“A wise man can learn more from a foolish question than a fool can learn from a wise answer.”

– Bruce Lee

Jobs Update

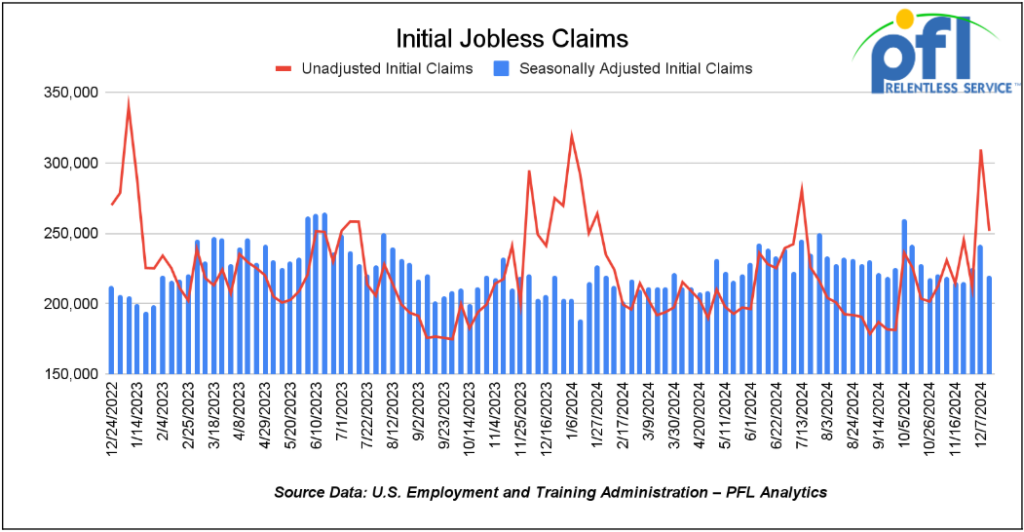

- Initial jobless claims seasonally adjusted for the week ending December 14th came in at 220,000, down -22,000 people week-over-week.

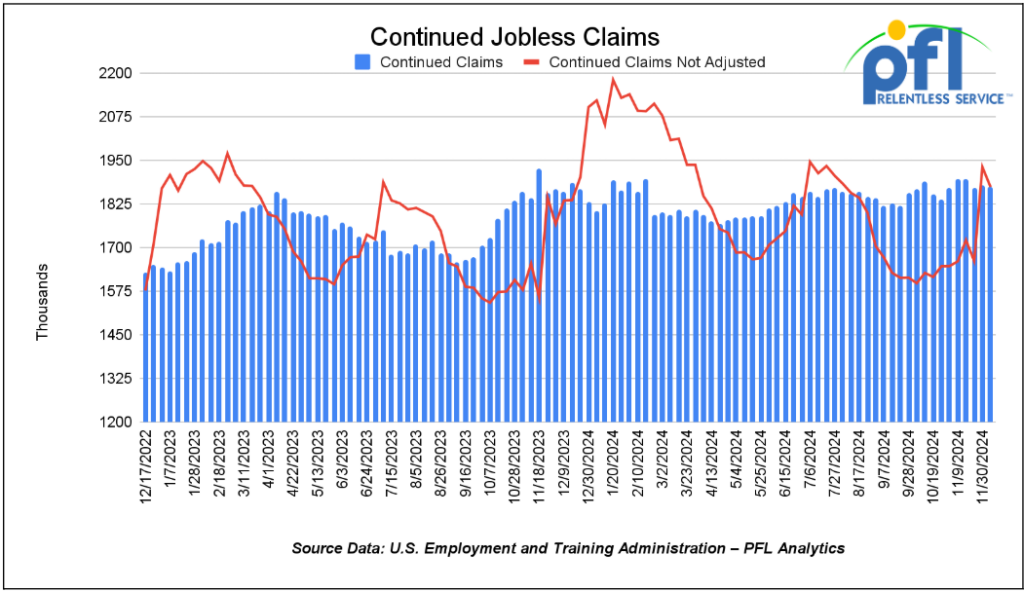

- Continuing jobless claims came in at 1.874 million people, versus the adjusted number of 1.879 million people from the week prior, down -5,000 people week-over-week.

