“Blessed is he who has learned to admire but not envy, to follow but not imitate, to praise but not flatter, and to lead but not manipulate.”

– William Arthur Ward

Jobs Update

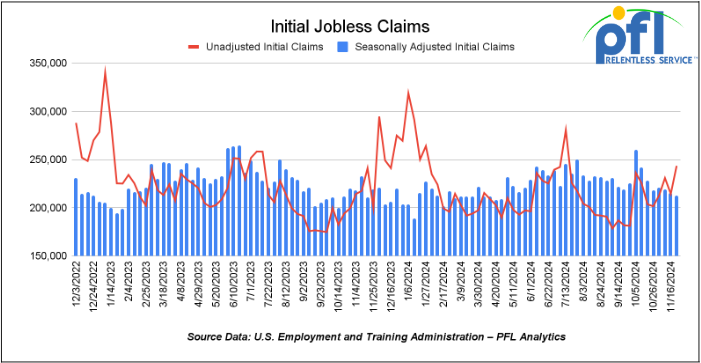

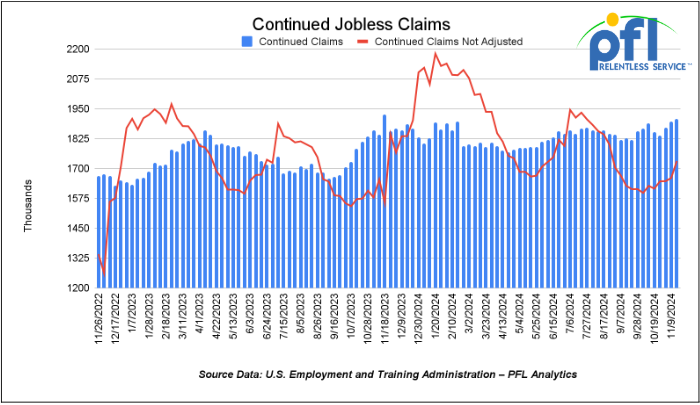

- Initial jobless claims seasonally adjusted for the week ending November 23rd came in at 213,000, down -2,000 people week-over-week.

- Continuing jobless claims came in at 1.907 million people, versus the adjusted number of 1.898 million people from the week prior, up 9,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 188.59 points (0.42%) and closing out the week at 44,910.65, up 614.14 points week-over-week. The S&P 500 closed higher on Friday of last week, up 33.64 points (0.56%), and closed out the week at 6,032.38, up 63.04 points week-over-week. The NASDAQ closed higher on Friday of last week, up 157.69 points (0.83%), and closed out the week at 19,218.17, up 214.52 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 45,000 this morning down 55 points.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up $0.15 per barrel (.22%) to close at $68.87 per barrel on Friday of last week, down -$2.37 per barrel week over week. Brent traded down $0.15 USD per barrel (-0.2%) on Friday of last week, to close at $73.13 per barrel, down -$2.04 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for January delivery settled Friday on last week at US$12.25 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US $56.62 per barrel.

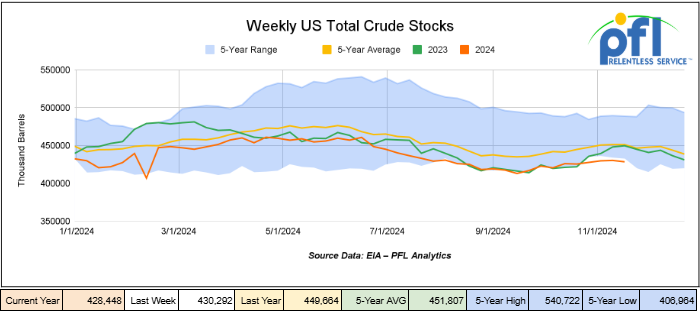

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.8 million barrels week-over-week. At 428.4 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

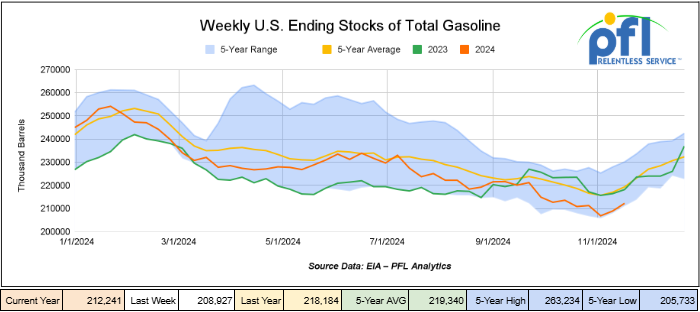

Total motor gasoline inventories increased by 3.3 million barrels week-over-week and are 3% below the five-year average for this time of year.

