“I still believe, in spite of everything, that people are truly good at heart.”

-Anne Frank

Jobs Update

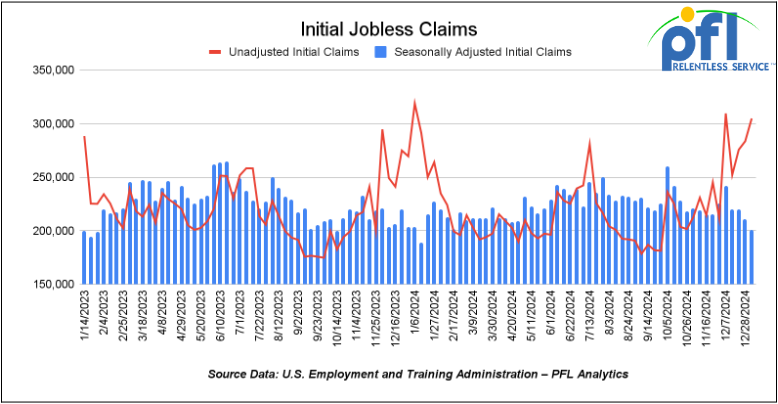

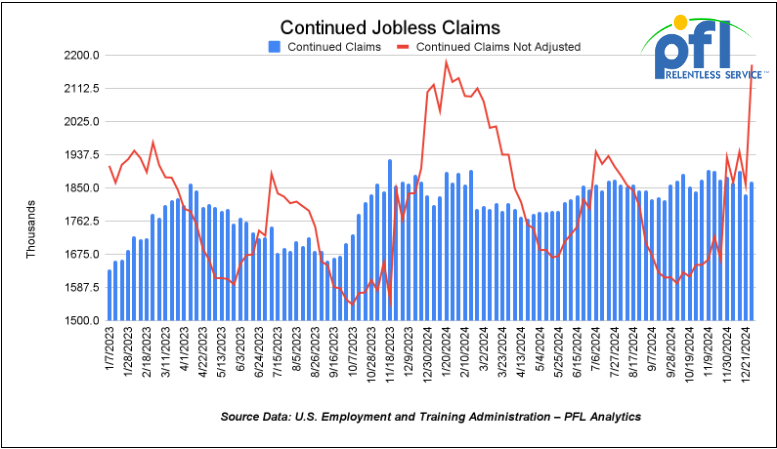

- Initial jobless claims seasonally adjusted for the week ending January 11th came in at 217,000, up 14,000 people week-over-week.

- Continuing jobless claims came in at 1.859 million people, versus the adjusted number of 1.877 million people from the week prior, down -18,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

Major indices experienced varied movements this week following geopolitical developments, strong U.S. employment figures, and mixed signs in inflation data.

The DOW closed higher on Friday of last week, up 334.7 points (0.78%) and closing out the week at 43,487.83, up 1,549.38 points week-over-week. The S&P 500 closed higher on Friday of last week, up 59.32 points, and closed out the week at 6,996.66, up 169.62 points week-over-week. The NASDAQ closed higher on Friday of last week, up 291.91 points (1.52%), and closed out the week at 19,630.2, up 468.57 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 43,868 this morning up 173 points.

Crude oil closed lower on Friday of last week, but higher week over week.

West Texas Intermediate (WTI) crude closed down $0.80 cents per barrel (-1%) to close at $77.88 per barrel on Friday of last week, up $1.58 per barrel week over week. Brent traded down -$0.50 cents USD per barrel (-0.6%) on Friday of last week, to close at $80.79 per barrel, up $1.34 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for February delivery settled on Friday of last week at US$13.25 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$64.14 per barrel.

