“In order to attain the impossible, one must attempt the absurd.”

-Miguel de Cervantes

Jobs Update

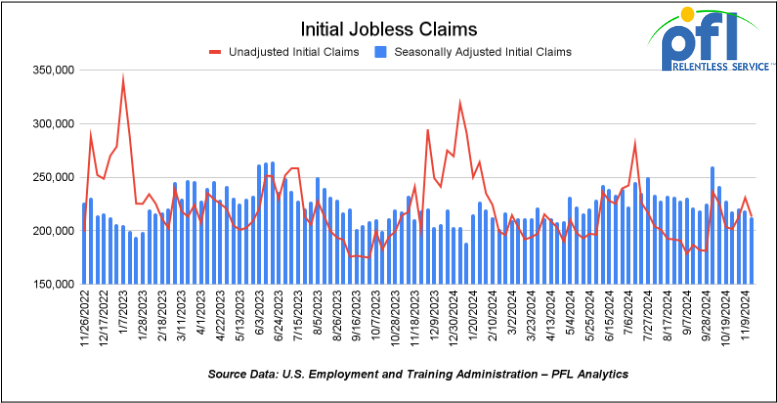

- Initial jobless claims seasonally adjusted for the week ending November 16th came in at 213,000, down -6,000 people week-over-week.

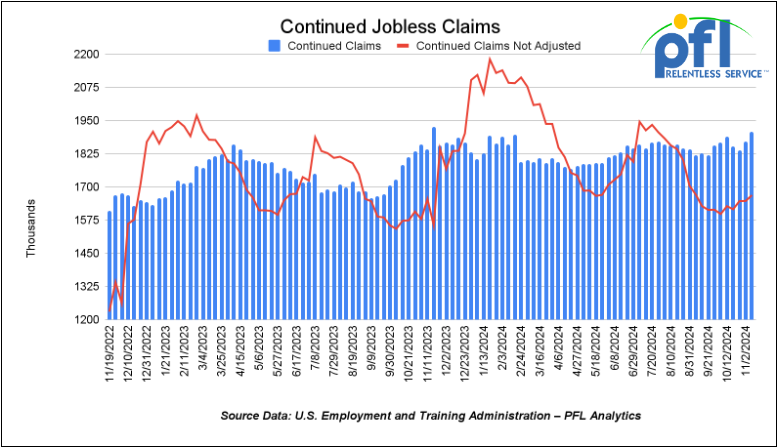

- Continuing jobless claims came in at 1.908 million people, versus the adjusted number of 1.872 million people from the week prior, up 36,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 426.16 points (-0.97%) and closing out the week at 44,296.51, up 851.53 points week-over-week. The S&P 500 closed higher on Friday of last week, up 20.63 points (0.35%), and closed out the week at 5,969.34, up 98.72 points week-over-week. The NASDAQ closed higher on Friday of last week, up 31.23 points (0.17%), and closed out the week at 9,003.65, up 325.12 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 44,684 this morning up 289 points.

Crude oil closed higher on Friday of last week and higher week over week.

West Texas Intermediate (WTI) crude closed up $1.14 per barrel (1.6%) to close at $71.24 per barrel on Friday of last week, up $4.22 per barrel week over week. Brent traded up $0.94 USD per barrel (1.3%) on Friday of last week, to close at $75.17 per barrel, up $4.13 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for January delivery settled Friday on last week at US$12.70 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 58.94 per barrel.

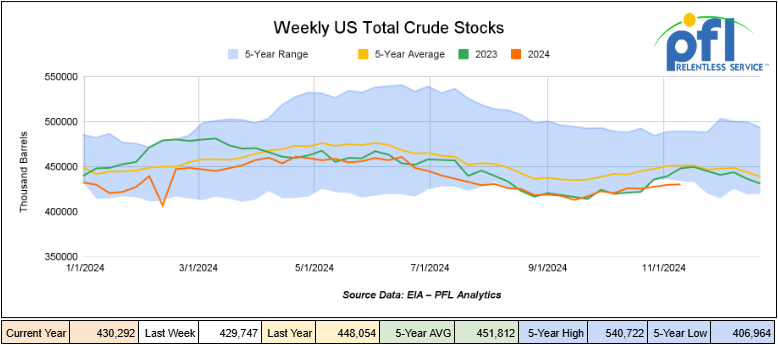

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 500,000 barrels week-over-week. At 430.3 million barrels, U.S. crude oil inventories are about 4% below the five-year average for this time of year.