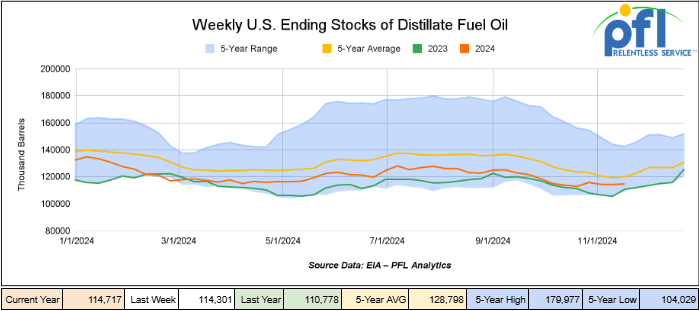

Distillate fuel inventories increased by 400,000 barrels week-over-week and are 5% below the five-year average for this time of year.

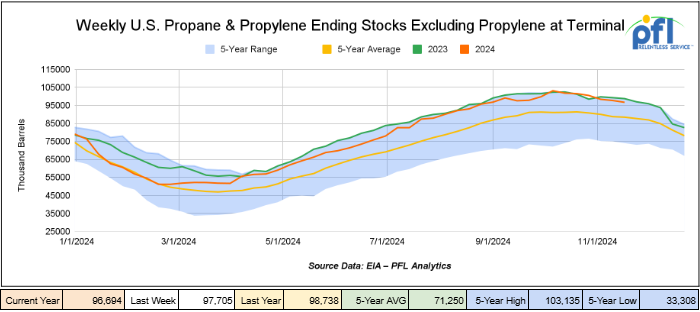

Propane/propylene inventories decreased by 1 million barrels week-over-week and are 9% above the five-year average for this time of year.

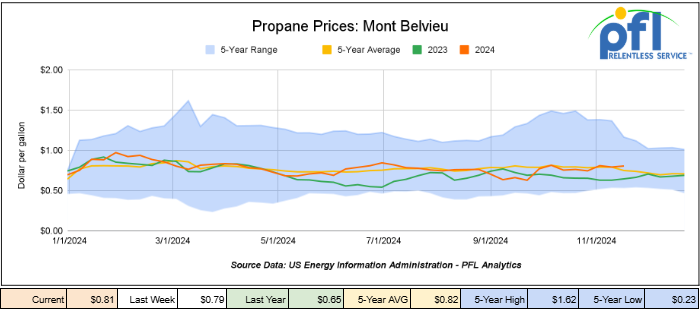

Propane prices closed at 81 cents per gallon on Friday of last week, up 2 cents per gallon week-over-week, and up 16 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 1.8 million barrels during the week ending November 22nd, 2024.

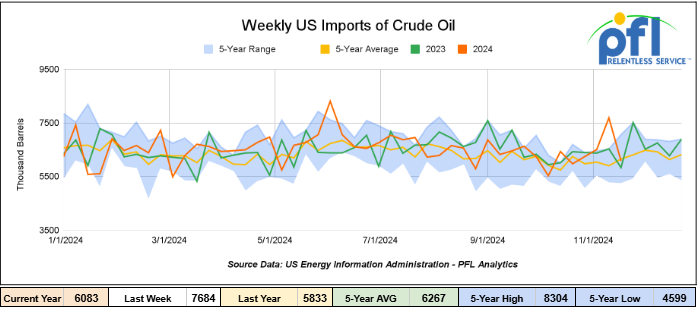

U.S. crude oil imports averaged 6.1 million barrels per day during the week ending November 22nd, 2024., a decrease of 1.6 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 5.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 636,000 barrels per day, and distillate fuel imports averaged 144,000 barrels per day during the week ending November 22nd, 2024.

