and improved shareholder returns, acknowledging that previous green strategies had underperformed.

A Wider Industry Trend:

BP’s pivot is reflective of a broader trend among major oil firms reassessing their renewable energy commitments:

- Shell: Under CEO Wael Sawan, Shell has conducted a comprehensive review to reduce costs and focus on high-return projects. This has led to a reduction in spending on low-carbon and it’s renewable business, with a heightened emphasis on oil and gas. Notably, Shell has decided against initiating new offshore wind projects, choosing instead to maximize the value of its existing renewable assets.

- Equinor: Facing financial challenges in the offshore wind sector due to inflation, high interest rates, and supply chain delays, Equinor has scaled back its renewables expansion. The company has exited markets in Spain, Portugal, and Vietnam, and reduced its 2030 installed capacity target from 12-16 gigawatts to 10-12 gigawatts. Additionally, Equinor has cut 20% of its renewable energy division workforce to streamline operations.

- TotalEnergies and ExxonMobil: continue to invest in low-carbon initiatives but have tempered expectations for immediate returns from renewables. While both companies have maintained commitments to projects such as carbon capture and hydrogen, they have emphasized that these technologies must be financially sustainable before scaling up investment. TotalEnergies has focused on biofuels and liquefied natural gas (LNG) as transition fuels, while ExxonMobil has prioritized carbon capture and storage (CCS) as a way to balance emissions without drastically cutting fossil fuel production.

These strategic adjustments highlight a growing skepticism within the oil industry regarding the immediate financial viability of large-scale renewable projects.

Factors Influencing the Retreat from Renewables:

Several key factors have influenced these strategic shifts which include:

Economic and Profitability Challenges – Renewable energy projects, particularly in offshore wind, have been affected by rising costs, supply chain disruptions, and regulatory uncertainties. These challenges have led to underwhelming returns, prompting companies to reconsider the financial attractiveness of such investments.

Shareholder Expectations – Investors are increasingly prioritizing strong financial returns, leading companies to focus on their core, high-margin oil and gas businesses. The long payback periods and uncertain profitability associated with renewable projects have made them less appealing.

Energy Security Concerns – Geopolitical tensions and fluctuating energy demands have underscored the importance of reliable energy sources. Fossil fuels continue to play a critical role in meeting global energy needs, influencing companies to maintain or increase investments in traditional energy sectors.

We are Watching Key Economic Indicators

Consumer Spending

In January 2025, total consumer spending adjusted for inflation decreased by 0.5% over December 2024. This follows a gain of 0.7% in December and a gain of 0.6% in November. According to the government, year-over-year inflation-adjusted total spending in January 2025 was up 2.6%. Inflation-adjusted spending on goods declined by 0.9% in January, following a 0.9% rise in December. Inflation-adjusted spending on services decreased by 0.2% in January, after a 0.6% increase in December, marking the first month-to-month decline in eleven months.

Consumer Confidence

The Conference Board’s Index of Consumer Confidence decreased to 98.3 in February 2024, down from 104.1 in January.

The University of Michigan’s Index of Consumer Sentiment fell to 67.8 in February, compared to 71.1 in January.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, GP Tanks needed off of various class 1s in various locations for 1-5 years.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website