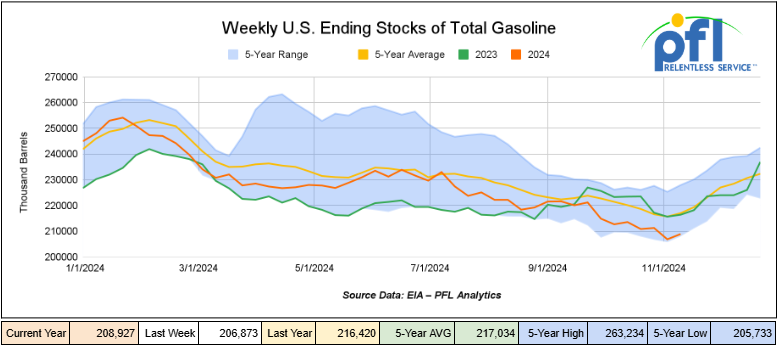

Total motor gasoline inventories increased by 2.1 million barrels week-over-week and are 4% below the five-year average for this time of year.

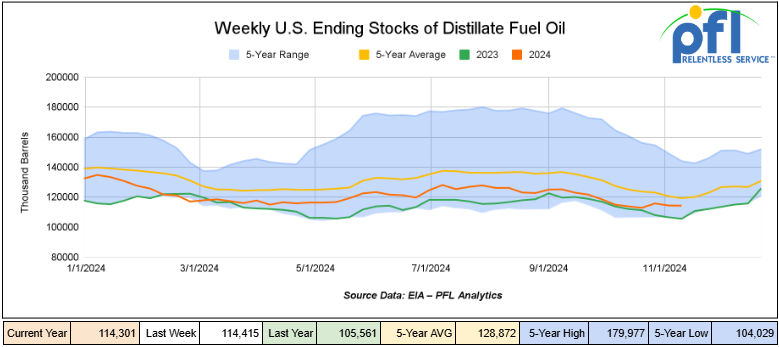

Distillate fuel inventories decreased by 100,000 barrels week-over-week and are 4% below the five-year average for this time of year.

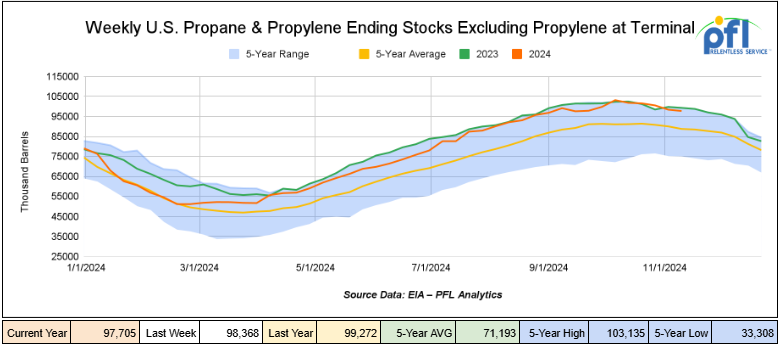

Propane/propylene inventories decreased by 700,000 barrels week-over-week and are 10% above the five-year average for this time of year.