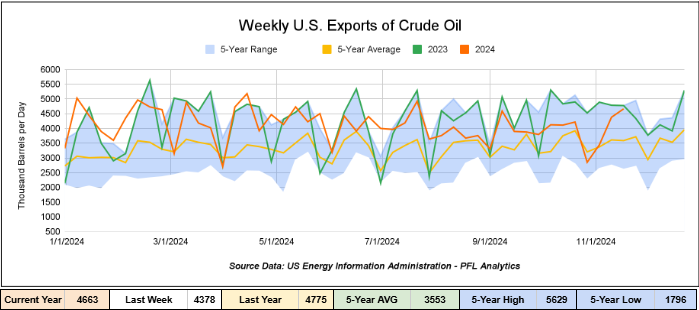

U.S. crude oil exports averaged 4,663 million barrels per day during the week ending November 22nd, 2024, an increase of 285,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.833 million barrels per day.

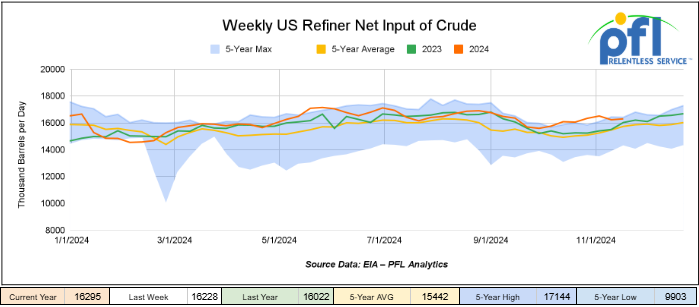

U.S. crude oil refinery inputs averaged 16.3 million barrels per day during the week ending November 22, 2024, which was 67,000 barrels per day more week-over-week.

WTI is poised to open at $68.68, up 68 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 27th, 2024.

Total North American weekly rail volumes were up (20.39%) in week 48, compared with the same week last year. Total carloads for the week ending on November 27th were 354,603, up (11.85%) compared with the same week in 2023, while weekly intermodal volume was 360,790, up (30.15%) compared to the same week in 2023. 10 of the AAR’s 11 major traffic categories posted year-over-year increases. The only decrease came from Coal, which was down (-7.06%). The most significant increase came from Nonmetallic Minerals, which was up (+33.66%).

In the East, CSX’s total volumes were up (22.71%), with the largest decrease coming from Farm Products (-4.59%), while the largest increase came from Nonmetallic Minerals (+51.75%). NS’s volumes were up (23.33%), with the largest increase coming from Grain (+82.71%).

In the West, BN’s total volumes were up (+23%), with the largest increase coming from Intermodal (+37.51%), while the largest decrease came from Coal, down (-6.8%). UP’s total rail volumes were up (21.92%) with the largest decrease coming from Coal, down (-25.13%), while the largest increase came from Grain, which was up (+40.72%).

In Canada, CN’s total rail volumes were up (1.28%) with the largest decrease coming from Other, down (-48.89%), while the largest increase came from Grain, up (+49.85%). CP’s total rail volumes were down (-0.57%) with the largest increase coming from Other (+77.14%), while the largest decrease came from Coal (-28.71%).

KCS’s total rail volumes were up (10.77%) with the largest decrease coming from Coal (-43.3%) and the largest increase coming from Grain (+79.67%).