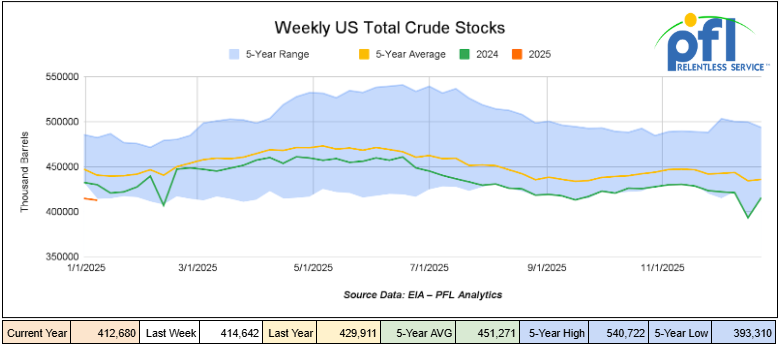

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2 million barrels week-over-week. At 412.7 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

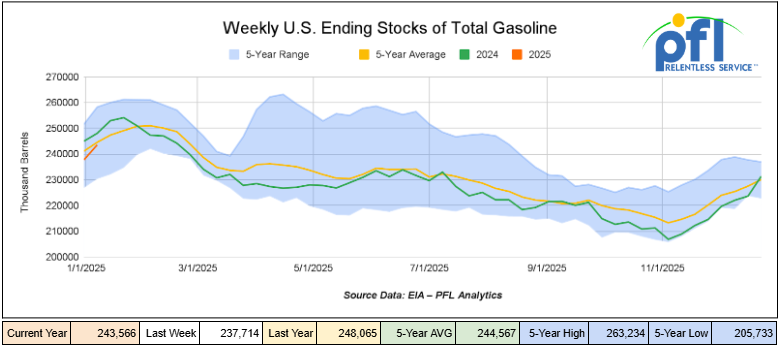

Total motor gasoline inventories increased by 5.9 million barrels week-over-week and are sightly below the five-year average for this time of year.

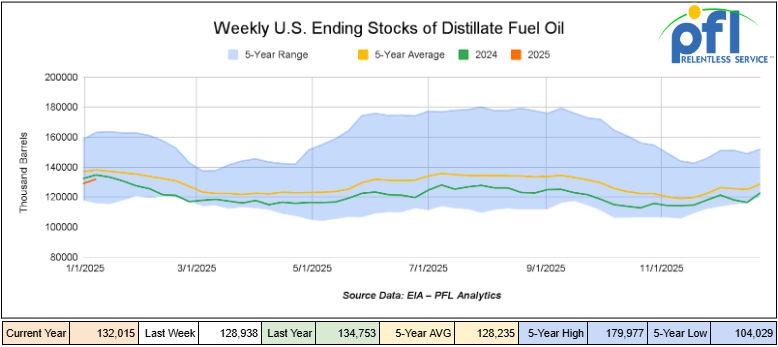

Distillate fuel inventories increased by 3.1 million barrels week-over-week and are 4% below the five-year average for this time of year.

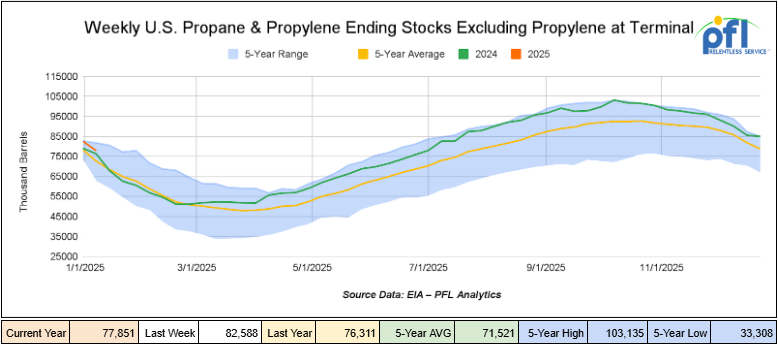

Propane/propylene inventories decreased by 4.7 million barrels week-over-week and are 7% above the five-year average for this time of year.