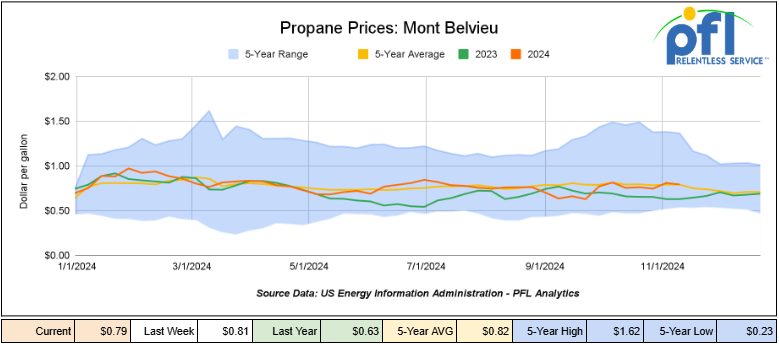

Propane prices closed at 79 cents per gallon on Friday of last week, down 2 cents per gallon week-over-week, but up 16 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 3.0 million barrels during the week ending November 15th, 2024.

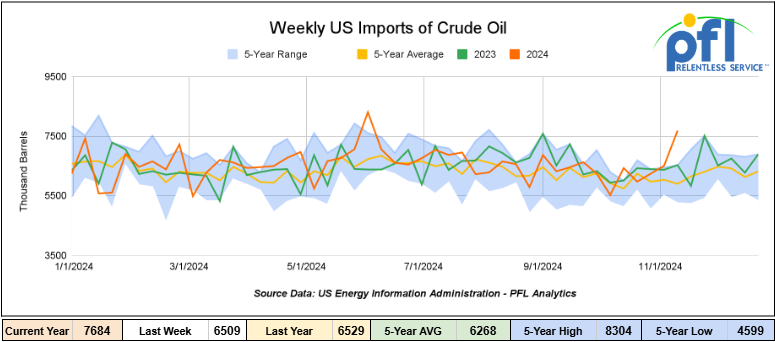

U.S. crude oil imports averaged 7.7 million barrels per day during the week ending November 15th, 2024, an increase of 1.2 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 2.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 374,000 barrels per day, and distillate fuel imports averaged 123,000 barrels per day during the week ending November 15th, 2024.

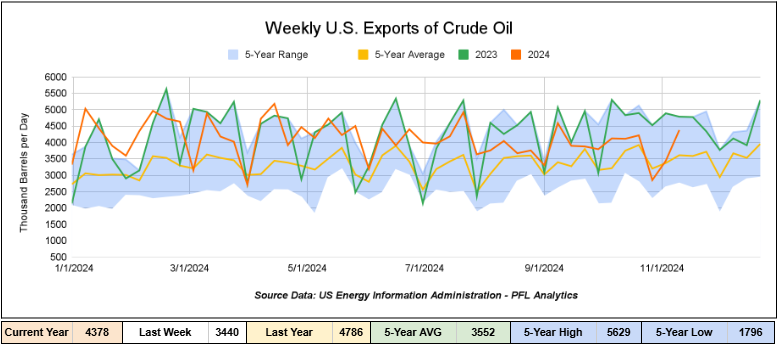

U.S. crude oil exports averaged 4,378 million barrels per day during the week ending November 15th, 2024, an increase of 938,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.721 million barrels per day.

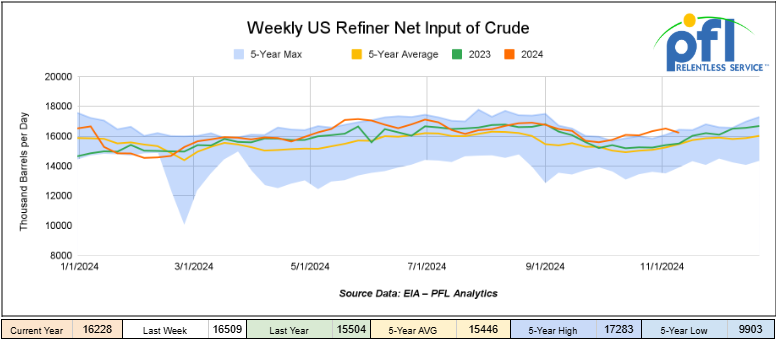

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending November 15, 2024, which was 281,000 barrels per day less week-over-week.

WTI is poised to open at $70.84, down -0.40 per barrel from Friday’s close.

North American Rail Traffic

Week Ending November 20th, 2024.