Source Data: AAR – PFL Analytics

Rig Count

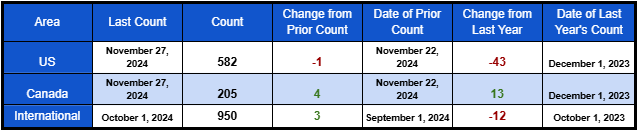

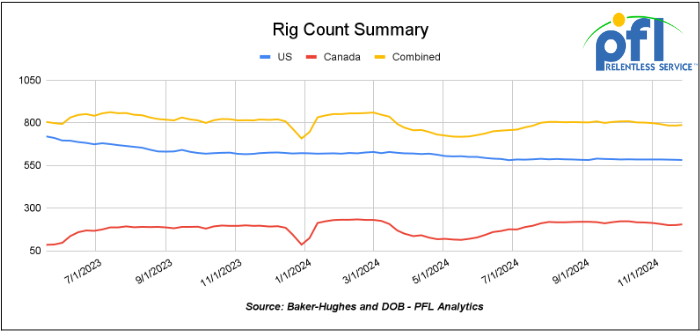

North American rig count was up 3 rigs week-over-week. U.S. rig count was down -1 rig week-over-week and down by -43 rigs year-over-year. The U.S. currently has 582 active rigs. Canada’s rig count was up 4 rigs week over week and up by 13 rigs year-over-year and Canada’s overall rig count is 204 active rigs. Overall, year over year we are down by -30 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Canada – Natural Gas and LPG’s

I am sure most of our readers are aware of President Trump’s latest move – imposing 25% tariffs on Canadian goods imported from Canada and Mexico on day 1 (January 20th) when he returns to office. The President is doing this to stop the flow of illegal aliens crossing our northern and southern borders and the constant inflow of illegal drugs that kill our youth. The result – apparently, we already have a deal with Mexico and Prime Minister Justin Trudeau, Canada’s leader, hopped on a plane over the weekend to meet with President Trump in Florida. If tariffs are levied against Canada, it is a big deal for them as the country exports, amongst other items, 4 million barrels a day of crude per day to the United States.

Will Justin Trudeau change his woke ways and help make America great again at the same time making Canada great again and learn lessons from Kamala Harris? Or will he continue alienating Canadians who are struggling in a big way because of his policies? Time will tell, but he continues to be at war with the Province of Alberta, initiating an emissions cap. Meanwhile, the Alberta government is using every weapon in its arsenal against an emissions cap with a new motion last week presented to the Canadian government.

The Alberta government is willing to fight the federal government’s oil and gas emissions cap in court and make changes that include assuming control of the industry’s emissions reporting.

In response to the proposed cap, the provincial government is putting forward a motion under the Alberta Sovereignty Within a United Canada Act.

“We have been very clear that we will use all means at our disposal to fight back against federal policies that hurt Alberta and that’s exactly what we’re doing,” Alberta Premier Danielle Smith told reporters on Tuesday of last week.

Ottawa, Canada’s capital city, released draft details of this cap on November 4, 2024. The federal government expects final regulations for this cap in 2025, and reporting and verification requirements for large operators to begin in 2026.

This is a cap-and-trade system that works in three-year periods. The first compliance period of 2030 to 2032 is set at 35 percent below 2019 emissions levels.

“We’re fighting back with every weapon in our arsenal,” said Smith. “The Alberta Sovereignty Within a United Canada Act was designed to protect our province from unconstitutional interference and now we’re going to use it again.”

The motion the Smith government is putting forward in the legislature uses the act to ask the legislative assembly for approval to “shield” Alberta if the cap becomes law, she added.

If passed, actions in the motion include an immediate constitutional challenge, a ban on provincial bodies enforcing the cap, and labeling oil and gas production facilities as essential infrastructure under the Alberta Critical Infrastructure Defense Act.

One of the potential actions would see all information related to greenhouse gases at these facilities declared as owned by the Alberta government with “data reported or disclosed at our discretion,” said Smith.

Through the motion, another proposed action is to prohibit entry of all individuals into these facilities except those licensed to enter by the Alberta government.