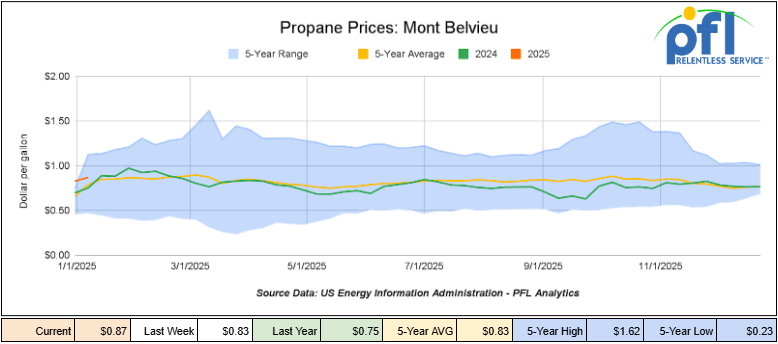

Propane prices closed at 87 cents per gallon on Friday of last week, up 4 cents per gallon week-over-week, and up 12 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 3.4 million barrels last week during the week ending January 10th, 2025.

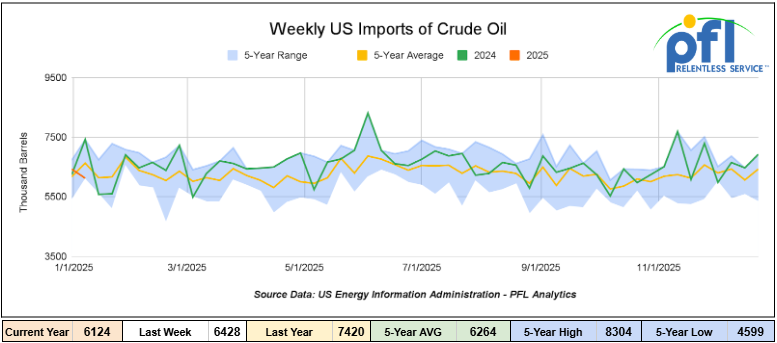

U.S. crude oil imports averaged 6.1 million barrels per day during the week ending January 10th, 2025, a decrease of 304,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 3.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 450,000 barrels per day, and distillate fuel imports averaged 219,000 barrels per day, during the week ending January 10th, 2025.

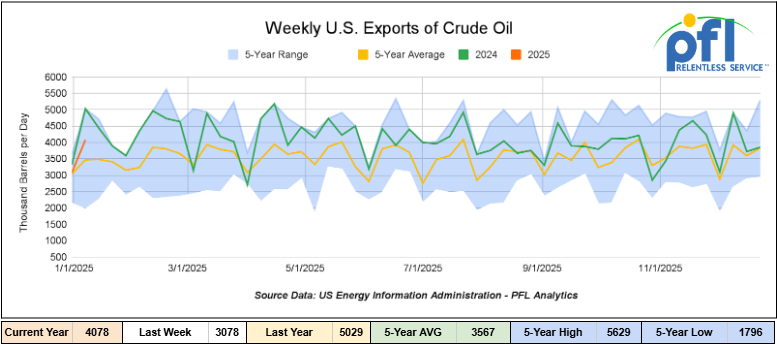

U.S. crude oil exports averaged 4,078 million barrels per day during the week ending January 10th, 2025, a, increase of 1 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.683 million barrels per day.

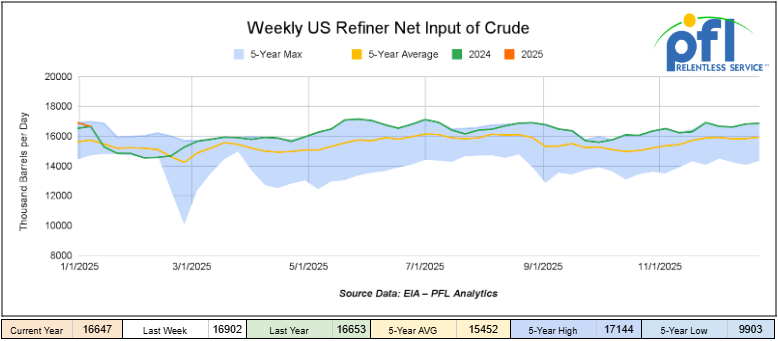

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending January 10, 2025, which was 255,000 barrels per day less week-over-week.