Stocks closed higher on Friday of last week, but lower week over week

Wall Street suffered its worst weekly loss in just over a month on Friday as market participants received a reality check from the Federal Reserve.

The central bank on Wednesday delivered a quarter-point interest rate cut, as widely expected. But, it was the Fed’s updated Summary of Economic Projections that was the story of the day. Policymakers now see higher inflation and fewer rate cuts in 2025, with chair Jerome Powell stressing caution going forward.

The Fed’s actions shook the markets on Wednesday of last week, sending the Nasdaq Composite down more than 3% and the benchmark S&P 500 (SP500) to its worst session since early August.

The negative sentiment did not last too long, however. After attempting a rebound on Thursday of last week, U.S. equities bounced back in earnest on Friday of last week, helped by a soft November core personal consumption expenditures price index reading—a gauge that is widely seen as the Fed’s preferred inflation marker.

The DOW closed higher on Friday of last week, up 498.02 points (1.18%) and closing out the week at 42,840.26, down -987.8 points week-over-week. The S&P 500 closed higher on Friday of last week, up 63.77 points, and closed out the week at 5,930.85, down -120.24 points week-over-week. The NASDAQ closed higher on Friday of last week, up 199.83 points (1%), and closed out the week at 19,572.6, down -354.13 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 43,318 this morning down -16 points.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up 8 cents per barrel (0.12%) to close at $69.46 per barrel on Friday of last week, down -$1.83 per barrel week over week. Brent traded up 6 cents USD per barrel (0.08%) on Friday of last week, to close at $72.96 per barrel, down -$1.53 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for February delivery settled Friday on last week at US$13.15 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$55.68 per barrel.

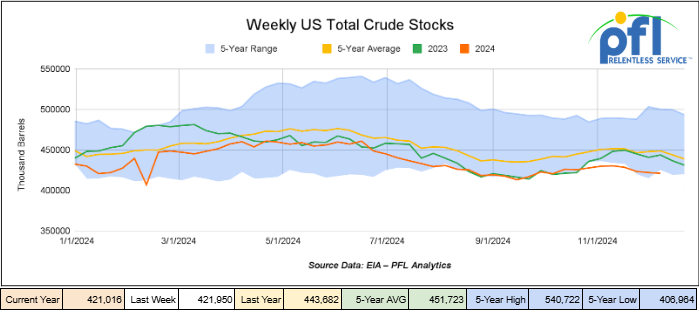

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 900,000 barrels week-over-week. At 421 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

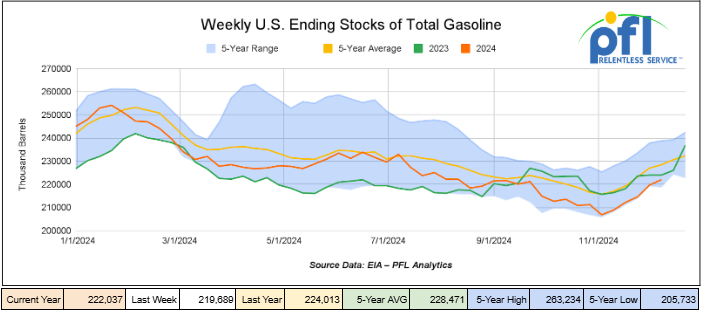

Total motor gasoline inventories increased by 2.3 million barrels week-over-week and are 3% below the five-year average for this time of year.

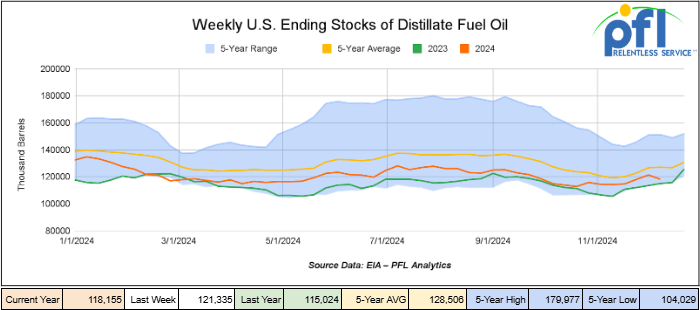

Distillate fuel inventories decreased by 3.2 million barrels week-over-week and are 7% below the five-year average for this time of year.