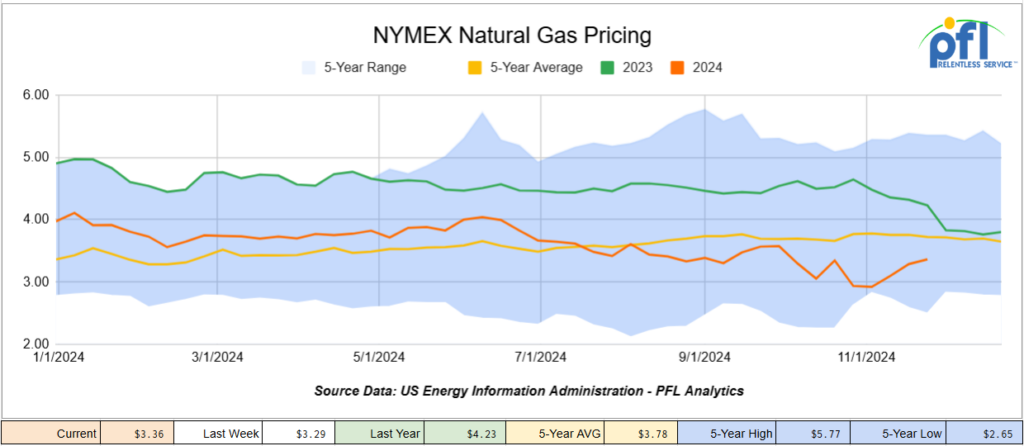

In other related news – folks, we are short-term bearish Natural Gas and Natural Gas Liquids, but we are long-term bullish. Natural gas liquids and natural gas are abundant in North America and are clean burning – it is the only transitional fuel if you think we need one that makes sense from a security and economic perspective. Folks are talking about nuclear – we don’t like it – it is kicking the can down the road and nuclear has a tremendous amount of hidden costs including, to say the least, decommissioning costs and plant turnaround costs that would make most people’s heads spin.

U.S. natural gas operators expect significant price volatility in 2025 as gas supplies behind the pipe are brought onstream in anticipation of higher demand and prices in the latter half of the year.

“2025 is really going to be an inflection point for North American gas demand,” said EOG Resources, Inc. chief executive officer Ezra Yacob at the company’s third-quarter earnings call.

A wave of LNG export terminals currently under construction will begin to come online next year and ones being built over the next three years, he said. “It will add up to 10–12 bcf/d of demand in that timeframe.”

But in the meantime, there is a lot of backed-up gas supply that needs to work its way through the system, Yacob said. North American gas inventory is currently five percent above the five-year average for this time of year. (See below) Operators have curtailed production awaiting higher prices to be brought back, and there is a growing inventory of drilled, but uncompleted wells (DUCs).

This excess supply will likely come back onstream in three bands, said EQT Corporation’s CFO Jeremy Knop.

“I think you will continue to see prices sort of ping-pong between US$2 and $3/mcf until all curtailments are back online. As you approach $3/mcf, all of that should come back online.” Well, we are there – See below:

Knop added: “I think there’s a second band between probably $3 and $3.50/mcf where you see some of the short-cycle DUCs and deferred TILs (turn-in lines) sitting out there that some of our peers have started coming online.”

EQT thinks once those wells come onstream increased activity will be needed to grow supply into expected LNG demand. And just as there is a delayed effect in production dropping when operators cut activity, there’s a delayed effect to production resuming growth when activity is added, he said.

“I think the longer production stays down where it is, the more difficult it’s going to be to bring it back.”

As for timing, EQT expects near-term early 2025 prices to sit below the $3 level with curtailed production coming back.

“And very quickly, you’re going to snap towards the high end of that level ($3.50) as you get towards the back half of 2025 and into 2026,” he said.

Increased Natural Gas production automatically comes with increased liquids production – Propane and Natural Gasoline – this is great news for rail – pressure cars and 117J’s 30,000-gallon capacity non-coiled cars will be in demand. Stay tuned to PFL. We are watching this one closely!

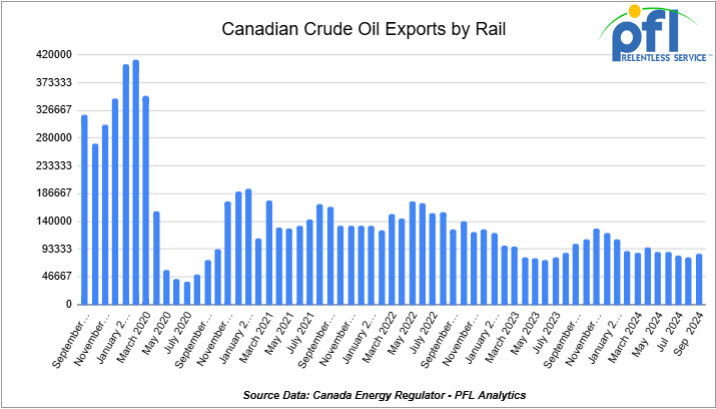

We are Watching Canadian Crude Oil Exports by Rail

Crude by rail out of Canada posted its first month-over-month increase in three months. The Canadian Energy regulator reported on November 22, 2024, that 85,867 barrels were exported during the month of September 2024 from 79,200 barrels in August of 2024, an increase of 6,667 barrels per day month over month.