WTI is poised to open at $76.15, down -$1.73 per barrel from Friday’s close.

North American Rail Traffic

Week Ending January 15th, 2025.

Total North American weekly rail volumes were down (-0.22%) in week 3, compared with the same week last year. Total carloads for the week ending on January 15th were 310,705, down (-6.2%) compared with the same week in 2024, while weekly intermodal volume was 319,228, up (6.38%) compared to the same week in 2024.

7 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Motor Vehicles and Parts, which was down (-24.06%) while the largest increase came from Farm Products which was up (7.96%).

In the East, CSX’s total volumes were down (-7.79%), with the largest decrease coming from Motor Vehicles and Parts (-36.46%), with the largest increase coming from Petroleum and Petroleum Products (7.5%). NS’s volumes were down (-9.02%), with the largest decrease coming from Motor Vehicles and Parts (-42.08%), while the largest increase came from Grain (5.56%).

In the West, BN’s total volumes were up (6.43%), with the largest decrease coming from Chemicals, down (-18.79%), while the largest increase came from Grain (23.63%). UP’s total rail volumes were up (9.04%) with the largest decrease coming from Petroleum and Petroleum Products, down (-11.71%), while the largest increase came from Intermodal Units (21.44%).

In Canada, CN’s total rail volumes were down (-4.49%) with the largest decrease coming from Intermodal Units, down (-18.19%), while the largest increase came from Farm Products, up (+26.83%). CP’s total rail volumes were down (-7.92%) with the largest increase coming from Petroleum and Petroleum Products (+25.49%), while the largest decrease came from Farm Products (-21.14%).

KCS’s total rail volumes were down (-6.21%) with the largest decrease coming from Other (-35.45%) and the largest increase coming from Motor Vehicles and Parts (+7.65%).

Source Data: AAR – PFL Analytics

Rig Count

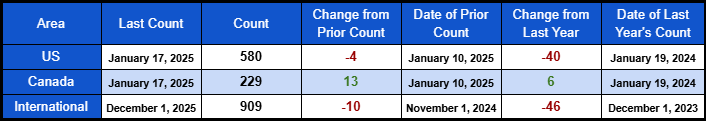

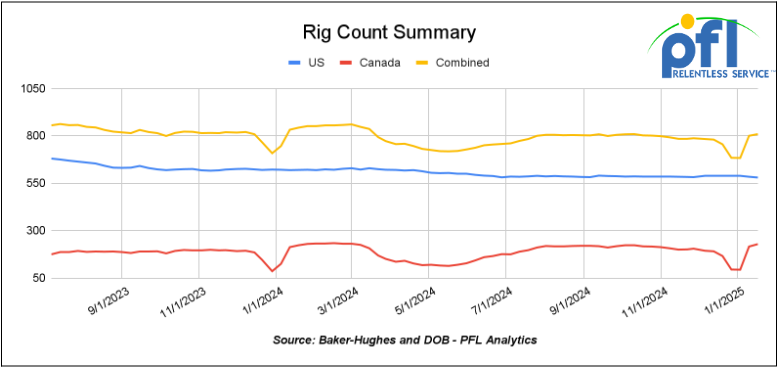

North American rig count was up by 9 rigs week-over-week. U.S. rig count was down -4 rigs week over week and down by -40 rigs year-over-year. The U.S. currently has 580 active rigs. Canada’s rig count was up 13 rigs week-over-week, and up by 6 rigs year-over-year, and Canada’s overall rig count is 229 active rigs. Overall, year over year we are down by -34 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Washington

The president moved swiftly in his first hours in office, signing a slew of executive orders in front of a roaring crowd and then in the Oval Office.