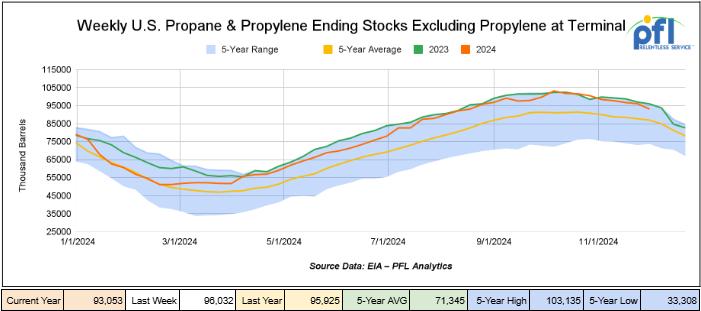

Propane/propylene inventories decreased by 3 million barrels week-over-week and are 7% above the five-year average for this time of year.

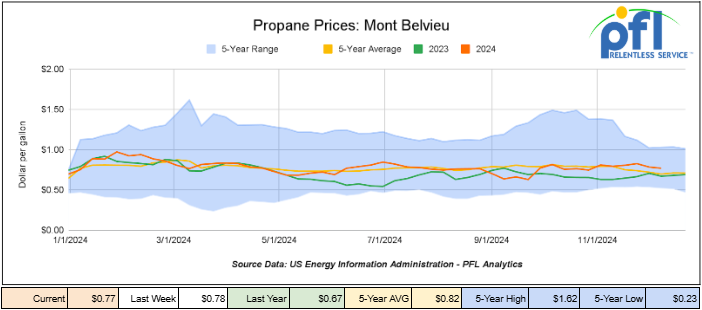

Propane prices closed at 77 cents per gallon on Friday of last week, down 1 cent per gallon week-over-week, but up 10 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 3.2 million barrels during the week ending December 13th, 2024.

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending December 13th, 2024, an increase of 665,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 2.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 755,000 barrels per day, and distillate fuel imports averaged 164,000 barrels per day.

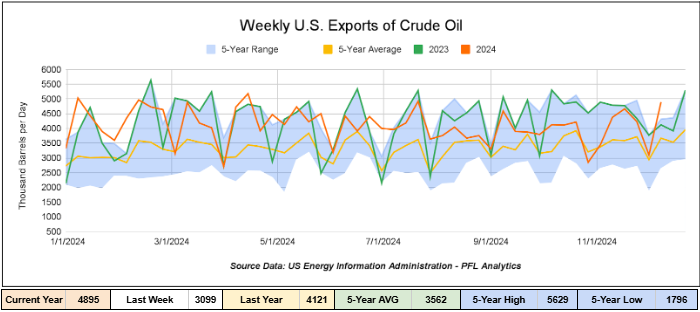

U.S. crude oil exports averaged 4.895 million barrels per day during the week ending December 13, 2024, an increase of 1.796 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.223 million barrels per day.

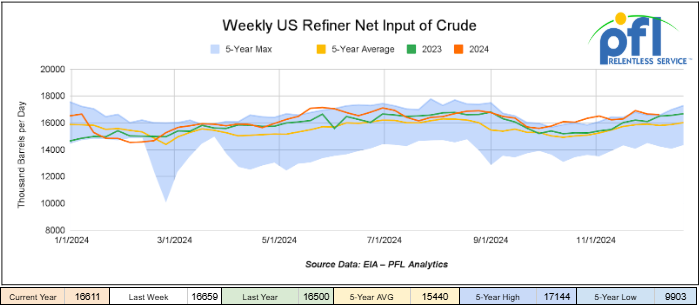

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending December 13, 2024, which was 48,000 barrels per day less week-over-week.

WTI is poised to open at $69, down 14 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 18, 2024.

Total North American weekly rail volumes were up (3.62%) in week 51, compared with the same week last year. Total carloads for the week ending on December 18th were 349,185, down (-2.5%) compared with the same week in 2023, while weekly intermodal volume was 367,767, up (10.18%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Motor Vehicles and Parts, which was down (-10.2%) while the largest increase came from Intermodal which was up (10.18%).