Despite crude oil production in western Canada reaching record highs, Canadian crude oil volumes exported by rail declined by 31% overall in 2023, averaging 98,300 barrels per day in 2023, down from 143,300 barrels per day in 2022 and so far in 2024, we have averaged a little over 90,000 barrels per day. This drop is largely due to crude oil increasingly being exported by pipelines instead of rail after additional pipeline capacity was brought online in recent years.

In 2019, crude exports by rail reached an annual historical high because pipelines in western Canada were operating near or at full capacity. This trend continued into early 2020, with February 2020 hitting a record monthly high of 412,000 b/d. Since then, annual average volumes exported by rail have been dropping, first from the COVID-19 pandemic oil demand has declined. The decline continued as additional pipeline capacity became available for oil exports out of western Canada since October 2021, with the completion of the Enbridge Mainline Line 3 replacement program, which added 370,000 barrels per day of capacity, and of course the recent completion of the Trans Mountain Expansion that added 590,000 barrels per day of capacity.

Now President-elect Donald Trump is talking about bringing back the Keystone XL pipeline. Remember the 1 million barrel per day crude oil pipeline that President Joe Biden canceled, which was almost complete on his first day in office after TransCanada spent $15 billion building it? Rumor has it that President-elect Donald Trump is looking to revive the Keystone XL oil pipeline on his first day back in the White House, according to news sources of three people familiar with the President-elect’s plan.

President Trump believes declaring the 1,200-mile Canada-to-Nebraska crude project back on the table would drive America’s energy independence, said people involved in the transition team who are in discussions about doing just that. Trump wants to reverse President Joe Biden’s decision, which reversed Trump’s initial 2017 approval of the project, which was strongly opposed by environmental groups

Despite all the pipeline expansions and the potential of Keystone XL apparently back on the table, we do expect crude by rail to continue upwards from current levels. Crude by rail out of Canada is popular for stranded oil without pipeline connectivity and for transporting raw bitumen without diluent that cannot flow in pipelines and is competitive with crude by rail as it ships as a non-haz product. Cenovus, Strathcona, and Gibson are adding capacity to ship more raw bitumen with Strathcona alone wanting to triple volumes produced from current levels by the end of 2026. We are watching this one closely, stay tuned to PFL for further details.

We Are Watching Key Economic Indicators

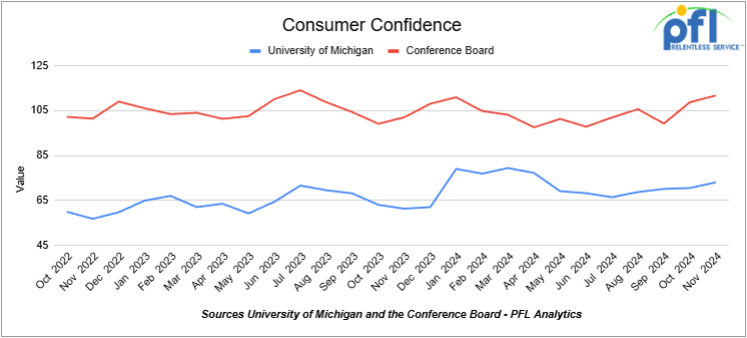

Consumer Confidence

The Conference Board’s Index of Consumer Confidence increased to 111.7 in November 2024, up from 108.7 in October.

Similarly, the University of Michigan’s Index of Consumer Sentiment rose to 73 in November, compared to 70.5 in October.

Consumer confidence and Consumer sentiment are up on the back of the reelection of Donald Trump in the hopes that change is on the way.

Consumer Spending

In October 2024, inflation-adjusted total consumer spending rose by 0.4% over September, sustaining the strong pace observed in the prior month. Year-over-year, inflation-adjusted spending increased by 2.8%, reflecting broad-based gains. Spending on goods increased by 0.6% in October, building on its recovery from earlier declines in the year. Meanwhile, spending on services rose by 0.2%, marking its eleventh consecutive month of growth.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 30K, 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|