Including:

- Freeze federal hiring, except for members of the military or “positions related to immigration enforcement, national security, or public safety.”

- Restore a category of federal workers known as Schedule F, which would lack the same job protections enjoyed by career civil servants.

- Halt new federal rules from going into effect before Trump administration appointees can review them.

- Review the investigative actions of the Biden administration, “to correct past misconduct by the federal government related to the weaponization of law enforcement and the weaponization of the intelligence community.”

- Grant top-secret security clearances to White House staff without going through traditional vetting procedures.

- End remote work policies and order federal workers back to the office full-time.

Immigration and the Border

- Bar asylum for people newly arriving at the southern border.

- Move to end birthright citizenship, which is guaranteed by the 14th Amendment, for the children of undocumented immigrants.

- Suspend the Refugee Admissions Program “until such time as the further entry into the United States of refugees aligns with the interests of the United States.”

- Declare migrant crossings along the U.S.-Mexico border to be a national emergency, allowing Mr. Trump to unilaterally unlock federal funding for border wall construction, without approval from Congress, for stricter enforcement efforts.

- Resume a policy requiring people seeking asylum to wait in Mexico while an immigration judge considers their cases.

- Consider designating cartels as “foreign terrorist organizations.”

Gender and Diversity, Equity and Inclusion Initiatives

- Terminate D.E.I. programs across the federal government.

- Recognize two sexes: male and female.

- Remove protections for transgender people in federal prisons.

Tariffs and Trade

- Direct federal agencies to begin an investigation into trade practices, including persistent trade deficits and unfair currency practices, as well as examine flows of migrants and drugs from Canada, China and Mexico to the United States

- Assess China’s compliance with a trade deal Mr. Trump signed in 2020, as well as the United States-Mexico-Canada Agreement, which Trump signed in 2020 to replace the North American Free Trade Agreement.

- Order the government to assess the feasibility of creating an “External Revenue Service” to collect tariffs and duties.

- Carry out a full review of the U.S. industrial and manufacturing base to assess whether further national security-related tariffs are warranted.

Energy and the Environment

- Withdraw the United States from the Paris Agreement, the pact among almost all nations to fight climate change.

- Declare a national energy emergency, a first in U.S. history, which could unlock new powers to suspend certain environmental rules or expedite permitting of certain mining projects.

- Attempt to reverse Mr. Biden’s ban on offshore drilling for 625 million acres of federal waters.

- Begin the repeal of Biden-era regulations on tailpipe pollution from cars and light trucks, which have encouraged automakers to manufacture more electric vehicles.

- Roll back energy-efficiency regulations for dishwashers, shower heads, and gas stoves.

- Open the Alaska wilderness to more oil and gas drilling.

- Restart reviews of new export terminals for liquefied natural gas, something the Biden administration had paused.

- Halt the leasing of federal waters for offshore wind farms.

- Eliminate environmental justice programs across the government, which are aimed at protecting poor communities from excess pollution.

- Review all federal regulations that impose an “undue burden” on the development or use of a variety of energy sources, particularly coal, oil, natural gas, nuclear power, hydropower and biofuels.

TikTok ban

- Consult federal agencies on any national security risks posed by the social media platform, then “pursue a resolution that protects national security while saving a platform used by 170 million Americans.” Mr. Trump ordered his attorney general not to enforce a law that banned the site for 75 days to give the Trump administration “an opportunity to determine the appropriate course forward.

Other

- Withdraw from the World Health Organization.

- Rename Mount Denali and the Gulf of Mexico.

- Ensure that states carrying out the death penalty have a “sufficient supply” of lethal injection drugs.

- Fly the American flag at full-staff on Monday and on future Inauguration Days.

- Implement the Department of Government Efficiency, the Elon Musk-led cost-cutting initiative.

- Revoke security clearances for 51 signers of a letter suggesting that the contents of Hunter Biden’s laptop could be Russian disinformation.