In the East, CSX’s total volumes were up (0.4%), with the largest decrease coming from Grain (-21.15%), while the only increase came from Petroleum and Petroleum Products (14.32%). NS’s volumes were up (2.87%), with the largest decrease coming from Motor Vehicles and Parts (-11.02%), while the largest increase came from Grain (23.81%).

In the West, BN’s total volumes were up (9.66%), with the largest decrease coming from Other, down (-21.94%), while the largest increase came from Intermodal (17.43%). UP’s total rail volumes were up (6.82%) with the largest decrease coming from Metallic Ores and Metals, down (-15.21%), while the largest increase came from Intermodal (18.67%).

In Canada, CN’s total rail volumes were down (-10.99%) with the largest decrease coming from Other, down (-68.03%), while the largest increase came from Grain, up (+31.82%). CP’s total rail volumes were down (-8.57%) with the largest increase coming from Other (+71.11%), while the largest decrease came from Grains (-27%).

KCS’s total rail volumes were down (-2.9%) with the largest decrease coming from Petroleum and Petroleum Products (-31.63%) and the largest increase coming from Motor Vehicles and Parts (+33.86%).

Source Data: AAR – PFL Analytics

Rig Count

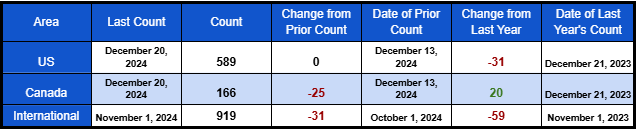

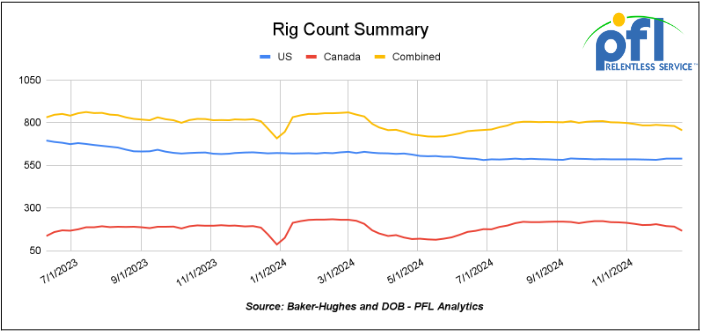

North American rig count was down -25 rigs week-over-week. U.S. rig count was flat week-over-week, but down by -31 rigs year-over-year. The U.S. currently has 589 active rigs. Canada’s rig count was down -25 rigs week over week, but up 20 rigs year-over-year, and Canada’s overall rig count is 166 active rigs. Overall, year over year we are down by -11 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,776 from 29,839, which was a loss of 63 rail cars week-over-week. Canadian volumes were mixed. CN’s shipments were higher by +6.4% week over week, CPKC’s volumes were lower by -0.2% week-over-week. U.S. shipments were also mixed. The CSX had the largest percentage decrease and was down by -6.4%. The NS had the largest percentage increase and was up by +4.4%.

We are watching Trump

U.S. President-elect Donald Trump said on Friday of last week that the European Union may face tariffs if the bloc does not cut its growing deficit with the United States by making large oil and gas trades with the world’s largest economy.

The EU is already buying the lion’s share of U.S. oil and gas exports, according to U.S. government data, and no additional volumes are currently available unless the United States increases output or volumes are re-routed from Asia — another big consumer of U.S. energy.

“I told the European Union that they must make up their tremendous deficit with the United States by the large-scale purchase of our oil and gas,“ Trump said in a post on Truth Social.

“Otherwise, it is TARIFFS all the way!!!,” he added.

The European Commission said it was ready to discuss with the president-elect how to strengthen an already strong relationship, including in the energy sector.

“The EU is committed to phasing out energy imports from Russia and diversifying our sources of supply,” a spokesperson said.

The United States already supplied 47 percent of the European Union’s LNG imports and 17 percent of its oil imports in the first quarter of 2024, according to data from EU statistics office Eurostat.

Trump has vowed to impose tariffs on most, if not all, imports, and said Europe would pay a heavy price for having run a large trade surplus with the U.S. for decades.