Total North American weekly rail volumes were up (1.38%) in week 47, compared with the same week last year. Total carloads for the week ending on November 20th were 348,337, down (-5.34%) compared with the same week in 2023, while weekly intermodal volume was 357,096, up (8.91%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Coal, which was down (-19.27%). The most significant increase came from Intermodal, which was up (+8.91%).

In the East, CSX’s total volumes were up (0.67%), with the largest decrease coming from Coal (-14.67%), while the largest increase came from Petroleum and Petroleum Products (+27.34%). NS’s volumes were up (1.46%), with the largest increase coming from Other (+15.25%), while the largest decrease came from Chemicals (-10.22%).

In the West, BN’s total volumes were up (+5.69%), with the largest increase coming from Intermodal (+18.26%) while the largest decrease came from Coal, down (-17.06%). UP’s total rail volumes were up (5.4%) with the largest decrease coming from Coal, down (-30.71%), while the largest increase came from Intermodal, which was up (+18.66%).

In Canada, CN’s total rail volumes were down (-17.15%) with the largest decrease coming from Intermodal, down (-52.11%) while the largest increase came from Grain, up (+24.63%). CP’s total rail volumes were down (-14.55%) with the largest increase coming from Other (+393.75%), while the largest decrease came from Intermodal (-42.7%).

KCS’s total rail volumes were down (-6.75%) with the largest decrease coming from Coal (-41.11%) and the largest increase coming from Motor Vehicles and Parts (+45.41%).

Rail Traffic in Canada, as noted above, was down significantly in week 47, this was due to port strikes in Montreal and Vancouver, Canada’s busiest ports. On top of that, 55,000 Canadian Postal workers went on strike, but everyone is back to work now.

Operations have resumed at strike-hit ports across Canada, but the work stoppage has resulted in a huge backlog of containers and shippers likely to face a new wave of detention and demurrage (D&D) charges.

Work resumed at Montreal, as ordered by the Canada Industrial Relations Board (CIRB).

The Montreal Authority (MPA) revealed last week there were more than 5,000 teu on the ground, 22 vessels on their way or waiting at anchor, and some 2,750 teu of rail cargo to handle.

“It may take a few weeks to re-establish the fluidity of the supply chain and process all goods currently at the port of Montreal or in transit and due to arrive in the next few days,” it said.

Meanwhile, on Canada’s west coast, Vancouver Fraser Port Authority (VFPA) said the 10-day strike had also “significantly disrupted port operations”, adding: “As a result, several commercial vessels are currently waiting offshore to enter the port of Vancouver and proceed to berth.”

VFPA said it was implementing “a priority-based anchorage allocation system to balance the needs of all business sectors and commodities.”

It may take a few weeks to re-establish the fluidity of the supply chain and process all goods currently at the ports or in transit to arrive in the coming days.

There seems to be quite a bit of unrest in Canada right now. Riots broke out in Montreal over the weekend, calling for the destruction of Israel. At the same time Justin Trudeau, Canada’s Prime Minister, was singing and dancing at a Taylor Swift conference in Toronto. We will have to see how things turn out in Canada in general. There is significant pressure to call an election in Canada, but that requires the cooperation of one party, the New Democratic Party (“NDP”) to cooperate, which they are not. Federal elections are currently scheduled for October 2025, but Trudeau’s Liberals lead a minority government in a hung Parliament, and opposition parties could join forces to compel an early vote at any time. Click this link to see Trudeau Tracker.