We Were at MARS last week

Folks, as usual January MARS conference was well attended with over 900 people in attendance (others – locals were hanging out in the lobby). It is one of our favorite conferences, a lot of deals are always done at that conference and this year was no exception. MARS kicks off the year and most are bullish and looking forward to 2025. PFL was in full force with a table. Our company President, Curtis Chandler attended together with Brian Baker and Cyndi Popov from PFL’s office in Calgary. The speakers were great and it was good to see old friends and meet new ones. It is always interesting to hear the economist’s point of view and as to where they think we are headed as a nation. It seems not to be great, at least that was our takeaway. Consumer debt and the Federal government’s debt are at an all-time high said Landstreet, Managing Director/Founder, from Armada Corporate Intelligence. He is not bullish on interest rates coming down anytime soon. Tom is manager of the global macro N3L Fund, named for Newton’s 3rd Law. Tom analyzes government economic policies and their incentive effects on behavior and prices in the real economy. His behavioral economic analysis leads him to specific investments. For more information on SWARS please reach out to PFL today.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,038 from 29,053, which was a loss of 15 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were higher by +9.1% week over week, CN’s volumes were higher by +6.8% week-over-week. U.S. shipments were mixed. The CSX had the largest percentage increase and was up by +16.1%. The UP had the largest percentage decrease and was down by +8.3%.

We are watching the Green New Deal

Folks, we have a new President and hopefully no new handouts for the Green New Deal are announced. We don’t know about you, but we here at PFL are experiencing Climate Fatigue – the story of saving the planet does not sell anymore – solar panels and wind are not green. We don’t how much more of this we can take as a free market society. For the record, here is what happened last week that you the taxpayer are going to pay for:

1) U.S. DEPARTMENT OF ENERGY INVESTS NEARLY $14 MILLION TO ADVANCE TECHNOLOGIES THAT TRANSFORM CARBON EMISSIONS INTO VALUABLE PRODUCTS

2) U.S. DEPARTMENT OF ENERGY ANNOUNCES $100 MILLION FOR PILOT-SCALE CARBON CONVERSION

3) U.S. DEPARTMENT OF ENERGY INVESTS $101 MILLION TO ESTABLISH CARBON CAPTURE, REMOVAL, AND CONVERSION TEST CENTERS

We are watching Canada

On Sunday we were under the impression that it looked as though tariffs were coming for Canada, we were a little surprised. Canada still does not have a leader, and Justin Trudeau has left Canada in a position that it really can’t negotiate itself out of in the short term. The failed Prime Minister of Canada stood in the way of converting a natural gas pipeline from Alberta to Quebec that would have increased crude oil flows into eastern Canada – he pretty much sent Biden a thank you card when Biden canceled the Keystone pipeline on his first day in office 4 years ago to the day.

Alberta and Ontario have been marketing their respective provinces independently of any Federal leadership, and on Sunday we thought the writing was on the wall. Ontario has been advertising relentlessly on U.S. television that Ontario has always been on the U.S. side and is the largest trading partner for 17 states in the U.S.

Meanwhile, Alberta exports nearly 4 million barrels of crude oil per day into the U.S. most of it by existing pipeline infrastructure so they are a little pigeonholed at the moment. The Premier of Alberta Daniele Smith even took border security into her own hands, much the same as Texas has done. After her trip to Mar-a-Lago a week ago Sunday she warned Canadians that tariffs were on the way and to be prepared.

Economists have been warning that the U.S. consumer is going to pay for the tariffs. We did somewhat agree with that hypothesis, but we are now not convinced that this would be the case. As it relates to Canadian crude, it seems as though traders were bracing for the impact. As mentioned above One Exchange WCS (Western Canadian Select) for February delivery settled on Friday of last week at US$13.25 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$64.14 per barrel. Basis not so long ago was at $US9.00 per barrel below the WTI-CMA (West Texas Intermediate – Calendar Month Average). Basis has blown out for prompt barrels $4.25 cents per barrel – more importantly, the forward curve is trading at US$18 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). What this means is the market was telling us crude would continue to flow to the U.S. as usual, however, Canadian producers due to lower netbacks and the Alberta government due to reduced royalties were going to pay for the duties and not the U.S. consumer. This is not the outcome we expected but it seems to make sense, and you can’t argue with the market – one gets run over if they do! Canada has nowhere to send crude to due to failed Trudeau policies – Trump knows it and was poised to take advantage of the situation.