Trump has repeatedly highlighted the U.S. trade deficit for goods, but not trade as a whole.

The U.S. had a goods trade deficit with the EU of 155.8 billion euros (US$161.9 billion) last year. However, in services it had a surplus of 104 billion euros, Eurostat data shows.

Trump, who takes office on Jan. 20, has already pledged hefty tariffs on three of the United States’ largest trading partners — Canada, Mexico and China.

We are watching the Green New Deal

More government handouts continue during the lame duck session. The U.S. government announced on Friday of last week $850 million to reduce methane pollution from the oil and gas sector. U.S. Environmental Protection Agency (EPA) said approximately $850 million for 43 projects selected for negotiation that will help small oil and gas operators, Tribes, and other entities across the country to reduce, monitor, measure, and quantify methane emissions from the oil and gas sector as part of President Biden’s Investing in America agenda.

On the same day in a separate release The U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) announced it is re-opening a funding opportunity to make up to $500 million available for projects that will help expand carbon dioxide (CO2) transportation infrastructure across the United States. Accelerating the development and deployment of carbon management technology to capture CO2 emissions from industrial operations and power generation, as well as directly from the atmosphere, requires a safe and reliable system that can transport the captured CO2, either for permanent geologic storage or for conversion to useful, durable products. They say these efforts will reduce CO2 emissions, provide new job opportunities, and enhance our Nation’s energy security.

“As we continue to expand our Nation’s carbon management infrastructure to reduce the harmful effects of carbon dioxide emissions, we must jointly explore solutions to move the growing volumes of captured carbon dioxide to geologic storage or other end-use locations,” said Brad Crabtree, Assistant Secretary of Fossil Energy and Carbon Management. “DOE is making investments in large-capacity, common-carrier carbon dioxide transport projects to help spur the development of regional networks our country will need to meet this future increase in demand.”

We are watching Class 1 Industry Headcount

Class I railroads employed 120,354 workers in the United States in November 2024, a 0.05% increase from October 2024’s count of 120,290 and a -1.64% year-over-year decrease from November 2023’s total of 122,356, according to Surface Transportation Board data.

Three of the six employment categories posted month-over-month increases between October and November. These were Executives, Officials, and Staff Assistants, which rose +0.04% to 7,860 workers; Transportation (other than train and engine), which increased +0.26% to 5,061 workers; and Transportation (train and engine), which increased +0.27% to 51,777 workers.

The categories that posted month-over-month decreases were Professional and Administrative, down -0.56% to 9,630 workers, and Maintenance of Equipment and Stores, down -0.21% to 17,116 workers.

Maintenance of Way and Structures remained unchanged at 28,910 workers.

Year over year, two categories posted an employment gain, which was Maintenance of Way and Structures, up 0.73%, and Transportation (other than train and engine), up 2.87%. Categories that registered year-over-year decreases in November were Executives, Officials, and Staff Assistants, down -3.78%; Professional and Administrative, down -6.51%; Maintenance of Equipment and Stores, down -4.62%; and Transportation (train and engine), down -1.04%.

We are watching Key Economic Indicators

Industrial Output & Capacity Utilization

Manufacturing accounts for approximately 75% of total industrial output. Manufacturing output in November 2024 increased by 0.2%, rebounding from a 0.7% decline in October. This modest gain was largely driven by a 3.5% rise in motor vehicle production, while aerospace output dropped by 2.6%.

Capacity utilization—a measure of how fully firms are using machinery and equipment—fell to 76.8% in November from 77.0% in October, marking the lowest level since April 2021. Within manufacturing, capacity utilization edged up to 76.0%, but it remains 2.3 percentage points below the long-run average.

Consumer Spending

In November 2024, total consumer spending adjusted for inflation rose by 0.3% over October 2024. This follows a gain of 0.2% in October and a gain of 0.1% in September. According to the government, year-over-year inflation-adjusted total spending in November 2024 was up 2.4%. Inflation-adjusted spending on goods increased by 0.4% in November, following a 0.3% rise in October. Inflation-adjusted spending on services rose by 0.2% in November, matching the gain in October and marking the eleventh consecutive month-to-month increase.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|