Source Data: AAR – PFL Analytics

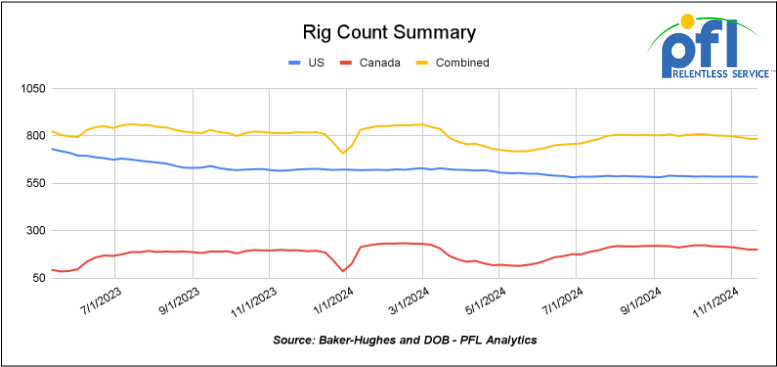

Rig Count

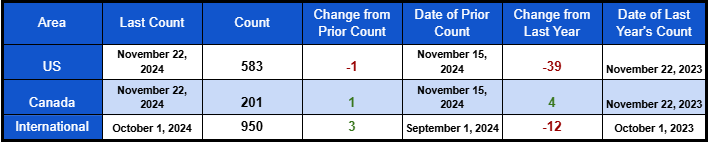

North American rig count was flat week-over-week. U.S. rig count was down -1 rig week-over-week and down by -39 rigs year-over-year. The U.S. currently has 583 active rigs. Canada’s rig count was up 1 rig week over week and up by 4 rigs year-over-year and Canada’s overall rig count is 201 active rigs. Overall, year over year we are down by -35 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,745 from 29,457, which was a gain of 288 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were higher by +4.8% week over week, and CN’s volumes were lower by -5.4% week-over-week. U.S. shipments were also mixed. The BN had the largest percentage decrease and was down by -2.7%. The UP had the largest percentage increase and was up by 6.6%.

We are watching the Keystone XL Pipeline

Remember the 1 million barrel per day crude oil pipeline that President Joe Biden canceled, which was almost complete on his first day in office after TransCanada spent $15 billion building it? Rumor has it that President-elect Donald Trump is looking to revive the Keystone XL oil pipeline on his first day back in the White House, according to news sources of three people familiar with the president-elect’s plan.

President Trump believes declaring the 1,200-mile Canada-to-Nebraska crude project back on the table would drive America’s energy independence, said people involved in the transition team who are in discussions about doing just that. Trump wants to reverse President Joe Biden’s decision, which reversed Trump’s initial 2017 approval of the project, which was strongly opposed by environmental groups. We are watching this one closely, stay tuned to PFL for further details.

We are watching Key Economic Indicators

Industrial Output & Capacity Utilization

Manufacturing accounts for approximately 75% of total output. Industrial production (IP) decreased 0.3% in October 2024, following a 0.5% decline in September. A strike at a major civilian aircraft manufacturer reduced IP growth by an estimated 0.3% percent in September and 0.2% percent in October, while Hurricanes Milton and Helene combined subtracted 0.1% in October.

Capacity utilization, a measure of how fully firms are using their machinery and equipment, declined slightly from 77.4% in September to 77.1% in October, 2.6% percent below long-term averages.

We are Watching Class 1 Industrial Head Count

Class I railroads employed 120,290 workers in the United States in October 2024, a -0.09% decrease from September 2024’s count of 120,399 and a -1.72% year-over-year decrease from October 2023’s total of 122,393, according to Surface Transportation Board data.

Two of the six employment categories posted month-over-month increases between September and October. These were Maintenance of Equipment and Stores, which rose +0.27% to 17,152 workers, and Transportation (other than train and engine), which increased +0.42% to 5,048 workers.

The categories that posted month-over-month decreases were Executives, officials, and staff assistants, down -0.01% to 7,857 workers, Professional and administrative, down -0.46% to 9,684 workers, Transportation (train and engine), down -0.23% to 51,638 workers, and Maintenance of way and structures, down -0.04% to 28,911 workers.

Year over year, two categories posted an employment gain, which was Maintenance of Way and Structures up 0.15% and Transportation (other than train and engine) up 2.33%. Categories that registered year-over-year decreases in October were Executives, officials, and staff assistants down -4.49%; Professional and Administrative down -5.84%; Maintenance of equipment and stores down -4.73%, and Transportation (train and engine) -0.84%.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 30K, 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|