Then comes Monday Trump and the Trump factor kicked in – you never know what this man is going to do and that is what makes him a great President. Instead, Trump signed an executive order yesterday to investigate alleged unfair trade and currency practices by Canada, Mexico, and China. In November Trump threatened to hit Canada with steep 25 percent across-the-board tariffs in one of his first executive orders on his first day back in office. Be prepared for volatility in the supply chain

Regardless of the outcome Canada needs to come up with more outlets for its commodities and quit punishing the country and its companies and scrap its version of Green New Deal and Carbon taxes – it is killing Canadians and Canadian companies. Canada has arguably the cleanest oil produced on earth, and it is rich in rare earth minerals and plenty of natural gas and coal that can be burned cleanly. It is a shame to see this happening to our Canadian friends. Equally, it is a shame that we have had to live as Americans the way we have for the last four years. There are better days to come for both countries, but right now Canada must look after Canada and the U.S. must look after the U.S. and it is important that we continue to work together and with our European allies, (the Europeans are in a much-needed revamp in policies as well!) Stay tuned to PFL, we are watching this one closely – going to be an interesting couple of months, folks.

We Are Watching Key Economic Indicators

Industrial Output & Capacity Utilization

Manufacturing accounts for approximately 75% of total output. Manufacturing output in December was up 0.6% from November 2024.

Capacity utilization is a measure of how fully firms are using the machinery and equipment — Capacity Utilization was up 0.6% from November in December.

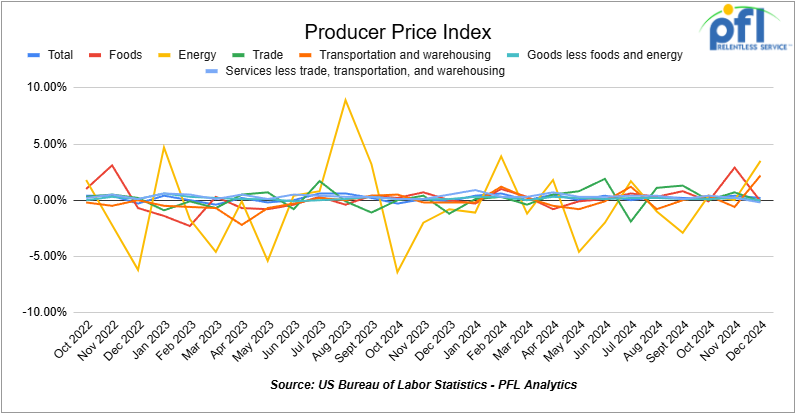

Producer Price Index

In December, the Producer Price Index (PPI) increased by 0.2%, slightly below economists’ expectations of 0.3%. This uptick was primarily due to a 0.6% rise in goods prices, marking the third consecutive monthly increase, while services prices remained unchanged. Annually, the PPI rose 3.3%, the highest since February 2023, indicating a notable increase from the 1.1% gain in 2023.

The Consumer Price Index (CPI) rose 0.4% in December, aligning with forecasts, leading to an annual inflation rate of 2.9%, up from 2.7% in November. Core CPI, which excludes food and energy, increased by 0.2% over the month, slightly below the 0.3% rise observed in the previous four months, bringing the annual core inflation rate to 3.2%.

In response to these inflation trends, the Federal Reserve is anticipated to maintain interest rates at their current levels until at least June 2025, balancing the labor market data against potential inflationary pressures. Goldman Sachs forecasts two interest rate cuts in 2025, while others believe the Fed’s easing cycle has concluded.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website